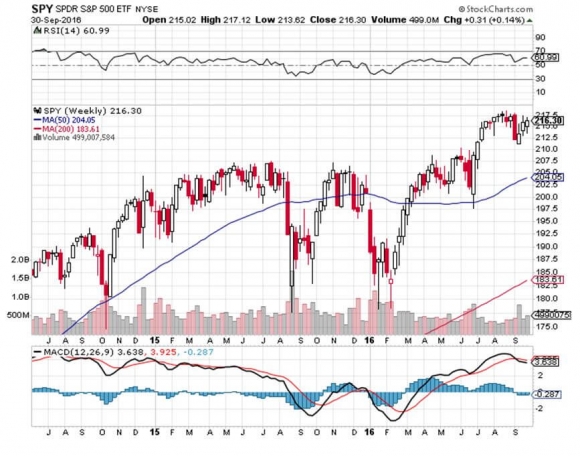

The S&P 500 has just bounced off the 214 level for the second time this month.

Is it safe to come out of your cave? Is to time to take the hard hat back to the basement?

If you had taken Cunard?s round-the-world cruise three months ago, as I recommended, you would be landing in New York about now, wondering what the big deal was. Indexes are unchanged since you departed.

This truly has been the Teflon market. Nothing will stick to it. In June when Brexit hit, many predicted the end of the world. The market crashed. Then within days, it recovered the loss and moved on to new all time highs..

Go figure.

It makes you want to throw up your hands in despair and throw your empty beer can at the TV. All this work, and I?ve delivered the perfectly wrong conclusions?

Let me point out a few harsh lessons learned from this most recent melt down, and the rip your face off rally that followed.

Remember all those market gurus poo pooing the effectiveness of the ?Sell in May and go away? strategy? This year it worked better than ever.

This is why almost every Trade Alert I shot out for the past five months has been from the short side. It is also why I was so quick to cover my most recent shorts for a loss.

We are about to move from a ?Sell in May? to a ?Buy in November? posture.

The next six months are ones of historical seasonal market strength (click here for the misty origins of this trend at ?If You Sell in May, What To Do in April??).? You must be logged into your account to read this article.

The other lesson learned this summer was the utter uselessness of technical analysis. Usually these guys are right only 50% of the time. This year, they missed the boat entirely.

When the S&P 500 (SPY) was meandering in a narrow nine point range, and the Volatility Index ($VIX) hugged the 12-15 neighborhood, they said this would continue for the rest of the year.

It didn?t.

When the market finally broke down in June, cutting through imaginary support levels like a hot knife through butter, they said the market would plunge to 175, and possibly as low as 158.

It didn?t do that either.

When the July rally started, pitiful technical analysts told you to sell into it.

If you did, you lost your shirt. The market just kept going, and going, and going like the Energizer Bunny.

This is why technical analysis is utterly useless as an investment strategy. How many hedge funds use a pure technical strategy?

Absolutely none, as it doesn?t make any money.

At best, it is just one of 100 tools you need to trade the market effectively. The shorter the time frame, the more accurate it becomes.

On an intraday basis, technical analysis is actually quite useful. But I doubt few of you engage in this hopeless pursuit.

This is why I advise portfolio managers and financial advisors to use technical analysis as a means of timing order executions and nothing more.

Most professionals agree with me.

Technical analysis derives from humans? preference for looking at pictures instead of engaging in abstract mental processes. A picture is worth 1,000 words and probably a lot more.

This is why technical analysis appeals to so many young people entering the market for the first time. Buy a book for $5 on Amazon, and you too can become a Master of the Universe.

Who can resist that?

The problem is that high frequency traders also bought that same book from Amazon a long time ago and have designed algorithms to frustrate every move the technical analyst makes.

Sorry to be a buzz kill, but that is my take on technical analysis.

Hope you enjoyed your cruise.