Global Market Comments

May 8, 2020

Fiat Lux

Featured Trade:

(MAY 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(UNG), (UAL), (DAL), (INDU), (SPY), (SDS),

(P), (BA), (TWTR), (GLD), (TLT), (TBT)

Global Market Comments

May 8, 2020

Fiat Lux

Featured Trade:

(MAY 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(UNG), (UAL), (DAL), (INDU), (SPY), (SDS),

(P), (BA), (TWTR), (GLD), (TLT), (TBT)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader May 6 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What broker do you use? The last four bond trades I couldn’t get done.

A: That is purely a function of selling into a falling market. The bond market started to collapse 2 weeks ago. We got into the very beginning of that. We put out seven trade alerts to sell bonds, we’re out of five of them now. And whenever you hit the market with a sell, everyone just automatically drops their bids among the market makers. It’s hard to get an accurate, executable price when a market is falling that fast. The important point is that you were given the right asset class with a ticker symbol and the right direction and that is golden. People who have been with my service for a long time learn how to work around these trade alerts.

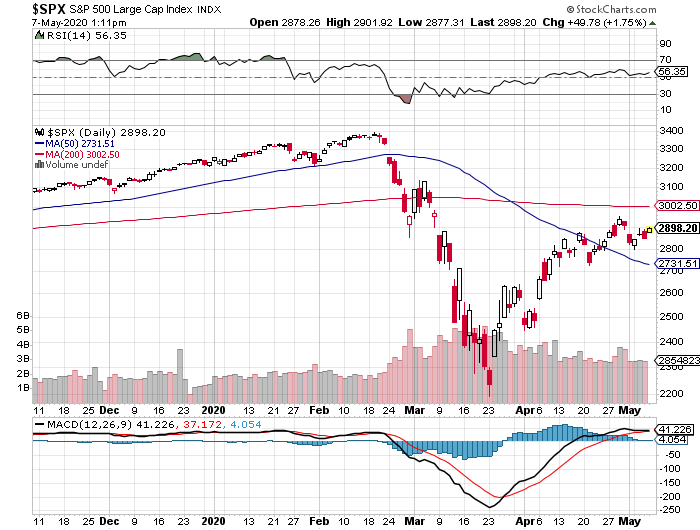

Q: Is there any specific catalyst apart from the second wave that will trigger the expected selloff?

A: First of all, if corona deaths go from 2 to 3, 4, 5 thousand a day, that could take us back down to the lows. Also, the market is currently expecting a V-shaped recovery in the economy which is not going to happen. The best we can get is a U-shape and the worst is an L-shape, which is no recovery at all. What if everything opens up and no customers show? This is almost certain to happen in the beginning.

Q: How long will the depression last?

A: Initially, I thought we could get out of this in 3-6 months. As more data comes in and the damage to the economy becomes known, I would say more like 6-9, or even 9-12 months.

Q: In natural gas, the (UNG) chart looks like a bullish breakout. Does it seem like a good trade?

A: No, the energy disaster is far from over. We still have a massive supply/demand gap. And with (UNG), you want to be especially careful because there is an enormous contango—up to 50 or 100% a year—between the spot price and the one-year contract price, which (UNG) owns. Once I saw the spot price of natural gas rise by 40% and the (UNG) fell by 40%. So, you could have a chart on the (UNG) which looks bullish, but the actual spot prices in front month could be bearish. That's almost certainly what’s going to happen. In fact, a lot of people are predicting negative prices again on the June oil contract futures expiration, which comes in a couple of weeks.

Q: What about LEAPS on United (UAL) and Delta (DAL)?

A: I am withdrawing all of my recommendations for LEAPS on the airlines. When Warren Buffet sells a sector for an enormous loss, I'm not inclined to argue with him. It’s really hard to visualize the airlines coming out of this without a complete government takeover and wipeout of all existing equity investors. Airlines have only enough cash to survive, at best, 6-8 months of zero sales, and when they do start up, they will have more virus-related costs, so I would just rather invest in tech stocks. If you’re in, I would get out even if it means taking a loss. They don’t call him the Oracle of Omaha for nothing.

Q: Any reason not to do bullish LEAPS on a selloff?

A: None at all, that is the best thing you can do. And I’m not doing LEAPS right now, I’m putting out lists of LEAPS to buy on a selloff, but I wouldn't be buying any right now. You’d be much better off waiting. Firstly, you get a longer expiration, and secondly, you get a much better price if you could buy a LEAP on a 2,000 or 3,000 point selloff in the Dow Average (INDU).

Q: Would you add the 2X ProShares Ultra Short S&P 500 (SDS) position here if you did not get on the original alert?

A: I would, I would just do a single 10% weighting. But don’t expect too much out of it, maybe you'll get a couple of points. And it’s also a good hedge for any longs you have.

Q: What happens if the second wave in the epidemic is smaller?

A: Second waves are always bigger because they’re starting off with a much larger base. There isn't a scientist out there expecting a smaller second wave than the first one. So, I wouldn't be making any investment bets on that.

Q: Pfizer (P) and others seem close to having a vaccine, moving on to human trials. Does that play into your view?

A: No, because no one has a vaccine that works yet. They may be getting tons of P.R. from the administration about potential vaccines, but the actual fact is that these are much more difficult to develop than most people understand. They have been trying to find an AIDS vaccine for 40 years and a cancer vaccine for 100 years. And it takes a year of testing just to see if they work at all. A bad vaccine could kill off a sizeable chunk of the US population. We’ve been taking flu shots for 30 years and they haven’t eliminated the flu because it keeps evolving, and it looks like coronavirus may be one of those. You may get better antivirals for treatment once you get the disease, but a vaccine is a good time off, if ever.

Q: Is this a good time to buy Boeing (BA)?

A: No, it’s too risky. The administration keeps pushing off the approval date for the 737 MAX because the planes are made in a blue state, Washington. The main customers of (BA), the airlines, are all going broke. I would imagine that their 1,000-plane order book has shrunk considerably. Go buy more tech instead, or a hotel or a home builder if you really want to roll the dice.

Q: How can the market actually drop to the lows, taking massive support from the Fed and further injections into account?

A: I don’t think we will get to new lows, I think we may test the lows. And my argument has been that we give half of the recent gains, which would take us down to 21,000 in the Dow and 2400 in the (SPX). But I've been waiting for a month for that to happen and it's not happening, which is why I've also developed my sideways scenario. That said, a lot of single stocks will go to new all-time lows, such as in retailers (RTF) and airlines (JETS).

Q: Would you stay in a Twitter (TWTR) LEAP?

A: If you have a profit, I would take it.

Q: What about Walt Disney (DIS)?

A: There are so many things wrong with Disney right now. Even though it's a great company for the long term, I'm waiting for more of a selloff, at least another $10. It’s actually rallying today on the earnings report. Around the low $90s I would really love to get into LEAPS on this. I think more bad news has to hit the stock for it to get lower.

Q: Are you continuing to play the (TLT)?

A: Absolutely yes, however, we’re at a level now where I want to take a break, let the market digest its recent fall, see if we can get any kind of a rally to sell into. I’ll sell into the next five-point rally.

Q: Any reason not to do calls outright versus spreads on LEAPS?

A: With LEAPS, because you are long and short, you could take a much larger position and therefore get a much bigger profit on a rise in the stock. Outright calls right now are some of the most expensive they’ve ever been. So, you really need to get something like a $10 or $15 rise in the stock just to break even on the premium that you’re paying. Calls are only good if you expect a very immediate short term move up in the stop in a matter of days. LEAPS you can run for two years.

Q: Is gold (GLD) still a buy?

A: Yes, the fundamental argument for gold is stronger than ever. However, it has been tracking one for one with the stock market lately. That's why I'm staying out of gold—I’d rather wait for a selloff in stocks to take gold down; then I’ll be in there as a buyer.

Q: Should I take profits on what I bought in April and reestablish on a correction?

A: Absolutely. If you have monster profits on a lot of these tech LEAPS you bought in the March/early April lows, then yes, I would take them. I think you will get another shot to buy these cheaper, and by coming out now and coming in later, you get to extend your maturity, which is always good in the LEAPS world.

Q: Would you buy casinos, or is it the same risk as the airlines?

A: I would buy casinos and hotels—they have a greater probability of survival than the airlines and a lot less debt, although they’re going to be losing money for years. I don’t know exactly how the casinos plan on getting out of this.

Q: Should we exit ProShares ultra short 20+ year Treasury Bond Fund (TBT) now?

A: No, that’s more of a longer-term trade. I would hang on to that—you could get from $16 to $20 or $25 in the foreseeable future if our down move in bond continues.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

September 26, 2018

Fiat Lux

Featured Trade:

(DID SIRIUS OPEN UP PANDORA'S BOX?),

(SPOT), (P), (SIRI), (AAPL), (AMZN)

In a flurry of deals, the music streaming industries consolidation is powering on as some of the industry’s biggest players have completed new acquisitions.

Is there a new King of the Castle?

Not yet.

In any case, the shakeout still allows Spotify to claim itself as the No. 1 company in the music streaming industry, but Apple (AAPL) and Sirius XM (SIRI) have gained.

There is still work to be done for the trailing duo but it is a step in the right direction.

Apple’s deal with Shazam, which just gained approval, was consummated last December, but was held up by European regulators over antitrust problems.

The Europeans have clamped down on American tech companies of late forcing them to play nicer after decades of running riot inside the region.

The Shazam app analyzes then pinpoints titles from music, movies, and television shows based on a brief sample through the device’s microphone.

If your neighbors are blasting the tunes upstairs at a Friday night shindig and you want to find out what song is causing you to lose sleep at night, just turn on your microphone and upload it into Shazam.

Shazam will tell you exactly the song’s title and the artist’s name.

Even dating back to 2013, this app was among the top 10 most popular apps in the world.

In 2018, Shazam has carved out a user base of more than 150 million monthly average users (MAU) and growing.

Shazam is used more than 20 million times per day.

An opportunity lies in urging Shazam users to then adopt Apple music.

Interestingly enough, to upgrade the quality of the app’s functionality, Apple is stripping away digital ads in Shazam.

Apple has made an unrelenting attempt to avoid introducing lower grade tech that could potentially taint its clean-cut brand.

Recently enough, film producers have complained that Apple is completely averse to any content with gratuitous violence, excessive drug use, and candid sex scenes.

Apple wants to cultivate and sell its pristine image.

Digital ads also fail to make the cut.

This spotless image boosts Apple’s pricing power along with the high quality of products that has seen Apple retain its place as the producer of the best smartphone in the world.

Other smart phone brands are still in catchup mode with a brand image significantly inferior to Apple’s.

And Apple CEO Tim Cook isn’t even interested in monetizing Apple music, and is more focused on “doing the right thing” for it.

Yes, the job of every company is to be in the black, but the No. 1 responsibility for a modern tech company is to grow and grow profusely.

Tech investors pay for growth, period.

As investors have seen with Netflix, companies can always raise prices after seizing market share because of the stranglehold on eyeballs inside a walled garden.

That potent formula has been the bread and butter of powerful tech companies of late.

Spotify is a captive of the music industry, of which it is entirely dependent for its source of goods, in this case songs.

At the same time, the music industry has fought tooth and nail to destroy the likes of Spotify, which benefits immensely from distributing the content it creates.

History is littered with failed music streaming services outgunned in the courtroom. Pandora (P) is the biggest public name out there whose share price has tanked over the long haul.

Pandora has created a proprietary algorithm offering song recommendations to listeners, but it is more or less an online music streaming app heavily reliant on a freemium pricing model with ads.

Sirius XM Holdings, a satellite radio company, signaled its intent in the music streaming business by taking a 19% in Pandora’s business last year.

It has followed that up now by completing a full takeover of the Oakland, California company for $3.5 billion.

This move adds 75 million users to its 36 million usership on Sirius and, in my view, the main objective is an eyeball grab to buy more listeners dragging them into its walled garden.

To triple a user base instantly to 75 million listeners is a boon for Sirius, which now has the firepower to legitimately compete with Spotify.

Pandora has been shopping itself around for the past two years, and companies such as Facebook were whispered to be eyeing this company.

Facebook chose to focus on developing dating and romance functions on its platform, and has mainly ignored the music streaming possibilities.

More critically, it allows Sirius to diversify out of the car space where satellite radio is predominantly used.

As much as Americans love to drive, the home is where they rest, and sleep, and Pandora will unlock a path into the home of listeners.

Synergies between home audio through Pandora, and car audio through Sirius should be evident over time.

The music streaming industry, such as the television streaming industry, has become fiercely competitive as of late. And this is a prudent move for Sirius to buy a new customer base at the same time as moving into the home.

The trend of tech companies penetrating the home and making it as smart as possible is revived constantly.

This piece of news isn’t as earth-shattering as Amazon’s (AMZN) smart home product launch event, but nonetheless indicates another leg up in competition for fresh user growth and its data.

This M&A surge is occurring amid a backdrop of the music industry’s obsession to exterminate Spotify and the other music streaming companies.

They are on a mission to force up the royalties these Internet giants must pay to pad their pockets and protect their interests.

Royalties are the music streaming companies’ main cost, and for Spotify, these royalty payments eat up 78% of total revenue.

But that does not mean Spotify is a bad company or even a bad stock.

Every company has its share of pitfalls. Throw in the mix that Amazon (AMZN) and Apple have music streaming services that do not even need to make a profit, and you will understand why some might be wary about putting new money to work in music streaming business stocks.

The primary reason that Spotify shares will outperform for the foreseeable future is because it is the preeminent music streaming platform.

Also, there is favorable latitude to make way toward the goal of monetization, and ample space to improve gross margins.

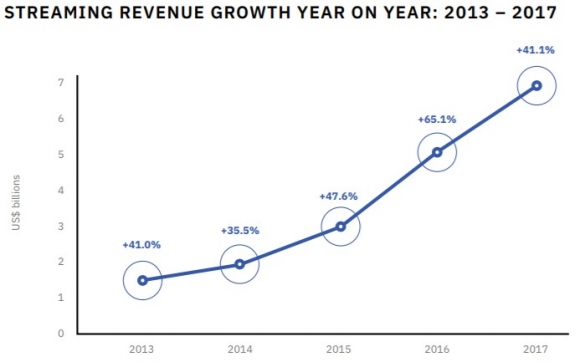

Global streaming revenue growth has gone ballistic as the migration to mobile devices and cord cutting has exacerbated the monetization prospects of the music industry.

Streaming revenue was a shade under $2 billion in 2013, and continued to post a growth trajectory of more than 40% each year since.

As it stands now, total global streaming revenue registered just a tick under $7 billion per year in 2017, and that was an improvement of 41.1% from 2016.

The choice among choices is Spotify in 2018.

The company was dogged by many years of famous artists removing their proprietary content from the platform citing unfavorable terms.

Eventually, almost all artists have relented and reinstalled their music on Spotify. They depend on alternative moneymaking avenues to compensate for lack of royalties, mainly live music.

Spotify has seized even more industry power with its new function of completely bypassing the music industry altogether, by offering a way for aspiring artists to directly upload music content onto its online platform.

Crushing the middleman has been a widespread theme in the tech industry for the past few decades, and the music industry is no different.

As technology has hyper-accelerated, the cost of producing music has plummeted giving access to just about anyone who has any talent.

No need to rent a sound studio for thousands of dollars per hour anymore in West Hollywood, and the music industry knows it.

It could be possible that the next cohort of viral artists will never cough over a dime to the music industry, and the bulk of the profits will be collected by a music streaming titan that distributes their content online.

How does Spotify make money?

It earns its crust of bread through paid subscriptions but lures in eyeballs using an ad-supported free version of its platform.

Naturally, the paid version is ad-less, and this subscription is around $5 to $15 per month.

In the second quarter, Spotify’s paid subscription volume surpassed 83 million, a sharp uptick of 40% YOY.

Ad-supported users came in at more than 101 million, even under the damage that General Data Protection Regulation (GDPR) did to western tech companies.

The ad-supported subscribers rose 23% YOY, and the paid version expects between 85 million to 88 million paid subscribers in the third quarter.

Many of the new paid subscribers are converts from its free model.

Spotify is poised to increase revenue between 20% to 30% for the rest of 2018.

The rise of Spotify's developing data division could extract an additional $580 million of revenue in 2023, making up 2% of total revenue.

When Spotify did go public, the robust price action was with conviction, making major investors - such as China’s Tencent, which possess a 9.1% stake and Tiger Global Management, which owns 7.2% - happy stakeholders.

In the last quarter’s earnings report, Spotify CFO Barry McCarthy reiterated the company’s goal to push gross margins from the mid-20% range to “gross margins in the 30% to 35% range.”

A jump in gross margins would go a long way in making Spotify appear more profitable, and that is the imminent goal right now.

Bask in the glow of the growth sweet spot Spotify finds itself in right now.

For the time being, the music division of Amazon and Apple are just a side note, even with Apple’s purchase of Shazam.

But Apple is vigorously improving its service products as its software and services segment moves from strength to strength, but that doesn’t particularly mean Apple Music.

Investors must sit on their hands to see how Sirius’s acquisition of Pandora plays out. These are by no means two extraordinary companies, and a major overhaul is required to make these two mediocre companies into one overperformer.

If you had to choose among Sirius, Pandora, or Spotify, then cautiously leg into a few shares of Spotify to test the waters.

Mad Hedge Technology Letter

August 29, 2018

Fiat Lux

Featured Trade:

(THE BEST TECH STOCK YOU’VE NEVER HEARD OF),

(TTD), (AMZN), (GOOGL), (NFLX), (BIDU), (BABA), (SPOT), (P), (FB)

If you asked me which is the best company that most people do not know about then there is one clear answer.

The Trade Desk (TTD).

This company was founded by one of the pioneers of the ad tech industry Jeff Green, and he has spent the past 20 years improving data-based digital advertising.

Green established AdECN in 2004 and its claim to fame was the world’s first online ad exchange.

After three years, Microsoft gobbled up this firm and Green stayed on until 2009 when he launched The Trade Desk. This is where he planned to infuse everything he learned about the digital ad agency into his own brainchild.

Green concluded that creating a self-service platform, avoiding privacy issues, and harnessing big data for digital ad campaigns was the best route at the time.

Green hoped to avoid the pitfalls that damaged the digital ad industry mainly bundling random ads together that diluted the quality and potency of the ad campaigns.

It did not make sense that a digital ad for baby diapers could be commingled with an ad for retirement homes.

Green created real-time bidding (RTB), which is a process in which an ad buyer bids on a digital ad and, if won, the buyer’s ad is instantly displayed on the selected site.

This revolutionary method allowed ad buyers to optimize ad inventory, prioritize ad channels, and boost the effectiveness of campaigns.

(RTB) is a far better way to optimize digital ad campaigns than static auctions, which group ads by the thousand.

In real time, advertisers are able to determine a bespoke ad for the user to display on a website. Green used this model to develop his company by building a platform tailor-made to execute (RTB).

Naturally, he won over many naysayers and his company took off like a rocket.

Results, in a results-based business, were seen right away by ad buyers.

A poignant example was aiding a performance-based ad agency in trimming ad waste by more than 50% for a national fast food chain with thousands of locations across America.

It took just one year for The Trade Desk to carve out a profitable business as ad agencies flocked to its platform desiring to take advantage of (RTB) or also commonly known as programmatic advertising.

Customer satisfaction is evident in its client retention rate of 95% for the past few years highlighting the dominating position The Trade Desk possesses in the digital ad industry.

The Trade Desk has not raised fees for ad buyers lately, but the value added from The Trade Desk to customers is accelerating at a brisk pace.

A great value proposition for potential clients.

The vigor of the business was highlighted when Green cited that each second his company is “considering over 9 million ad opportunities” for their ad inventory shows how The Trade Desk is up to date on almost every single ad permutation out there.

This speaks volume of the ad tech, which is the main engine powering the bottom lines at Google search and rogue ad seller Facebook (FB).

Google only gets 63,000 searches per second and shows that The Trade Desk has pushed the envelope in providing the best platform for ad buyers to seek its perfect audience.

Green’s mission of supporting big ad buyers optimize their ad budget has really caught fire and in a way that is completely transparent and objective.

The foundations that Green has assembled became even more valuable when Alphabet (GOOGL) chose to remove DoubleClick IDs, which would now prevent ad buyers from cross-platform reporting and measurement.

Previously, DoubleClick ID could cull data from assorted ads and online products based on a unique user ID named DoubleClick ID.

Ad purchasers then would data transfer to pull DoubleClick log files and measure them against impressions served from other ad servers across the web.

Effectively, ad buyers could track the user through the whole ad process and determine how useful an ad would be to that specific user.

In an utter conservative move to satisfy Europe’s General Data Protection Regulation (GDPR), DoubleClick IDs are no longer available for use, and tracking the ad inventory performance from start to finish became much harder.

Cutting off the visibility of the DoubleClick ID in the DoubleClick ecosystem was a huge victory for The Trade Desk because DoubleClick ID measured 75% of the global ad inventory.

Ad buyers would be forced to find other measurement systems to help calculate ad performance.

Branding and executing as the transparent and fair ad platform helping ad agencies was a great idea in hindsight with the world becoming a great deal more sensitive to data privacy.

The Trade Desk is perfectly placed to reap all the benefits and boast excellent technology to capitalize on this changing big data landscape. It is already seeing this happen with new business wins including large global brands such as a major food company, a global airline, and another large beverage company.

The global digital ad market is a $700 billion market today and trending toward $1 trillion in the next five to seven years

The generational shift to mobile and online platforms will invigorate The Trade Desk’s bottom line as more big ad buyers will make use of its proprietary platform to place programmatic ads.

Content distribution systems are fragmenting into skinny bundles hyper-targeting niche content users such as Sling TV, FuboTV, and Hulu.

There are probably 30 different ways to watch ESPN now, and these 30 platforms all require ad placement and optimization.

Some of the names The Trade Desk is working with are the who’s who of digital content ownership or distribution including Baidu (BIDU), Google, Alibaba (BABA), Pandora (P), and Spotify (SPOT) -- and the names are almost endless.

It’s the Wild West of ads and content these days because TV distribution has never been more fragmented.

Content creation avenues are desperate to boost ad income and are increasingly attempting to go direct to consumers.

Ad-funded Internet TV barely existed a few years ago. And ad inventory is all up for grabs benefitting The Trade Desk.

All of this explains why the stock is up more than 180% in 2018, and this is just the beginning.

The growth numbers put Amazon (AMZN) and Netflix (NFLX) to shame.

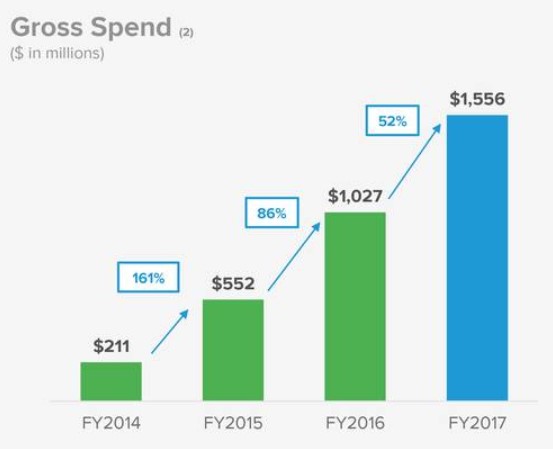

The Trade Desk scale on inventory has spiked by more than 700% YOY.

The option to hyper-target increases as more ad inventory is stocked.

Management mentioned in its second-quarter performance that “nearly everything went right. We executed well and one of the most dynamic environments we've seen.”

It is one of the most bullish statements I have heard from a public company.

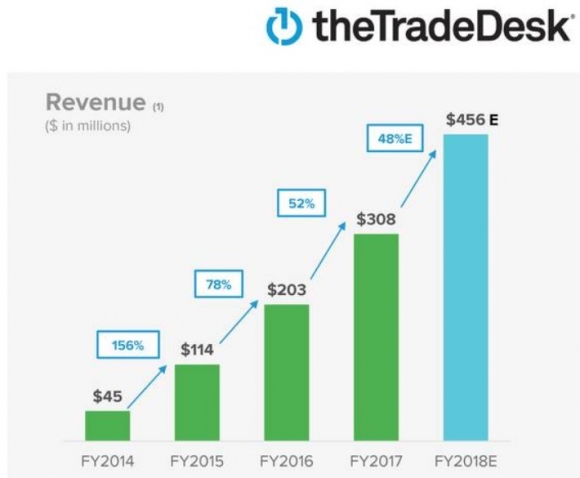

Quarterly revenue ballooned 54% YOY to a record $112 million, and the 54% YOY growth equaled the 54% YOY growth in Q2 2017.

Ad Age's top 50 worldwide advertisers doubled ad spend in the past year positioning The Trade Desk for continued hyper-growth, not only for 2018 but in 2019 and beyond.

Mobile spend jumped nearly 100% YOY, accounting for 45% of ad spend on the platform, which is 400% higher than the industry average for mobile ad spend according to eMarketer.

Data spend was also a huge winner rising by nearly 100% smashing another record.

In the meantime, the overseas business continued its robust growth in Europe and Asia, up 85% YOY.

The Trade Desk confidence in its performance chose to increase guidance to $456 million for the year, a 48% YOY improvement.

When upper management says “when we see surprises, they typically are to the upside” you take notice, because this tech company is perfectly placed in a growth sweet spot.

Massive developing markets are just starting to dabble with programmatic advertising. Markets such as China will see it become the new normal soon, opening up even more business for The Trade Desk.

The Trade Desk is also rolling out new products that will automate more of the process and reduce the number of clicks.

Wait for the pullback to get into this ad tech stock because even though it is up big this year, we are still in the early innings, and shares will march even higher.

________________________________________________________________________________________________

Quote of the Day

“I have a deep respect for the fundamentals of television, the traditions of it, even, but I don't have any reverence for it,” – said Netflix chief content officer Ted Sarandos.

Mad Hedge Technology Letter

August 28, 2018

Fiat Lux

Featured Trade:

(SPOTIFY STILL HAS SOME UPSIDE),

(SPOT), (AMZN), (AAPL), (P)

Investors sulking about Spotify’s (SPOT) inability to make money do not get the point.

Yes, the job of every company to be in the black, but the No. 1 responsibility for a modern tech company is to grow, and grow fast.

Tech investors pay for growth, period.

As investors have seen from Netflix, companies can always raise prices after seizing market share because of the stranglehold on eyeballs inside a walled garden.

That potent formula has been the bread and butter of powerful tech companies of late.

Spotify is a captive of the music industry, of which it is entirely dependent for its source of goods, in this case songs.

At the same time, the music industry has fought tooth and nail to destroy the likes of Spotify, which benefits immensely from distributing the content it creates.

History is littered with failed music streaming services outgunned in the courtroom. Pandora (P) is the biggest public name out there whose share price has tanked over the long haul.

The music industry will battle relentlessly to exterminate Spotify and force up the royalties these Internet giants must pay as their main input.

But that does not mean Spotify is a bad company or even a bad stock.

Every company has its share of pitfalls. Throw in the mix that Amazon (AMZN) and Apple (AAPL) have music streaming services that do not even need to make a profit, and you will understand why some might be wary about putting new money to work in music streaming business stocks.

The primary reason that Spotify shares will outperform for the foreseeable future is because it is the preeminent music streaming platform.

Also, there is favorable latitude to make way toward the goal of monetization, and ample space to improve gross margins.

Global streaming revenue growth has gone ballistic as the migration to mobile and cord cutting has exacerbated the monetization prospects of the music industry.

Streaming revenue was a shade under $2 billion in 2013, and continued to post a growth trajectory of more than 40% each year since.

As it stands now, total global streaming revenue registered just a tick under $7 billion per year in 2017, and that was an improvement of 41.1% from 2016.

There are no signs of yielding as more avid music fans push into the music streaming space.

Social media platforms have helped publicize popular artists’ content.

Music is effectively a strong part of youth culture, which will eventually see the youth integrate a music streaming app into their daily lives for the rest of their adult lives.

The choice among choices is Spotify in 2018.

The company was dogged by many years of famous artists removing their proprietary content from the platform citing unfavorable terms.

A prime example was in 2009 when Lady Gaga’s hit song “Poker Face” only received $167 in royalty payments from Spotify for the first million streams. This highlighted the rock-solid position Spotify has curated inside the music industry.

Individual artists’ fight against Spotify has been dead on arrival from the outset, but the benefits and exposure from cooperating with the company far outweigh the drawbacks.

Eventually, almost all artists have relented and reinstalled their music on Spotify. They depend on alternative moneymaking avenues to compensate for lack of royalties, which is mainly live music.

That is why it costs an arm and a leg to go see Taylor Swift in living flesh now, and why those summer festivals dotted around America such as Coachella command premium ticket prices.

How does Spotify make money?

It earns its crust of bread through paid subscriptions but lures in eyeballs using an ad-supported free version of its platform.

Naturally, the paid version is ad-less, and this subscription is around $5 to $15 per month.

In the second quarter, Spotify’s paid subscription volume surpassed 83 million, a sharp uptick of 40% YOY.

Ad-supported users came in at more than 101 million, even under the damage that General Data Protection Regulation (GDPR) did to western tech companies.

The ad-supported subscribers rose 23% YOY, and the paid version expects between 85 million to 88 million paid subscribers in the third quarter.

Many of the new paid subscribers are converts from its free model.

Spotify is poised to increase revenue between 20%-30% for the rest of the year.

The rise of Spotify's developing data division could extract an additional $580 million of revenue in 2023, making up 2% of total revenue.

Remember that Spotify’s reference price set by the New York Stock Exchange (NYSE) was $132 in April 2018. The parabolic move in the stock on the verge of eclipsing $200 undergirds the demand for high-quality tech companies.

When Spotify did go public, the robust price action was with conviction, making major investors - such as China’s Tencent, which possess a 9.1% stake and Tiger Global Management, which owns 7.2% - happy stakeholders.

In the last quarter’s earnings report, Spotify CFO Barry McCarthy reiterated the company’s goal to push gross margins from the mid-20% range to “gross margins in the 30% to 35% range.”

A jump in gross margins would go a long way in making Spotify appear more profitable, and that is the imminent goal right now.

The path to real profitability is still a long way down the road and small victories will offer short-term strength to the share price.

If Spotify can retrace to around the $185, that would serve as a perfect entry point into a stock that has given investors few chances in which to participate.

July and August have only offered meager entry points into this stock, one around the $180 level in August, and another around $170 in July.

Spotify enjoyed a great first day of being public after its unorthodox IPO ending the day at $149. The momentum has continued unabated while Spotify has posted all the growth targets investors come to expect from companies of this ilk.

Bask in the glow of the growth sweet spot Spotify finds itself in right now.

The long-term narrative of this stock is intact for a joyous ride upward, and only whispers of Amazon and Apple meaningfully attempting to monetize this segment could derail it.

For the time being, the music part of Amazon and Apple are just a side business. They have other priorities, such as Apple’s battle to avoid being exterminated from communist China, and Amazon’s integration of Whole Foods and new-fangled digital ad business.

________________________________________________________________________________________________

Quote of the Day

“Ever since Napster, I’ve dreamt of building a product similar to Spotify,” – said cofounder and CEO of Spotify Daniel Ek.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds: