Global Market Comments

December 2, 2020

Fiat Lux

FEATURED TRADE:

(WHAT HAPPENED TO THE DOW?)

($INDU), (EK), (S), (BS), (CVX), (DD), (MMM),

(FBHS), (MGDDY), (FL), (GE), (TSLA), (GM)

Global Market Comments

December 2, 2020

Fiat Lux

FEATURED TRADE:

(WHAT HAPPENED TO THE DOW?)

($INDU), (EK), (S), (BS), (CVX), (DD), (MMM),

(FBHS), (MGDDY), (FL), (GE), (TSLA), (GM)

When I joined Morgan Stanley some 35 years ago, one of the grizzled old veterans took me aside and gave me a piece of sage advice.

“Never buy a Dow stock”, he said. “They are a guarantee of failure.”

That was quite a bold statement, given that at the time the closely watched index of 30 stocks included such high-flying darlings as Eastman Kodak (EK), Sears Roebuck & Company (S), and Bethlehem Steel (BS). It turned out to be excellent advice.

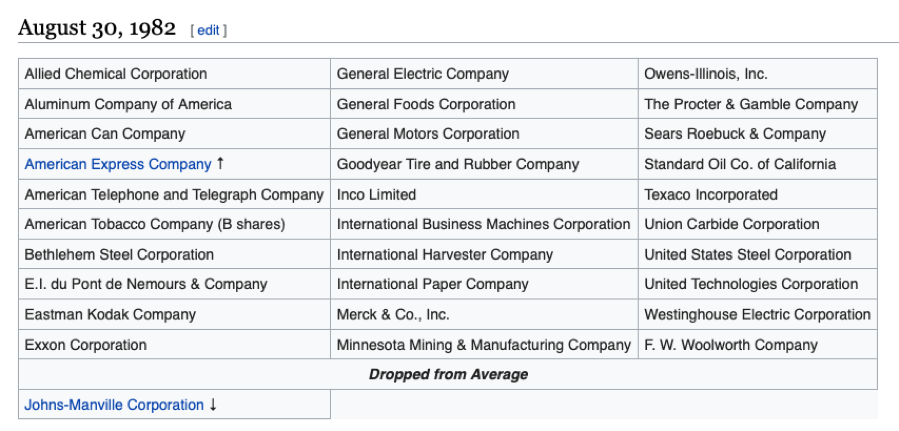

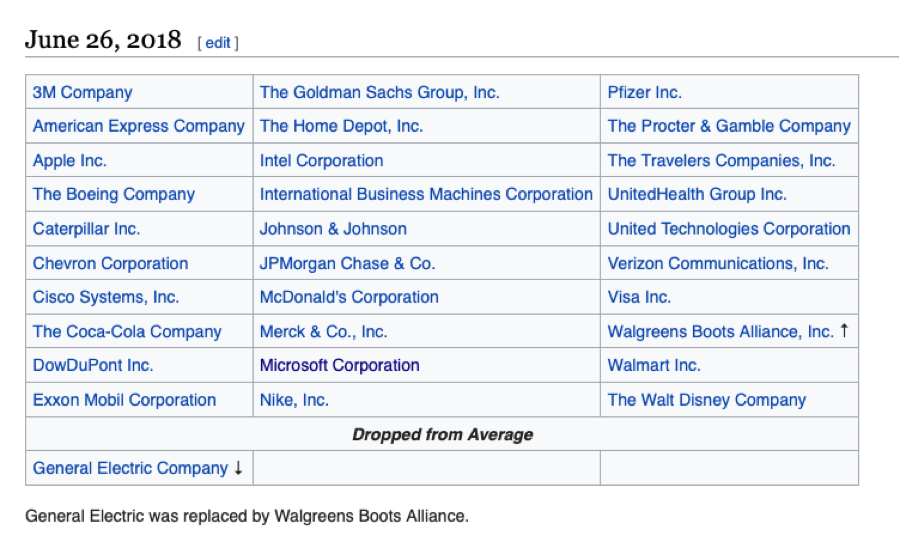

Only ten of the Dow stocks of 1983 are still in the index (see tables below), and almost all of the survivors changed names. Standard Oil of California became Chevron (CVX), E.I du Pont de Nemours & Company became DowDuPont, Inc. (DD), and Minnesota Mining & Manufacturing became 3M (MMM).

Almost all of the rest went out of business, like Union Carbide Corporation (the Bhopal disaster) and Johns-Manville (asbestos products) or were taken over. A small fragment of the old E.W. Woolworth is known as Foot Locker (FL) today.

Charles Dow created his namesake average on May 26, 1896, consisting of 12 names. Almost all were gigantic trusts and monopolies that were broken up only a few years later by the Sherman Antitrust Act.

In many ways, the index has evolved to reflect the maturing of the US economy, from an 18th century British agricultural colony, to the manufacturing powerhouse of the 20th century, to the technology and services-driven economy of today.

Of the original Dow stocks, only one, US Leather, vanished without a trace. It was the victim of the leap from horses to automobile transportation and the internal combustion engine. United States Rubber is now part of France’s Michelin Group (MGDDY).

American Tobacco reinvented itself as Fortune Brands (FBHS) to ditch the unpopular “tobacco” word. National Lead moved into paints with the Dutch Boy brand. It sold off that division when the prospects for leaded paints dimmed in 1970 (they cause mental illness in children).

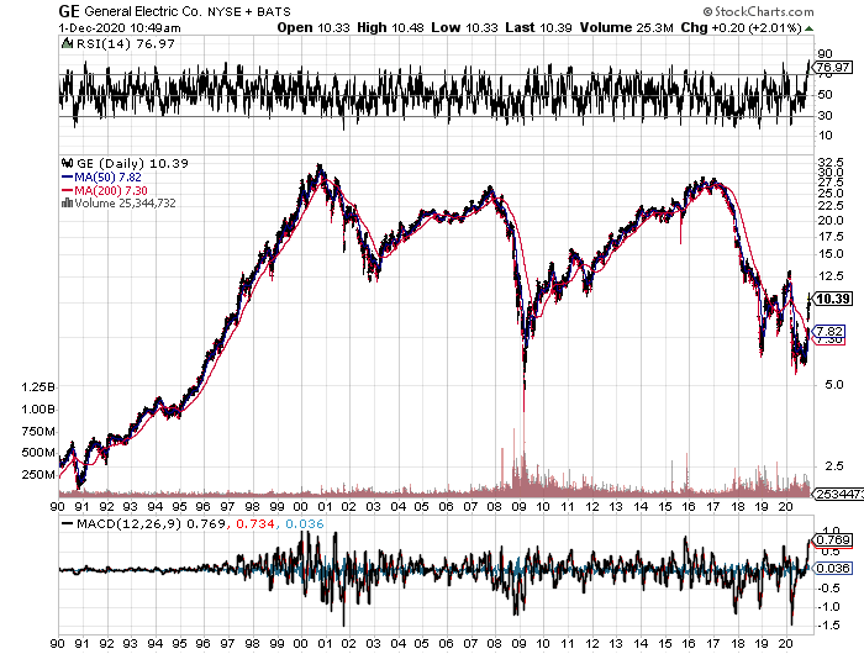

What was the longest-lived of the original 1896 Dow stocks? General Electric (GE), originally founded by light bulb inventor Thomas Edison. It went down in flames thanks to poor management and was delisted in 2018. It was a 122-year run. Today, it is one of the great turnaround challenges facing American Industry.

Which company is the American Leather of today? My bet is that it’s General Motors (GM), which is greatly lagging behind Tesla (TSLA) in the development of electric cars (99% market share versus 1%). With a product development cycle of five years, it simply lacks the DNA to compete in the technology age.

What will be the largest Dow stock in a decade? Regular readers of the Mad Hedge Fund Trader already know the answer.

Global Market Comments

May 4, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE NEXT BOTTOM IS THE ONE YOU BUY),

(SPY), (SDS), (TLT), (TBT), (F), (GM), (TSLA), (S), (JCP), (M)

It was only a year ago that I was driving around New Zealand with my kids, admiring the bucolic mountainous scenery, with Herb Albert and the Tijuana brass blasting out over the radio. Believe me, the tunes are not the first choice of a 15-year-old.

Today, it is all a distant memory, with any kind of international travel now unthinkable. For me, that is like a jail sentence. It is all a reminder of how well we had it before and how bleak is the immediate future.

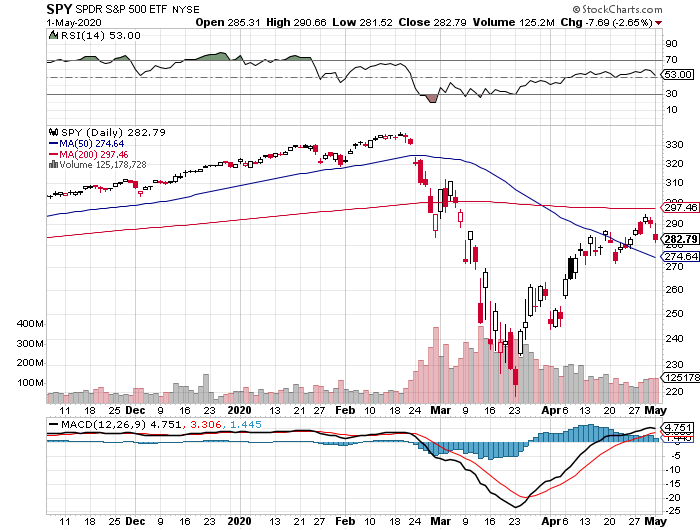

Stock traders have certainly been put through a meat grinder. The best and worst months in market history were packed back to back, down 39% and then up 37%. At the March 23 low, the Dow average had fallen by 11,400 in a mere six weeks. Those who lived through the 1929 crash have lost their bragging rights, if there are any left.

However, like my college professor used to say, “Statistics are like a bikini bathing suit. What they reveal is fascinating, but what they conceal is essential.”

Most of the index gains were achieved by just five FANG stocks. Virtually all of the gains were from “stay at home” companies taking in windfalls from cutting-edge online business models. The “recovery” had a good week, and that was about it.

The other obvious development is that if any business was in trouble before the health crisis, you can safely write them off now. That includes retailers like Sears (S), JC Penny’s (JCP), Macy’s (M), almost all brick-and-mortar clothing sellers, and the small and medium-sized energy industry.

The worst economic data points since the black plague are about to hit the tape. Some 30 million in newly unemployed is nothing to dismiss, and that number grows to 40 million if you include discouraged workers.

That is 25% of the workforce, the same as peak joblessness during the great depression. But $14 trillion in QE and fiscal stimulus is about to hit the market too.

Which brings us to the urgent question of the day: What to do now?

It’s a vexing issue because this is not your father’s stock market. This is not even the market we’d grown used to only six months ago. All I can say is that the virology course I took 50 years ago today is worth its weight in gold.

I think you would be mad not to count a second Covid-19 wave into your calculations. This could occur in weeks, or in months, after the summer respite. This makes a second run at the lows a sure thing. I don’t think we’ll make it, but a loss of half the recent gains is entirely possible.

That takes us back down to a Dow Average of 21,000, or an S&P 500 (SPX) of 2,400.

If you are a long term investor looking to rebuild your retirement nest egg, there are only two sectors left in the market, Tech and Biotech & Healthcare. Looking at anything else is both risky and speculative. So, if we do get another meltdown, these are the only areas you should target.

If I am wrong, the market will probably bounce along sideways in a narrow range for months. That is a dream scenario if you pursue a vertical bull and bear call and put option spread strategy that I have been offering up to followers for the past decade.

Pending Home Sales Were Down a Staggering 20.8% in March and off 16.3% YOY. The worst is yet to come. The West, the first into shelter-in-place, was down a monster 26.8%. Prices still aren’t moving because nobody can buy or sell. The way homebuilder stocks like (LEN) and (KBH) are trading, I’d say your home will be worth a lot more in a year when the huge demographic push resumes. I’m not selling.

The 60,000 peak in deaths proposed by the administration only weeks ago is now looking wildly optimistic. Their worst-case scenario of 200,000 deaths, the announcement of which set the March 23 bottom of the Dow Average at 18,200, is now likely.

It will take place when the epidemic peaks in the southern and midwestern states that never sheltered in place or went in late and are coming out early. That second wave may well create a second bottom in stock prices, and that is the one you jump into and buy with both hands.

US Corona Deaths topped 66,000 last week, more than we lost after a decade of the Vietnam War. Total cases exceed one million.

Bank of America sees negative 30% GDP this quarter annualized, so says CEO Brian Moynihan. His economists expect negative 9% in Q3 and plus 30% in Q4. Suffice it to say, this is the ultra-optimistic case. Q4 doesn’t include the millions of businesses that will disappear because the Paycheck Protection Plan is failing so badly. Most government aid will take three to six months to hit the economy.

US GDP crashed 4.8% in Q1, the worst quarter since the depths of the 2008 Great Recession. Q2 will be far worse. We are now officially in recession, which should last 3-4 quarters. But is it already in the price? Next week’s April Nonfarm Payroll report should be a real humdinger.

Ford (F) lost $5 billion in Q2, and there is no guidance about the future. Avoid (F) on pain of death. Late to electric, they may not make it this time. They’re still in the buggy whip business.

Weekly Jobless Claims topped 3.8 million, bringing the six-week total to a staggering 30 million, more than those lost at the peak of the Great Depression. Florida, California, and Georgia led with applications. This implies a U-6 Unemployment rate of 25% with next week’s April Nonfarm Payroll Report. And the Dow Average is up 37% since March 23?

The Bond Market crashed on a Trump threat to default on US Treasury bonds, of which China owns $900 billion. It’s Trump’s retaliation for the Middle Kingdom spawning the Coronavirus, which he calls the “Chinese virus.” The (TLT) dropped three points on the news. Good thing I am triple short a market that is about to get crushed by massive government borrowing.

A glut of imported autos is parked at sea, steaming in circles, awaiting a recovery in the US economy. They are no doubt finding company with imported oil tankers. So many unwanted cars coming in the land-based storage areas were overflowing. It’s tough to see (F) and (GM) recovering from this. Keep buying made in the USA (TSLA) on dips, which is headed to $2,500 a share.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $0 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

My Global Trading Dispatch performance had one of the best weeks in years, up a blistering +8.05%. We are now only 6.67% short of a new all-time high. The 100 new subscribers who came in the previous week are sitting pretty and must think I’m some sort of guru.

My aggressive triple weighting in short bond positions came in big time when Trump threatened to default on US debt. My shorts in the S&P 500 (SPY) helped. I took profits on my last long there the previous week. (SDS), another short play, clawed back some losses.

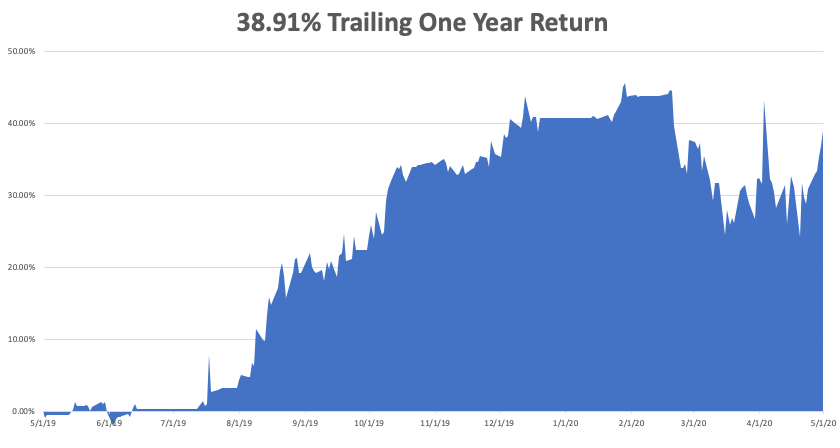

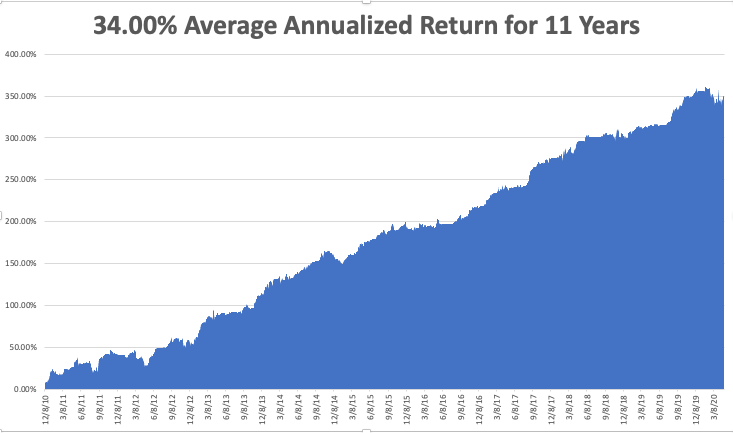

We closed out up a blockbuster +4.55% in April and May is up +2.11%, taking my 2020 YTD return up to only -1.75%. That compares to a loss for the Dow Average of -18.20% from the February top. My trailing one-year return returned to 38.91%. My ten-year average annualized profit returned to +34.00%.

This week, Q1 earnings reports continue and so far, they are coming in much worse than the most dire forecasts. We also get the monthly payroll data, which should be heart-stopping to say the list.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, May 4 at 9:00 AM, the US Factories Orders for March are out and are expected to be disastrous. Berkshire Hathaway (BRK/B) and Eli Lilly (LLY) report.

On Tuesday, May 5 at 11:00 AM, the US Crude Oil Stocks are published and will be another bomb. Netflix (NFLX) and Coca-Cola (KO) report.

On Wednesday, May 6, at 7:15 AM, API Private Sector Employment Report is released. Lan Research (LRCX) and Electronic Arts (EA) announce earnings.

On Thursday, May 7 at 8:30 AM, another horrible Weekly Jobless Claims are out. Bristol Myers Squibb (BMY) reports.

On Friday, May 8, the April Nonfarm Payroll Report is printed, the worst unemployment rate since the Great Depression. AbbVie (ABBV) reports.

As for me, to battle cabin fever, I am setting up a tent in my back yard and staying there tonight, just to change the scenery. The girls need one more campout to qualify for camping merit badge, an important Eagle Scout one, and this will qualify.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

February 19, 2020

Fiat Lux

Featured Trade:

(BUY THE CORONA DIP),

(VZ), (T), (TMUS), (S), (AAPL), (BABA), (CSCO), (EXPE)

The coronavirus hammer finally came down and hit one of the dominant soldiers of big tech.

Apple (AAPL) led morning headlines nationwide by slashing quarterly revenue guidance stemming from production delays and weak demand in China.

Deleting the China demand for new iPhones is enough for the company to signal a looming revenue miss and rightly so, coronavirus has been 24-hour news for the past 2 months on the Asian continent.

As we speak, the cruise liner named the Diamond Princess is parked outside the port of Yokohama with the victims of infected rising by the day.

The optics are ugly, and China’s cover-up of the spreading went awfully awry and now pandora’s box is open.

Naturally, tech stocks can expect a few percentage points shaved off of this year’s annual growth targets and short-term sluggishness in shares exposed to China revenue.

What are the ramifications?

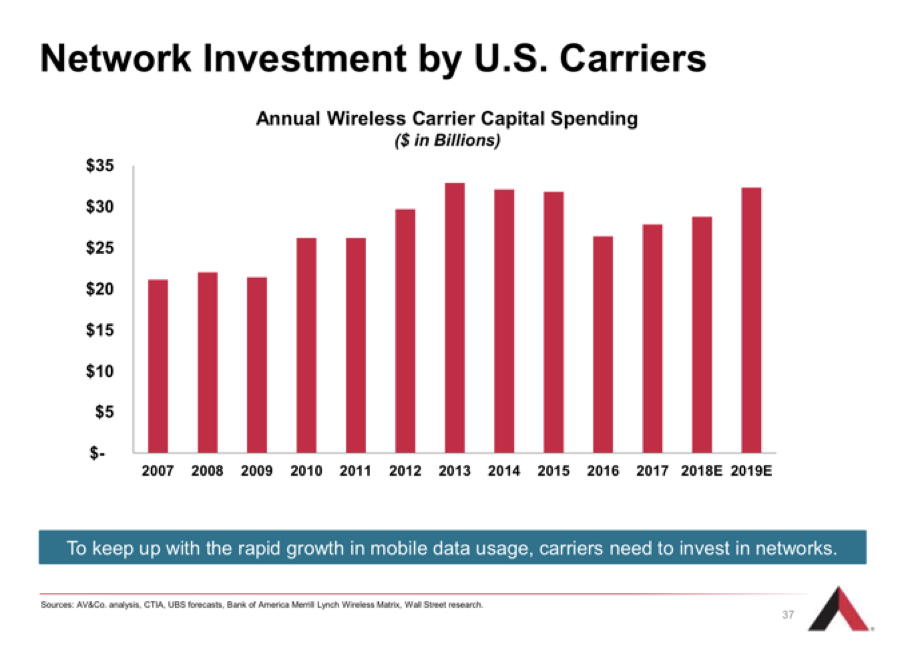

Telecom companies are in the incubation period of building out 5G wireless networks.

Naturally, tech shares will receive a bounce as network deployment gains traction as management commentary, during company earnings calls, on 5G business heats up.

However, the Mobile World Congress was cancelled by organizers stealing the chance for 5G stocks to hype up their position in 5G.

It is almost guaranteed at this point that China coronavirus will slow down the schedule for 5G wireless network buildouts.

Think about this, SARS lasted roughly half a year during 2002-2003, and the coronavirus appears to be worse than that.

Chinese telcoms will need to delay 5G and related equipment along with business that has around 150 million Chinese ensnared by the domestic quarantine.

Apple’s 5G iPhones in late 2020 could be delayed if there is no meaningful breakthrough in the contagion of the coronavirus and its ill effects on global business.

Apple stock appreciated on the hope that 5G iPhones aim to deliver the first meaningful consumer upgrade cycle in several years with a hefty price tag of $1,250.

This next generation iPhone could get pushed back to 2021 as Apple’s supply chain has been put on ice in mainland China.

If Verizon Communications (VZ), AT&T (T), T-Mobile US (TMUS) and Sprint (S) desire to aggressively expand their 5G networks, they might be in for a rude awakening because semiconductor companies might be stretched to limit and cannot provide the right components with supply chains pressured everywhere.

The truth is that supply chains are impacting diverse and interconnected sectors of the electronics industry.

And the epidemic, arriving at dawn of 5G's mainstream deployment phase, is guaranteed to disrupt the progress of the next-generation wireless standard, as the crisis slows the production of key smartphone components, including displays and semiconductors.

Chip companies and their shares have naturally been rocked by the recent news and they aren’t the only ones.

Expedia (EXPE), the online travel company, revealed it will avoid providing a full-year forecast as the online travel services company reevaluates the impact of the coronavirus outbreak on its operations.

Investors can imagine that on mainland China, the situation is grim exerting a fundamental impact on the country’s consumers and merchants and will slice off revenue growth in the current quarter.

Alibaba (BABA), the Amazon of China, told investors that the virus is undermining production and output in the economy because many workers are stuck at home.

The virus has also changed the commerce patterns of consumers by pulling back on discretionary spending, including travel and restaurants.

The Chinese e-commerce giant’s revenue surged year-over-year by an impressive 38% to 161.5 billion yuan ($23.1 billion), while net income rose 58% to 52.3 billion yuan, but that could symbolize the high-water mark.

Chief Executive Officer Daniel Zhang and Chief Financial Officer Maggie Wu were explicit in mentioning that risks from the pandemic could deaden a piece of revenue moving forward and they weren’t shy about stating this.

Sound bites such as “overall revenue will be negatively impacted,” and expecting growth to be “significantly” negative is quite black and white.

China is almost certain to print weak GDP growth numbers because of cratering imports and a big drop in demand.

Echoing Alibaba’s weakness was network infrastructure company Cisco (CSCO) with a revenue shortfall of 3.5% year-over-year as major product categories like Infrastructure Platforms and Applications were hit.

Cisco must find new cycles in core activities to regain any momentum and chip companies must do the same as the administration turns the screws on Huawei and injects more barriers to U.S. chip companies selling abroad.

This adds to the broader risks of elevated corporate debt and the upcoming U.S. election where tech management is nervous that a new President could throw big tech under the bus.

The coronavirus pours fuel on the flames.

The silver lining is the blows to these companies are softened by the ironic fact that big tech has become the safety trade to the coronavirus and even if 5G is delayed, chip stocks will eventually benefit from a fresh wave of revenue drivers when the 5G network is finally deployed.

However, it is way too early to announce the death of big tech, there are far too many secular tailwinds driving these companies.

The tech bull market is still intact and there will be opportunity to buy.

Global Market Comments

January 9, 2020

Fiat Lux

Featured Trade:

(WEDNESDAY, FEBRUARY 5 MELBOURNE, AUSTRALIA STRATEGY LUNCHEON)

(CAPTURING SOME YIELD WITH CELL PHONE REITS),

(CCI), (AMT), (SBAC),

(JNK), (SPG), (AMLP), (AAPL), (VZ), (T), (TMUS), (S)

I am constantly bombarded with requests for high-yield, low-risk investments in this ultra-low interest rates world.

While high-yield energy Master Limited Partnerships LIKE (AMLP) can offer double-digit returns, they carry immense risks. After all, if the prices of oil drop to $5-$10 a barrel, replaced by alternatives as I eventually expect, all of these instruments will get wiped out.

You can earn 5%-8% from equity-linked junk bonds. However, their fates are tied to the future of the stock market at a 20-year valuation high against flat earnings.

You might then migrate to Real Estate Investment Trusts (REITs) like Simon Property Group (SPG), which acts as a pass-through vehicle for investments in a variety of property investments. However, many of these are tied to shopping malls and the retail industry, the black hole of investment today.

So where is the yield-hungry investor to go?

You may have heard about something called 5G. This refers to the rollout of fifth-generation wireless technology that will increase smartphone capabilities tenfold. Whole new technologies, like autonomous driving and artificial intelligence, will get a huge boost from the advent of 5G. Apple (AAPL) will launch its own 5G phone in September.

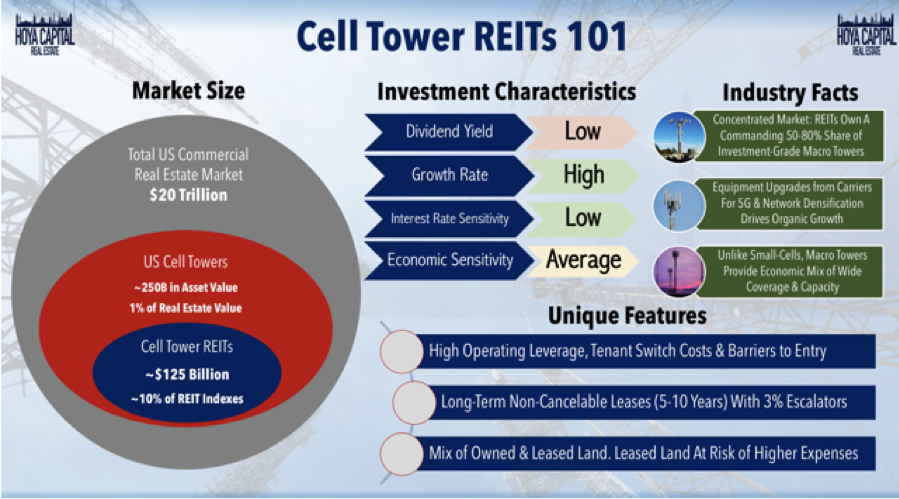

5G, like all cell phone transmissions, rely on 50-200-foot steel towers strategically placed throughout the country, frequently on mountain peaks or the tops of buildings. With demand from the big phone carriers soaring, there is a construction boom underway in cell phone towers. There just so happens to be a class of REITs that specializes in investment in this sector.

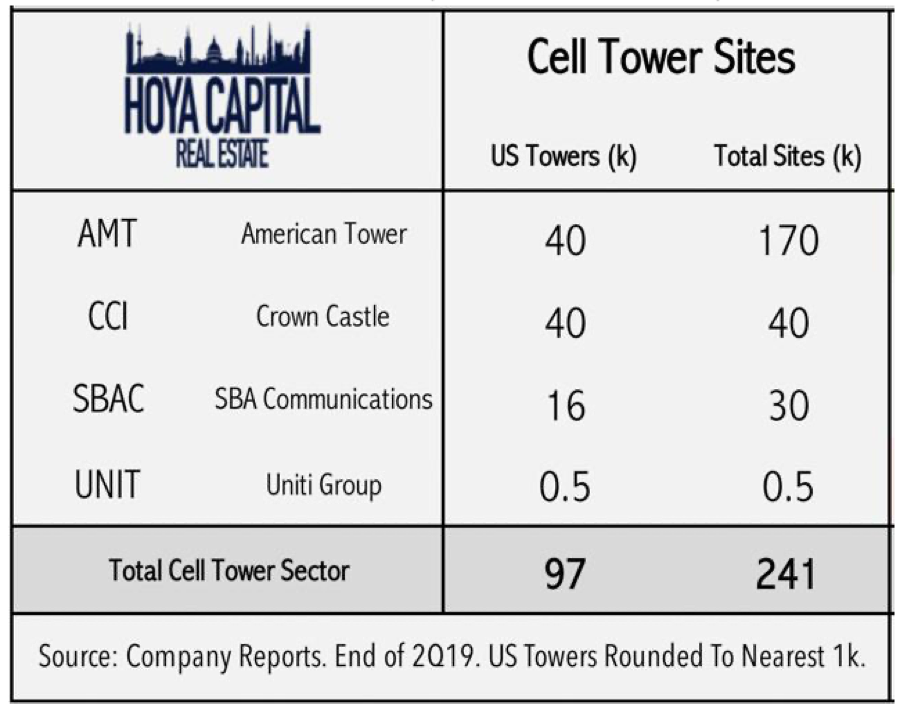

Cells Phone REITs constitute a $125 billion market and make up 10% of the REIT indexes. They own 50%-80% of all investment-grade towers. They are all benefiting from a massive upgrade cycle to accommodate the 5G rollout. These REITs own or lease the land under the cell towers and then lease them to the phone companies, like Verizon (VZ), AT&T (T), T-Mobile (TMUS), and Sprint (S) for ten years with 3% annual escalation contracts.

American Tower (AMT) is far and away the largest such REIT, with 170,000 towers, has provided an average annual return over the past ten years, and offers a fairly safe 1.65% yield. They are currently expanding in Africa. Even during the 2008 crash, (AMT) still delivered an 8% earnings growth.

SBA Communications (SBAC) is the runt of the sector with only 30,000 towers. However, it has a big presence in Central and South America and is seeing earnings grow at a prolific 80% annual rate. (SBAC) is offering a 1.48% yield at today’s prices.

Crown Castle International (CCI) is in the middle with 40,000 large towers and 65,000 small ones. 5G signals travel only a 1,000 meters, compared to several miles for 4G, requiring the construction of tens of thousands of small towers where (CCI) is best positioned. (CCI) offers a hefty 3.39% yield.

Small cell towers are roughly the size of an extra-large pizza box and will soon be found on every urban street corner in the US. AT&T (T) has estimated that there is a need for over 300,000 small cell phone towers in the US alone.

So, if you’re looking for a sea anchor for your portfolio, a low-risk, high-return investment that won’t see a lot of volatility, Cell phone REITs may be your thing. Buy (CCI) on dips.

Can you hear me now?

Global Market Comments

November 26, 2019

Fiat Lux

Featured Trade:

(WHAT HAPPENED TO THE DOW?)

($INDU), (EK), (S), (BS), (CVX), (DD), (MMM),

(FBHS), (MGDDY), (FL), (GE), (TSLA), (GM)

(WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

Global Market Comments

January 17, 2019

Fiat Lux

Featured Trade:

(WHAT HAPPENED TO THE DOW?)

($INDU), (EK), (S), (BS), (CVX), (DD), (MMM),

(FBHS), (MGDDY), (FL), (GE), (TSLA), (GM)

(WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds: