Have you ever wanted to spend your summers basking in the sunlight at your mountain top Tuscan villa, surveying the manicured vineyards which produce your own estate bottled wine? Are you drawn by the cachet of claiming George Clooney as a celebrity neighbor on the model strewn shores of Lake Como? How about a luxury apartment that is walking distance from the Vatican?

Hedge fund managers are salivating at the prospect of one of the greatest fire sales in history, as assets of every description were being dumped in the wake of the hard times that hit Europe. On the menu are trillions of dollars of distressed loans hived off by desperately downsizing and deleveraging continental banks. Corporations are expected to dump money losing divisions and subsidiaries in a race to raise cash.

In many respects, these deals of the century represent the second shoe to fall after similar bargains were had in the US during the 2008 crash. Europe?s day of reckoning was postponed by four years, thanks to a recovery in the US, QE1, QE2, QE3, and Federal Reserve policies that kept interest rates at century lows.

The complacency in Europe since then has been staggering, with many turning their noses up, claiming it could never happen there. Some are predicting that the balance sheet scrub could take as long as a decade, similar to Japan?s tortuously long repair of its own banking system.

Some hedge funds are taking advantage of the wholesale withdrawal of European banks from the credit markets to beef up their own international lending?at much higher interest rates. The same funds, like Highbridge, similarly locked in enormous spreads in the US when conditions were dire.

Several American private equity firms are said to be setting up new European distressed asset funds to peddle to pension funds and high net worth individuals. Those who made similar investments in the US four years ago, made fortunes.

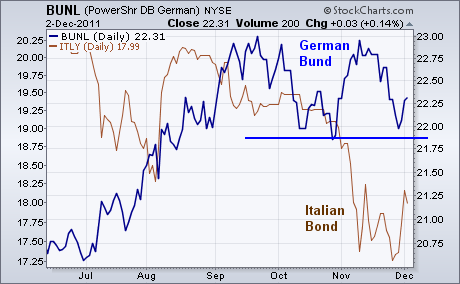

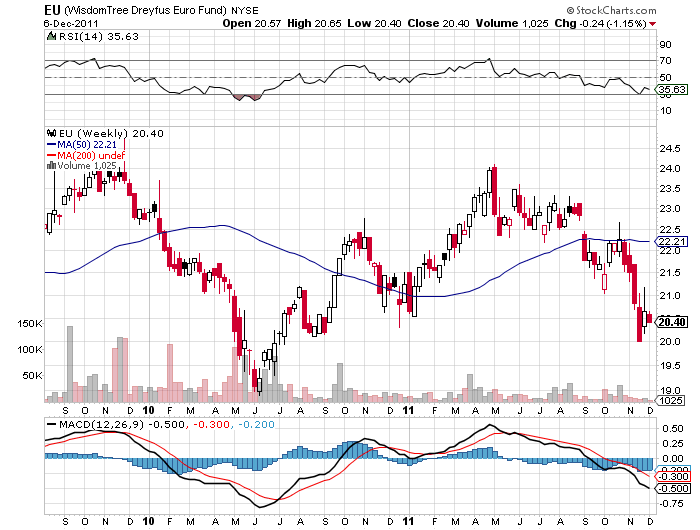

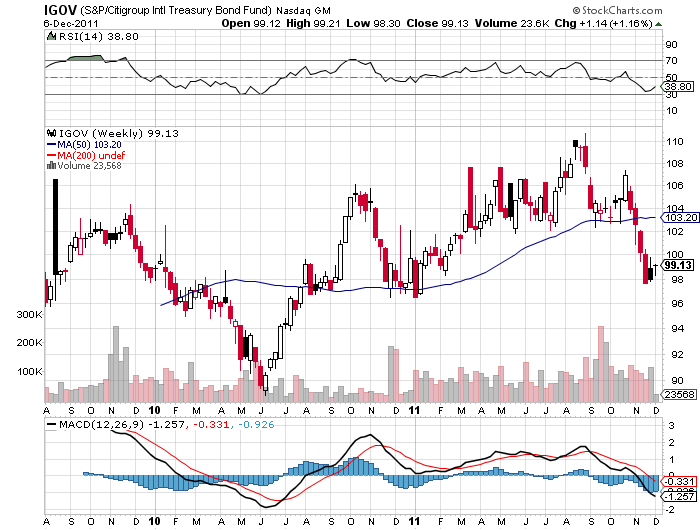

For individual investors the easiest and ripest pickings may be among the European bond ETF?s that already trade in the market. Many of these have suffered gut churning declines in recent months as the European melt down unfolded, despite offering yields multiples of what can be found at home.

Below is a short list of continental ETF?s you may want to consider:

PowerShares DB Italian Treasury Bond Fund (ITLY)

Wisdom Tree Euro Debt Fund (EU)

iShares S&P Citigroup International Treasury Bond Fund (IGOV)

SPDR Barclays Capital International Treasury Bond ETF (BWX)

Germany Bond Index (BUND)

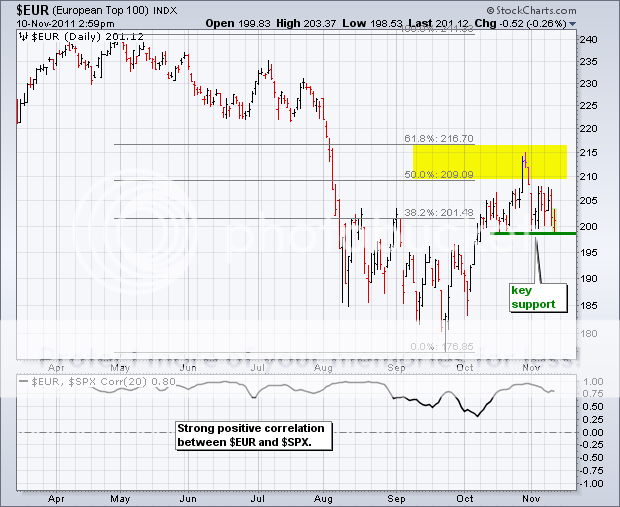

Of course, the eternal question of when to buy is the open to debate. There have been enormous declines in European bond yields since the peak. It was a simple shortage of paper, not any ECB intervention that drove yields down so rapidly.

Aggressive traders are already starting to scale in.