Global Market Comments

May 15, 2019

Fiat Lux

(SPECIAL CHINA ISSUE)

Featured Trade:

(WHY CHINA IS DRIVING UP THE VALUE OF YOUR TECH STOCKS)

(QCOM), (AVGO), (AMD), (MSFT), (GOOGL), (AAPL), (INTC), (LSCC)

Global Market Comments

May 15, 2019

Fiat Lux

(SPECIAL CHINA ISSUE)

Featured Trade:

(WHY CHINA IS DRIVING UP THE VALUE OF YOUR TECH STOCKS)

(QCOM), (AVGO), (AMD), (MSFT), (GOOGL), (AAPL), (INTC), (LSCC)

Reduce the supply on any commodity and the price goes up. Such is dictated by the immutable laws of supply and demand.

This logic applies to technology stocks as well as any other asset. And the demand for American tech stocks has gone global.

Who is pursuing American technology more than any other? That would be China.

Ray Dalio, founder and chairman of hedge fund Bridgewater Associates, described the first punch thrown in an escalating trade war as a “tragedy,” although an avoidable one.

Emotions aside, the REAL dispute is not over steel, aluminum, which have a minimal effect of the US economy, but rather about technology, technology, and more technology.

China and the U.S. are the two players in the quest for global tech power and the winner will forge the future of technology to become chieftain of global trade.

Technology also is the means by which China oversees its population and curbs negative human elements such as crime, which increasingly is carried out through online hackers.

China is far more anxious about domestic protest than overseas bickering which is reflected in a 20% higher internal security budget than its entire national security budget.

You guessed it: The cost is predominantly and almost entirely in the form of technology, including CCTVs, security algorithms, tracking devices, voice rendering software, monitoring of social media accounts, facial recognition, and cloud operation and maintenance for its database of 1.3 billion profiles that must be continuously updated.

If all this sounds like George Orwell’s “1984”, you’d be right. The securitization of China will improve with enhanced technology.

Last year, China’s communist party issued AI 2.0. This elaborate blueprint placed technology at the top of the list as strategic to national security. China’s grand ambition, as per China’s ruling State Council, is to cement itself as “the world’s primary AI innovation center” by 2030.

It will gain the first-mover advantage to position its academia, military and civilian areas of life. Centrally planned governments have a knack for pushing through legislation, culminating with Beijing betting the ranch on AI 2.0.

China possesses legions of engineers, however many of them lack common sense.

Silicon Valley has the talent, but a severe shortage of coders and engineers has left even fewer scraps on which China’s big tech can shower money.

Attempting to lure Silicon Valley’s best and brightest also is a moot point considering the distaste of operating within China’s great firewall.

In 2013, former vice president and product spokesperson of Google’s Android division, Hugo Barra, was poached by Xiaomi, China’s most influential mobile phone company.

This audacious move was lauded and showed China’s supreme ability to attract Silicon Valley’s top guns. After 3 years of toiling on the mainland, Barra admitted that living and working in Beijing had “taken a huge toll on my life and started affecting my health.” The experiment promptly halted, and no other Silicon Valley name has tested Chinese waters since.

Back to the drawing board for the Middle Kingdom…

China then turned to lustful shopping sprees of anything tech in any developed country.

Midea Group of China bought Kuka AG, the crown jewel of German robotics, for $3.9 billion in 2016. Midea then cut German staff, extracted the expertise, replaced management with Chinese nationals, then transferred R&D centers and production to China.

The strategy proved effective until Fujian Grand Chip was blocked from buying Aixtron Semiconductors of Germany on the recommendation of CFIUS (Committee on Foreign Investment in the United States).

In 2017, America’s Committee on Foreign Investment and Security (CFIUS), which reviews foreign takeovers of US tech companies, was busy refusing the sale of Lattice Semiconductor, headquartered in Portland, Ore., and since has been a staunch blockade of foreign takeovers.

CFIUS again in 2018 put in its two cents in with Broadcom’s (AVGO) attempted hostile takeover of Qualcomm (QCOM) and questioned its threat to national security.

All these shenanigans confirm America’s new policy of nurturing domestic tech innovation and its valuable leadership status.

Broadcom, a Singapore-based company led by ethnic Chinese Malaysian Hock Tan, plans to move the company to Delaware, once approved by shareholders, as a way to skirt around the regulatory issues.

Microsoft (MSFT) and Alphabet (GOOGL) are firmly against this merger as it will bring Broadcom intimately into Apple’s (APPL) orbit. Broadcom supplies crucial chips for Apple’s iPads and iPhones.

Qualcomm will equip Microsoft’s brand-new Windows 10 laptops with Snapdragon 835 chips. AMD (AMD) and Intel (INTC) lost out on this deal, and Qualcomm and Microsoft could transform into a powerful pair.

ARM, part of the Softbank Vision Fund, is providing the architecture on which Qualcomm’s chips will be based. Naturally, Microsoft and Google view an independent operating Qualcomm as healthier for their businesses.

The demand for Qualcomm products does not stop there. Qualcomm is famous for spending heavily on R&D — higher than industry peers by a substantial margin. The R&D effort reappears in Qualcomm products, and Qualcomm charges a premium for its patent royalties in 3G and 4G devices.

The steep pricing has been a point of friction leading to numerous lawsuits such as the $975 million charged in 2015 by China’s National Development and Reform Commission (NDRC) which found that Qualcomm violated anti-trust laws.

Hock Tan has an infamous reputation as a strongman who strips company overhead to the bare bones and runs an ultra-lean ship benefitting shareholders in the short term.

CFIUS regulators have concerns with this typical private equity strategy that would strip capabilities in developing 5G technology from Qualcomm long term. 5G is the technology that will tie AI and chip companies together in the next leg up in tech growth.

Robotic and autonomous vehicle growth is dependent on this next generation of technology. Hollowing out CAPEX and crushing the R&D budget is seriously damaging to Qualcomm’s vision and hampers America’s crusade to be the undisputed torchbearer in revolutionary technology.

CFIUS’s review of Broadcom and Qualcomm is a warning shot to China. Since Lattice Semiconductor (LSCC) and Moneygram (MGI) were out of the hands of foreign buyers, China now must find a new way to acquire the expertise to compete with America.

Only China has the cash hoard to take a stand against American competition. Europe has been overrun by American FANGs and is solidified by the first mover advantage.

Shielding Qualcomm from competition empowers the chip industry and enriches Qualcomm’s profile. Chips are crucial to the hyper-accelerating growth needed to stay at the top of the food chain.

Implicitly sheltering Qualcomm as too important to the system is an ink-drenched stamp of approval from the American government. Chip companies now have obtained insulation along with the mighty FANGs. This comes on the heels of Goldman Sachs (GS) reporting a lack of industry supply for DRAM chips, causing exorbitant pricing and pushing up semiconductor companies’ shares.

All the defensive posturing has forced the White House to reveal its cards to Beijing. The unmitigated support displayed by CFIUS is extremely bullish for semiconductor companies and has been entrenched under the stock price.

It is likely the hostile takeover will flounder, and Hock Tan will attempt another round of showmanship after Broadcom relocates to Delaware as an official American company paying American corporate tax. After all, Tan did graduate from MIT and is an American citizen.

The chip companies are going through another intense round of consolidation as AMD (AMD) was the subject of another takeover rumor which lifted the stock. AMD is the only major competitor with NVIDIA (NVDA) in the GPU segment.

The cash repatriation has created liquid buyers with a limited amount of quality chip companies. Qualcomm is a firm buy, and investors can thank Broadcom for showing the world the supreme value of Qualcomm and how integral this chip stalwart is to America’s economic system.

Mad Hedge Technology Letter

May 15, 2019

Fiat Lux

Featured Trade:

(TRUE COST OF THE CHINA TRADE WAR)

(EXPE), (TRIP), (GOOGL), (CTRP)

As the trade misunderstanding escalates to a new stratum of ferociousness, certain parts of the economy are ripe to be battered.

Tourism and in particular, international travel, will be one of the first luxuries to be sliced off consumers' list.

China’s most popular online travel agent Ctrip.com (CTRP) has suffered a damaging drop in demand from would-be international travelers.

Jonathan Grella, spokesman at the US Travel Association said, “The US runs a US$28 billion travel and tourism trade surplus with China” and preliminary numbers appear that Chinese travel to the US in the past year has dropped around 20%.

Compounding the woes is the weakening of the Chinese yuan which could become collateral damage from the trade negotiations if American and Chinese corporations repurpose supply chains to other countries and stop sending dollars to the mainland.

The ball is already rolling with 93 percent of Chinese companies considering making some changes to their supply chains to mitigate the effects of trade tariffs in an ingenious way to circumvent extra costs.

Of these, 18% are open to a complete supply chain remake and production transformation, with 58% making meaningful changes.

A further 17% plan to make minor tweaks in response to the trade war, with only 7% making no changes at all.

Chinese and American companies are reconsidering their Chinese manufacturing bases to avoid the tariffs placed on US$250 billion of Chinese exports by US President Donald Trump.

The unintended consequence will be a powerful surge in economic activity in South East Asia with also India benefitting from the chaos.

Apart from the supply chain complexities, the worsening of Chinese yuan strength could put a massive damper on Chinese international travel plans.

The annual Chinese international travel growth rate of 5.5% would be in dire straits translating into current travel demand rerouted to lower margin Asian countries such as Thailand, Vietnam, and Malaysia which are quite popular for budget travelers.

If lower sales do not manifest itself because tourists opt to forego expensive western countries, this demand will correlate into fewer dollars per traveler because of cheaper destinations which might force companies to double down on promotions to lure higher volume.

The same goes for American consumers who will be on the hook for the tariff-loaded consumer items that trickle onto our shores.

Decaying relations have already poisoned the US tourism sector that’s seen its growth flatline for the first time in 10 years.

And while only a small percentage of the 80 million visitors to the US in 2018 were Chinese, the potential for that segment’s growth remains robust.

Only 6 percent of Chinese citizens have passports signaling an imminent rise in outbound Chinese tourists that will reach 220 million by 2025.

The opportunity cost of these dollars migrating to other locations will be a kick in the teeth.

I reiterate my negative call for American online travel companies with recent damage control coming from TripAdvisor for last quarter’s debacle when the company reported dismal top-line results combined with a drop in monthly average unique visitors.

The company’s first-quarter revenues of $376 million missed badly up against the consensus forecast of $386.8 million.

TripAdvisor’s quarterly revenues fell 1% YOY as a result of the core hotel business underperforming and revenues from TripAdvisor’s Hotels, Media & Platform (or HM&P) showing zero growth at $254 million.

Revenues from its fringe businesses, which includes rentals, Flights/Cruise, SmarterTravel, and Travel China, plunged 33% to $42.

The proof is in the pudding with the company’s falling unique visitor count putting the kibosh on TripAdvisor’s growth prospects.

The company’s average monthly unique visitors cratered 5% YOY to 411 million users in the first quarter, contrasting with TripAdvisor’s performance last year when it reported an 11% YOY unique visitor growth.

Google is the boogie man in the equation with the company rolling out a more holistic travel product to integrate flight and hotel search functions while organizing people’s travel plans and saving research.

Alphabet will also repurpose more travel data on Google Maps, and integrate hotel and restaurant reservations for customers who are logged on.

Linking the Google travel and map functions seem like a no brainer to me and will be the precursor before the company starts selling ads on Google Maps including travel ads.

Google’s pivot into online travel marks an existential crisis for the incumbents and will strengthen its position in travel by driving further searches and potential higher-qualified leads for its partner companies, such as airlines and hotels.

Consumers have already recognized Google as the go-to place where to do travel research.

In a zero-sum game, Expedia (EXPE) and TripAdvisor (TRIP) will directly lose out.

Highlighting the erosion was Expedia’s super growth asset Vrbo whose gross bookings totaled $4.16 billion, up a paltry 5 percent from a year earlier.

The growth rate was less than half of the main online travel agency business which should sound off alarm bells.

As it stands now, Google generates referral traffic although it does process some bookings on its own site for other travel merchants.

Unlike travel agencies such as Expedia or Priceline, Google doesn’t directly sell travel products such as hotel rooms or airline tickets but that could change quickly.

This ties back to my continuing thesis of the low-value proposition of broker apps in the tech ecosystem, either there will be one with a monopoly, or a bigger fish will hijack their business model and become the new monopolistic dominator.

Such is the high stakes of Silicon Valley in 2019.

Global Market Comments

May 6, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR HERE’S ANOTHER BOMBSHELL),

(DIS), (QQQ), (AAPL), (INTU), (GOOGL), (LYFT), (UBER), (FCX))

I was all ready to write this week that massive monetary stimulus created by the Federal Reserve will cause the stock market to continue its slow-motion melt up.

The president had other ideas.

As of this writing, the US will impose without warning a surprise 25% increase in tariffs on $200 billion worth of Chinese imports, effective Friday, or in four days.

Clearly, the trade negotiations are not going as well as advertised by the administration. My bet is that the stock market won’t like this. All I can say is that I’m glad I’m 90% in cash and 10% in a Walt Disney vertical bull call spread that expires in nine trading days.

The bigger and unanswerable question is whether this is just a negotiating strategy already well known by the Bronx Housing Authority that sets up a nice dip to buy? Or is it this the beginning of a long overdue summer correction?

Nobody knows.

Certainly, the rally was getting long in the tooth, rising almost every day in 2019, with NASDAQ reaching new all-time highs. Those who kept their big-cap technology stock through the sturm und drang of the December meltdown have been rewarded handsomely. Index players reigned supreme.

However, we live in unprecedented times. Never before has a stock market received this much artificial stimulus at an all-time high unless you hark back to the Tokyo 1989 top. Japanese shares are now trading at 43% lower than that high….30 years later. We all know that our own decade-old bull market will eventually end in tears, but will it be in days, weeks, months, or years?

I had plenty of great wisdom, wonderful sector selections, colorful witticisms, and killer stock picks to serve up to you this week, but they have all be outrun by events. There’s nothing to do now but wait and see how the market responds to this tariff bombshell at the Monday morning opening.

After three months of decidedly mixed data, the information flow on the economy suddenly swung decidedly to the positive. The jobs data could have been more positive.

Of course, the April Nonfarm Payroll Report was a sight to behold. It came in at 263,000, about 80,000 more than expected, and more than makes up for last month’s dismal showing. It was a bull’s dream come true. This is what overheating looks like fueled by massive borrowing. Play now, pay later.

The headline Unemployment Rate fell a hefty 0.2% to 3.6%, the most since 1969 when the Vietnam War was raging, and the economy was booming. I remember then that Levi Strauss (LEVI) was suffering from a denim shortage then because so much was being sent to Southeast Asia to use as waterproof tarps. Wages rose 3.2% YOY.

Professional and Business Services led at a massive 76,000 jobs, Construction by 33,000 jobs, and Health Care by 27,000 jobs. Retail lost 12,000 jobs.

The ADP came in at a hot 275,000 as the private hiring binge continues. Then the April Nonfarm Payroll Report blew it away at 263,000. The headline unemployment rate plunged to a new 49-year low at 3.6%.

Consumer Spending hit a decade high, up 0.9% in March while inflation barely moved. Is Goldilocks about to become a senior citizen?

Apple (AAPL) blew it away with a major earnings upside surprise. The services play is finally feeding into profits. Stock buybacks were bumped up from $100 billion to $150 billion. Don’t touch (AAPL) up here with the stock just short of an all-time high. How high will the shares be when Apple’s revenue split between hardware and software revenues is 50/50?

Pending Home Sales jumped 3.8% on a signed contract basis. No doubt the market is responding to the biggest drop on mortgage rates in a decade. At one point, the 30-year fixed rate loan fell as low as 4.03%. Avoid housing for now, it’s still in a recession.

Topping it all off, the Fed made no move on interest rates. Like this was going to be a surprise? This may be the mantra for the rest of 2019. The big revelation that the Fed will start ending quantitative tightening now and not wait until September, as indicated earlier. More rocket fuel for the stock market. Let the bubble continue.

Uber (UBER) hit the Road for its IPO with valuations being cut daily, from a high of $120 billion to a recent low of $90 billion. The issue goes public on Friday morning. Rival Lyft (LYFT) definitely peed on their parade with their ill-fated IPO plunging 33%.

It wasn’t all Champaign and roses. San Francisco home prices fell for the first time in seven years. The median price is now only $830,000, down 0.1% YOY. Back up the truck! Clearly a victim of the Trump tax bill, this market won’t recover until deductions for taxes are restored. That may take place in two years….or never!

The Mad Hedge Fund Trader suffered a modest setback with the sudden collapse of copper prices last week, thus giving up all its profit in Freeport McMoRan (FCX). Global Trading Dispatch closed the week up 14.48% year to date and is down -1.48% so far in May. My trailing one-year retreated to +18.85%.

Reflecting the huge sector divergence in the market, the Mad Hedge Technology Letter leaped to another new all-time high on the back of two new very short-term positions in Intuit (INTU) and Google (GOOG), which we picked up after the earnings debacle there. Some 11 out of 13 Mad Hedge Technology Letter round trips have been profitable this year.

My nine and a half year profit shrank to +314.62%. The average annualized return backed off to +33.11%. With the markets at all-time highs and my Mad Hedge Market Timing Index forming a 2 ½ month high, I am now 90% in cash with Global Trading Dispatch and 80% cash in the Mad Hedge Tech Letter.

The coming week will be pretty boring after last week’s excitement, at least on the hard data front.

On Monday, May 6, Occidental Petroleum (OXY), now engaged in a ferocious takeover battle for Anadarko, reports. So does (AIG).

On Tuesday, May 7, 3:00 PM EST, we obtain March Consumer Credit. (LYFT), one of the worst performing IPOs this year, gives its first ever earnings report.

On Wednesday, May 8 at 2:00 PM, we get the most important earnings report of the week with Walt Disney (DIS), along with (ROKU).

On Thursday, May 9 at 8:30 the Weekly Jobless Claims are produced. At the same time, we get the March Producer Price Index. Dropbox (DBX) reports.

On Friday, May 10 at 8:30 AM, we get the Consumer Price Index. The Baker-Hughes Rig Count follows at 1:00 PM. (UBER)’s IPO will be priced at the opening. Viacom (VIA) Reports.

As for me, I’ll be watching the Kentucky Derby on Saturday. The field is wide open, now that the favorite, Omaha Beach, has been scratched.

As I will be attending the Las Vegas SALT conference during the coming week, the Woodstock of hedge fund managers, I will take the opportunity to rerun some of my oldies but goodies. We also have recently enjoyed a large number of new subscribers so I will be publishing several basic training pieces.

Maybe it was something I said?

For more on the SALT conference, please click here (you must be logged in to your account to access this piece).

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

May 6, 2019

Fiat Lux

Featured Trade:

(PAYPAL GOES FROM STRENGTH TO STRENGTH)

(PYPL), (SQ), (GOOGL), (LYFT)

It’s time to revisit one of my favorite tech picks for 2019 that is a constant trade alert candidate.

The attention is warranted with the stock performance delivering a tidal wave of euphoria rising around 30% in the first half of 2019.

I expected PayPal to have a great year, but I didn’t expect them to perform better than Square who are growing from a lower install base.

PayPal’s overperformance signals to the wider business establishment how important a broad install base can be that can tap the network effect to reel in profits.

This is how once legacy dinosaurs can reinvent themselves in months.

The lack of entry points is a concern prodding investors to chase the stock if they want a piece of the action.

This is one of the drastic side effects of PayPal’s meteoric rise that has been buttressed by dovish Fed policy.

Investors are literally praying to the skies for any softness in tech earnings reports because for the best of the bunch, there have been no moderate pullbacks of note since last winter.

PayPal did offer a slight data point that might be construed as disappointing when total payment volume (TPV) of $161 billion was slightly lower than the consensus of $163 million for the quarter.

It’s slim pickings for the bear camp with not much to feast on in an otherwise pretty solid earnings report.

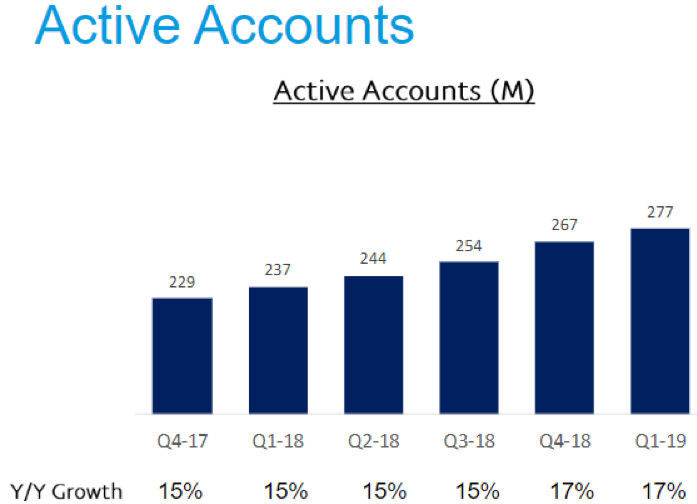

As PayPal expanded by 9.3 million new active accounts, bringing its total up to 277 million, management has super charged this legacy fintech company into an outright renaissance.

Doing even more to shed the tag of a legacy company, PayPal invested half a billion dollars at $47 per share into the upcoming Uber IPO signaling possibilities that their payment software could at some point integrate into Uber’s network down the road.

Alphabet (GOOGL) has shown that if you get in early with these Silicon Valley unicorns, synergistic effects are plenty with Alphabet lapping up revenue charging Lyft (LYFT) for providing digital ad capabilities on top of the appreciating value of their investment stake.

And if you remember that way back, PayPal was tied to eBay before it was spun out.

Better to attach future hopes and dreams to a leading visionary and innovator instead of a legacy e-commerce platform.

Illustrating the tough task of turning around eBay, eBay clocked in negative TPV growth of 4% in the past quarter.

PayPal offered us more detail into active-account numbers for its Venmo peer-to-peer service with more than 40 million people using Venmo for at least one transaction in the last 12 months.

Venmo processed $21 billion in TPV last quarter, mushrooming by 73%, while the core PayPal platform’s TPV grew 41% to $42 billion.

The success paved the way to raise its full-year EPS outlook from $2.94 to $3.01 ensuring that its prior forecast on revenue and TPV will be met.

PayPal previously guided lower with an expected $2.84 to $2.91 in adjusted EPS and $17.75 billion to $18.1 billion in revenue.

When we tally up all the positive points, it’s hard to ignore the 12% YOY increase in revenue to $4.13B and the more impressive 37% YOY rise in EPS growth signaling the company is applying its giant scale to maximum effect.

Customer engagement of 37.9 payment transactions per active account rose 9% YOY while the TPV which came in lower than consensus was still growth of 22% YOY.

I love that PayPal has migrated towards the heart of innovation while being a legacy fintech company.

Venmo and the Venmo card are rapidly infiltrating the center of consumer’s daily financial lives wielded for groceries, gas, and restaurants.

In February, PayPal introduced a limited-edition rainbow card which became the fastest adopted Venmo card.

I want to reiterate how the proof is in the pudding with Venmo volume increasing 73% to approximately $21B in the quarter.

Not only does this legacy fintech have super growth drivers, they have become quasi venture capitalists applying a horde of capital to snap up attractive assets.

An example is a $750 million investment in the e-commerce and payments leader in Latin America called MercadoLibre which creates a network effect to PayPal’s core business in the region.

If the steady drip of news wasn’t good enough, PayPal announced a partnership with Instagram to process payments when customers are shopping on Instagram in the U.S.

Management is convincingly delivering the goods with 110 basis points of operating margin expansion.

PayPal’s flawless performance is a great model in how to survive the volatile times of rapid tech shifts, and the best way to alter a model to reduce existential threats.

The company has growth drivers, have migrated capital into growth tech, are innovating with the best of them, and management is executing surgically taking advantage of a massive install base.

Buy on any weakness, entry points are few and far between.

Mad Hedge Technology Letter

May 2, 2019

Fiat Lux

Featured Trade:

(APPLE’S HOME RUN)

(AAPL), (CRM), (GOOGL)

The company that Steve Jobs built is an earnings thoroughbred with money growing out of their ears.

Apple’s earnings report was real confirmation that Apple’s pivot into a services company is overshadowing its drop in iPhone revenue.

They even elevated forward guidance for next quarter.

Being an economic bellwether that it is, the earnings success could point to more bullish momentum for not only the tech sector but the broader market.

The tech strength showing up in the squiggly figures of the sector’s earnings report indicates that the expected earnings recession will be more of a pause rather than a dip that was first expected.

The next bout of bullish strength that permeates through the market will take many tech stocks to higher highs.

The numbers backed up this premise with Q2 2018 revenue from the services category comprising 20% of total revenue in Q2 2019—a rubber stamp of confidence that this isn’t a false dawn after service sales only comprised of 16% of total revenue the prior year.

The death of the smartphone is upon us with most people who can afford a premium one already using one as we speak with no intentions for a quick refresh.

Apple’s strategy of selling expensive iPhones to Chinese nationals is over with iPhone sales getting slaughtered by 17% to about $31 billion—an accelerated decline for a product that has been hamstrung by smartphone rivals in China offering better phones for lower prices.

The $11.5 billion from its services division and the end result of registering revenue in the high end of its $55-59 billion projection for the quarter is a stark shift from the underperformance of 2018 when Chinese iPhones sales were so bad that they stopped reporting the segment altogether.

The $58 billion of quarterly revenue was still a drop of 5% YOY which included $31 billion in iPhone sales, a shell of its former self when they generated $37.5 billion in iPhone sales the same quarter in 2018.

The disruption in handing off the baton to the services brigade caused outsized ructions inside the company causing the stock to plummet 20% last winter.

Wearables put the cherry on top of the sundae expanding at a rate close to 50% during the quarter with AirPods and Apple Watch leading the charge as best sellers.

Apple plans to inject $75 billion on share repurchases and it also approved a 75-cent dividend per share, a 5% increase.

These repurchases could boost Apple’s stock by up to 7% per year offering investors another compelling reason to hold this stock long-term.

The upgraded dimensions of Apple’s business model could finally give investors peace of mind as they wean themselves from Chinese iPhone sales.

Moving forward, the relationship between American tech and the Chinese consumer will be contentious at best, and battling with Huawei on its turf is not a sensible strategy.

Highlighting this weakness were the Greater Chinese revenue registering only $10.2 billion in sales, down from the Q2 2018 tally of $13 billion.

On the positive side, the Chinese weakness is already baked into the pastry ceding way for the services narrative to move to the forefront.

Generating more incremental revenue from its existing base of 1.4 billion Apple accounts is the order of the day.

I initially believed Apple would make major headway in the services segment and foresaw services composing about 25% of total revenue.

However, I didn’t believe they would be able to achieve this for a few years, and the surprise to investors is the velocity of change to the upside in its services business.

Adding the new magazine subscription for $9.99 to its platform is another feather in their cap even though it doesn’t transform the industry.

Respondents to emarketer.com made it widely known that Apple as a platform was the second most important platform for news publishers behind Google offering a great opportunity to carve out more income from their new news app.

Apple is still in dire need of attractive video options for its content basket and assets on the market are plenty from live sports, shows, movies, and video games.

My money would be on Cook to prefer video games as a viable growth driver because it resonates deeply with younger audiences from abroad and avoids the polarity of controversial content which societies are increasingly sensitive to.

Another option would be to dive headfirst into the enterprise software business moving towards a Salesforce (CRM) model selecting cloud companies à la carte to integrate into a business cloud.

Many Apple device holders already wield their devices for their own online businesses, and this would represent a solid growth driver if they could make their services more business-friendly.

What can we expect moving forward?

In short, less iPhone sales and more service revenue as a proportion of total revenue.

If Apple can carefully choreograph its downshift of iPhones sales that doesn’t destroy overall revenue and profitability, they will successfully manage in transforming the company into a hybrid service company.

I believe that Apple’s services will contribute around 30% of total revenue by 2020 and this is a big deal that will buoy the stock.

Ultimately, these are happier times for Apple as their bet on services isn’t getting bogged down, eclipsing expectations, and will cement their status as a sure-fire $1 trillion market cap company.

Bravo!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.