Naturally, many people are wondering about which stocks to own in light of the coronavirus. The latest development on the race to find a coronavirus cure is a joint effort involving two giant names from the biotechnology industry: Regeneron Pharmaceuticals (REGN) and Sanofi (SNY).

Taking a page off Gilead Sciences’ (GILD) move to recycle HIV drug Remdisivir and Roche Holding’s (ROG) decision to utilize rheumatoid arthritis Actemra, Sanofi and Regeneron are looking into an existing drug’s ability to offer refuge for patients suffering from COVID-19.

According to a recent announcement, the two companies are looking to test rheumatoid arthritis medication Kevzara on COVID-19 patients.

This drug was initially approved in 2017 and while it failed to reach blockbuster status at the time, Sanofi and Regeneron are preparing to transform it into the next leader in this pandemic race.

It should be noted though that Kevzara is not a coronavirus cure. Rather, the companies are hoping to use this drug to combat the symptoms related to COVID-19.

This is why it’s promising.

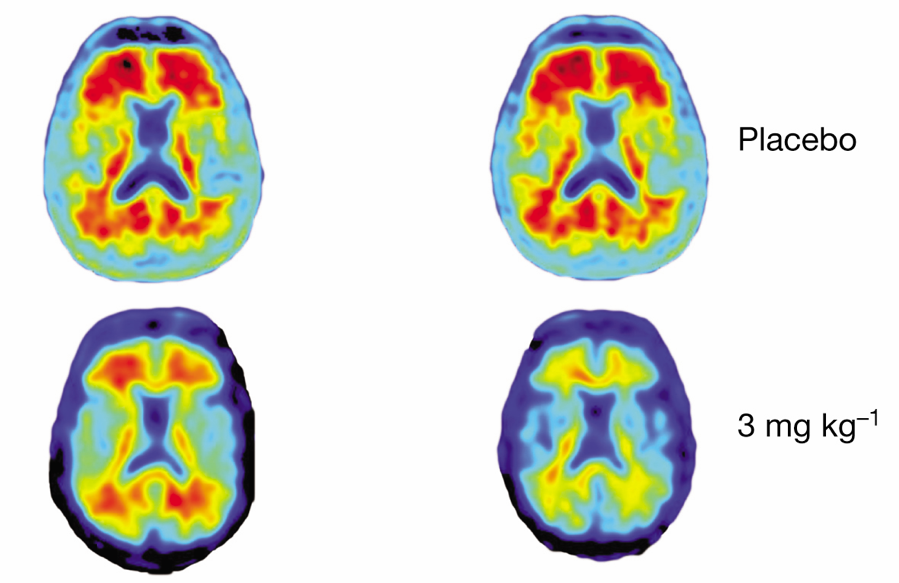

When a person gets infected by the novel coronavirus, the immune system is activated and starts attacking the virus to protect the body. As time passes, the immune system goes into overdrive and ends up overreacting, causing additional damage.

Gradually, the immune system starts attacking even the healthy tissue and organs as with the case for some COVID-19 patients.

This means that the coronavirus is causing an accelerated response from the immune system resulting in the patients’ damaged organs starting with the lungs.

This is where Kevzara comes in.

The drug functions as an inhibitor of the protein that triggers the patient’s immune and inflammatory response.

That is, Kevzara can stop the body from attacking itself despite the triggers caused by the coronavirus.

In terms of the specifics of this joint effort, Regeneron will take the lead for the US trials while Sanofi will be in charge of international efforts.

Aside from Kevzara, both Regeneron and Sanofi have been pursuing separate leads on how to deal with the pandemic.

Sanofi has been working in tandem with the US Department of Health and Human Services (HHS), specifically with the Biomedical Advanced Research and Development Authority (BARDA), to come up with a coronavirus vaccine.

However, it’s the coronavirus efforts of Regeneron that gained much attention in the past weeks.

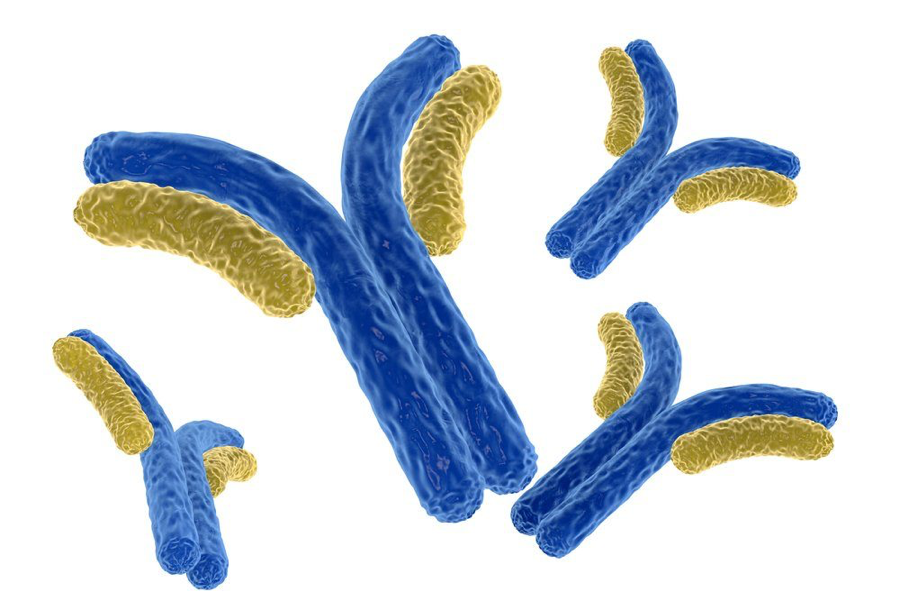

In February, Regeneron and the HHS expanded their partnership to come up with potential COVID-19 treatments. So far, the biotechnology giant has decided to work on monoclonal antibodies via its VelocImmune platform.

This avenue is particularly promising since Regeneron has already come up with an antiviral drug to combat Ebola. Its collaboration with HHS has also already resulted in plans to develop a MERS treatment, which is also a type of coronavirus.

According to Regeneron executives, the company will have a coronavirus treatment ready for human testing by August. If all goes well, then it aims to produce 200K prophylactic doses.

Although its innovative coronavirus proposals are exciting, Regeneron remains focused on its older and more dependable money makers particularly the eye drug Eylea.

This strength is in display in Regeneron’s fourth quarter results, which showed better than expected numbers.

For Eylea alone, the company generated an 11% year-over-year growth in sales.

Despite the emergence of new competitors like Novartis’ (NOVN) Beovu, Regeneron’s eye drug remains the leading product in this sector. In fact, Eylea managed to cross $2 billion in global sales just for the year 2019.

As for inflammation-reducer Dupixent, the treatment’s global sales climbed 136% in 2019.

Meanwhile, revenue from its cancer immunotherapy Libtayo soared to over quintuple from the previous period.

Building from the strength of Eylea, Regeneron also announced its successful late-stage clinical study that aimed to expand the indication of the drug to moderately severe to severe non-proliferative diabetic retinopathy (NPDR).

If this Eylea expansion pushes through, then Regeneron has yet another blockbuster drug in its hands.

In the past five years, Regeneron has demonstrated a strong EPS growth, growing by 23.74% annually. Given its recent performance and based on forward-looking statements, the company can be expected to report an average of 17.4% growth on its EPS in the next two years.

Amid the panic and confusion caused by the coronavirus pandemic, it’s crucial to remain objective, especially with the stock market.

Before making a decision, ask yourself this question: “Will this current situation change the 10-year or even the 20-year outlook for the financial sector?”

Despite the paranoia proliferating in the market in the past months, I believe the answer to this question is still a resounding “no.”

For now, it would be wise to treat owning stocks like how to own businesses. It's important to think about which stocks to own during the coronavirus, but don’t do it just to make a quick buck. Rather, take a look at lasting and stable companies with the capacity to not only grow over the years but also to compound their returns.