Below please find subscribers’ Q&A for the May 15 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

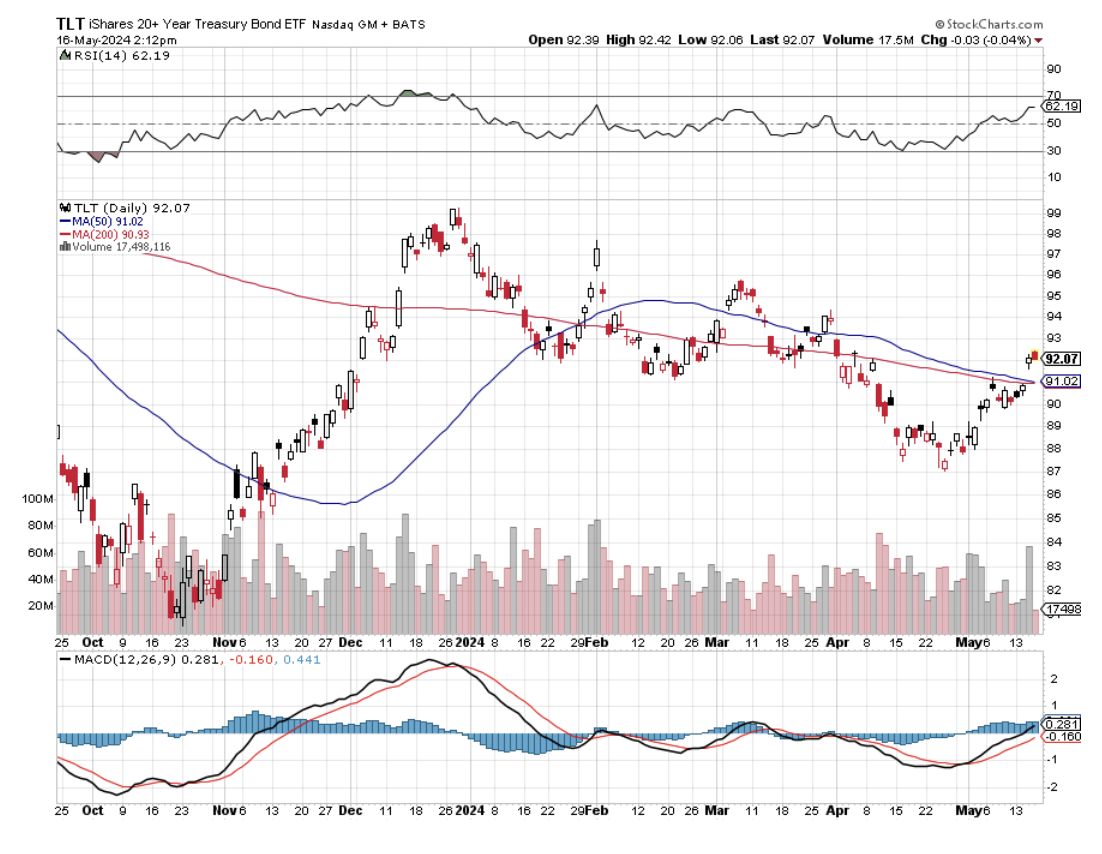

Q: Is it time to get out of the 94/97 (TLT) spread?

A: No. We're getting close to a stop, but I think markets will peak out in the next couple of days and we can get out with a small profit. The weak PPI/CPI/Nonfarm, payroll was a game changer. So watch carefully as always. I could have come out of that with 2/3 of the profit last week, but who knew the market would go up 10 out of 11 days?

Q: What are your thoughts on meme stocks? I see that GameStop (GME) is up 550% in a week.

A: This is not investment, it's pure gambling. And if you do want to gamble, there are much better games to play than meme stocks. For example, Blackjack gives you a 51-49% risk in your favor, and slot machines are not too far off at 55-45%. This is not the same meme stock run that we had three years ago. Back then, the short interest in (GME) was 125%, which is more than the outstanding shares that existed. People are still trying to figure out how that happened. Now, the short interest is only 20%, so this may peak out a lot quicker than last time. In any case, it’s a totally random movement. It's just for kids to do because if kids lose all their money, they can start over again and still have enough money to retire. Chances are if you lose all your money, you won't have enough money to retire, so just another reason to stay out of meme stocks.

Q: I'm noticing the REITs are beginning to make a comeback. Can you comment?

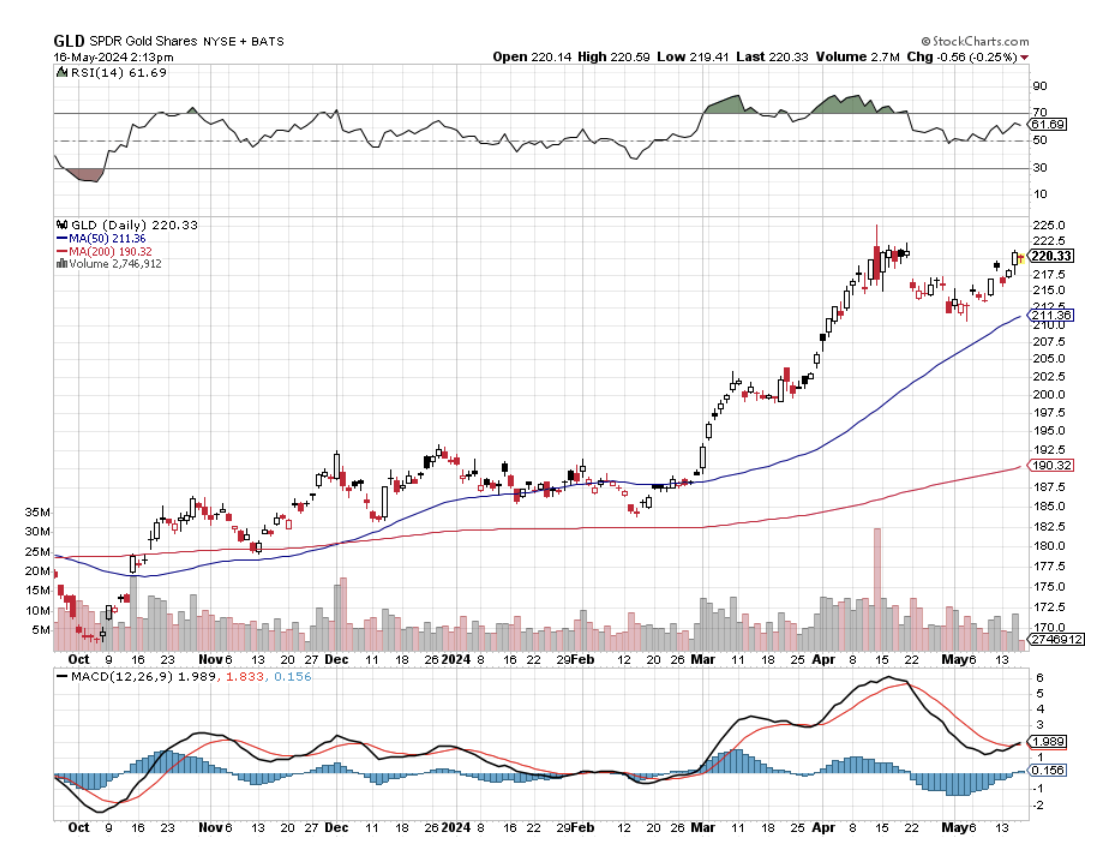

A: They've actually been on a terrific run the last several weeks. Some of my favorites like Crown Castle Inc. (CCI) have had really big moves, and this is just the beginning of a major upside; and not only REITs, but all interest rate plays, and it turns out almost everything is an interest rate play when you look at it. Utilities, secured loans, junk bonds—it's a huge universe. So that's why I say buy everything; everything that's going to go up at all is especially positively affected by lower rates, especially precious metals—gold and silver. And when things go up, the definition of a precious metal expands. It now includes copper, palladium, and platinum, which has had an enormous run.

Q: Can we expect a recession to hit in 2025?

A: Absolutely not. We're in the early stages of a golden age of a decade, of appreciating assets of all kinds; not only stocks and bonds, but real estate, collectibles, baseball teams—you name it. So don't leave the game after the first inning, to use a baseball metaphor. And for you foreigners out there who know nothing about baseball, that means don't leave too early.

Q: Is the housing market overvalued in the US?

A: Good question, you'd certainly think that if you're out there trying to buy a house (and I've been shopping myself lately). The answer is absolutely not. It may be overpriced in the most expensive US markets like Manhattan, Honolulu, Hawaii, or San Diego, but it's still a fraction of what you have to pay in Hong Kong, Australia, or Vancouver, Canada. So prices can go a lot higher. Remember, we have a structural shortage of 10 million homes in the US and they’re not building new ones fast enough. They could double in price from here, especially if the Fed starts to cut interest rates, which they have promised to do. I think we're on the verge of another big housing boom, which will create more home equity, and guess what happens to that home equity? It eventually ends up in the stock market. It becomes a virtual love fest with housing prices making stocks go up and stocks making housing prices go up.

Q: Would you consider Bitcoin now?

A: Absolutely not, especially when you can buy things like Wheaton Precious Metals (WPM) and Barrick Gold (GOLD), which will probably double in the next year and actually have real assets with real earnings flows. With Bitcoin, you're essentially buying ether, and the time to buy Bitcoin was at $6,000, not at $60,000. You don't buy stuff after it's gone up 10 times. So again, just from a market timing point of view, it's a terrible idea. So there are better things to do. You can buy high-quality stocks at reasonable multiples right now.

Q: Is Airbnb (ABNB) a buy here?

A: I would. It is the world's largest hotel in an economic recovery. There's a huge demand for hotels and revenge travel. They're also branching out into higher-margin items like experiences. So yes, I do love the company and the quality of its management for sure.

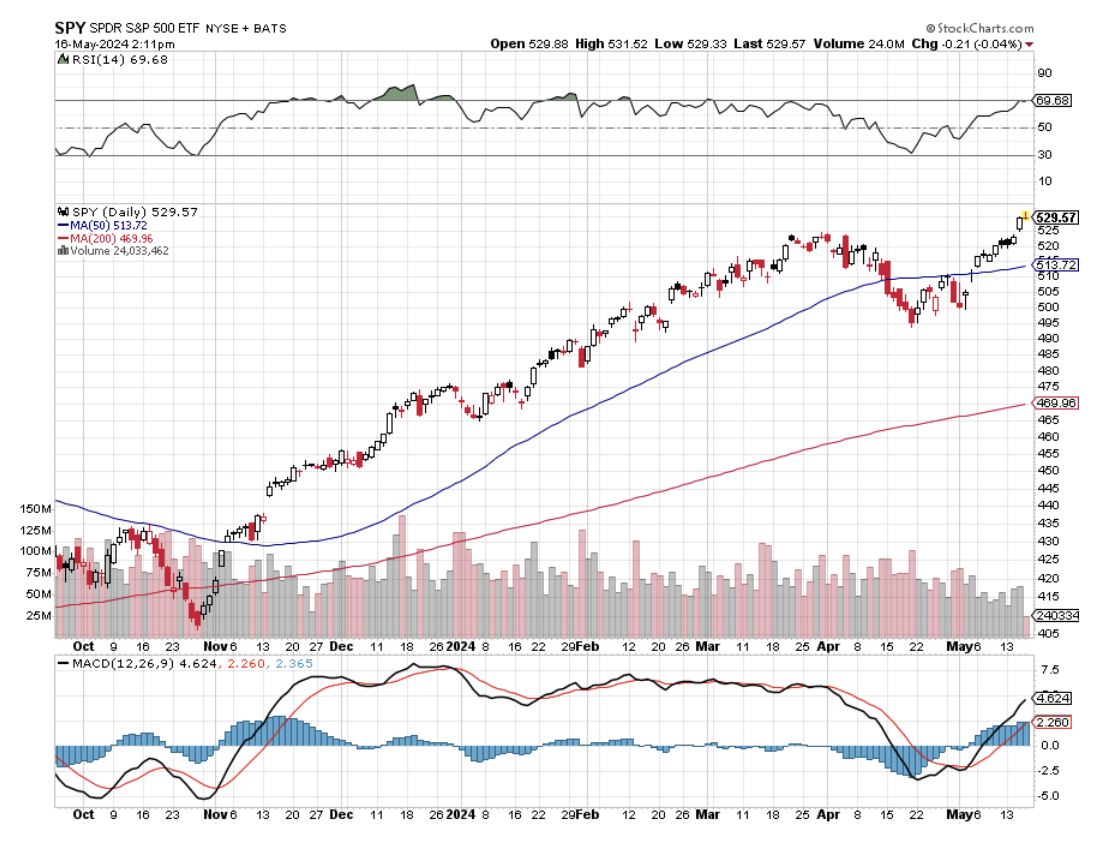

Q: Markets are all-time high. Should I sell in May and go away?

A: Only if you're a short-term trader. If you’re a long-term investor and you sell now, I guarantee you'll miss the next bottom to get back in. So for short-term traders, yes, take profits like crazy—markets are way overbought. They either need some kind of correction or flat-line move for a period of time.

Q: Is buying American farmland a good investment for buying an index fund?

A: Well, if you look at the big portfolios of the great wealthy names like the Rockefellers, the Duponts, and all of my former clients at Morgan Stanley basically; they have loads of farmland and loads of forests—lots of forests. In fact, forests are trading at a big premium right now. It's considered the world's safest long-term asset. And as long as you don't have debt on it, it always goes up in value over time. So yes, that is a good investment. US farmland is the most productive in the world, and the number of people in the world isn't shrinking. In fact, the main reason China will never start a war with the US is because they're dependent on the US for about half its total food supply. So that's why I can always ignore all these China or Taiwan invasion warnings.

Q: Should I take a look at defense stocks?

A: Absolutely, yes, thanks to the invasion of Ukraine. Virtually every country in the world that has any money is expanding defense spending. This is not a short-term thing. Defense is a very long-time lag industry. When countries like the US buy planes, it's often for ten or twenty years, and then you have the upgrades to follow that, and third-country sales. So the big stocks are Lockheed Martin (LMT) and Raytheon (RTX). I would buy both of those on the dips. They have already had good moves, but what hasn't? Though there are not a lot of bargains left in this market after a heroic six to seven-month run.

Q: Is the webinar recorded for replay?

A: Yes, just go to our website madhedgefundtrader.com. Log in, go to My Account, and you'll see the opportunity to review the video of this presentation.

Q: Is it time to buy Google (GOOG)?

A: Yes, I think we're on an uptrend that continues for the rest of the year, and Google will keep leaking out its advantage in AI in bits and pieces. I saw the video you were talking about; you just leave the phone’s video on all the time, and then you could say, “Where are my glasses?” and it'll tell you where your glasses are: “You left them on the table in the dining room.” That's one of the many millions of applications we will see.

Q: Thoughts on Tesla (TSLA)?

A: We're trying to put in a bottom here. Get ready for the buy alerts—I think on the next plunge down I may actually jump in. We still have a very high volatility, and you have plenty of great pickings in the options market with high implied volatilities.

Q: Where are we on refilling the strategic oil reserves (USO)?

A: Biden made no effort to refill them. They were about at half-full levels when we hit the bottom last time, so maybe he will next time. I think he's more interested in just getting out of the oil business altogether, moving to alternative energy, and getting rid of the strategic oil reserve since we are now a net energy producer, net oil exporter, the world's largest oil producer in the world. We don't really need emergency reserves like we did in 1970 when these were first set up.

Q: Sometime back, you said to avoid miners of precious metals. Is that still your opinion?

A: No, I think we're in a position now where the miners can start to catch up with the metals. In the beginning of the year, it was clear the metals were going to outperform the miners because the miners were seeing their margins cut by high inflation. That's still the case. My first choice is still the metal, but you could get a big catch-up trade in the silver and gold miners. So, as I keep saying, buy Barrick Gold (GOLD) and (WPM).

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader