Anyone out there who has children in high school or college, the best piece of advice to give them to prepare for a highly lucrative career in technology is that their path will most likely start outside of the United States.

Why?

In one fell swoop, Big Tech and other smaller tech firms have decided that American salaries are not worth the money and have accelerated a full-on position migration to the rest of the world.

The salary arbitrage is something that gets missed in corporate America but is also a reason why these American tech companies keep beating earnings results.

Everyone knows the biggest expensive line item to a tech firm isn’t the software, but the salaries.

Every executive I talk to has widespread plans to cut jobs, whether it be in Seattle, Washington, or Los Angeles, California, and install them in places like India, Moldova, or even notorious Ukraine.

This is happening quietly, but the trend has picked up pace in 2025.

The early numbers in the United States are portending poorly for US employment and many good tech jobs will be reinstalled in cheaper countries and paid 5X lower than what it once was.

Since 2017, the United States has created 0 jobs for native born Americans, and this is part of the reason why.

Compounding the situation, in a global survey, some 61% of tech companies worldwide said they expected to reduce their workforces over the next five years because of the rise of artificial intelligence.

Tech firms such as Dropbox and IBM have previously announced job cuts related to AI. Tech jobs in big data, fintech, and AI are meanwhile expected to double by 2030.

The digital-financial-services company Ally is firing roughly 500 employees, or 7% of staff.

Ally made a similar level of cuts in October 2023, the Charlotte Observer reported.

Jeff Bezos's rocket company, Blue Origin, is sacking about 10% of its workforce, a move that could affect more than 1,000 employees.

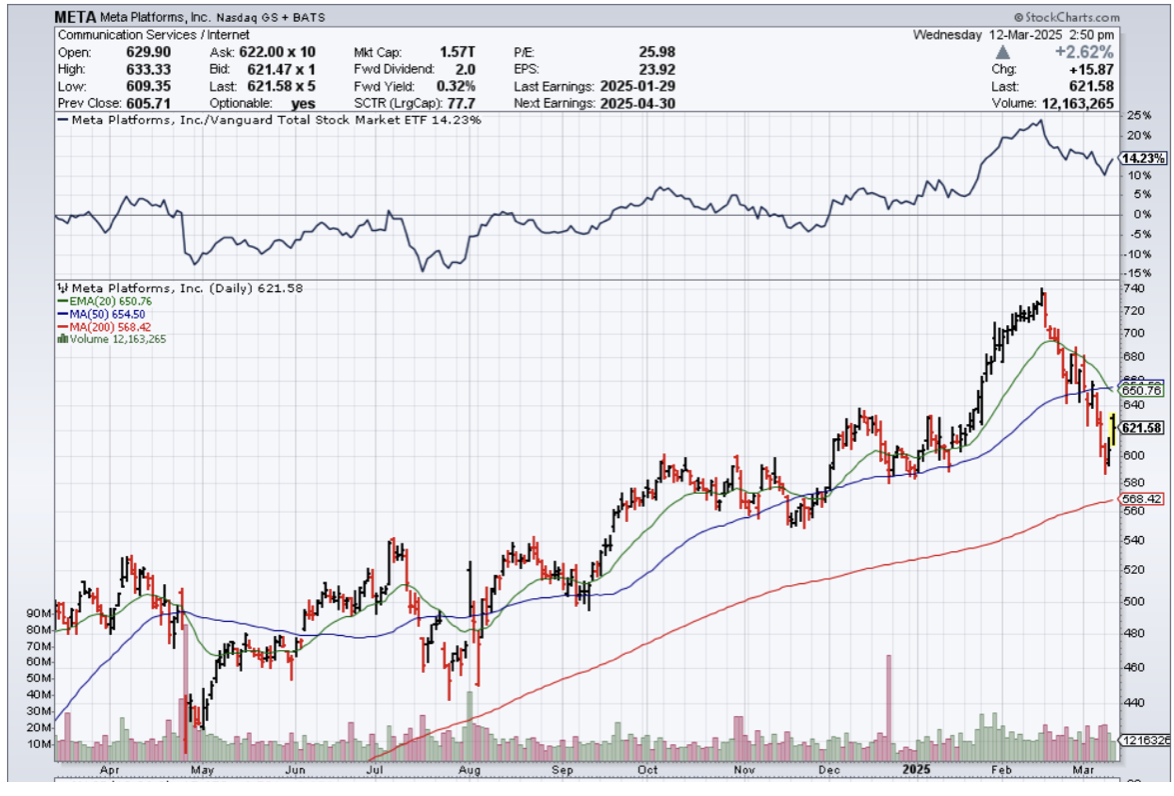

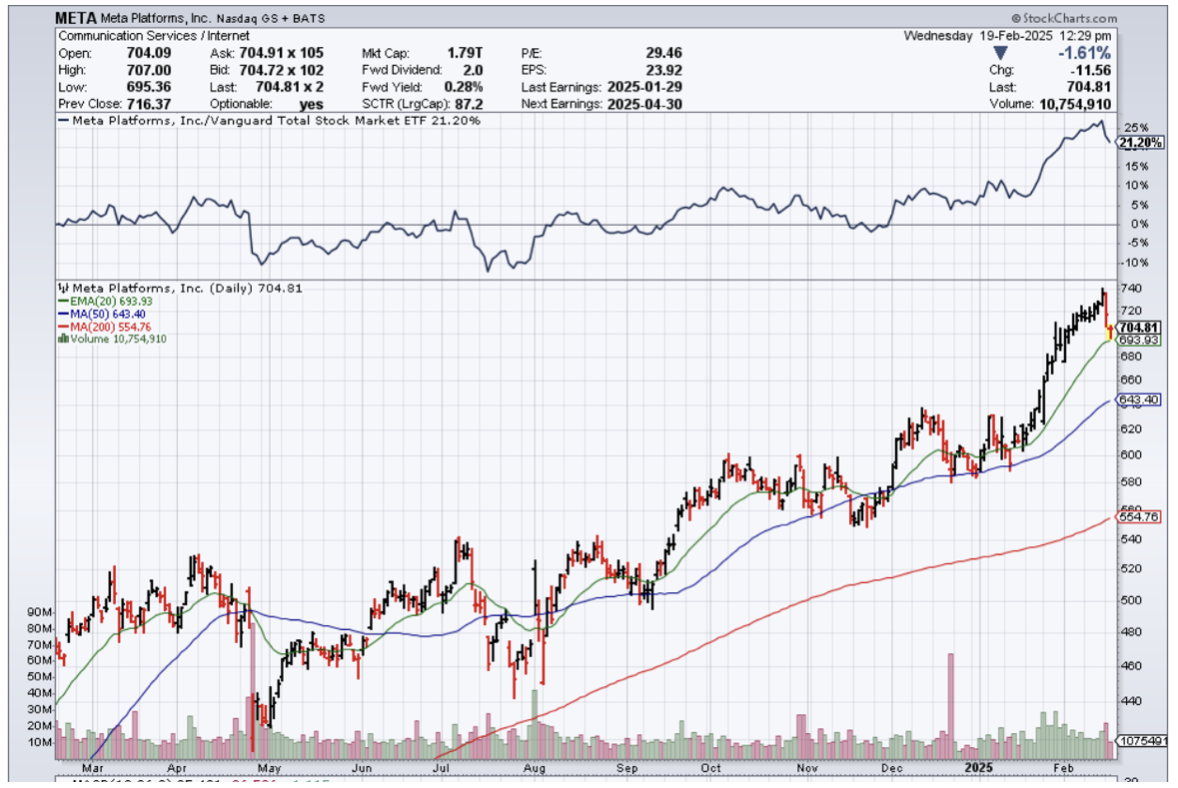

Meta CEO Mark Zuckerberg told staff he "decided to raise the bar on performance management" and will act quickly to "move out low-performers." On just recently, the company had laid off more than 21,000 workers since 2022.

Microchip Technology is cutting its head count across the company by around 2,000 employees, the semiconductor company said a few days ago.

Last year, Microchip announced it was closing its Tempe, Arizona facility because of slower-than-anticipated orders. The closure begins in May 2025 and is expected to affect 500 jobs.

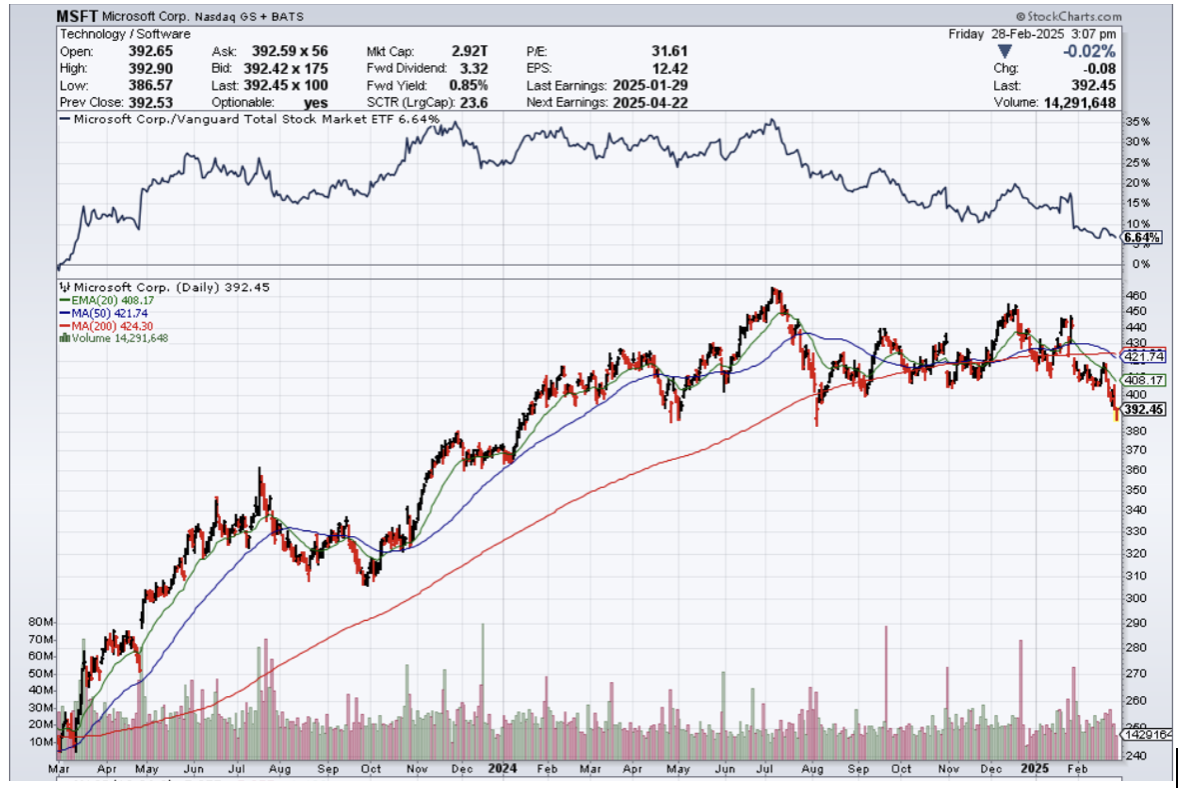

Microsoft cut an unspecified number of jobs in January based on employees' performance.

If anyone thinks this is a blip on the radar, then check your head again.

Once the WFH (work from home) movement started during 2020, there was no going back from there.

Tech companies don’t need warm bodies in offices anymore, so physical location doesn’t matter for lower-level employees.

95% of Silicon Valley will now be outsourced, and all “entry-level” jobs will originate in low-cost-of-living countries.

This is the new American tech sector. Ownership will still be mostly American, but workers will be offshore.

What is the result of this?

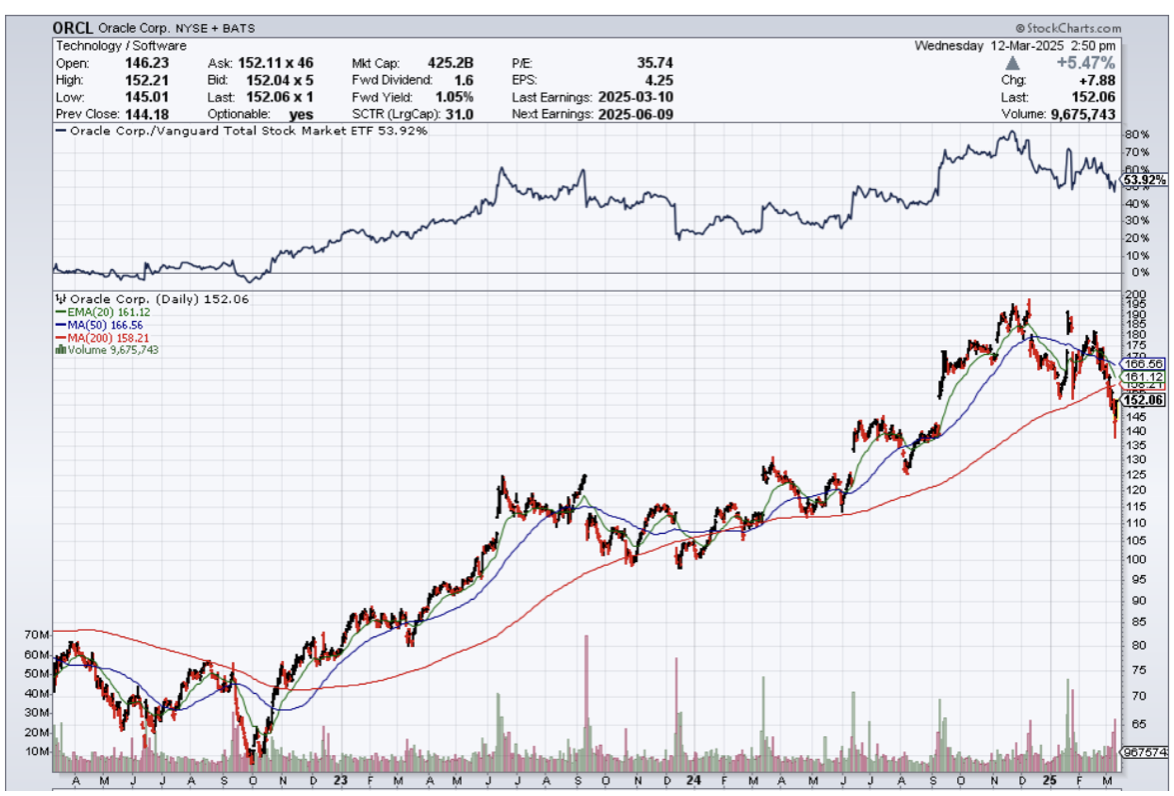

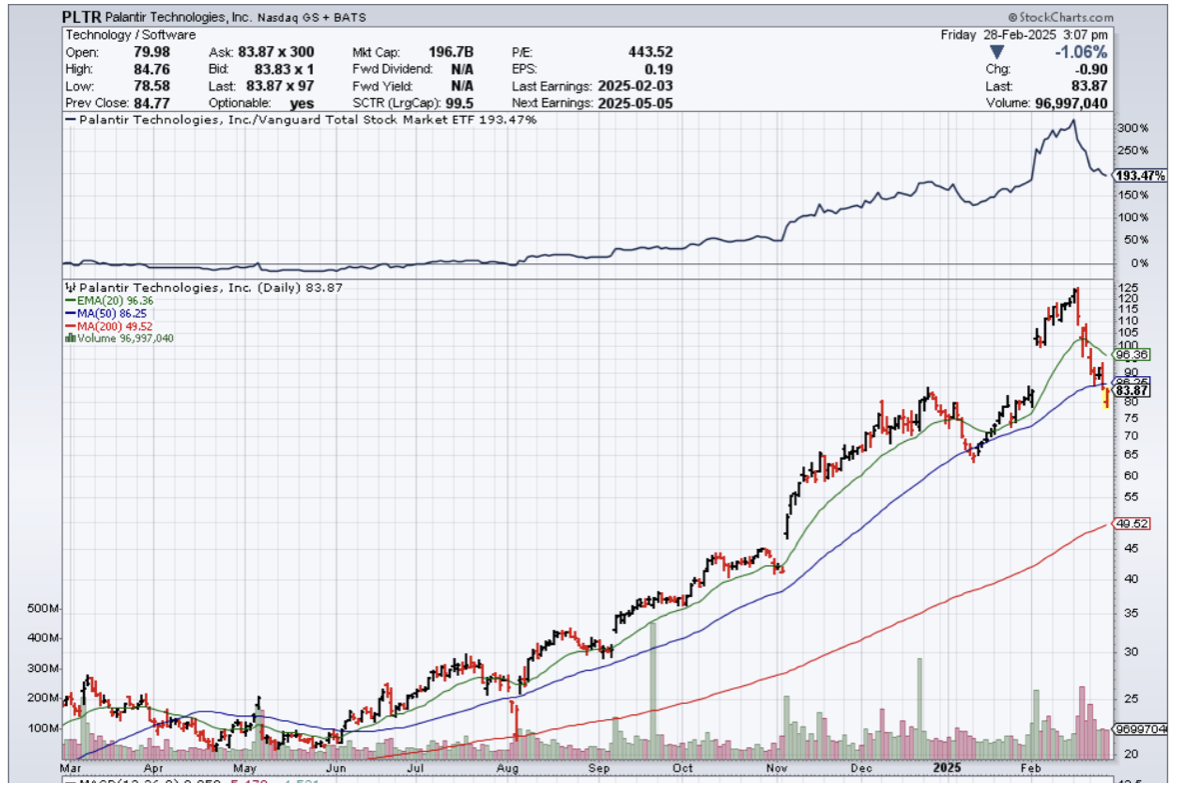

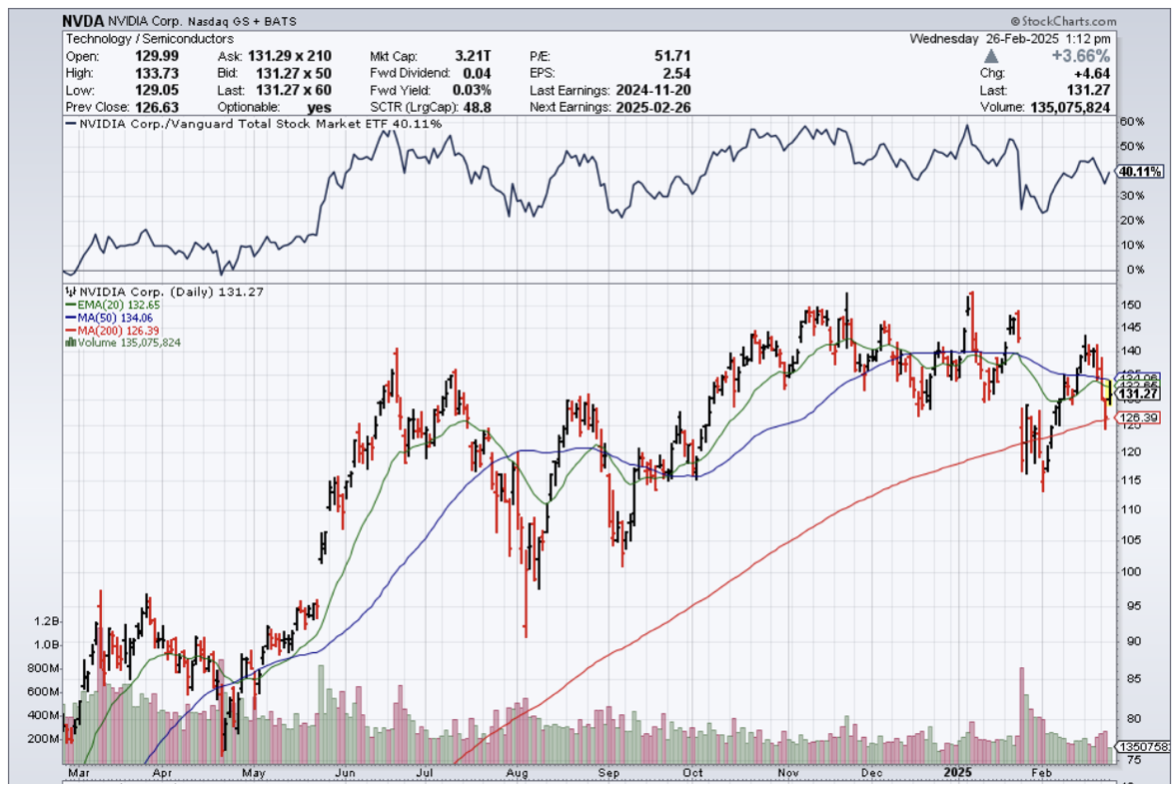

Tech stocks will stay higher for longer because of the massive cost savings in wages, which will allow management to beat earnings quarter after quarter.

It gives the balance sheet a reprieve allowing tech to hire more workers elsewhere for less money even if they aren’t an equal replacement.

It also opens the opportunities to deliver more value back to shareholder in the form of dividends or stock splits.

Tech firms won’t die off, but balance sheets will be financially engineered to the max to the benefit of executive management and to the chagrin of the American tech worker.

Once the macroeconomic backdrop calms, it will be time again to jump into tech stocks.