Below please find subscribers’ Q&A for the January 24 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Silicon Valley, CA.

Q: Will you stop out of (TLT) if it breaches the $93 level?

A: Yes, and I'm actually hoping it will do that because that sets up some really great two-year LEAPS for the (TLT) going out long-term. It's trying to hold in here at the bottom. It's been in the $93 handle for several days now, so we'll just watch.

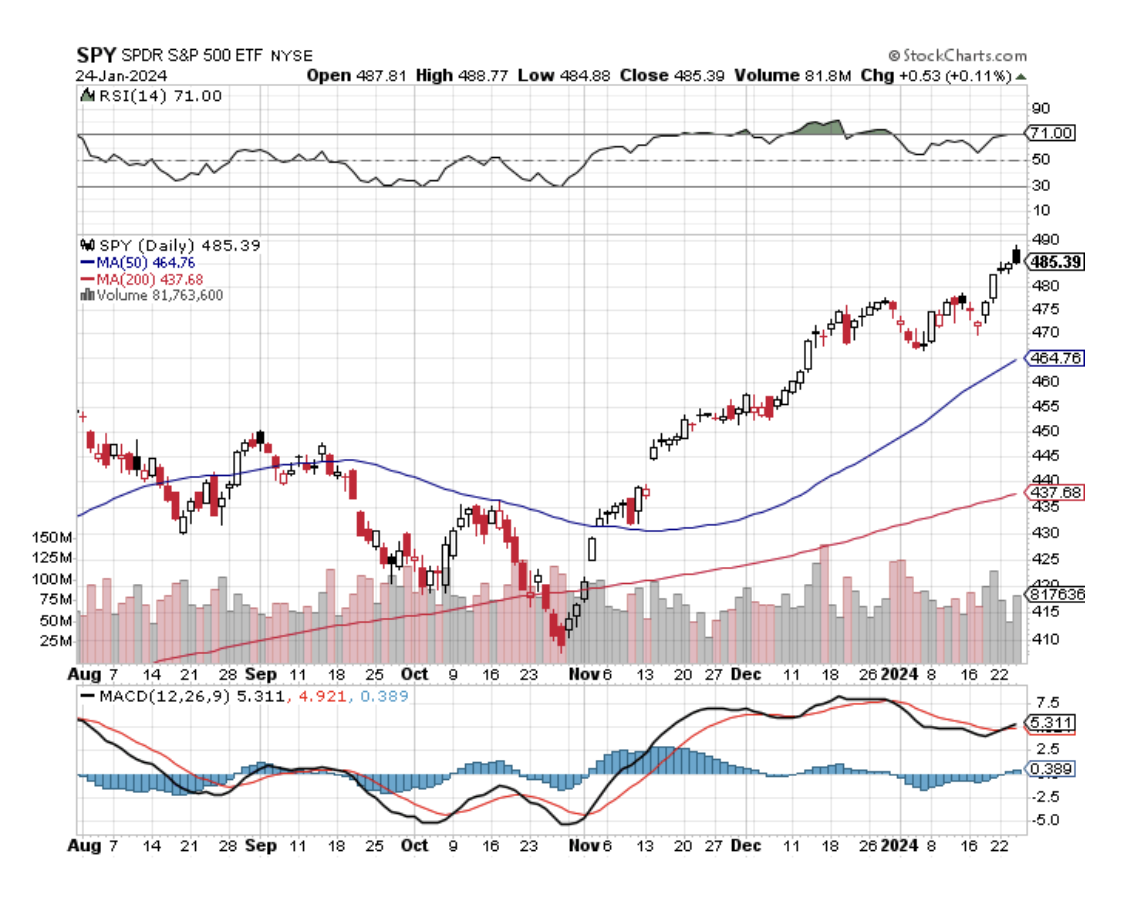

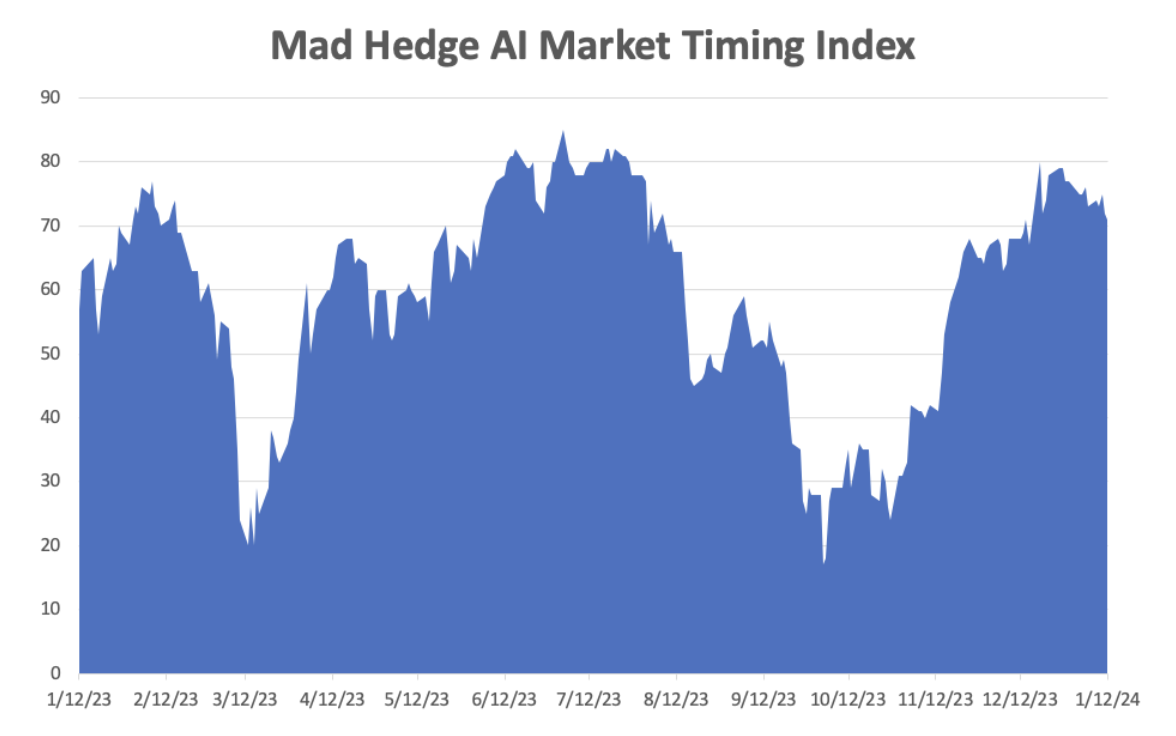

Q: There seems to be negativity all over the place, but markets continue upwards. What are the chances of a black swan this year, and what do you think it might be?

A: Well, there always is a possibility of a black swan. That's why we do risk control and risk management all the time because black swans are by definition unpredictable. The reason people are negative is that they don't own more stocks, and they keep going straight up, at least the tech ones do. Money managers always look dumber not owning a market that's going up than owning a market that's going down and losing money with everybody else. It's just the way investor psychology works.

Q: Do you expect small caps (IWM) to outperform the S&P 500 (SPY) this year?

A: Yes I do, but it'll be a second half of the year game. They really need the big drops in interest rates to get earnings moving.

Q: Would Boeing (BA) be good for a LEAPS?

A: Yes, it would, but I would go out to the maximum maturity, say two to two and a half years, and you may get a double on your money on that. Basically, there are only two airplane manufacturers in the world that have a monopoly (or a duopoly to be technically correct) and Boeing is one of them. So love them or hate them, you still have to buy their airplanes; look no further than Alaska Airlines (ALK) and United (UAL), which have had to cancel literally tens of thousands of flights because they don't have enough airplanes. They had to ground all their 737 maxes.

Q: With all the shooting going on in the Middle East, why isn't oil higher?

A: It's all about China (FXI). As long as China is in a recession which seems to be getting worse, oil demand falls. China is the world's largest importer of oil by a large margin. They're also taking all the natural gas that the US will produce, and that is a big drag on prices. That will end when China starts to recover, and we did get a major stimulus package out of the Chinese government this week.

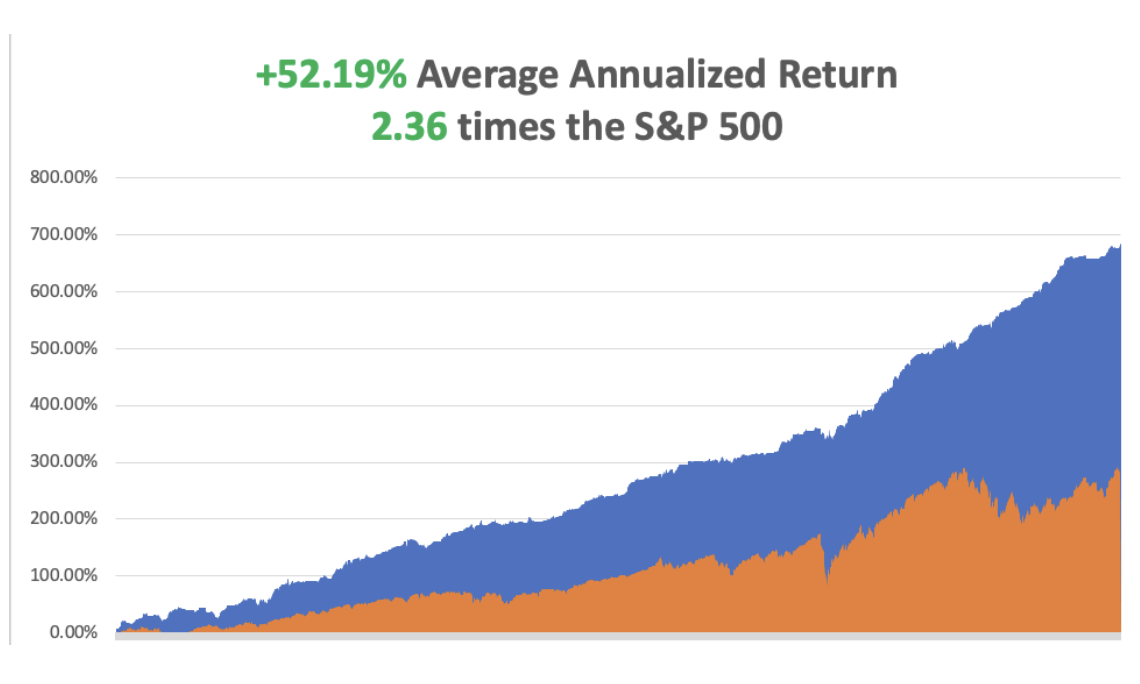

Q: What about NVIDIA (NVDA)? It's gone up so much. I'm up 300% since my cost. Should I sell now and take profits or just run the long?

A: This whole group, which I now call the AI 5—Microsoft (MSFT), Google (GOOGL), Amazon (AMZN), NVIDIA (NVDA), and Meta (META) could drop 20% at any time and then go on to new highs, and that's exactly what happened in the fall. We had a 20% drop in everything and then it just shot off to the races. So as long as you can handle a 20% decline in these stocks, and if you're a long-term investor, then you should keep them. Because the risk is you'll take profits, generate a big tax bill, and then won't be able to get back in at the next low, and you'll end up missing the next $1,000 point move. If you're the trader of the century like me, you can do that. But for your average garden variety trading at-home investor, I would say keep what's winning—keep the AI 5.

Q: Thanks John, I got a double on your (UNG) LEAPS that you put out over Christmas. It's since given back much of the gains. Do you see another big rally in (UNG) this year?

A: Yes, that was a 2-year LEAPS I put out. It doubled in 2 weeks, and I do see a bigger recovery in the second half of the year once the Chinese economy starts to recover. Their marginal first choice for new energy supplies is American natural gas; it's not oil from the Middle East. They're trying to clean up their atmosphere as much as we are, so look for another big demand spike for (UNG) later in the year.

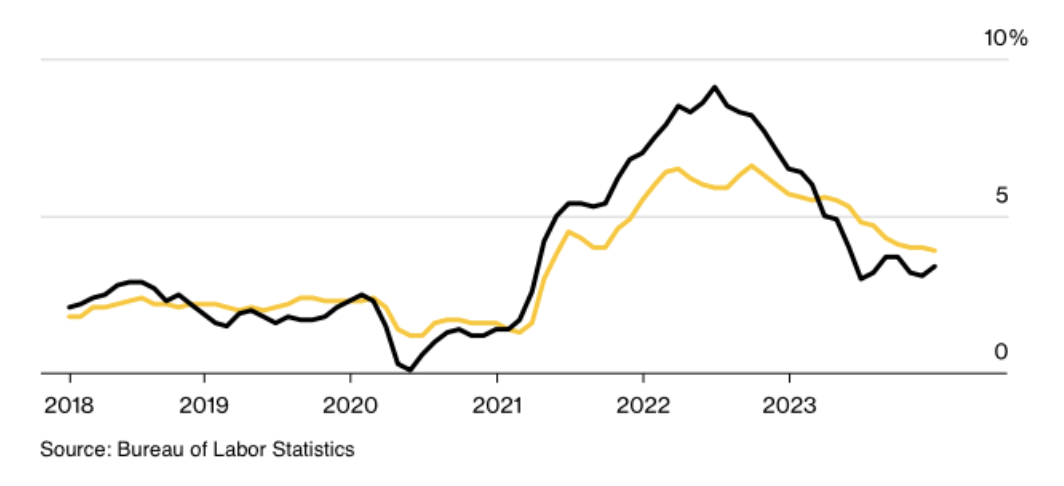

Q: Why has the dollar (UUP) been so strong?

A: Rising interest rates. Currencies are all about interest rates and where the next interest rate move is going to be. Money always pours into the currency that has the next rise in interest rates. That's been the US dollar for all of this year so far.

Q: Will the election have an effect on the market?

A: Absolutely not. Nobody cares about the election. If you're an election junkie, you may stay glued to your TV. I'm not interested myself. I don't expect any changes in the economy to take place this year, and that's all investors and money managers really care about—is how they will do by the end of this year. So you're better off watching sports on ESPN is all I can tell you. Oh yes, and this is supposed to be a record year for disinformation about elections and candidates. Another reason to not bother with the election this year. Go watch the Jack Reacher series. At least there you can keep track of the body count.

Q: Is it a good time to buy a home right now?

A: Yes, if you have cash. It is still too expensive to borrow money to buy a home with 30-year mortgages at 6.5% and 5/1 ARMs at 6% or even 5.5%, but if you have cash, it is a great time to buy a house because what is the next move? Interest rates go down. Suddenly everybody in the world can afford houses and they now want to buy your house. So very rapid price rises are coming for the housing market once the rates start to fall, which could be March, could be June, depending on how Jerome Powell feels that morning.

Q: With EV sales up 50% last year (TSLA), why has copper been so weak?

A: The old high price of copper was based on continuing 50% per year increases in EV sales for the indefinite future. In fact, we got a 50% increase last year and forecasts for 10% growth only this year, so that's a big part of it. Also, backing out the Chinese construction demand gives copper a huge hit. New construction in China is essentially at zero and will be at zero for quite some time because of the real estate crisis there. Some people in China are looking at prices on their homes down 80%, which sounds like a repeat of our 2008 financial crisis. So that is another major drag on copper.

Q: Is it a good time to “buy wrights”?

A: Absolutely yes. If you read today's newsletter, it tells you how to do a buy write, and you do “buy rights” on the most expensive stocks. For example, NVIDIA (NVDA) at $600 today—you can get $8 for the February $650 calls, which you sell short against your stock ownership at $600, or you can go out to March 15th and you can get $19 for the March $650 calls. That will reduce your average cost for the shares by $19, so actually (NVDA) is, in fact, one of the best stocks to do this in, because it has the highest implied volatility of any options, second to Tesla (TSLA), it turns out.

Q: How did you predict the S&P 500 so accurately last year? You got within a point, pretty amazing.

A: All I can say is 55 years of practice helps! And I am a bit of a contrarian person; so when everybody said the market was going to go down, I said, “How about new all-time highs?” But also the answer to all questions really is people are wildly underestimating the impact of technology and AI, which continues to surprise the upside and will keep doing so for the next decade. That is the driver of all asset prices everywhere right now, and people will figure that out in probably about 5 years.

Q: Crown Castle Inc. (CCI), is that a good one to watch, with renewed interest in REITS?

A: Absolutely yes, and it's also a great interest-rate play. It had a horrible selloff going into October and has since made back all of those losses. We actually had a LEAPS in (CCI), which is now making money.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader