Science rarely gets communicated accurately.

Earlier this month, UK health experts said that an existing drug called dexamethasone can cut the risk of death among patients suffering from severe COVID-19.

According to the Oxford University researchers, dexamethasone lowered the COVID-19 deaths by roughly 35% among patients in ventilators and 20% among those who required oxygen.

The experts clarified that this means for every 8 patients on ventilators treated with dexamethasone, they were able to save 1 life.

In response to this study, here’s the gist of what most news outlets reported: “Miracle COVID-19 cure discovered!”

Now, health experts are scrambling to get their voices heard over the loud pronouncements of opportunistic businesses heralding the sale of this life-saving drug.

Days after the UK experts released this information, government authorities have issued warning after warning against stockpiling this drug for personal consumption.

Up until today, they’re still convincing people that dexamethasone is not a community drug and should only be used if prescribed by a medical professional.

That is, dexamethasone is a treatment for the sickest of the sick and should not be used as a preventive treatment.

Here’s how it works, and why it can only be used in severe cases.

The dexamethasone dampens the immune system for patients in ventilators or oxygen. This is effective because in severe cases, the immune system turns against the body, specifically the lungs, causing deaths. That’s what dexamethasone addresses.

This means that dexamethasone cannot be used on mild COVID-19 cases. Patients classified under this category still have relatively healthy immune systems, which would of course be more preferable tools to fight the disease.

Although there has been a misconception about this treatment, this drug is definitely a breakthrough that the world badly needs at the moment. The positive results of its efficacy make it a first-line therapy until a vaccine gets approved.

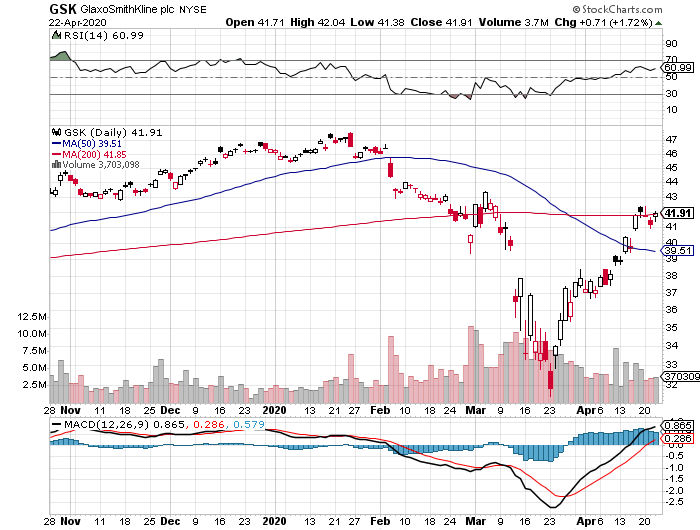

So far, the leaders in the vaccine race include Moderna (MRNA), Inovio (INO), Sinovac Biotech (SVA), AstraZeneca (AZN)/Oxford, Merck (MRK), Sanofi (SNY), GlaxoSmithKline (GSK), Novavax (NVAX), Johnson & Johnson (JNJ), and Pfizer (PFE).

Dexamethasone has been around for almost 60 years, making the drug available practically everywhere.

It’s also safe since dexamethasone is included in the WHO’s list of essential drugs.

What we know is that this drug has been approved by the UK government to be used on COVID-19 patients in ventilators and oxygen.

Before being identified as a potential COVID-19 cure, dexamethasone has been widely used as a steroid treatment for rheumatoid arthritis, asthma, bowel disorders, skin disease, and some cancers.

The average retail cost of this drug is around $50 per 10mg. Since the treatment only requires a low dosage, the price would fall somewhere between $6 to $8 per patient.

Needless to say, this cheap treatment could hurt the sales of competing drugmakers aiming to come up with their own COVID-19 cure.

To date, the leaders in this field include Eli Lilly (LLY), Regeneron (REGN), and of course, Gilead Sciences (GILD).

Among those, the only treatment to show a noticeable effect in treating severe COVID-19 patients is Gilead’s Remdesivir.

Although Remdesivir has not been hailed as a miracle cure, this Gilead product managed to offer sufficient benefits to fuel demand.

According to its Phase 3 trial data, 65% of patients dosed with Remdesivir for five days showed better clinical improvement compared to a standard-of-care group.

When the pandemic broke out, Gilead announced that it’s giving away its remaining supply of Remdesivir, which amounts to roughly 1.5 million doses.

Nonetheless, the company disclosed that it plans to invest up to $1 billion on the development of the drug for COVID-19 patients.

Since government funding also comprises a portion of Remdesivir’s development, the arrangement inevitably raises the question of how much revenue the drug can generate.

After all, pricing will definitely be crucial because the company will have to strike a balance between making an acceptable profit and offering an affordable cure to patients.

Financial analysts estimate that Remdesivir’s potential profit could reach $7.7 billion by 2022.

If these estimates turn out right, then Gilead investors are sitting on a veritable gold mine.

Regardless of Remdesivir’s sales, Gilead remains a giant biotechnology and pharmaceutical company with a market capitalization of $97.18 billion.

In fact, it’s considered as one of the recession-resistant companies today thanks to its diversified portfolio and strategic acquisitions.

One of the main reasons for its stature in the industry is the fact that Gilead continues to be the definitive leader in the HIV market today.

Its top-selling drug Biktarvy recorded an impressive $4.1 billion in sales for the first quarter of 2020 alone, a substantial increase from its $3.6 billion earnings during the same period in 2019.

On top of that, Gilead secured patent exclusivity for Biktarvy until the early 2030s. This all but guarantees that the company’s cash cow remains safe from competition for many years.

The expansion of gene therapy Yescarta to cover the European market also proved to be effective. Sales of this lymphoma treatment jumped from $96 million in the first quarter of 2019 to $140 million in the same period this year.

Meanwhile, Gilead’s $4.9 billion acquisition of Forty Seven in April this year indicated the company’s move to expand its oncology sector. Specifically, blood cancer therapy Magrolimab is projected as the next blockbuster.

All these demonstrate that Gilead is well-positioned to handle major financial and even health crises.

More importantly, Gilead’s position as a leader in the search for a COVID-19 cure indicates its capacity to withstand a possible second wave of this pandemic as well as the potential to boost its sales in the process.