Mad Hedge Technology Letter

May 21, 2018

Fiat Lux

Featured Trade:

(HERE'S THE BIGGEST TECHNOLOGY CONTRACT IN HISTORY)

(AMZN), (MSFT), (ORCL), (IBM), (GOOGL)

Mad Hedge Technology Letter

May 21, 2018

Fiat Lux

Featured Trade:

(HERE'S THE BIGGEST TECHNOLOGY CONTRACT IN HISTORY)

(AMZN), (MSFT), (ORCL), (IBM), (GOOGL)

The return of the Jedi is coming.

Luke Skywalker and Obi-Wan Kenobi will enter the cloud and use the force.

Not the Jedi of the famous George Lucas films, but JEDI - Joint Enterprise Defense Infrastructure commissioned by the Department of Defense.

This large contract is up for grabs.

Rumor has it that Amazon is in the driver's seat to become the government's right-hand man.

The purpose of this broad-based upgrade is to enhance communication channels among military branches by loading up operations into the cloud.

Artificial Intelligence (A.I.) and machine learning will be integrated as well.

One task slated for modernization includes the heaps of documents waiting to be translated from Arabic, Farsi, Chinese and other foreign languages into English.

A.I. will organize which documents have priority over others as well as aiding in raw translation. This will save the Department of Defense's overworked linguists thousands of hours in brute translation work.

As it stands, the government is grappling with an overlapping fractious system with legacy software up to 20 years old.

These legacy systems of yore are poor at keeping out the cyber criminals looking for a smash-and-data grab.

One instance where massive inefficiencies rear its ugly head is in the Department of Agriculture.

This department has 22 chief information officers that require seven more personal assistants inflating the IT budget.

The government could become the best turnaround story in the tech industry in years.

This turnaround could eventually become bigger than Microsoft and Cisco, which are the poster children for extreme cosmetic surgery in Silicon Valley.

The government burns $90 billion per year servicing IT operations, and JEDI is slated to offer an attractive sum of $100 billion over 10 years to a private company.

Not only will the Department of Defense modernize, but every part of the government will adopt new technologies.

Security is a priority for this administration after its legitimacy was questioned due to alleged nefarious Russian involvement.

The Committee on Foreign Investment in the United States (CFIUS) has buckled down rejecting a myriad of attempted foreign takeovers of cutting-edge tech companies stressing the need to properly harness local tech companies' ingenuity to the benefit of the country.

These new opportunities do not affect the already $1 billion per quarter that Alphabet (GOOGL) takes in from government servicing.

The $1 billion contract was given to Alphabet to develop the Algorithmic Warfare Cross-Functional Team industrially working on Project Maven.

Project Maven is the Department of Defense's attempt to integrate A.I. and machine learning into motion detector technology applied to surveillance drones using the Google cloud.

Project Maven received an additional boost to its objectives with an additional $100 million cash injection recently underlining the government's efforts to make warfare more efficient and less expensive.

Amazon Web Services (AWS) has also carved out a nice $5 billion per quarter business thanks to the power brokers in Washington.

Another side deal consummated recently has thrust Microsoft into the frame as well.

Microsoft (MSFT) agreed with the Office of the Director of National Intelligence to service 17 intelligence agencies with the Microsoft Azure cloud platform.

The deal was reported to be valued at "hundreds of million" of dollars.

Another separate deal agreed by both parties has Microsoft migrating another 3.4 million users and 4 million devices from the Department of Defense into the cloud.

All told, Microsoft has pulled in more than $1.3 billion of orders from the government in the past five years.

Bill Gates's old company was rewarded certification to supply the government with computers, operating systems, Microsoft Office, and the cloud services bolstering their credentials to potentially extract more government business.

The administration has adopted a winner takes all approach to the JEDI contract preferring one cloud provider to maintain the infrastructure.

Companies are scratching and clawing to get within a shout of winning this valuable revenue stream that could extrapolate down the road.

JEDI accounts for just 20% of the cloud possibilities for the tech companies in the government system.

The further 80% of digitization will happen down the road.

Firms are up in arms about the single platform solution and believe branching out to multiple platforms will come in use if part of the operation goes down.

Hybrid solutions are the norm for 80% of Fortune 500 companies.

As it is, International Business Machines Corp. (IBM), Oracle (ORCL), Alphabet, Amazon (AMZN), and Microsoft have been adamant that they are the best candidates for the job.

Amazon has been on a one-man mission mobilizing its all-star team of lobbyists to gain an edge.

Amazon has been part of the government's purse strings for quite some time.

It was awarded a $600 million contract in 2013.

Secretary of Defense James Mattis spoke about the relationship with Amazon in glowing terms characterizing Amazon's performance as "impressive" in terms of securing data and functionality.

The positive Amazon feedback has given AWS a head start. It hopes to capitalize on the biggest transfer of data to the cloud in modern history.

Once completed, departments will at last be able to access files from different branches on the same platform. This process is currently done manually.

Quickening the pace of modernization is a prerogative for the new administration.

President Donald Trump signed an executive order to spur on the process of getting rid of the decaying system.

Son-in-law Jared Kushner has also been an advocate of the agonizing overhaul.

This bold initiative ties in well with enhancing cybersecurity inside Washington at a time when hackers have penetrated legacy systems with ease.

Getting the White House up and running will improve the operation of the government. From an investor's point of view, it will add materially to the bottom line of companies that start to win more contracts.

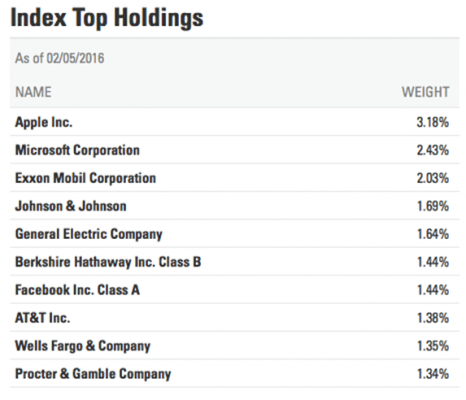

This underscores the reliance of our government and economy on the large cap tech companies that are single-handedly propping up the current bull market.

The White House will wake up one day and understand that technology innovation is more powerful than ever, and even the mayhem inside the White House can't stop the digitization of politics.

Going forward Amazon and Microsoft should get a healthy boost to their overflowing coffers. Legacy companies such as IBM and Oracle could be punished by the government as well as investors for being legacy companies, which could lead the government to pass over IBM and Oracle.

Yes Mr. President ... An Upgrade Is Needed

_________________________________________________________________________________________________

Quote of the Day

"What would I do? I'd shut it down and give the money back to the shareholders." - said Michael Dell in 1997, the founder of Dell Technologies, when asked what he would do if he was in charge of Apple.

Mad Hedge Technology Letter

April 23, 2018

Fiat Lux

Featured Trade:

(HOW NETFLIX CAN DOUBLE AGAIN),

(NFLX), (AMZN), (IQ), (ORCL), (MU), (AMAT), (CRUS), (QRVO), (IFNNY), (NVDA), (JD), (BABA), (MSFT)

The first batch of earnings numbers are trickling in, and on the whole, so far so good.

A spectacular earnings season will further cement tech's position at the vanguard of the greatest bull market in history.

The bull case for technology revolves around two figures indicating "RISK ON" or "RISK OFF".

The first set of numbers from Netflix (NFLX) emanated sheer perfection.

Netflix has gambled on its international audience to drive its growth and unceasing creation of premium content to reach these lofty targets set forth.

It worked.

Consensus was that domestic subscription growth had peaked, and Netflix would have to lean on overseas expansion to beat earnings estimates.

American subscription growth knocked it out of the ballpark, beating expectations by 480,000 subscriptions. The street expected only 1.48 million new adds. The 1.96 million shows the American online streamer is resilient, and the migration toward cord-cutting is happening faster than initially thought.

International adds were pristine, beating the 5.02 million estimates by 440,000 million new subscribers.

Content is king as Netflix has proved time and time again (we notice that here at Mad Hedge Fund Trader, too). Netflix plans to fork out about 700 original series in 2018.

By 2023, Netflix could grow its subscriber base to close to 400 million. The potential for international advancement is immense considering foreign companies are playing catch-up and cannot compete with the level of Netflix's content.

The earnings report coincided with Netflix announcing a forceful push into Europe, doubling its allocated content-related investments to $1 billion.

All of Netflix's estimates take into consideration that it is shut out of the Chinese market. Ironically, the Netflix of China, named iQIYI (IQ), just recently went public on the Nasdaq.

Amazon Web Services (AWS), the cloud-arm of Amazon (AMZN), revenue numbers are the other numbers that are near and dear to the pulsating heartbeat of the bull market.

Jeff Bezos, Amazon's CEO, penned a letter to shareholders that Amazon prime subscribers blew past the 100 million mark.

The positive foreshadowing augurs nicely for Amazon to surprise to the upside when it reports earnings next week on April 26.

Expect more of the same from cloud companies that are overperforming.

The few glitches in tech are minor. It is mindful to stay on the right side of the tracks and not venture into marginal names that haven't proved themselves.

For instance, Oracle (ORCL) had a good, not great, earnings report but shares still cratered after CEO Safra Catz dissatisfied analysts with weak cloud forecasts of just 19%-23% growth.

The street was looking for cloud guidance over 24%. Oracle is still being punished for its legacy tech segments.

The chip sector got pummeled after several chip manufacturers announced weak supply order from Apple.

This is hardly a surprise with Apple slightly missing iPhone estimates last quarter by 1%.

Chip stocks such as Lam Research (LRCX), Micron (MU), and Applied Materials (AMAT) look like affordable bargains. They should be seriously considered after share prices stabilize buttressed by support levels.

The outsized problem is that hardware suppliers have headline risks because of large cap tech's preference toward vertically integrating.

Along with price efficiencies, vertically integration aids design aspects and streamline product production time horizons.

This is not the end of chips.

Consumers need the silicon to generate and extract all the data coming to market.

Particularly, Apple (AAPL) went over its skis trying to push expensive smartphones to a saturated market when all the rip-roaring growth is at the low end of the market.

Apple still managed to sell more than 77 million iPhones, but the trade war rhetoric will deter Chinese consumers from purchasing American tech products. Until now, Apple has counted on China as its best growth prospect. The administration had other ideas.

Any noteworthy Apple supplier has gotten punched in the nose, but crucially, investors must stay out of the SMALLER chip players that rely on narrow revenue sources to keep them afloat.

Bigger chip companies can withstand the shedding of a few revenue sources but not Cirrus Logic (CRUS).

(CRUS) shares have been beaten mercilessly the past year sliding from $68 to a horrifying $37.74 today.

(CRUS) produces audio amplifier chips used in iPhone devices, and weak iPhone X guidance is the cue to bail out of this name.

The company extracts more than 75% of its revenues by selling audio chips used in iPhone devices. Ouch!

Last quarter saw horrific performance, stomaching a 7.7% decline in revenues due to tepid demand for smartphones in Q4 2017.

Cirrus Logic provided an underwhelming outlook, and it is not the only one to be beaten into submission behind the woodshed.

Apple has signaled to its suppliers that it will view production in a different way.

Imagination Technologies, a U.K. company, was informed that its graphic chips are not needed after 2018.

Dialog Semiconductor, another U.K.- based operation, shared the same destiny, as its power management chip was cut out of the production process, sacrificing 74% of revenue.

To top it all off, Apple just announced it plans to manufacture its own MicroLED screens in Silicon Valley, expunging its alliance with Samsung, Sharp, and LG, which traditionally yield smartphone screens for Apple. And Apple plans to make its own chips, phasing out Intel's chips in Apple's MacBook by 2020.

Qorvo (QRVO), Apple's radio frequency chips manufacturer, also can be painted with the same brush.

Apple was responsible for 34% of the company's total revenues in 2017.

Weak iPhone guidance set off a chain reaction, and the trembles were most felt at the bottom feeder group.

Put Infineon Technologies (IFNNY) in the same egg basket as Qorvo and Cirrus Logic. This company installs its cellular basebands in iPhones.

FANG has split into two.

Netflix and Amazon continue producing sublime earnings reports, and Apple and Facebook have hit a relative wall.

It will be interesting if the government's harsh rhetoric toward Amazon amounts to anything.

One domino that could fall is Amazon's lukewarm relationship with the US Postal Service.

Logistics is something the Chinese Amazon's JD.com (JD) and Alibaba (BABA) have successfully adopted. Look for Amazon to do the same.

However, I will say it is unfair that most tech companies are measured against Netflix and Amazon, even for Apple, which earned almost $50 billion in profits in 2017.

It is insane that companies tied to a company that prints money are reprimanded by the market.

But that highlights investors' pedantic fascination with pandemic growth, cloud, and big data.

Making money is irrelevant today. Investors should be laser-like focused on the best growth in tech such as Amazon, Netflix, Lam Research, Nvidia (NVDA), and Microsoft (MSFT), which know how to deliver the perfect cocktail of results that delight investors.

__________________________________________________________________________________________________

Quote of the Day

"$500? Fully subsidized? With a plan? That is the most expensive phone in the world. And it doesn't appeal to business customers because it doesn't have a keyboard. Which makes it not a very good email machine." - said former CEO of Microsoft Steve Ballmer on the introduction of the first iPhone.

Mad Hedge Technology Letter

April 10, 2018

Fiat Lux

Featured Trade:

(WHY I'M PASSING ON ORACLE),

(ORCL), (MSFT), (AMZN), (CRM)

To say 2018 is the Year of the Cloud is an understatement.

Oracle (ORCL) felt the tremors of investors' fickle preference for quality cloud growth when the stock sold off hard after earnings that were relatively solid but unspectacular.

Oracle is a Silicon Valley legacy firm established in 1977 under the name of Software Development Laboratories. The company was co-founded by Larry Ellison, Bob Miner, and Ed Oates and the name later was changed to Oracle.

The company made its name through database software and still relies on it for the bulk of its $37 billion in annual revenue.

Legacy companies are put through the meat grinder by investors, and analysts are micro-sensitive to just a few narrow-defined metrics.

Not all cloud companies are treated equally.

It has become consensus that the only way to move forward is through advancing the cloud model, and neglecting this segment is a death knell for any quasi-cloud stock.

Oracle skirted any sort of calamitous earnings performance but left a lot to be desired.

Cloud SaaS (software-as-a-service) revenue for the quarter was $1.2 billion, up 21% YOY, and growth rates were in line with many that are part of the winners' bracket.

Oracle's overall cloud business is still a diminutive piece of its overall business constituting just 16%, which is incredibly worrisome.

This number accentuates the lack of brisk execution and its late entrance into this industry.

Gross cloud margin only increased 2% to 67%, up from 65% QOQ, providing minimum incremental growth.

Total cloud revenue guidance was substantially weak, which includes SaaS, PaaS (platform-as-a-service) and IaaS (infrastructure-as-a-service) expected to grow 19% to 23% in 2018, much less than the forecasted guidance of 27%.

Oracle should be growing its cloud segment faster, especially since its cloud business is many times smaller than competition, and growing pains habitually occur later in the growth cycle.

The outsized challenge is attempting to leverage its foundational database business to convince existing corporate clients to adopt Oracle's in-house cloud services instead of diverting capital toward cloud offerings from Microsoft (MSFT), Salesforce (CRM), or Amazon (AMZN).

It could be doing a better job.

Weak guidance of 1%-3% for annual total revenue topped off a generally underwhelming cloud forecast.

The lack of over-performance is highly disappointing for a company that has been touting its pivot to cloud.

The message from Oracle is the transformation is nowhere close to finished. That was investors' queue to stampede for the exits.

Investors only need to look a few miles up the coast at the competition.

Salesforce is putting up solid numbers, and many cloud companies are judged solely on a relative basis to the industry leaders.

The turnaround companies are getting crushed by these growth magnates. Salesforce is sequentially increasing total revenue over 20% each quarter and expects total revenue to rise more than 20% in 2019. It has set ambitious revenue targets for 2020, 2030, and 2040.

Microsoft Azure grew cloud revenue 98% QOQ, and Microsoft Windows, its legacy business, only makes up 42% of Microsoft's total revenue and is shrinking by the day.

Microsoft has earned its positon as the King of the Legacy Businesses offering proof by way of its position as the industry's second-best cloud company, engineering cloud quarterly revenue of $7.8 billion and gaining on Amazon Web Services (AWS).

Microsoft was in the same situation as Oracle a few years ago, stuck with a powerful business in a declining industry. It then turned to the cloud and never looked back.

Instead of leveraging databases, Microsoft leveraged its operating system and proprietary software to persuade new clients to adopt its cloud platform - and the numbers speak for themselves.

Oracle still has the chance to pivot toward the cloud because its database product is a brilliant entrance point for potential cloud converts.

In the meantime, Amazon has its sights set on Oracle's database product and plans to go after market share.

Oracle believes its database product is the best in the business - more affordable, quicker, and dependable. However, technology is evolving at such a rapid pace that these nimble companies can flip the script on their opponents in no time.

It's a dangerous proposition to compete with Amazon because of the nature of competing means dumping products, and unlimited cash burn battering opponents into submission by crushing profitability.

Oracle's margins would get hammered in this circumstance at a time when Oracle's gross margins have been a larger sore spot than first diagnosed.

Legacy companies are unwilling to enter price wars with Amazon because they still have dividends to defend and profit margins to nurture skyward.

Concurrently, Salesforce and Microsoft Dynamics CRM are attacking Oracle's CRM products (Customer Relationship Management), which could further impair margins.

The breadth of competition showed up to the detriment of margins with PaaS and IaaS gross margins eroding from 46% YOY, down to 35% YOY.

Microsoft's cloud revenue eked out a better than 60% gross margin even with its gargantuan size.

Investors punished Oracle for whispers of its cloud business plateauing with a size that is just a fraction of Microsoft Azure.

The leveling out is hard to take after Larry Ellison claimed cloud margins would soon breach 80% in upcoming quarters.

Conversely, Microsoft has claimed margins could start to erode as the company reallocates capital into expanding its cloud infrastructure, but it is understandable for maturing companies that must battle with the law of large numbers.

At the end of the day, Oracle's cloud business is failing to grow enough.

Oracle's competitors are speeding down the autobahn while Oracle has been dismissed to the frontage road.

Growth impediments with the small size of Oracle's cloud business is a red flag.

Avoid this legacy turnaround story that hasn't turned around yet.

Oracle looks like a value play at this point and could rise if it gets its cloud act together or the mere anticipation of a resurgence.

But with margins and competition pressuring its attempts at transformation, I would take a wait-and-see approach.

It's clear that Oracle is in the third inning of its turnaround, and teething problems are expected.

If you get the urge to suddenly buy cloud stocks, better look at any dip from Microsoft, Salesforce, and Amazon, which all directly compete with Oracle but are performing at a much higher level.

__________________________________________________________________________________________________

Quote of the Day

"A company is like a shark, it either has to move forward or it dies." - said Oracle co-founder Larry Ellison.

Corporate earnings are up big! Great!

Buy!

No wait!

The economy is going down the toilet!

Sell! Buy! Sell! Buy! Sell!

Help!

Anyone would be forgiven for thinking that the stock market has become bipolar.

According to the Commerce Department?s Bureau of Economic Analysis, the answer is that corporate profits accounts for only a small part of the economy.

Using the income method of calculating GDP, corporate profits account for only 15% of the reported GDP figure. The remaining components are doing poorly, or are too small to have much of an impact.

Wages and salaries are in a three decade long decline. Interest and investment income is falling, because of the ultra low level of interest rates. Farm incomes are up, but are a tiny proportion of the total. Income from non-farm unincorporated business, mostly small business, is unimpressive.

It gets more complicated than that.

A disproportionate share of corporate profits is being earned overseas. So multinationals with a big foreign presence, like Apple (AAPL), Intel (INTC), Oracle (ORCL), Caterpillar (CAT), and IBM (IBM), have the most rapidly growing profits and pay the least amount in taxes.

They really get to have their cake, and eat it too. Many of their business activities are contributing to foreign GDP?s, like China?s, more than they are here. Those with large domestic businesses, like retailers, earn less, but pay more in tax, as they lack the offshore entities in which to park them.

The message here is to not put all your faith in the headlines, but to look at the numbers behind the numbers. Those who bought in anticipation of good corporate profits last month, got those earnings, and then got slaughtered in the marketplace.

Caveat emptor. Buyer beware.

Has the Market Become Bipolar?

Has the Market Become Bipolar?Corporate earnings are up big! Great! Buy! No wait! The economy is going down the toilet! Sell! Buy! Sell! Buy! Sell! Help! Anyone would be forgiven for thinking that the stock market has become bipolar. According to the Commerce Department?s Bureau of Economic Analysis, the answer is that corporate profits account for only a small part of the economy. Using the income method of calculating GDP, corporate profits account for only 15% of the reported GDP figure. The remaining components are doing poorly, or are too small to have much of an impact. Wages and salaries are in a three decade long decline. Interest and investment income is falling, because of the low level of interest rates and the collapse of the housing market. Farm incomes are up, but are a small proportion of the total. Income from non-farm unincorporated business, mostly small business, is unimpressive. It gets more complicated than that. A disproportionate share of corporate profits are being earned overseas. So multinationals with a big foreign presence, like Intel, Oracle (ORCL), Caterpillar (CAT), and IBM (IBM), have the most rapidly growing profits and pay the least amount in taxes. They really get to have their cake, and eat it too. Many of their business activities are contributing to foreign GDP?s, like China?s, more than they are here. Those with large domestic businesses, like retailers, earn less, but pay more in tax, as they lack the offshore entities in which to park them. The message here is to not put all your faith in the headlines, but to look at the numbers behind the numbers. Those who bought in anticipation of good corporate profits last month, got those earnings, and then got slaughtered in the marketplace. Caveat emptor. Buyer beware.

Has the Market Become Bipolar?

Has the Market Become Bipolar?Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.