Below please find subscribers’ Q&A for the August 24 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: I’ve heard another speaker say that we are not heading for a Roaring Twenties; instead, we are heading for a Great Depression. Who is right?

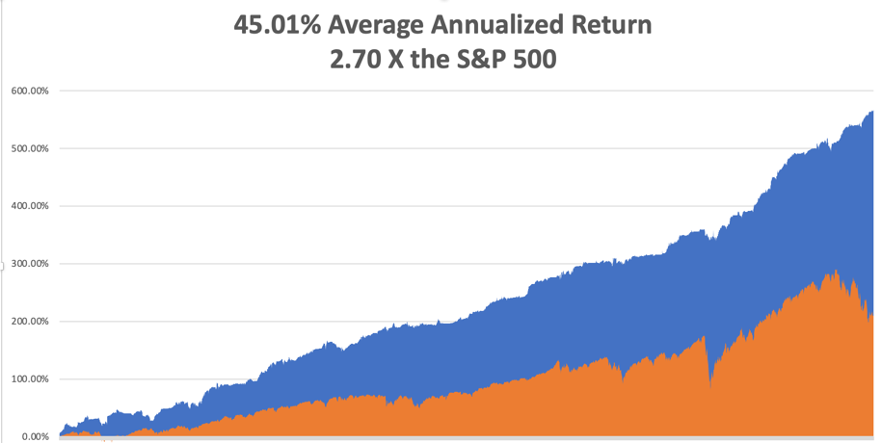

A: There are many different possible comments to this. Number one, in the newsletter business, the easiest way to make money is to predict the Great Depression and panic people. Stock market Gurus have been predicting the next Great Depression for all of the 54 years that I have been in the financial markets. We’ve gone through a whole series of Dr. Doom's over this time. We had Nouriel Roubini, we had Henry Kaufman, and before that, there was Joe Granville who predicted Dow 300 when the Dow was at 600 and never gave up. The reason is very simple: the people making these dire forecasts are based in depressionary places. If you live in Puerto Rico, or Ukraine, or Europe, it’s easier to be depressed right now, because the economy is falling to pieces. If you live in Silicon Valley, like I do, and you see these incredible technologies delivering every day, it’s easy to be bullish about the future. So, that is another part of it. On top of that, we’ve just had a recession. And even during this last recession, earnings continued to grow at 5% for the main market, and 20-30% for individual technology companies. The market goes up 80% of the time so if you’re bullish, you’re right 80% of the time. In fact, that may increase going into the future because we just had six months of down days behind us.

Q: How do you know when to buy?

A: Well, I have about 100 different market indicators that I look at, but my favorite one is the Volatility Index (VIX). The (VIX) is the perfect contrary indicator because when fear is high the payoff for taking on risk is huge. The risk/reward swings overwhelmingly in your favor. The simplest indicators are usually the best ones. When (VIX) gets to $30—I don’t think I’ve ever lost money in my life adding on a new trade with (VIX) at $30. If I add positions with the (VIX) at under $30, the loss rate goes up; so, I’m inclined to only do trades when the (VIX) gets close to $30. If that means doing nothing for a month, that’s fine with me. If telling you to stay out of the market makes more money than getting you into the market, I’ll keep you out of the market. I’m not a broker so, I don’t get paid commission; I get paid to give you the highest annual returns so you’ll renew because I only get paid if you renew. Our renewal rate is about 80% these days, and the other 20% either die or retire.

Q: What about the Tesla (TSLA) 3:1 split?

A: In the short term I would stand back and do nothing because you often get a “buy the rumor sell the news” selloff in stocks after splits. Long term, Tesla is a strong buy; short term, we are up close to 60% in a couple of months. Betting that Tesla would rise going into this split was one of the most successful trades that I’ve ever done.

Q: Did you know Julian Robertson?

A: Yes, I did. Julian was one of the first investors in my hedge fund, and then he was one of the first buyers of my Mad Hedge newsletter. He was also my first concierge client. He had one heck of a temper; if you didn’t know your stuff cold, he would just absolutely blow up at you. But he did tend to surround himself with geniuses. He drew on Morgan Stanley people a lot, so I knew a lot of the tiger cubs. But he certainly knew stocks, and he knew markets.

Q: What do we do on the SPDR S&P 500 ETF (SPY) position?

A: Just run it into expiration. As it is my only position, I don’t really have anything else to do and I don’t really see any explosive upside moves in markets this month. And then after that, we will be 10 days to expiration; so there may be enough profit there at that time.

Q: As a long-term investor, should I take Tesla profits now?

A: If you're really a long-term investor and sell now, you’ll miss the move to $10,000. However, if you’re a trader, you should take some profits now and look to buy and scale in down $50 and more down $100, and so on, depending on what the market does.

Q: What are your thoughts on Nvidia Corporation (NVDA) and semis?

A: When recession fears exist, you will have sharp downturns in the semis, because this is the most volatile sector in the market. However, in the long term in Nvidia you might be looking at a 20% of downside, and 200% of upside on a three-year view. It just depends on how much pain you want to take while keeping your long-term position.

Q: Why is September typically the worst month of the year for stocks?

A: You need to go back 120 years when farmers accounted for 50% of the US population. In the farming business, September/October is your maximum stress point, because you’ve put out all your money for seed, for water, for fertilizer, but you don’t get paid until you sell your crop in September/October. That creates a point of maximum stress—when farmers have to max out the loans from the banks, and that creates cascading stresses in the financial system. That’s why almost every stock market crash happened in October. And of course, since that cycle started, it has become a self-fulfilling prophecy to this day. Even though only 2% of the population is in farming now, that selloff in September/October is still there. There’s no real current reason behind it.

Q: How do you find good spreads?

A: You find a good stock first, then a good chart, and then wait for the market to come to you with a high Volatility Index (VIX) with a good micro and macro tailwind. It’s that simple.

Q: Do you think healthcare will sell off once the recession fear is gone?

A: It may not because it had a massive selloff across the entire industry when COVID went away. They've taken that COVID hit. That's a recession if you’re a healthcare company. Now COVID is essentially gone, so they haven’t got it left to lose. In the meantime, technology continues to hyper-accelerate in the healthcare area, just in time for old people like me.

Q: How would you invest $1 million in a retirement portfolio today?

A: Call me—that’s a longer conversation. Or better yet, sign up for the concierge service, and we can talk as long as you want.

Q: Any hope for Facebook (META)?

A: No, when you’re advertising that you’re going to lose money and that you’re not going to make money for five years, that’s bad for the stock. I’m sorry Mr. Zuckerberg, but you should have taken those financial markets classes instead of just doing the programming ones.

Q: Will Powell be dovish or hawkish in his speech?

A: I think he has to go hawkish because he needs to justify the next interest rate hike in September. That’s why I’m 90% cash. The market is set up here not to take disappointments on top of a 4,000-point rally in two months. It’s very sensitive to disappointment, so it’s a good time to be in cash.

Q: What stocks go down the most if we get a 5-10% correction?

A: Semiconductors. Nvidia (NVDA), Advanced Micro Devices (AMD), Micron Technology (MU) are your high beta stocks. Having said that, those are the ones you want to buy at market bottoms. I’ve caught many doubles on Nvidia over the years just using that strategy. When you’ve had a horrible market, you want to go for the highest beta stocks out there, and those are the semis. Plus, semis have a long-term undercurrent of always making more money, always improving their products, always increasing market shares. So, you want to invest with tailwinds behind you all the time. 30 years ago, a new car needed ten chips. Now they need 100. That accelerates exponentially as the entire auto industry goes EV.

Q: What’s your opinion on Lithium companies?

A: You know, I haven’t really done much in this area because it is a basic commodity. The profit margins are minimal, there is no Lithium shortage in the world like there is an oil shortage. Plus, no one has a secret method of mining Lithium that is more profitable than another. No one has an advantage.

Q: Is there a logical maximum number of stocks to have in a share portfolio?

A: I keep mine at ten. You should be able to cover every good sector in the market with ten. When I talk to new concierge customers and review their portfolios, one of the most common mistakes is they own too many stocks – there can be 50, 100, 200 stocks, even several gold stocks. And you never want to own more than you can follow on a daily basis. It’s better to follow ten stocks very closely than 100 stocks just occasionally.

Q: How low do you think Apple (APPL) will go on this dip?

A: Minimum 10%, maybe 20%. Just depends on how weak the market will go in this correction.

Q: What was your defensive plan when you sold short Tesla puts?

A: If they got exercised against me and the Tesla shares were sold to me at my strike price, I was going to take the stock, then let the stock rally. If my long-term view for Tesla is $10,000, it’s not such a problem having a $500 put exercise against you—you just take the stock and run the stock. That was always the strategy. Never sell short more puts than you can take delivery of in the stock. Your broker won’t let you do it anyway to protect themselves.

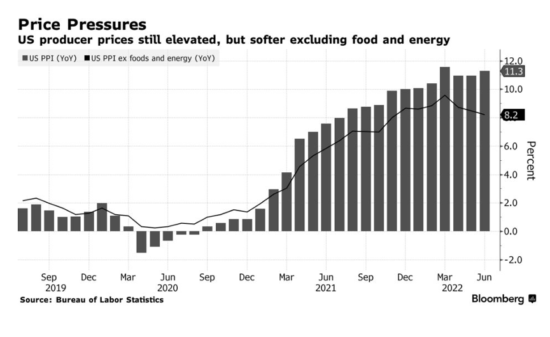

Q: Do you think we could get a strong rally on the next CPI report?

A: Yes. The report is due out on September 13. But some of a sharp drop in the CPI in the next report is already in the market, so don’t expect another 2,000-point stock market rally like we got last time. It’ll be a much lesser move and after that, we’ll need to see more data. We may get 1,000 points out of it, probably not much more. After that, the November midterm election becomes the dominant factor in the market.

Q: When is natural gas (UNG) going to roll over?

A: When the Ukraine War ends, and that day is getting closer and closer. I think it’ll be sometime in 2023. And if you get an end to the war (and the resumption of Russian supplies is not necessarily a sure thing) you’d get a move in natgas from $9 down to $2. So, that’s why I’m very cautiously avoiding energy plays right now. The big money has been made; next to happen is that the big money gets lost.

Q: What are your thoughts on Florida’s pension fund now banning ESG stocks? I live on Florida state pension fund payments.

A: You might start checking out other income opportunities, like becoming an Uber (UBER) driver or working at MacDonalds (MCD). What the Florida governor has done is ban the pension fund from the sector that is most likely to go up over the next ten years and restricted them to the sector (oil) which is most likely to go down. That is very bad for Florida’s pension fund and any other pension funds that follow them. And I’ve seen this happen before, where a pension fund gets politicized, and it’s 100% of the time a disaster. Governors aren't great market timers; politicians are terrible at making market calls. There are too many examples to name. ESG stocks were one of the top performing sectors of the market for 5 years until we got the pandemic crash. So, that is an awful idea (and one of the many reasons I don’t live in Florida besides hurricanes, humidity, alligators, and the Bermuda Triangle).

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER, or BITCOIN LETTER, whichever applies to you, then select WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader