We’ve just seen our last interest rate rise in the economic cycle. Yes, I know that our central bank took no action at their last meeting in September. The market has just done its work for it.

And the markets are no shrinking violet when it comes to taking bold action. The 50 basis points it took bond yields up over the last two weeks is far more than even the most aggressive, economy-wrecking, stock market-destroying Fed was even considering.

And that doesn’t even include the rate hikes no one can see, the deflationary effects of quantitative tightening, or QT. That is the $1 trillion a year the Fed is sucking out of the economy with its massive bond sales.

It really is a miracle that the US economy is growing as fast as it is. After a warm 2.4% growth rate in Q2, Q3 looks to come in at a blistering 4%-5%. That is definitely NOT what recessions are made of.

Where is all this growth coming from?

Some of the credit goes to the pandemic spending, the free handouts we call got to avoid starvation while Covid ravaged the country. You probably don’t know this, but nothing happens fast in Washington. Government spending is an extremely slow and tedious affair.

By the time that contracts are announced, bids awarded, permits obtained, men hired, and the money spent, years have passed. That means money approved by Congress way back in 2020 is just hitting the economy now.

But that is not the only reason. There is also the long-term structural push that is a constant tailwind for investors:

Hyper-accelerating technology.

Yes, I know, there goes John Thomas spouting off about technology again. But it is a really big deal.

I have noticed that the farther away you get from Silicon Valley, the more clueless money managers are about technology. You can pick up more stock tips waiting in line at a Starbucks in Palo Alto than you can read a year’s worth of research on Wall Street.

What this means is that most large money managers, who are based on the east coast are constantly chasing the train that is leaving the station when it comes to tech.

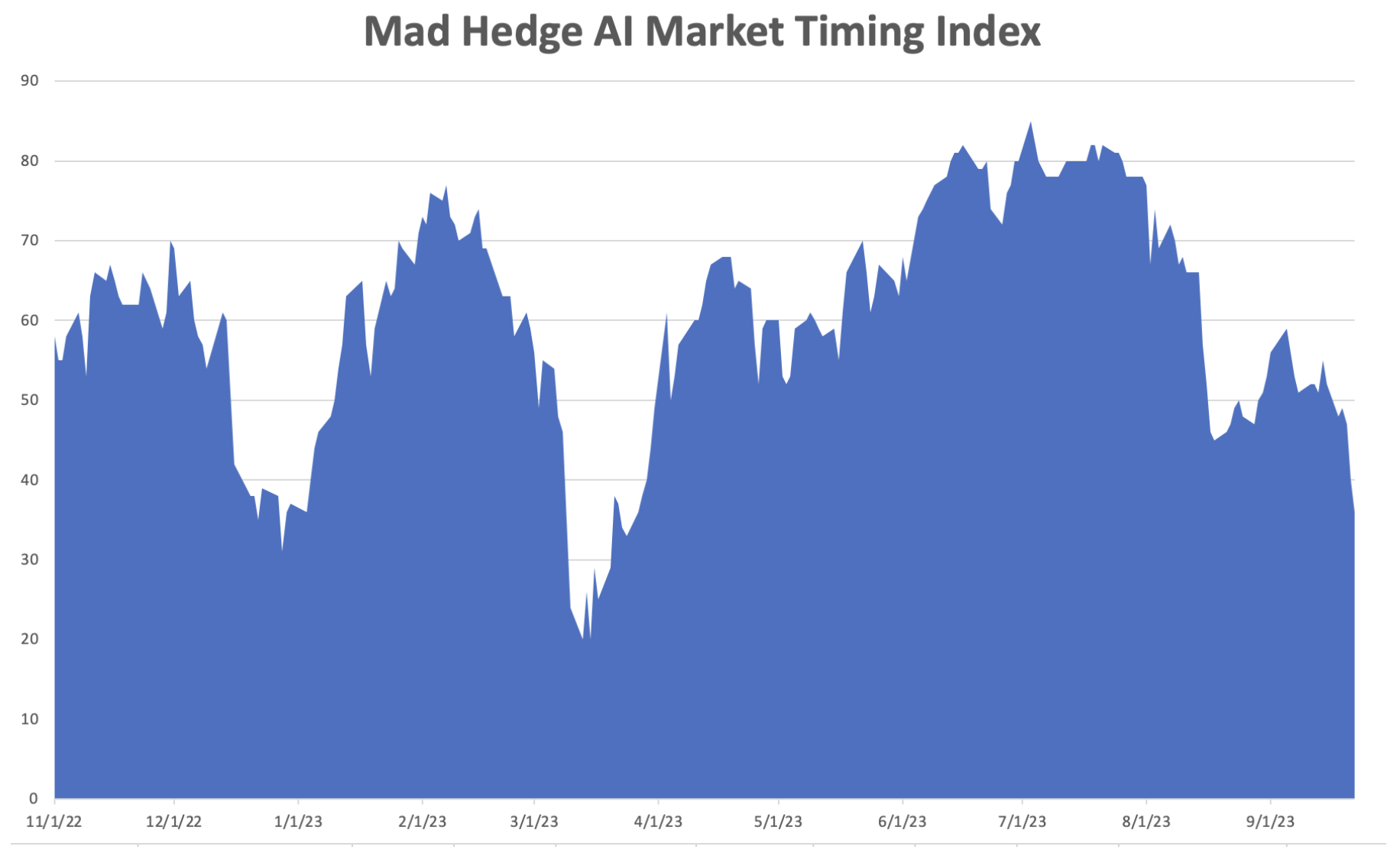

On the west coast, managers not only know about the new tech, but the tech that comes after that and another tech that comes after that, if they are not already insiders in the current hot deal. This is how artificial intelligence stole a march on almost everyone, until a year ago, unless you were on the west coast already working in the industry. Mad Hedge has been using AI for 11 years.

You may be asking, “What does all of this mean for my pocketbook?” a perfectly valid question. It means that there isn’t going to be a recession, just a recession scare. That technology will bail us out again, even though our old BFF, the Fed, has abandoned us completely.

Which brings me to the current level of interest rates. I have also noticed that the farther away you get from New York and Washington, the less people know about bonds. On the west coast mention the word “bond” and they stare at you cluelessly. Indeed, I spent much of this year explaining the magic of the discount 90-day T-bill, which no one had ever heard of before (What! They pay interest daily?).

In fact, most big technology companies have positive cash balances. Look no further than Apple’s $140 billion cash hoard, which is invested in, you guessed it, 90-day T-bills when it isn’t buying its own stock, and is earning a staggering $7.7 billion a year in interest.

The great commonality in the recent stock market correction is easy to see. Any company that borrows a lot of money saw its stock get slaughtered. Technology stocks held up surprisingly well. That sets up your 2024 portfolio.

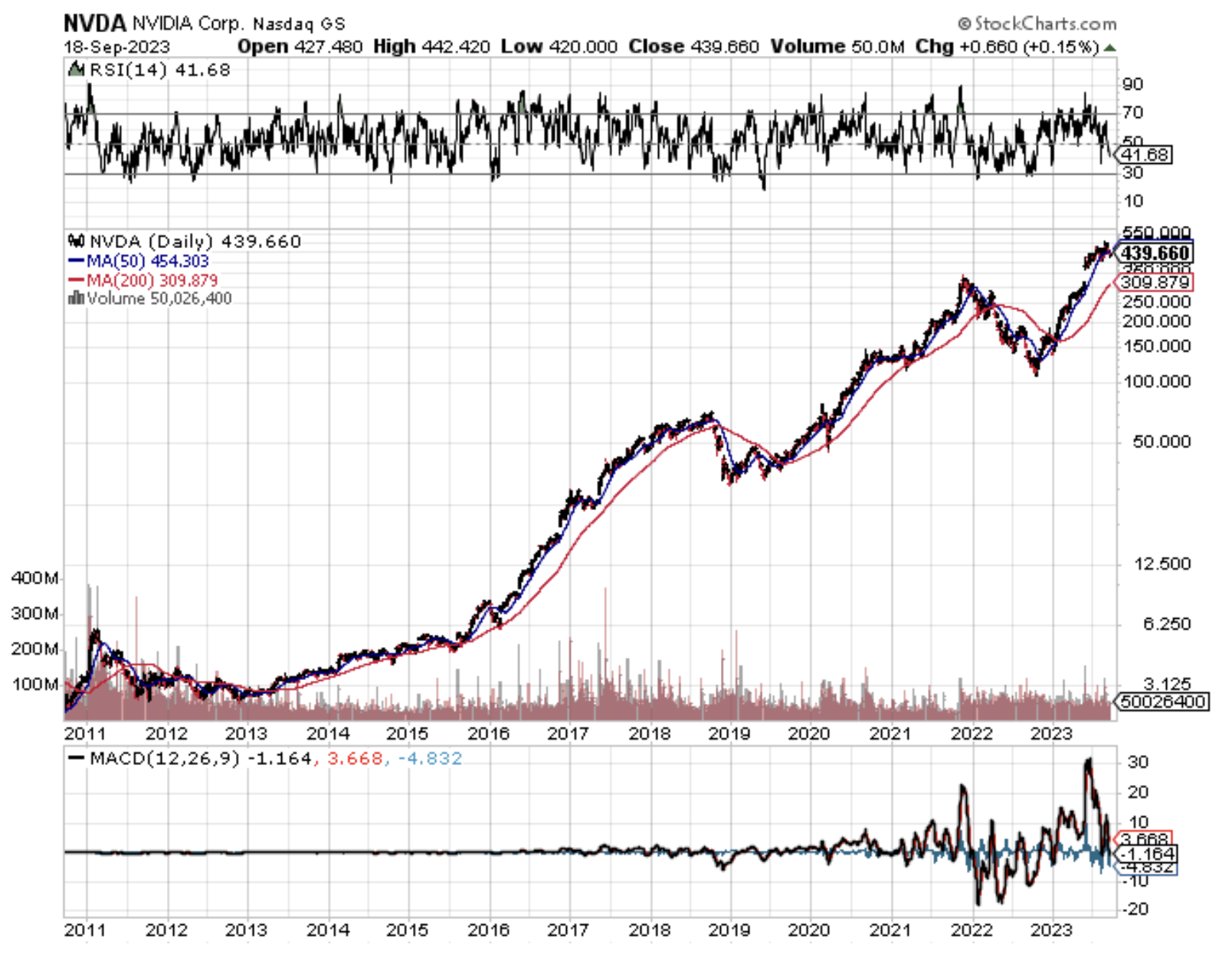

Put half your money in the Magnificent Seven stocks of Apple (AAPL), Amazon (AMZN), Meta (META), Microsoft (MSFT), Tesla (TSLA), (NVIDIA), and Salesforce (CRM).

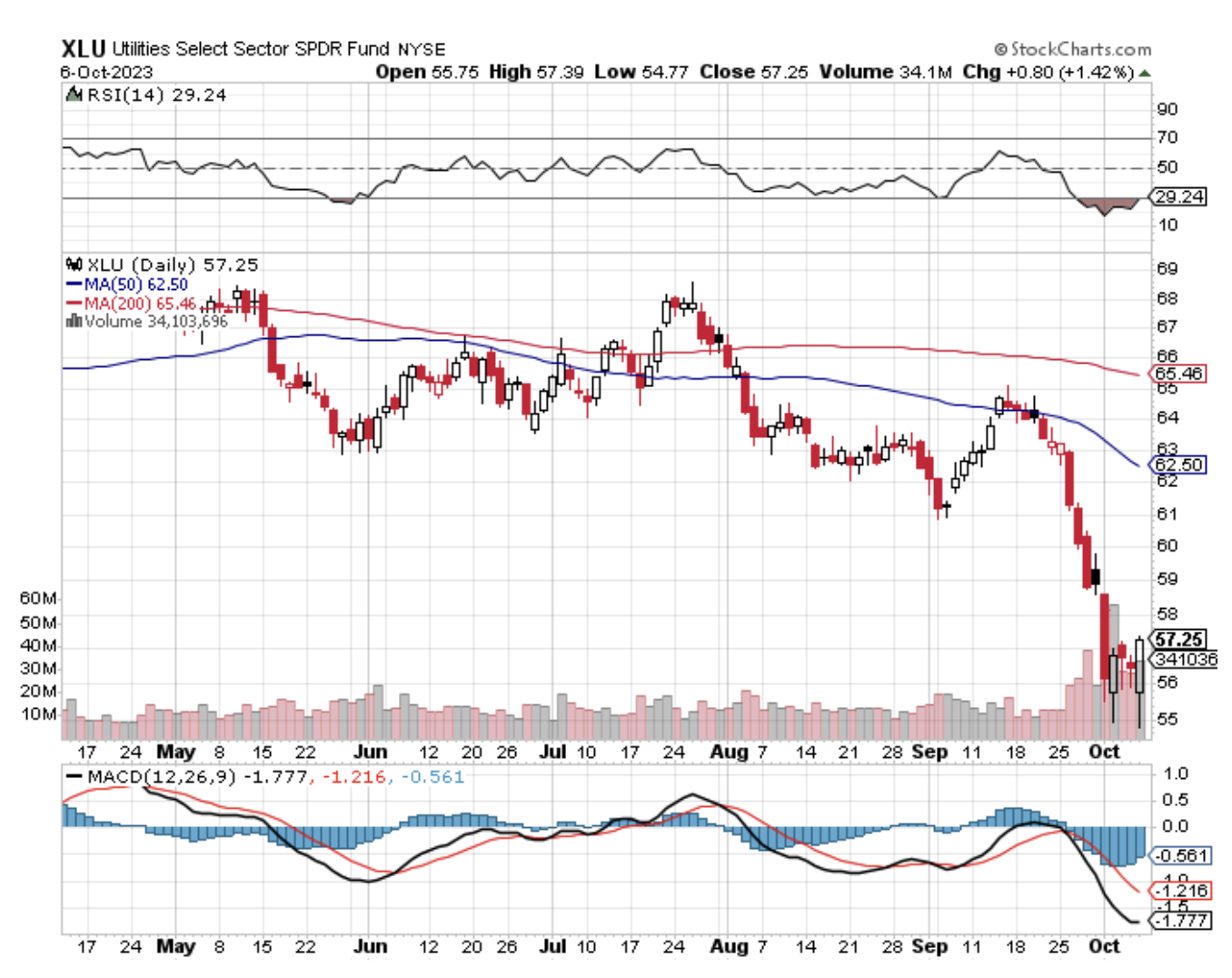

Put your other half into heavy borrowers that benefit from FALLING interest rates, including bonds (TLT), junk bonds (JNK), (HYG), Utilities (XLU), precious metals (GOLD), (WPM), copper (FCX), foreign currencies (FXA), (FXE), (FXY), emerging markets (EEM).

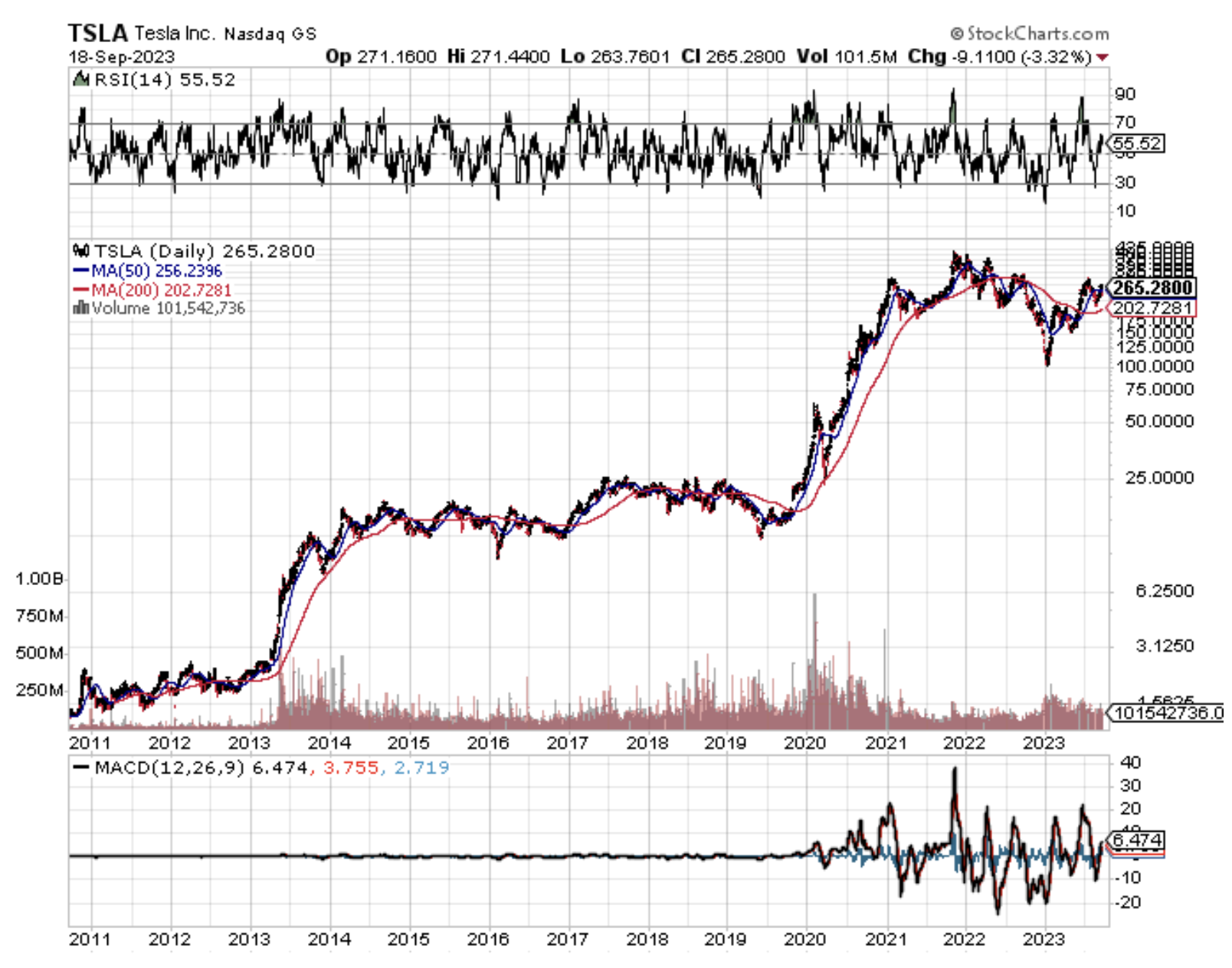

As for me, I never do anything by halves. I’m putting all my money into Tesla. If I want to diversify, I’ll buy NVIDIA. Diversification is only for people who don’t know what is going to happen.

I just thought you’d like to know.

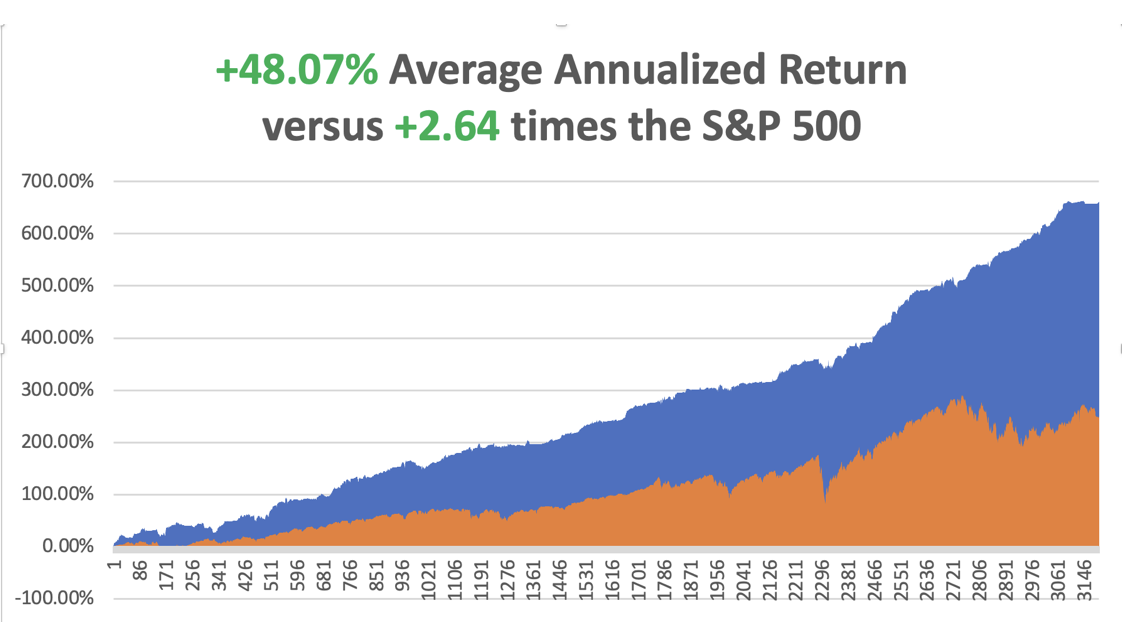

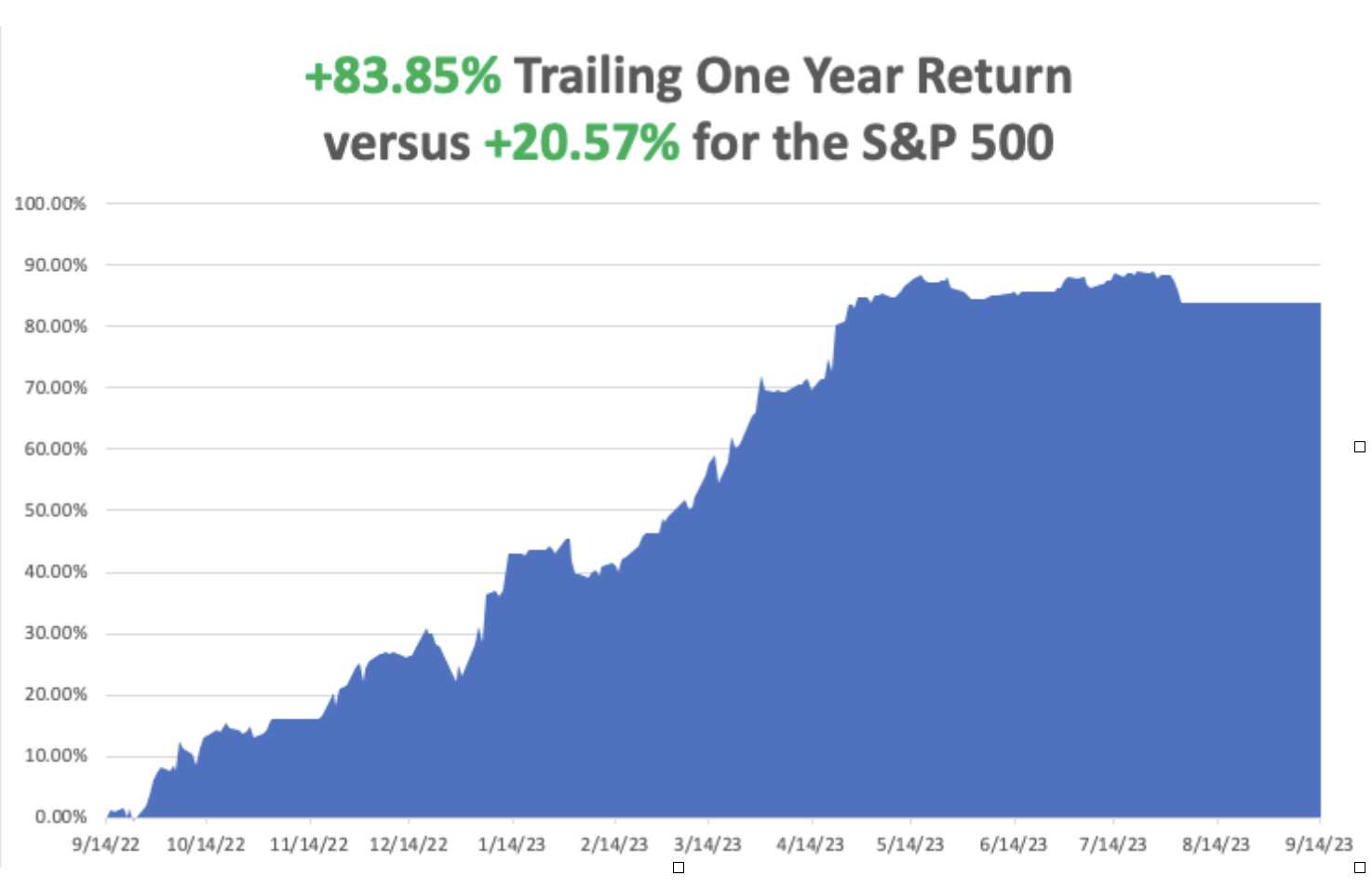

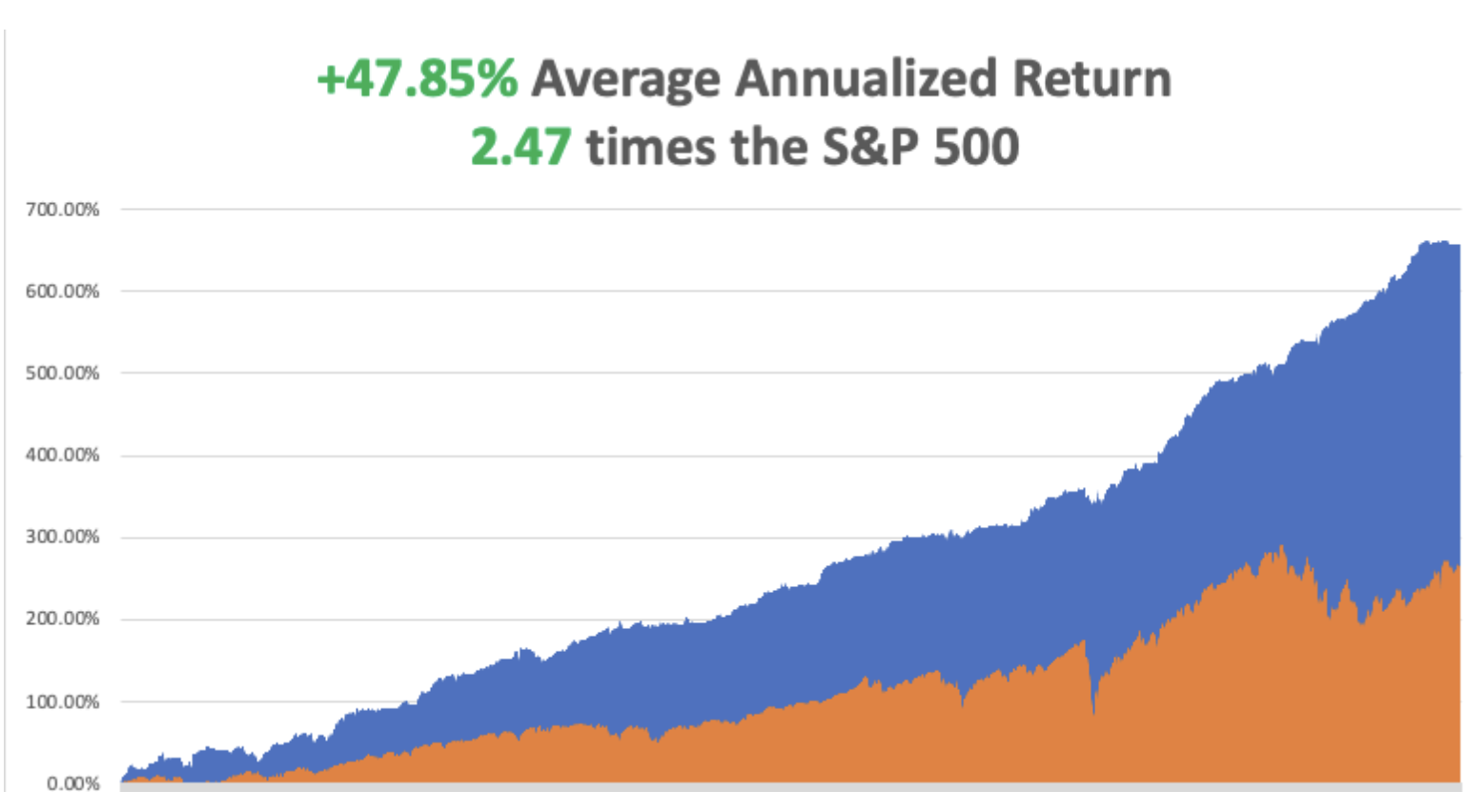

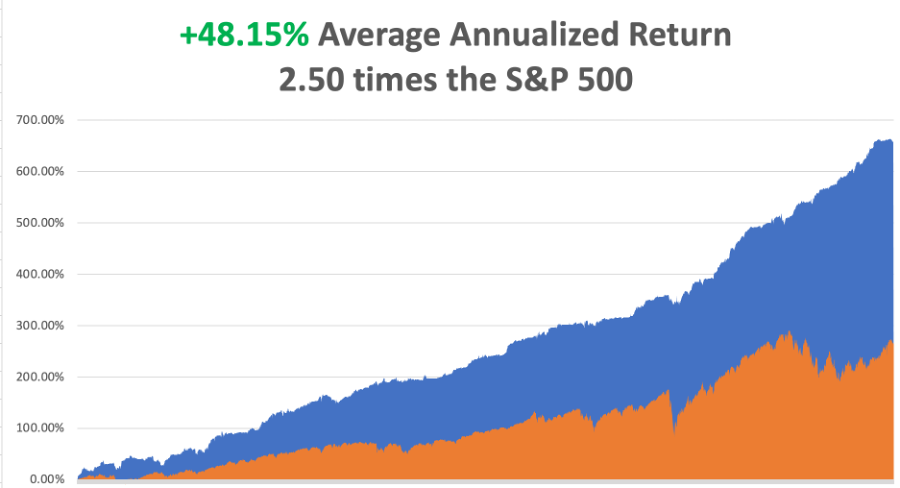

So far in October, we are up +2.96%. My 2023 year-to-date performance is still at an eye-popping +63.76%. The S&P 500 (SPY) is up +12.89% so far in 2023. My trailing one-year return reached +76.46% versus +22.57% for the S&P 500.

That brings my 15-year total return to +660.95%. My average annualized return has fallen back to +48.07%, another new high, some 2.64 times the S&P 500 over the same period.

Some 44 of my 49 trades this year have been profitable.

Chaos Reigns Supreme in Washington, with the firing of the first House speaker in history. Will the next budget agreement take place on November 17, or not until we get a new Congress in January 2025? Markets are discounting the worst-case scenario, with government debt in free fall. Definitely NOT good for stocks, which are reaching for a full 10% correction, half of 2023’s gains.

September Nonfarm Payroll Report Rockets, to 336,000, and August was bumped up another 50,000. The economy remains on fire. The headline Unemployment Rate remains steady at an unbelievable 3.8%. And that’s with the UAW strike sucking workers out of the system. This is supposed to by impossible with 5.5% interest rates. Throw out you economics books for this one!

JOLTS Comes in Hot at 9.61 million job openings in August, 700,000 more than the July report. The record labor shortage continues. Will the Friday Nonfarm Payroll Report deliver the same?

ADP Rises 89,000 in September, down sharply from previous months, showing that private job growth is growing slower than expected. August was revised down. It’s part of the trifecta of jobs data for the new month. The mild recession scenario is back on the table, at least stocks think so.

Weekly Jobless Claims Rise to 207,000, still unspeakably strong for this point in the economic cycle. Continuing claims were unchanged at 1.664%.

Traders Pile on to Strong Dollar, headed for new highs, propelled by rising interest rates. There is a heck of a short setting up for next year.

Yen Soars on suspected Bank of Japan intervention in the foreign exchange markets to defend the 150 line against the US dollar. The currency is down 35% in three years and could be the BUY of the century.

Kaiser Goes on Strike with 75,000 health care workers walking out on the west coast. The issue is money. The company has a long history of labor problems. This seems to be the year of the strike.

Oil (USO)Gets Slammed on Recession Fears, down 5% on the day to $85, in a clear demand destruction move and worsening macroeconomic picture. Europe and China are already in recession. It’s the biggest one-day drop in a year. Is the top in?

Tesla Delivers 435,059 Vehicles in September, down 5% from forecast, but the stock rose anyway. The Cybertruck launch is imminent, where the company has 2 million new orders. Keep buying (TSLA) on Dips. Technology is accelerating.

EVs have Captured an Amazing 8% of the New Car Market. They have been helped by a never-ending price war and generous government subsidies. EV sales are now up a miraculous 48% YOY and are projected to account for a stunning 23% of all California sales in Q3. Tesla is the overwhelming leader with a 52% share in a rapidly growing market, distantly followed by Ford (F) at 7% and Jeep at 5%. However, a slowdown may be at hand, with EV inventories running at 97 days, double that of conventional ICE cars. This could create a rare entry point for what will be the leading industry of this decade, if not the century. Buy more Tesla (TSLA) on bigger dips, if we get them.

Apple Upgrades New iPhone 15 to deal with overheating from third-party gaming. It will shut down some of its background activity, including some of the new AI functions, which were stressing the central processor. Third-party apps were adding to the problem, such as Uber and games from (META). This is really cutting-edge technology.

Moderna (MRNA) Bags a Nobel Prize in Chemistry. Katalin Kariko and Drew Weissman’s work helped pioneer the technology that enabled Moderna and the Pfizer Inc.-BioNTech SE partnership to swiftly develop shots. I got four and they saved my life when I caught Covid. I survived but lost 20 pounds in two weeks. It was worth it.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, October 9, there is no data of note released.

On Tuesday, October 10 at 8:30 AM EST, the Consumer Inflation Expectations is released.

On Wednesday, October 11 at 2:30 PM, the Producer Price Index is published.

On Thursday, October 12 at 8:30 AM, the Weekly Jobless Claims are announced. The Consumer Price Index is also released.

On Friday, October 13 at 1:00 PM the September University of Michigan Consumer Expectations is published. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, one of the many benefits of being married to a British Airways senior stewardess is that you get to visit some pretty obscure parts of the world. In the 1970s, that meant going first class for free with an open bar, and occasionally time in the cockpit jump seat.

To extend our 1977 honeymoon, Kyoko agreed to an extra round trip for BA from Hong Kong to Colombo in Sri Lanka. That left me on my own for a week in the former British crown colony of Ceylon.

I rented an antiquated left-hand drive stick shift Vauxhall and drove around the island nation counterclockwise. I only drove during the day in army convoys to avoid terrorist attacks from the Tamil Tigers. The scenery included endless verdant tea fields, pristine beaches, and wild elephants and monkeys.

My eventual destination was the 1,500-year-old Sigiriya Rock Fort in the middle of the island which stood 600 feet above the surrounding jungle. I was nearly at the top when I thought I found a shortcut. I jumped over a wall and suddenly found myself up to my armpits in fresh bat shit.

That cut my visit short, and I headed for a nearby river to wash off. But the smell stayed with me for weeks.

Before Kyoko took off for Hong Kong in her Vickers Viscount, she asked me if she should bring anything back. I heard that McDonald’s had just opened a stand there, so I asked her to bring back two Big Macs.

She dutifully showed up in the hotel restaurant the following week with the telltale paper bag in hand. I gave them to the waiter and asked him to heat them up for lunch. He returned shortly with the burgers on plates surrounded by some elaborate garnish and colorful vegetables. It was a real work of art.

Suddenly, every hand in the restaurant shot up. They all wanted to order the same thing, even though the nearest stand was 2,494 miles away.

We continued our round-the-world honeymoon to a beach vacation in the Seychelles where we just missed a coup d’état, a safari in Kenya, apartheid South Africa, London, San Francisco, and finally back to Tokyo. It was the honeymoon of a lifetime.

Kyoko passed away in 2002 from breast cancer at the age of 50, well before her time.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Sigiriya Rock Fort

Kyoko