Some people say that the entirety of November can be considered the Halloween season for investors, especially with the current stock market climate.

Stock valuations are higher than ever, while inflation has started to rear its ugly head since the month began.

Personally, I don’t believe that investors should be scared.

Throughout history, there has always been a bogeyman or two emerging as a reason to veer far away from the stock market. More often than not, though, these frightening situations tend to be overblown.

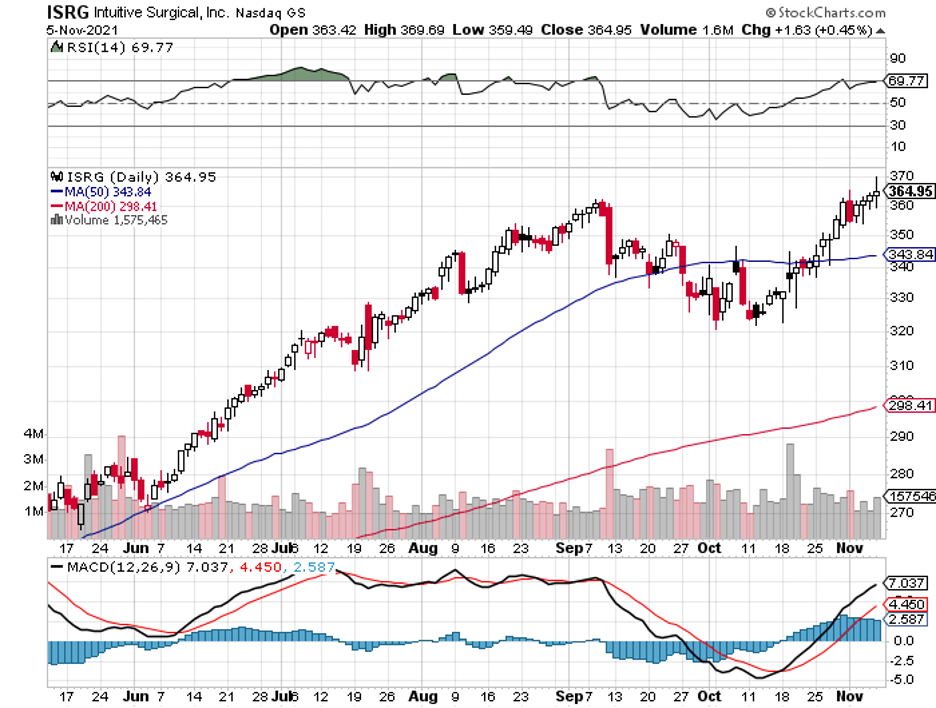

One of the companies that investors are afraid to risk their money on is Intuitive Surgical (ISRG).

However, Intuitive Surgical has the markings to realistically expand to 10X or even more over the following decades.

If anything, I think this is a stock that investors should be more frightened to pass up rather than to buy.

Admittedly, Intuitive Surgical’s high-tech robotic surgical platforms do look sort of scary. Nonetheless, the stock tells a completely different story.

Intuitive Surgical is a pioneer in robotic surgery, with the company’s work dating back to the late 1990s.

To date, it has over 6,500 of its systems installed across the globe and more than 9.7 million procedures performed utilizing its robotic platforms.

Basically, Intuitive Surgical offers a robotic-assisted surgery structure called the “da Vinci System.”

Surgeons use this in an effort to lessen the invasiveness of surgeries. The company’s robotic systems have been used in various surgery types like gallbladder, hernia, gynecological, colorectal, and bariatric.

While the da Vinci System has become synonymous with Intuitive Surgical, what most people don’t know is that the company gets the majority of its revenue from recurring orders of accessories, instruments, and service.

In fact, these comprise 69% of the company’s revenue in the first 6 months of 2020, with the number rising to 72% during the same period in 2021.

After all, hospitals invest millions in buying the machines and training the surgeons, so it makes sense that they want to keep them in tiptop shape.

Although these numbers look impressive, the truth is that Intuitive Surgical is barely scratching the surface of this opportunity.

Given its history and growth trajectory, the company projects that it will perform approximately 6 million procedures annually based only on its systems with regulatory clearances. In comparison, Intuitive Surgical recorded 1.2 million procedures in 2020.

Intuitive Surgical still believes that it can surpass this projected five times growth opportunity despite this promising outlook.

In recent years, the company has been investing heavily in its R&D sector to expand its reach.

One of the potential markets in its sights is the soft-tissue surgery segment, which has recorded roughly 20 million procedures every year.

And these are all based on the current population. If we factor in the aging demographics, then we can definitely expect to drive the volume higher in the coming decades.

Considering the massive potential of this market, it comes as no surprise that Intuitive Surgical faces more and more competition.

Although several big and small companies have tried to enter the robotic surgical systems segment, none can compare to the proven track record of Intuitive Surgical.

Given the 20-year headstart of Intuitive Surgical, saying that it would be difficult to catch up to its accomplishments is an understatement.

Moreover, the company controls roughly 80% of the surgical robotics market globally—and that’s a multi-billion dollar market.

Some of the companies trying to penetrate the space are Johnson & Johnson (JNJ) , Stryker Corporation (SYK), Becton, Dickinson, and Company (BDX) and Medtronic (MDT).

Intuitive Surgical has a proven track record of being one of the most notable regardless of industry, even in terms of profitability.

If you compare its bottom line, net profit margin, to its competitors, the company’s margin looks so much better than the combined margin of SYK, BDX, and MDT.

Bear in mind that the medical technology sector is one of the areas that will tremendously benefit from the reopening.

While it’s not top of mind, many elective surgeries and diagnoses were sidelined during the lockdowns.

The influx of COVID-19 cases in hospitals caused many doctors to delay these procedures, and patients didn’t want to risk infection either. This resulted in a colossal backlog of elective surgeries.

With the vaccination rates going up and the pandemic getting handled more efficiently, these very same patients will need to get treatment for the postponed surgeries.

Needless to say, this will trigger a post-pandemic boom in the elective surgeries and diagnostics field—and Intuitive Surgical will be there, ready and waiting to reap the rewards.

Overall, Intuitive Surgical is a safe pick with impressive growth potential.

Other than the immediate benefits from the post-COVID-19 era, the company has a remarkable expansion rate and innovative technology.

It’s good to be reminded though, that best-in-breed stocks don’t go on sale as frequently. The truth is, Intuitive Surgical isn’t for bargain hunters.

However, it’s a successful company that’s worth adding, especially on the dip and holding for long-term investors.