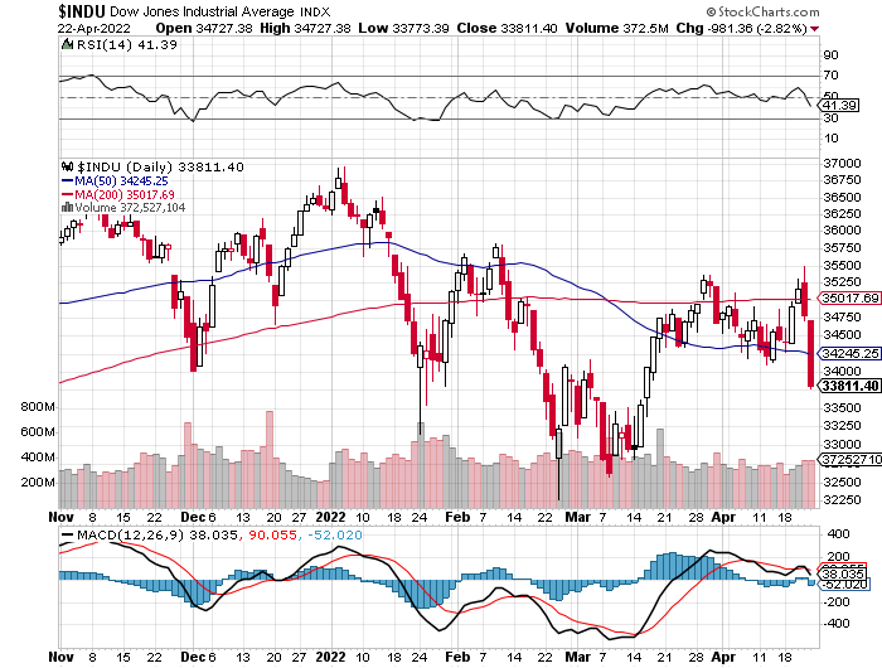

On Friday, we saw the worst day in the market since October 2020. And it won’t be the last such meltdown day.

The big question for the market now is how far it can fall without actually having a recession. The answer is 20%, and we are down 8.6% so far.

The economy is as strong as ever and everyone that is predicting a recession is using outdated, useless models. If I have to wait nine months for the delivery of my sofa demand is still off the charts.

Spoiler Alert!

I have to do some math here to explain the current situation. So, don’t run down the street screaming with your hair on fire. Math is your friend, not your enemy.

With an average estimated $227.33 forecast earnings for the S&P 500, we are currently trading at a multiple of 19.29X ($4,386 divided by $227.33). At the November high, we were trading at 24X. At the 2009 Financial Crisis low, we saw 9.5X for a few nanoseconds. There’s our range, 9.5X to 24X.

So, stocks are still historically expensive. They won’t start to approach cheap until we drop to 15X, a level we haven’t seen in nearly a decade. That is another 4.29 multiple points lower, or down 22.23%.

How do we get to cheap?

Since November, the S&P 500 has earned another $60, or 1.36X multiple points. We’ll probably pick up another $55, or 1.25X multiple points in Q2. That gets us halfway there.

The (SPX) is down 8.6% so far in 2022, or $414. If Q2 earnings come in as expected, then the (SPX) only has to fall by another 1.68X multiple points, or 8.72% to $4,004 to get to our 15X downside target.

I hasten to remind you that this was exactly 10% below my downside forecast of an H1 loss of 10% in my 2022 Annual Asset Class Review (click here)for the link.

The Ukraine War and the third oil shock, neither of which I, or anybody else, predicted, account for the second 10% loss.

How long will it take to reach these new, enhanced downside targets? My guess is by the summer.

And you wondered why I was still 100% in cash….until Thursday?

So what does the Federal Reserve make of all this? Even though they say they don’t care about the stock market, it really does, especially when it is crash-prone.

Some 2.50% in expected interest rate hikes are already discounted by the futures market. The market has already done the Fed’s work, and we were short all the way, via the (TLT). We will likely get aggressive half-point rate hikes through April to June, especially if inflation goes double-digit, which it might.

At that point, the Fed may be ahead of the curve. If we get the slightest backtrack in inflation, even just for one month, the Fed may well back off a bit on its tightening strategy and skip a meeting, igniting a monster stock market rally in the second half.

Poof! Your inflation fears have gone away.

Jay Powell Thrust a Dagger into the heart of the Stock Market, sending the Dow down 1,000. At this point, the only question is whether we get two back-to-back 50 basis point rate hikes coming, or two back-to-back 75 basis point rate hikes. 75 basis points is becoming the new 25 basis points.

TINA is dead (there is no alternative to stocks) with virtually all fixed income securities offering a 3.00% yield and junk bonds paying 6%. These kinds of yields have started sucking money out of stocks into bonds, which is why I am long bonds.

There is one other sparkly asset class that is worthy of attention here. Gold, the yellow metal, the barbarous relic (GLD), may have just entered a long-term structural bull market. By evicting Russia from the global financial system, we have driven it out of dollars and into gold and Bitcoin for good. Take a look at the Gold Miners ETF (GDX).

And Russia is not alone in pouring its revenues into gold, which can’t be seized by foreign governments, so is every other country that might be subject to future sanctions, like China. This adds up to a heck of a lot of new gold buying and could take the barbarous relic to my old long-term target of $3,000 an ounce.

Bonds Crash Again, with ten-year US Treasury bond yields topping 3.02% overnight, a three-year high. Those who took my advice to buy the (TBT) in November are now up 44%. The market is now oversold in the extreme and could rally $5-$10 at any time. This could happen right around the next Fed meeting on April 28.

Tesla Earnings Soar by 87% YOY, taking the stock up $90. Musk is still predicting that 50% YOY growth in sales will continue as far as the eye can see and could reach 2 million this year if they can get the lithium. There is a one-year wait for a Tesla now. With gasoline at $6.00 a gallon everyone who bought a Tesla in the last 12 years is looking like a genius. $10,000 a share here we come! Keep buying (TSLA) on dips, as I have been begging you do to for the last 12 years.

Netflix Gets Destroyed, on horrific earnings and falling subscribers. Disney and Amazon are clearly eating their lunch. Hedge fund manager Bill Ackman dumped his position with a $400 million loss. At this point, (NFLX) is a high risk, high return trade than may take years to play out, not my cup of tea.

Corn Hits Nine-Year High, above $8 a bushel. Russia’s invasion of Ukraine may take one-third of the global wheat supply off the market and cause Africa to starve. Who is the world’s largest food importer? China, which may be why the yuan has seen a rare selloff.

Weekly Jobless Claims Fall to 184,000, why the unemployed hit a 52-year low. No need for stimulus here. It’s clear that fear of interest rate rises is not scaring off companies from hiring. Fifty basis points here we come. The unemployment rate may hit an all-time low with the April report on May 6.

Twitter Adopts Poison Pill, to fight off Elon Musk’s takeover attempt. Musk’s offer is a generous 20% higher than the Friday close. If the poison pill is successful then Musk will dump his 9.9% holding, cratering the stock. The battle of the century is on! Incredibly, the stock is up today. (TWTR) holders should take the money and run.

Investor Optimism Hits 30-Year Low, according to the Association of Individual Investors. Now only 15.8% of investors are bullish, down 9% in a week. A lot of pros are starting to see this as a “BUY” signal.

World Bank Cuts Global Growth Outlook on Russian War, from 4.1% in January to 3.2%. This compares to 5.7% in 2021. Europe and central Asia are taking the big hits.

Natural Gas Hits 13-Year High, to $7.80 per MM BTU, up 100% YTD. American exports are rushing to fill the gap in Europe. With the war showing no end in sight, prices will go higher before they go lower.

Copper is Facing a Giant Short Squeeze, and the world rushes into alternative energy, says Freeport McMoRan (FCX) CEO Richard Adkerson. World copper output will have to triple just to accommodate Tesla’s long-term target of 20 million vehicles a year. Buy (FCX) on dips, like this one.

US Housing Starts Hit 15 Year High, up 0.3% in March to 1.79 million. Applications to build top 1.87 million. The US has a structural shortage of 10 million homes caused by the large number of small builders that went under during the financial crisis and never came back.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

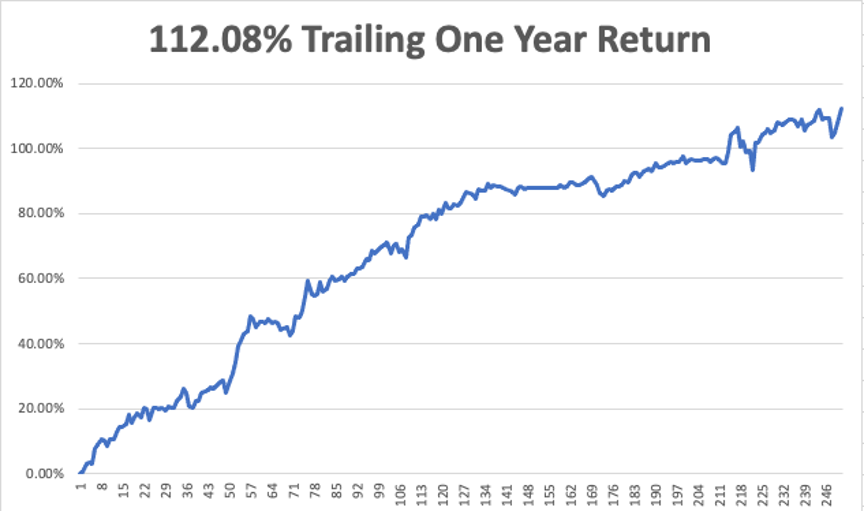

My March month-to-date performance retreated to a modest 2.58%. My 2022 year-to-date performance ended at a chest-beating 29.28%. The Dow Average is down -6.8% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 71.86%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

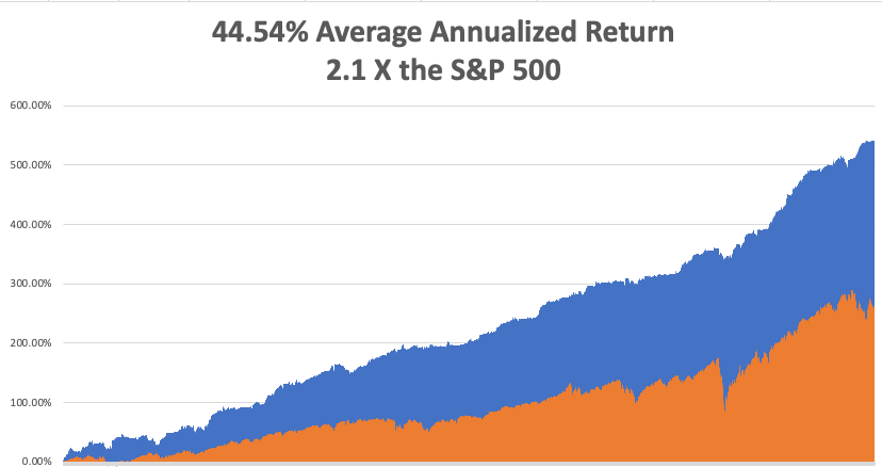

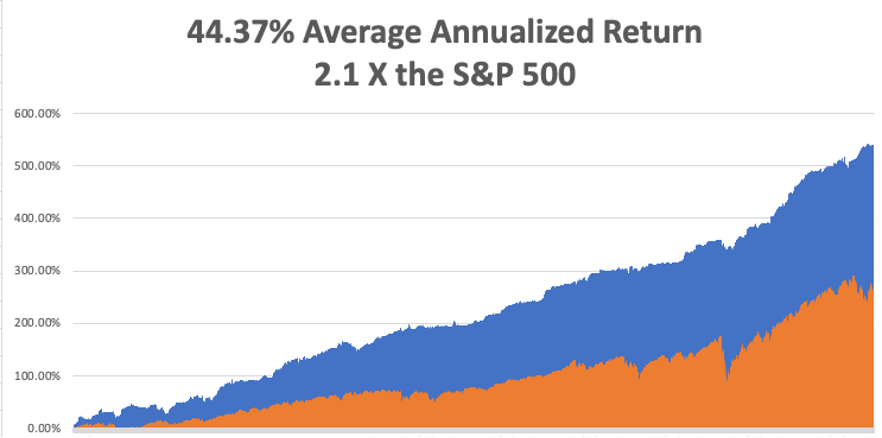

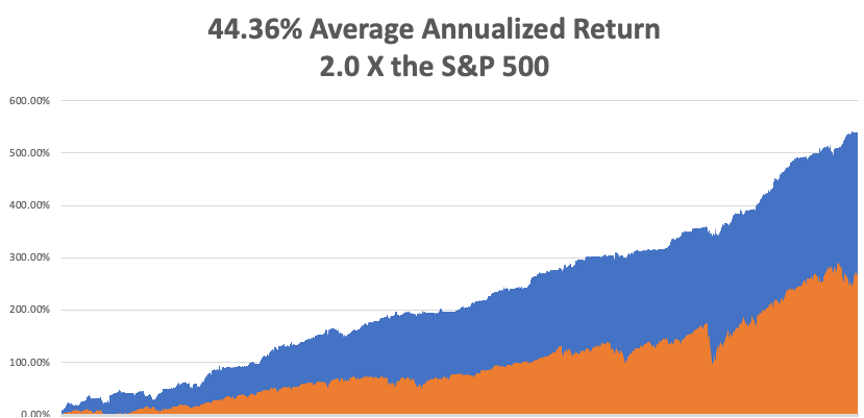

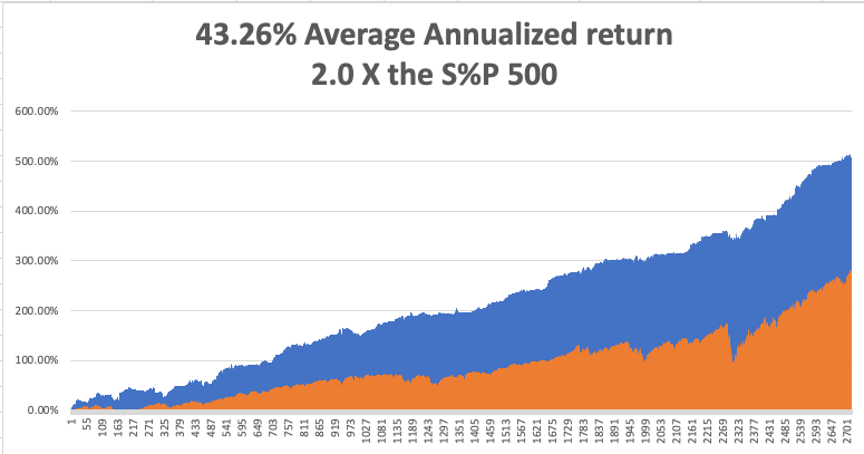

That brings my 13-year total return to 541.94%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.54%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 80.6 million, up only 300,000 in a week, and deaths topping 988,000 and have only increased by 3,000 in the past week. Wow, we only lost the equivalent of eight Boeing 747 crashes in a week! Great news indeed. You can find the data here. Growth of the pandemic has virtually stopped, with new cases down 98% in two months.

The coming week is a big one for tech earnings.

On Monday, April 25 at 8:30 AM EST, the Chicago Fed National Activity Index for March is out. Activision Blizzard Reports (ATVI).

On Tuesday, April 26 at 8:30 AM, US Durable Goods for March are printed. At 9:00 AM the S&P Case Shiller National Price Index is announced. Alphabet (GOOGL) and Microsoft (MSFT) report.

On Wednesday, April 27 at 8:30 AM, the Pending Homes Sales for March are released. Qualcomm and Meta (FB) report.

On Thursday, April 28 at 8:30 AM, the Weekly Jobless Claims are printed. We also get the first look at Q1 GDP. Apple (AAPL), Amazon (AMZN) and Intel (INTC) report.

On Friday, April 29 at 8:30 AM, the Personal Income and Spending for March are disclosed.At 2:00 PM, the Baker Hughes Oil Rig Count is out.

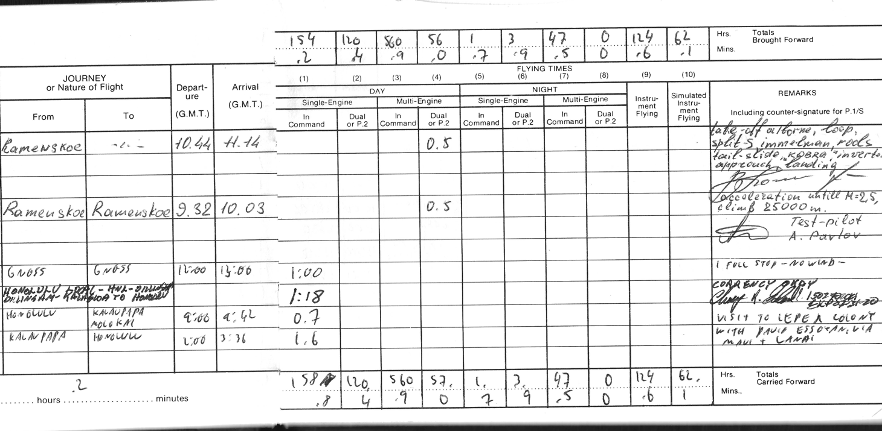

As for me, when you are a guest of the KGB in Russia, you get treated like visiting royalty par excellence, no extravagance spared. That was the setup I walked into when I was sent by NASA to test fly the MiG 25 in 1993.

Far a start, I was met at Moscow’s Sheremetyevo Airport by Major Anastasia Ivanova, who was to be my escort and guide for the week. She had a magic key that would open any door in Russia and gave me a tour worthy of a visiting head of state.

Anastasia was drop-dead gorgeous. She topped 5’11” with light blonde hair, and was statuesque with chiseled high cheekbones and deep blue eyes. She could easily have taken a side job as a Playboy centerfold. But I could tell from her hands she was no stranger to martial arts and was not to be taken lightly. And wherever we went people immediately tensed up. They knew.

For a start, I was met on the tarmac by a black Volga limo. No need for customs or immigration here. Anastasia simply stamped my passport and welcomed me to Russia, whisking me off to the country’s top Intourist hotel.

The next morning, I was given a VIP tour of the Kremlin and its thousand-year history. I was shown a magnificent yellow silk 18th century ball gown worn by Catherine the Great. I asked her if the story about the horse was true, and she grimaced and said yes.

In a side room were displayed the dress uniforms of Adolph Hitler. I asked what happened to the rest of him and she said he was buried under a parking lot in Magdeburg, East Germany.

Out front, I was taken to the head of the line to see Lenin’s Tomb, which looked like he was made of wax. I think he has since been buried. In front of the Kremlin Armory, I found the Tsar Cannon, a gigantic weapon meant to fire a one-ton ball.

There was only one decent restaurant in Moscow in those days and Anastasia took me out to dinner both nights. Suffice it to say that the Beluga caviar and Stolichnaya vodka were flowing hot and heavy. The service was excellent. We were never presented with a bill. I guess it just went on the company account.

After my day in the capital, I was whisked away 200 miles north to the top secret Zhukovky Airbase to fly the MiG 25. A week later, Anastasia was there in her limo to take me back to Moscow.

The next morning Anastasia was knocking on my door. “Get dressed,” she said. “There’s something you want to see.”

She drove me out to a construction site on the southwestern outskirts of the city. As Moscow was slowly westernizing, suburbs were springing up to accommodate a rising middle class. One section was taped off and surrounded by the Moscow Police. That’s where we headed.

While digging the foundation for a new home, the builders had broken into a bunker left from WWII. Moscow had grown to reach the front lines of the 1942 Battle of Moscow. In Berlin during the 1960s, I worked with a couple of survivors of this exact battle. I was handed a flashlight and we ventured inside.

There were at least 30 German bodies inside in full uniform, except that only the skeletons were left. They still wore their issued steel helmets, medals, belt buckles, and binoculars. There were also dozens of K-98 8 mm rifles, an abundance of live ammunition and potato mashers (hand grenades), and several MG-42’s (yes, I know my machines guns).

The air was dank and musty. My guess was that the bunker had taken a direct hit from a Soviet artillery shell and had remained buried ever since. As a cave in threatened, we got the hell out of there in a few minutes.

Then Anastasia continued with our planned day. Since it was Sunday, she took me to the Moscow Flea Market. Russia was suffering from hyperinflation at the time, and retirees on fixed incomes were selling whatever they had in order to eat.

Everything from the Russian military was for sale for practically nothing, including hats, uniforms, medals, and night vision glasses. I walked away with a pair of very high-powered long-range artillery binoculars for $5. I paused for a moment at an 18th century German bible printed in archaic fraktur. But then Anastasia said I might get hung up by Russia’s antique export ban on my departure.

Anastasia and I kept in touch over the years. I sent him some pressed High Sierra wildflowers, which impressed her to no end. She said such a gesture wouldn’t even occur to a Russian man.

We gradually lost contact over the years, given all the turmoil in Russia that followed. But Anastasia left me with memories I will never forget. And I still have those binoculars to use at the Cal football games.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader