In the long history of stock markets, last week will be viewed as one of the pivotal ones of the 21st century. That was when investors flipped from anticipating the end of interest rate rises to the beginning of interest rate cuts.

That is a big deal.

I have been anticipating this for months, putting all my chips on the most interest rate-sensitive sectors: US Treasury bonds (TLT), Junk bonds (JNK), REITS (NLY), and big tech. The payoff has been huge, with some followers calling me up daily with literal tears of joy. They have just made the most money in their lives.

November has been the best month of the year, up 10% from the October low, and it's only half over.

And here is the good news. We are not only in the first inning of a new bull market for all risk assets but also the first pitch of the first at-bat of the first inning. 2024 should be one of the easiest trading years in a decade. This could go on for a decade.

This is how things will play out.

After the hottest quarter of GDP growth in three years at 4.9% in Q3, the economy is slowing. Virtually every business sector is seeing sales weaken, especially real estate and EVs.

That sets up a sharp drop in the inflation rate from the current 3.2% to the Fed’s target of 2%. Get a few months of that and the Fed starts cutting interest rates from the current 5.25%-5.5%. Fed futures are currently indicating a 40% probability that will happen in March.

We could be at 4.0% overnight interest rates by the end of 2024 and 3.0% by the end of 2025 when they stabilize. Stocks and bonds will eat this up.

Better hope that the Fed stays data dependent as promised, because coming data is weak, even if it doesn’t arrive for months. We only need one weak quarter to kill off inflation, and that quarter began on October 1.

Priority One is for the Fed to de-invert the yield curve or get short-term interest rates below long rates. For encouragement, the Fed should look at the most rapidly shrinking money supply in history, which I have been glued to.

There has been no monetary growth for two years, and zero bank deposit growth for three years. The Fed's balance sheet has plunged by $1.5 trillion in 18 months. Fed quantitative tightening continues at $120 billion a month. This is unprecedented in economic history.

The biggest risk to markets is that Powell delays cutting rates as much as he delayed raising rates two years ago. This is a very slow-moving, backward-looking Fed.

If you have a ten-year view of the markets, as I do, this is all meaningless. You need to buy stocks right now. If the Fed does play hardball and rigidly holds to the 2% target it risks causing a recession.

If you see any reasons to shoot down my bull case please, please email me. I’d love to hear them.

It’s not that stocks are expensive. 2024 S&P 500 (SPY) earnings are now 18X. If you take out the Magnificent Seven, they are at 15X earnings, close to the 2008 crash low. Small cap stocks are at a bargain basement 12X earnings and are already priced for recession.

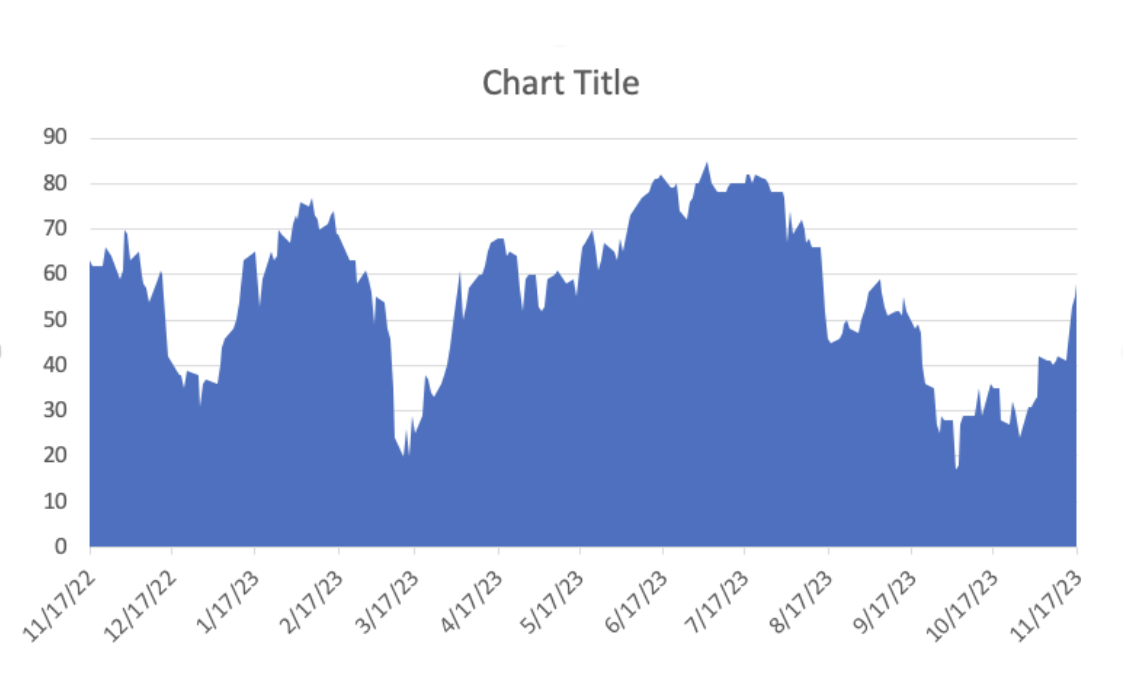

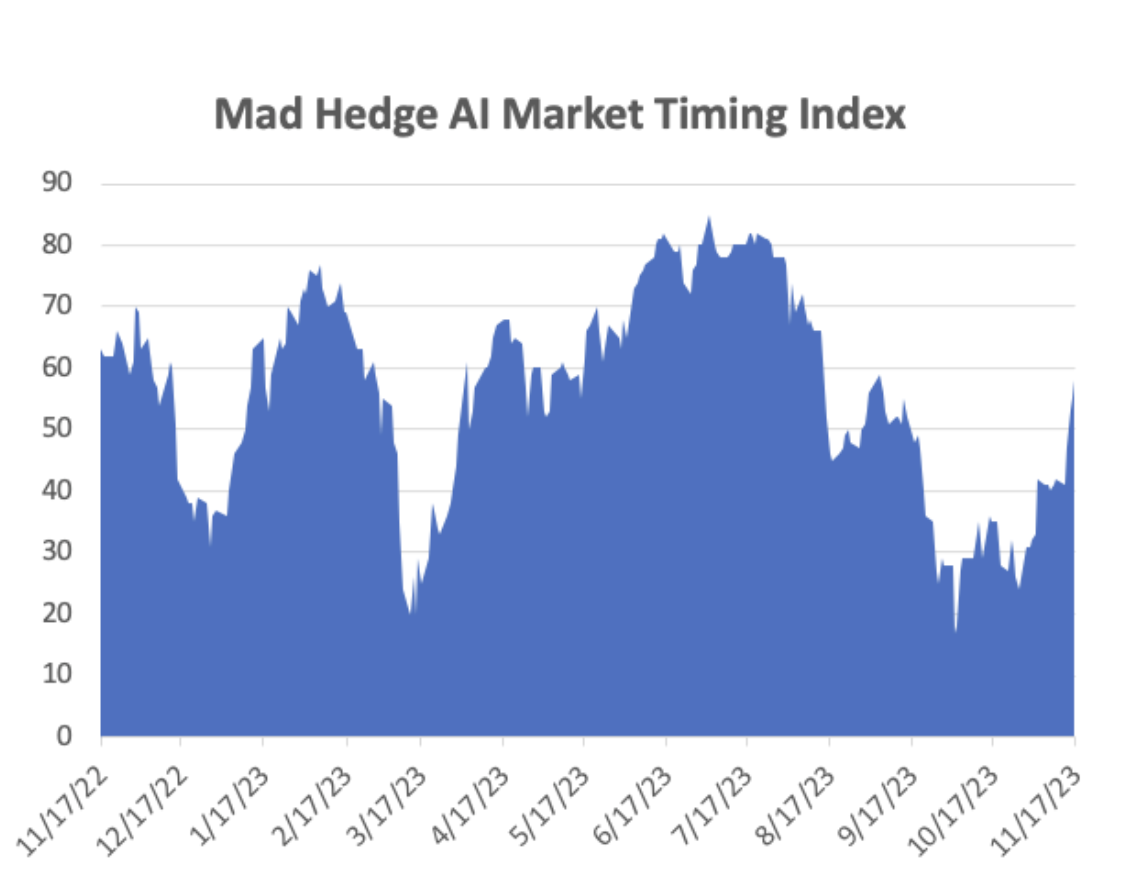

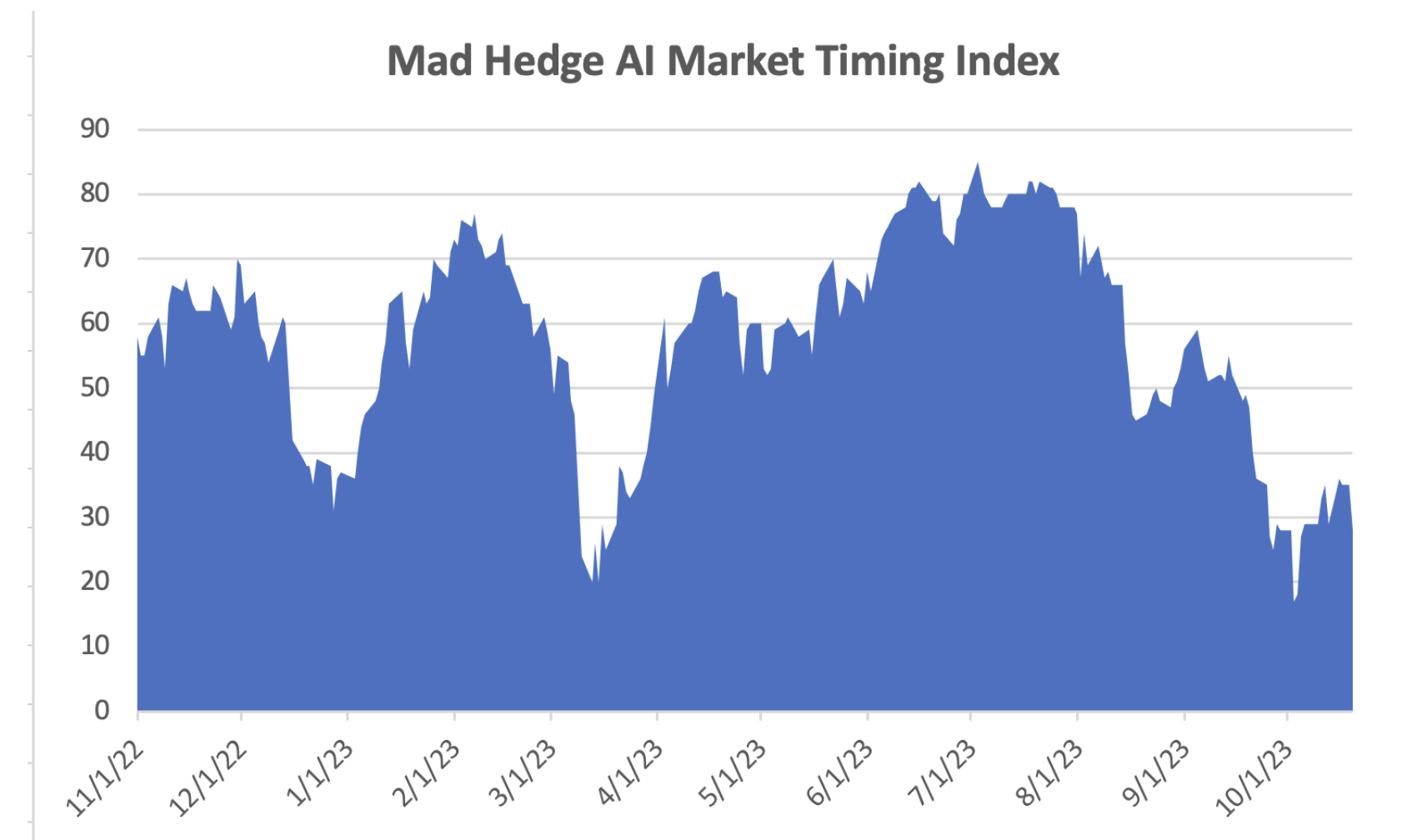

So a strong case for a new decade-long bull market is there. All you have to do is believe it. To see how this will play out look at the chart below as tech stocks are now extremely overbought short term. We no longer have the luxury of waiting for big dips. Small ones will have to do.

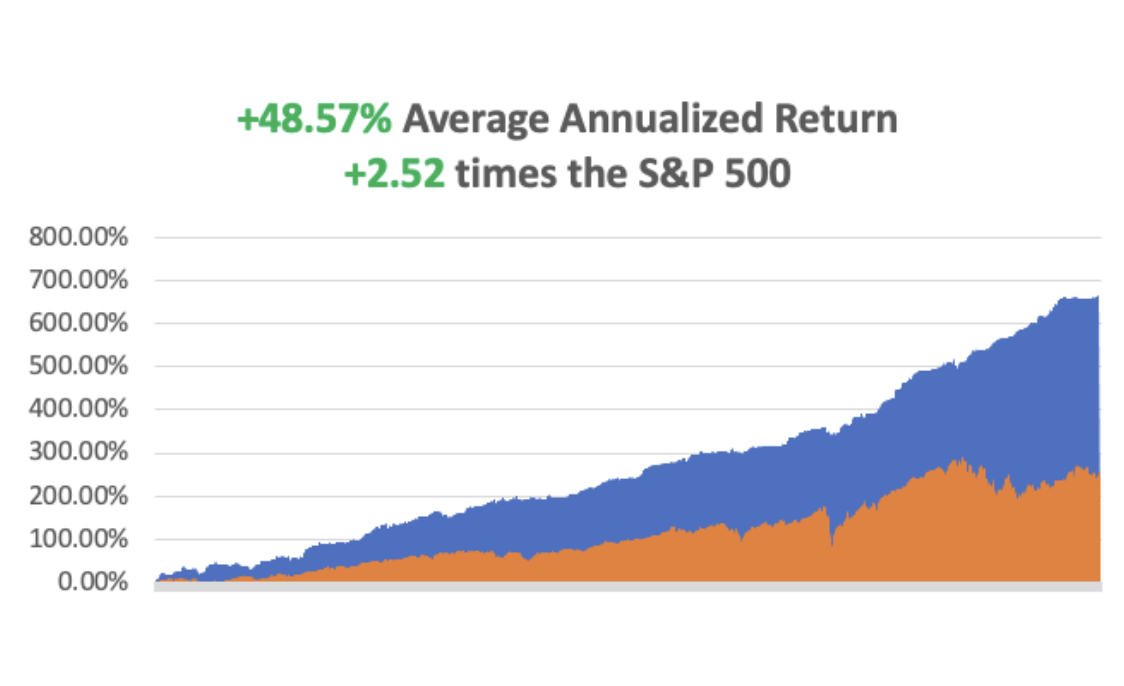

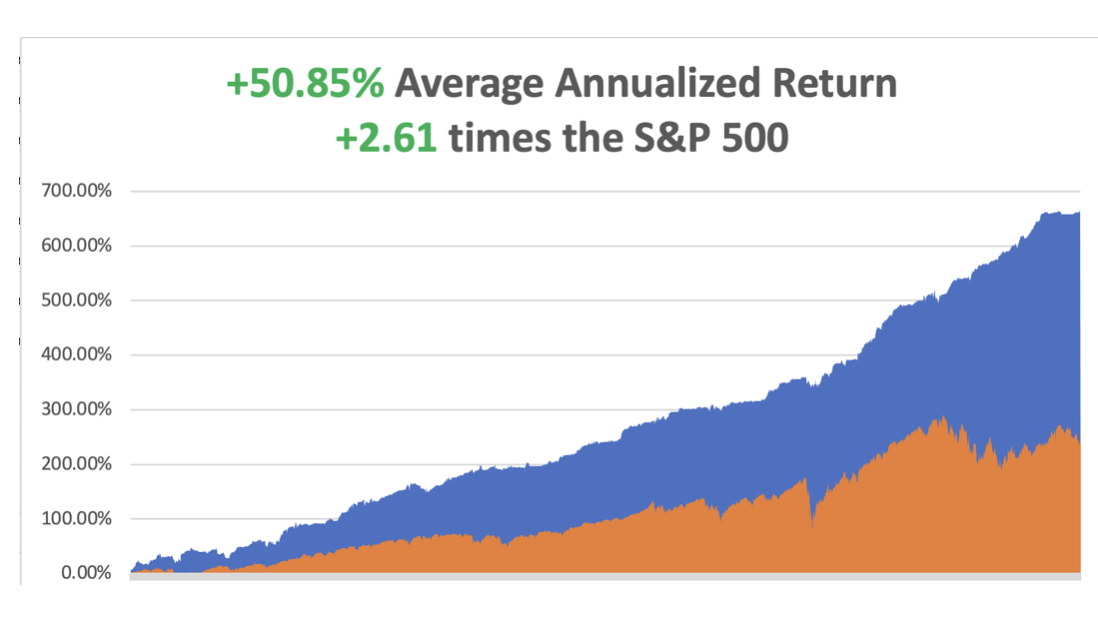

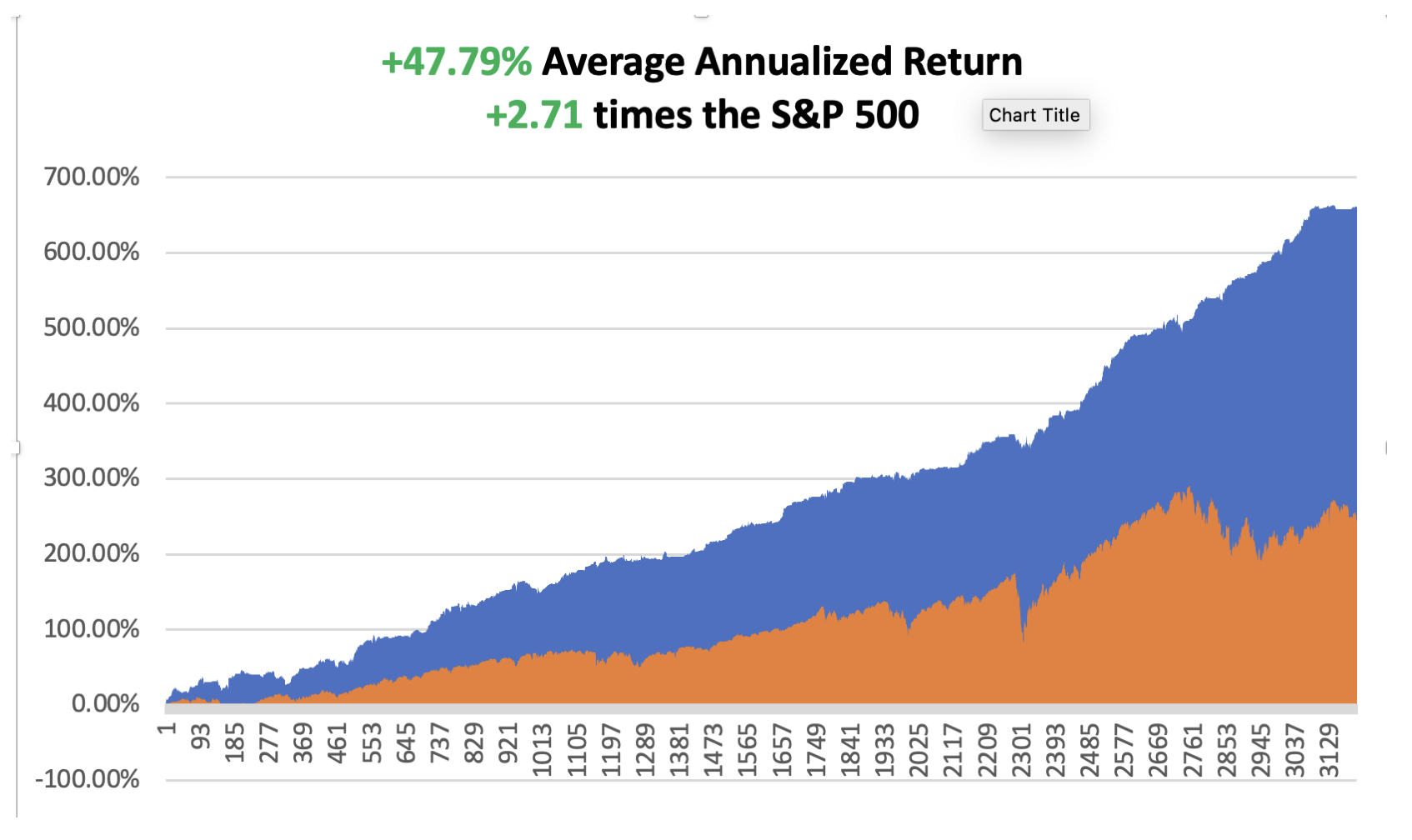

So far in November, we are up a breathtaking +12.59%. My 2023 year-to-date performance is still at an eye-popping +78.76%. The S&P 500 (SPY) is up +18.42% so far in 2023. My trailing one-year return reached +85.42% versus +20% for the S&P 500.

That brings my 15-year total return to +675.95%. My average annualized return ballooned to +48.57%, another new high, some 2.52 times the S&P 500 over the same period.

Some 60 of my 65 trades this year have been profitable.

CPI Comes in Flat at 3.2%, much weaker than expected. This is a game-changer. The first Fed rate cut has been moved up to May. Stocks and bonds loved it, taking ten-year US Treasury yield down to a six-week low at 4.44%. Shelter prices, which make up about a third of the overall CPI index, climbed 0.3%, half the prior month’s pace. Taking profits on my long in (TLT).

Fed to Cut Interest Rates as Early as March, or so says the futures market, which gives this a 40% probability. The (TLT) should top $100 and stocks will rocket, especially the interest sensitives. The most recent indications on the CME Group’s FedWatch gauge point to a full percentage point of interest rate cuts by the end of 2024.

Weekly Jobless Claims Hit Three Month High, up 13,000 to 231,000, as the US economy backs off from the superheated Q3. The path for a lower inflation rate is opening up. Do I hear 2%.

PPI Fell by 0.5% in October, a much bigger than expected drop, a three-year low. Inflation is fading fast. YOY came in at 1.3%. Stocks loved the news. 2024 is shaping up to be a great year for risk after two miserable ones.

Government Shutdown Delayed Until 2024, with the passage of a temporary spending bill by the House. It looks like there is a new coalition of the middle of both parties, as the bill passed with 339 votes, topping a two-thirds majority. The Johnson bill would fund some parts of the government through Jan. 19 and others through Feb. 2, setting up the possibility of yet another shutdown deadline on Groundhog Day.

The US Dollar (UUP) Takes a hit as the falling interest rate scenario starts to unfold. Even the Japanese yen rose. This could be a new decade-long trade. Currencies with falling interest rates are always the weakest.

Goldman Sachs Goes Bullish on Gold. The investment bank expects the S&P GSCI, a commodities markets index, to deliver a 21% return over the next 12 months as the broader economic environment improves, OPEC moves to support crude prices as refining is tight and with energy and gold acting as hedges against supply shocks. Buy (GLD), (GDX), and (GOLD) on dips.

Copper Bull Predicts 80% Gain in the Coming Decade, to $15,000 per metric tonne, up from $8,277 says Trafigura’s Kotas Bintas, the world’s largest metal trader. Exploding demand from EV makers is the reason, set to hit 20 million vehicles a year. Electrification of global energy sources is another. Buy (FCX) on dips.

Boeing Lands Monster Order, some $52 billion from Emirates Airlines for 90 new 777x’s and five 787’s. The stock rose 5% on the news. A giant China order is also lurking in the wings. Buy (BA) on dips.

Moody’s Rating Service Downgrades the US, citing deteriorating fiscal conditions and worsening chaos in Washington. However, it maintained its AAA Rating. Oh, and the government shut down on Friday. Buy (TLT) on the dip. Where else are investors going to go for quality?

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, November 20, no data of note were published.

On Tuesday, November 21 at 11:00 AM EST, the Minutes from the previous Fed meeting are released.

On Wednesday, November 22 at 8:30 AM, the Durable Goods are published.

On Thursday, November 23 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, November 24 at 2:30 PM the November S&P Flash PMI’s are published and the Baker Hughes Rig Count is printed.

As for me, I was invited to breakfast last week at the Incline Village Hyatt Hotel and was told to expect someone special, but they couldn’t tell me who for security reasons.

I was nursing a strong black coffee when a bulky figure with white hair wearing a Hawaiian shirt and thermal vest sat down at the table. It was Mike Love, lead singer of the Beach Boys.

During the 1950s, Mike’s dad was a regular visitor to Lake Tahoe, bringing his family up to camp on the then-vacant beaches. My family couldn’t have been far away.

When Mike made his fortune with one of the top rock groups of the 1960s, the natural thing to do was to buy an estate high up the mountain in Incline Village, Nevada with a great lake view. Like me, Mike fell for crystal-clear lake views in summer and spectacular snow-covered mountain vistas in winter. Local real estate agents refer to it as a “poor man’s Aspen.”

Mike ended up raising a family here, his kids eventually growing up and heading out to start their music groups. One was Wilson Phillips, made up of two of Mike’s daughters and the daughter of John Phillips of the Mamas and the Papas, who I taught how to swim at summer camp one year.

But Mike stayed. He loved the lake too much to leave so he made Incline his base for a touring schedule that ran up to a punishing 200 gigs a year.

Mike’s residence was something of a Tahoe insider’s secret. Those who knew where he lived kept the closely guarded secret. We have plenty of celebrities here, Larry Ellison, Mike Milliken, and Peoplesoft’s David Duffield, but Mike is the one everyone loves.

Mike, now 82, is not your typical rock star and I have known many. He is humble, self-effacing, and an alright guy. He avoided drugs and smoking to preserve his voice. He is a health fanatic. He has also been fighting a lifelong battle with depression which kept him off the touring circuit for years at a time and led to contemplations of suicide.

The Beach Boys formed in Hawthorne, California, a beachside suburb of Los Angeles in 1961. The group's original lineup consisted of brothers Brian, Dennis, and Carl Wilson, their cousin Mike Love, and friend Al Jardine. They were the original garage band. Together they created one of the greatest vocal harmonies of all time.

In 1963, the band enjoyed their first national hit with “Surfin USA”, beginning a string of top ten singles that reflected a southern California youth culture of surfing, cars, and teenage romance dubbed the “California sound.”

Those included "I Get Around", "Fun, Fun, Fun", "Help Me Rhonda", "Good Vibrations" and "Don't Worry Baby, which I’m sure you remember well. If you don’t, look them up on iTunes. Their 1966 album “Pet Sounds” was considered one of the most innovative ever produced.

I remember it like it was yesterday. They were one of the few groups that could stand up to the Beatles, who they became friends with. The Beach Boys were regulars on my car’s AM radio.

Buzz kill: the Beach Boys didn’t know how to surf.

All of the early Beach Boys songs were inspired by the Southern California beaches, but only half the country had beaches. So a new manager encouraged them to sing about cars, extending the life of the group by another decade. That is how we got “Little Deuce Coup,” and “409.” After all, the entire country owned cars.

The Beach Boys would eventually sell 100 million records second only to the Beatles. They were also one of the first groups to wrest production control away from the studios, a revolution for the industry that opened doors for generations of successive musicians.

In the late 1960s, the group took a religious bent, traveling to India to study under the celebrity guru Maharishi Mahesh Yogi. Mike has since been practicing transcendental meditation, and it probably saved his life.

By the 1970s, the California sound faded and was eventually killed off by disco. Their last album together was Endless Summer in 1974.

There are only three original Beach Boys left, and Mike Love alone is still touring. In 1983, Dennis Wilson drowned in a boating accident which is thought to be drug-related. In 1998, Carl Wilson died of lung and brain cancer after years of heavy smoking.

Mike was pleased that I recalled his 1980 London concert at Wembley Stadium. I had front-row seats; unaware that I would meet Mike 43 years later. In 1988, Mike was inducted into the Rock and Roll Hall of Fame.

Mike was very annoyed by the pandemic shutdown in 2020 because it prompted the cancelation of over 200 concerts worldwide. He still thinks Covid was fake. He doesn’t need to work as his royalties from 60 years of work are worth a fortune. He tours simply for the love of it.

Mike is now touring with a reconstituted Beach Boys. For their tour schedule, please click here. On November 17, 2023, Love released a special double album entitled “Unleash the Love” featuring 13 previously unreleased songs and 14 Beach Boys classics.

It was a pleasant way to spend a morning recalling the 1960s. It’s a miracle we both survived. It’s all proof that if you live long enough, you meet everyone.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader