I had the pleasure of meeting Supreme Court Justice Ruth Bader Ginsberg only last year. She was funny, a great storyteller, and smart as a tack. If she disagreed with you, she pounced like a lion with a prescient one-liner.

She was also a goldmine of historical anecdotes about American history over the past 60 years, recalling incidents seen from her front-row seat as if they had happened yesterday.

She was also frail and rail-thin as if a faint breeze could knock her over at any time. Contracting cancer five times will do this to a person. Assistants helped her walk.

Her unexpected passing is now on the verge of creating a new financial crisis. Any chance of passing further stimulus in the US congress has just turned to ashes. The focus in Washington has turned entirely to the Supreme Court for the rest of 2020.

As a result, tens of thousands more small business will go under, millions of families will be thrown out on to the street, and the Great Depression will drag on. There is nothing left to spike the punch bowl with.

The Dow Average on Monday morning will open down 1,000 points, led by Tesla (TSLA) and the big technology stocks. US Treasury bonds (TLT) will rocket $5. The US dollar (UUP) will soar on a flight to safety bid.

Traders were already cutting positions and scaling back risk to duck the coming turmoil of the presidential election. We are also trying to front-run a yearend stock selloff prompted by a Biden rise in the capital gains tax from 21% to 40%.

That’s a bit of a moot point as 75% of stock ownership is owned by tax-exempt funds. The remaining 25% is most tied up in institutions that duck the tax by never selling or are embedded on corporate cross ownerships which never change.

Now we have uncertainty with a turbocharger, with gasoline poured in the air intake (pilot talk).

With Democrats refighting the battle of the Alamo, I doubt that Trump can ram through a third Supreme Court nomination. Remember how the last one went, for Brett Cavanaugh? Filibusters alone could delay proceeding by a month. These are NOT developments that make stocks go up.

If Trump succeeds, it may be a pyrrhic victory, costing Republicans at least five Senate seats, losing a majority, and increasing the margin of a presidential loss. If retired astronaut wins the Senate in Arizona on November 3, only two Republicans need to fold to make a Supreme Court nomination impossible.

It’s not like the stock market was in such great shape going into this, the biggest black swan of 2020. The market is being flooded with high priced initial public offerings, some 12 in the coming week alone. Apparently, there is an extreme shortage of high growth large-cap technology stocks and Silicon Valley is more than happy to meet that demand.

Cloud storage player Snowflake (SNOW) saw price talk at $70, an IPO of $120, and a first-day peak of $275. This created $70 billion in market value with the stroke of a key.

Of course, flooding the market like this ends up killing the goose thay laid the golden eggs and is a common signal of market tops. Existing stock holdings have to be sold to buy new ones, taking markets south.

We have already seen the 30-day and 50-day moving averages broken, and sights are clearing set on the 200-day. They would take us to a full top to bottom correction in the indexes of 20%. That would take the S&P 500 from $3,600 to $3,000, The Dow Average from $26,298 to $24,000, and Apple from $137 to $84.

If the Volatility Index (VIX) goes over $50, I’ll start sending out lists of very low risk, high return two-year options LEAPS like I did last time.

The Fed says no interest rate hike until 2023 and promises to heat up the economy even more than previously. The long-term average 2% inflation target I reaffirmed. Jay sees a net shrinkage of the US GDP this year ay 3.7%. Since governor Jay Powell promised to run the economy hot weeks ago, ten-year US treasury bonds have only eked out a paltry rise to 72 basis points.

The market isn’t buying it. It’s tough to beat ever hyper-accelerating technology that crushes prices. Still, I’ll keep selling short bond rallies because it’s just a matter of time before the government crushes the market with massive over-issuance. Sell every rally in the (TLT). The Fed put lives! Buy stocks on dips.

Election chaos is starting to price in, with the US dollar (UUP) getting an undeserved bid in a flight to safety trade and stock down 1,000 points from the week’s high. All sorts of Armageddon scenarios are making the rounds now and traders are pulling out of the market to protect hard-earned profits. For details watch the final season of House of Cards, where martial law is declared in Ohio to reverse an election outcome. No kidding!

Citigroup announced a surprise $900 million loss. I can’t wait for the excuse for this surprise, out-of-the-blue “operational error.' It’s most likely an expensive hack. It’s the kind of black swan that can hit you any time if you are a short-term trader. Long term investors should be buying the dip in (C).

China’s Retail Sales rise for the first time in 2020, up 0.5% in August. First into the pandemic, first out. Keeping Corona deaths to 4,000 was also a big help. It’s proof that economies CAN recover post-COVID-19. Buy China on dips (BABA), (BIDU). Stocks there will enjoy a huge post-election rally once the trade war winds down.

US Consumer Sentiment hits six-month high, up from a 75 estimate to 78.9. The University of Michigan report is proof that those who have money are spending it. Another green shoot. Didn’t help stocks today though.

Oil collapsed 15% on the dimming outlook for the global economy. Not even massive well shutdowns caused by this week’s hurricane could boost prices. Avoid all energy plays like the plague.

Morgan Stanley says the trading boom won’t last forever, says my former employer coming off of a record quarter. Too much of a good thing won’t last forever. Make hay while the sun shines.

The value rotation is on, with large scale selling of technology stocks and the chasing of banks and other recovery plays. It’s been a long time coming and could well persist until the end of the year. The option expiration at the close on Friday was exacerbating all moves, which is why I dumped my last two tech positions days prior. It’s too early to buy tech again on dips. Wait for a pre-election meltdown.

Copper hit a new four-year high as traders bet on an accelerating recovery in the global economy. My favorite, Freeport McMoRan, the world’s largest copper producer and a long time Mad Hedge subscriber is soaring, up 257% from the market lows. China, which is done with the Coronavirus and whose economy is recovering rapidly, has returned as a major buyer of the red metal. Keep buying (FCX) on dips.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old.

My Global Trading Dispatch clocked its third blockbuster week in a row. I cashed in on my winnings with longs in (JPM), (TLT), (V), (GLD), (AAPL), and (AMZN), rang the cash register with shorts in (TLT) and (SPY), and booked a small loss in a long in (C). This took my cash position from 0% to 80% and I am looking to go to 100% in the coming week. The risk/reward in the market now is terrible.

Notice that I am shifting my longs away from tech and toward domestic recovery plays.

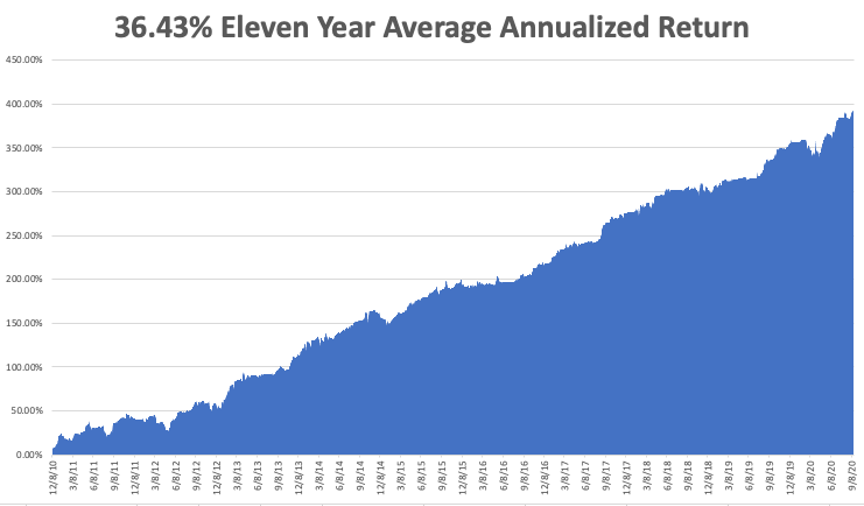

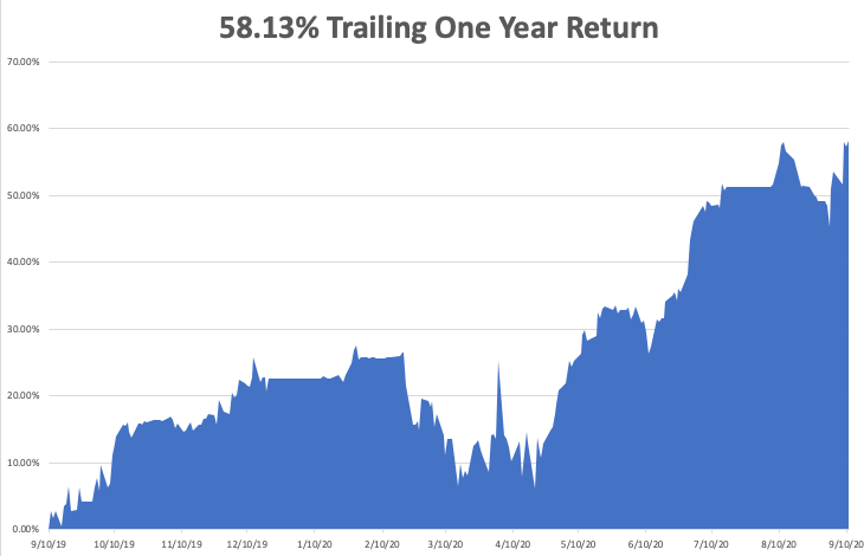

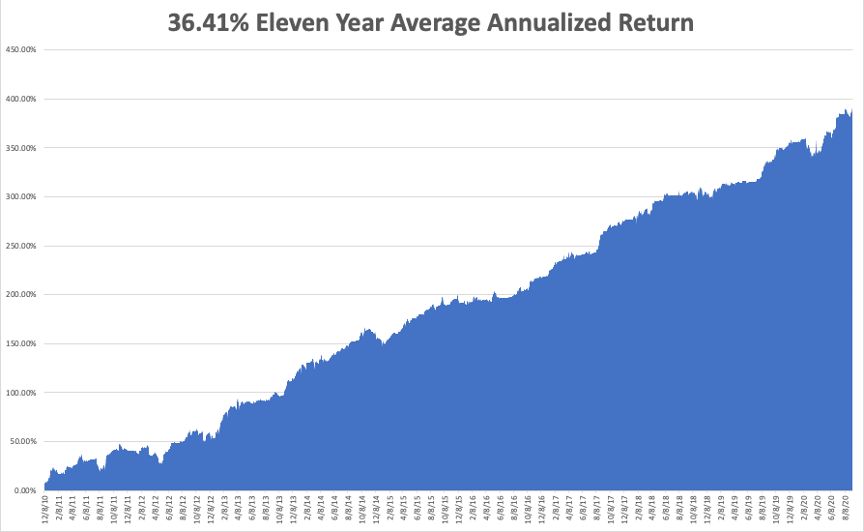

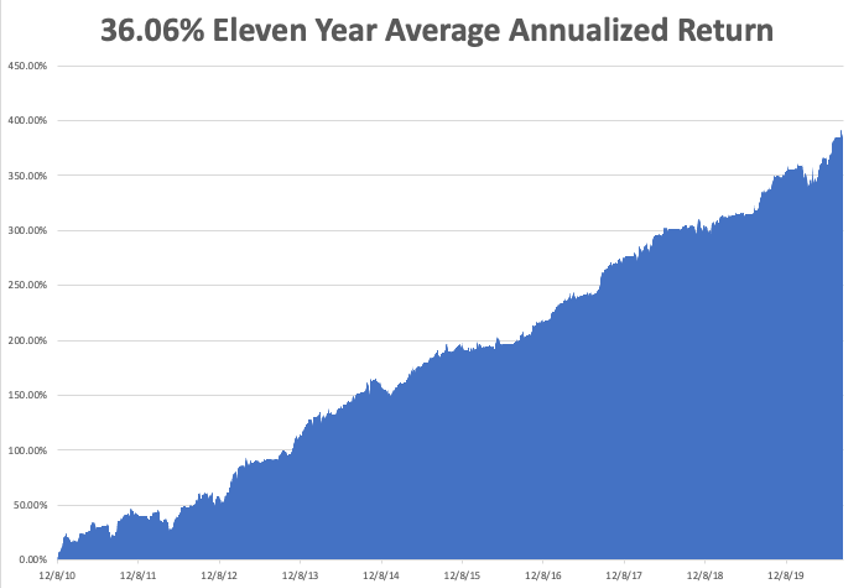

That takes our 2020 year-to-date back up to a blistering 35.74%, versus -2.93% for the Dow Average. September stands at a nosebleed 9.19%. That takes my eleven-year average annualized performance back to 36.43%. My 11-year total return is back for another new all-time high at 392.12%. My trailing one-year return popped back up to 54.87%.

The coming week is a big one for housing data. The only numbers that really count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, September 21 at 8:30 AM EST, the Chicago Fed National Activity Index is out.

On Tuesday, September 22 at 10:00 AM EST, Existing Home Sales for July are released.

On Wednesday, September 23 at 9:00 AM EST, the US Home Price Index for July is printed. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out.

change.

On Thursday, September 24 at 8:30 AM EST, the Weekly Jobless Claims are announced. At 10:00 AM the all-important Existing Home Sales for July are published.

On Friday, September 25, at 8:30 AM EST, US Durable Goods Sales for August are disclosed. At 2:00 PM The Bakers Hughes Rig Count is released.

As for me, I’ll climb up on the roof this weekend and clean the ash from my 59 solar panels. The fallout from the nearby raging forest fires has been so extreme that it has cut my solar output by 25%.

It’s not just me. Over a million homes in California have the same problem, putting a serious dent in the state’s electricity production.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader