Below please find subscribers’ Q&A for the Mad Hedge Fund Trader September 4 Global Strategy Webinar broadcast from Silicon Valley with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: If Trump figures out the trade war will lose him the election; will he stop it?

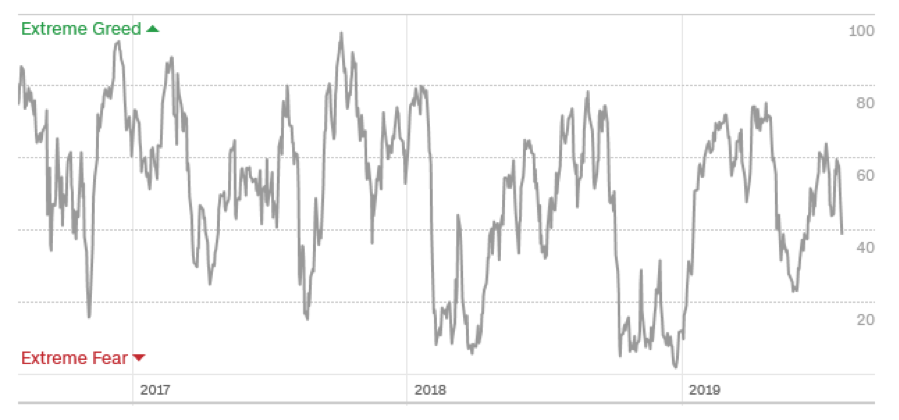

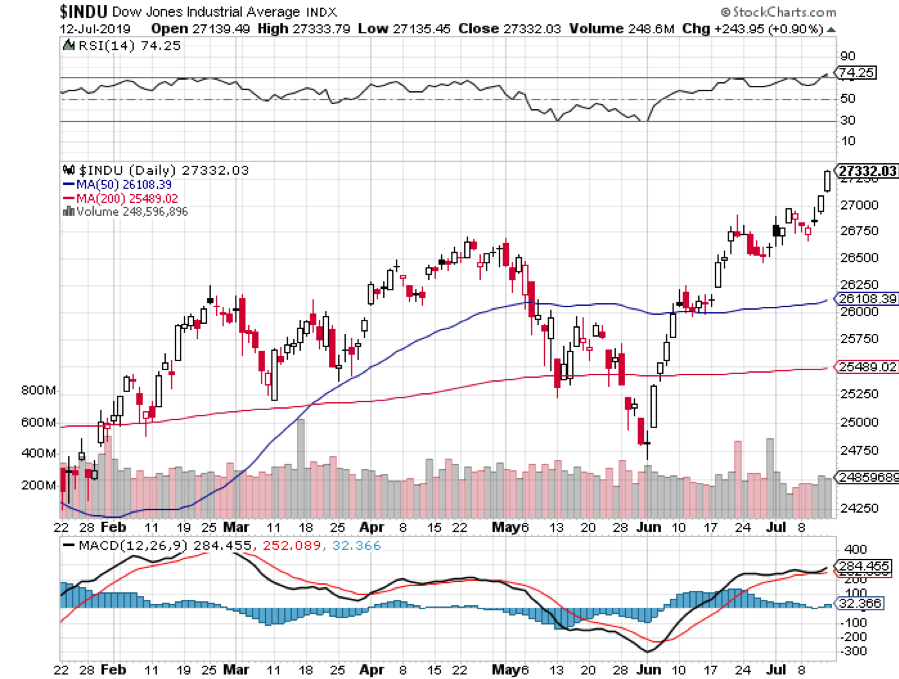

A: Yes, and that is a risk that hovers over all short positions in the market at all times these days because stocks will soar (INDU) when the trade war ends. We now have 18 months of share appreciation that has been frustrated or deferred by the dispute with China. The problem is that the US economy is already sliding into recession and it may already be too late to turn it around.

Q: Do you see the British pound (FXB) dropping more on the Brexit turmoil? Do you think the UK will stay in the EU?

A: If the UK ends Brexit through an election, then the pound should recover from $1.19 all the way back up to $1.65 where it was before Brexit happened four years ago. If that does happen, it will be one of the biggest trades of the year anywhere in the world, going long the British pound. This is how I always anticipated it would end. I was in England for the Brexit vote and I was convinced that if they held the election the next day, it would have lost. The only reason it won was because nobody thought it would— a lot like our own 2016 election. That brings Britain back into the EEC, saves Europe, and has a positive impact on markets globally. So, this is a big deal. Not to do so would be economic suicide for Britain, and I think wiser heads will prevail.

Q: Do you think it’s a good idea for Saudi ARAMCO to go public in Japan as reports suggest?

A: When the Arabs want to get out of the oil business (USO), (XLE), you want to also. That’s what the sale of ARAMCO is all about. They’re going to get a $1 trillion or more valuation, raising $100 billion in cash. And guess who the biggest investors in alternative energy in California are? It’s Saudi Arabia. They see no future in oil, nor should you. This is why we’ve been negative on the sector all year. By the way, bankruptcies by frackers in the U.S. are at an all-time high, another indicator that low oil prices can’t be tolerated by the US industry for long.

Q: Is it time to buy the ProShares Ultra Short 20 year Plus Treasury Bond Fund (TBT)?

A: No, not yet; I think we’re going to break 1.33% — the all-time low yield for the (TLT) will probably be somewhere just below 1.00%. We probably won’t go to absolute zero because we still have a growing economy. The countries that already have negative interest rates have shrinking economies or are already in recession, like Germany or Great Britain can justify zero rates.

Q: Are you going to run all your existing positions into expiration?

A: I’m going to try to—it’s only 12 days to expiration, and we get to keep the full profit if we do. As long as the market is dead in the middle here, there are no other positions to put on, no extreme low to buy into or extreme high to sell into. It’s a question of letting this sort of nowhere-trend play out, but also there's nothing else to buy, so there is no need to raise cash. So, we’re 60% invested now and we’re going to try running as many of those into expiration as we can. Looks like all the long technology positions are safe (FB), (AMZN), (MSFT), (DIS). The only thing we’re pressing here are the shorts in Walmart (WMT) and Russell 2000 (IWM).

Q: Do you think it’s a good idea for Tesla (TSLA) to build another Gigafactory in Shanghai, China during a trade war? Will this blow up in Elon’s face?

A: I don’t think so because the Chinese are desperate for the Tesla technology and they just gave Tesla an exemption on import duties on all parts that need to go there to build the cars. So, that’s a very positive development for Tesla and I believe the stock is up about $10 since that news came out.

Q: Will Roku (ROKU) ever pull back? Would you buy it up here?

A: No, we recommended this thing last year at $40; it’s now up to $165, and up here it’s just wildly overbought, in chase territory. Of course, the reason that’s happening is that the big concern last year was Amazon wiping out Roku, yet they ultimately ended up partnering with Roku, and that’s worth about a 400% gain in the stock. You know the second you get into this, it’s over. There are just too many better fish to fry in the technology area.

Q: What happens if our existing Russell 2000 (IWM) September 2019 $153-$156 in-the-money vertical BEAR PUT spread Russell 2000 position closes between $156 and $153?

A: You lose money. You will get the Russell 2000 shares put to you, or sold to you at $153.00, which means you now own them, and you’ll get a big margin call from your broker for owning the extra shares. If ever it looks like we’re getting close to the strike price going into expiration, I come out precisely because of that risk. You don’t want random chance dictating whether you’re going to make money in your position or not going into expiration. If you’re worried about that, I would get out now and you can still come out with a nice profit. Or, you can always wait for another down day tomorrow.

Q: Is it time to get super aggressive shorting Lyft (LYFT) or Uber (UBER) when they openly admit that they won’t make a profit anytime in the near future?

A: The time to short Uber (UBER) and Lyft was at the IPO when the shares became available to sell. Down here I don’t really want to do very much. It’s late in the game and Uber’s down about one third from its IPO price. We begged people to stay away from this. It’s another example where they waited for the company to go ex-growth before it went public, but it didn’t leave anything for the public. It was a very badly mishandled IPO—it’s now at $31 against a $45 IPO price and was at a new all-time low just 2 days ago. You knew when they offered the drivers shares, the thing was in trouble. Sometime this will be a buy, but not yet. Go take a long nap first.

Q: Is the fact that rich people are hoarding cash a good indicator that a recession is approaching?

A: Yes, absolutely. Bonds yielding 1.45% is also an indication that the wealthy are hoarding cash from other investment and parking it in US treasury bonds. I went to the Pebble Beach Concourse d’ Elegance vintage car show a few weeks ago and all of the $10 million plus cars didn’t sell, only those priced below $100,000. That is always a good indicator that the wealthy are bailing ahead of a recession. If you can’t get a premium price for your vintage Ferrari, trouble is coming.

Q: Argentina just implemented currency controls; is this the start of a rolling currency crisis among emerging nations?

A: No, I believe the problems are unique to Argentina. They’ve adopted what is known as Modern Momentary Theory—i.e. borrowing and printing money like crazy. Unfortunately, this is unsustainable and results in a devalued currency, general instability, and the eventual hanging of their leaders from the nearest lamppost. This is exactly the same monetary policy that the Trump administration has been pursuing since he came into office. Eventually, it will lead to tears, ours, not his.

Q: Is the new all-electric Porsche Taycan a threat to Tesla?

A: No, it’s not. Their cheapest car is $150,000 and it gets one third less range than Tesla does. It’s really aimed at Porsche fanatics, and I doubt they will get outside their core market. In the meantime, Tesla has taken over the middle part of the electric market with the Model 3 at $37,000 a car. That’s where the money is, and Porsche will never get there.

Q: How will the US pull out of recession if the interest rates are at or below zero?

A: It won’t—that’s what a lot of economists are concerned about these days. With interest rates below zero, the Fed has lost its primary means to stimulate the economy. The only thing left to do is use creative means like feeding the economy with currency, which Europe has been doing for 10 years, and Japan for 30, with no results. That’s another reason to not allow rates to get back to zero—so we have tools to use when we go into a recession 12-24 months from now.

Q: What’s the best way to buy silver?

A: The ETF iShares Silver Trust (SLV) and, if you want to be aggressive, the silver miners with the Global X Silver Miners ETF (SIL).

Q: Have global central banks ruined the western economic system as we know it for future generations?

A: They may have—mostly by printing too much money in the last 10 years in order to get us out of recession. This hasn’t really worked for Europe or Japan, mind you, though who knows how much worse off they would be if they hadn’t. What it did do here is head off a Great Depression. If we go back to money printing in a big way, however, and it doesn’t work, we will not have prevented a Great Depression so much as pushed it back 10 or 15 years. That’s the great debate ongoing among economists, and it will eventually be settled by the marketplace.