Global Market Comments

October 25, 2024

Fiat Lux

Featured Trade:

(OCTOBER 23 BIWEEKLY STRATEGY WEBINAR Q&A),

(TLT), (JNK), (CCJ), (VST), (BRK/B), (AGQ), (FCX), (TM), (BLK), (NVDA), (TSLA), (T), (SLV), (GLD), (MO), (PM)

Global Market Comments

October 25, 2024

Fiat Lux

Featured Trade:

(OCTOBER 23 BIWEEKLY STRATEGY WEBINAR Q&A),

(TLT), (JNK), (CCJ), (VST), (BRK/B), (AGQ), (FCX), (TM), (BLK), (NVDA), (TSLA), (T), (SLV), (GLD), (MO), (PM)

Below, please find subscribers’ Q&A for the October 23 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe, Nevada.

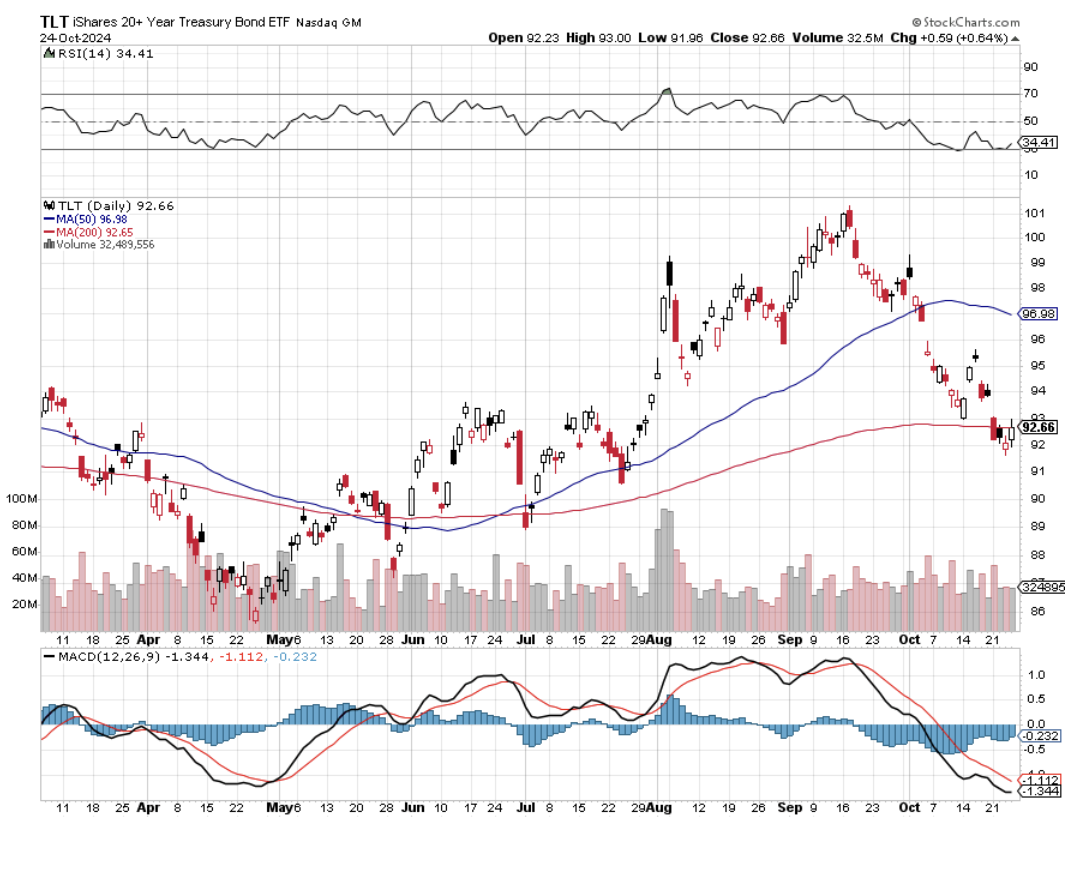

Q: What the heck is happening with the iShares 20+ Year Treasury Bond ETF (TLT)? It keeps dropping even though interest rates are dropping. It seems to be an anomaly.

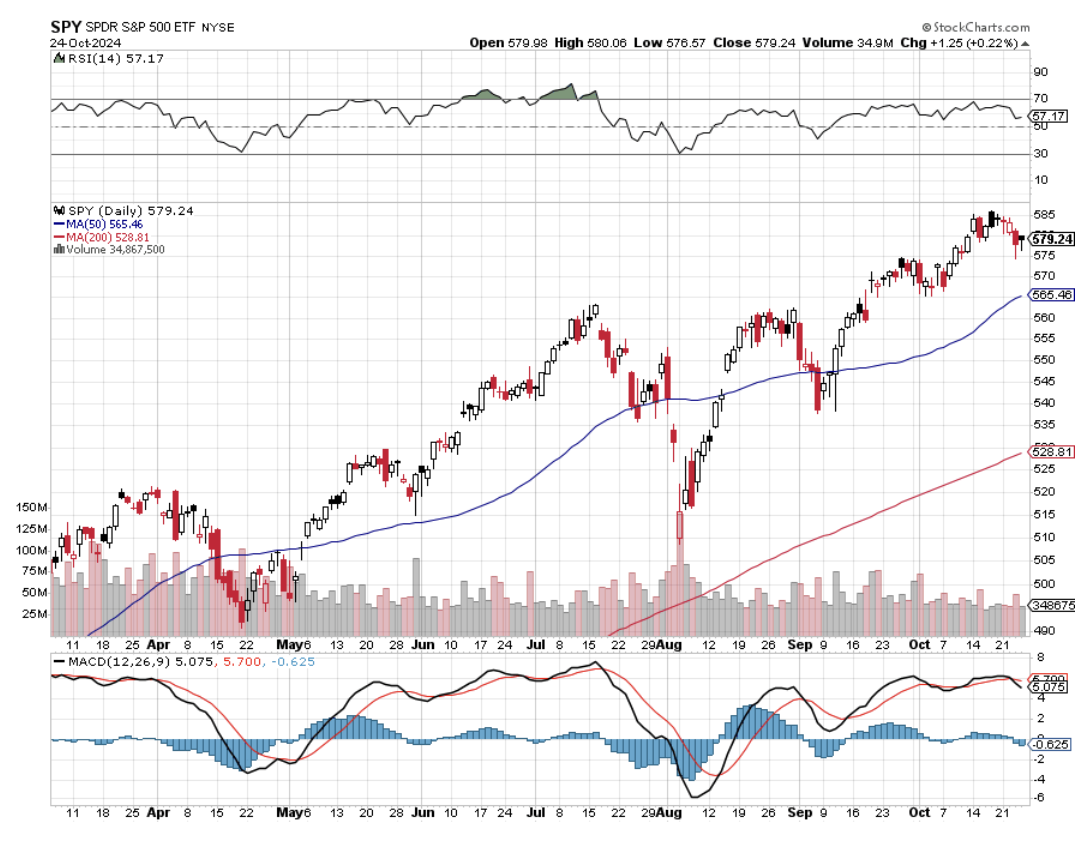

A: It is. What’s happening is that bonds are discounting a Trump win, and Trump has promised economic policies that will increase the national debt by anywhere from $10 to $15 trillion. Bonds don’t like that—you borrow more money through bonds, and the price goes up. Interest rates could go as high as 10% if we run deficits that high (at least the bond market may go that low.) On the other hand, stocks are discounting a Harris win. Stocks went up 60% over the last four years. I did roughly double that. And a Harris win would mean basically four more years of the same. So stocks have been trading at new all-time highs almost every day until this week when the election got so close that the cautious money is running to the sidelines. So what happens if there's a Harris win? Bonds make back the entire 10 points they lost since the Fed cut interest rates. And what happens if Trump wins? Bonds lose another 10 points on top of the 10 points they've already lost. Someone with a proven history of default doesn't exactly inspire confidence in the bond market. So that is what's going on in the bond market.

Q: Will the US dollar continue its run into year-end?

A: No, I have a feeling it’s going to completely reverse in two weeks and, give up all of its gains, and resume a decade-long trend to new lows. So, I think everything reverses after election day. Stocks, bonds, commodities, precious metals—the only thing that doesn't is energy, and that keeps going down because of global oversupply that even a Middle Eastern war can’t support.

Q: Are you expecting a major correction in 2025?

A: I am, actually. We basically postponed all corrections into 2025 and pulled forward all performance in 2024. So, I think we could get at least a 10% correction sometime next year, and that is normal. Usually, we get a couple of them. This year, we only got the one in July/August. So, back to normal next year, which means smaller returns from the stock market. In fact, smaller returns from everything except maybe gold and silver. This is why they're going up so much now.

Q: Are you discounting a huge increase in the deficit under Biden-Harris?

A: No, the huge increase in the deficit is behind us because we had all the pandemic programs to pay for, and if anything, technology inflation should go down because of accelerating technology. We're already seeing that in many industries now, so I don't think there'll be any policy changes under Harris, except for little tweaks here and there. All the big policies will remain the same.

Q: What is a dip?

A: A dip is different for every stock and every asset class. It depends on the recent volatility of the underlying instrument. You know, a dip in something like McDonald's (MCD) or Berkshire Hathaway (BRK/B) might be 5%, and a dip in Nvidia (NVDA) might be 15 or 20%. So, it really depends on the volatility of the underlying stock, and no two volatilities are alike.

Q: What are your top picks on nuclear?

A: Well, we've been in Cameco (CCJ), the Canadian uranium company, since the beginning of the year, and it has doubled. Vistra Corp (VST) is another one, and there are many more names after that.

Q: What are your thoughts on Toyota (TM)?

A: I love Toyota for the long term. The fact that they were late into EVs is now a positive since the EV business is losing money like crazy. They're the ones who really pioneered the hybrid business, and I’ve toured many of their factories in Japan over the years. Great company, but right now, they're being held back by the slow growth of the Japanese economy.

Q: Market timing index says get out. We're heading into the seasonally bullish time of the year. Should we be in or out over the next two months?

A: I would be in as long as you can handle some volatility around the stock market. When the market timing index is at 70, that means any new trades that you initiate have a 30% chance of making money. Now, they can sit at highs sometimes for months, and it actually did that earlier this year. Markets can get overbought and stay overbought for months, and that is a really difficult time to trade. If you're a long-term investor, you just ignore all of this and just stay in all the time.

Q: Silver has broken out; what's next?

A: Silver had had a massive run since the beginning of September—some 30%. We're up to about $31/oz. The obvious target for silver is the last all-time high, which I think we did 40 years ago, and that was at $50/oz. So there's another easy 60% of upside in silver. That's why I put out a LEAPS on the 2x long silver play (AGQ), and people are already making tons of money on that one. I think Silver will be your big performer going forward.

Q: Too late to invest in Chinese stocks?

A: No, it's selling off again. IT Could retest the lows, especially if the government sits on its hands for too long with more stimulus packages.

Q: Is big tech still a good bargain buy?

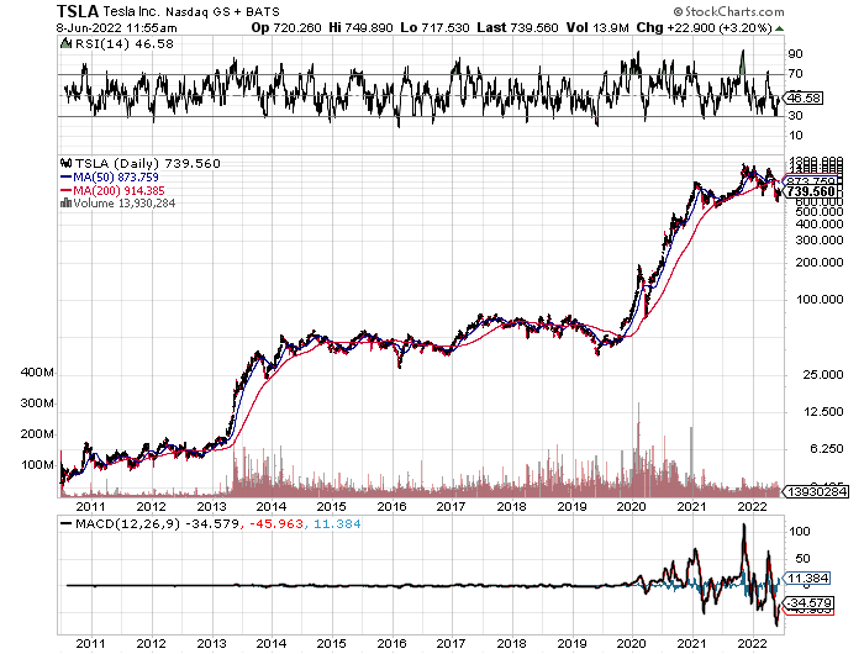

A: I would take “bargain” out of that. The rule on tech investing is you're always buying expensive stuff because the future always has a spectacular outlook. So, tech investing is all about buying something expensive that gets more expensive. This is exactly what tech stocks have been doing for the last 50 years, so it's not exactly a new concept. I know tons of people who never touched Nvidia (NVDA) or Tesla (TSLA) because it was too expensive. (NVDA) was too expensive when it was $2, and now it's even more expensive at $140 or, in Tesla's case, $260.

Q: Will Tesla (TSLA) go up or down tonight?

A: I have no idea. Anybody else who says they have an idea is lying. You go to timeframes that short, and you are subjecting yourself to random chance; even the weather could affect your position by tomorrow.

Q: How uncomfortable is the stem cell extraction?

A: Extremely uncomfortable. If they say it won't hurt a bit, don't believe them for a second. They take this giant needle hammer it into your backbone to get your spinal fluid (and I count the hammer blows.) Last time, I think I got up to 50 before I couldn't take the pain anymore, and they extracted the spinal fluid to get the stem cells. So, for those who don't tolerate pain very well, this is absolutely not for you.

Q: Why is Intel (INTC) stock doing so badly this year?

A: Low-end products, no new products, poor manager. Whenever a salesman takes over a technology company, you want to run a mile. That's what happened at Intel because they have no idea how the technology works.

Q: Should I sell my Philip Morris (PM) stock? It's just had a huge run-up.

A: No. For dividend holders, this is the dream come true. They pay a 4.1% dividend. This was a pure dividend play ever since the tobacco settlement was done 40 years ago. Then they bought a Swedish company that has these things called tobacco pouches, and that has been a runaway bestseller. So, all of a sudden, the earnings at Philip Morris are exploding. The dividend is safe. I think Philip could go a lot higher, so buy PM on dips. And I will dig into this story and try to get some more information out of it. I love high growth high dividend plays.

Q: What's the best play for silver?

A: I'm doing the ProShares Ultra Silver (AGQ), which is a 2x long silver and has gone from $30 to $50 since the beginning of September. If you want to sleep at night (of course, I don't need to), then you just buy the iShares Silver Trust (SLV), which is a 1x long silver play and that owns physical silver. I think it's held in a bank vault in London.

Q: Time to sell Copper (FCX)?

A: Short term, yes, as China weakens. Long-term, hang on because we are coming into a global copper shortage, and that'll take the price of copper up to $100 or (FCX) up to $100. So yes, love (FCX) for the long term. Short term, it has a China drag.

Q: Will inflation come back in 2025?

A: No, it won't. Technology is accelerating so fast, and AI is accelerating so fast it's going to cut costs at a tremendous rate. And that's why you're seeing these big tech companies laying off people hundreds at a time; it's because the low-end jobs have already been replaced by AI. There is a lot more of that to come. I'm not worried about inflation at all.

Q: Do you disagree with Tudor Jones on inflation?

A: Yes, I disagree with him heartily. Tudor Jones is talking his own book, which means he doesn't want to get a tax increase with a Harris administration. So he's doing everything he can to talk up Trump, and that isn't helping me with my investment strategy whatsoever. By the way, Tudor Jones is often wrong, you know; he made most of his money 30 years ago. And before that, it was when he was working for George Soros. So, yes, I agree with the man from Memphis. He’s in the asset protection business. You’re in the wealth creation business, a completely different kettle of fish.

Q: Do you hold the ProShares Ultra Silver (AGQ) overnight?

A: I've been holding my (AG for four months, and the cost of carry-on that is actually quite low because silver doesn't pay any dividend or interest. There really isn't much of a contango in the precious metals anyway—it's not like oil or natural gas. It’s a 3X plays that you really shouldn’t hold overnight.

Q: Where is biotech headed?

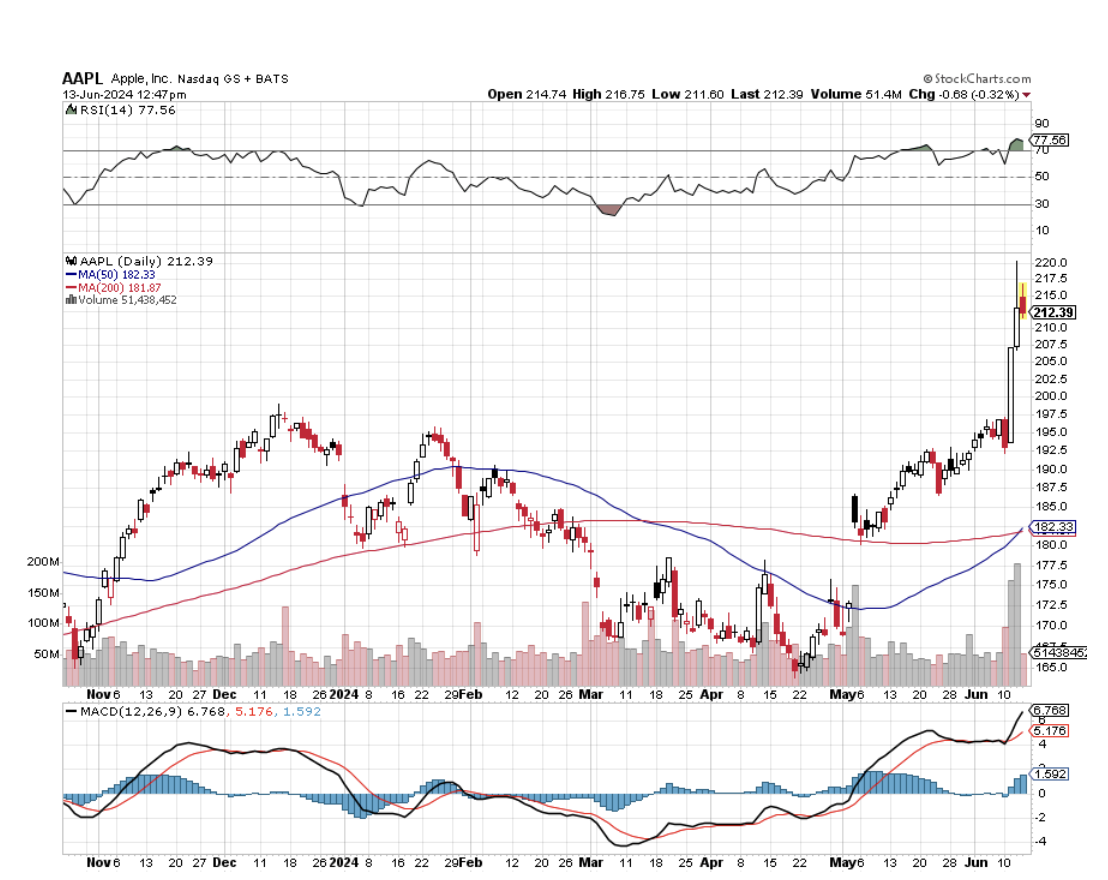

A: Up for the long term, sideways for the short term. That's because, after the election, risk on will go crazy. We could have a melt-up in stocks, and when that happens, people don't want to buy “flight to safety” sectors like Biotechs and healthcare; they want to buy more Nvidia. Basically, that's what happens. More Nvidia (NVDA), more Meta (META), and more Apple (APPL). They want to buy all the Mag7 winners. Well, let's call them the Mag7 survivors, which are still going up after a ballistic year.

Q: Any suggestions on where to park cash for five to six years?

A: 90-day T-Bills are yielding 4.75%. That would be a safe place to put it. And you might even peel off a little bit of that—maybe 10% — and put that into a junk fund, which is yielding 6%. You're still getting a lot of money for cash—but not for much longer. The golden age of the 90-day T-bill is about to end.

Q: BlackRock (BLK) keeps growing, trillions after trillions. Why is the stock so great at building value?

A: Because you get a hockey stick effect on the earnings. As the stock market goes up, which it always does over time, their fees go up. Plus, their own marketing brings in new money. So, you have multiple sources of income rising at a rapid pace. I'm kicking myself for not buying the stock earlier this year.

Q: How does any antitrust action by the government affect stock prices?

A: Short-term, it caps them. Long term, it doubles them because when you break up these big companies, the individual pieces are always worth a lot more than the whole. We saw that with AT&T (T), where you're able to sell the individual seven pieces for really high premiums. So, that's why I'm never worried about antitrust.

Q: Do dividend stocks provide little upward appreciation since they're paying investors already?

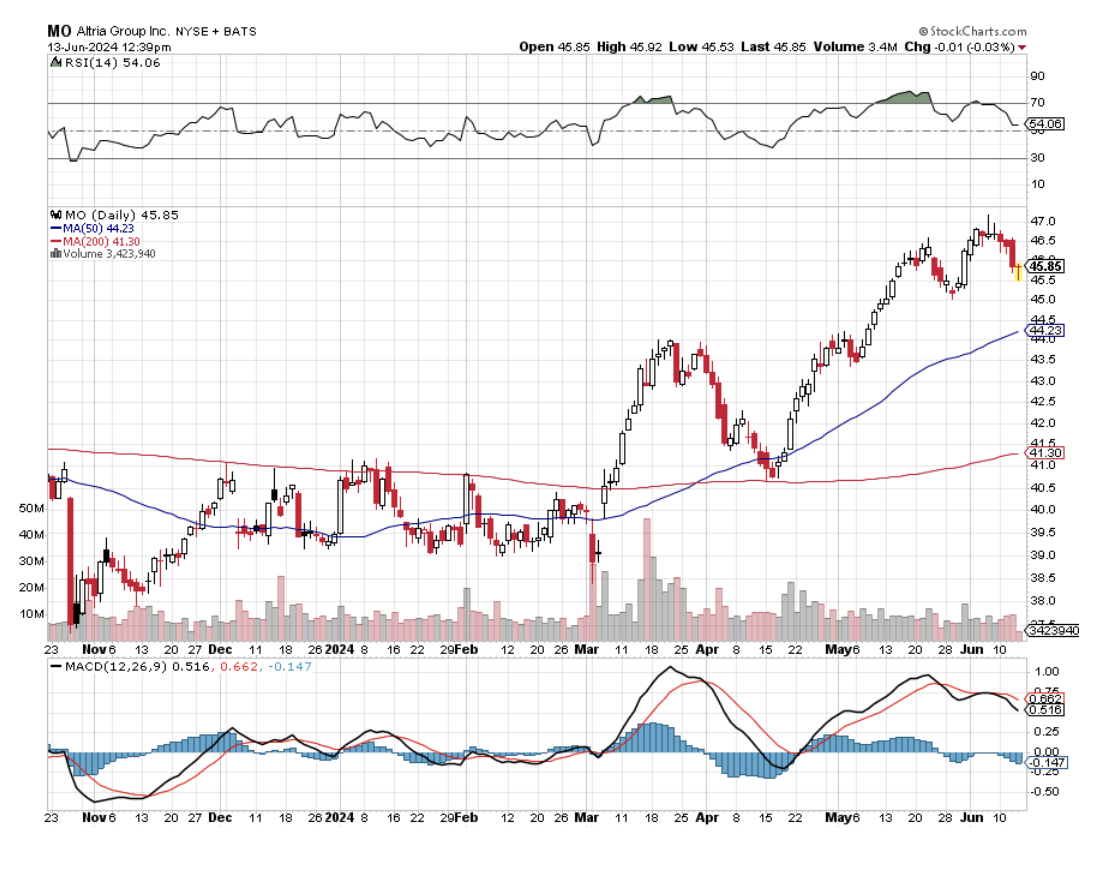

A: To some extent, that's true because low-growth companies like formerly Philip Morris (PM) and Altria (MO) had to pay high dividends to get people to buy their stock because the industries were not growing. AT&T is another classic example of that—high dividend, no growth. But that does set you up for when a no-growth company can become a high-growth company, and then the stocks double practically overnight. And that's what's happening with Philip Morris.

Q: Are you buying physical gold (GLD) and silver (SLV)?

A: I bought some in the 1970s when it was $34/oz for gold, and the US went off the gold standard, and I still have them. It's sitting in a safe deposit box in a bank I will not mention. The trouble with physical gold is high transaction costs—it costs you about 10% or more to buy and sell. It can be easily stolen—people who keep them hidden at home or have safes at home regularly get robbed. And what if the house burns down? You really can't insure gold holdings accept with very high premiums. So, I've always been happy buying the gold ETFs. The tracking error is very small unless you get into the two Xs and three Xs. Gold coins are good for giving kids as graduation presents—stuff like that. I still have my gold coins for my graduation a million years ago (and that was a really great investment! $34 up to, you know, $2,700.)

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

2015 in Italy

Global Market Comments

June 14, 2024

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(JUNE 12 BIWEEKLY STRATEGY WEBINAR Q&A),

(NVDA), (AVGO), (ARM), (GM), (TSLA), (SQM), (FMC), (ALB), (AAPL), ($VIX), (AMZN), (MO), (NFLX), (ABNB)

Below please find subscribers’ Q&A for the June 12 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

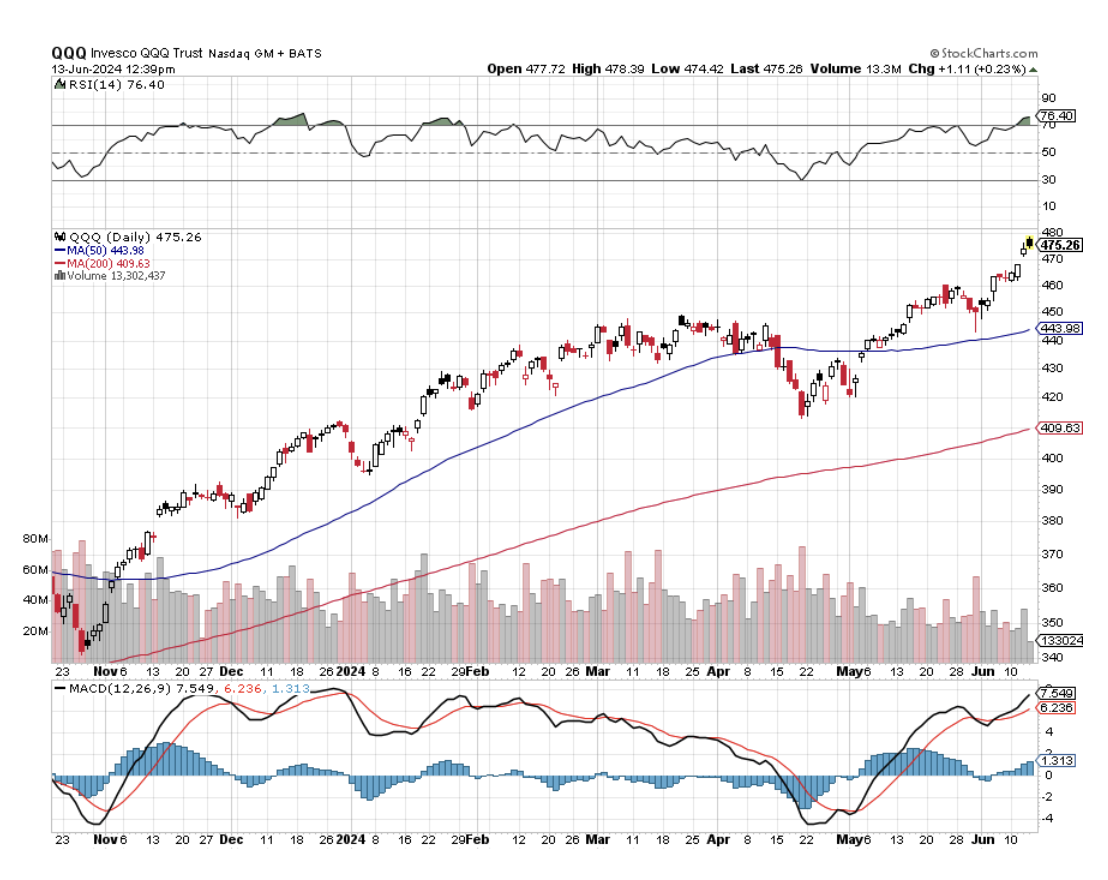

Q: How will Nvidia (NVDA) trade post-split?

A: Well, it’ll probably keep going up, because I think the year-end target—the old $1400, which is now $140—is still good. And I have a whole bunch of LEAPS, which are post-split $40, $50, $60 in-the-money, and I’m just keeping those. It’s a good cash management tool to have. So, even $500 points in the money, you’re still looking at about 20% returns by the end of the year on a January LEAPS. If you can buy the January 2025 $70-$71 LEAPS for 83 cents that’s a 20.48% profit at expiration in six months. So if you want a safe, very high return, that is the best way to do it in the financial markets, is to go way in the money. LEAPS will still pay you a lot of money amazingly. This trade will disappear someday but it’s there now and I’m taking it. Screw 90-day T-bills—I’m going into $500 in-the-money LEAPs on Nvidia, which pays four times as much.

Q: Is Broadcom Inc (AVGO) the next Nvidia?

A: There is no next Nvidia—the next Nvidia is Nvidia. Buy Nvidia on a 20% decline, which I think we may get sometime this summer. That’s a dip you want to buy for a year-end run to $140. Also, Broadcom isn’t exactly undiscovered at this point. It has doubled since October, while Nvidia is up 4 times. So if the bargain in the market for you is double in six months, I’m not sure you should be in the market. That said, I put out a report on split candidates last week and (AVGO) is very high on the list.

Q: What’s the best way to trade split candidates?

A: I actually just wrote a newsletter about this last week. There are in fact 36 high-priced, good money-earning split candidates, and I listed them all. You can buy really any of those if you’re looking for a high-priced stock that is growing. And management has a huge incentive to do splits because it makes the stock go up faster, and they’re all paid in stock options. So that is another reason you go into these. The best way to trade splits is buying the candidates because the biggest move is on the announcement of the split—you usually get 10%, 15%, or even 20% returns on the announcement.

Q: How do you envision AI in 10 years?

A: Well, it’s unimaginable. I can tell you from experiencing a lot of these big technology changes—it’s always tremendously underestimated by the markets, and you can safely bet on that. It’ll go up a lot more than you realize. That’s what happened when we jumped from six track tapes to cassettes, Betamax to VHS, teletypes to faxes, and faxes to emails. I thought Steve Jobs was crazy when he introduced the iPhone. Nobody makes money in handsets. But he proved me wrong. That makes my $240,000 DOW by 2030 projection completely reasonable.

Q: What will inflation do for the rest of the year, and how will it affect stocks?

A: Inflation will go flat to down for the rest of the year. And that is being driven by artificial intelligence—the greatest deflationary product ever created in the history of the economy. It’s unbelievable the rate at which AI is replacing real people in jobs. If you want a good example of that, I had to call Verizon yesterday to buy an international plan, and I never even talked to a human. They listed out three international plans in a calm, even male voice, and I picked one. Or go to McDonald's where $500 machines are replacing $40,000 a year workers. This is going on everywhere at the same time at the fastest speed I have ever seen any new technology adopted. So buy stocks, that’s all I can say.

Q: What’s your opinion on Arm Holdings (ARM)?

A: I love it. There are very few serious companies in the chip area, and this is one of them.

Q: Do you expect gold mining stocks to continue upward?

A: Yes, but the better play here is the metal. Gold and silver aren't being held back by inflation while the miners are. Plus, the main buyers in the market now are the Chinese, and they don’t buy gold miners—they buy gold, silver, copper, platinum, and uranium outright.

Q: What about Tesla (TSLA) long-term? Kathy Woods's target is $2000 long-term.

A: I think Kathy Woods is right. But we have to get through the nuclear winter in the EV space first, where suddenly the market got saturated. I think Tesla is the only one who could come out of this alive by cutting costs and advancing technology, as they have always done. When I bought my first Tesla Model S1 in 2010, the battery cost $32,000. Now it’s $6,000, and you get a lot more range. Did (GM) offer an equivalent cost improvement with internal combustion engines? So, yes, never bet against Elon Musk—that’s a good 25-year lesson on my part, and should be for you too.

Q: Can you elaborate on the lithium trades?

A: I listed three names in my letter last week, (SQM), (FMC), (ALB), and the only thing you know for sure is that they’re cheap now. They could stay cheap for another six or 12 months. But when you get a turnaround in the global EV market and the manufacturers start screaming for more lithium, and all of the lithium stocks will double, or triple and they’ll do it fairly quickly. You can’t beat a market bottom for getting involved. Just look at my above (NVDA) trade. Not only would they be good stocks buy, but it would be a good LEAPS buy down here because then you could get 4 or 5 times your money on a small move.

Q: Can you suggest Amazon (AMZN) LEAPS?

A: January 2025 $195-200 just out of the money, should give you a return of about 120% over the next 6 months. That gets you the annual yearend run-up. And that’s my conservative position. My aggressive ones are all in Nvidia.

Q: Do you think zero-day options have permanently forced the Volatility Index ($VIX) to the $12 handle?

A: Yes, I do; it’s killed that market. Something like 40% of all the option traders on the CBOE were trading the ($VIX) from the short side. Shorting the ($VIX) now would be madness. That has to bring tough times for that whole industry. Trading call spreads at a $12 volatility, you’re better off buying the LEAPS because the LEAPS give you much bigger returns with much less risk. And a $12 ($VIX) means you’re getting your LEAPS at half the historic price. I’m just waiting for a new market low to start pumping out the LEAPS recommendations. All the more reason to sign up for the Mad Hedge Concierge Service to get an early read into the LEAPS recommendations. For more information on that, contact support at support@madhedgefundtrader.com

Q: What will happen to Apple (AAPL) after the 11% surge?

A: It goes to $250 by the end of the year. Now that it has the kiss of AI on it, people will pour into it.

Q: Why is value lagging?

A: Because AI is entirely a growth story, and you look at all the domestic value stocks, they’re going absolutely nowhere. Value has been in the dog house for years and I’m in no hurry to get in there.

Q: What is the best dividend stock I can invest in right now?

A: That’s an easy one. Altria (MO) has a 9% dividend—you can’t beat that. But you have to hold your nose when you buy this stock because they are in the cigarette business. However, their big growth now is in Asia ex-Japan where the government has a monopoly on tobacco, particularly China. Note that this is not an undiscovered idea; lots of people like a 9% dividend stock and (MO) has already gone up 20% this year, but I think there is still some money to be made here.

Q: How can we subscribe to get early LEAPS recommendations?

A: That would be the Concierge Service. Contact Filomena at customer support, and they will get you taken care of right away.

Q: What about the small nuclear plays?

A: I actually happen to know quite a lot about nuclear plant design, having worked for the Atomic Energy Commission in my youth, and the new designs address every major issue that held back nuclear power with the old 1950s designs. For example, building them underground and eliminated the need for these giant billion-dollar four-foot-thick reinforced concrete containment structures that dot the horizon. Not using pure Uranium alloys that can’t go supercritical is another great idea. So I like them. Are they good stock plays? Not right now. It takes a long time to introduce a new energy technology. Bill Gates is financing a new plant built by Terrapower in Wyoming, and it looks like a fantastic plant, but only Bill Gates could invest at this stage and expect to make money on it. He has very long-term money and you don’t. I would wait until you get a working model plant in the United States before going into these things, but potentially you’re looking at a 10 to 100 times return on your money if it works.

Q: Should I invest in Airbnb (ABNB) because of increased international travel?

A: Yes, we like Airbnb. Especially since they will get a push with the Paris Olympics next month. Not only does that get people to Paris, but it gets people to all of Europe because they usually add on additional trips to a visit to the Olympics.

Q: What would you do in Netflix (NFLX), and what strikes would you use?

A: I would do a LEAPS. Wait for a correction, at least 10%, preferably 20%, and then I would go at the money one year out and that would get you about 100% return. So, that’s the way to do that. This is not LEAPS territory right here —all-time highs are not LEAPS territory. You want to put on LEAPS when everyone else is throwing up on their shoes; the last time they did that was October 26.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

You Only Need One Big Hit to Make a Great Year

Global Market Comments

June 9, 2022

Fiat Lux

Featured Trade:

(WHAT THE HECK IS ESG INVESTING?),

(TSLA), (FSLR), (TAN), (MO)

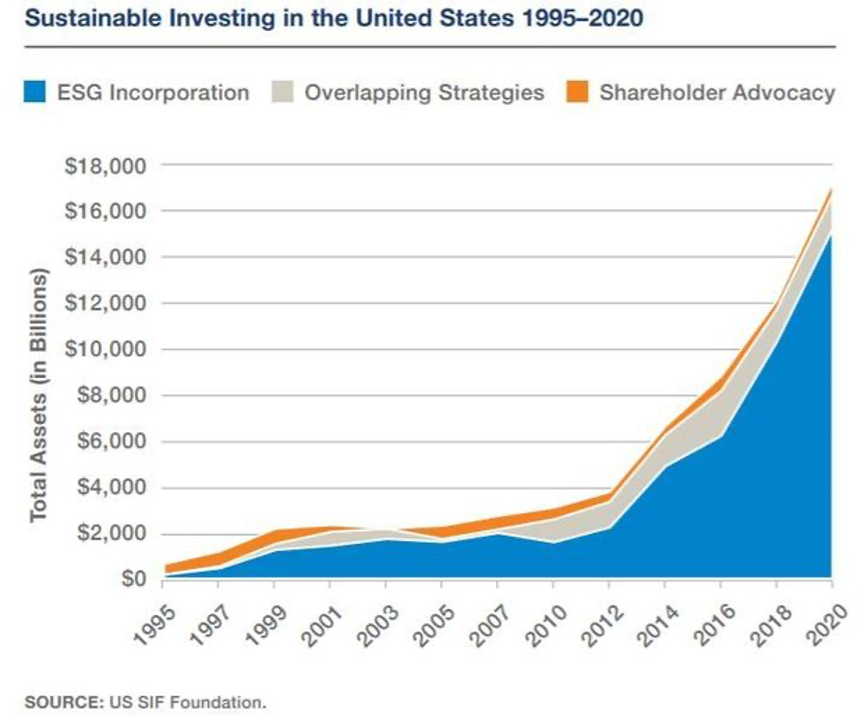

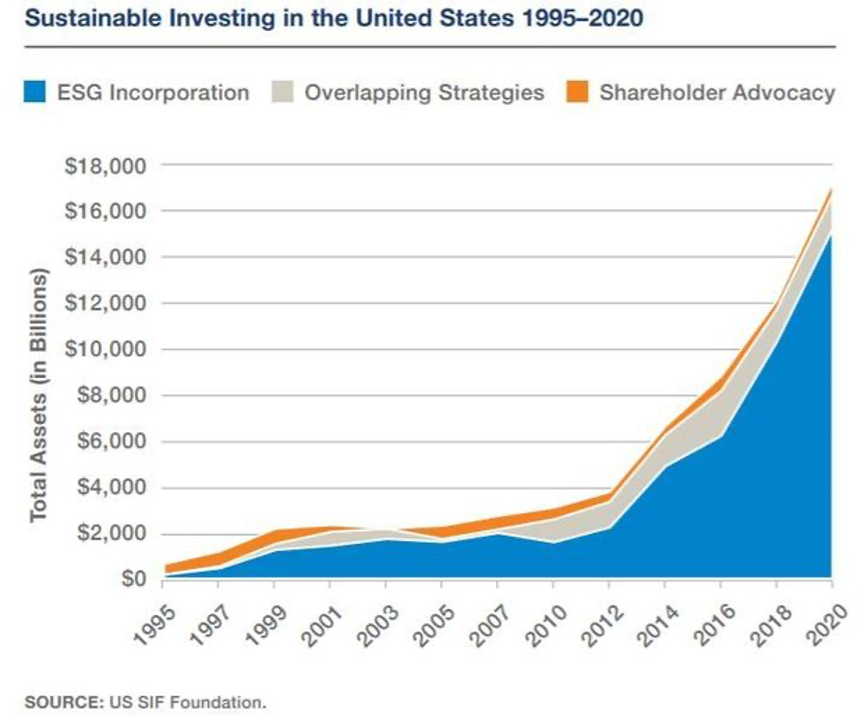

It’s truly astonishing how much money is pouring into ESG investing. Maybe it was another year of blistering heat worldwide that did it. It now accounts for one-third of all US equity investments.

In 2020, BlackRock, one of the largest fund managers in the country, made a major new commitment to ESG investment by rolling out several new ETFs. I thought I’d better take him seriously, as his firm is one of the largest money managers in the world with $10 trillion in assets.

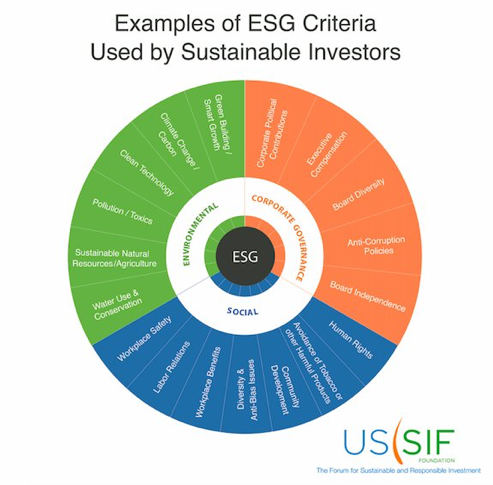

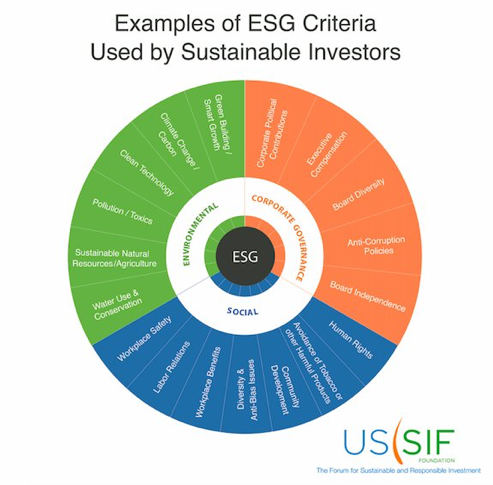

So what the heck is ESG investing?

Environmental, Social, and Governance Investing (ESG) seeks to address climate change in any way shape or form possible. Its goal is to move the economy and capital away from carbon-based energy forms, like oil (USO), natural gas (UNG), and coal, to any kind of alternative.

I am always suspicious of investment themes are politically correct and ideologically directed, as they usually end in tears. I can’t tell you how many people I know who invested their life savings in solar companies to save the world, like Solyndra, Sungevity, American Solar Direct, and Suniva, only to get wiped out when they went under.

As laudable as the goals of these companies may have been, they were unable to deal with collapsing prices, Chinese dumping, and the harsh realities of doing business in a cutthroat competitive world.

As a venture capital friend of mine once told me, “Technology is a bakery business”. If you can’t sell your products immediately, you go broke. Technology always drops prices dramatically and if you can’t stay ahead of the curve you don’t stand a chance.

Still, what I believe is not important. The fastest-growing group of new investors in the market today are Millennials, and they happen to take ESG investing very seriously.

There does seem to be a method to BlackRock’s madness. Over the past year, ESG-influenced funds have grown from 1% to 3.6% of total investment. Other major fund families like Vanguard have already jumped on the bandwagon.

ESG can include a panoply of activities, including, recycling, climate change mitigation, carbon footprint reduction, water purification, green infrastructure, environmental benefits for employees, and greenhouse gas reduction. There are many more.

There is even an ESG rating system for funds and companies produced by firms like Refinitiv, which scores 7,000 companies around the world based on their environmental sensitivity. Companies like United Utilities Group PLC, the UK’s largest water company, get an A+, while China’s Guangdong Investment Ltd, which supplies water and energy to Hong Kong, gets a D-.

It goes without saying that companies from emerging nations tend to score very poorly. So do manufacturing companies relative to service ones, and energy companies versus non-energy ones.

The ESG concept began in 2005 when UN Secretary-General Kofi Annan wrote to 50 global CEOs urging them to take climate change seriously. A major report by Ivor Knoepfel followed a year later entitled “Who Cares Wins.”

The report made the case that embedding environmental, social and governance factors in capital markets makes good business sense and leads to more sustainable markets and better outcomes for societies. The snowball has been rolling ever since.

Themed investing is not new. “Sin” stocks have long been investment pariahs, including alcohol and tobacco companies. As a result, these companies trade at permanently low multiples. The newest investment ban is on firearms-related companies.

ESG investment received a major tailwind in 2021 when the price of oil took off like a rocket. When oil prices rise, it also makes all forms of alternative energy more competitive. But over production by US fracking companies will eventually cause supply gluts that will lead to chronically lower prices. The US happens to have a new 200-year supply of oil and gas, thanks to the fracking revolution.

Saudi Arabia floated their oil monopoly, Saudi ARAMCO, raising a record $26 billion. When Saudi Arabia wants to get out of the oil and gas business, so should you. It’s not because they can’t think of new ways to spend money that they’re unloading it.

That’s why I have been advising followers to avoid energy investments like the plague for the past decade. It’s just a matter of time before alternatives rule the world. Even the oil industry won’t expand production now because they don’t want to buy at the top only to see prices collapse, as they have done many times in the past.

Who is the greenest company in America? That would be electric car and autonomous driving firm Tesla (TSLA). Perhaps ESG investing helps explain why the shares have risen 400 times since I started buying.

What is the top-performing listed stock of the last 30 years? Tobacco company Altria Group (MO), the old Philip Morris.

It’s proof that investment shaming doesn’t always work.

Global Market Comments

October 28, 2021

Fiat Lux

Featured Trade:

(WHAT THE HECK IS ESG INVESTING?),

(TSLA), (MO)

Global Market Comments

January 14, 2021

Fiat LuxFeatured Trade:

(WHAT THE HECK IS ESG INVESTING?),

(TSLA), (MO)

Looking at the New Year equity allocations, it’s truly astonishing how much money is pouring into ESG investing. Maybe it was another year of blistering head worldwide that did it. It now accounts for one-third of all US equity investment.

Last year, BlackRock, one of the largest fund managers in the country, made a major new commitment to ESG investment by rolling out several new ETFs. I thought I’d better take him seriously, as his firm is one of the largest money managers in the world with $7 trillion in assets.

So what the heck is ESG investing?

Environmental, Social, and Governance investing (ESG) seeks to address climate change in any way, shape, or form possible. Its goal is to move the economy and capital away from carbon-based energy forms, like oil (USO), natural gas (UNG), and coal (KOL), to any kind of alternative.

I am always suspicious of investment themes that are politically correct and ideologically directed, as they usually end in tears. I can’t tell you how many people I know who invested their life savings in solar companies to save the world, like Solyndra, Sungevity, American Solar Direct, and Suniva, only to get wiped out when they went under.

As laudable as the goals of these companies may have been, they were unable to deal with collapsing prices, Chinese dumping, and the harsh realities of doing business in a cutthroat competitive world.

As a venture capital friend of mine once told me, “Technology is a bakery business”. If you can’t sell your products immediately, you go broke. Technology always drops prices dramatically and if you can’t stay ahead of the curve you don’t stand a chance.

Still, what I believe is not important. The fastest growing group of new investors in the market today are Millennials, and they happen to take ESG investing very seriously.

There does seem to be a method to BlackRock’s madness. Over the past year, ESG-influenced funds have grown from 1% to 3.6% of total investment. Other major fund families like Vanguard have already jumped on the bandwagon.

ESG can include a panoply of activities, including recycling, climate change mitigation, carbon footprint reduction, water purification, green infrastructure, environmental benefits for employees, and greenhouse gas reduction. There are many more.

There is even an ESG rating system for funds and companies produced by firms like Refinitiv, which scores 7,000 companies around the world based on their environmental sensitivity. Companies like United Utilities Group PLC, the UK’s largest water company, get an A+, while China’s Guangdong Investment Ltd, which supplies water and energy to Hong Kong, gets a D-.

It goes without saying that companies from emerging nations tend to score very poorly. So do manufacturing companies relative to service ones, and energy companies versus non-energy ones.

The ESG concept began in 2005, when UN Secretary General Kofi Annan wrote to 50 global CEOs urging them to take climate change seriously. A major report by Ivor Knoepfel followed a year later entitled “Who Cares Wins.” The report made the case that embedding environmental, social and governance factors in capital markets makes good business sense and leads to more sustainable markets and better outcomes for societies. The snowball has been rolling ever since.

Themed investing is not new. “Sin” stocks have long been investment pariahs, including alcohol and tobacco companies. As a result, these companies trade at permanently low multiples. The newest investment ban is on firearms-related companies.

ESG investment may be about to get a major tailwind. The laws of supply and demand have oil prices disappearing up their own exhaust pipe. Overproduction by US fracking companies has caused supply gluts that will lead to chronically lower prices. The US happens to have a new 200-year supply of oil and gas, thanks to the fracking revolution.

Saudi Arabia just floated their oil monopoly, Saudi ARAMCO, raising a record $26 billion. When Saudi Arabia wants to get out of the oil and gas business, so should you. It’s not because they can’t think of new ways to spending money that they’re unloading it.

That’s why I have been advising followers to avoid energy investments like the plague for the past decade. My recent trade alerts for oil have been on the short side. It’s just a matter of time before alternatives rule the world.

Who is the greenest company in America? That would be electric car and autonomous driving firm Tesla (TSLA). Perhaps ESG investing helps explain the tripling of the share price since June.

What is the top-performing listed stock of the last 30 years? Tobacco company Altria Group (MO), the old Philip Morris.

It’s proof that investment shaming doesn’t always work.

Global Market Comments

January 16, 2019

Fiat Lux

Featured Trade:

(WHAT THE HECK IS ESG INVESTING?),

(TSLA), (MO)

(WILL UNICORNS KILL THE BULL MARKET?),

(TSLA), (NFLX), (DB), (DOCU), (EB), (SVMK), (ZUO), (SQ),

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds: