The technology-laced film Ready Player One gives viewers a snapshot into the future where technology, income inequality, and society have run their course, and the year 2045 looks vastly different from the world of 2018.

Set in a semi-dystopian backdrop, the movie offers us a deeper insight into how certain technology trends will permeate into everyday life.

The first and most obvious future trend is the copious use of avatars.

Avatars will become the new normal. The first place that humans will find them is through the use of social media and entertainment, as children eventually becoming a part of us like our social media profiles today.

The Mad Hedge Technology Letter has incessantly hammered home about the phenomenon of gaming, and this will incorporate virtual reality allowing gamers access to a new digital world.

This was the on show in the film where the likes of protagonist Wade Watts, played by Tye Sheridan spent most of his life playing in the virtual world of Oasis using his character Parzival.

This could be your child in the future.

Wade Watts character is the new cool for Generation Z, as they are largely unconcerned about underage drinking and partying like the generations before them.

Gaming and hanging out on their preferred social media platforms are the new cool.

The companies dictating the current video game industry will have the first crack at it to realize profits and develop new businesses such as Microsoft (MSFT), Nvidia (NVDA), Advanced Micro Devices (AMD), Electronic Arts Inc. (EA), Take-Two Interactive Software, Inc. (TTWO), and Activision Blizzard, Inc. (ATVI).

Children just aren’t going outside like they used to and per most studies, they are addicted to the smartphone you bought them at age 10.

Most studies have found that once a child becomes hooked on technology, it is hard to reverse the habit, as once they enter into adult life and start their career, they become even more reliant on the technologies that got them to that point in the first place.

If your kid is already staring at tech devices three to four hours per day now for activities other than school work, expect that to grow to a minimum of six to seven hours per day once he hits puberty and smartphone time limits begin to fade away.

This all means that VR and gaming could be the handsome winner in all this, and the use of social media platforms will reap the benefits as well.

Generation Z just surpassed Millennials in terms of population comprising 25% of the American populace.

Neither of these generations have grown up with VR in their daily lives because the technology wasn’t advanced enough to really make a dent in their lives.

More than 75% of Generation Z has access to a smartphone, and they can truly be called the first generation of digital natives.

Avatars will push deeper into everyday life because the facial tracking technology has advanced by leaps and bounds.

Instead of cartoon-like avatars, lifelike avatars have replaced the less refined versions. It will be a tough time going forward distinguishing what is real and what is fake.

If you think fake news is a problem now, imagine how fake it will become in the future.

This could devastate the news industry as news organizations run the risk of melting down at any point, or just being completely taken over by tech companies and their algorithms, which is already happening now with Alphabet (GOOGL).

The future looks bleak for all newspaper assets, and the ones with the most advanced digital strategies will survive.

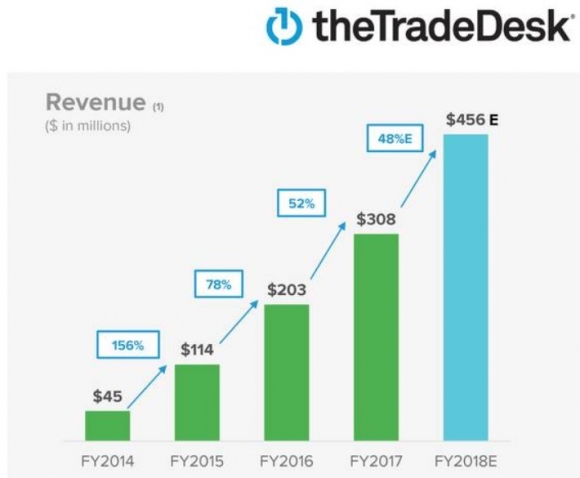

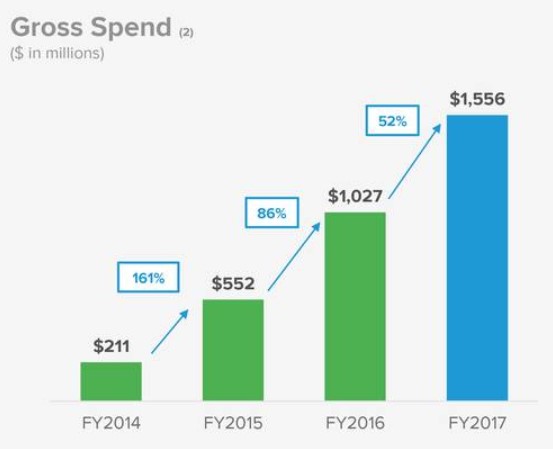

Newspapers only have so much time they can hang on with digital ad revenue, the reason they are still in business.

Viewers don’t want to see ads – period. And at some point, they will be disrupted as well.

Swashbuckling youth already have downloaded ad-blockers to completely remove ads from their lives, and refuse to open any website that forces them to white list a website.

There are children in Generation Z who might never have seen an ad before because their digital native capability allows them to navigate around ads with adept skill.

Or the easy solution for many Millennials is just watch Netflix because the platform is ad-less. The aversion to ads is so strong that traditional media giants such as Fox are experimenting with six-second ads because that is all a viewer can tolerate these days.

The traditional media giants were forced to adopt this new format after Alphabet’s YouTube rolled out micro-ads.

Popular browser Mozilla announced it will block all tracking scripts by default beginning in 2019, thwarting unregulated data collection and relentless ad pop-ups.

The reason why digital ads will have an existential crisis is because companies will be able to monetize the pure data, forcing companies with huge digital ad businesses such as Facebook (FB) to battle with the new competition that only wants your data and not hawk ads.

This is already happening in the e-brokerage space with disruptors such as Robinhood, which charges no commission and is more interested in collecting data and getting by with interest payment revenue.

Let’s face it, digital ads are not a high-quality business even though they are a high-margin business. As tech moves forward, the quality of tech will rise eliminating all low-grade tech that is still profiting in 2018.

On the business side of things, automation is replacing humans faster than humans realize, and the replacement will be an avatar representing the face of a company.

For lower-end services, an avatar chosen by the customer will populate to often give better service than a human can provide.

If this type of service is scaled, it would offer a massive cut in costs for American corporations saving on employee costs.

It will have the same effect that self-checkout kiosks have at supermarkets, wiping out another position at the low-end.

The front-end avatar that will service you is all possible because of the rapid advancement of artificial intelligence.

Every possible situation will be programmed in the software and executed briskly.

If customers desire the human touch, they will have to pay up.

Human interaction will command a premium price because human interaction cannot be automated.

The financial industry has a huge target on its back, and swaths of financial advisors could be sacked in favor of avatars with the functional software behind it to produce profits.

In fact, many financial advisors are instructed to refrain from recommendations now and urged to collect input to enter into a proprietary algorithm that will decide the customers’ portfolio.

Big banks have enjoyed their time in the sun, but technology will disrupt them in the near future. This is why you have seen huge run-ups in innovative fintech companies such as Square (SQ) and PayPal (PYPL).

Many forms of outside entertainment are on the chopping block, as well as indoor entertainment such as Hollywood.

Hollywood A-list actors command hefty premiums to contract their services, and that could all crumble if younger audiences prefer avatar-based films with the human roles performed by unknowns.

Johnny Depp earns more than $50 million for one movie, and these insane amounts could deflate rapidly if human participation in films becomes marginalized.

Ready Player One was a test case for how much technology could be infused into a movie, and the audience easily absorbed it.

I could argue that audiences could argue even more in this VR format.

The movie had a budget of $175 million, and returned $582 million at the box office.

The resounding success will encourage more directors to inject technology into their movies, and they will have to, if they hope to tempt younger audiences to the movie theater.

Going to the movie theater is another activity that has struggled to cope against the rise of Netflix and technology.

Theaters have been forced to improve the overall experience of watching a film with prime seating, comfortable seats, and other extras that never existed.

Every industry is going through the same headache of competing with technological disruption.

Stagnation is akin to surrendering in 2018.

And it wasn’t just a fringe director creating Ready Player One, it was visionary director Steven Spielberg, one of the most famous movie directors to ever exist.

This will pave the way for other lesser-known movie directors relying on technology to pump out the profits.

They wouldn’t be the first people or the first industry to go down this road either.

The Avatars Used In Ready Player One

________________________________________________________________________________________________

Quote of the Day

“The worst thing a kid can say about homework is that it is too hard. The worst thing a kid can say about a game is it's too easy,” – said American media scholar Henry Jenkins III.