Mad Hedge Technology Letter

October 31, 2018

Fiat Lux

Featured Trade:

(IBM’S PUTS ON A RED HAT)

(RHT), (IBM), (AMZN), (MSFT), (GOOGL), (ORCL)

Mad Hedge Technology Letter

October 31, 2018

Fiat Lux

Featured Trade:

(IBM’S PUTS ON A RED HAT)

(RHT), (IBM), (AMZN), (MSFT), (GOOGL), (ORCL)

What took you so long, Ginni?

That was my first reaction when I heard International Business Machines Corporation (IBM) was making a big strategic shift by purchasing open source cloud company Red Hat (RHT) in a landmark $34 billion deal.

Ginni Rometty, IBM’s CEO since 2012, has presided over persistent negative sales growth and has done zilch for investors to conjure up some type of lasting hope for this company.

Not only has Rometty failed to grow the top line, but with an underwhelming 3-year EPS growth rate of -2%, the execution and performance haven’t been there as well.

Somehow and someway, she has maintained an iron-clad grip on her job at the helm of IBM and her legacy at IBM will be wholly determined by the failure or success of this Red Hat acquisition.

IBM shares sold off on the news as shareholders digested this bombshell.

Rometty took a hatchet to share buybacks and suspended them for 2020 and 2021 alienating a segment of their loyal shareholder base.

I can tell you one thing about this move – it smells of desperation and it won’t vault IBM into the conversation of Amazon (AMZN) Web Services or the Microsoft (MSFT) Azure.

The biggest winner of this deal is Red Hat’s CEO Jim Whitehurst who has been dangling the company for sale for a while.

Alphabet (GOOGL) was in the mix and had the opportunity to snag a last-second deal, but it never came to fruition.

The 63% premium IBM must pay for a company who only grew quarterly sales 14% YOY and quarterly EPS by 10% is expensive, but that is where we are with IBM.

Clearly overpaying was better than doing nothing at all.

IBM continues to hemorrhage sales and stopping the blood flow is the first step.

Rometty was responsible for the utter failure of artificial intelligence initiative Watson whose terrible management was a key reason for its implosion.

Analyzing this historic company gave me insight into the pitiful causing me to write a bearish story on IBM last month. To read that story, please click here.

Not only was the agreed price exorbitant, but Red Hat’s stock was trending south even before the interest rate induced sell-off rocked the tech sector of late.

Red Hat missed on sales revenue forecasts and offered weak guidance.

It could be the case that Whitehurst was actively seeking a buyer because he felt that Red Hat would go ex-growth in the next few years.

Red Hat was rumored to be on the market for quite a while looking to fetch a premium price for a company starting to stagnate with its visions of grandeur growth.

Rometty’s career-defining moment is high-risk and high-reward and is born out of being cornered by leading tech companies leaving IBM in their dust.

The deal finally allows IBM to return back to sales growth which will occur two years later, and Rometty will finally have that monkey off her back for now.

But the bigger question is will Rometty still have her job in two years if this experiment becomes toxic.

My guess is that Red Hat CEO Jim Whitehurst is automatically the next in line for the IBM throne if Rometty missteps, and piling on pressure will force IBM to evolve or die out.

And even though they will return back to growth, 2% growth is no reason to do cartwheels over.

The real work starts now and it will take years to turn around this dinosaur.

On the brighter side, the massive deals instantly improve sentiment that was flagging for years and puts IBM back on the map.

The synergies between IBM and Red Hat could be robust.

Red Hat can surely help IBM become a higher-quality hybrid cloud solutions company.

Models like this are the industry standard as luring a company into your cloud is one thing, but being able to cross-sell a plethora of extra add-on software services in the cloud is the necessary path to raising profitability.

IBM also inherits a slew of talented software engineers that it can mobilize for innovative cloud products. Red Hat’s products such as JBoss middleware and the OpenShift software for deploying applications in virtual containers could make IBM’s hybrid cloud more appealing and could help retain customers with the additional offerings.

Doubling down on the software side of the business was a strategy I pinpointed at the Mad Hedge Lake Tahoe conference and deals like this highlight the value of this type of assets.

There is a hoard of legacy tech companies like Oracle (ORCL) that is in dire need of such strategic injections and fresh ideas.

This won’t be the last deal of 2018, other cloud deals could shortly follow.

On the other side of the coin, hardware deals have turned rotten quickly with stark examples such as Hewlett-Packard’s (HPQ) $25 billion acquisition of Compaq, Microsoft’s $7.2 billion disastrous buy of Nokia’s mobile handset business and Google’s unimpressive $12.5 billion deal for Motorola Mobility that they later unloaded to Chinese PC company Lenovo.

Investors must be patient if IBM has any chance of completing this turnaround.

Listening to Rometty talk about this deal clearly reveals that she is hyping it up for something way bigger than it actually is.

Let’s not forget that Rometty’s tenure as CEO began in 2012 when IBM shares were trading north of $200 and she has presided over the company while the stock got pulverized by almost 30%.

It pains me that she is the one given the chance to turn the company around after years of underperformance.

Let’s not forget that at the end of 2017, IBM only had a 1.9% share of the cloud infrastructure, about 25 times smaller than Amazon Web Services.

The costly nature of the deal could also put a dent into IBM’s dividend, alienating another swath of its hardcore shareholder base.

Historically, IBM has had minimal success with transformative M&A and the industry competitors dominating IBM magnify the poor management performance headed by Rometty.

Rometty declaring that this deal means IBM will be “no. 1 in hybrid cloud” is overly optimistic, but this is a move in the right direction and could keep IBM spiralling out of control.

A return to sales growth might help stem the bleeding of its downtrodden share price, but Amazon and Microsoft are too far ahead to catch.

Investors will need to wait and see if the synergies between IBM’s and Red Hat’s products are meaningful or not.

Mad Hedge Technology Letter

September 19, 2018

Fiat Lux

Featured Trade:

(IBM’S SELF DESTRUCT),

(IBM), (BIDU), (BABA), (AAPL), (INTC), (AMD), (AMZN), (MSFT), (ORCL)

International Business Machines Corporation (IBM) shares do not need the squeeze of a contentious trade war to dent its share price.

It is doing it all by itself.

Stories have been rife over the past few years of shrinking revenue in China.

And that was during the golden years of China when American tech ran riot on the mainland before the dynamic rise of Baidu (BIDU), Alibaba (BABA), and Tencent, otherwise known as the BATs.

Then the Oracle of Omaha Warren Buffett drove a stake through the heart of IBM shares earlier this year by announcing he was fed up with the company’s direction and dumped a 35-year position.

Buffett unloaded all of his shares in favor of putting down an additional 75 million shares in Apple (AAPL) in the first quarter of 2018.

Topping off his Apple position now sees Buffett owning a mammoth 165.3 million total shares in the resurgent tech company.

Buffett’s shrewd decision has been rewarded, and Apple’s stock has rocketed more than 20% since he jovially declared his purchase in May.

IBM has been a rare misstep for Buffett, who took a moderate loss on his IBM position disclosing an average cost basis of $170 on 64 million shares that Berkshire bought in 2011.

IBM has flatlined since that Buffett interview, and slid around 25% since its peak in mid-2014.

IBM is grappling with the same conundrum most legacy companies deal with – top line contraction.

In 2014, IBM registered a tad under $93 billion in annual revenue, and followed up the next three years with even lower revenue.

A horrible recipe for success to say the least.

In an era of turbo-charged tech companies whose value now comprise over a quarter of the S&P, IBM has really fluffed its lines.

IBM’s prospects have been stapled to the PC market for years.

A recent JP Morgan note revealed the PC market could contract by 5% to 7% in the fourth quarter because of CPU shortages from Intel (INTC).

The report’s timing couldn’t have been worse for IBM.

The PC industry has been tanking for the past six consecutive years unable to shirk shrinking volume.

Intel is another company I have been lukewarm on lately because it is being outmaneuvered by chip competitor Advanced Micro Devices (AMD).

Even worse, this year has been a bad one for Intel’s management, which saw former CEO Brian Krzanich resign for sleeping with a coworker.

The poor management has had a spillover effect with Intel needing to delay new product launches as well.

To read more about my timely recommendation to pile into AMD in mid-August at $19, please click here.

Meanwhile, AMD shares have gone parabolic and surpassed an intraday price of $34 recently.

Investors should ask themselves, why invest in IBM when there are so many other tech companies that are growing, and growing revenue by 20% or more per year?

If IBM does manage to eke out top line growth in 2018, it will be by 1% to 2%, similar to Oracle’s recent performance.

Unsurprisingly, the price action of Oracle (ORCL) for the past year has been flatter than a bicycle ride around Beijing.

Live by the sword and die by the sword.

Thus, the Mad Hedge Technology Letter has been ushering readers into high-performance stocks that will bring technological and societal changes.

If you put a gun to my head and forced me to give sage investment advice, then the answer would be straightforward.

Buy Amazon (AMZN) and Microsoft (MSFT) on the dip and every dip.

This is a way to print money as if you had a rich uncle writing you checks every month.

Legacy tech is another story.

The IBMs and the Oracles of the world are bringing up the tech sector’s rear.

To add insult to injury, the lion’s share of IBM’s revenue is carved out from abroad, and the recent surge in the dollar is not doing IBM any favors.

IBM’s Watson initiative was billed as the savior for Big Blue.

The artificial intelligence initiative would integrate health care data into an actionable app.

The expectations were high hoping this division would drag up IBM from its long period of malaise.

IBM bet big on this division ploughing more than $15 billion into it from 2010-2015, predicting this would be the beginning of a new renaissance for the historic American company.

This game changing move fell on deaf ears and has been a massive bust.

IBM swallowed up three companies to ramp up this shift into the AI world - Phytel, Explorys, and Truven.

The treasure trove of health care data and proprietary analytics systems these companies came with were what this division needed to turn the corner.

These three companies were strong before the buy out and engineers were upbeat hoping Watson would elevate these companies to another level.

Wistfully, IBM Management led by CEO Ginni Rometty grossly mishandled Watson’s execution.

Phytel boasted 160 engineers at the time of IBM’s purchase and confusingly slashed half the workforce earlier this year.

Engineers at the firm even lamented that now, even smaller firms were “eating them alive.”

Unimpressed with the direction of the artificial intelligence division at IBM, many of these three companies’ best and brightest engineers jumped ship.

The inability for IBM to integrate Watson reared its ugly head in plain daylight when MD Anderson Cancer Center in Texas halted its Watson project after draining $62 million.

This was one of many errors that Watson AI accrued.

The failure to quicken clinical decision-making to match patients to clinical trials was an example of how futile IBM had become.

In short, a spectacular breakdown in execution mixed with an abrupt brain drain of AI engineers quickly imploded the prospect of Watson ever succeeding.

In 2013, IBM confidently boasted that Watson would be its “first killer app” in health care.

Internal leaks shined a brighter light on IBM’s subpar management skills.

One engineer described IBM’s management as having “no idea” what they were doing.

Another engineer said they were uncertain of a “road map” and “pivoted many times.”

Phytel, an industry leader at the time focusing on population health management, was bleeding money.

The engineers explained further, chiming in that IBM’s management had zero technical experience that led management wanting to create products that were “simply impossible.”

Not only were these products impossible, but they in no way took advantage of the resources these three companies had at their disposal.

Do you still want to invest in IBM?

Fast forward to today.

IBM is being sued in federal court with the plaintiff’s, former employees at the firm, claiming the company unfairly discriminated against elderly employees, firing them because of their age.

The documents submitted by the plaintiff’s state that “IBM has laid off 20,000 employees who were over the age of 40” since 2012.

This prototypical legacy company has more problems than the eye can see in every nook and cranny of the company.

If you have IBM shares now, dump them as soon as you can and run for cover.

It’s a miracle that IBM shares have eked out a paltry gain this year. And this thesis is constant with one of my overarching themes – stay away from all legacy tech firms with no cutting-edge proprietary technologies and stagnating growth.

________________________________________________________________________________________________

Quote of the Day

“Some say Google is God. Others say Google is Satan. But if they think Google is too powerful, remember that with search engines unlike other companies, all it takes is a single click to go to another search engine,” said Alphabet cofounder Sergey Brin.

Mad Hedge Technology Letter

September 12, 2018

Fiat Lux

Featured Trade:

(HOW TO PLAY “SOFTWARE AS A SERVICE”),

(AMZN), (IBM), (ADBE), (CRM), (BABA), (CSCO), (SAP), (ORCL), (GOOGL)

If you have read any of our content in the first year of the Mad Hedge Technology Letter, the content is distinctly bullish technology stocks.

A fundamental driver propelling this cogent argument is the dominant Software-as-a-Service (SaaS) industry booming inside the confines of Silicon Valley.

If you want to boil down your tech investment thesis to one indispensable rule – only invest in tech companies that carve out prominent SaaS businesses.

If you stick with this nostrum, you will be delivered profits in spades.

We have recently taken in a swarm of new tech letter subscribers and understanding the panacea that is SaaS will entrench your portfolio in a glorious position to reap untold profits.

What is SaaS?

SaaS is a distribution method in which software is diffused to paid subscribers, usually on an annual, reoccurring payment plan, and the software is remotely stored on a centralized cloud platform awaiting use.

Unsurprisingly, SaaS remains the most lucrative segment of the cloud market.

In 2017, the tech industry did $60.2 billion in annual SaaS sales, that number is poised to explode to $117.1 billion in 2021.

The near doubling of sales underscores the robust nature of these tech firms setting up businesses of this ilk, and the positive effects dripping down to the bottom line.

Simply put, no SaaS business, no reason to invest.

SaaS isn’t the only cloud revenue companies can carve out. Tech firms also offer platform-as-a-service (PaaS) and infrastructure-as-a-service (IaaS).

However, SaaS is by far the prominent growth lever in the high-margin cloud industry.

The indomitable presence inside the SaaS industry is Bill Gates’ creation Microsoft (MSFT).

Microsoft leads all companies with a 17% global share of the SaaS market.

The Redmond, Washington, outfit blew past stalwart Salesforce (CRM) nine quarters ago.

Microsoft’s sizzling SaaS business is an oversized contributor to its 45% revenue growth rate, which is head-and-shoulders above the industry average.

Salesforce (CRM), Adobe (ADBE), Oracle (ORCL) and SAP (SAP) fill out the top five largest global SaaS businesses, but it is really a tale of two stories.

Oracle and SAP, which are competing in the same market, are grappling with legacy database businesses and legacy tech, which are punished by investors.

John Dinsdale, a chief analyst at Synergy Research Group, mentioned two outliers of “Cisco (CSCO) and Google too who are making ever-bigger inroads into the SaaS market” leveraging Cisco’s multitude of software assets and Google’s G Suite.

The thing that makes SaaS the x-factor for tech companies is that inevitably every company from every walk of life will adopt this mode of software, giving legs to this distribution model.

Vendors are scrambling to put together some resemblance of a SaaS product together, and this trend is a vital contributor to an industry that is growing 32% YOY worldwide.

Kevin Cochrane, chief marketing officer of SAP Customer Experience lay bare his thoughts about this type of service describing it as the “Golden Age of SaaS.”

Companies are becoming digital first from end to end, explaining the sharp rise in IT professional salaries and rise in quality software products.

As we look around the corner to the IaaS part of the cloud industry, which is growing at around 30% YOY, there is one dominant player, and everybody knows its name.

Amazon (AMZN) is the No. 1 vendor with Microsoft, Alibaba (BABA), Google, and International Business Machines Corporation (IBM) trailing behind.

The top four IaaS players have carved out a total of 73% of the global market ravaging any resemblance of competition.

Amazon is the industry standard with the best record of customer success.

If Amazon branched off into the SaaS industry, it could unlock an additional $100 billion in annual revenue.

A shift into this direction could pad Amazon’s margin’s even more after successfully boosting North American e-commerce margins from 2.4% to 4.7%.

It’s not entirely inconceivable that Amazon could break the $2 trillion valuation in three to five years, as its revved up digital ad business registered growth of 129% YOY last quarter.

Microsoft seized the runner-up position in the IaaS market to Amazon by growing 98% YOY with sales eclipsing $3.1 billion in 2017.

Wherever you turn, whether toward the cloud business or gaming, investors can find Microsoft making sales.

Microsoft has been a favorite of the Mad Hedge Technology Letter and it’s hard pressed to find a better public tech company in operation now.

The SaaS industry is not a one-size-fits-all proposition.

Thus, there is abundant room for niche offerings that quench companies’ demand for specific services.

This is the reason why cloud companies have participated in a non-stop buying binge of smaller companies that fit their needs.

Microsoft purchased developer favorite GitHub for $7.5 billion earlier this year, and similar examples are scattered all over the tech ecosphere.

Artificial Intelligence (AI) will be the kicker that powers SaaS performance to new heights because incorporating this groundbreaking technology will enhance functionality and, in return, raise profits for all involved.

The scalability of SaaS products has allowed companies to offer software for affordable prices allowing the smallest of firms to adopt a digital-first strategy.

This software connects with other software seamlessly integrating an array of productive apps that help teams overperform and overdeliver.

In the American workplace, 73% of companies will be exclusively using SaaS to function by 2020.

American companies are using 16 apps on average per day, a 33% jump in the number of apps they were using just two years ago.

The migration to mobile has swallowed up SaaS products as well with more mobile-specific software rolling out to mobile devices.

The meteoric rise of SaaS offerings has cut IT security budgets substantially as security has been delegated to the cloud instead of in expensive in-house security teams.

No longer do tech firms need to beef up guarding their own gates.

Protection is provided on a centralized cloud with a third-party company ensuring safety.

This development has helped a new industry rise – cloud security.

Whether people realize it or not, the SaaS industry is here to stay and will become more prevalent in every industry going forward.

This is incredibly bullish for companies that sell SaaS products as revenue will continue to rise.

________________________________________________________________________________________________

Quote of the Day

“Growth and comfort do not coexist,” – said CEO of IBM Ginni Rometty.

Global Market Comments

August 23, 2018

Fiat Lux

Featured Trade:

(WHY THE DOW IS GOING TO 120,000),

(X), (IBM), (GM), (MSFT), (INTC), (DELL),

($INDU), (NFLX), (AMZN), (AAPL), (GOOGL),

(THE MAD HEDGE CONCIERGE SERVICE HAS AN OPENING),

(TESTIMONIAL)

For years, I have been predicting that a new Golden Age was setting up for America, a repeat of the Roaring Twenties. The response I received was that I was a permabull, a nut job, or a conman simply trying to sell more newsletters.

Now some strategists are finally starting to agree with me. They too are recognizing that a ganging up of three generations of investment preferences will combine to drive markets higher during the 2020s, much higher.

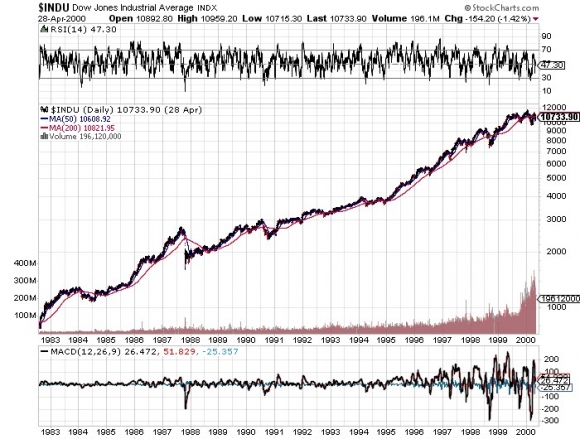

How high are we talking? How about a Dow Average of 120,000 by 2030, up another 465% from here? That is a 20-fold gain from the March 2009 bottom.

It’s all about demographics, which are creating an epic structural shortage of stocks. I’m talking about the 80 million Baby Boomers, 65 million from Generation X, and now 85 million Millennials. Add the three generations together and you end up with a staggering 230 million investors chasing stocks, the most in history, perhaps by a factor of two.

Oh, and by the way, the number of shares out there to buy is actually shrinking, thanks to a record $1 trillion in corporate stock buybacks.

I’m not talking pie in the sky stuff here. Such ballistic moves have happened many times in history. And I am not talking about the 17th century tulip bubble. They have happened in my lifetime. From August 1982 until April 2000 the Dow Average rose, you guessed it, exactly 20 times, from 600 to 12,000, when the Dotcom bubble popped.

What have the Millennials been buying? I know many, like my kids, their friends, and the many new Millennials who have recently been subscribing to the Diary of a Mad Hedge Fund Trader. Yes, it seems you can learn new tricks from an old dog. But they are a different kind of investor.

Like all of us, they buy companies they know, work for, and are comfortable with. During my Dad’s generation that meant loading your portfolio with U.S. Steel (X), IBM (IBM), and General Motors (GM).

For my generation that meant buying Microsoft (MSFT), Intel (INTC), and Dell Computer (DELL).

For Millennials that means focusing on Netflix (NFLX), Amazon (AMZN), Apple (AAPL), and Alphabet (GOOGL).

That’s why these four stocks account for some 40% of this year’s 7% gain. Oh yes, and they bought a few Bitcoin along the way too, to their eternal grief.

There is one catch to this hyper-bullish scenario. Somewhere on the way to the next market apex at Dow 120,000 in 2030 we need to squeeze in a recession. That is increasingly becoming a topic of market discussion.

The consensus now is that an impending inverted yield curve will force a recession sometime between August 2019 to August 2020. Throwing fat on the fire will be a one-time only tax break and deficit spending that burns out sometime in 2019. These will be a major factor in U.S. corporate earnings growth dramatically slowing down from 26% today to 5% next year.

Bear markets in stocks historically precede recessions by an average of seven months so that puts the next peak in top prices taking place between February 2019 to February 2020.

When I get a better read on precise dates and market levels, you’ll be the first to know.

To read my full research piece on the topic please click here to read “Get Ready for the Coming Golden Age.”

Mad Hedge Technology Letter

July 17, 2018

Fiat Lux

Featured Trade:

(THE PATH AHEAD),

(IBM), (AMZN), (FB), (MSFT), (NFLX), (QQQ), (AAPL), (DBX), (BLK)

The Red Sea has parted, and the path has opened up.

Technology has been a beacon of light providing comfort to the equity market, when a trade war could have purged the living daylights out of bullish investor sentiment.

If an increasingly hostile, tit-for-tat trade skirmish threatening overseas revenue can't bring tech equities to its knees, what can?

It seems the more bellicose the administration becomes, the higher technology stocks balloon.

Does this all add up?

The Nasdaq (QQQ) continues its processional march skyward. If you were a portfolio manager at the beginning of the year without technology exposure, then polish off the resume before it picks up too much dust.

The Nasdaq has set all-time highs even after a brutal 700-point sell-off at the end of January.

Apple (AAPL), Microsoft (MSFT), Netflix (NFLX), and Amazon (AMZN) can take credit for 83% of the S&P 500's gains in 2018.

And that fearsome four does not even include Facebook (FB), which has left the shorts in the dust.

Each momentous sell-off has proved to be a golden buying opportunity, propelling tech stocks to higher highs and retracing to higher lows.

And now the path to tech profits is gaping wide, luring in the marginal investor after two highly bullish events for the tech world boding well for the rest of fiscal year 2018.

Xiaomi, one of China's precious unicorns, which sells upmarket smartphones, went public on the Hong Kong Hang Seng market last week.

The timing couldn't be poorer.

The rhetoric between the two global leaders reached fever pitch with the administration proposing $200 billion worth of tariffs levied on Chinese imports.

China reiterated its entrenched stance of not backing down, triggering a tense war of words between the two global powers.

The beginning of March saw the Shanghai stock market nosedive through any remnants of support levels.

The 50-day moving average, 100-day, and 200-day were smashed to bits and Shanghai kept trending lower.

The trade skirmish has had the reverse effect on Chinese equities compared to the Nasdaq's brilliance, and combined with the strong dollar, has seen emerging markets hammered like the Croatian soccer team in Moscow.

Xiaomi's IPO was priced in the range of HK$17 to $22, and when it opened up on the first day at HK$16.60, investors were holding their breath.

Take the recent IPO triumph of cloud company Dropbox (DBX), whose IPO was priced in the expected range of US$18 to $20. The first day of trading showed how much appetite there is for to- quality cloud companies, with Dropbox starting its trading day at US$29, 40% higher than the expected range.

Dropbox finished its first day at a lofty US$28.48, a nice 35% return in one trading day.

No doubt Xiaomi's shares were not expected to perform like Dropbox, but it held its own.

Astonishingly, this company did not even exist nine years ago and is now the fourth-largest smartphone manufacturer in the world, grossing $18 billion in revenue in 2017.

The unimaginable pace of development highlights the speed at which the Chinese economy and consumer zigs and zags.

Chinese retail sales were up a staggering 9% YOY for the month of June 2018. Its overall economy met its 6.7% target for the second quarter of 2018.

The price range settled for the IPO gave Xiaomi a valuation of $54 billion.

Instead of getting roiled, Xiaomi came through with flying colors posting a 26% gain after the first week of trading.

Poor price action could have given Beijing ammunition to cry foul, laying blame for the underperformance on the U.S. tariffs.

The healthy price action underscores there is still room for Chinese and American companies to flourish in 2018, albeit through a highly politicized environment.

Specifically, Apple comes through unscathed as a disastrous Xiaomi IPO could have resulted in negative local press stoking higher operational risks in greater China.

Apple is in the eye of the storm, but untouchable because it employs more than 4 million local Chinese employees throughout its expansive ecosystem and has been praised by Beijing as the model foreign company.

Apple earned $13 billion in revenue from China in Q2 2018, a 21% YOY increase.

Hounding Apple out of China will be the inflection point when tech investors know there is a serious problem going on and need to hit the eject button.

If this ever happens, The Mad Hedge Technology Letter will be the first to resort to risk off strategies.

BlackRock's (BLK) CEO Larry Fink let everyone know his piece saying, "the lack of breadth in the equity markets is troubling."

Investors cannot blame tech companies for executing their way to the top behind the tailwind of the biggest technological transformation in mankind.

And even in the tech industry, winners can turn into losers in a blink of an eye, such as legacy tech company IBM (IBM).

Someone better tell Fink that this is the beginning.

Amazon recorded 44% of total U.S. e-commerce sales in 2017, equaling 4% of total retail sales in the U.S.

This number is expected to breach 50% by the end of 2018.

The second piece of bullish tech news was lifting the ban on Chinese telecommunications company ZTE.

It is open for business again.

From a national security front, this is an unequivocal loss. However, it saved 75,000 Chinese jobs and gave a small victory to American regulators attempting to patrol the mischievous behemoth.

The U.S. Department of Commerce lifted the seven-year ban even after ZTE sold telecommunication products to North Korea and Iran.

ZTE was fined $1 billion, changed the senior management team, and put into place an American compliance team that will monitor its business for the next 10 years.

Diluting the penalty lowers the operational risk for American tech companies because it shows the administration is willing to reach compromises even if the compromise isn't perfect.

China is a lot less willing to ransack Micron and Intel's China revenues, if America allows China to save face and 75,000 local jobs.

This is a big deal for them and their employees.

America has a strong hand to play with against China because China still requires Uncle Sam's semiconductor components to build its future.

This hand is only effective if Chinese still thirst for American technology. As of today, America is higher on the technological food chain than China.

The move is also a model of what the U.S. Department of Commerce will do if Chinese companies run amok, which Chinese tech companies often do because of the lack of corporate governance and transparency.

These two recent China events empower the overall American tech sector, and the market will need a berserk shock to the tech ecosphere foundations to make it crumble.

As it stands, the tech sector is handling the trade war fine, and with expected blowout tech earnings right around the corner, short tech stocks at your own peril.

________________________________________________________________________________________________

Quote of the Day

"All of the biggest technological inventions created by man - the airplane, the automobile, the computer - says little about his intelligence, but speaks volumes about his laziness," - said author Mark Kennedy.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.