Below please find subscribers’ Q&A for the April 28 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA.

Q: There is talk of digital currencies being launched in the US. Is there any truth to that? How would that affect the dollar?

A: There is no truth to that; there is not even any serious discussion of digital currency at the US Treasury. My theory has always been that once Bitcoin works and is made theft-proof, the government will take it over and make that the digital US dollar. So far, Bitcoin has existed regulation-free; in fact, the IRS is counting on a trillion dollars in capital gains being taxed going forward in helping to address the budget deficit.

Q: If you have a choice, what’s the best vaccine to get?

A: The best vaccine is the one you can get the fastest. I know you’re a little slow on the rollout in Canada. Go for Pfizer (PFE) if you’re able to choose. You should avoid Moderna (MRNA) because 15% of people getting second shots have one-day symptoms after the second shot. But basically, you don’t get to choose, only kids get to choose because only Pfizer has done trials on people under the age of 21. So, if you take your kids in, they will all get Pfizer for sure.

Q: Should I buy Freeport McMoRan (FCX) here or wait for a bigger dip?

A: Freeport has just had a 25% move up in a week. I wouldn’t touch that. We put out the trade alert when it was in the mid $30s, and it's essentially at its maximum profit point now. So, you don't need to chase—wait for a bigger dip or a long sideways move before you get in.

Q: How do I trade copper if I don't do futures?

A: Buy (FCX), the largest copper producer in the US, and they have call options and LEAPS. By the way, if we do get another $5 dip in Freeport, which we just had, I would really do something like the (FCX) $45-$50 2023 LEAP. You can get 5 times your money on that.

Q: Time to buy oil stocks (USO) for the summer?

A: No, the big driver of oil right now is the pandemic in India. They are one of the world's largest consumers—you find out that most poor countries are using oil right now as they can’t afford the more expensive alternative sources of power. And when your biggest customer is looking at a billion corona cases, that’s bad for business. Remember, when you trade oil, you’re trading against a long-term bear trend.

Q: Would you buy Delta Airlines (DAL) at today’s prices?

A: Yes, I’m probably going to go run the numbers on today's call spread; I actually have 20% of cash left that I could spend. So that looks like a good choice—summer will be incredible for the entire airline industry now that they have all staved off bankruptcy. Ticket prices are going to start rising sharply with an impending severe aircraft shortage.

Q: What are your thoughts on the Buffet index which shows that stocks are more stretched vs GDP at any time vs 2000?

A: The trouble with those indicators is that they never anticipated A) the Fed buying $120 billion a month in US Treasury bonds, B) the Fed promising to keep interest rates at zero for three years, and C) an enormous bounce back from a once-in-a-hundred-year pandemic. That's why not just the Buffet Index but virtually all technical indicators have been worthless this year because they have shown that the market has been overbought for the last six months. And if you paid attention to your indicators, you were either left behind or you went short and lost your shirt. So, at a certain point, you have to ignore your technical indicators and your charts and just buy the damn market. The people who use that philosophy (and know when to use it, and it’s not always) are up 56% on the year.

Q: What trade categories are getting fantastic returns? It’s certainly not tech.

A: Well, we actually rotated out of tech last September and went into banks, industrial plays, and domestic recovery plays. And you can see in the stocks I just showed you in our model portfolio which one we’re getting the numbers from. Certainly, it was not tech; tech has only performed for the last four weeks and we jumped right back in that one also with positions in Microsoft (MSFT). So yes, it’s a constantly changing game; we’re getting rotations almost daily right now between major groups of stocks. The only way to play this kind of market is to listen to someone who’s been practicing for 52 years.

Q: I am 83 years old and have four grandchildren. I want to invest around $20,000 with each child. I was thinking of your bullish view on Tesla (TSLA) on a long-term investment. Do you agree?

A: If those were my grandchildren, I would give them each $20,000 worth of the ProShares Ultra Technology Fund (ROM), the 2x long technology ETF. Unless tech drops 50% from here, that stock will keep increasing at twice the rate of the fastest-growing sector in the market. I did something similar with my kids about 20 years ago and as a result, their college and retirement funds for their kids have risen 20 times. So that’s what I would do; I would never bet everything on a single stock, I would go for a basket of high-tech stocks, or the Invesco QQQ NASDAQ Trust (QQQ) if you don’t want the leverage.

Q: Do you like Amazon (AMZN) splitting?

A: I don’t think they’ll ever split. Jeff Bezos worked on Wall Street (with me at Morgan Stanley) and sees splits as nothing more than a paper shuffle, which it is. It’s more likely that he’ll break up the company into different segments because when they get to a $5 trillion market cap, it will just become too big to manage. Also, by breaking Amazon up into five companies—AWS, the store, healthcare, distribution, etc., —you’re getting a premium for those individual pieces, which would double the value of your existing holdings. So, if you hold Amazon stock, you want it to face an antitrust breakup because the flotation will double the value of your total holdings. That has happened several times in the past with other companies, like AT&T (T), which I also worked on.

Q: When is Tesla going to move and why is it going up with earnings up 74%?

A: Well, the stock moved up a healthy 46% going into the earnings; it’s a classic sell the news market. Most stocks are doing that this quarter and they did so last quarter as well. And Tesla also tends to move sideways for years and then have these explosive moves up. I think the next double or triple will come when they announce mass production of their solid-state batteries, which will be anywhere from 2 to 5 years off.

Q: How can I renew my subscription?

A: You can call customer support at 347-480-1034 or email support@madhedgefundtrader.com and I guarantee you someone will get back to you.

Q: Top gene-editing stock after CRISPR Therapeutics (CRSP)?

A: There are two of them: one is Intellia (NTLA); it’s actually done better than CRISPR lately. The second is Editas (EDIT) and you’ll find out that the same professionals, including the Nobel prize winner Jennifer Doudna here at Berkeley, rotate among all three of these, and the people who run them all know each other. They were all involved in the late 2000's fundamental research on CRISPR, and they’re all frenemies. So yes, it's a three-company industry, kind of like the cybersecurity industry.

Q: What about PayPal (PYPL)?

A: I would wait for the earnings since so many companies are selling off on their announcements. See if they sell off 3-5%, then you buy it for the next leg up. That is the game now.

Q: Do you like any 3D printing stocks like Faro Technologies (FARO)?

A: No, that’s too much of a niche area for me, I’m staying away. And that's becoming a commodity industry. When they were brand new years ago, they were red hot, now not so much.

Q: Do you see the chip companies continuing their bull run for the next few months?

A: I do. If anything, the chip shortage will get worse. Each EV uses about 100 chips, and they’re mostly the low-end $10 chips. Ford (F) said production of a million cars will be lost due to the chip shortage. Ford itself has 22,000 cars sitting in a lot that are fully assembled awaiting the chips. Tesla alone has $300 worth of chips just in its inverters, and there are two inverters in every car. So, when you go from production of 500,000 cars to a million in one year, that's literally billions of chips.

Q: The airlines are packed; what are your thoughts?

A: Yes, one of the best ways to invest is to invest in what you see. If you see airlines are packed, buy airline stocks. If you can’t hire anyone, you know the economy is booming.

Q: What about the Russel 2000 (IWM)?

A: We covered it; it looks like it wants to break out to new highs from here. By the way, there are only 1,500 stocks left in the Russell 2000 after the pandemic, mergers, and bankruptcies.

Q: Are there other ways to play copper out there like (FCX)?

A: Yes; one is the (COPX)— a pure copper futures ETF. However, be careful with pure metal ETFs of any kind because they have huge contangos and you could get a 50% move up in your commodity while your ETF goes down 50% over the same time. This happens all the time in oil and natural gas, and to a lesser degree in the metals, so be careful about that. Before you get into any of these alternative ETFs, look at the tracking history going back and I think you'll see you're much better off just buying (FCX).

Q: How long do you typically hold onto your 2-year LEAPS? Based on my research, the time decay starts to accelerate after about 3 months to one year on LEAPS.

A: Actually, with LEAPS, the reason I go out to two years is that the second year is almost free, there's almost no extra cost. And it gives you more breathing room for this thing to work. Usually, if I get my timing right, my LEAP stocks make big moves within the first three months; by then, the LEAP has doubled in value, and then you have to think about whether you should keep it or whether there are better LEAPS out there (which there almost always are). So, you sell it on a double, which only took a 30% move in the stock, or you may be committed to the company for the long term, like a Microsoft or an Amazon. And then you just run it through the expiration to get a 400% or 500% profit in two years. That is how you play the LEAP game.

Q: Are these recorded?

A: Yes, we record these and we post them on the website after about 2 hours. Just log into the site, go to “my account”, then select your subscription type (Global Trading Dispatch or Technology Letter), and “webinars” will be one of the button choices.

Q: Can you also sell calls on LEAPS?

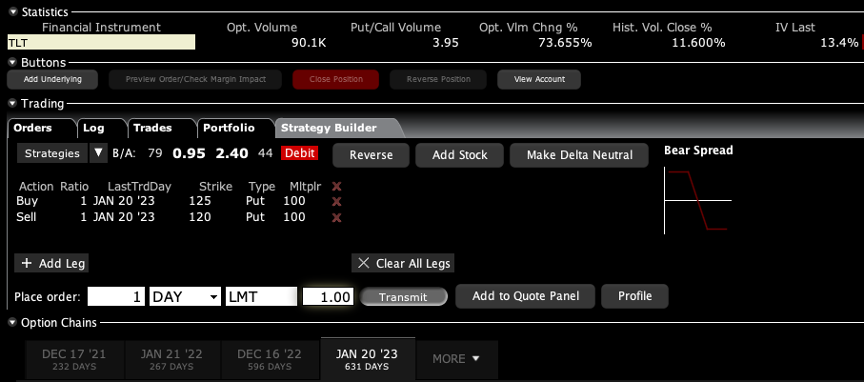

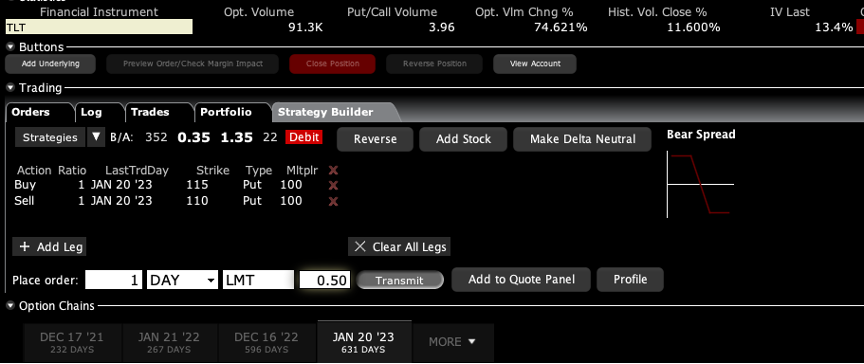

A: Yes and the only place to do that is the US Treasury market (TLT). There you either want to be short calls far above the market, out two years, or you want to be long puts. And by the way, if you did something like a $120-$125 put spread out to January 2023, then you’re looking at making about a 400% gain. That is a bet that 20-year interest rates only go up a little bit more, to 2.00%. If you really want to bet the ranch, do something like a $120-$122 and you might get a 1000% return.

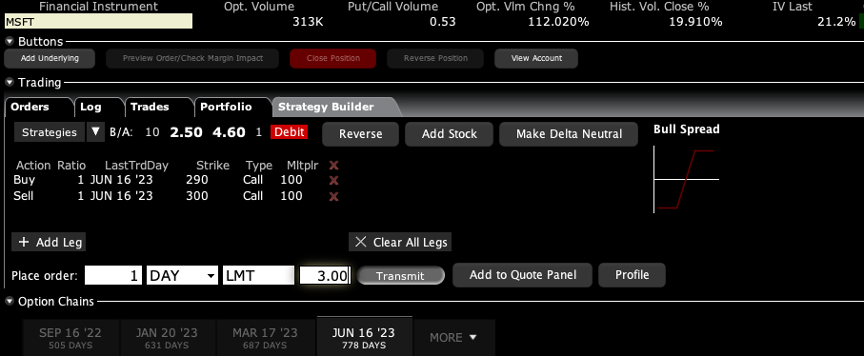

Q: What is the best LEAP to trade for Microsoft (MSFT)?

A: If you want to go out two years, I would do something like a June 2023 $290-$300 vertical bull call spread. There is an easy 67% profit in that one on only a 20% rise in the stock. I do front monthlies for the trade alert service, so we always have at least 10 or 20 trade alerts going out every month. And the one I currently have for is a deep in the money May $230-$240 vertical bull call spread which expires in 12 days.

Q: What is the best way to play Google (GOOG)?

A: Go 20% out of the money and buy a January 2023 $2,900-$3,000 vertical bull call spread for $20—that should make about 400%. If you want more specific advice on LEAPS, we have an opening for the Mad Hedge Concierge Service so send an email to support@madhedgefundtrader.com with subject line “concierge,” and we will reach out to you.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

I Think I See Another Winner