Mad Hedge Technology Letter

June 15, 2020

Fiat Lux

Featured Trade:

(DON’T TAKE YOUR EYES OFF BIG TECH SHARES),

(GOOGL), (AAPL), (MSFT), (NFLX), (FB), (AMZN), (IBM), (CSCO)

Mad Hedge Technology Letter

June 15, 2020

Fiat Lux

Featured Trade:

(DON’T TAKE YOUR EYES OFF BIG TECH SHARES),

(GOOGL), (AAPL), (MSFT), (NFLX), (FB), (AMZN), (IBM), (CSCO)

There is literally no possible scenario in a post-second-wave lockdown where the 7 tech stocks of Facebook, Google, Apple, Microsoft, Netflix, Facebook, and Amazon don’t shoot the lights out unless the world ceases to exist.

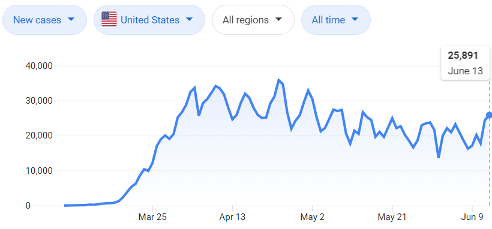

25,891 – that is the number of new coronavirus cases registered in the U.S. on June 13th, 2020 which is about in line with the recent near-term peaks of total daily U.S. coronavirus cases.

Why is this important?

Traders are calculating whether a “second wave” will possibly rear its ugly head to crush the frothy momentum in tech stocks.

That is where we are at now in the tech market.

Tech stocks could possibly ride another magnificent ride up in share appreciation if the reopening of the economy can kick into second gear.

Skeptics are sounding the alarms that this is not even the “second wave” and we still in the latter half of the first wave.

Consensus has it that this could be just a head fake.

The jitters are real with recent dive in tech shares.

The five biggest tech companies burned more than $269 billion in value last Thursday - the worst day for U.S. stocks since March and the 25th worst day in stock market history.

Nasdaq stocks ended the day largely 5% in the red with Microsoft shedding $80 billion in market cap in just one day.

Larger drops were led by IBM who lost 9% and Cisco who lost 8%.

It was a dreadful day at the office, to say the least.

We are teetering on a knife's edge and the tension is running high in the White House with Treasury Secretary Steven Mnuchin already announcing that the U.S. can’t afford another lockdown.

It’s not up to him in the end, it’s about how consumers will assess the confronted health risks.

Tech will undoubtedly be dragged down with the rest on the next lockdown sparing few survivors.

The housing market might actually go down as well as the initial push to the suburbs will dissipate and fresh forbearances will explode higher.

Consumers might not even have the cash to pay for their monthly Apple phone service or internet bill if the worst-case scenario manifests itself.

The health scare has already dented new software purchases by small and medium businesses (SMBs) and tech companies in industries such as travel, retail, and hospitality; online ad spending by the likes of automakers and online travel agencies; and smartphone, automotive and industrial chip purchases.

Small business has held off on reducing their tech software spending too much on the expectation that macro conditions will perform a V-shaped recovery.

Numerous tech firms have cited “demand stabilization,” but it’s not guaranteed to last if we revert to another lockdown.

If a lockdown happens again, it will be another referendum on Fed’s enormous liquidity impulses versus the drop in real earnings or flat out losses to tech business models.

Even with the media’s onslaught of vicious fearmongering campaigns, I do believe this is the time for long-term investors to scale into the best of tech such as Amazon, Apple, Google, Microsoft, Facebook, Netflix.

If you thought these 7 companies had anti-trust issues before, then look away.

We could gradually head into an economy where up to 40% of the public markets comprise of only 7 tech stocks which is at a mind-boggling 25% now.

Never waste a good crisis – tech is following through like no other sector!

Bonds don’t make money anymore and hiding out now means putting your life savings into these 7 premium tech stocks.

In the short-term, this is a good opportunity for a tactical bullish tech trade.

Global Market Comments

January 24, 2020

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE FRIDAY, FEBRUARY 7 PERTH, AUSTRALIA STRATEGY LUNCHEON)

(JANUARY 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(BA), (IBM), (DAL), (RCL), (WFC),

(JPM), (USO), (UNG), (KOL), (XLF),

(SEE YOU IN TWO WEEKS)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader January 22 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Are you concerned about a kitchen sink earnings report on Boeing (BA) next week?

A: No, every DAY has been a kitchen sink for Boeing for the past year! Everyone is expecting the worst, and I think we’re probably going to try to hold around the $300 level. You can’t imagine a company with more bad news than Boeing and it's actually acting as a serious drag on the entire economy since Boeing accounts for about 3% of US GDP. If (BA) doesn’t break $300, you should buy it with both hands as all the bad news will be priced in. That's why I am long Boeing.

Q: Do you think IBM is turning around with its latest earnings report?

A: They may be—They could have finally figured out the cloud, which they are only 20 years late getting into. They’ve been a lagging technology stock for years. If they can figure out the cloud, then they may have a future. They obviously poured a lot into AI but have been unable to make any money off of it. Lots of PR but no profits. People are looking for cheap stuff with the market this high and (IBM) certainly qualifies.

Q: Will the travel stocks like airlines and cruise companies get hurt by the coronavirus?

A: Absolutely, yes; and you’re seeing some pretty terrible stock performance in these companies, like Delta (DAL), the cruise companies like Royal Caribbean Cruises (RCL), and the transports, which have all suffered major hits.

Q: Will the Wells Fargo (WFC) shares ever rebound? They are the cheapest of the major banks.

A: Someday, but they still have major management problems to deal with, and it seems like they’re getting $100 million fines every other month. I would stay away. There are better fish to fry, even in this sector, like JP Morgan (JPM).

Q: Will a decrease in foreign direct investment hurt global growth this year?

A: For sure. The total CEO loss of confidence in the economy triggered by the trade war brought capital investment worldwide to a complete halt last year. That will likely continue this year and will keep economic growth slow. We’re right around a 2% level right now and will probably see lower this quarter once we get the next set of numbers. To see the stock market rise in the face of falling capital spending is nothing short of amazing.

Q: Do you think regulation is getting too cumbersome for corporations?

A: No, regulation is at a 20-year low for corporations, especially if you’re an oil (USO), gas (UNG) or coal producer (KOL), or in the financial industry (XLF). That’s one of the reasons that these stocks are rising as quickly as they have been. What follows a huge round of deregulation? A financial crisis, a crashing stock market, and a huge number of bankruptcies.

Global Market Comments

October 17, 2019

Fiat Lux

Featured Trade:

(UPDATING THE MAD HEDGE LONG TERM MODEL PORTFOLIO),

(USO), (XLV), (CI), (CELG), (BIIB), (AMGN), (CRSP), (IBM), (PYPL), (SQ), (JPM), (BAC), (EEM), (DXJ), (FCX), (GLD)

Global Market Comments

October 3, 2019

Fiat Lux

Featured Trade:

(GOOGLE’S MAJOR BREAKTHROUGH IN QUANTUM COMPUTING),

(GOOGL), (IBM)

(AI AND THE NEW HEALTHCARE),

(XLV), (BMY), (AMGN)

Global Market Comments

September 12, 2019

Fiat Lux

Featured Trade:

(WILL ANTITRUST DESTROY YOUR TECH PORTFOLIO?),

(FB), (AAPL), (AMZN), (GOOG), (SPOT), (IBM), (MSFT)

In recent days, two antitrust suits have arisen from both the Federal government and 49 states seeking to fine, or break up the big four tech companies, Facebook (FB), Apple (AAPL), Amazon (AMZN), and Google (GOOG). Let’s call them the “FAAGs.”

And here is the problem. These four companies make up the largest share of your retirement funds, whether you are invested with active managers, mutual funds, or simple index funds. The FAAGs dominate the landscape in every sense, accounting 13% of the S&P 500 and 33% of NASDAQ.

They are also the world’s most profitable large publicly listed companies with the best big company earnings growth.

I’ll list the antitrust concern individually for each company.

Facebook has been able to maintain its dominance in social media through buying up any potential competitors it thought might rise up to challenge it through a strategy of serial defense acquisitions

In 2012, it bought the photo-sharing application Instagram for a bargain $1 billion and built it into a wildly successful business. It then overpaid a staggering $19 billion for WhatsApp, the free internet phone and texting service that Mad Hedge Fund Trader uses while I travel. It bought Onovo, a mobile data analytics company, for pennies ($120 million) in 2013.

Facebook has bought over 70 companies in 15 years, and the smaller ones we never heard about. These were done largely to absorb large numbers of talented engineers, their nascent business shut down months after acquisition.

Facebook was fined $5 billion by the Fair Trade Commission (FTC) for data misuse and privacy abuses that were used to help elect Donald Trump in 2016.

Apple

Apple only has a 6% market share in the global smart phone business. Samsung sells nearly 50% more at 9%. So, no antitrust problem here.

The bone of contention with Apple is the App Store, which Steve Jobs created in 2008. The company insists that it has to maintain quality standards. No surprise then that Apple finds the products of many of its fiercest competitors inferior or fraudulent. Apple says nothing could be further from the truth and that it has to compete aggressively with third party apps in its own store. Spotify (SPOT) has already filed complaints in the US and Europe over this issue.

However, Apple is on solid ground here because it has nowhere near a dominant market share in the app business and gives away many of its own apps for free. But good luck trying to use these services with anything but Apple’s own browser, Safari.

It’s still a nonissue because services represent less than 15% of total Apple revenues and the App Store is a far smaller share than that.

Amazon

The big issue is whether Amazon unfairly directs its product searches towards its own products first and competitors second. Do a search for bulk baby diapers and you will reliably get “Mama Bears”, the output of a company that Amazon bought at a fire sale price in 2004. In fact, Amazon now has 170 in-house brands and is currently making a big push into designer apparel.

Here is the weakness in that argument. Keeping customers in-house is currently the business strategy of every large business in America. Go into any Costco and you’ll see an ever-larger portion of products from its own “Kirkland” branch (Kirkland, WA is where the company is headquartered).

Amazon has a market share of no more than 4% in any single product. It has the lowest price, and often the lowest quality offering. But it does deliver for free to its 100 million Prime members. In 2018, some 58% of sales were made from third-party sellers.

In the end, I believe that Amazon will be broken up, not through any government action, but because it has become too large to manage. I think that will happen when the company value doubles again to $2 trillion, or in about 3-5 years, especially if the company can obtain a rich premium by doing so.

Directed search is also the big deal here. And it really is a monopoly too, with some 92% of the global search. Its big breadwinner is advertising, where it has a still hefty 37% market share. Google also controls 75% of the world’s smart phones with its own Android operating software, another monopoly.

However, any antitrust argument falls apart because its search service is given away to the public for free, as is Android. Unless you are an advertiser, it is highly unlikely that you have ever paid Google a penny for a service that is worth thousands of dollars a year. I myself use Google ten hours a day for nothing but would pay at least that much.

The company has already survived one FTC investigation without penalty, while the European Union tagged it for $2.7 billion in 2017 and another $1.7 billion in 2019, a pittance of total revenues.

The Bottom Line

The stock market tells the whole story here, with FAAG share prices dropping a desultory 1%-2% for a single day on any antitrust development, and then bouncing back the next day.

Clearly, Google is at greatest risk here as it actually does have a monopoly. Perhaps this is why the stock has lagged the others this year. But you can count on whatever the outcome, the company will just design around it as have others in the past.

For start, there is no current law that makes what the FAAGs do illegal. The Sherman Antitrust Act, first written in 1898 and originally envisioned as a union-busting tool, never anticipated anticompetitive monopolies of free services. To apply this to free online services would be a wild stretch.

The current gridlocked congress is unlikely to pass any law of any kind. The earliest they can do so will be in 18 months. But the problems persist in that most congressmen fundamentally don’t understand what these companies do for a living. And even the companies themselves are uncertain about the future.

Even if they passed a law, it would be to regulate yesterday’s business model, not the next one. The FAAGs are evolving so fast that they are really beyond regulation. Artificial intelligence is hyper-accelerating that trend.

It all reminds me of the IBM antitrust case, which started in 1975, which my own mother worked on. It didn’t end until the early 1990s. The government’s beef then was Big Blue’s near-monopoly in mainframe computers. By the time the case ended, IBM had taken over the personal computer market. Legal experts refer to this case as the Justice Department’s Vietnam.

The same thing happened to Microsoft (MSFT) in the 1990s. After ten years, there was a settlement with no net benefit to the consumer. So, the track record of the government attempting to direct the course of technological development through litigation is not great, especially when the lawyers haven’t a clue about what the technology does.

There is also a big “not invented here” effect going on in these cases. It’s easy to sue companies based in other states. Of the 49 states taking action against big tech, California was absent. But California was in the forefront of litigation again for big tobacco (North Carolina), and the Big Three (Detroit).

And the European Community has been far ahead of the US in pursuing tech with assorted actions. Their sum total contribution to the development of technology was the mouse (Sweden) and the World Wide Web (Tim Berners Lee working for CERN in Geneva).

So, I think your investments in FAAGs are safe. No need to start eyeing the nearest McDonald’s for your retirement job yet. Personally, I think the value of the FAAGs will double in five years, as they have over the last five years, recession or not.

Global Market Comments

July 19, 2019

Fiat Lux

Featured Trade:

(DON’T MISS THE JULY 24 GLOBAL STRATEGY WEBINAR)

(WHAT’S HAPPENED TO APPLE?), (AAPL)

(STORAGE WARS)

(MSFT), (IBM), (CSCO), (SWCH)

Mad Hedge Technology Letter

April 8, 2019

Fiat Lux

Featured Trade:

(THE BATTLE FOR COFFEE IN CHINA)

(SBUX), (MSFT), (AAPL), (IBM)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.