Here’s the good news.

You know those pesky seasonals that have been a drag of the market for the past five months? You know, that sell in May and go away thing?

It’s about to end, vanish, and vaporize.

We are only ten trading days away from when seasonals turn hugely positive on November 1.

On top of that, the pandemic is rapidly receding, the economy reaccelerating, and workers are returning to the workforce. The action Biden took with the west coast ports should unlock the logjam there. It all sounds like a Goldilocks scenario.

The ports issue has nothing to do with the pandemic. The truth is that with 6% GDP growth, the US economy is growing faster than it has ever done before. That means we are buying a lot more stuff, more than our antiquated infrastructure can handle. Unlock the ports, and growth could accelerate even further.

Bitcoin has been on fire as well, doubling since August 1. The focus has been on the launch of the first crypto futures ETF, which may happen as early as today. All of the trade alerts we issued in this space have been total home runs. (Click here for our Bitcoin Letter).

As a result, Bitcoin is within striking range of hitting a new all-time high at $66,000. Break that, and we could see a melt-up straight to $100,000.

Want another reason to be bullish? The Millennial generation is about to inherit $68 trillion by 2030. Guess where that is going? Bitcoin and all other risk assets, as younger investors tend to be more aggressive.

So, what to do about all of this?

Keep doing more of what’s working. Buy financials and Bitcoin and sell short bonds. Wait for tech to bottom out at the next interest rate peak, then load the boat there once again.

Make as much money as you can now because 2022 could be a year of diminished expectations. Stocks might rise by only 15% compared to this year’s 30% torrid rate.

As for Bitcoin, that is a horse of a different color.

CPI Hits 5.4%, and was up 0.4% in September, a high for this cycle. This time, it was food and energy that took the lead. Used car prices, which went ballistic last month, showed a decline. Supply chain problems are wreaking havoc and those with inventory can charge whatever they want. The Fed thinks this is transitory, the bond market doesn’t. Sell rallies in the (TLT).

Weekly Jobless Claims Plunge to 293,000, a new post-pandemic low. With delta in retreat, higher wages are luring people back to work to deal with massive supply chain problems. This may be the beginning of the big drop in unemployment to pre-pandemic levels. Stocks will love it. Buy stocks on dips.

Big Banks Report Blowout Earnings and are firing on all cylinders. The best is yet to come. Interest rates are rising, default rates are falling, profit margins expanding, and the economy is growing at a record rate. Buy (JPM), BAC), and (C) on dips.

The Nonfarm Payroll Bombs in September, coming in at only 194,000. That follows a weak 235,000 in August. The headline Unemployment Rate dropped to a new post-pandemic low of 4.8%, down from a peak of 22%. It’s not a soggy economy that’s causing this, but a shortage of people to hire. Some 10 million workers have gone missing from the American economy, and many may never come back.

Bitcoin Soars to $61,000, a five-month high, putting the previous $66,000 high in range. With ten crypto ETFs waiting in the wings for SEC approval, a flood of money is about to hit the sector. Several countries are now considering the adoption of Bitcoin as a national currency after El Salvador’s move. Keep buying Bitcoin dips. Mad Hedge Bitcoin Letter followers are making a fortune.

Oil (USO) Tops $80, after OPEC limits production increases to 400,000 barrels a day, dragging on the stocks market. Prices are approaching levels that will restrain growth. Pandemic under-investment and distribution problems have triggered a short squeeze. There will be many spikes on the way to zero.

Fed Minutes Show Taper to Start in November, as discussed in the September meeting. They may start with $15 billion a month in fewer bond purchases. The inflation boogie man is getting bigger with the 5.4% print on Tuesday. Sell rallies in the (TLT)

JOLTS Comes in at 10.4 million indicating that the labor shortage is getting more severe. Millions are still staying home for fear of catching covid. There is also a massive skills disparity resulting from decades of under-investment in education.

IMF Cuts Global Growth Forecast to 5.9%. Supply chains, delta, inflation worries, and vaccine access are to blame.

US Dollar (UUP) Hits One-Year High on rising interest rates. This will continue for the foreseeable future. Stand aside from the (UUP) as this is a countertrend trade. We may be only 15 basis points away from an interim peak in rates at 1.76% for the ten-year.

My Ten Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My Mad Hedge Global Trading Dispatch saw a heroic +8.91% gain so far in October. My 2021 year-to-date performance soared to 81.51%. The Dow Average was up 15.4% so far in 2021.

Figuring that we are either at, or close to a market bottom, and being a man of my convictions, I kept 90% invested in financial stocks all the wall until the October 15 options expirations. Those include (MS), (GS), (JPM), (BLK), (BRKB), (BAC), and (C).

The payday was big and more than covered earlier in the month stop-losses in (SPY) and (DIS). I quick trip by the Volatility Index (VIX) to $29, then back to $15 was a big help.

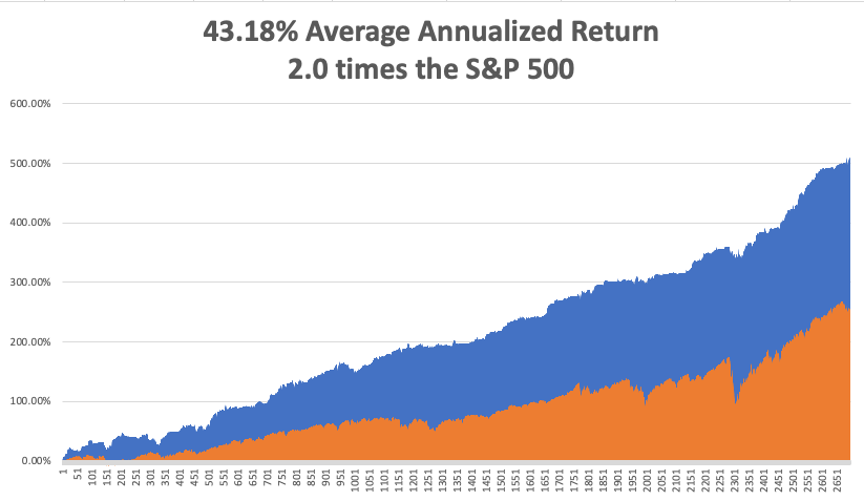

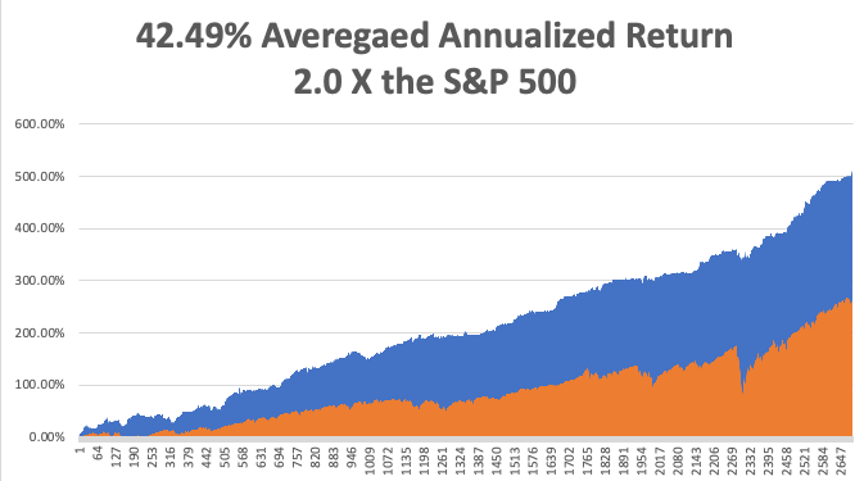

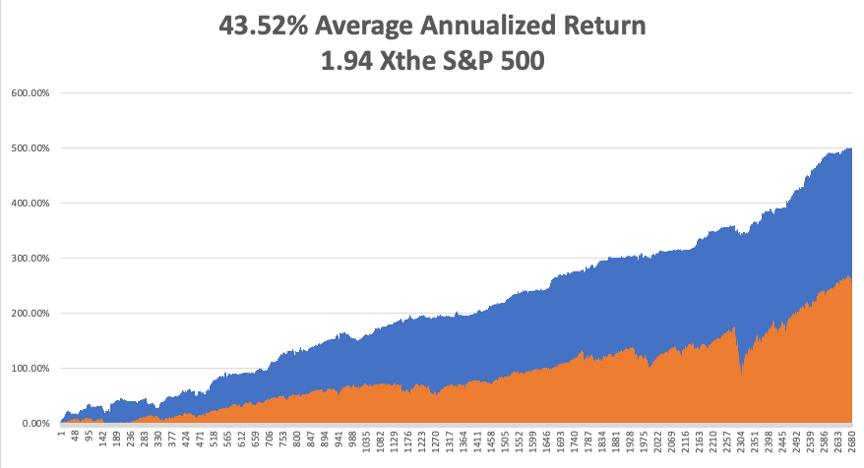

That brings my 12-year total return to 511.06%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 43.19%, easily the highest in the industry.

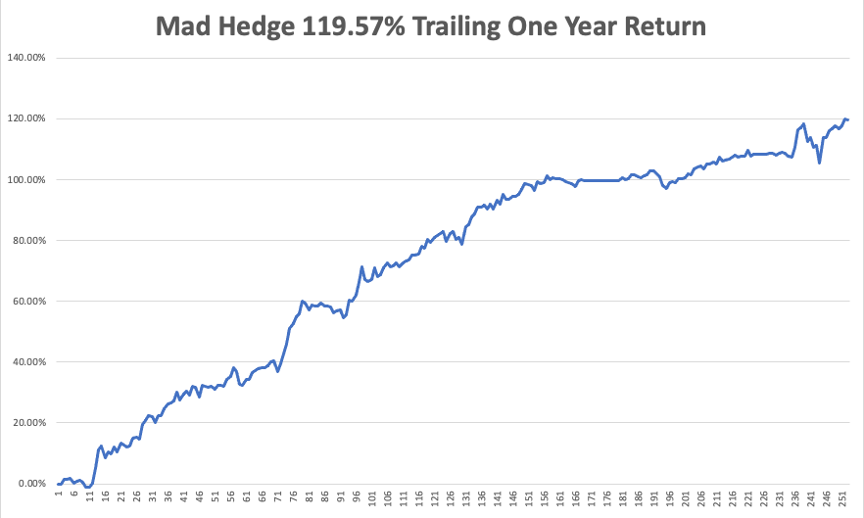

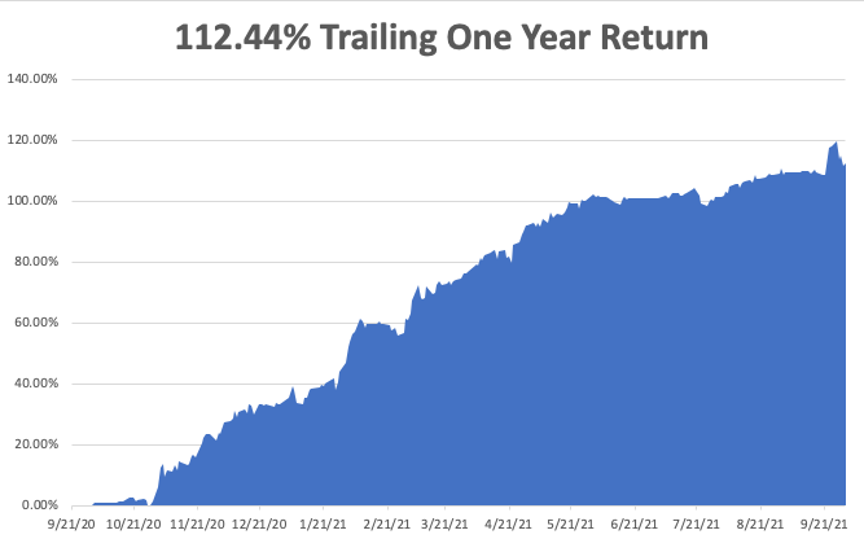

My trailing one-year return popped back to positively eye-popping 119.57%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 45 million and rising quickly and deaths topping 725,000, which you can find here.

The coming week will be slow on the data front.

On Monday, October 18 at 8:15 AM, Industrial Production for September is published. Johnson & Johnson (JNJ) reports.

On Tuesday, October 19 at 8:00 AM, the Housing Starts for September are released. Netflix (NFLX) reports.

On Wednesday, October 20 at 7:30 AM, Crude Oil Stocks are announced. Tesla (TSLA) and IMB (IBM) report.

On Thursday, October 21 at 8:30 AM, Weekly Jobless Claims are announced. At 10:00 AM, Existing Home Sales for September are printed. Alaska Air (ALK) and Southwest Air (LUV) report.

On Friday, October 22 at 8:45 AM, the US Markit Flash Manufacturing and Services PMI is out. American Express (AXP) reports. At 2:00 PM, the Baker Hughes Oil Rig Count are disclosed.

As for me, I normally avoid the diplomatic circuit, as the few non-committal comments and soggy appetizers I get aren’t worth the investment of time.

But I jumped at the chance to celebrate the 70th anniversary of the founding of the People’s Republic of China with San Francisco consul general Gao Zhansheng.

Happy Birthday, China!

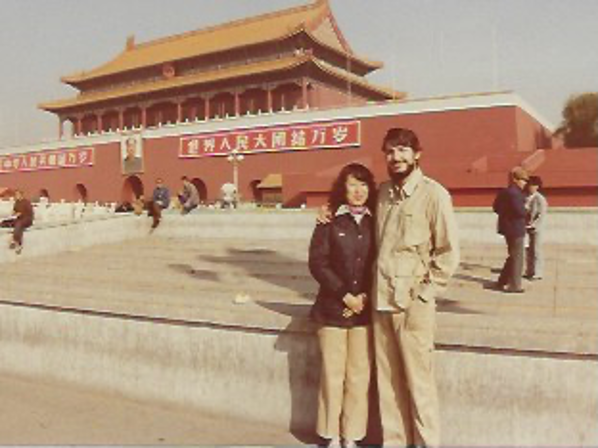

When I casually mention that I survived the Cultural Revolution from 1968 to 1976 and interviewed major political figures like Premier Deng Xiaoping, who launched the Middle Kingdom into the modern era, and his predecessor, Zhou Enlai, modern-day Chinese are enthralled.

It’s like going to a Fourth of July party and letting drop that I palled around with Thomas Jefferson and Benjamin Franklin.

Five minutes into the great hall, and I ran into my old friend Wen. She started out her career with the Chinese Intelligence Service and had made the jump to the Foreign Ministry, as all their best people did. Wen was passing through town with a visiting trade mission.

When I was touring China in the seventies as the guest of the Bank of China, Wen was assigned as my guide and translator, and we kept in touch over the years. I was assigned a bodyguard who doubled as the driver of a tank-like Russian sedan, a Volga.

The Cultural Revolution was on, and while the major cities were safe, we ran the risk of running into a renegade band of xenophobic Red Guards, with potentially fatal consequences.

By the time Wen married, China had already adopted its one-child policy. As much as she wanted more children, she understood the government’s need to adopt such a drastic policy. Without it, the population today would be 1.6 billion, not 1.2 billion, and all of the money that went into buying capital goods would have been spent on food imports instead.

The country would have stagnated at its 1980 per capita income of $100/year. There would have been no Chinese economic miracle. She was very proud of her one son, who was a software engineer at Microsoft (MSFT) in Beijing.

I asked if she recalled our first trip together and a dark cloud came over her face. We were touring a section of Fuzhou in southern China when three policemen marched up. They started shouting at Wen that we were in a restricted section of the city where foreigners were not allowed. They started mercilessly beating her with clubs.

I was about to intercede when my late wife, Kyoko, let go with a blood-curdling tirade in Japanese that froze them in their tracks. I saw from the fear in their faces that she had ignited their wartime fear of Japanese authority and the dreaded Kempeitai, or secret police, and they beat a hasty retreat.

To this day, I’m not exactly sure what Kyoko said. We took Wen back to our hotel room and bandaged her up, putting ice on the giant goose egg on her head. When I left, I gave her my paperback copy of HG Well’s A Short History of the World, which she treasured, as the book was then banned in China.

Wen mentioned that she was approaching the mandatory retirement age of 60, and soon would be leaving the Foreign Service. I suggested she move to San Francisco, which offered a thriving Chinese community.

She laughed. No matter how much prices had fallen, she could never afford anything here on a Chinese civil servant’s salary.

I asked Wen if she still had the book I gave her nearly five decades ago. She said it had become a treasured family heirloom and was being passed down through the generations.

As she smiled, I notice the faint scar on her eyebrow from that unpleasantness so long ago.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Kyoko and I in Beijing in 1977