-

-

Global Market Comments

May 14, 2021

Fiat LuxFeatured Trade:

(MAY 12 BIWEEKLY STRATEGY WEBINAR Q&A),

(FCX), (QQQ), (JWN), (DAL), (MSFT), (PLTR), (V), (MA), (AXP), (UUP), (FXA), (SPWR), (FSLR), (TSLA), (ARKK), (CLX), (NIO), (EPEV), (SOX), (VIX), (USO), (XLE)

-

Tag Archive for: (JWN)

Mad Hedge Technology Letter

June 3, 2020

Fiat Lux

Featured Trade:

(ABOUT YOUR RIOT-PROOF PORTFOLIO),

(COMPQ), (WMT), (APPL), (AMZN), (TGT), (JWN), (EQIX), (GOOGL), (MSFT)

Social unrest will have NO material effect on tech shares moving forward.

Some investors expected the Nasdaq (COMPQ) index to roll over big time, throttled by a national insurrection. Anti-police-violence protests, some becoming riots, have broken out in more than 60 cities.

However, it appears to be another false negative for the Nasdaq as it motors upwards acting on the momentum of outperformance during the coronavirus.

One thing that the coronavirus pandemic, as well as protests, have taught investors is the unwavering faith in technology’s strength will continue powering the overall market rebound.

Any social unrest will not stop tech shares because they simply don’t subtract from their revenue models.

This will perpetuate into the rest of 2020 and beyond.

Much of the public reaction from big tech has been paying some form of lip service about the national situation being untenable followed up with a small donation.

Apple (AAPL) says it's making donations to various groups including the Equal Justice Initiative, a non-profit organization based in Montgomery, Alabama that provides legal representation to marginalized communities.

To read more about big tech’s donations, click here.

Aside from some PR formalities, it will be business as usual after things settle down.

Apple might suffer some slight inconveniences of having some stores looted, but that doesn’t mean consumers can’t buy products online.

Tech companies simply contort to fit the new paradigm and that is what they are best at doing.

Apple has charged hard into the digital service as a subscription world that has served Amazon, Apple, Google (GOOGL), and Microsoft (MSFT) so well.

To read more about the robust performance of software stocks, please click here.

Many of these tech companies don’t need a physical presence to drive forward earnings, revenue models, and widen their competitive advantages.

That’s the beauty of it and their brands are so entrenched that it doesn’t matter what happens in the outside world at this point.

It’s true that a few tech companies might have to scale back or modify operations until the storm subsides but not at a great scale that will worry investors.

Amazon is reducing deliveries and changing delivery routes in some areas affected by the protests.

Big tech dodged a bullet with the majority of the financial burden falling on the shoulders of big-box retailers like Walmart (WMT) and Target (TGT) and city center-located businesses.

Walmart closed hundreds of stores one hour early on Sunday, but most are slated to reopen. Nordstrom (JWN) temporarily closed all its stores on Sunday.

Amazon (AMZN)-owned Whole Foods are often located in neighborhoods that are perceived likely to escape the bulk of the turmoil.

The events of the last few days will have significant side effects on the normalcy of society or the new normal of it.

Combined with the pandemic, consumers will opt for more spacious housing options in less concentrated areas of the U.S.

The social unrest once again delivers the goodies into the hands of e-commerce as people will be less inclined to leave their house to consume.

A stock that really sticks out during all of this is the leader in interconnected data centers Equinix (EQIX) because of the explosion of data being consumed from the stay-at-home revolution.

Sadly, the price of tech share does not account for life quality which is part of the reason we see stocks lurching higher.

By the time all the different crises, including coronavirus and protests, are snuffed out, we could be in a world where the only strong companies left are technology, "big tech".

They have an insurmountable lead at this point with guns still blazing.

When you add the windfall of trillions in cash the Fed has pumped out and unwittingly diverted into tech shares recently, it is hard to envision ANY scenario in which the Nasdaq will be down a year from now.

I am bullish on the Nasdaq index and even more bullish on big tech.

Even the supposed “rotation” to value has only meant that tech shares haven’t gone down.

A dip now in tech shares means shares dip for two hours before resurging.

Why would anyone want to sell the best and highest growth industry in the public markets with unlimited revenue-generating potential?

Global Market Comments

May 29, 2020

Fiat Lux

Featured Trade:

(JOIN THE JUNE 4 TRADERS & INVESTORS SUMMIT),

(THE CONTINUING DEATH OF RETAIL),

(AMZN), (WMT), (M), (JWN),

(TESTIMONIAL)

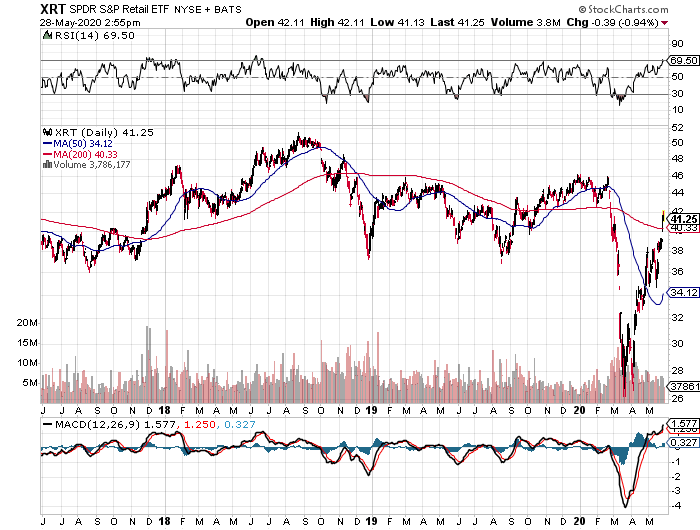

If you had to pick the biggest loser of our ongoing pandemic and the trade wars, it would be the retail industry (XRT). Higher costs which can’t be passed on, rising minimum wages, lower selling prices, and a massive inventory glut is not what money-making is all about.

Now, take all of those problems and drop your revenues by half, thanks to the pandemic. A future where touching, feeling, and trying on things before you buy them is about to become an extravagant luxury.

The stocks have delivered as expected, providing one of the worst-performing sectors of the past three years. Half of them probably won’t even make it until Christmas.

In fact, Sears and Macy’s have announced more store closings nationwide. The overhead is killing them in a micro margin world devoid of window shopping customers.

So, I stopped at a Walmart (WMT) the other day on my way to Napa Valley to find out why.

I am not normally a customer of this establishment. But I was on my way to a meeting where a dozen red long stem roses would prove useful. I happened to know you could get these for $10 a dozen at Walmart, 60% cheaper than anywhere else.

After I found my flowers, I browsed around the store to see what else they had for sale. The first thing I noticed was that half the employees were missing their front teeth.

The clothing offered was out of style and made of cheap material. It might as well have been the Chinese embassy. Most concerning, there was almost no one there, customers OR employees.

The Macy’s downsizing is only the latest evidence of a major change in the global economy that has been evolving over the last two decades.

However, it now appears we have reached both a tipping point and a point of no return. The future is happening faster than anyone thought possible. The pandemic has forced business evolution to move at hyper fast forward and the Death of Retail is no exception.

I remember the first purchases I made at Amazon 20 years ago. I personally knew the founder, Jeff Bezos, from my Morgan Stanley days. The idea sounded so dubious that I made my initial purchases with a credit card with only a low $1,000 limit. That way, if the wheels fell off, my losses would be limited.

And how stupid was that name, Amazon, anyway? At least he didn’t call it “Yahoo” because it was already taken.

Today, I do almost all of my shopping at Amazon (AMZN). It saves me immense amounts of time while expanding my choices exponentially. And I don’t have to fight traffic, engage in the parking space wars, or wait in line to pay.

It can accommodate all of my requests, no matter how bizarre or esoteric. A WWII reproduction Army Air Corps canvas flight jacket in size XXL? No problem!

A used 42-inch Sub Zero refrigerator with a front door ice maker and water dispenser? Have it there in two days, with free shipping at one fifth the $17,000 full retail price.

So I was not surprised when I learned that Amazon accounted for 25% of all new online sales in 2019 in a market that is already growing at a breathtaking 20% YOY.

In 2000, after the great “Y2K” disaster that failed to show, I met with Bill Gates Sr. to discuss his foundation’s investments.

It turned out that they had liquidated their entire equity portfolio and placed all their money into bonds. It turned out to be a brilliant move, coming mere months before the Dotcom bust and a 20-year bull market in fixed income which only peaked two months ago.

Mr. Gates (another Eagle Scout) mentioned something fascinating to me. He said that unlike most other foundations their size, they hadn’t invested a dollar in commercial real estate. Today, that looks like a prescient move in the extreme with 60% of mall tenants skipping their rent.

It was his view that the US economy would move entirely online, everyone would work from home, emptying out city centers, and rendering commuting unnecessary. Shopping malls would become low rent climbing walls and paintball game centers.

Mr. Gates’ prediction may finally be occurring. In the San Francisco Bay area, the only employed people are those who are telecommuting.

Even before the pandemic, it was common for staff to work Tuesday-Thursday at the office, and from home on Monday and Friday. Productivity increases. People are bending their jobs to fit their lifestyles. And oh yes, happy people work for less money in exchange for personal freedom, boosting profits.

The Mad Hedge Fund Trader itself may be a model for the future. We are entirely a virtual company, with no office. Everyone works at home in four countries around the world. Oh, and we all use Amazon to do our shopping.

The downside to this is that whenever there is a snowstorm anywhere in the country, it affects our output. Two storms are a disaster, and at three, such as last winter, we grind to a virtual halt.

The main thing I am worried about is the Internet in the Philippines which is unable to handle the tenfold increase in demand since the start of the pandemic. They don’t have our infrastructure. If you wonder why your customer support at any company has suddenly gotten poor, that is the reason.

You may have noticed that I can work from anywhere and anytime (although sending a Trade Alert from the back of a camel in the Sahara Desert was a stretch), so was sending out an Alert while hanging on the cliff face of a Swiss Alp. But they both made money.

Moroccan cell coverage is better than ours, but the dromedary’s swaying movement made it hard to hit the right keys.

The cost of global distribution is essentially zero. Profits go into a bonus pool shared by all. Oh, and we’re hiring, especially in marketing.

It is happening because the entire “bricks and mortar” industry is getting left behind by the march of history.

Sure, they have been pouring millions into online commerce and jazzed up websites. But they all seem to be poor imitations of Amazon, with higher prices and worse service. It is all “hour late and dollar short” stuff.

In the meantime, Amazon has soared by an eye-popping 56% since the March 23 low and is one of the top-performing big-cap stocks of 2020. There is now a cluster of Amazon analyst forecasts targeting the $3,000 mark, including me.

And here is the bad news. Bricks and Mortar retailers are about to lose more of their lunch to Chinese Internet giant Alibaba (BABA), which is ramping up its US operations and is FOUR TIMES THE SIZE OF AMAZON!

There’s a good reason why you haven’t heard much from me about retailers. I made the decision 30 years ago never to touch the troubled sector.

I did this when I realized that management never knew beforehand which of their products would succeed and which would bomb, and therefore, were constantly clueless about future earnings.

The business for them was an endless roll of the dice. That is a proposition in which I was unwilling to invest. There were always better trades.

I confess that I had to look up the ticker symbols for this story, as I never use them.

You will no doubt be enticed to buy retail stocks as the deal of the century by the talking heads on TV, Internet research, and maybe even your own brokers, citing how “cheap” they are because the prices are so low.

Never confuse a low stock price with “cheap.”

It will be much like buying the coal industry (KOL) a few years ago, another industry headed for the dustbin of history. That was when “cheap” was on its way to zero for almost every company. Don’t buy the next coal company.

So the next time someone recommends that you buy retail stocks, you should probably lie down and take a long nap first. When you awaken, hopefully the temptation will be gone.

Or better yet, go shopping at Amazon. The deals are to die for.

To read “An Evening with Bill Gates Sr.,” please click here.

Global Market Comments

August 7, 2019

Fiat Lux

Featured Trade:

(WHY I SOLD SHORT MACYS’),

(AMZN), (WMT), (M), (JWN), (KOL)

(TESTIMONIAL)

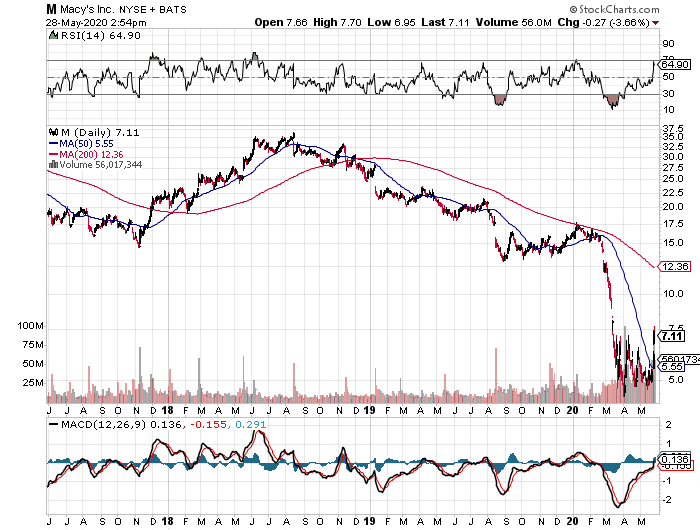

Sorry, the Trade Alert to sell short Macys’ (M) went out late yesterday. I was speaking to a retail expert and his list of things wrong with the marquee name was so long that I couldn't get off the phone. New Yorkers are going to have to find something else to do on Thanksgiving Day than attend their famous parade.

His bottom line? Retail is in a death spiral from which it will never recover. Trying on clothes in a shopping mall will soon become a thing of the past, going the way of the buggy whip, black and white TV, and six-track tapes.

If you had to pick the biggest loser of our ongoing trade wars, which have just been ratcheted up in intensity, it would be the retail industry (XRT). Higher costs and tariffs can’t be passed on, minimum wages are rising in the big cities, lower selling prices are lower, and a massive inventory glut is NOT what money-making is all about.

The stocks have delivered as expected, providing one of the worst-performing sectors of 2019. Half of them probably won’t even make it until 2020.

In fact, Sears (S) and Macy’s (M) have announced more store closings nationwide. The overhead is killing them in a micro margin world.

So, I stopped at a Walmart (WMT) the other day on my way to Napa Valley to find out why.

I am not normally a customer of this establishment. But I was on my way to a meeting where a dozen red long-stem roses would prove useful. I happened to know you could get these for $10 a dozen at Walmart.

After I found my flowers, I browsed around the store to see what else they had for sale. The first thing I noticed was that half the employees were missing their front teeth.

The clothing offered was out of style and made of cheap material. It might as well have been the Chinese embassy. Most concerning, there was almost no one there, customers OR employees.

The Macy’s downsizing is only the latest evidence of a major change in the global economy that has been evolving over the last two decades.

However, it now appears we have reached both a tipping point and a point of no return. The future is happening faster than anyone thought possible. Call it the Death of Retail.

I remember the first purchases I made at Amazon 20 years ago. Even though I personally knew the founder, Jeff Bezos, from my Morgan Stanley days, the idea sounded so dubious that I made my initial purchases with a credit card with only a low $1,000 limit. That way, if the wheels fell off, my losses would be limited.

And how stupid was that name Amazon, anyway? At least, he didn’t call it “Yahoo” because it was already taken.

Today, I do almost all of my shopping at Amazon (AMZN). It saves me immense amounts of time while expanding my choices exponentially. And I don’t have to fight traffic, engage in the parking space wars, or wait in line to pay.

It can accommodate all of my requests, no matter how bizarre or esoteric. A WWII reproduction Army Air Corps canvas flight jacket in size XXL? No problem!

A used 42-inch Sub Zero refrigerator with a front-door icemaker and water dispenser? Have it there in two days, with free shipping at one fifth the $17,000 full retail price.

So I was not surprised when I learned this morning that Amazon accounted for 25% of all new online sales in 2018 in a market that is already growing at a breathtaking 20% YOY.

In 2000, after the great “Y2K” disaster that failed to show, I met with Bill Gates Sr. to discuss his foundation’s investments.

It turned out that they had liquidated their entire equity portfolio and placed all their money into bonds, a brilliant move coming mere months before the Dotcom bust and a 16-year bull market in fixed income.

Mr. Gates (another Eagle Scout) mentioned something fascinating to me. He said that unlike most other foundations their size, they hadn’t invested a dollar in commercial real estate.

It was his view that the US economy would move entirely online, everyone would work from home, emptying out city centers and rendering commuting unnecessary. Shopping malls would become low-rent climbing walls and paintball game centers.

Mr. Gates’ prediction may finally be occurring. Some counties in the San Francisco Bay area now see 25% of their workers telecommuting.

It is becoming common for staff to work Tuesday-Thursday at the office, and from home on Monday and Friday. Productivity increases. People are bending their jobs to fit their lifestyles. And oh yes, happy people work for less money in exchange for personal freedom, boosting profits.

The Mad Hedge Fund Trader itself may be a model for the future. We are entirely a virtual company with no office. Everyone works at home in four countries around the world. Oh, and we all use Amazon to do our shopping.

The downside to this is that whenever there is a snowstorm anywhere in the country, it affects our output. Two storms are a disaster, and at three, such as last winter, we grind to a virtual halt.

You may have noticed that I can work from anywhere and anytime (although sending a Trade Alert from the back of a camel in the Sahara Desert was a stretch), so was sending out an Alert while hanging on the cliff face of a Swiss Alp, but they both made money.

Moroccan cell coverage is better than ours, but the dromedary’s swaying movement made it hard to hit the keys.

The cost of global distribution is essentially zero. Profits go into a bonus pool shared by all. Oh, and we’re hiring, especially in marketing.

It is happening because the entire “bricks and mortar” industry is getting left behind by the march of history.

Sure, they have been pouring millions into online commerce and jazzed up websites. But they all seem to be poor imitations of Amazon with higher prices. It is all “Hour late and dollar short” stuff.

In the meantime, Amazon soared by 49% from December to the May high, and was one of the top performing stocks of 2018. There are now a cluster of Amazon analyst forecasts around the $3,000 mark.

And here is the bad news. Bricks and Mortar retailers are about to lose more of their lunch to Chinese Internet giant Alibaba (BABA), which is ramping up its US operations and is FOUR TIMES THE SIZE OF AMAZON!

There’s a good reason why you haven’t heard much from me about retailers. I made the decision 30 years ago never to touch the troubled sector.

I did this when I realized that management never knew beforehand which of their products would succeed, and which would bomb, and therefore were constantly clueless about future earnings.

The business for them was an endless roll of the dice. That is a proposition in which I was unwilling to invest. There were always better trades.

I confess that I had to look up the ticker symbols for this story as I never use them.

You will no doubt be enticed to buy retail stocks as the deal of the century by the talking heads on TV, Internet research, and maybe even your own brokers, citing how “cheap” they are.

Never confuse a low stock price with “cheap.”

It will be much like buying the coal industry (KOL) a few years ago, another industry headed for the dustbin of history. That was when “cheap” was on its way to zero for almost every company.

So the next time someone recommends that you buy retail stocks, you should probably lie down and take a long nap first. When you awaken, hopefully the temptation will be gone.

Or better yet, go shopping at Amazon. The deals are to die for.

To read “An Evening with Bill Gates Sr.”, please click here.

Global Market Comments

June 7, 2019

Fiat Lux

Featured Trade:

(SUNDAY, JUNE 30 MANILA, PHILIPPINES STRATEGY LUNCHEON)

(THE CONTINUING DEATH OF RETAIL),

(AMZN), (WMT), (M), (JWN),

(TESTIMONIAL)

Global Market Comments

February 15, 2019

Fiat Lux

Featured Trade:

(THE CONTINUING DEATH OF RETAIL),

(AMZN), (WMT), (M), (JWN),

(TESTIMONIAL)

Global Market Comments

August 24, 2018

Fiat Lux

Featured Trade:

(AUGUST 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(BIDU), (BABA), (VIX), (EEM), (SPY), (GLD), (GDX), (BITCOIN),

(SQM), (HD), (TBT), (JWN), (AMZN), (USO), (NFLX), (PIN),

(TAKING A BITE OUT OF STEALTH INFLATION)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.