Mad Hedge Technology Letter

September 13, 2021

Fiat Lux

Featured Trade:

(THE DATABASE MOST WANTED BY DEVELOPERS 4 YEARS RUNNING)

(MDB), (MSFT), (IBM), (SAP), (ORCL), (CLDR)

Mad Hedge Technology Letter

September 13, 2021

Fiat Lux

Featured Trade:

(THE DATABASE MOST WANTED BY DEVELOPERS 4 YEARS RUNNING)

(MDB), (MSFT), (IBM), (SAP), (ORCL), (CLDR)

MongoDB’s latest earnings’ results validate the concept open source software as a rival to the opposed closed-source software grid.

A keen rival of MongoDB’s RedHat was also acquired by IBM (IBM) a few years ago showing the vitality of the sub-sector.

Don’t sleep on these companies as another one Cloudera (CLDR) were taken private by private equity firms KKR and Clayton, Dubilier & Rice.

These are highly valuable assets and I’m not the only one shouting from the rooftops.

How did this all first start?

The first open-source projects were not really businesses, they were counter attacks against the unfair profits that closed-source software companies were reaping.

Microsoft (MSFT), Oracle (ORCL), SAP (SAP), to name a few, were enforcing monopoly-like “rents” for software that were substandard in quality.

The latest evolution of open source came when developers evolved the projects with two important elements.

The first is that the open-source software is now developed largely within the confines of businesses.

Often, more than 90% of the lines of code in these projects are written by the employees of the company that commercialized the software.

Second, these businesses offer their own software as a cloud service from inception.

In a sense, these are Open Core / Cloud service hybrid businesses that can obtain multiple pathways to monetize their product and that is exactly what MongoDB did.

By offering the products as SaaS, these businesses can interweave open-source software with commercial software so customers no longer have to worry about which license they should be taking.

MongoDB Atlas is a great example of this evolution and can become the dominant business model for software infrastructure.

This is their hottest product which is a fully-managed cloud database and Atlas handles all the complexity of deploying, managing, and healing deployments on the cloud service provider of your choice like Amazon or Google.

MongoDB changed how open-source software is licensed, and they introduced the new cloud service that required them and partners to compete with the largest cloud providers.

Looking quickly at second-quarter financial results, they generated revenue of $199 million, a 44% year-over-year increase and above the high-end of guidance. They grew subscription revenue 44% year over year.

Mongo Atlas revenue grew 83% year over year and now represents 56% of revenue, and they had another strong quarter of customer growth, ending the quarter with over 29,000 customers.

Businesses that can develop software faster are able to ultimately outgrow their competition.

MongoDB’s results are a clear indication that customers view MongoDB as a critical platform to accelerate their digital innovation agenda.

Customers of all types are choosing MongoDB because they can develop so much faster using this platform to build new applications and replatform legacy applications across a broad range of use cases to drive business forward.

Even though MongoDB open-source software is lower cost per unit, it makes up the total market size by leveraging the elasticity in the market. When something is cheaper, more people buy it. That’s why open-source companies have such massive and rapid adoption when they achieve product-market fit.

The model now is that companies are venturing as far as actually open sourcing all their software but applying a commercial license to parts of the software base. The premise being that real enterprise customers would pay whether the software is open or closed, and they are more incentivized to use commercial software if they can actually read the code.

Observing how airline JetBlue deployed MongoDB is how these new approaches and improved products manifest themselves in the topline revenue.

JetBlue came to the decision to overhaul their core e-commerce app, and JetBlue chose the MongoDB application data platform.

MongoDB's flexible data model allowed JetBlue to build a dynamic customer experience with modern ticketing applications, as well as predictive analytics in real-time.

An avalanche of firms is leveraging the tools of MongoDB tools to up their digital game.

Management has steered the narrative to include the ease of use and expanding the capabilities of the MongoDB platform to make it more compelling for customers to standardize on MongoDB.

For example, a serverless, customer can get started with MongoDB without having to pick a specific machine type or size. The application connects to Atlas, and they handle the elastic scaling of compute and storage seamlessly, whether an application scales fast or becomes popular. Customers no longer must do capacity planning or manual intervention to adjust the size of the deployment.

The verdict is in and deploying MongoDB to harness in-house developers to build unique commercial applications has been a winning formula.

Not only are they sheltered from rigid closed-source software, but customers can even integrate the code first, then pay later when it is deployed, and this licensing model has been extremely beneficial for developers who need to test out whether certain code is valuable or not.

Atlas is now the cash cow for MongoDB and forecasts predict acceleration in top-line growth.

Yes, this company is still small procuring revenue of just $166 million in 2018, but 2023 will see annual revenue surpass $1 billion which is why everyone wants to hop on MondoDB’s train.

I would consider any dips to deploy capital in MongoDB, I would call it a rising star of the software world, and a gem in the developers’ world.

Mad Hedge Technology Letter

June 2, 2021

Fiat Lux

Featured Trade:

(WHEN TO GET BACK INTO SALESFORCE?)

(CRM), (SONO), (HON), (SAP)

Looking for that optimal balance between growth and profitability is the ideal but of course if a tech firm in that state is also leaning towards driving growth...

That company is Salesforce (CRM) and it looks attractive now after pulling back from its peak.

Investing in growth, especially in this insatiable demand environment, is simply the best thing a tech firm can do for a company.

That said, I am also a staunch believer that a focus on discipline makes for a stronger and more durable company.

Over the long term, I believe tech firms need to be able to deliver both revenue acceleration and versatility in its revenue acceleration.

That shows up for Salesforce in the $3.2 billion in cash flow on $5.96 billion in revenue which adds up to being up 74% year over year.

CRM’s numbers reflect a strong performance since the onset of the public health situation and their operating margin is producing almost as if it was completely redesigned from the bottom up.

CRM has raised its operating margin to 18% and they are on track to doing $50 billion by 2025.

Then there are unbelievable stories to digest that make readers understand the true power of CRM.

The Sonos (SONO) story is just one to absorb — they just had this 84% growth when they went to consumer using CRM products.

More importantly, how to integrate operations with a cloud platform is at the forefront of every CEO’s thinking.

This takes looking at the trends of this past year and again, the individual stories where CRM has made that big difference, like the Honeywell (HON) story when they shifted 7,000 salespeople from in-person to virtual customer meetings — customer meetings aren't going back to conference rooms only.

Then when the business environment dictates that CRM is helping through the Service Cloud, together with Field Service and Experience Cloud to enable Honeywell to seamlessly dispatch technicians for on-site product maintenance and proactive asset management, connected service partner experiences, and customer experience for scheduling appointments and instantly solving troubleshooting problems.

It’s field service capability that helped CRM to amplify an already close-knit relationship with Honeywell, and that's when management started to collaborate and say, wow, we could bring this to the aviation business in Honeywell to transform and streamline the work they do via the cloud.

To succeed in the all-digital work-anywhere world enabling you to digitize your entire customer experience and get back to growth is the overarching goal in this incredible 2021 economy.

The outperformance really stretches across the portfolio. When we talk about the fact that of the seven-figure deals, they, on average, included more than four of CRM cloud services, meaning they are not selling individual products.

CRM’s AI Einstein started doing over 100 billion predictions per day. And it's a great example of these platform investments that CRM did multiple years ago that customers and the whole economy go digital are benefiting from.

It means every email is more personalized and every e-commerce you paid for is suited to your interest and your needs, driving growth and success for customers.

MuleSoft is now doing 4.86 billion integration transactions every day. That is up 28% quarter over quarter.

Integrating these legacy systems so customers can move faster in the face of an economy that’s shifting more rapidly than ever before shows the importance of CRM’s acquisitions as it relates to the overall value proposition of Customer 360.

Total revenue for the first quarter was $5.96 billion, up 23% year over year and CRM’s vertical strategy continues to align products to strategic industries.

In particular, we saw strength in the public sector, which continues to accelerate as governments around the world turn to Salesforce Solutions. Service Cloud demonstrated another quarter of incredible growth at scale with Q1 revenue of $1.5 billion, growing 20% year over year, and Tableau continues to perform well.

In Q1, Tableau was in eight of CRM’s top 10 deals for the company and in more than 60% of seven-figure plus deals.

The company expects Q2 revenue of $6.23 billion or approximately 21% growth year over year and CRM even raised annual revenue guidance by $250 million.

They are about to pass SAP as the largest enterprise applications company in the world. And all the analysts have their models. I know they track SAP and Salesforce.

It really shows the whole world is going digital, and customers are connecting with their customers in a new way, and everyone needs CRM to do it or get left behind.

They also need CRM’s analytics — they need integration and CRM just happens to be the leader in that area.

CRM has undergone an M&A consolidation after heavily paying for acquisitions. This earnings report signaled to investors to expect these headwinds to drop off towards the end of the year and since the stock market is forward-looking, CRM will start to transform into the buy the dip tech firm it was once before these expensive acquisitions took place.

Readers should keep an eye out for Salesforce for really any substantial pullback and long-term, this software company is a reliable revenue accumulator with a strong brand name.

Mad Hedge Technology Letter

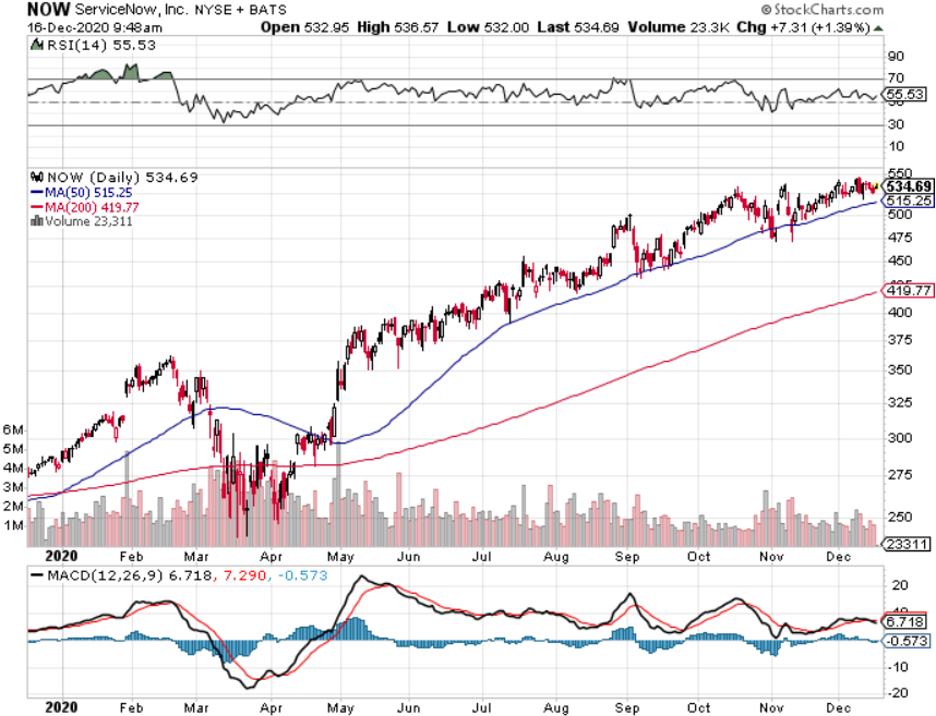

December 16, 2020

Fiat Lux

Featured Trade:

(THE NEW SALESFORCE)

(NOW), (CRM), (SAP), (ORCL), (IBM), (MSFT)

During Bill McDermott’s leadership as CEO, German software firm SAP's market value increased from $39 billion to $156 billion.

No doubt that this experience at SAP paved the way to become one of the fastest-growing major cloud vendors in 2020.

McDermott is now CEO of ServiceNow (NOW), a company that offers specific IT solutions. It allows you to manage projects and workflow, take on essential HR functions, and streamline your customer interaction and customer service. It does all of this, thanks to a comprehensive set of ServiceNow web services, as well as various plug-ins and apps.

Their market value has doubled to $100 billion and this is just the beginning.

ServiceNow almost doesn’t exist after numerous attempts to be acquired, like the time it was almost sold to VMware for $1.5 billion.

Company founder Fred Luddy, who is now chairman, and the board of directors were intrigued by the VMware offer, but venture-capital firm Sequoia Capital argued that $1.5 billion wasn’t a premium at that time let alone market rate for this burgeoning cloud player.

Then-CEO Frank Slootman was eventually replaced by former eBay Inc. (EBAY) CEO John Donahoe in February 2017, who took the company to $3.46 billion in annual 2019 sales.

Donahoe then bolted for Nike Inc. (NKE), and McDermott joined from SAP, locking in the firm for a new era of meteoric growth.

ServiceNow is now on its way to become the defining enterprise-software company of the 21st century and if you look at their position in the market today, they’re the only born-in-the-cloud software company to have surpassed $100 billion market cap without large-scale M&A.

This underdog cloud company whose automation software is deployed to improve productivity is leading to what is known as a “workflow revolution.”

Their set of software tools fused with the sudden emphasis on digital tracking of employees and business systems — has played into ServiceNow’s strengths.

The seismic shift is accelerating: By 2025, most of the millennial generation will work from home permanently, based on internal company reports.

It expects revenue of $4.49 billion in fiscal 2020 and still has a mountain to climb with revenue of just 20% of Salesforce, one-sixth of SAP, and one-ninth of Oracle Corp. (ORCL).

But ServiceNow is catching up as corporations and government agencies pour billions of dollars into their digital infrastructures.

So far, more than $3 trillion has been invested in digital transformation initiatives. Yet only 26% of the investments have delivered meaningful returns on investment.

This is launching the workflow revolution, where ServiceNow is the missing cog that can integrate systems, silos, departments, and processes, all in simple, easy-to-use cross-enterprise workflows.

A demand surge for “workflow automation” technology went parabolic in 2020 and is part of the puzzle helping ServiceNow sustain 25%-plus revenue growth.

ServiceNow most recently raised its full-year guidance after disclosing it has 1,012 customers with more than $1 million in annual contract value, up 25% year-over-year.

That included 41 such transactions in the third quarter, with new customers such as the U.S. Senate and New York City’s Mount Sinai Hospital.

ServiceNow raised guidance for the full year on subscription-revenue range to between $4.257 billion and $4.262 billion, up 31% year-over-year in constant currency.

The company has detailed a goal of $10 billion in annual sales as something feasible in the mid-term and its bevy of strategic relationships will help, like in July, Microsoft Corp. (MSFT) expanded its relationship with ServiceNow; shortly thereafter, Accenture (CAN) and IBM created new business units in partnership with ServiceNow to develop new opportunities.

In March, ServiceNow added a new computing platform, Orlando, that added artificial intelligence and machine learning that lets the MGM Macau casino resort, for example, use a virtual agent to automate and handle repetitive requests.

The integration of virtual agents will supplement casino employees with 24/7 support experiences when human staff is unavailable.

After hitting the $100 billion market cap, McDermott has identified M&A as the catalyst to take NOW higher with the CEO squarely looking at artificial intelligence targets.

ServiceNow has enabled firms to unite front, middle and back office functions, increasing productivity during this time period when speed and simplicity matter the most to digital customers.

I would describe NOW as a baby brother to Salesforce and its entrance into the first and most likely continuous acquisition cycle will most probably result in higher share prices.

ServiceNow turns out to be placed in the perfect position benefitting from Americans moving their careers online with the added effect of the broad-based secular digital migration to remote work.

As long as this firm is generating revenue in the mid-20% annually, it will be a constant buy-the-dip candidate for the foreseeable future regardless of whether there is a pandemic or not.

Mad Hedge Technology Letter

September 12, 2018

Fiat Lux

Featured Trade:

(HOW TO PLAY “SOFTWARE AS A SERVICE”),

(AMZN), (IBM), (ADBE), (CRM), (BABA), (CSCO), (SAP), (ORCL), (GOOGL)

If you have read any of our content in the first year of the Mad Hedge Technology Letter, the content is distinctly bullish technology stocks.

A fundamental driver propelling this cogent argument is the dominant Software-as-a-Service (SaaS) industry booming inside the confines of Silicon Valley.

If you want to boil down your tech investment thesis to one indispensable rule – only invest in tech companies that carve out prominent SaaS businesses.

If you stick with this nostrum, you will be delivered profits in spades.

We have recently taken in a swarm of new tech letter subscribers and understanding the panacea that is SaaS will entrench your portfolio in a glorious position to reap untold profits.

What is SaaS?

SaaS is a distribution method in which software is diffused to paid subscribers, usually on an annual, reoccurring payment plan, and the software is remotely stored on a centralized cloud platform awaiting use.

Unsurprisingly, SaaS remains the most lucrative segment of the cloud market.

In 2017, the tech industry did $60.2 billion in annual SaaS sales, that number is poised to explode to $117.1 billion in 2021.

The near doubling of sales underscores the robust nature of these tech firms setting up businesses of this ilk, and the positive effects dripping down to the bottom line.

Simply put, no SaaS business, no reason to invest.

SaaS isn’t the only cloud revenue companies can carve out. Tech firms also offer platform-as-a-service (PaaS) and infrastructure-as-a-service (IaaS).

However, SaaS is by far the prominent growth lever in the high-margin cloud industry.

The indomitable presence inside the SaaS industry is Bill Gates’ creation Microsoft (MSFT).

Microsoft leads all companies with a 17% global share of the SaaS market.

The Redmond, Washington, outfit blew past stalwart Salesforce (CRM) nine quarters ago.

Microsoft’s sizzling SaaS business is an oversized contributor to its 45% revenue growth rate, which is head-and-shoulders above the industry average.

Salesforce (CRM), Adobe (ADBE), Oracle (ORCL) and SAP (SAP) fill out the top five largest global SaaS businesses, but it is really a tale of two stories.

Oracle and SAP, which are competing in the same market, are grappling with legacy database businesses and legacy tech, which are punished by investors.

John Dinsdale, a chief analyst at Synergy Research Group, mentioned two outliers of “Cisco (CSCO) and Google too who are making ever-bigger inroads into the SaaS market” leveraging Cisco’s multitude of software assets and Google’s G Suite.

The thing that makes SaaS the x-factor for tech companies is that inevitably every company from every walk of life will adopt this mode of software, giving legs to this distribution model.

Vendors are scrambling to put together some resemblance of a SaaS product together, and this trend is a vital contributor to an industry that is growing 32% YOY worldwide.

Kevin Cochrane, chief marketing officer of SAP Customer Experience lay bare his thoughts about this type of service describing it as the “Golden Age of SaaS.”

Companies are becoming digital first from end to end, explaining the sharp rise in IT professional salaries and rise in quality software products.

As we look around the corner to the IaaS part of the cloud industry, which is growing at around 30% YOY, there is one dominant player, and everybody knows its name.

Amazon (AMZN) is the No. 1 vendor with Microsoft, Alibaba (BABA), Google, and International Business Machines Corporation (IBM) trailing behind.

The top four IaaS players have carved out a total of 73% of the global market ravaging any resemblance of competition.

Amazon is the industry standard with the best record of customer success.

If Amazon branched off into the SaaS industry, it could unlock an additional $100 billion in annual revenue.

A shift into this direction could pad Amazon’s margin’s even more after successfully boosting North American e-commerce margins from 2.4% to 4.7%.

It’s not entirely inconceivable that Amazon could break the $2 trillion valuation in three to five years, as its revved up digital ad business registered growth of 129% YOY last quarter.

Microsoft seized the runner-up position in the IaaS market to Amazon by growing 98% YOY with sales eclipsing $3.1 billion in 2017.

Wherever you turn, whether toward the cloud business or gaming, investors can find Microsoft making sales.

Microsoft has been a favorite of the Mad Hedge Technology Letter and it’s hard pressed to find a better public tech company in operation now.

The SaaS industry is not a one-size-fits-all proposition.

Thus, there is abundant room for niche offerings that quench companies’ demand for specific services.

This is the reason why cloud companies have participated in a non-stop buying binge of smaller companies that fit their needs.

Microsoft purchased developer favorite GitHub for $7.5 billion earlier this year, and similar examples are scattered all over the tech ecosphere.

Artificial Intelligence (AI) will be the kicker that powers SaaS performance to new heights because incorporating this groundbreaking technology will enhance functionality and, in return, raise profits for all involved.

The scalability of SaaS products has allowed companies to offer software for affordable prices allowing the smallest of firms to adopt a digital-first strategy.

This software connects with other software seamlessly integrating an array of productive apps that help teams overperform and overdeliver.

In the American workplace, 73% of companies will be exclusively using SaaS to function by 2020.

American companies are using 16 apps on average per day, a 33% jump in the number of apps they were using just two years ago.

The migration to mobile has swallowed up SaaS products as well with more mobile-specific software rolling out to mobile devices.

The meteoric rise of SaaS offerings has cut IT security budgets substantially as security has been delegated to the cloud instead of in expensive in-house security teams.

No longer do tech firms need to beef up guarding their own gates.

Protection is provided on a centralized cloud with a third-party company ensuring safety.

This development has helped a new industry rise – cloud security.

Whether people realize it or not, the SaaS industry is here to stay and will become more prevalent in every industry going forward.

This is incredibly bullish for companies that sell SaaS products as revenue will continue to rise.

________________________________________________________________________________________________

Quote of the Day

“Growth and comfort do not coexist,” – said CEO of IBM Ginni Rometty.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.