Playboy is going public.

Its flagship magazine was wiped out by free internet porn last year after a storied 66-year run. During the 1970s, an invitation to a new club opening was the hottest ticket in town.

Of course, I bought the magazine only to read the articles.

Melania Trump as a centerfold? The business possibilities boggle the mind. Of course, it’s going public through a SPAC. Nobody else would touch this with a ten-foot pole. The ticker symbol will be (PLBY).

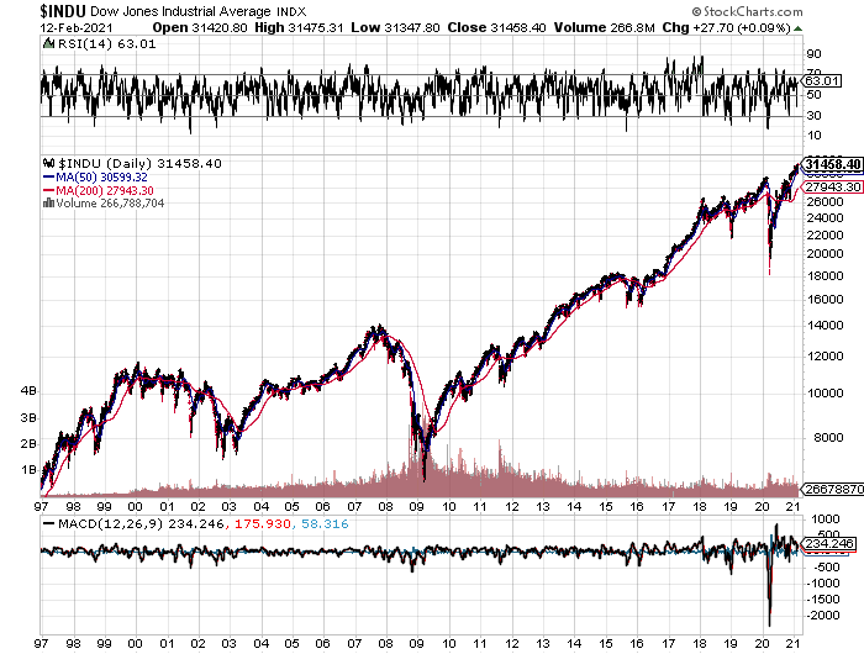

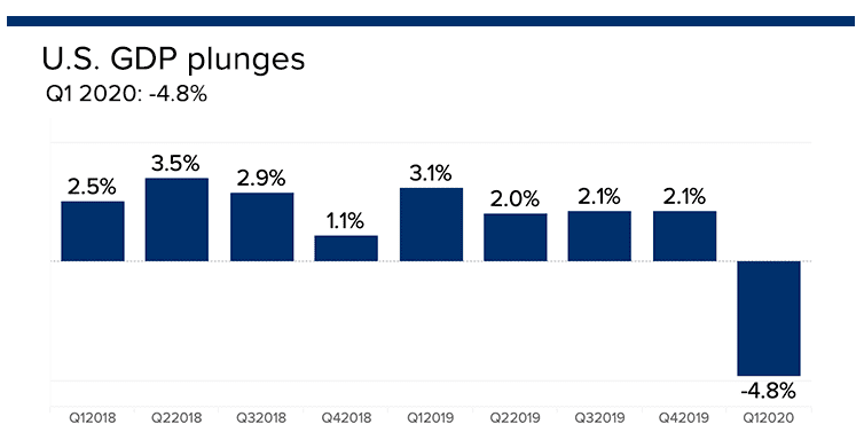

What this IPO does tell me is how overheated the markets are getting. In 1996, former Fed governor, saxophone player, and Ayn Rand acolyte, the gnomish Alan Greenspan warned the stock market of “irrational exuberance.” Since then, the Dow Average has risen by 5.2 times in 23 years, revisiting the 6,000 low once in 2009.

In fact, let me explain to you why stocks are so cheap.

At the 2000 Dotcom Bubble top, ten-year US Treasury yields stood at 6%. Stocks would have to rise five times more from today’s paltry 1.20% to reach the same relative valuation.

Dow 163,000 anyone?

Similarly, the big FANG stocks would have to triple in value to get us to the 100X price earnings multiple that prevailed in 2000. That gets us at least to Dow 94,500.

And this is what people don’t get about liquidity-driven bull markets. They go on far, far longer than anyone imagines possible. You had to be in Tokyo in 1989 to understand this.

If you’re really and truly worried about stocks, take a look at the chart below and how they reacted to the last catastrophic selloff that took place during 2007-2009.

After an initial, frenetic move, they rose by, you guessed it, 5.2 times.

The Global Chip Shortage is spreading beyond cars to phones and electronics. High prices beckon across the board. Could this be the black swan that heads off the recovery? It’s all a screaming BUY for (NVDA), (AMD), and (MU). I can’t believe these haven’t moved yet.

Biden created a Bull Market in Oil (USO) when he banned new leases on federal lands. The move took 3 million barrels a day off the market, taking a bite out of the 10 million barrels a day oversupply. And economic recovery should soak up the remaining 7 million barrels, 2021 forecasts for Texas tea are now reaching as high as $80.

Space X is taking pre-orders for Starlink, Elon Musk’s Global satellite WIFI network. Another industry disrupted. For a $99 deposit, you can access 500 megabytes a second, faster than available for most of the US. The goal is to launch 11,943 satellites by 2024. If it works, AT&T (T), Comcast (CMCSA), and Verizon (V) could be in big trouble. When you own your own rocket company, it’s easy to undercut the competition.

Weekly Jobless Claims are still weak, at 793,000, far higher than expected, but less than last week. Total jobless claims have it an unbelievable 20.44 million, just short of the 1930’s Great Depression high. Perhaps 20% of the country is living on government handouts.

The Pandemic Property Boom continues, posting the hottest numbers since 2005. The National Association of Realtors says the price of a single-family home rose by a staggering 14.9% in Q4. The Northeast was the leader at a 21% gain. The market keeps going from strength to strength.

Will the Dow double in a year? We only have 4,500 points to go for a 100% gain from the last March 20 low. We have already seen the sharpest gain in history, beginning when Biden took the lead in the primaries. Will passage of the $1.9 trillion rescue package take us over the finish line? And are we setting up for a “Buy the rumor, sell the news? We’ll know in a month. I bet you’ve just made more money in stocks than you’ve ever imagined possible. Take short-term profits in everything.

Bonds hit new lows, taking the ten-year US Treasury yield up to 1.20%. The Feds hit the markets for a massive $120 million in debt this week and buyers are obviously glutted. Keep selling those rallies in the (TLT). Maybe you should start selling dips, too. Use bond selloffs for your stock market timing. They’re about to become “certificates of confiscation” again.

No hint of rising rates soon, hints Fed governor Jay Powell. Recovery is the only goal, damn the inflation torpedoes.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

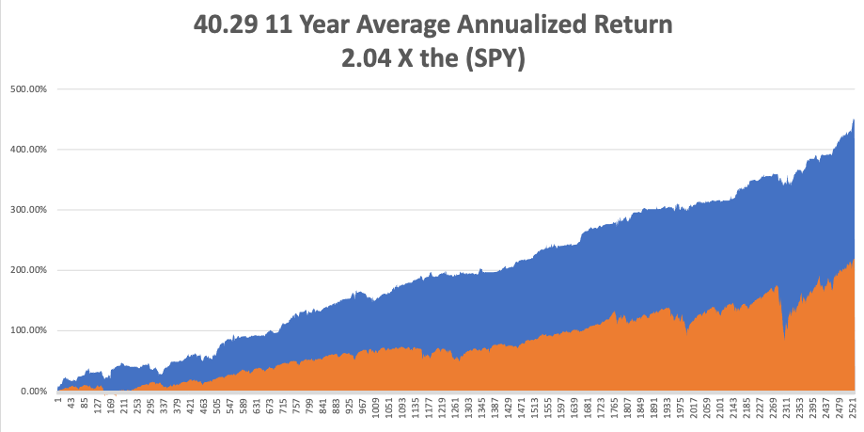

My Mad Hedge Global Trading Dispatch earned an amazing 16.48% so far in February after a blockbuster 10.21% in January. The Dow Average is up a trifling 2.80% so far in 2021.

This is my fourth double-digit month in a row. My 2021 year-to-date performance soared to 26.69%. There are only four trading days left until the February 19 option expiration, when I automatically go into 80% cash. That’s convenient!

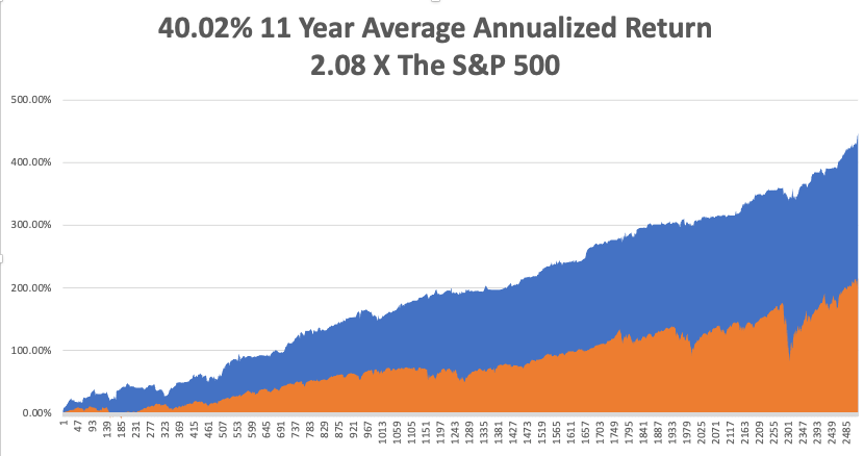

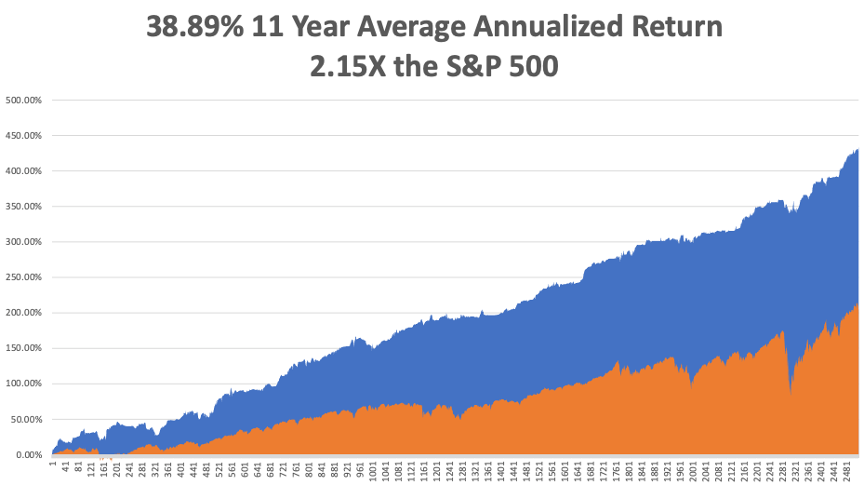

That brings my 11-year total return to 449.24%, some 2.04 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an Everest-like new high of 40.29%.

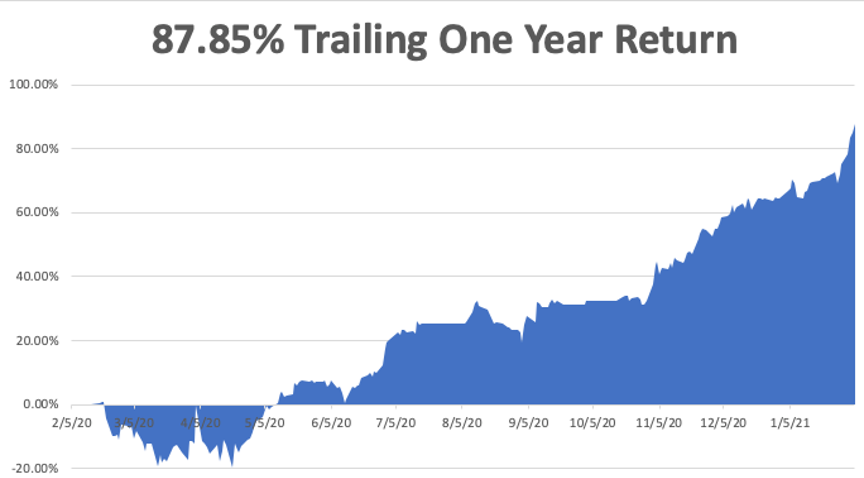

My trailing one-year return exploded to 90.96%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 108.63% since the March 20, 2020 low.

We need to keep an eye on the number of US Coronavirus cases at 27.7 million and deaths approaching 500,000, which you can find here. We are now running at a heartbreaking 3,000 deaths a day. But that is down 35% from the recent high.

The coming week will be a boring one on the data front.

On Monday, February 15, markets are closed for Presidents Day.

On Tuesday, February 16 at 8:30 AM EST, the NY Empire State Manufacturing Index is out. CVS (CVS) and Zoetis report.

On Wednesday, February 17 at 8:30 AM, US Retail Sales for January are published. At 2;00 PM, we learn the Fed Open Market Committee minutes from the last meeting. Shopify and Twilio report.

On Thursday, February 18 at 9:30 AM, Weekly Jobless Claims are printed. Barrick Gold (GOLD) and Roku (ROKU) report.

On Friday, February 19 at 10:00 AM, Existing Home Sales for January are released. We learn the Baker-Hughes Rig Count. As we have a three-day weekend following, option volatility should collapse. John Deere (DE) reports.

As for me, let me tell you what the last weeks of the great Japanese bull market were like at the end of 1989.

The big thing then was to eat sushi salted with flecks of pure gold. Any foreigner who could speak Japanese was worth hundreds of thousands of dollars a year.

The brokers would hire anyone. Kids went from running sandwich shops to trading desks at Morgan Stanley. Others upgraded from bicycles to Porsche Carrera’s and used to race on Tokyo’s abandoned freeway system in the middle of the night.

And you know what? Someone offered me a piece of gold-flecked sushi just the other day!

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Stock Gains Since Greenspan’s “Irrational Exuberance” Comment