Exactly 84 years ago from yesterday, the Great 1929 stock market crash occurred. The Dow Average plunged a stunning 30 points to 230, a one-day decline of 12%. The ticker tape lagged the market by two hours, and the newly bankrupt were jumping out of downtown windows. I remember it like it was yesterday.

Well not really.

But a number of friends over the decades lived through that fateful day, and relived it for me, men like Sir John Templeton and Tubby Burnham. My grandfather prided himself on never buying a stock in his life, and was deluged by entreaties from reckless and freshly busted relatives to move into his Bay Ridge, Brooklyn basement.

The S&P 500 came just eight points short of my 2013 target of 1,780 yesterday. By the time you read this, it may already be there.

To refer back to my many pleadings for you to load the boat with US equities, please click here to read ?Why US Stocks Are Dirt Cheap? and ?My 2013 Stock Market Outlook?.

When I made this prediction in January, abuse was hurled upon me. Clearly, the sequester, debt ceiling crisis, taper, sluggish economic growth, a China crash, and a government shutdown were going to collapse the market, taking the (SPX) as low as 300. Gold was the safe place to be, I was told. The only way I could conclude that stocks were headed northward was if I was smoking one of California?s largest agricultural products.

It turns out they were right, but only if you hold your charts upside down.

So it was with some amusement that I listened to the comments of Dr. Jeremy Siegel of the Wharton School of Business. He has been one of the most unremittingly bullish commentators all year, to the point of becoming a Wall Street laughing stock. There is only one catch: he has been dead right. And when people are that right, I sit up and take notice.

Dr. Siegel?s view on the economy mirrors my own. The absence of further spending cuts and tax increases should enable US GDP growth to spring from 2% to 3.5%. At that robust rate the Federal Reserve could completely eliminate quantitative easing with no serious market impact. All surprises will be to the upside. Only a ten year Treasury yield falling to 2% would signal that this scenario has run off the rails.

The Federal Reserve will keep interest rates ultra low for longer than most expect because of its mortal fear of deflation. Endemic and structurally falling prices have the effect of increasing the real debts of individuals and corporations. The central bank clearly wants debt loads to move in the other direction.

While major entitlement reform poses some risk, the likelihood is that the committee convened to make recommendations will simply kick the can down the road, well past the 2014-midterm elections. That?s because both parties believe they can then gain the upper hand. Only one of them can be right.

Dr. Siegel observes that November and December have the calendar working for them as historically positive months. There will be an extra tailwind coming from highly favorable Q4 YOY earnings comparisons. Dividends are up a healthy 10%-15% YOY, and will continue to improve. This action should spill into the first half of 2014.

There is no doubt that the taper has been delayed. In fact, there are no major uncertainties of any kind until well into next year. Periodically, premature fears of tightening will trigger market setbacks. But they will be of the smaller kind, typically 4%-7%.

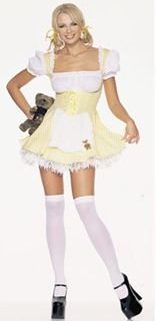

Welcome to the Goldilocks market.

The only development that could bring this parade to an end would be a second and more prolonged government shutdown, possibly as early as January. But the Republicans have been severely chastised for their behavior in the opinion polls, so it is highly unlikely we will see a repeat, unless we are about to become a one party state.

Welcome to the Goldilocks market.