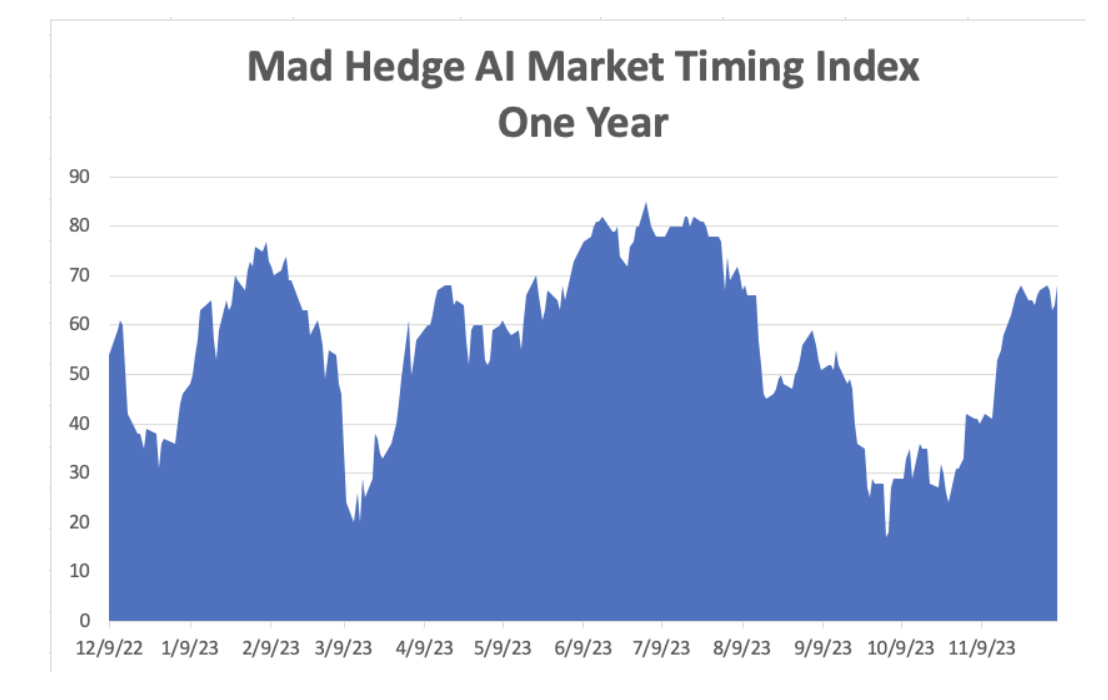

What if Goldilocks decided to hang around for a while? I’ve always been in favor of a long-term relationship.

It could be weeks. It could be months.

Certainly, the widely predicted New Year selloff has failed to materialize.

Failure to fall after the first week of 2024 has delivered a rally almost as ferocious as the one that launched in October. (NVDIA) up 15% in a week? Good thing I have a double position. Cameco (CCJ) up 25%? The market action was so positive that it rushed me into a rare 100% fully invested portfolio.

Which all begs the question of what WILL eventually kill this market. After all, nothing goes up forever.

It's very simple.

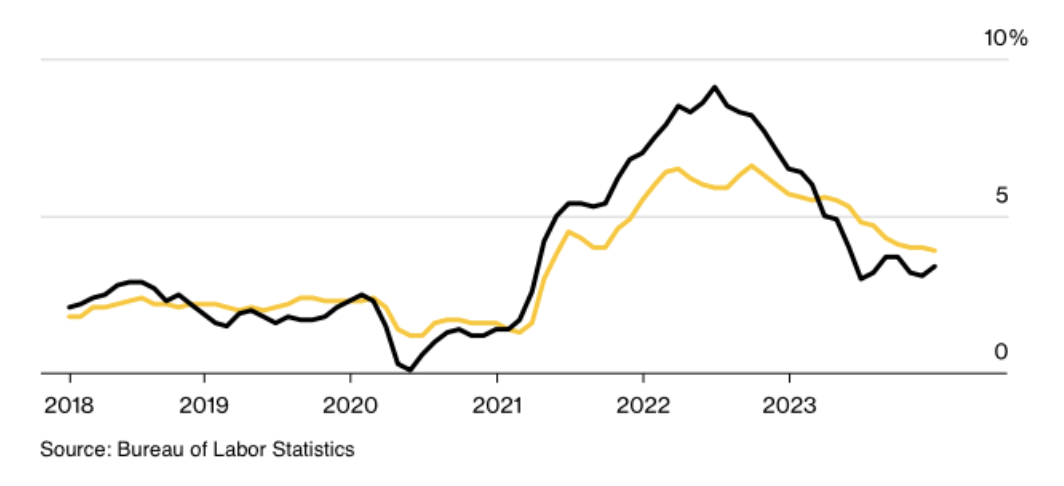

If the coming Fed interest rate cuts become so certain that companies start aggressively investing for the recovery NOW, there could be a problem. The headline Unemployment Rate never falls, inflation reaccelerates, and even the idea of interest rate cuts gets pushed off until 2025. That would thrust a dagger through the heart of the current rally post haste, which has been interest rate-driven from day one.

If there’s anyone who will save our bacon from this dire scenario, it is the legion of dour analysts out there who are perpetually behind the curve with their ultra-conservative earnings forecasts. That is scaring companies from expanding too quickly and is why every announcement delivers an upside surprise. That alone could provide enough of a drag on the economy to keep the Goldilocks scenario on track.

Watch Out Above!

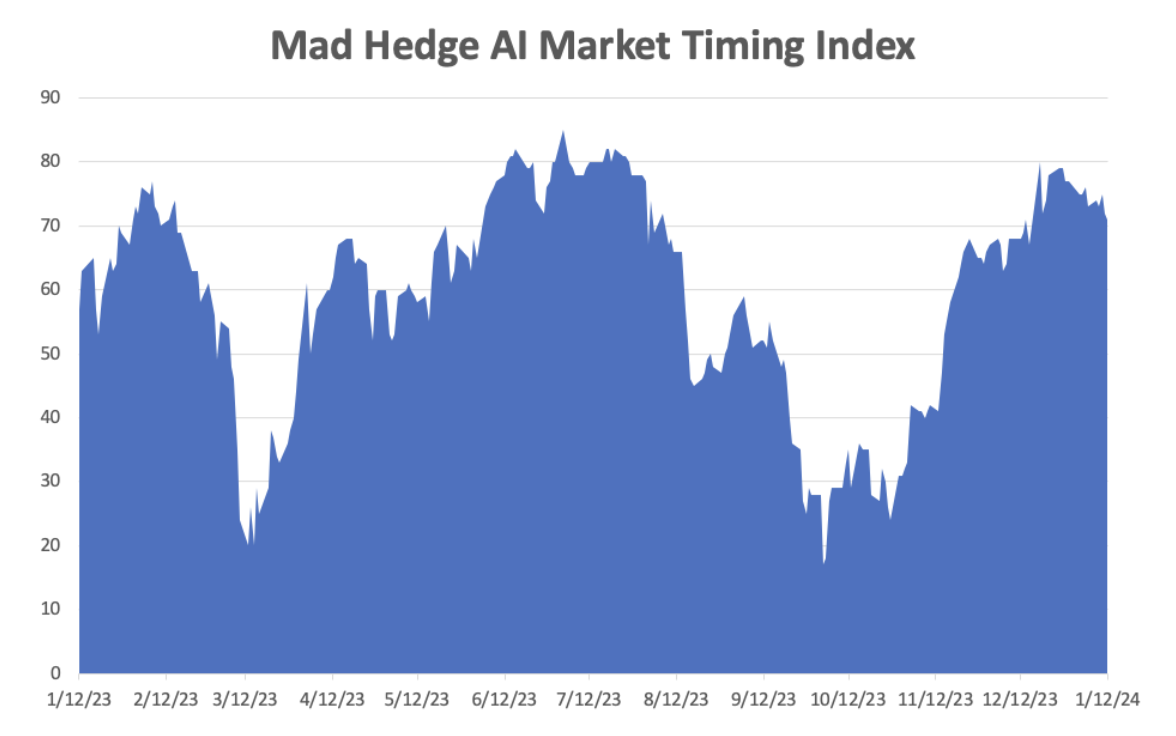

If that is the case, then the ten positions I added last week to achieve a rare 100% invested portfolio should do pretty well, which has a strong technology bent. In the AI-dominated world, data is king. Let’s see who owns the data.

Microsoft (MSFT) – knows every keystroke you have executed since you bought your first PC in 1990.

Google (GOOGL) – knows every search you have performed since 2005 plus every YouTube video you have watched, even the X-rated ones (oops!).

Tesla (TSLA) – knows every function your car has performed since 2010 and has 12 videos of where you have been (double oops!).

Meta (META)– knows every keystroke you have performed on your social media accounts.

If all of this sounds scary, it should be. But it also means that while these stocks may be expensive relative to 2023 earnings, they are still in the bargain basement regarding 2024 and 2025 earnings. Buy everything on dips. Investors are adding to what they already own because it’s been working big time, including me.

On a completely different topic, Uranium is going nuclear again. Yellow cake, the fuel used by nuclear power plants, has seen prices up 45% since May. Before the Ukraine war, Russia produced 50% of the world’s nuclear fuel. Now it is banned due to sanctions. The US has announced the creation of a nuclear fuel stockpile.

Congress is about to vote on a ban on Russian fuel. France just announced the addition of 14 large nuclear plants. Oh, and it’s green.

Uranium prices endured a long nuclear winter starting with the Three Mile Island accident in 1979, followed by Chernobyl in 1986, and Fukushima in 2011. That time is now over, thanks to more advanced reactor designs and better risk control.

I used to collect Czech uranium glass, which emits a very low level of gamma radiation and glows in the dark under ultraviolet light. Time to collect some of Canadian uranium miner Cameco (CCJ) also … again.

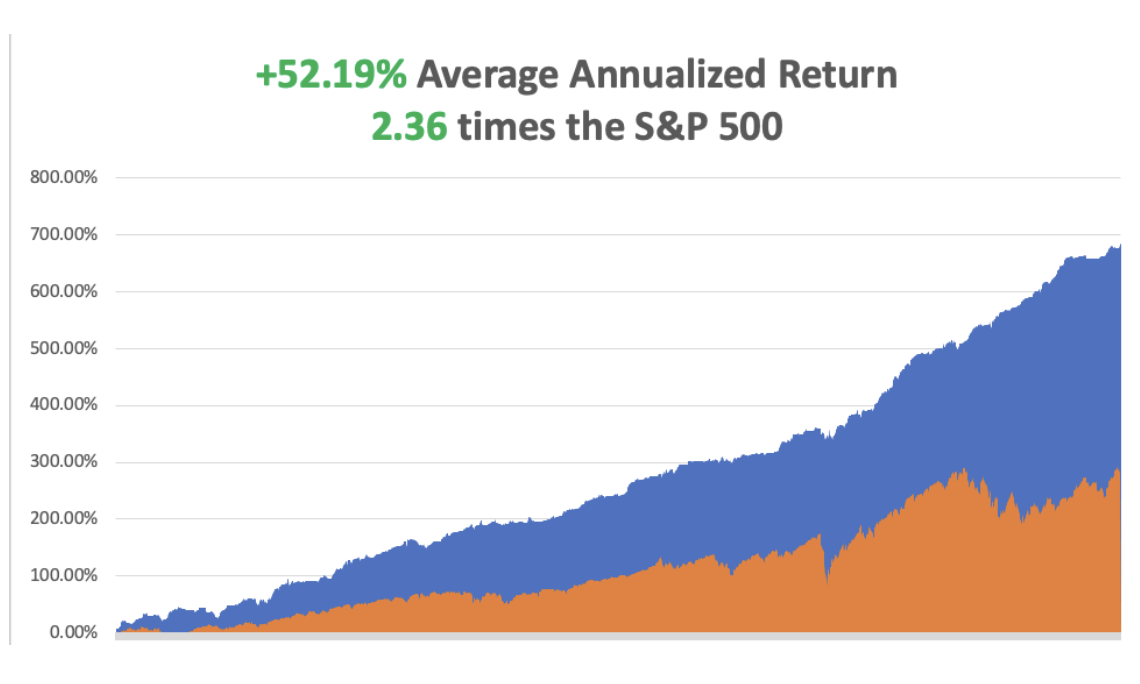

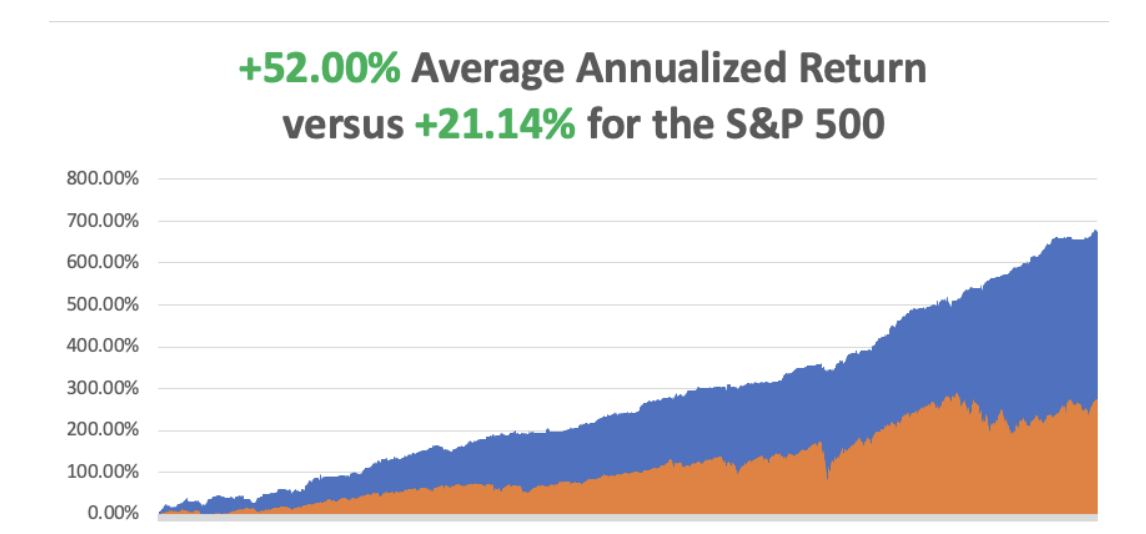

So far in January, we are up +6.19% with a 100% invested position. My 2024 year-to-date performance is also at +6.19%. The S&P 500 (SPY) is down -0.07% so far in 2024. My trailing one-year return reached +67.65% versus +37.82% for the S&P 500.

That brings my 15-year total return to +682.82%. My average annualized return has exploded to +52.19%, another new high.

Some 63 of my 70 trades last year were profitable in 2023.

I am going into 2024 with longs in (MSFT), (BA), (AMZN), (DAL), (V), (PANW), (CCJ), (TLT), and a double long in (NVDA).

FAA Grounds the Boeing 737 Max….Again, after a huge chunk of the fuselage fell off on a passenger flight which made an emergency landing in Portland. Dozens of the troubled aircraft were grounded. The move affects about 171 planes worldwide. The 737 Max is by far Boeing’s most popular aircraft and its biggest source of revenue. United Airlines is the biggest operator of the type followed by Alaska. Use any major dips to buy (BA) stock, which is facing a golden age.

NVIDIA Ramps Up its Graphics Cards. Nvidia is playing up its strength in consumer GPUs for so-called “local” AI that can run on a PC or laptop from home or an office. The new chip can be used to generate images on Adobe Photoshop’s Firefly generator to remove backgrounds in video calls, or even make games that use AI to generate dialogue. Buy (NVDA) on dips, as I did this last week.

Energy Prices Collapse Again, with Texas tea diving 4% to $70 on Saudi price cuts. This is despite steady buying from the US government for the SPR. The kingdom is moving to shortcut cheating by lesser OPEC members, as it usually does. If you throw good news in the market and it fails to go up, you sell it. Avoid (USO), (XOM), and (OXY).

Natural Gas Goes Ballistic, up 50% in three weeks. The 2026 $8-9 LEAPS I recommended over Christmas have already doubled. Expansion of export facilities to China is the reason, for accommodating more demand. BUY (UNG) on dips.

Mortgage Demand Soars by 10% in the first week of the year, and the next leg in the bull market for residential housing begins anew. Applications to refinance a home loan jumped 19% from the previous week and were 30% higher than the same week one year ago.

Consumer Price Index Flies, coming in at 0.3% for December instead of the anticipated 0.2%, a 3.4% annual rate. Fed rate cuts just got pushed back from March to June, where they belong. Used car and apparel prices get the blame. Car insurance was up a shocking 20% YOY. Go figure.

Bitcoin ETF’s SEC Approved, after a ten-year wait, potentially marking a market top. The SEC is still warning about market risks, even if the ETF sellers don’t. During the last crypto spike, there was an absence of cheap quality growth stocks. Now there is an abundance. Bitcoin prospered when we had a cash surplus and asset shortage. Now we have the opposite.

Global EV and Hybrid Sales Jump by 31% in 2023, compared to only 10% for internal combustion driven cars. Global sales of fully electric and plug-in hybrid vehicles (PHEVs) rose 31% in 2023, down from 60% growth in 2022, according to market research firm Rho Motion. For 2024, there are forecasts of global EV sales growth of between 25% and 30%. That’s really quite amazing given the weak 2023 global economy.

Microsoft Tops Apple, as the world’s most valuable publicly traded company, with a $3 trillion market cap. A huge lead in AI and a growing storage presence with Azure are the reasons. I’m long (MSFT) lower down.

US Budget Deficit Tops $500 Billion in Q1, starting October 1, 2023. But the frenetic price action, up a mind-blowing $19 in 2 ½ months proves the government isn’t borrowing too much money, it isn’t borrowing enough! There is a severe bond shortage in the marketplace. Never argue with Mr. Market as he is always right. Buy the (TLT) on dips, as I have.

Tesla to Halt Production in Germany, thanks to soaring shipping costs in the Red Sea. Tesla has been selling Berlin-made Model Ys to China via the Suez Canal. Shipping costs have doubled to $5,000 per container since October.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, January 15, markets are closed for Martin Luther King Day.

On Tuesday, January 16 at 8:30 AM EST, the New York Empire State Manufacturing Index will be released.

On Wednesday, January 17 at 2:00 PM, the Retail Sales are published.

On Thursday, January 18 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the Building Permits for December.

On Friday, January 19 at 2:30 PM, the December University of Michigan Consumer Sentiment is published. At 2:00 PM, the Baker Hughes Rig Count is printed.

Uranium Glass

As for me, when you make millions of dollars for your clients, you get a lot of pretty interesting invitations. $5,000 cases of wine, lunches on superyachts, free tickets to the Olympics, and dates with movie stars (Hi, Cybil!).

So it was in that spirit that I made my way down to the beachside community of Oxnard, California just north of famed Malibu to meet long-term Mad Hedge follower, Richard Zeiler.

Richard is a man after my own heart, plowing his investment profits into vintage aircraft, specifically a 1929 Travel Air D-4-D.

At the height of the Roaring Twenties (which by the way we are now repeating), flappers danced the night away doing the Charleston and the bathtub gin flowed like water. Anything was possible, and the stock market soared.

In 1925, Clyde Cessna, Lloyd Stearman, and Walter Beech got together and founded the Travel Air Manufacturing Company in Wichita, Kansas. Their first order was to build ten biplanes to carry the US mail for $125,000.

The plane proved hugely successful, and Travel Air eventually manufactured 1,800 planes, making it the first large-scale general aviation plane built in the US. Then, in 1929, the stock market crashed, the Great Depression ensued, aircraft orders collapsed, and Travel Air disappeared in the waves of mergers and bankruptcies that followed.

A decade later, WWII broke out and Wichita produced the tens of thousands of the small planes used to train the pilots who won the war. They flew B-17 and B-25 bombers and P51 Mustangs, all of which I’ve flown myself. The name Travel Air was consigned to the history books.

Enter my friend Richard Zeiler. Richard started flying support missions during the Vietnam War and retired 20 years later as an Army Lieutenant Colonel. A successful investor, he was able to pursue his first love, restoring vintage aircraft.

Starting with a broken down 1929 Travel Air D4D wreck, he spent years begging, borrowing, and trading parts he found on the Internet and at air shows. Eventually, he bought 20 Travel Air airframes just to make one whole airplane, including the one used in the 1930 Academy Award-winning WWI movie “Hells Angels.”

By 2018, he returned it to pristine flying condition. The modernized plane has a 300 hp engine, carries 62 gallons of fuel, and can fly 550 miles in five hours, which is far longer than my own bladder range.

Richard then spent years attending air shows, producing movies, and even scattering the ashes of loved ones over the Pacific Ocean. He also made the 50-hour round trip to the annual air show in Oshkosh, Wisconsin. I have volunteered to copilot on a future trip.

Richard now claims over 5,000 hours flying tailwheel aircraft, probably more than anyone else in the world. Believe it or not, I am also one of the few living tailwheel-qualified pilots in the country left. Yes, antiques are flying antiques!

As for me, my flying career also goes back to the Vietnam era as well. As a war correspondent in Laos and Cambodia, I used to hold Swiss-made Pilatus Porter airplanes straight and level while my Air America pilot friend was looking for drop zones on the map, dodging bullets all the way.

I later obtained a proper British commercial pilot license over the bucolic English countryside, trained by a retired Battle of Britain Spitfire pilot. His favorite trick was to turn off the fuel and tell me that a German Messerschmidt had just shot out my engine and that I had to land immediately. He only turned the gas back on at 200 feet when my approach looked good. We did this more than 200 times.

By the time I moved back to the States and converted to a US commercial license, the FAA examiner was amazed at how well I could do emergency landings. Later, I added on additional licenses for instrument flying, night flying, and aerobatics.

Thanks to the largesse of Morgan Stanley during the 1980s, I had my own private twin-engine Cessna 421 in Europe for ten years at their expense where I clocked another 2,000 hours of flying time. That job had me landing on private golf courses so I could sell stocks to the Arab Prince owners. By 1990, I knew every landing strip in Europe and the Persian Gulf like the back of my hand.

So, when the first Gulf War broke out the following year, the US Marine Corps came calling at my London home. They asked if I wanted to serve my country and I answered, “Hell, yes!” So, they drafted me as a combat pilot to fly support missions in Saudi Arabia.

I only got shot down once and escaped with a crushed L5 disk. It turns out that I crash better than anyone else I know. That’s important because they don’t let you practice crashing in flight school. It’s too expensive.

My last few flying years have been more sedentary, flying as a volunteer spotter pilot in a Cessna-172 for Cal Fire during the state’s runaway wildfires. As long as you stay upwind, there’s no smoke. The problem is that these days, there is almost nowhere in California that isn’t smokey. By the way, there are 2,000 other pilots on the volunteer list.

Eventually, I flew over 50 prewar and vintage aircraft, everything from a 1932 De Havilland Tiger Moth to a Russian MiG 29 fighter.

It was a clear, balmy day when I was escorted to the Travel Air’s hanger at Oxnard Airport. I carefully prechecked the aircraft and rotated the prop to circulate oil through the engine before firing it up. That reduced the wear and tear on the moving parts.

As they teach you in flight school, better to be on the ground wishing you could fly than be in the air wishing you were on the ground!

I donned my leather flying helmet, plugged in my headphones, received a clearance from the tower, and was good to go. I put on max power and was airborne in less than 100 yards. How do you tell if a pilot is happy? He has engine oil all over his teeth. After all, these are open-cockpit planes.

I made for the Malibu coast and thought it would be fun to buzz the local surfers at wave top level. I got a lot of cheers in return from my fellow thrill seekers.

After a half hour of low flying over elegant sailboats and looking for whales, I flew over the cornfields and flower farms of remote Ventura County and returned to Oxnard. I haven’t flown in a biplane in a while and that second wing really put up some drag. So, I had to give a burst of power on short finals to make the numbers. A taxi back to the hangar and my work there was done.

There are old pilots and there are bold pilots, but there are no old, bold pilots. I can attest to that.

Richard’s goal is to establish a new Southern California aviation museum at Oxnard airport. He created a non-profit 501 (3)(c), the Travel Air Aircraft Company, Inc. to achieve that goal, which has a very responsible and well-known board of directors. He has already assembled three other 1929 and 1930 Travel Air biplanes as part of the display.

The museum’s goal is to provide education, job training, restoration, maintenance, sightseeing rides, film production, and special events. All donations are tax-deductible. To make a donation, please email the president of the museum, my friend Richard Conrad at rconrad6110@gmail.com

Who knows, you might even get a ride in a nearly 100-year-old aircraft as part of a donation.

To watch the video of my joyride, please click here.

Where I Go My Kids Go

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader