Below, please find subscribers’ Q&A for the February 12 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

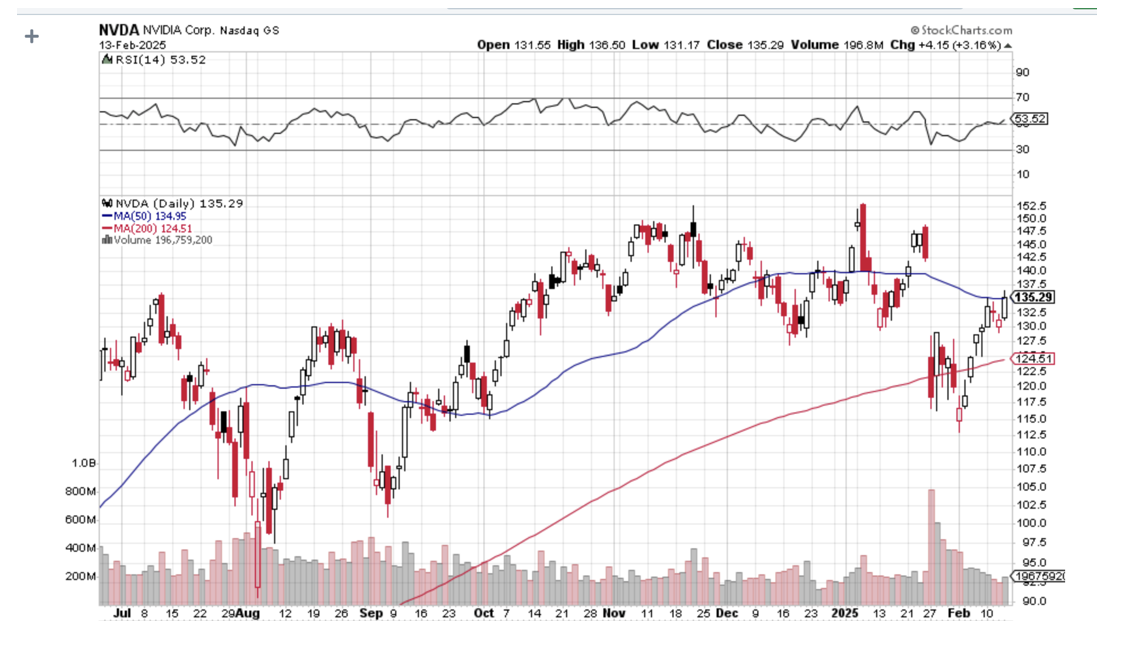

Q: Can Nvidia (NVDA) go to $200 in the next three years?

A: I would imagine probably, yes. They still have a fabulous business—enormous orders and record profits. But it's not going to happen in the next six months. You need to get us out of the current stock market malaise before anything moves dramatically one way or the other, except for META, which is at an all-time high. Their basic business is still great, and the threat posed by DeepSeek is wildly overblown.

Q: Why is McDonald's (MCD) seeing declining sales?

A: Partly, it's because they have been cutting prices. So, of course, that automatically feeds into declining sales. Also, I think the weight loss drugs Mounjaro or Ozempic are having an impact. People just don't go in and eat three Big Macs for lunch anymore. They may not need any Big Macs at all. And forget about the fries and the super-size high fructose corn syrup drink. When these drugs first came out, it was speculated that fast food companies would be the number one victim of these drugs, and that is turning out to be true. Some 15.5 million people in the United States suddenly aren't hungry anymore; they just take one bite of a meal and then push their food around the plate with their fork. That’s better than taking amphetamines, which people like Judy Garland used to take to lose weight. I think that will affect not only McDonald's, but all fast-food companies which I avoid like the plague anyway because my doctor says I shouldn't eat that food.

Q: Should I buy First Solar (FSLR) based on the revised higher sales outlook?

A: I don't want to touch alternative energy anything right now. I think the government will eliminate all subsidies for all alternative energy—be it solar, windmills, hydrogen, nuclear, whatever—and turn us back into an all-oil and coal economy. That is the announced goal of the new administration. So that eliminates the subsidies for sure. It certainly will be a blow to the earnings of all solar-type companies. If you are going to do an energy form, I would do nuclear, which benefits from deregulation, if that ever happens.

Q: Do price caps fix supply problems? Because Europe is thinking about capping energy prices in the short term.

A: Price caps never work, nor does any other attempt to artificially control prices, because all it does is dry up supply. If you cap the prices, and therefore the profits that energy companies can make, they'll quit. They'll abandon the energy business, or they'll pare it down, or they won't expand. One way or the other, you reduce the return on capital. Capital is like water; it will go where it gets the highest return, and price caps certainly are not part of that formula. But what do I know? I only drilled for natural gas for six years.

Q: What's your top AI choice?

A: Well, I would say it's Nvidia (NVDA) still, and the big AI users which include Meta (META), Google (GOOG), and Amazon (AMZN). Nothing has changed here.

Q: Is there any chance that Ford Motors (F) will be bought out anytime soon or never?

A: My view of all of the legacy car companies, including Stellantis, which is the old Chrysler, Ford (F), and General Motors (GM), is that they are basically giant mountains of scrap metal and only have a scrap metal value, which is about 5 cents on the dollar. That's what they fell to in the 2008 financial crisis, and all of them except for Ford went bankrupt. So I am not a big fan of the legacy auto industry now. And now, they have a trade war. They happen to be one of the biggest victims of trade wars because to stay competitive with Tesla, they moved a lot of their production to Canada and Mexico, and now those plans are going up in flames. So it seems like they're damned if they do and they're damned if they don't. I'm happy driving my Tesla, but I'm wondering if my next car is a BYD. Prices are so low, it might even be worth paying 100% duty just to get a cheaper car that has better self-driving capability. But the future is unknown, to say the least.

Q: Is the next big rotation out of Silicon Valley and into Chinese tech stocks?

A: Over the long term, that may happen, but with the current administration and China (the number one target in restraint of trade and trade wars), I don't want to touch anything Chinese. There are too many better things to do in the U.S. Imagine you buy a Chinese stock, and then the administration announces a total cutoff of trade with China the next day. Not good. Chinese stocks are incredibly cheap. Most of the big ones are now single-digit multiples compared to multiples in the 20s, 30s, and 40s for our stocks. But they come with a very high political risk, and that has been true for several years now. There are better fish to fry than in China. I'd rather buy Europe than China right now if you really do want to go international. But I have no idea why they're going up unless they're discounting an end to the Ukraine War.

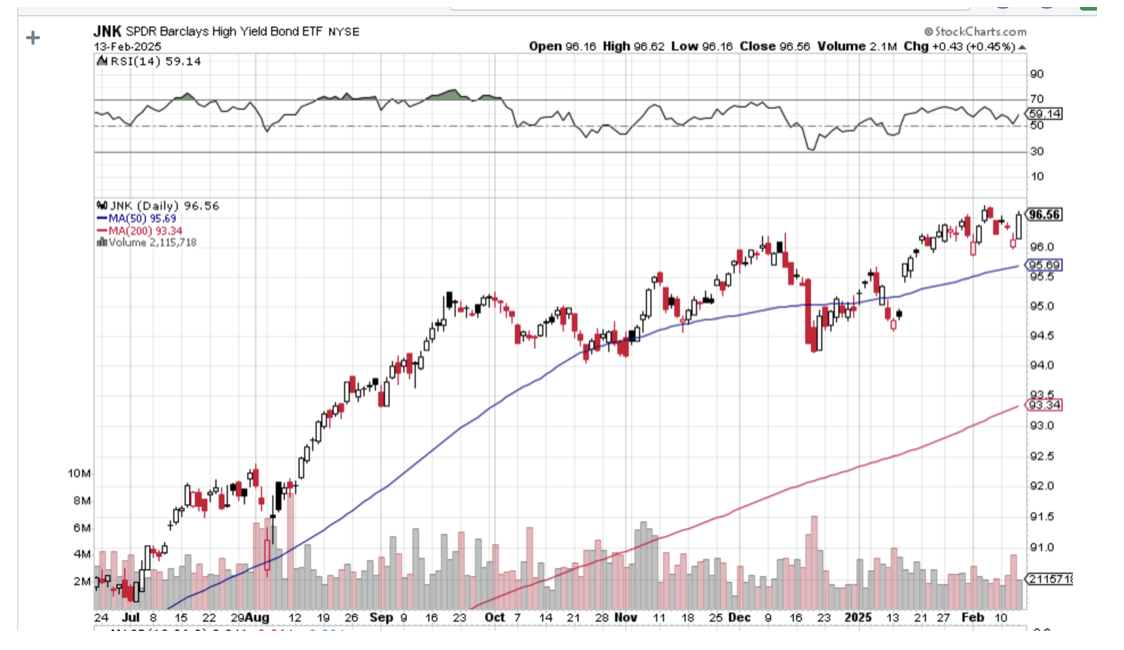

Q: Are junk bonds (JNK) and (HYG) a good play?

A: I would say yes. Their default risk has always been over-exaggerated thanks to their unfortunate name. They're yielding 6.54% and change, but it's a very slow mover. If we do get any improvement, any economy without inflation junk will go to $100. It's currently around $96. And you know, yield is a nice thing to have these days since the capital gain side seems to have dried up and turned into dust on almost any asset class.

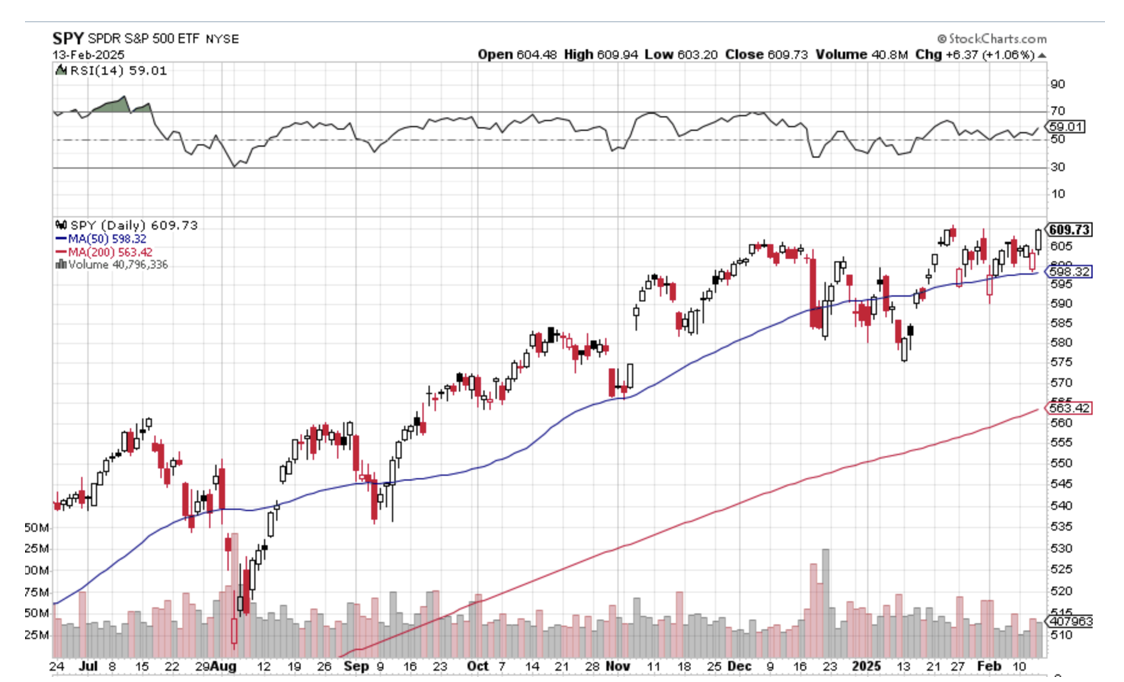

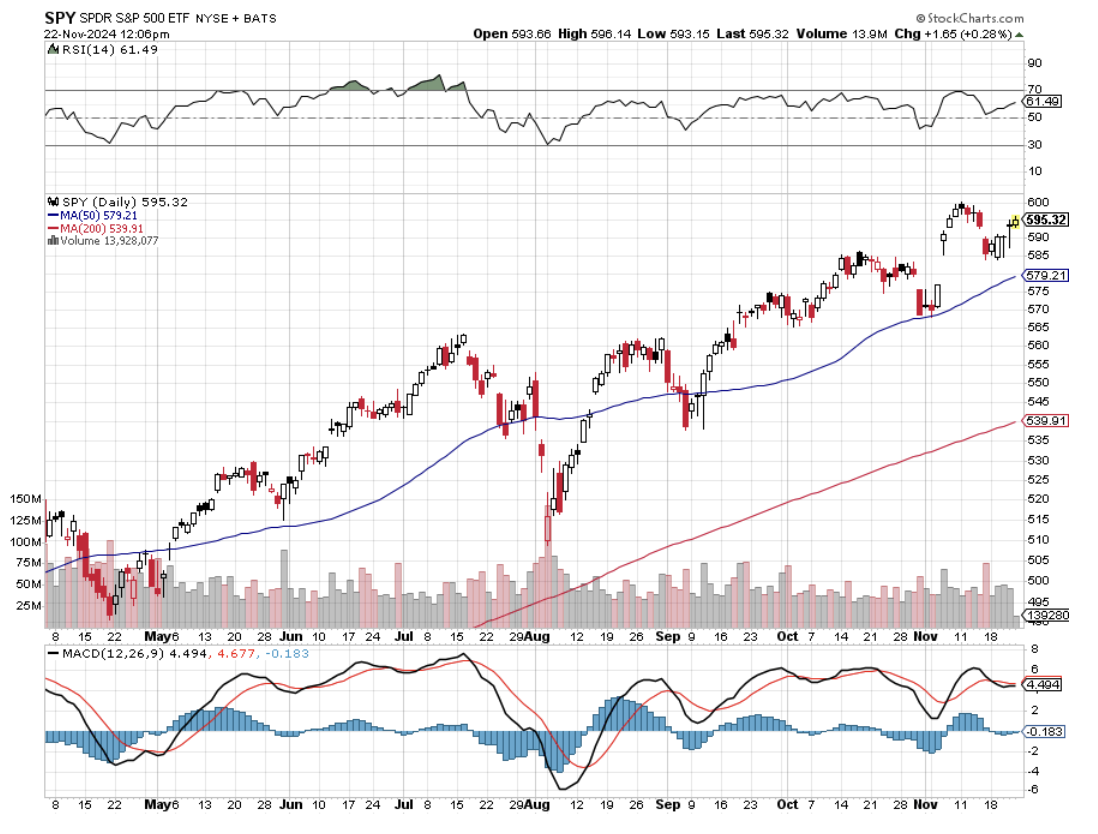

Q: How can I decide when to sell the stocks that we bought on your recommendations?

A: Well, our trade alerts always have a buy recommendation and a sell recommendation or an expiration date. If you bought the stocks and kept it, just read Global Trading Dispatch for an updated market view. Watch our Mad Hedge Market Timing Index. When we get up into the 70s and 80s, that is definitely sell territory. It's hard for individuals to have an economic view going out to the rest of the year, but even the people who are economists have no idea what's going to happen right now. As I said, uncertainty is at an 8-year high, and that is being reflected in the market. So nothing beats cash, especially when you can earn 4.2% on 90-day US treasury bills. No one ever got fired for taking a profit.

Q: Can Intel (INTC) make a comeback this year?

A: No. I'm sorry, but they won’t. They had a horrible manager. They dumped him after a couple of disastrous years. I knew he was a horrible manager. I fought off all the pressure to buy Intel. So far, that's working. I mean, the stock has been terrible, so it is very cheap, but there is no guarantee that they will ever recover and, in fact, may get taken over by somebody else. So—too many better things to do. I'd rather be buying more Nvidia right now at these prices than sticking my neck out and praying for a miracle at Intel.

Q: A couple of years ago, I bought a bunch of Palantir (PLTR) on your recommendation for the next 10 bagger. I now have a 10 bagger. What should I do?

A: You know, we did recommend Palantir about 10 years ago, and it did nothing for the longest time. And then last year, it just took off like a rocket—I think it's up 400% last year. Price-earnings multiples are insanely high now. So what I would do is sell half your position. That way, the remaining half is all profit. You're playing with the house's money, and you're reducing your risk in a high-risk environment. Sell half, keep the other half. If it looks like it's starting to roll over and die, then you sell your remaining half.

Q: What's your favorite currency this year, and what should we do about it?

A: My favorite currency is the US dollar. If we're not going to get any interest rate cuts this year, the dollar will remain the highest-yielding currency in the world, and then everybody wants to buy it. It's really that simple. It’s all about interest rate differentials. Everybody else in the world has low interest rates, so stick with the dollar and don't touch the foreign currencies yet.

Q: Inflation expectations have exploded higher in view of today's number. Do you expect it to get worse?

A: If the trade war continues, it will absolutely get worse. 25% price increases are inflationary—period. End of story. A price increase is the definition of inflation, and right now, we are increasing the number of countries subject to high punitive tariffs, not decreasing them. You can expect markets to worry about that. And even if they put a temporary hold on these, people are raising prices now. They are not waiting for the actual tariff to hit; they are front-running that right now. So if you don't believe me, go to the grocery store where prices are through the roof. I actually went to a grocery store the other day, and I couldn't believe what things cost.

Q: I'd like to hedge my Nvidia (NVDA) position with a covered call. Which one should I do?

A: Well, it's not actually a hedge. What a covered call does is reduce your cost price and increase income. Right now, we have NVDA at $135. If you shorted something like the February $145 calls, you might get a dollar for that. That reduces your average price by a dollar. If you shorted the March $145 calls, that'll bring in probably $5, reduce your costs by $5, or bring in an extra $5 in income. And if you keep doing this every month and Nvidia stays stuck in a range, you can end up taking $10, $20, or even $30 in premium income over the next six months. And I have a feeling that will be the winning strategy for the first half of this year, using rallies to sell covered calls. You really could get your average cost down quite a lot; that way, if we have a massive sell-off, a lot of that loss will already be covered. If we get a massive rally, your stock just gets called away, and you buy it back on the next dip. The only negative here is the tax consequences of taking capital gains on the call-aways.

Q: You mentioned that the US has a demographic problem coming up; how will that affect the market in the short term?

A: It doesn't affect the market in the short term. Demographics are a long-term game. You have to think in terms of a generation being the round lot, which is about 20 years. Suffice it to say, when demographics go against you, like they did in Japan for 30 years, markets are horrible. Demographics are going against China now, and you're getting horrible markets. Demographics are good now in the US because we have millennials just entering their peak spending years, and that's when economies boom, and that should continue up to 2030. That is how to play demographics, and we keep updated here, although the government has suddenly ceased making available all demographic data to the public—I don't know why, but it's going to make the science of demographics much more difficult to follow without the government data. I don't know why they did that. I don't know what they hope to gain by clouding the demographic picture. Maybe it has to do with the allocation of congressional seats to the states or something like that.

Q: Do you have information on how to place a LEAPS order?

A: Just go to www.madhedgefundtrader.com, go to the search box, put in LEAPS in all caps, and you will find an encyclopedia of information on how to do LEAPS or Long Term Equity Anticipation Securities.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or JACQUIE'S POST, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader