Global Market Comments

March 8, 2019

Fiat Lux

Featured Trade:

(MARCH 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SDS), (TLT), (TBT), (GE), (IYM),

(MSFT), (IWM), (AAPL), (ITB), (FCX), (FXE)

Global Market Comments

March 8, 2019

Fiat Lux

Featured Trade:

(MARCH 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SDS), (TLT), (TBT), (GE), (IYM),

(MSFT), (IWM), (AAPL), (ITB), (FCX), (FXE)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader March 3 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Are you sticking to your market top (SPY), (SDS) by mid-May?

A: Yes, at the rate that economic data is deteriorating, and earnings are falling, there’s no prospect of more economic stimulation here, my May top in the market is looking better than ever. Europe going into recession will be the gasoline on the fire.

Q: Where do you see interest rates (TLT) in 1-2 years?

A: Interest rates in 2 years could be at zero. If interest rates peaked at 3.25% last year, then the next move could be to zero, or negative numbers. The world is awash in cash, and without any economic growth to support that, you could have massive cuts in interest rates.

Q: Will (TLT) be going higher when a market panic sets in?

A: It will, which is why I’m being cautious on my short positions and why I’m only using tops to sell. You can be wrong in this market but still make money on every put spread, as long as you’re going far enough in the money. That said, when the stock market starts to roll over big time, you want to go long bonds, not short, and we may do that someday.

Q: Do you see a selloff to stocks similar to last December?

A: As long as the Fed does not raise interest rates, I don’t expect to get a selloff of more than 5% or 6% initially. If we do get a dramatic worsening of economic data and it looks like we’re headed in that direction, the Fed will start cutting interest rates, the recession signal will be on and only then will we drop to the December lows—and possibly as low as 18,000 in the Dow.

Q: General Electric has gone from $6 to $10; what would you do now?

A: Short term, sell with a 66% gain in a stock. Long term, you probably want to hold on. However, their problems are massive and will take years to sort out, probably not until the other side of the next recession.

Q: Microsoft (MSFT): long term hold or sell?

A: Absolutely long-term hold; look for another double in this company over the next 3 years. This is the gold standard in technology stocks today. Short term, you’re looking at no more than $15 of downside to the December low.

Q: Would you short banks (IYF) here since interest rates have failed to push them higher?

A: I would not; they’ve been one of the worst performing sectors of the market and they’re all very low, historically. You want to short highs like I’m doing now in the (SPY), the (IWM), and Apple (AAPL), not lows.

Q: Is the China trade deal (FXI) a ‘sell the news’ event?

A: Absolutely; there’s not a hedge fund out there that isn’t waiting to go short on a China trade deal. The weakness this week is them front-running that news.

Q: Do you see emerging markets (EEM) pushing higher from the 42 level, or will a global recession bring it back to earth?

A: First of all, (EEM) will go higher as long as interest rates in the U.S. are flatlining, so I expect a rally to last until the spring; however, when a real recession does become apparent, that sector will roll over along with everything else.

Q: Would you buy homebuilders (ITB) if this lower interest rate environment persists?

A: I wouldn’t. First of all, they’ve already had a big 28% run since the beginning of the year— like everything else—and second, low-interest rates don’t help if you can’t afford the house in the first place.

Q: Would you short corporate bonds if you think there’s going to be a recession next year?

A: I’m glad you asked. Absolutely not, not even on pain of death. I would buy bonds because interest rates going to zero takes bond prices up hugely.

Q: Should you buy stocks in front of a blackout period on corporate buybacks?

A: Absolutely not. Corporate buybacks are the number one buyers of shares this year, possibly exceeding $1 trillion. Companies are not allowed to buy their own stocks anywhere from a couple of weeks to a month ahead of their earnings release. By removing the principal buyer of a share, you want to sell, not buy.

Q: What are the chances the China trade deal (FXI) breaks down this month and no signing takes place?

A: I have a feeling Trump is desperate to sign anything these days, and I think the Chinese know that as well, especially in the wake of the North Korean diplomatic disaster. He has to sign the deal or we’ll go to recession, and that would be tough to run on for reelection.

Q: Which stock or ETF would you short on real estate?

A: If you short the iShares US Home Construction ETF (ITB), you short the basket. Shorting individual stocks is always risky—you really have to know what’s going on there.

Q: What’s the best commodity play out there?

A: Copper. If China is the only country that’s stimulating its economy right now, and China is the largest consumer of copper, then you want to buy copper. The electric car boom feeds into copper because every new vehicle needs 20 pounds of copper for wiring and rotors. Copper is also cheap as it is coming off of a seven-year bear market. What do you buy at market tops? Only cheap stuff.

Q: Why did you go so far in the money in the Freeport-McMoRan (FCX) call spread with only a 10% profit on the trade in five weeks?

A: In this kind of market, I’ll take 10% in 5 weeks all day long. But additionally, when prices are this high, I want to be as conservative as possible. Going deep in the money on that is a very low-risk trade. It’s a bet that copper doesn’t go back to the December lows in five weeks, and that’s a bet I’m willing to make.

Q: Will a new round of QE in Europe affect our stock market?

A: Yes, it’s terrible news. It will weaken the Euro (FXE), strengthen the dollar (UUP), and force US companies to lower earnings guidance even further. That is bad for the market and is a reason why I have been selling short.

Global Market Comments

November 5, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or THE MAD HEDGE FUND TRADER HITS A NEW ALL TIME HIGH),

(AAPL), (FB), (RHT), (GE), (VXX), (AMZN), (SPY), (IWM), (CRM)

I used to do a lot of skydiving from 20,000 feet. There’s nothing like a freefall, feeling the wind rip at your jumpsuit as you plunge towards the earth at terminal velocity of 125 miles per hour. In the beginning, the ground looks very far away. Then it suddenly gets very close, very fast.

I used to do this during the 1960s with WWII surplus silk parachutes with a “double L” cut. You hit the ground like a ton of bricks. Sometimes, we’d swing back and forth from the wings of the airplane before letting go just to have fun and freak out the pilot who had no chute.

Over time, you develop a very accurate sense of how fast the ground is approaching and when to pull the ripcord. If you’re wrong, you die.

That’s how I felt when markets went into freefall last Monday. However, after a half-century of trading, I have a highly developed sense of where the bottom is.

So, I piled on the “bet the ranch” longs in technology stocks and shorts in the bond market right at the absolute bottom. And to make sure everyone to a man got in, shares swooshed down one final time when rumors spread that Trump was escalating the trade war with China once again.

By Wednesday morning, the Mad Hedge Fund Trader model portfolio had booked its largest two day gain since the inception of this letter 11 years ago, some 12%. By miracle of miracles, we ended up positive for October, virtually the only one to do so in the entire hedge fund industry.

I would like to think that 50 years of toil in the markets is finally starting to pay off for me. The truth is, the harder I work, the luckier I get.

Stocks lost $2 trillion in market value in October, off 6.9%. Other than that, how was the play, Mrs. Lincoln? Tech took the worst hit in a decade, with many favorites down 20%-30%.

I am raising as much cash as I can ahead of the Midterm Elections tomorrow. Democrats seizing the House of Representatives is priced into the market already.

If the Republicans end up keeping the House, you can count on at least a 1,000-point rally in the Dow Average in the next few days as the door is now open for more tax cuts, more deregulation, and more deficit spending.

If the Democrats end up taking both the Senate and the House you can look for a 1,000 point drop in the Dow. That would bring on a huge “flight to safety” bid in the bond market and yet another opportunity to sell short at great prices.

Either way, I want more dry powder with which to take advantage of any extreme moves that may take place. “Extreme” seems to be the order of the day.

By the way, we are so far in the money with our remaining positions that even with a 1,000 point drop we should still reap the maximum profit with the November 16 option expiration in only 9 trading days.

Not that it matters, but October Nonfarm Payroll Report came in at a red-hot 250,000. The headline Unemployment Rate remained at a two-decade low at 3.7%. The Broader U-6 “Discouraged worker” unemployment rate fell 0.1% to 7.4%.

For the first time in yonks, no sector lost jobs last month. HealthCare added 36,000 jobs, Manufacturing 32,000 jobs, and Leisure & Hospitality 42,000 jobs.

However, the real blockbuster was that Average Hourly Earnings exploded to a 3.1% YOY rate, the highest in ten years. Yes, ladies and gentlemen, this is what inflation looks like, up close and ugly.

The number immediately knocked the wind out of the bond market taking it to a new low for the year. Yes, this is what double short positions in bonds are all about. I saw this coming a mile off.

The backdrop for the bond market is looking worse than ever. The budget deficit is about to break $1 trillion for the first time since the 2009 crash. Rising interest rates mean the government’s debt burden is about to grow by leaps and bounds, eventually becoming its largest expenditure.

The US Treasury is hitting the markets daily with massive new issuance, and the Chinese are dumping what US bonds they have to support the Yuan, now at a ten-year low. This is what Armageddon looks like in slow motion.

Last week was dominated by a China trade war that was on again, then off, then on one more time. The stock market ratcheted four-digit figures every time this happened.

Apple (AAPL) announced record profits yet again but countered with cautious forward sales guidance. Social media pariah Facebook (FB) delivered an earnings report beyond all expectations popping the stock $10.

IBM took over Red Hat (RHT) for $33 billion, the third largest merger in history. It’s too little too late for Big Blue as the stock falls on the news. It all reeks of a “Hail Mary.”

General Electric (GE) cut its dividend from 12 cents a share to one cent after reporting a breathtaking $22.8 billion loss. The Feds have opened a criminal investigation into accounting practices. This may define the final bottom in the stock. Take another look at those long-term LEAPS.

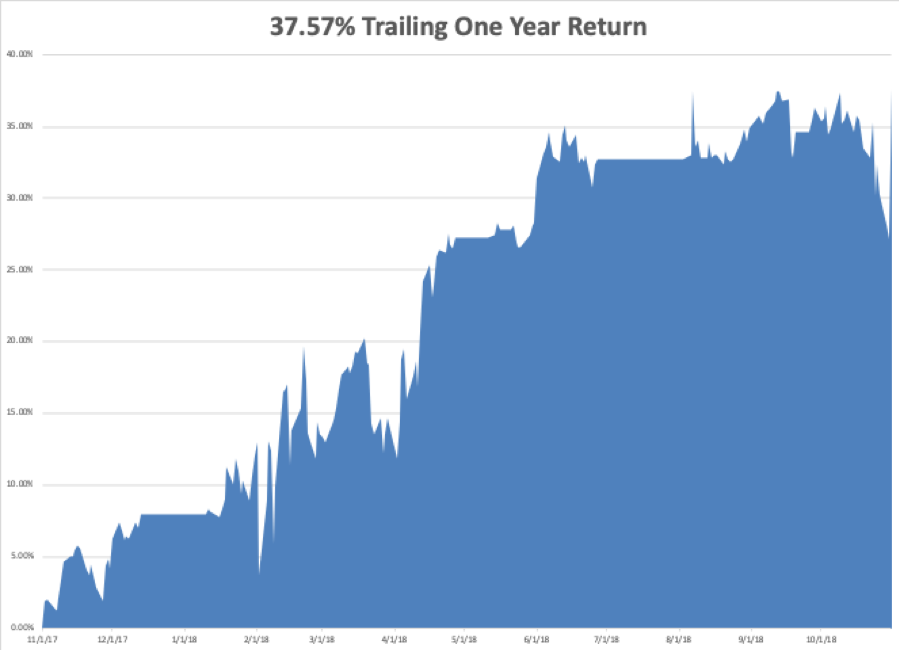

My year-to-date performance rocketed to a new all-time high of +33.17%, and my trailing one-year return stands at 37.57%. October finished at +1.24% and that includes an ill-fated -4.23% loss in the iPath S&P 500 VIX Short Term Futures ETN (VXX).

And this is against a Dow Average that is up a miniscule 1.9% so far in 2018. So far in November, we are up an eye-popping +3.54%.

Incredible as it may seem, the Mad Hedge Fund Trader has been up 18 consecutive months. That’s what you pay for and that’s what you’re getting. There’s nothing more fulfilling in life than making promises to friends, then delivering in spades.

As the market collapses, I scaled into longs in Amazon (AMZN), the S&P 500 (SPY), the Russell 2000 (IWM), and Salesforce (CRM). I used the flight to safety bid in the bond market to double up my short position there, and am kicking myself for not going triple weight.

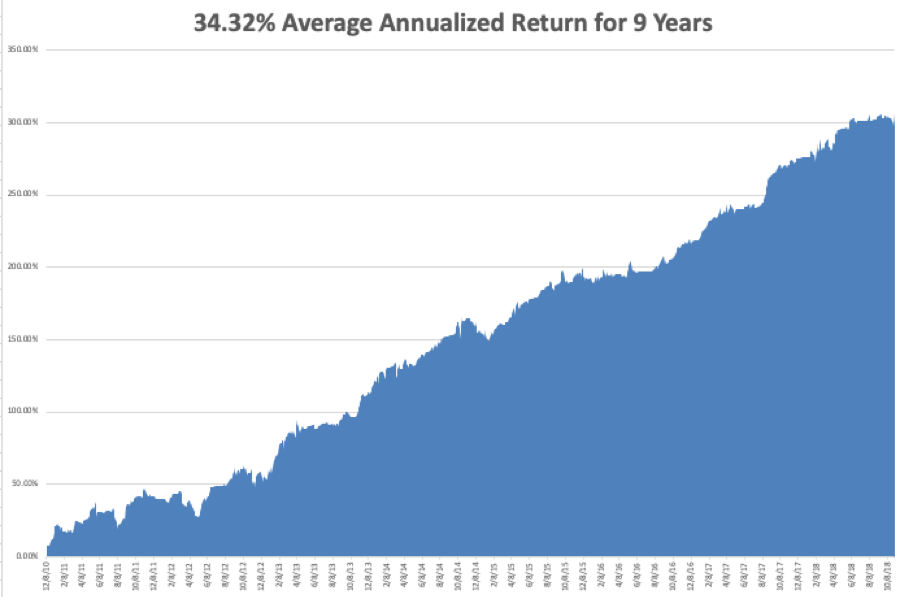

My nine-year return ballooned to 309.64%. The average annualized return stands at 34.72%.

All the BSDs are done reporting Q3 earnings and only a few tag ends are left to report. The carnage is over until we restart the cycle once again in February. In any case, economic data pales in comparison to the election in terms of market impact.

On Monday, November 5 at 10:00 AM, the ISM Manufacturing Index is out.

On Tuesday, November 6 is Election Day. Trading will be a subdued affair and the results will start coming out at 11:00 EST after the west coast polls close.

On Wednesday, October 24 we have the election aftermath to deal with. Up 1,000, down 1,000, or unchanged, who knows?

At 10:30 AM the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

Thursday, October 25 at 8:30, we get Weekly Jobless Claims. The Federal Open Market Committee meets to discuss interest rates but will take no action.

On Friday, October 26, at 8:30 AM, the October Producer Price Index is out, an important read on inflation.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I made a massive amount of money personally in the October crash. I am going to plop down $150,000 and buy a brand new Tesla Model X for myself. The ashtrays are full on the old one, and besides, there is a tiny nick in the windshield from driving up to Lake Tahoe. I hear the new one has new “Summon” technology that allows it to drive into a parking lot by itself and drive around until it finds an empty space, then back into it, all untouched by human hands.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

June 28, 2018

Fiat Lux

Featured Trade:

(FRIDAY, AUGUST 3, 2018, AMSTERDAM, THE NETHERLANDS GLOBAL STRATEGY DINNER),

(TRAPPED IN PURGATORY),

(INDU), (SPY), (NASDAQ), (IWM), (TLT)

I can't believe my eyes.

Here we are at the midpoint of 2018 and the main markets are virtually unchanged. The Dow Average is down 1.5%, the S&P 500 is up +1%, NASDAQ has gained 8.79%, and the Russell 2000 has tacked on 7.18%.

Despite all the promises that happy days are here again, here we are dead in the water. Since the passage of one of the most simulative tax bills in December, we have gone absolutely nowhere.

We are essentially stuck in stock market purgatory.

Of course, you can blame the trade wars, the onset of which marked the top of the bull market on January 24 at 26,252.

The president got one thing right. Trade wars are easy to win, but for dictatorships not for democracies.

If you complain about trade policies in China you are told to shut up or face getting sent to a re-education camp. Worst case you might disappear in the night as has happened to a number of Chinese billionaires lately.

In America any restraint of trade anywhere invites 10,000 highly paid lobbyists desperate to reverse the action. Offer any resistance and the reprobates are thrown out of office, as may happen here in four months.

The Chinese have one weapon against which we have no defense. They can go hungry. They'll just tell their people to toughen up for the greater good of the nation. When I first arrived in the Middle Kingdom 45 years ago they were still recovering from the aftereffects of a famine that killed 50 million (there are NO substitutes for food). Try doing that in the U.S.

The Chinese have another secret weapon at their disposal. They paid $3.63 a week for a subscription to the New York Times (including Sundays). Because of this they know that the president is going into the midterm elections with the lowest approval ratings in history.

And they are doing this running on a policy of sending children to concentration camps, which they don't even do in China anymore. This will cost the party votes in every state except in Oklahoma.

So the Chinese are content to hang tough, meet every tit with a tat, match every escalation, and wait out the current administration. The only question for them is whether the president will be gone in 2 1/2 years or in six months, so it pays to stall.

This is a country where history is measured in millennia. When I asked premier Zhou Enlai in the 1970s what the outcome of the 1792 French Revolution was, he responded "It's too early to say."

None of this is good for stock prices.

So I will continue with my now five-month-old prediction that markets will remain trapped in narrow ranges until before the midterms, and then rally strongly. It will do this not because of who wins, but because of the mere fact that it is over.

If you are a trader, unless you can buy stocks on those horrific capitulation panic days and sell on the most euphoric peaks, it's better just to stay away. I can do that, but I bet most of you can't. But then I've been practicing for 50 years. This is why I dumped the last of my positions yesterday morning at the highs of the day, shooting out three Trade Alerts in rapid succession.

By the way, these are excellent reasons to avoid the bond market as well. While the fundamentals tell us that interest rates should continue to rise for years, the charts tell us a different story.

With 10-year U.S. Treasury bond yields (TLT) hitting a five-month low today, it is hinting that a recession isn't a 2019 event, it in fact has already started. Bulls better fall down on their knees and pray to their chosen idol that this is nothing more than an extended short covering rally.

It all sounds like a great time to take a long cruise to me.

China in 1973

Suddenly, the consolidation turned into a correction and maybe even a bear market.

A crucial part of trading a crash is knowing what to do at the bottom. Don?t worry. You?ll receive a flurry of text alerts from me right when that happens.

Many individual investors simply run to the bathroom and lock the door, hoping nobody knocks on the door for a couple of days.

Worse, they dump every stock they have. That?s what makes market bottoms.

Trades that once seemed impossible can now get done, provided you use limit orders.

Let me get this right. Stocks are crashing because:

1) The Federal Reserve isn?t going to raise interest rates anymore.

2) The price of oil has dropped 84% in five years.

3) Commodities have reached multi-decade lows.

4) The US dollar has suddenly stabilized.

5) Investors are yanking money from abroad and pouring it into the US on a flight to safety trade because it is the only place they can obtain a positive return, especially in stocks.

May I point out the screamingly obvious right here?

These are all reasons for 90% of US companies that borrow money and consume energy and commodities to increase earnings and to boost their share prices.

Only the 10% that derive revenues from ripping oil and commodities out of the ground should get hurt here.

Of course the market doesn?t know that. It is anything but rational when we hit big triple digit declines. There was only one direction on, and that was OUT.

And that is where you make your money

Margin clerks rule supreme, squeezing every bit of leverage out of their clients they can find.

The Dow and (SPY) are already posting large negative numbers for 2016.

Of course, I saw all of this coming a mile off.

I have been banging drums, pulling fire alarms, shooting off flare guns, and otherwise warning readers that the technical situation for the market was terrible ever since I went 100% into cash in December.

When the breakdown appeared imminent, I shot out Trade Alerts to sell short the S&P 500 (SPY) in size as fast as I could write them. And I started buying outright (SPY) puts for the first time in ages.

As a result of these sudden tactical moves, my model-trading portfolio has been keeping its head above water all month, up 2%. The Dow Average is off by a nausea inducing -10.7% at today?s low.

Yes, yes! All the hard work and research is paying off!

Ignore my musings at your peril!

What is even more stunning is that these declines are occurring in the face of US macro economic numbers that are going from strength to strength. The blockbuster December nonfarm payroll report of 292,000 is the real writing on the wall.

Housing, which accounts for about one third of the US economy, has been on fire. I?m sorry, but if you can?t find a parking space at Target, there is no recession.

Another crucial leg of the US economy, auto manufacturing, has been in overdrive. Auto sales are at a record 18 million annual rate, and some summer production shut downs have been cancelled.

That is, everywhere except Volkswagen.

With two of the most important legs firing on all cylinders, it?s clearly not about the economy, stupid!

There certainly hasn?t been a geopolitical event to justify moves of this magnitude.

As far as I can tell, Hitler has not invaded Poland, nor have the Japanese attacked Pearl Harbor.

Sure, there is whining about China, which has the Shanghai Index approaching the 2,900 level once again, down 40% from the top.?

Which leads me to believe that all of this is nothing more than a temporary hiccup. A BIG Hofbrauhouse kind of hiccup, but a hiccup nonetheless.

In a zero interest rate world, stocks only have to fall back from a price earnings multiple of 18 to 15 to flush out a ton of buying, and they will have done just that when the (SPY) hits $174.

THAT IS MY LINE IN THE SAND.

If nothing else, corporate buybacks should reaccelerate here, which could reach $1 trillion in 2016. Some 75% companies exit their quiet period by February 5 and can resume buying.

That could signal an interim market bottom.

The great thing about this selloff is that the best quality companies have fallen the most. This has been a function of the heavy sovereign wealth fund selling the bridge oil deficits.

After all, when share prices are in free fall, you have to sell what you can, not what you want to. It is only human to realize profits rather than incur losses, so quality has been trashed.

I am therefore going to give you a list of ten of my favorite stocks to buy at the bottom, highlighting the sectors that will lead us into a yearend rally.

The themes here are home builders, consumer discretionary, autos, solar, old technology, and international. I?m sorry, but the entire interest sensitive sector is on hold for the rest of the year, thanks to likely Fed inaction.

Watch out, because when I sense that the market has burned itself out on the downside, the Trade Alerts are going to be coming hot and heavy.

You have been forewarned!

Read ?em and weep with joy!

10 Stocks to Buy at the Bottom

Lennar Homes (LEN)

Home Depot (HD)

Microsoft (MSFT)

General Electric (GE)

Tesla (TSLA)

Apple (AAPL)

First Solar (FSLR)

Palo Alto Networks (PANW)

Wisdom Tree Japan Hedged Equity (DXJ)

Wisdom Tree Europe Hedged Equity (HEDJ)

When the US Department of Labor announced its blockbuster May nonfarm payroll showing a 280,000 gain, stocks behaved like the world had just ended.

The 32,000 in March and April upward revisions didn?t help either.

You would think data showing that the economy is improving much faster than many realized would be positive for ?RISK ON? equity investments.

It wasn?t.

Now, the laser focus is on the bond market, which is collapsing globally. The complete disappearance of liquidity is exacerbating the moves.

Bond traders are now hyper sensitive to any news of a stronger American economy, which will soon lead to higher interest rate rises by Janet Yellen?s Federal Reserve.

A world is ending, but not the one you think. The zero interest rate regime on which we have all become heavily addicted over the last eight years is about to go into the history books.

Welcome to the looking glass world of investment these days. Good new is bad news and bad news good.

Players are in a manic depressive mood, expecting the economy to plunge into recession one month, and then discounting a robust recovery the next.

Then there?s Greece, which threatens to default on its debt on alternate days, and then offers to pay on the others. This has prompted the Euro (FXE) to undergo more gyrations than a circus contortionist.

Not a friendly environment for a trader. Sturm und drang with no net movement in the indexes doesn?t pave the road to trading riches. Even staying long volatility (VIX) is not working, unless you have the fastest finger in Chicago.

This is why I am keeping the Mad Hedge Fund Trader model trading portfolio to an absolute minimum bare bones of positions, a single 10% weighting in the S&P 500 that I snapped up at the Friday lows. And even that one has me edgy.

After polling many of my most loyal, long-term readers, I learned that they would rather see a small number of great trades than a large number of positions that include a few losers.

So, cherry picking it is, at least, for now.

To say that the nonfarm was fantastic is something of an under statement.

Private nonfarm jobs jumped by a dynamic 262,000. High paying professional and business services employment increased by a runaway 63,000. Leisure and hospitality ramped up to 57,000. Health care picked up 47,000.

The big loser was mining (coal, gold, silver), which shed 17,000 jobs. Headline unemployment held steady at 5.5%, while average hourly earnings rose by 0.3%.

It was almost a perfect report.

It certainly reinforces my own forecast of a hot 3% GDP growth rate for the final three quarters of 2015. The question bedeviling traders and investors alike now is, ?How much of this growth is already discounted in today?s prices??

You almost wonder if stocks are tired of going up, which have been appreciating for more than six years. Stock buyers need a new story.

With a discount Euro beckoning, it sounds like this summer will be the best ever to take a long vacation.

I think I have figured out the course of the global financial markets over the next few months.

We are currently transitioning from an economic data flow from Q1 that was very weak, to the second quarter, which will almost certainly deliver us a robust set of numbers. This is on the heels of a white hot Q1, 2014.

Hot, cold, hot; this is a trader?s dream come true, as it gives us the volatility we need to make a fortune, as we skillfully weave in and out of these gyrations.

That is, if you read the Diary of a Mad Hedge Fund Trader.

This is not a new thing. A weak Q1 has been a recurring event over the last 30 years. The anomaly has been so reliable that not a few traders have been able to earn a living from it. :) Heaven help us if the government ever tries to fix it.

To further complicate matters, some markets see this, while others have yet to open their eyes.

The stock market (SPY), (QQQ), (IWM) agree with my view, probing new all time highs, while companies announce diabolical Q1 earnings (Twitter (TWTR)? Yikes!). So do commodities, like oil (USO) and copper (FCX), whose recent strength suggests we are on the doorstep of a great economic Golden Age.

However, the foreign exchange market (FXE), (FXY) doesn?t see it this way. They can only comprehend the last data point that just crossed the tape.

If it is weak, they assume the Federal Reserve won?t even think about raising interest rates until well into 2016. If it is healthy, they bet the Fed will jack up rates tomorrow.

You might assume this is ridiculous, and you?d be right. However, forex traders live in a world where interest rate differentials are the principal, and to many the only driver of foreign exchange rates.

One market is right, and one is wrong. Did I mention that this is also a license for we nimble traders to print money?

Of course, you can play both side of the fence, as I do. That?s how I was able to coin it with a long position in the euro (a weak economy trade) the same day my long US equity portfolio (a strong economy trade) was going through the roof.

Let me give you another iteration of these scenarios. Inside the dollar correction we are seeing a pronounced sector rotation among US stocks.

Traders are moving out of small caps (IWM) that sheltered then from a strong dollar into large caps (SPY). They are also taking profits in biotech and rolling it into financials (GS), cyber security (PANW) and solar (TAN).

Goldman Sachs (GS) gave us more rocket fuel for the bull case for of American stocks this morning. The sage investment bank, in which my Trade Alert Service currently maintains a profitable long position, says that corporations will return a mind blowing $1 trillion to investors in 2015.

Share buy back from companies should rise by 18%, while dividends should pop by 7%. It is all a continuation of a six-year trend.

Apple (AAPL) certainly kicked off this quarter?s cavalcade of higher payouts on Monday, when it added $50 billion to its own stock repurchase program and jacked up its dividend by 11%.

Markets could get even more interesting after next week, when some 80% of S&P 500 companies will have existed the ?black out? period when they are not allowed by SEC regulations to buy their own stock.

I say ?tally ho,? and ?tally ho? again.

I?ll let you in on my top secret investment strategy that has brought me blockbuster results over the past six years.

Listen to the Wharton Business School?s professor, Jeremy Siegel.

The good doctor has been unremittingly bullish year in and year out, nearly pegging the stock index performance annually.

So, when he says that the Dow Average is going to rise to 20,000 by the end of 2015, that?s good enough for me. In fact Siegel thinks that at current price earnings multiple of 17 times, the bull market has years to run.

It would not be until we hit nosebleed levels of 25X or 30X earnings that he would get worried. And the current ultra low level of interest might even make these high multiple numbers justifiable.

So for the foreseeable future, we are going to see long periods of tedious range trading, followed by frenetic rounds of buying, once the market decides that it is time to discount the next rise in corporate earnings.

We happen to be in one of those range-trading periods right now, which my partner, Mad Day Trader Jim Parker, thinks could last all the way until September.

Actually, it is a little more complicated than that.

There is good reason for the stock market to go to sleep over the next two weeks.

Do you hear that great sucking sound? That is the noise of 170 million tax payers writing checks to the US Internal Revenue Service.

Foreign readers may not realize this, but tax payments are due in the United States on April 15 every year. I would ask for your sympathy, but I know all of you pay far more in taxes than we do. I know, because I used to pay them myself when I lived abroad for 23 years.

Of the $6 trillion in revenues from all sources due to Uncle Sam in 2015, 37%, or $2.2 trillion will come in the form of individual income taxes. That is a big hit for the financial system. That means for the next two weeks there won?t be any extra money lying around to put into the stock market.

There is another reason why the stock indexes are stagnating here. The Q1, 2015 corporate earnings reporting season kicks off when Alcoa (AA) reports on April 8, or in six trading days. Until then, we are in the quiet period, and companies are not allowed the buy back their own stock.

This is a big deal, since companies buying back their own shares have provided major support for the stock market for many years. Possibly a quarter of all the net cash flow pouring into stocks since 2009 has come from this source.

Take it away, even for a short period, and the most bullish thing the market can do is move sideways, which is exactly what it has been doing for the past two months.

What happens when the tax payment deadline passes and the quiet period ends? Stocks take off like a bat out of hell. That will take us to the spring interim peak.

This is why I strapped on three new ?RISK ON? positions last Friday, longs in the Russell 2000 (IWM) and Goldman Sachs (GS) and a short in the euro (FXE).

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.