After too long of an absence, Goldilocks has moved back in once again. She arrived with Santa Claus too, a month ahead of schedule.

Can life get any better than that, Goldilocks and Santa Claus?

Santa confused Thanksgiving with Christmas this year. I saw it coming a mile off, and it’s not because my failing eyesight has suddenly improved.

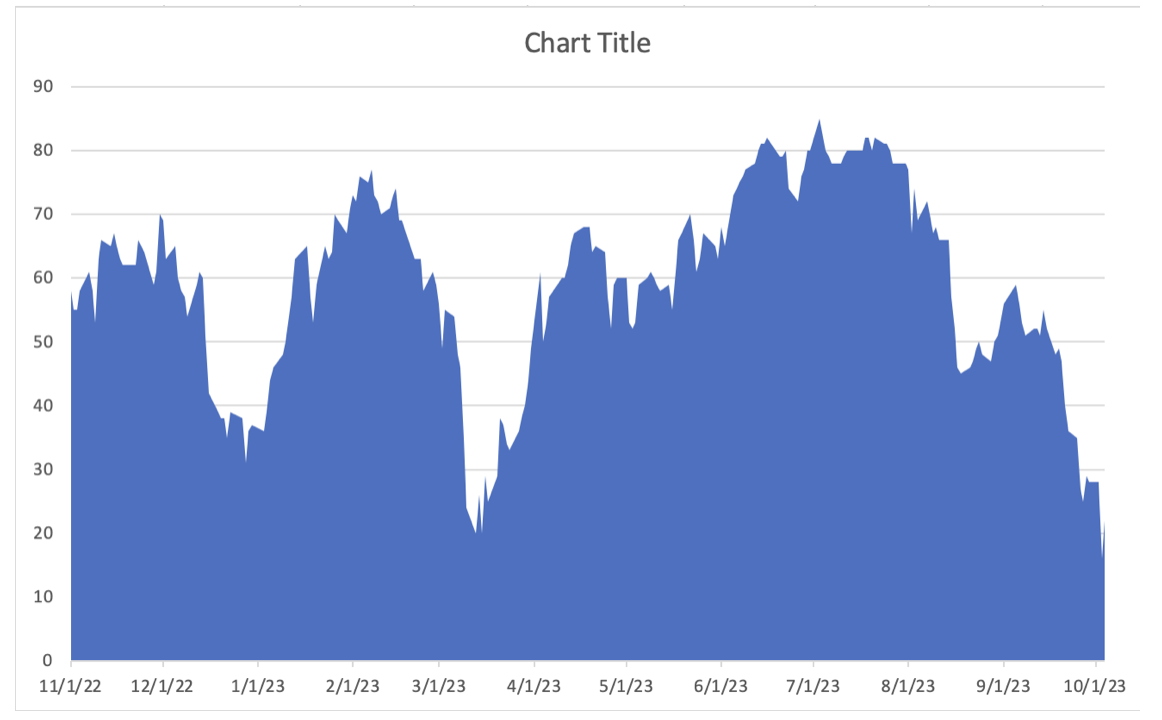

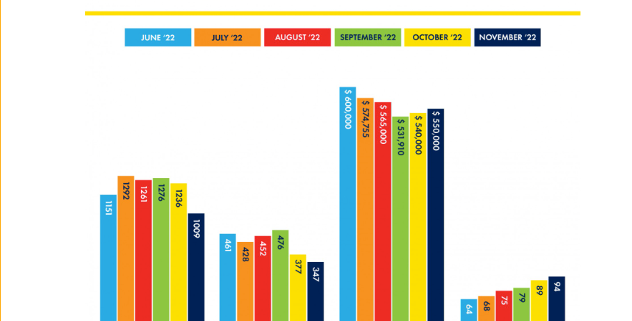

Since October 26, Mad Hedge followers have earned an impressive 25%. We are on track to top an 86.5% profit for 2023, the best in the 15-year history of the service.

Concierge members who own our substantial LEAPS portfolio, now at 33 names, are up much more.

I hate to boast but let me take my victory lap. I earned it.

Stocks and bonds should continue rising but at a much slower rate. More likely is the diversification of the rally from Big Tech and big bonds (TLT) to medium tech, commodities (FCX), industrials (CAT), junk bonds (JNK), (HYG), and REITS (NLY).

Buy everything on dips.

And here are your assumptions. Collapsing energy prices will lead the inflation rate down to the Fed’s well-publicized 2% inflation rate target in the coming months. Accelerating technology and AI will reign in this year’s runaway wage increases, if not reverse them.

The UAW’s 25% salary increase over four years will only hasten the demise of General Motors (GM), as well as their own. Interest rates have to take a swan dive, supercharging all risk assets.

Goldilocks is not moving in for a fling, but a long-term relationship. Your retirement funds will love it.

Last spring, with 75 feet of snow over the winter, the rivers pouring out of the High Sierras were at record levels. That brought the solo hobbyist gold miners out in force.

It is widely believed that the 1849 gold rush extracted only 10% of the gold in the mountains and the remaining 90% is still up there. Heavy rainfalls like we received last winter flushed out some of the rest.

Rounding a turn in the river, I spotted a group of modern-day 49ers equipped with shoulder-high waders and inner tubes floating pumps and sluice boxes. So I parked the car and waded out in the freezing, fast-running water to get an update on this market.

One man proudly showed off a one-ounce gold nugget that he had found only that morning worth about $1,800. Nuggets are worth more than spot gold because they attract a collector’s market.

A record eight-ounce nugget was discovered in a river near Merced the week earlier. This year, the state government in Sacramento issued a record number of gold mining licenses.

I explained to my newfound friend that he should hang on to his gold because it would be worth a lot more the following year. Inflation was falling and that would eventually induce the Federal Reserve to cut interest rates sharply.

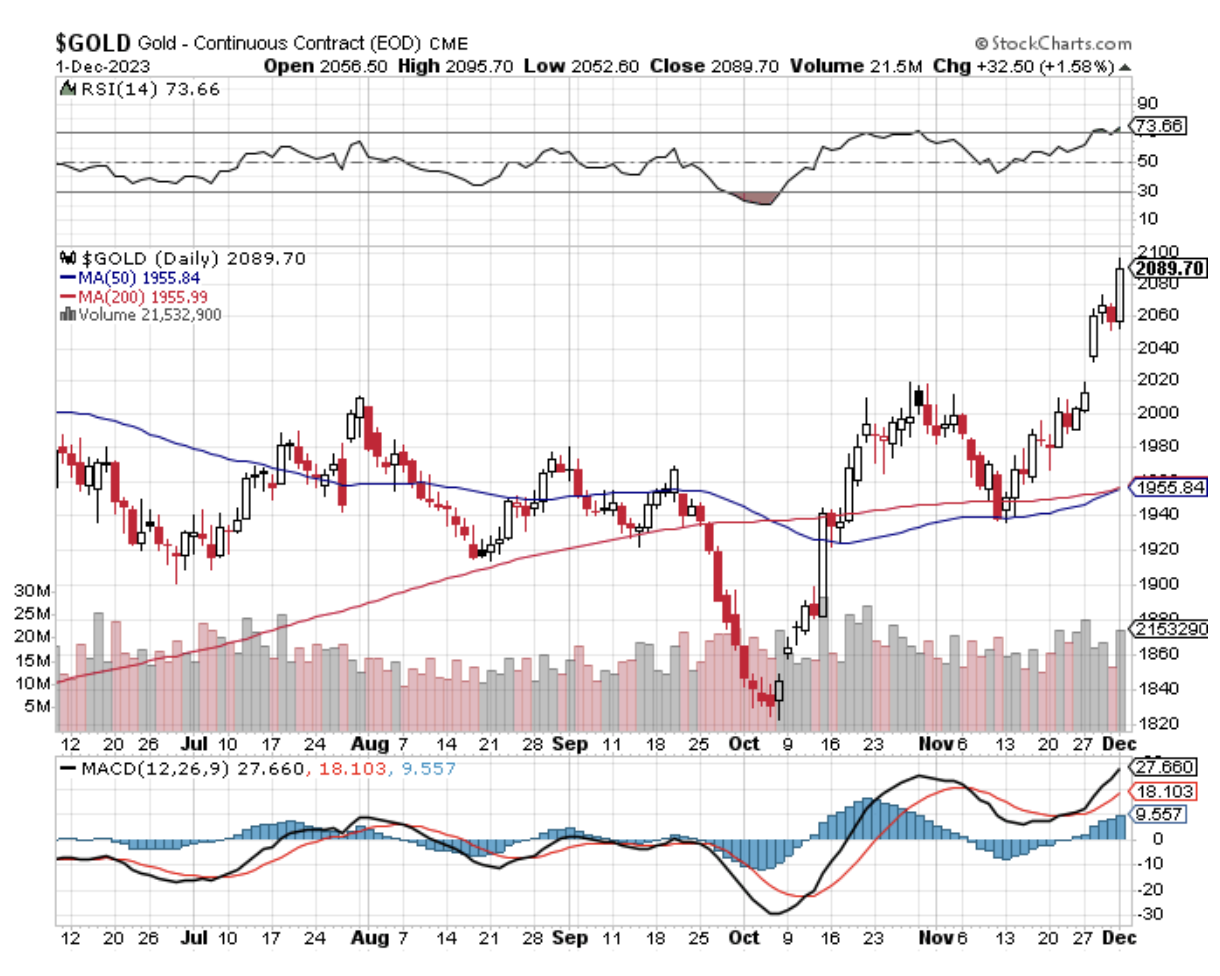

That meant less interest rate competition for gold and silver, which yielded nothing taking prices upward. Personally, I think this gold could hit $3,000 an ounce and silver $50 an ounce in 2025.

In addition, there was a constant bid from Russia, China, and North Korea looking to dodge financial sanctions. Money managers are also picking up the yellow metal as a hedge against any unanticipated volatility in 2024.

My friend looked at me quizzically, wondering if perhaps I was some kind of nutjob who had waded out mid-river to rob him of his prized nugget.

I’ll do anything to gain a trading edge, even freezing off my cajones.

It was a tough week for 90- and 100-year-olds with the passing of Charlie Munger, Henry Kissinger, and Supreme Court Justice Sandra Day O’Connor. I had the privilege of knowing all three.

I was in the White House Press Room one day when the press secretary James Brady asked if any of the press could ride a horse. Sheepishly, I was the only one to raise a hand.

I was ordered to pick up my riding boots and report to the White House Stables on 17th Street. I had no idea why. Back then, even the press didn’t ask some questions.

When I arrived, I understood why. Supreme Court Justice Sandra Day O’Connor was already there kitted out ready to ride. It turns out that the justice from Arizona rode weekly with Ronald Reagan. This week, an international crisis prevented the president from doing so. I was the fill-in escort.

We talked about growing up in the Colorado Desert, and pre-air conditioning, as we enjoyed a peaceful ride along the Potomac River. A security detail kept a safe distance.

A lot of history is being in the right place at the right time.

The clock is ticking.

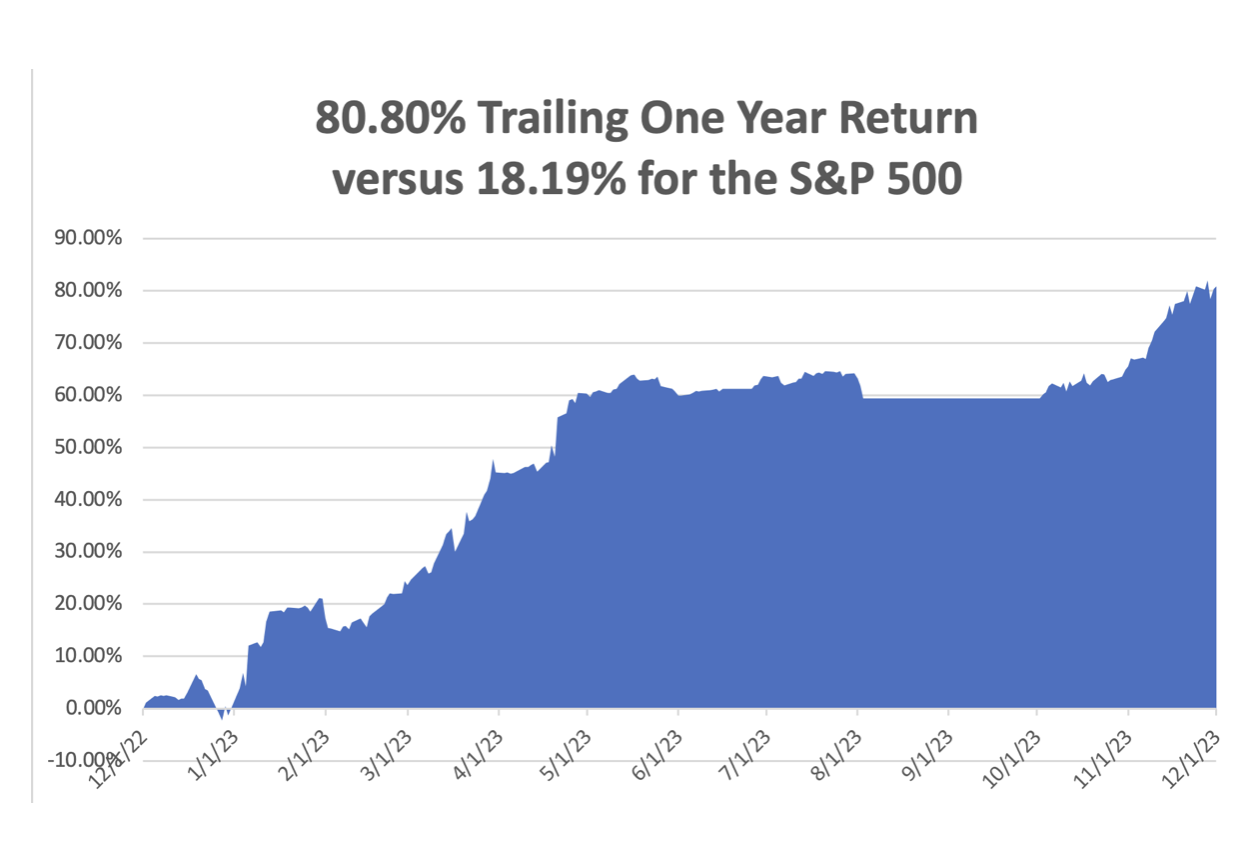

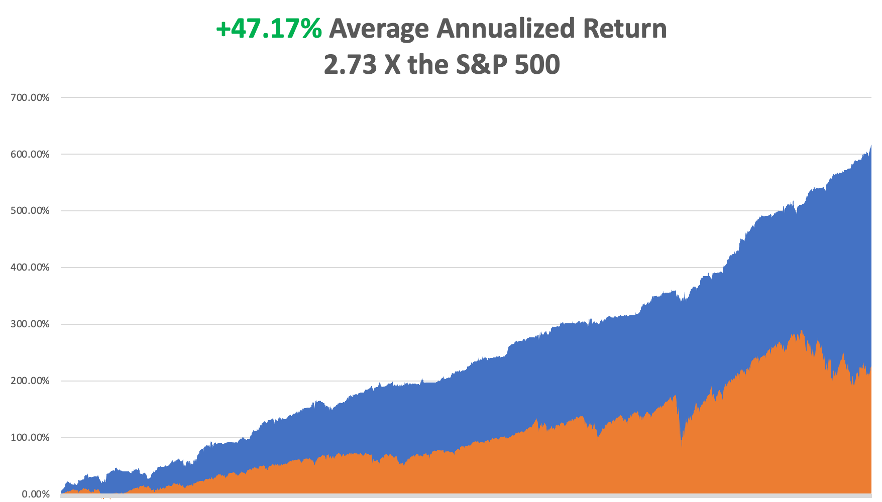

November closed out at +15.54%. My 2023 year-to-date performance is still at an eye-popping +81.71%. The S&P 500 (SPY) is up +19.73% so far in 2023. My trailing one-year return reached +80.80% versus +18.19% for the S&P 500.

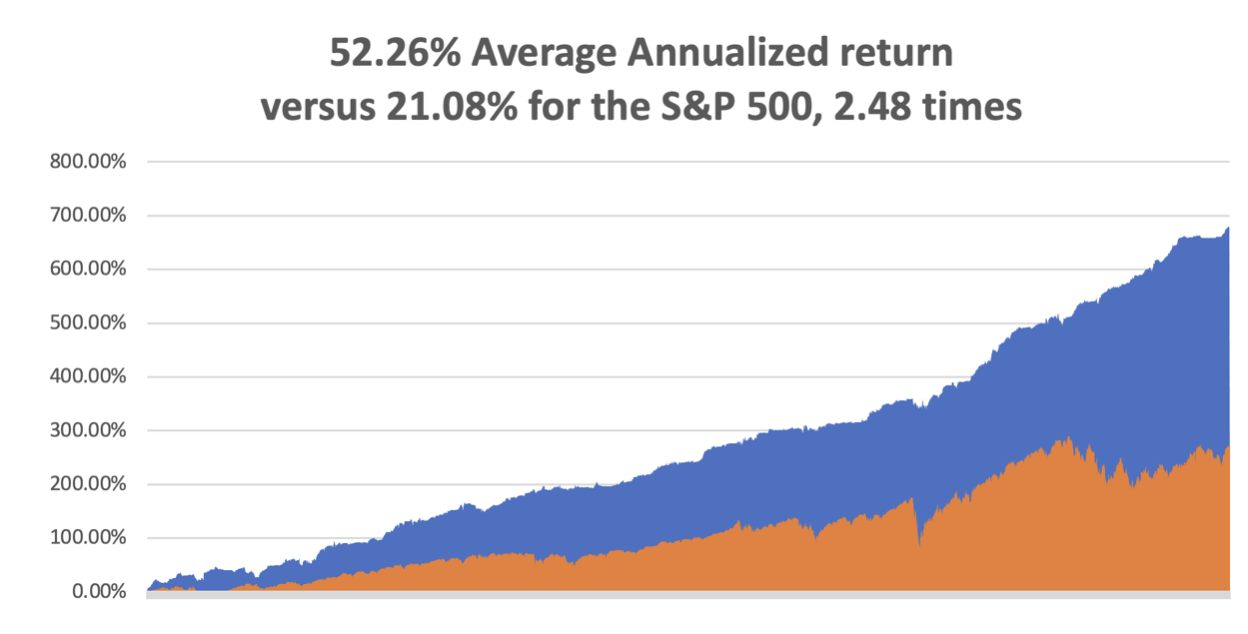

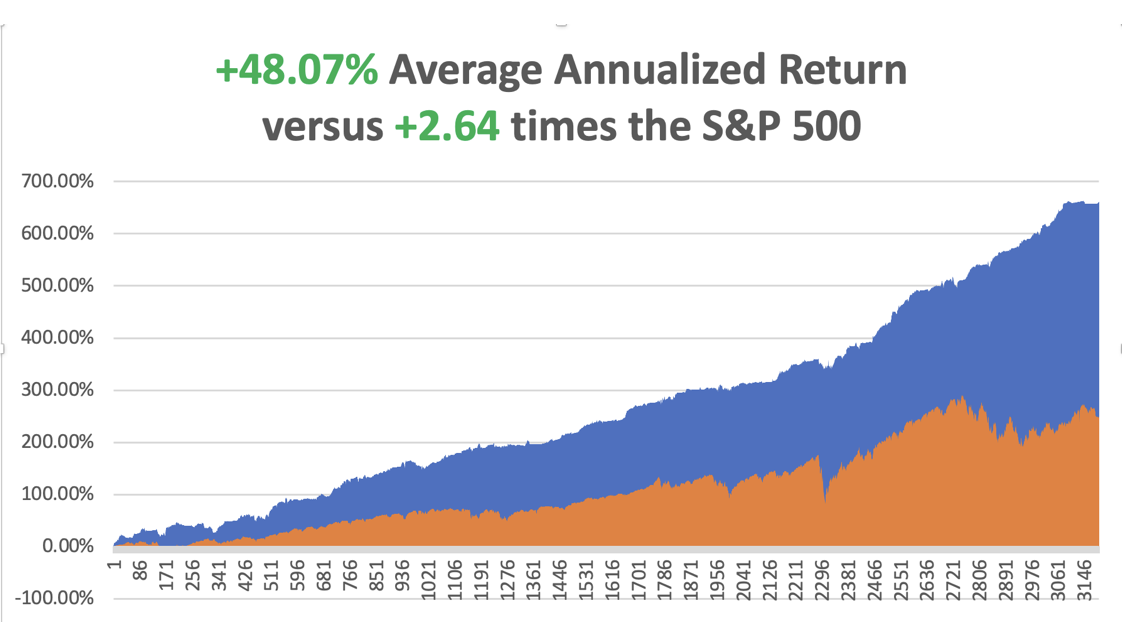

That brings my 15-year total return to +678.90%. My average annualized return has exploded to +52.26%, another new high, some 2.48 times the S&P 500 over the same period.

I am 90% fully invested, with longs in (MSFT), (NLY), (BRK/B), (CCJ), (GOOGL), (SNOW), (CAT), and (XOM). I have one short in the (TLT). I took profits on (CRM) on Friday.

Some 56 of my 61 trades this year have been profitable this year.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, December 4, at 8:30 AM EST, the US Factory Orders are out.

On Tuesday, December 5 at 2:30 PM, the JOLTS Job Openings Report is released.

On Wednesday, December 6 at 8:30 AM, the ADP Private Employment Report is published.

On Thursday, December 7 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, December 8 at 2:00 PM the Baker Hughes Rig Count is printed and at 2:30 PM, the November Nonfarm Payroll Report is published.

As for me, back in the early 1980s, when I was starting up Morgan Stanley’s international equity trading desk, my wife Kyoko was still a driven Japanese career woman.

Taking advantage of her near-perfect English, she landed a prestige job as the head of sales at New York’s Waldorf Astoria Hotel.

Every morning we set off on our different ways, me to Morgan Stanley’s HQ in the old General Motors Building on Avenue of the Americas and 47th street and she to the Waldorf at Park and 34th.

One day, she came home and told me this little old lady living in the Waldorf Towers needed an escort to walk her dog in the evenings once a week. Back in those days, the crime rate in New York was sky-high, and only the brave or the reckless ventured outside after dark.

I said “Sure” “What was her name?”

Jean MacArthur.

I said THE Jean MacArthur?

She answered “Yes.”

Jean MacArthur was the widow of General Douglas MacArthur, the WWII legend. He fought off the Japanese in the Philippines in 1941 and retreated to Australia in a dramatic night PT Boat escape.

He then led a brilliant island-hopping campaign, turning the Japanese at Guadalcanal and New Guinea. My dad was part of that operation, as were the fathers of many of my Australian clients. That led all the way to Tokyo Bay where MacArthur accepted the Japanese in 1945 on the deck of the battleship USS Missouri.

The MacArthur then moved into the Tokyo embassy where the general ran Japan as a personal fiefdom for seven years, a residence I know well. That’s when Jean, who was 18 years the general’s junior, developed a fondness for the Japanese people.

When the Korean War began in 1950, MacArthur took charge. His landing at Inchon Harbor broke the back of the invasion and was one of the most brilliant tactical moves in military history. When MacArthur was recalled by President Truman in 1952, he had not been home for 13 years.

So it was with some trepidation that I was introduced by my wife to Mrs. MacArthur in the lobby of the Waldorf Astoria. On the way out, we passed a large portrait of the general who seemed to disapprovingly stare down at me taking out his wife, so I was on my best behavior.

To some extent, I had spent my entire life preparing for this job.

I had stayed at the MacArthur Suite at the Manila Hotel where they had lived before the war. I knew Australia well. And I had just spent a decade living in Japan. By chance, I had also read the brilliant biography of MacArthur by William Manchester, American Caesar, which had only just come out.

I also competed in karate at the national level in Japan for ten years, which qualified me as a bodyguard. In other words, I was the perfect after-dark escort for Midtown Manhattan in the early eighties.

She insisted I call her “Jean”; she was one of the most gregarious women I have ever run into. She was grey-haired, petite, and made you feel like you were the most important person she had ever run into.

She talked a lot about “Doug” and I learned several personal anecdotes that never made it into the history books.

“Doug” was a staunch conservative who was nominated for president by the Republican party in 1944. But he pushed policies in Japan that would have qualified him as a raging liberal.

It was the Japanese that begged MacArthur to ban the army and the navy in the new constitution for they feared a return of the military after MacArthur left. Women gained the right to vote on the insistence of the English tutor for Emperor Hirohito’s children, an American Quaker woman. He was very pro-union in Japan. He also pushed through land reform that broke up the big estates and handed out land to the small farmers.

It was a vast understatement to say that I got more out of these walks than she did. While making our rounds, we ran into other celebrities who lived in the neighborhood who all knew Jean, such as Henry Kissinger, Ginger Rogers, and the UN Secretary-General.

Morgan Stanley eventually promoted me and transferred me to London to run the trading operations there, so my prolonged free history lesson came to an end.

Jean MacArthur stayed in the public eye and was a frequent commencement speaker at West Point where “Doug” had been a student and later the superintendent. Jean died in 2000 at the age of 101.

I sent a bouquet of lilies to the funeral.

Kyoko passed away in 2002.

In 2014, Chinas Anbang Insurance Group bought the Waldorf Astoria for $1.95 billion, making it the most expensive hotel ever sold. Most of the rooms were converted to condominiums and sold to Chinese looking to hide assets abroad.

The portrait of Douglas MacArthur is gone too. During the Korean War, he threatened to drop atomic bombs on China’s major coastal cities.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader