Below please find subscribers’ Q&A for the November 2 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: The country is running out of diesel fuel this month. Should I be stocking up on food?

A: No, any shortages of any fuel type are all deliberately engineered by the refiners to get higher fuel prices and will go away soon. I think there was a major effort to get energy prices up before the election. If that's the case, then look for a major decline after the election. The US has an energy glut. We are a net energy exporter. We’re supplying enormous amounts of natural gas to Europe right now, and natural gas is close to a one-year low. Shortages are not the problem, intentions are. And this is the problem with the whole energy industry, and the reason I'm not investing in it. Any moves up are short-term. And the industry's goal is to keep prices as high as possible for the next few years while demand goes to zero for their biggest selling products, like gasoline. I would be very wary about doing anything in the energy industry here, as you could get gigantic moves one way or the other with no warning.

Q Is the SPDR S&P 500 ETF (SPY) put spread, correct?

A: Yes, we had the November $400-$410 vertical bear put spread, which we just sold for a nice profit.

Q: I missed the LEAPS on J.P. Morgan (JPM) which has already doubled in value since last month, will we get another shot to buy?

A: Well you will get another shot to buy especially if another major selloff develops, but we’re not going down to the old October lows in the financial sector. I believe that a major long-term bull move has started in financials and other sectors, like healthcare. You won’t get the October lows, but you might get close to them.

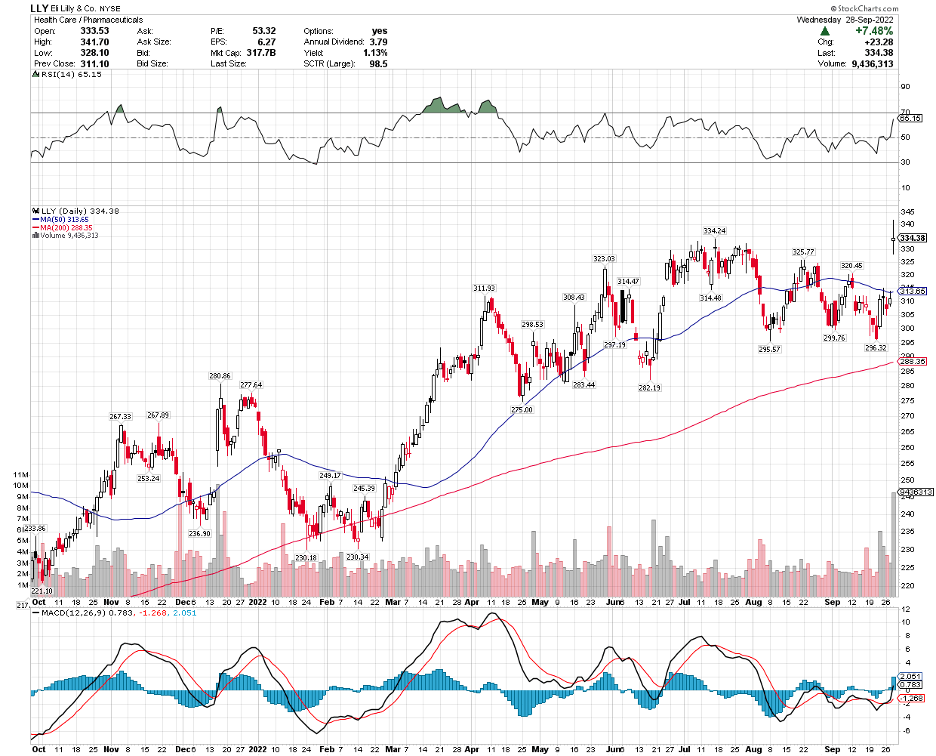

Q: I’m waiting for a dip to get into Eli Lilly (LLY), but there are no dips.

A: Buy a little bit every day and you’ll get a nice average in a rising market. By the way, I just added Eli Lilly to my Mad Hedge long-term model portfolio, which you received on Thursday.

Q: Any thoughts about the conclusion of the Twitter deal and how it will affect tech and social media?

A: So far all of the indications are terrible. Advertisers have been canceling left and right, hate speech is up 500%, and Elon Musk personally responded to the Pelosi assassination attempt by trotting out a bunch of conspiracy theories for the sole purpose of raising traffic and not bringing light to the issue. All indications are bad, but I've been with Elon Musk on several startups in the last 25 years and they always look like they’re going bust in the beginning. It’s not even a public stock anymore and it shouldn’t be affecting Tesla (TSLA) prices either, which is still growing 50% a year, but it is.

Q: In terms of food commodities for 2023, where are prices headed?

A: Up. Not only do you have the war in Ukraine boosting wheat, soybean, and sunflower prices, but every year, global warming is going to take an increasing toll on the food supply. I know last summer when it hit 121 degrees in the Central Valley, huge amounts of crops were lost due to heat. They were literally cooked on the vine. We now have a tomato shortage and people can’t make pasta sauce because the tomatoes were all destroyed by the heat. That’s going to become an increasingly common issue in the future as temperatures rise as fast as they have been.

Q: Do I trade options in Alphabet (GOOG) or Alphabet (GOOGL)?

A: The one with the L is the holding company, the one without the L is the advertising company and the stock movements are really identical over the long term, so there really isn’t much differentiation there.

Q: Why can’t inflation be brought down by increasing the supply of all goods?

A: Because the companies won’t make them. The companies these days very carefully manage output to keep prices as high as possible. It’s not only the energy industry that does that but also all industries. So those in the manufacturing sector don’t have an interest in lowering their prices—they want high prices. If they see the prices fall, they will cut back supply.

Q: What do you think about growth plays?

A: As long as interest rates are rising, growth will lag and value will lead, and that has been clear as day for the last month. This is why we have an overwhelming value tilt to our model portfolio and our recent trade alerts. They’ve all been banks—JP Morgan (JPM), Bank of America (BAC), Citigroup (C), plus Berkshire Hathaway (BRK) and Visa (V) and virtually nothing in tech.

Q: I don’t know how to execute spread trades in options so how do I take advantage of your service?

A: Every trade alert we send out has a link to a video that shows you exactly how to do the trade. I have to admit, I’m not as young as I was when I made the videos, but they’re still valid.

Q: Is the US housing market about to crash?

A: There is a shortage of 10 million houses in the US, with the Millennials trying to buy them. If you sell your house now, you may not be able to buy another one without your mortgage going from 2.75% to 7.75%—that tends to dissuade a lot of potential selling. We also have this massive demographic wave of 85 million millennials trying to buy homes from 65 million gen x-ers. That creates a shortage of 20 million right there. That's why rents are going up at a tremendous rate, and that's why house prices have barely fallen despite the highest interest rates in 20 years.

Q: If we get good news from the Fed, should we invest in 3X ETFs such as the ProShares UltraPro QQQ (TQQQ)?

A: No, I never invest in 3X ETFs, because they are structured to screw the investor for the benefit of the issuer. These reset at the close every day, so do 2 Xs and not more. If you're not making enough money on the 2Xs, maybe you should consider another line of business.

Q: Do you think BlackRock Corporate High Yield Fund (HYT) will show the pain of slights because of their green positioning?

A: No I don’t, if anything green investing is going to accelerate as the entire economy goes green. And you’ll notice even the oil companies in their advertising are trying to paint themselves as green. They are really wolves in sheep’s clothing. They’ll never be green, but they’ll pretend to be green to cover up the fact that they just doubled the cost of gasoline.

Q: Where do you find the yield on Blackrock?

A: Just go to Yahoo Finance, type in (BLK), and it will show the yield right there under the product description. That’s recalculated by algorithms constantly, depending on the price.

Q: Do you like Cameco (CCJ)?

A: Yes, for the long term. Nuclear reactors have been given an extra five years of life worldwide thanks to the Russian invasion of Ukraine. Even Japan is opening theirs.

Q: Should I short the US dollar (UUP) here?

A: The answer is definitely maybe. I would look for the dollar to try to take one more run at the highs. If that fails, we could be beginning a 10-year bear market in the dollar, and bull market in the Japanese yen, Australian dollar, British pound, and euro. This could be the next big trade.

Q: What is your outlook on Real Estate Investment Trusts (REITs) now?

A: I think it looks great. REITs are now commonly yielding 10%. The worst-case scenario on interest rates has been priced in—buying a REIT is essentially the same thing as buying a treasury bond, but with twice the leverage, because they have commercial credits and not government credits. We’ll be doing a lot more work on REITS. We also have tons of research on REITS from 12 years ago, the last time interest rates spiked. I'll go in and see who’s still around, and I'll be putting out some research on it.

Q: How do you see the price development of gold (GLD)?

A: Lower—the charts are saying overwhelmingly lower. Gold has no place in a rising interest rate world. At least silver (SLV) has solar panel demand.

Q: Do you have any fear of Korea going into IT?

A: Yes, they will always occupy the low end of mass manufacturing, and you can see that in the cellphone area; Samsung actually sells more phones than Apple, but they’re cheaper phones with lower-end lagging technology, and that’s the way it’s always going to be. They make practically no money on these.

Q: When can we get some more trade alerts?

A: We are dead in the middle of my market timing index, so it says do nothing. I’m looking for either a big move down or big move up to get back into the market. This is a terrible environment to chase trades when you're trading, so I'm going to wait for the market to come to me.

Q: What about water as an investment? The Invesco Water Resources ETF (PHO)?

A: Long term I like it. There’s a chronic shortage of fresh water developing all over the world, and we, by the way, need major upgrades of a lot of water systems in the US, as we saw in Jackson, MS, and Flint, MI.

Q: Will REITs perform as well as buying rental properties over the next 10 to 20 years?

A: Yes, rental properties should do very well, as long as you’re not buying any city that has rent control. I have some rental properties in SF and dealing with rent control is a total nightmare, you’re basically waiting for your tenants to die before you raise the rent. I don’t think they have that in Nevada. But in Las Vegas, you have the other issue that is water. I think the shortage of water will start to drag on real estate prices in Las Vegas.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log on to www.madhedgefundtrader.com go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

It’s Been a Tough Market