I have an unusually sensitive nose. Maybe that is because it is so big. It is particularly attuned to detecting bullpucky in broker research reports. So when an analyst recently downgraded the mid-level broker, Jeffries & Co (JEF), on the back of its European debt exposure, the stench was overwhelming.

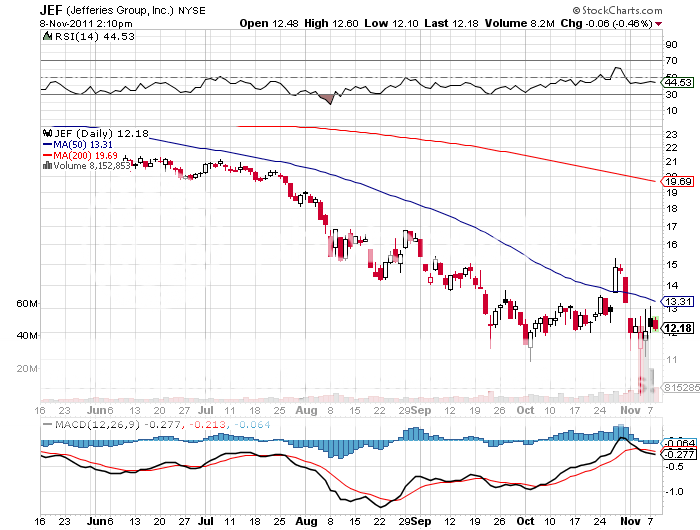

I went to the website at http://www.jefco.com/ and had a quick look at the balance sheet and income statement. The leverage was a conservative 12:1 and earnings were growing nicely. But when I looked at the chart, it had chapter 11 written all over it, the stock plunging 40% in days. Things were just not adding up.

So I called someone I knew in senior management. The European problems were being vastly exaggerated. Total positions amounted to 2% of assets, and these were all fully hedged, both by underlying security and duration. The firm was about to post its entire European portfolio on its website with every detail, down to the last CUSIP number, an unprecedented level of disclosure. There is no need for an emergency dilutive capital raise whatsoever. What?s more, he only knew of one client in his department who had pulled funds in the past week, and he would probably return, once the dust had settled.

It all had the makings of a classic bear raid to me. This is where some opportunistic traders spread false rumors about the health of a company in the hope of making some quick profits on the short side. With MF Global, once the world?s largest future broker, having gone bust on Monday, the market was particularly sensitive to this kind of news.

With any luck, a panic will ensue causing the decline to snowball and quickly take the share price to zero. If a few thousand people lose their jobs, and a few tens of thousands of shareholders get wiped out, that is tough luck. Such are the cruel and heartless ways of Wall Street in search of the eternal buck.

However, given JEF?s bold and decisive action, I didn?t think the bears would be successful this time. And, to me, that spells opportunity with a capital ?$O$?.

If the rest of the market reaches the same conclusions that I have, then the stock is poised to rocket. At the very least, it could rapidly return to the pre-rumor level of $15.50. That would cause the January, 2012 $11 calls to double from my current cost of $2.40. If Europe cools off a bit and the market and global risk assets take another leg up, you could get a lot more.

This is still a financial, a sector that I am not exactly enamored with. So I am going to limit this position in the calls to only a high risk allocation of 2.5% of my portfolio. There are still plenty of black swans out there looking for a place to land. For my notional ?virtual? $100,000 fund, this amounts to 10 contracts ($2,500/100/$2.40). With any luck, we?ll be out of this next week.

Newsletter subscribers should note that this is a trade alert that went out from my Macro Millionaire Service at opening last Friday, November 4, when the stock was trading at $11.30. Yes, this is the program with the model portfolio that is up 47% year to date. For those who wish to participate in Macro Millionaire, my highly innovative and successful trade mentoring program, please email John Thomas directly at madhedgefundtrader@yahoo.com . Please put ?Macro Millionaire? in the subject line, as we are getting buried in emails. Hurry up, because our software limits the number of subscribers, and we are running out of places.

You are Cleared for Landing