When I ran the international equity trading desk at Morgan Stanley during the 1980s, there was always one guy I was trying to recruit and that was David Tepper at Goldman Sachs. Whenever we did a trade with David, we lost money.

If we sold David a stock it usually took off like a rocket. If we bought a stock from him it plummeted like a stone. Eventually, unable to lure David over with a monster salary, I had to ban trading with him as it was such a loser for us.

David never did get pried away from Goldman until he left to start his own firm, Appaloosa Management, after he was mistakenly passed over for partner two years in a row. After that, he racked up an annualized return of over 40%, near my own results.

But David was doing it with $20 billion in real money, while I was doing it with newsletters. In 2012, David received a $2.2 billion performance bonus from his fund, one of the largest in history. I bet the partners at Goldman are kicking themselves.

So, I thought it timely to check in with David, now the owner of the Carolina Panthers football team, to see what he thought about the market. The S&P 500, the Dow, Ten-year bond yields, and Bitcoin all simultaneously hit all-time highs last week, and we were long all of them.

David was phlegmatic at best. “There are times to make money and there are times to not lose money, and this is definitely time to make money.” However, nothing is cheap. There are no screaming buys here or screaming shorts. He did expect stocks to keep rising through the end of 2021.

Keep in mind that David is a trader just like me and rarely has a view beyond six months. His last 13F filing on June 30 showed that his five largest positions were T-Mobile (TMUS), Amazon (AMZN), Facebook (FB), Google (GOOG), and Uber (UBER). Uber was the only new buy.

David is not alone in his views.

Up 89.20% so far in 2021, I am sitting here dazed, shocked, and pinching myself. This has been far and away my best year in a 53-year career. I know a lot of you made a lot more. I stared down every correction this year, loaded the boat, and won.

It’s not always like this.

So I think we are in for a few weeks of profit-taking, sideways chop, and minimal action. I call this the “counting your money” time. Traders have visions of Ferraris dancing in their eyes. Then once we form a new base, it will become the springboard for a new yearend rally.

I don’t think stocks will fall enough to justify selling here. And you might miss the next bottom.

Until then, I’m thinking of taking up the banjo.

That brings me to the foremost question in your collective minds. Can I top an astonishing 100% profit this year? Only if we get another great entry point with a 5% correction.

I’m sure that when the financial history of our era is written something in the future, this will be known as the week that Bitcoin went mainstream. That was prompted by the SEC approval of the first futures ETF, the ProShares Bitcoin Futures ETF (BITO).

By giving this approval, which had been sought for years, unlocks $40 trillion worth of assets owned by 100 million shareholders managed under the Investment Company Act of 1940 to go into Bitcoin. The possibilities boggle the mind. The consensus year-end target for Bitcoin is now $100,000, or up 65%.

It’s not too late to subscribe at the founder's rate of $995 a year for the Mad Hedge Bitcoin Letter by clicking here. After that, the price goes up….a lot.

Morgan Stanley (MS) Announces Stellar Earnings, with profits at $3.71 billion, up 36.4%. Morgan Stanley Asset Management sucked in an amazing $300 billion so far in 2021, bringing their total assets to $4.5 trillion.

Goldman Sachs (GS) announces blockbuster earnings, and we are laughing all the way to the bank. Profits soared an eye popping 63% to $5.28 billion.

Existing Home Sales soar by 7% in September to a seasonally adjusted 6.29 million units. First time buyers accounted for only 28%, the lowest since 2015. A brief drop in interest rates is the reason. There are only 1.29 million homes for sale, only a 2.4 month supply.

Housing Starts fall by 1.6% in September. Higher materials and labor costs, rising land expenses, and soaring energy costs are the culprit. A pop in interest rates may mean that the slowdown could last through the winter.

Single Family Rents are surging especially for the top end of the market. Nationally, rents rose 9.3% in August year over year, up from a 2.2% year-over-year increase in August 2020, according to CoreLogic. Buy homebuilders on dips like (KBH), (LEN), and (PHM)

If the Rescue Package passes in whatever size, it will trigger a massive new surge in risk prices, including stocks and Bitcoin. Don’t act surprised when it happens. $3.5 trillion, $1.5 trillion who cares? That’s a ton of money to be dumped into the economy ahead of the 2022 elections.

Tesla profits smash records in Q3, reporting a shocking $1.62 billion profit on $13.76 billion in revenues. A 30.5% profit margin blew people away. Imagine how much they’ll earn when they make 25 million cars a year in ten years. Buy (TSLA) on big dips.

Weekly Jobless Claims dive to 290,000, a new post-pandemic low. Delta is in fast retreat. A pre-pandemic normal level of 225,000 is coming within range.

Rising Interest rates are tagging the Real Estate Market, with the 30-year fixed rate hitting 3.23%. Refis are off 7% on the week. The Fed taper is looming large, especially if the 30-year hits 4.0%, which it should, taking affordability down.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My Mad Hedge Global Trading Dispatch saw a heroic +9.60% gain so far in October. My 2021 year-to-date performance soared to 89.20%. The Dow Average is up 16.60% so far in 2021.

After the recent ballistic move in the market, I am continuing to run my longs and those include (MS), (GS), (BAC), and a short in the (TLT). All are approaching their maximum profit point and we have nothing left but time decay to capture. So, I am going to run these into the November 19 expiration in 14 trading days. It’s like having a rich uncle write you a check once a day.

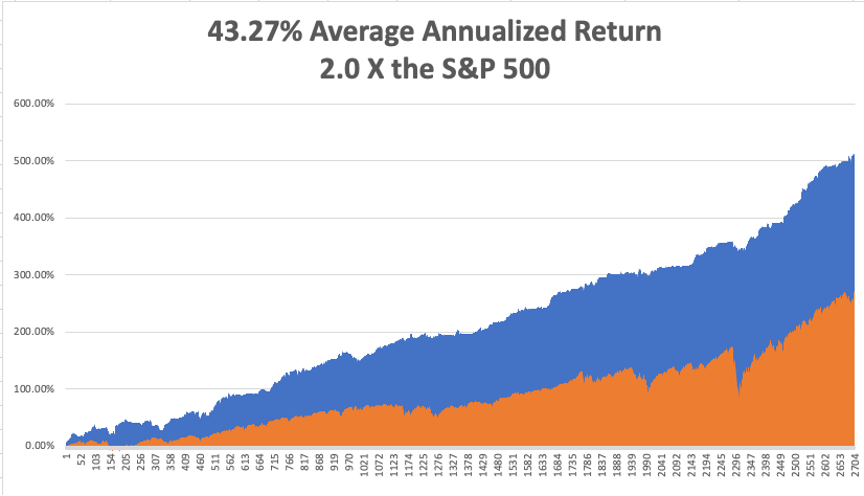

That brings my 12-year total return to 512.75%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 43.75%, easily the highest in the industry.

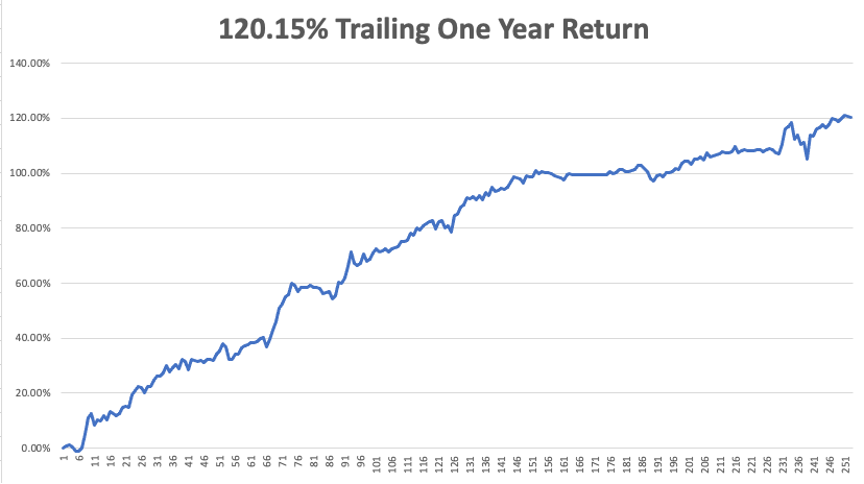

My trailing one-year return popped back to positively eye-popping 120.15%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases approaching 46 million and rising quickly and deaths topping 736,000, which you can find here.

The coming week will be slow on the data front.

On Monday, October 25 at 8:30 AM, the Chicago Fed National Activity Index is out. Facebook (FB) earnings are released.

On Tuesday, October 26 at 10:00 AM, the S&P Case-Shiller National Home Price for August Index is released. Alphabet (GOOGL) and Microsoft (MSFT) earnings are out at 5:00 PM.

On Wednesday, October 27 at 7:30 AM, Durable Goods Orders for September are printed. McDonald’s (MCD) earnings are out.

On Thursday, October 28 at 8:30 AM, Weekly Jobless Claims are announced. The first read on Q3 GDP is announced. Apple (AAPL) and Amazon (AMZN) earnings are out.

On Friday, October 29 at 8:45 AM, the US Personal Income & Spending for September is published. At 2:00 PM, the Baker Hughes Oil Rig Count is disclosed.

As for me, when I went to college in Los Angeles, the local rivalries between universities were intense.

UCLA and USC had a particularly intense rivalry, and I went to both. It was traditional to steal Tommy Trojan’s sword prior to each homecoming game and then paint the statue blue. USC had a mascot, a mixed breed dog called “Old Tire Biter.” Prior to one game, UCLA kidnapped the dog.

At halftime, the kidnappers appeared midfield, tied the dog to a helium-filled weather balloon, and let him waft away somewhere over the city. Enraged USC fans stormed the field only to find that the real dog was hidden in a nearby truck. The dog headed for the stratosphere was actually a stuffed one.

Of course, the greatest prank of all time was carried out by the California Institute of Technology in the 1961 Rose Bowl, which didn’t have a football team, on the Washington Huskies. Washington was famous for its elaborate card tricks, which spelled out team names and various corporate sponsors and images.

On the night before a game, imaginative mathematically-oriented Caltech students snuck into the stadium and changed the instructions on the back of each card packet sitting in the seats. When it came time to spell out an enormous “WASHINGTON”, “CALTECH: displayed instead. The incident was broadcast live on national TV ON NBC.

At Caltech, where I studied math, they are still talking about it today.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader