Global Market Comments

March 6, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A WEEK WITH JOHN THOMAS)

(SPY), (TLT), (TSLA), (NVDA), (WEAT)

CLICK HERE to download today's position sheet.

Global Market Comments

March 6, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A WEEK WITH JOHN THOMAS)

(SPY), (TLT), (TSLA), (NVDA), (WEAT)

CLICK HERE to download today's position sheet.

In 1942, after the First Marine Division won the battle of Guadalcanal and my Uncle Mitch won his Medal of Honor, they were shipped to Melbourne, Australia for six months of rest and relaxation.

Since their uniforms were in rags and many men were barefoot, they were handed scratchy WWI surplus wool uniforms. That’s all the Aussies had, as their army was off fighting Rommel in North Africa.

All 8,000 men lived in the Melbourne Cricket Ground, and the government delivered a truckload of beer barrels every day. Whenever the men went outside, they were invited by local families off the street to have dinner. After four months, they were fat and happy.

Then one day, they were placed on a train with full battle gear, taken 50 miles out of town, and told to walk back with no food and a canteen of water. They were retraining for the next battle, which would be in New Guinea.

When economic data flip-flops, so does the market.

The red-hot January Nonfarm Report with the Unemployment Rate at a 50-year low of 3.5% gave the bulls every reason to buy stock. So stocks can’t fall.

But a strong jobs market means the Fed will keep interest rates higher for longer gives plenty of fodder for the bears. So stocks can’t rise.

My Mad Hedge Market Timing Index is equally confused at 55. You can’t get any closer to 50, which means you should do absolutely nothing.

Notice that the S&P 500 (SPY) bounced off the 200-day moving average at $390.95 to the penny and rallied, a perfect symptom of this disease. When the fundamentals are confused, technicals win.

At this late age, the only one I take orders from is named Mr. Market. Ignore his instructions at your own peril and expense. Everyone else can get lost.

That leaves us nothing to do but to wait for the next events of market consequence, the March 14 CPI and the December 22 Fed interest rate decision. We might as well twiddle our thumbs and watch the clock until then.

So I will stick to my market-neutral strategy as long as I must take in enough money to keep the lights on. I keep doing this knowing full well that the last time I do will lose money.

This could go on for months.

In the meantime, I will keep researching the long term, which continues to look better and better. The dross ends in months. It’s the next decade we need to focus on now.

It's time to polish our armor, sharpen our weapons, and get back in shape, just as the First Marine Division did 81 years ago.

Remember that we are in the “what’s next” business. Whatever you buy now has to be discounting the following coming trends:

Falling interest rates

A weak dollar

Rising commodity prices

Rising energy prices

Reaccelerating tech earnings

A new boom in real estate

Precious metals going to record highs

Strong emerging markets

A Ukraine win leading to global peace

America’s principal adversary is rendered impotent

A second peace dividend ensues

Every trade alert I send you this year will be taking of one or more of these trends. It’s just a matter of time before they begin if they haven’t already.

We had a really great last two days of February, pushing me back in the green for February, taking me up +3.41% on the month. March has so far come in at +0.80%.

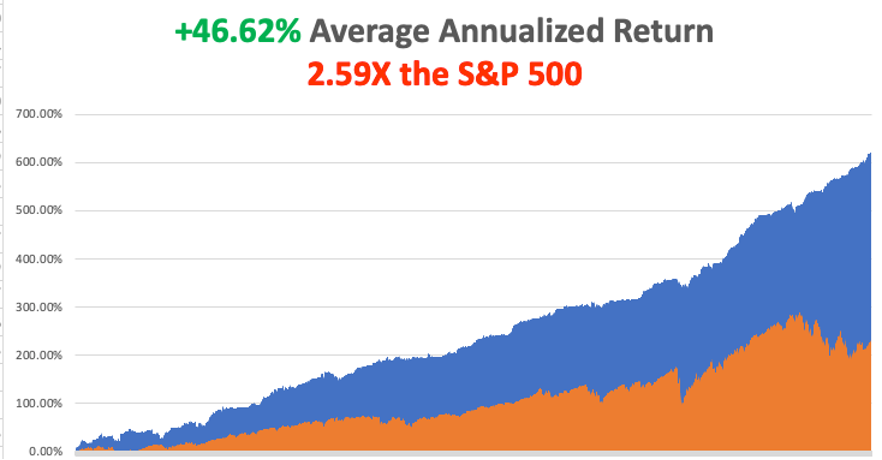

My 2023 year-to-date performance is still at the top at +26.56%. The S&P 500 (SPY) is up +6.36% so far in 2023. My trailing one-year return maintains a sky-high +85.51% versus -5.66% for the S&P 500.

That brings my 15-year total return to +623.75%, some 2.72 times the S&P 500 (SPX) over the same period. My average annualized return has recovered to +47.37%, still the highest in the industry.

Nothing Happens Until March 14, at 8:30 AM EST when the next big inflation read, the Core CPI comes out. It’s all about inflation right now. Look for a flat line until then. That’s why it’s a good time to run short strangles and own lots of cash. A dollar at a market bottom is worth $10 at a market top.

S&P Case Shiller Gains 5.7% in December, YOY according to its National Home Price Index. That’s a quarter of the gains seen a year ago. Miami (15.9%), Tampa (13.9%), and Atlanta (10.4%) showed the biggest gains. High mortgage interest rates are still a big drag and will continue for another six months.

Pending Home Sales Soar 8.7% in January on a signed contract basis. It is the second straight month of gains and the biggest in 2 ½ years. See what a 1.5% drop in mortgage rates can do? While rates are back up now it shows how much demand is building up in the residential real estate market. I think this market explodes to the upside by yearend.

Mortgage Rates Jump to 6.65%, snuffing out the green shoots that briefly appeared in January. Mortgages are still maintaining an unprecedented 200 basis point premium to 30-year Treasury bond rates, which should disappear by yearend. The seeds of the next housing boom are germinating.

Tesla Tanks Semiconductor Shares, after Elon Musk announced that he plans to cut silicon carbide chips by 75%. Improved new designs will also slash the number of chips needed for EVs, whose supply and prices are notoriously volatile. New chip designs will appear in the $25,000 model 2 due out in 2025.

Ark’s Dirty Little Secret. Cathy Woods’ ARK Innovation Fund (ARKK) is one of the top-performing funds so far in 2023, up 24%. But strip out the performance of Tesla (TSLA) and the five-year return has been precisely zero. Good thing (TSLA) is up 110% this year. Maybe its cheaper just to buy (TSLA) and skip the dross and high management fees at Ark? Elon Musk thinks it’s going to $1,000 a share and so do I. Oh, and they just dropped the price of their top end Model X by $20,000.

Stellantis (STLA) Buys a Copper Mine, taking a 14.2% stake in Argentina’s McEwen Copper mine. Gee, do you think the owner of the Chrysler brand is going into EVs? They also laid off 2,000 because with 80% fewer parts EVs require far less workers. Buy Copper and Freeport McMoRan (FCX) on dips. The global copper shortage is imminent.

China Manufacturing PMI Hits 11-Year High, at 52.6 in a surprising comeback from the end of covid lockdowns. The news hit the bond market, worried about rising inflation prospects. Supply chain problems in the US should ease as a result.

Wheat Prices Crash, seeing a 6% dive in February. What always follows a food shortage? A food glut, as farmers overplant to cash in on generous government subsidies, creating a bumper crop. It’s only a 100-year cycle. Prices will stay low as long as Ukraine can keep exporting.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, March 6 at 7:00 AM EST, US Factory Orders are out.

On Tuesday, March 7 January 31 at 7:00 AM EST, the Federal Reserve Governor Jerome Powell testifies in front of congress.

On Wednesday, March 8 at 7:00 AM EST, the JOLTS Job Opening Report is released.

On Thursday, March 9 at 8:30 AM EST, the Weekly Jobless Claims are announced.

On Friday, March 10 at 8:30 AM EST, the Nonfarm Payroll Report for February is released.

As for me, while I was in Hawaii the other week, I took the opportunity to meet up with my old friend, David, who reminded me of the week to end all week 25 years ago.

I first met David at a Tokyo karate dojo in 1974 when he was 16 and his dad was the Associated Press Bureau Chief.

As we were about the same size, Higaona Sensei paired is off as sparing partners. But to fight, David had to take off his glasses. It wasn’t long before I saw my front teeth flying across the room and skittering across the teak floorboards.

I next met David at Morgan Stanley when I was a London director, and he was a junior trader in Tokyo. After that, I took off to start my own hedge fund.

When Morgan ordered him to meet with their traders in Zurich, Switzerland, I saw the perfect excuse for an adventure. Starting in London, we first dropped off our wives for a week of shopping in Paris, flying my twin Cessna 340.

I used my old trick of getting permission to fly over the center of Paris so I could waggle my wings at the tourists as we passed the top of the Eiffel Tower.

In Zurich, I got in a fight with the tower because they ordered me into a parking stand that was still under construction. I left David to his meetings, thus enabling us to bill the entire trip to Morgan Stanley, aviation fuel, five-star hotels, three-star restaurants, and all. If you did that today at (MS) you’d probably get fired.

I then flew off to pick up a couple of cases of first-growth French wines from the owners in Bordeaux to kill time.

When I picked up David the next day, we headed south. It was a clear day, so I thought it might be a good time to visit the Matterhorn summit. As we circled, the day’s successful climbers waved their ice axes. Then it was up the Rhone River Valley, threading an Alpine valley.

When I realized that I couldn’t climb fast enough to escape the valley, I executed a quick Immelman turn. You’re never supposed to do this in a twin because there is a risk of entering a flat spin (watch the Top Gun movie to see what this is).

But I had my British Aerobatics license, my Swiss Alpine license, plenty of speed, and an oversupply of confidence, so I figured we’d be OK. I performed the first half of a loop, then at the top, I flipped the plane 180 degrees, thus righting it and heading in the opposite direction. But I think we singed the rear ends of a few mountain goats on the way.

Needless to say, this caught David’s attention.

When I popped out of the top of the Alps, I was immediately intercepted by a Mirage fighter from the Swiss Air Force. I was now in military air space. He took a few runs at me at just under Mach 1, using me for target practice. Once I was identified he went on off his merry way.

Now I was lost.

All the maneuvering put me too low to intercept any European navigational aids. So we just looked out the window. Eventually, we noticed that to roof tiles of the city below us were red, which meant we had to be over Italy. I correctly identified it as Bolzano. From there I calculated a direct track to the airfield at St. Moritz in Switzerland.

We stayed at the legendary Badrutt’s Palace Hotel. The next day, we took a cable car to the highest peak. While American ski resorts offer cheeseburgers or pizza, Swiss ones have Michelin Three Star Restaurants. We enjoyed the meal of a lifetime.

When the Tokyo stock market crashed, Morgan Stanley let go of most of its Tokyo staff. David landed on his feet, taking over as the head of trading at Lehman Brothers. He later moved on to a hedge fund, cashing in its Lehman stock well before he went under.

David later retired to the North Share of Oahu in Hawaii, and I visit whenever I’m in town. He is very proud of his tropical fruit orchard. When the 50-foot waves crash at nearby Waimea Bay, the ground shakes.

Whenever I see David, he reminds me of our “lost week” over the Alps. It was the most exciting week of his life. And I always respond, “But David, every week is like that for me.”

When I visit Bolzano this summer to research the battles there in WWI in which my great uncle perished, I’ll ask the residents if they noticed a lost airplane overhead 25 years ago.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The First Marine Division in the Melbourne Cricket Ground in 1942

Higaona Sensei in 1974

Badrutt’s Palace Hotel in St. Moritz

Refueling my Cessna 340 in 1988

Global Market Comments

February 27, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MAKING A SILK PURSE FROM A SOW’S EAR)

(META), (GOOGL), (MSFT), (AAPL), (AMZN), (NFLX), (TSLA), (SPY), (TLT), (ENPH), (UUP), (GLD), (SLV), (EEM)

CLICK HERE to download today's position sheet.

Call this the Dr. Jekyll and Mr. Hyde market.

On the up days, we see the kindly ministrations of Dr. Jekyll.

On the down days, we suffer from the evil hand of Mr. Hyde.

To say that traders are confused would be an understatement. Many seasoned pros have told me that this is one of the most difficult markets they have ever seen.

Fridays have been particularly treacherous when weekly options expire. Some 56% of all options trading now takes place with expirations of five days or less. Trading before 4:00 PM sees billions of dollars of hot money trying to force closing prices just in or out of the money for key at-the-money strike prices.

What is especially disturbing is that some 80% of the gain in the S&P 500 (SPY) this year has been in just seven names, Meta, (META), Alphabet (GOOGL), Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Tesla (TSLA). Most other stocks went nowhere….or down. That much concentration means that any rallies lack confidence and will fail….for now.

Remember these names because when we finally do get a real upside breakout, they will be the leaders. You can take that to the bank.

Thanks to turmoil in the House of Representatives intent on a national default, bonds have given up 70 of the 120-basis point drop in yields since October. That deprives us of one of our biggest money makers of 2022, our long bond trades.

That means were are also seeing the automatic flip side of the bond trade, a strong US Dollar (UUP), and weak precious metals, (GLD) and (SLV), and emerging markets (EEM).

This too shall end.

If it was excess liquidity that caused stocks to rocket for 13 years, then maybe we should be focusing on what little liquidity is left. That would be the font of government money pouring into infrastructure and alternative energy plays.

Some $370 billion I know available for investment in ESG, would most of it going into the battery industry for the burgeoning electric vehicle industry. Even foreign firms like Finland’s Neste is moving to the US to cash in on federal munificence, converting an old US oil refinery to produce diesel fuel out of animal and vegetable fat (click here for the link).

Probably the best bet here is in California-based Enphase Energy (ENPH), which makes a 40% gross profit margins on microinverters for solar panels and has just seen a 42% dive in its share price. That makes (ENPH) a BUY. Hint: solar stocks always follow the price of oil to which it is tied, which has lately been down.

Some nimble and aggressive trading managed to push me back in the green for February, taking me up +0.93% on the month. That’s a dramatic improvement of +5.48% from a week ago.

You might even call it making a silk purse from a sow’s ear.

My 2023 year-to-date performance is still at the top at +23.28%. The S&P 500 (SPY) is up +4.32% so far in 2023. My trailing one-year return maintains a sky-high +86.58% versus -12.97% for the S&P 500.

That brings my 15-year total return to +620.47%, some 2.78 times the S&P 500 (SPX) over the same period. My average annualized return has recovered to +46.83%, still the highest in the industry.

Last week, I piled on a Tesla (TSLA) March $155-$260 short strangle betting that the stock can stay within a $95 range for 19 trading days. I also added a deep in-the-money long in the bond market for the first time in six weeks. Both positions turned immediately profitable.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

Q4 GDP Dips, from 3.9% to 2.7% in the October-December quarter. Consumption took a dive, which is amazing over the holidays. This is nowhere near a recession.

Fed Minutes Show More Hikes to Come, with the emphasis on the plural. That could take the overnight borrowing rate to a 5.40% high. It certainly pees on the parade for the falling interest rates crowd.

The Tail is Wagging the Dog, with short, dated options, often same-day expiration dominating trading every Friday. Billions of dollars are battling around key strike prices attempting to force expirations in or out of the money. No place for the little guy. Better to take Fridays off.

Netflix Slashes Prices in 30 countries, taking the stock down a modest 3%. (NFLX) is still the leader in the sector with 231 million subscribers, followed by Amazon (200 million), Disney Plus (162 million, HBO Max (95 million, Peacock (18 million), and Hulu 47 million). Buy (NFLX) and (AMZN) on dips.

Individual 401k’s Lost 23% in 2022, according to a study from Fidelity. High inflation is shrinking the remaining purchasing power even faster. A rising number of workers are also borrowing against their 401k’s to make ends meet. Such loans can go up to 50% of the principal. Better start making up the losses or you’ll be spending your golden years working at Taco Bell.

Apple to Add Glucose Monitor on its Watches, to aid diabetic clients. Some 38 million Americans have diabetes and given the obesity epidemic that figure is certain to rise. It highlights Big Tech’s move into the low-hanging fruit in health care.

Existing Home Sales Dive 0.7% in January, to a 4 million annualized rate, the weakest since October 2010. That makes 12 consecutive months of falling sales. The Median Home Price sold rose to $359,000. An imminent national debt crisis and spiking interest rates is not a great environment in which to sell your home.

Biden Ukraine Visit Tanks Gas and Oil Prices, cutting Russia’s chances of a win and eventually leading to a flood of oil on the market. Biden’s visit is sending the message to Putin that there’s no chance of a win here. Energy is hitting two-year lows across the board. Only energy stocks are staying high. Energy is getting so cheap it might be worth a trade.

Germany Accelerates Move Towards Alternatives, permanently cutting all ties with Russia energy. Europe’s biggest economy, and the fourth largest in the world, hopes to get 80% of its electricity from solar and wind by 2030. Hydrogen is also entering the picture. Other countries will follow.

On Monday, February 27 at 8:30 AM EST, US Durable Goods are out.

On Tuesday, February 28 at 9:00 AM, the S&P Case Shiller National Home Price Index for December is released.

On Wednesday, March 1 at 10:00 AM, the ISM Manufacturing PMI is printed.

On Thursday, March 2 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, March 3 at 8:30 AM, the ISM Non-Manufacturing PMI. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, I usually get a request to fund some charity about once a day. I ignore them because they usually enrich the fundraisers more than the potential beneficiaries. But one request seemed to hit all my soft spots at once.

Would I be interested in financing the refit of the USS Potomac (AG-25), Franklin Delano Roosevelt’s presidential yacht?

I had just sold my oil and gas business for an outrageous profit and had some free time on my hands so I said, “Hell Yes,” but only if I get to drive. The trick was to raise the necessary $5 million without it costing me any money.

To say that the Potomac had fallen on hard times was an understatement.

When Roosevelt entered the White House in 1932, he inherited the presidential yacht of Herbert Hoover, the USS Sequoia. But the Sequoia was entirely made of wood, which Roosevelt had a lifelong fear of. When he was a young child, he nearly perished when a wooden ship caught fire and sank, he was passed to a lifeboat by a devoted nanny.

Roosevelt settled on the 165-foot USS Electra, launched from the Manitowoc Shipyard in Wisconsin, whose lines he greatly admired. The government had ordered 34 of these cutters to fight rum runners across the Great Lakes during Prohibition. Deliveries began just as the ban on alcohol ended.

Some $60,000 was poured into the ship to bring it up to presidential standards and it was made wheelchair accessible with an elevator, which FDR operated himself with ropes. The ship became the “floating White House,” and numerous political deals were hammered out on its decks. Some noted guests included King George VI of England, Queen Elisabeth, and Winston Churchill.

During WWII Roosevelt hosted his weekly “fireside chats” on the ship’s short-wave radio. The concern was that the Germans would attempt to block transmissions if broadcast came from the White House.

After Roosevelt’s death, the Potamac was decommissioned and sold off by Harry Truman, who favored the much more substantial 243-foot USS Williamsburg. The Potamac became a Dept of Fisheries enforcement boat until 1960 and then was used as a ferry to Puerto Rico until 1962.

An attempt was made to sail it through the Panama Canal to the 1962 World’s Fair in Seattle, but it broke down on the way in Long Beach, CA. In 1964 Elvis Presley bought the Potomac so it could be auctioned off to raise money for St. Jude Children’s Research Hospital. It sold for $65,000. It then disappeared from maritime registration in 1970. At one point there was an attempt to turn it into a floating disco.

In 1980 a US Coast Guard cutter spotted a suspicious radar return 20 miles off the coast of San Francisco. It turned out to be the Potomac loaded to the gunnels with bales of illicit marijuana from Mexico. The Coast Guard seized the ship and towed it to the Treasure Island naval base under the Bay Bridge. By now the 50-year-old ship was leaking badly. The marijuana bales soaked up the seawater and the ship became so heavy it sank at its moorings.

Then a long rescue effort began. Not wanting to get blamed for the sinking of a presidential yacht on its watch the Navy raised the Potomac at its own expense, about $10 million, putting its heavy lift crane to use. It was then sold to the City of Oakland, Ca for a paltry $15,000.

The troubled ship was placed on a barge and floated upriver to Stockton, CA, which had a large but underutilized unionized maritime repair business. The government subsidies started raining down from the skies and a down-to-the-rivets restoration began. Two rebuilt WWII tugboat engines replaced the old, exhausted ones. A nationwide search was launched to recover artifacts from FDR’s time on the ship. The Potomac returned to the seas in 1993.

I came on the scene in 2007 when the ship was due for a second refit. The foundation that now owned the ship needed $5 million. So, I did a deal with National Public Radio for free advertising in exchange for a few hundred dinner cruise tickets. NPR then held a contest to auction off tickets and kept the cash (what was the name of FDR’s dog? Fala!).

I also negotiated landing rights at the Pier One San Francisco Ferry Terminal, which involved negotiating with a half dozen unions, unheard of in San Francisco maritime circles. Every cruise sold out over two years, selling 2,500 tickets. To keep everyone well-lubricated I became the largest Bay Area buyer of wine for those years. I still have a free T-shirt from every winery in Napa Valley.

It turned out to be the most successful fundraiser in the history of NPR and the Potomac. We easily got the $5 million and then some. The ship received a new coat of white paint, new rigging, modern navigation gear, and more period artifacts. I obtained my captain’s license and learned how to command a former coast guard cutter.

It was a win-win-win.

I was trained by a retired US Navy nuclear submarine commander, who was a real expert at navigating a now thin-hulled 73-year-old ship in San Francisco’s crowded bay waters. We were only licensed to cruise up to the Golden Gate bridge and not beyond, as the ship was so old.

The inaugural cruise was the social event of the year in San Francisco with everyone wearing period Depression-era dress. It was attended by FDR’s grandson, James Roosevelt III, a Bay area attorney who was a dead ringer for his grandfather. I mercilessly grilled him for unpublished historical anecdotes. A handful of still-living Roosevelt cabinet members also came, as well as many WWII veterans.

As we approached the Golden Gate Bridge, some poor soul jumped off and the Coast Guard asked us to perform search and rescue until they could get a ship on station. No body was ever found. It certainly made for an eventful first cruise.

Of the original 34 cutters constructed only four remain. The other three make up the Circle Line tour boats that sail around Manhattan several times a day.

Last summer I boarded the Potomac for the first time in 14 years for a pleasant afternoon cruise with some guests from Australia. Some of the older crew recognized me and saluted. In the cabin, I noticed a brass urn oddly out of place. It contained the ashes of the sub-commander who had trained me all those years ago.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Captain Thomas at the Helm

Global Market Comments

February 24, 2023

Fiat Lux

Featured Trade:

(FEBRUARY 22 BIWEEKLY STRATEGY WEBINAR Q&A)

(SPY), (BA), (CCI), (HD), (TLT), (TSLA), (PPLT), (PALL),

(JPM), (NVDA), (AAPL), (GOOGL), (META), (AMZN)

CLICK HERE to download today's position sheet.

Below please find the subscribers’ Q&A for the February 22 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: Will Russia use nuclear weapons on Ukraine?

A: No, they won’t. If you’re trying to take over a country, you don’t exactly want to drop atomic bombs on it first and render it useless. If they do, Ukraine will retaliate in kind with the nukes they have. Most of the nuclear weapons the old Soviet Union had were assembled in Ukraine and the machinery is still there. We know Ukraine has four nuclear power plants and hundreds of tons of fuel so they have uranium. You only need to increase the purity from 80% to 93% and then convert it to plutonium to get weapons-grade and you only need 20 pounds to make a small bomb. At the very least, they could build a dirty truck bomb and make Moscow uninhabitable for 100 years. If the Russians did explode a nuke, the fallout cloud would blow back on them the next day, China in three days, the US in 10 days, and back on Russia again in two weeks. If Ukraine doesn’t remember how to make nuclear weapons, they can just ask me. I do have “Nuclear Test Site” on my resume.

Q: What would be the impact on the markets of a government debt default?

A: Bonds would collapse, causing interest rates to spike, and taking down stocks big time. Higher interest rates would crash the real estate market. You also can’t do real estate closings during a shutdown because Fannie Mae and Freddie Mac aren’t there to buy the debt. Commodities would fall sharply on recession fears. Even gold and silver do poorly on a massive liquidity squeeze. Government payments would cease, including Social Security, Medicare, and military salaries. Air traffic control would stop unless they are happy to work for free. The only place to hide is cash under your mattress since US Treasury bills and commercial banks will also be at risk. This is what the House Republicans are risking. It really depends on how long the shutdown lasts. Every time Georgia representative Marjorie Taylor Greene shouted “liar” at the State of the Union address you could see bond prices ticking down. She is one of the people who has to agree to a rise in the debt ceiling and she didn’t inspire a lot of confidence in bondholders. All that said, a $10 dip is a good place to buy the (TLT).

Q: Would you buy Boeing up here?

A: I loved Boeing at $100 and we did a could trades down there. At $220 not so much. It’s more than doubled off the October low and all the best-case scenarios have happened. The 737 MAX, which crashed twice due to an AI issue, got back in the air. The 787 Dreamliner is selling well. The company now has a two-year order backlog. And Air India followed up with the biggest aircraft order in history, some 450 planes over ten years. If Boeing dips $50 that would be another story because I think it hits a new all-time high at $450 in a couple of years. By the way, I took a 737 MAX on my flight back from Hawaii last weekend and the crew loved it. There are no screens on the seats. Instead, they broadcast the 800 greatest movies of all time on free WIFI.

Q: How do we know if your trade alert is for the stock, the ETF, or another underlying position?

A: Look at the ticker symbol—it always tells you exactly which security we are working in.

Q: With Bullard signaling a 50 basis-point rate hike, will the S&P (SPY) go down in the near term and how much?

A: Well Bullard is only one guy out of nine, so he doesn’t have the final say. It really depends on what Jay Powell wants. And if the data continues hot and inflation keeps rising, we will get a 50 basis point rise, and that should take the index down 10% from the recent high, or give up half of its recent year-to-date gains, so that’s a good rule of thumb. As long as we’re waiting for bad news, (which we won’t get until March 22) the markets will do nothing until then.

Q: What do you think about Crown Castle International (CCI), the cell tower company, taking a big hit with the bond market?

A: It pretty much moves in sync with the bond market, which has just dropped 10 points, so you probably want to be buying or doubling up on (CCI) right here, because it will be the first thing to recover once we see a negotiated increase in the debt ceiling which has to happen before the summer. The 5G buildout continues unabated.

Q: Would you recommend buying Tesla (TSLA) shares again?

A: Yes, but at least $50 lower, which we may get. Or at least $50 off the $217 top. I think Tesla goes to $1,000 sometime in the next couple of years and so does Elon Musk. All of the factors that could drive the stock that high are in progress. I know it’s happening over there, and that’s easily a $1,000 stock once their current breakthroughs go mass-market.

Q: Any interest in Iron Condors?

A: It is the same as Strangles, with more limited risk with four legs, a call spread and a put spread because you stop out your losses at much lower levels. But they are very trading-intensive, commission-intensive trades, and it’s really too much for most beginners to handle. However, if you’re a professional, you might consider doing iron condors on these positions. Iron Condors also max profits when nothing moves, and lately, no move is a pretty rare event. We’re going to get it for the next couple of months, but don’t count on that being a frequent trade.

Q: Any iShares 20 Plus Year Treasury Bond ETF (TLT) LEAPS to buy now?

A: Yes I've been kind of sitting on my hands waiting to see if this bottom here holds at 99 before I put out LEAPS, but we’re so close it really almost makes no difference. And if I were to do a LEAPS here it probably would be the $100-$105 one-year out. That might get you about a 100% profit in a year. That’s a very safe LEAPS, and I’ll get the numbers out when I get a chance.

Q: What’s your opinion on Home Depot (HD)?

A: I like it for the long term. Clearly, their disastrous earnings report shows that the economy for home repair is not as strong as we thought it was, so it may go lower first. I would hold off until we get a real capitulation selloff in those stocks.

Q: Are gold and silver possible candidates for LEAPS?

A: Yes, especially in view of the recent correction in these metals. And we did put these out last October at the market bottom. I probably will be updating that sometime in the next few weeks.

Q: How much longer will the Ukraine/Russia war last?

A: The general consensus among the military now is that this goes on for several more years, and both sides will just keep pouring troops into the meat grinder until they get exhausted.

Q: Any way to play Platinum (PPLT) or Palladium (PALL)?

A: Yes, there are ETFs on each of them.

Q: Any thoughts on the crypto industry?

A: I have given up on the crypto industry because it has been shown that so many of these trading platforms were stealing from their customers. Once you lose the confidence of a customer on trust, you never get it back in the financial industry. Also, crypto was interesting a couple of years ago when it was going up and everything else in the world was too expensive, but now you have all the best stocks trading not far from multi-year lows, and that makes quality stocks much more attractive than a crypto where you really don't know what’s going to happen. Crypto could be another Nikkei, which after 32 years still hasn’t reached its old highs. That is unless it gets taken over by big banks like (JPM) and regains respectability that way.

Q: Any thoughts on investing in the AI trend?

A: AI has suddenly become what crypto was 2 years ago, and what 3D printing was 15 years ago. It’s just the theme of the day, and something to promote. There are no pure AI plays. Basically, all companies have been using it for 10 or 15 years, it’s not a new thing. In fact, AI is already in every aspect of your life, you just might not know it yet. NVIDIA (NVDA) is probably the purest AI play out there whose chips everyone needs to execute AI. Beyond that, the biggest AI users are Apple (AAPL), Alphabet (GOOGL), Meta (META), and Amazon (AMZN). When Amazon makes ten more recommendations on books you might like or movies you might watch, that is AI.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

With Medal of Honor Winner Colonel Mitchel Paige

Global Market Comments

February 6, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WELCOME TO THE WHIPSAW)

(SPY), (TLT), (TSLA), (QQQ), (DOCU), (META), (AMZN)

CLICK HERE to download today's position sheet.

Note: We are moving webinar platforms to Zoom for the February 8, 12:00 EST Mad Hedge Biweekly Strategy

Webinar. To join, please click here.

Well, that was some week!

The next time there is a Fed interest rate announcement, earnings from all the big tech companies, and a Nonfarm Payroll Report all within five days, I am going to call in sick, volunteer at the Oakland Food Bank, or explore some remote Pacific island!

For good measure, a top-secret Chinese spy balloon passed overhead before it was shot down, which I was able to read all about in USA Today.

Still, when you live life in the front trenches and on the cutting edge and use the kind of leverage that I do, you are going to take hits. It’s all a cost of doing business. If you can’t stand the heat, get out of the kitchen.

The last month in the markets have seen one of the greatest whipsaws of all time. Many leading stocks are up 40%-100%, while the Volatility Index ($VIX) plunged to a two-year low. Stocks have gone from zero bid to zero offered. The bulls are back in charge, for now.

Go figure.

This year has proved full of flocks of black swans so far, with February setting me back -5.70%. My 2023 year-to-date performance is still at the top at +16.65%. The S&P 500 (SPY) is up +9.92% so far in 2023. My trailing one-year return maintains a sky-high +84.10%.

That brings my 15-year total return to +613.84%, some 2.59 times the S&P 500 (SPX) over the same period. My average annualized return has retreated to +46.62%, still the highest in the industry.

Last week, I got stopped out of my short position in the (QQQ), in what will hopefully be my biggest loss of the year, but not the last. Once or twice a year, you get a major gap opening that takes you through one, and sometimes two full strike prices, taking you to the cleaners, and this was one of those times. It takes three more winning trades to make up for these.

I also took small profits on my remaining long in Apple (AAPL). That leaves me 80% in cash, with a double short in Tesla (TSLA). Markets are wildly overextended here with my own Mad Hedge Market Timing Index well into “SELL” territory at 76. Tread at your own peril. Cash is king right here.

Growth stocks are on fire and small caps have been prospering, all classic bull market indicators. This has triggered panic short covering by hedge funds which have seen their worst start to a New Year in decades. The old pros are getting carried out on stretchers.

Maybe this is a good time to hire some kid to do your trading, like one who has never seen markets go down before, one who started his career only on January 1? Or maybe one who retired on December 31 2021, and took a year off?

So, what are markets trying to tell us? That in an hour, the view of the economy has flipped from a mild recession to a soft landing? That interest rates don’t matter anymore? That big chunks of the economy can operate without outside money? That big tech will always make money, it will just rotate from large profits to small ones and back to outrageous ones again?

Those who instead bet on a severe recession are currently filling out their applications as Uber drivers. Warning: it’s harder than it used to be, no more fake IDs or salvage title cars. Next, they’ll want your DNA sample.

If it is any consolation, Fed governor Jay Powell hasn’t a clue about what’s happening either, and that’s with 100 PhD's in economics on his staff. He was just as flummoxed as we over a January Nonfarm Payroll Report that came in 2.5 X expectations on top of 4.5% in interest rate hikes.

Clearly, a new economy has emerged from the wreckage of the pandemic, and no one, not anyone, has quite figured out what it is yet.

Some ten years’ worth of economic evolution has been pulled forward. Everything is digitizing at an astonishing rate. What do I do after slaving away in front of a computer all day? Go back to my computer to have fun. Lots of “zeros” and “ones” there.

It looks like we get a new stock market too.

All of this frenetic market action does fit one theory that I spelled out for you in great detail last week. It is that technology stocks are about to spin off such immense profits that it is about to replace the Fed as a new immense supply of free money.

META up 20% in a day? That’s what it says to me. Notice that Mark Zuckerberg mentioned “AI” 16 times in his earnings call.

Is it possible that I nailed this one….again?

On another related topic, the last three months have just given us a wonderful illustration of how well the Mad Hedge Market Timing Index works (see chart below). We got a strong BUY at an Index reading of 30 on December 22, when the (SPY) began a robust 12% move up. We are now at the top end of an upward trend with my Index at 76. You’d be Mad to add a long position here, at least for the short term.

Someone asked me the other day if the algorithm has gotten smarter in the seven years I have been using it. The answer is absolutely “yes,” and you can see it in my performance. During this time, my average annualized return has jumped from 31% to 46%. That’s because the algorithm gets smarter with the hundreds of new data points that are added every day. Believe it or not, this is how much of the economy is run now.

But there is another factor. I get smarter every year. Believe it or not, when you go from year 54 to 55, you actually learn quite a lot about the markets. Of course, markets are evolving all the time and the rate of change is accelerating. When I saw the market moving towards algorithms, I wrote an algorithm. The challenge is to solve each new problem the market throws at you every year, which I love doing.

Nonfarm Payroll Report at 513,000 Blows Away Estimates, more than double expectations. The Headline Unemployment Rate fell to a new 53-year low at 3.4%. Leisure & Hospitality gained an incredible 128,000, Professional & Business Services 82,000, and Government 74,000. You can kiss that interest rate cut goodbye. Bonds believe it, down 3 points, but stocks are still in Lalaland, reversing a 300-point reversal in the (QQQ)s.

Fed Raises Rates 25 basis points, but Powell talks hawkish, smashing stocks for an hour. He needs more evidence that inflation is finally headed down. He might as well have said he’ll burn the place down. One or two more rate rises to go before the pivot.

Weekly Jobless Claims Hit New 9 Month Low, at 183,000, down 3,000, and is close to a multi-generational low. A recession is rapidly moving off the table as today’s move in tech stocks indicates.

JOLTS Surges Past 11 Million Job Openings in December to a five-month high. The Fed’s assault on labor clearly isn’t working. The million who died from Covid certainly aren’t coming back to work, nor are the 500,000 long Covid cases. That’s 1% of the US workforce.

Ukraine War is Accelerating Move to Green Energy, or so thinks British Petroleum, cutting its ten-year energy demand forecast. Russian energy has proven unreliable at best, and the key pipelines have been blown up anyway. Massive subsidies have been unleashed in Europe and the US for solar, wind, EVs, hydro, and even nuclear. The war gave coal a respite from oblivion, but only a temporary one.

S&P Case Shiller Drops to an 8.6% Annual Gain, the National Home Price Index falling for five consecutive months. No green shoots here. The deeply lagging indicator may not turn positive until yearend. Miami, Tampa, and Atlanta showed the biggest gains, with San Francisco the biggest loser.

Office Occupancy Recovers to 50%, according to a private research firm. New York, San Jose, and San Francisco are still lagging. With the work-from-home trend and high interest rates, commercial properties have entered a perfect storm. Austin, TX was the highest at 68%.

Europe Delivers Surprising Q4 Growth, despite WWIII playing out on its doorstep. GDP increased by 0.1% when a decline was expected. European stocks should outperform American ones in 2023.

IMF Upgrades Global Growth Forecast for 2023 to 2.9% and sees a modest recovery in 2024. The figures are an improvement from the last report, thanks to falling inflation and energy prices. China ending lockdowns is another plus.

General Motors to Invest $650 Million in Lithium Americas, pouring money into a Nevada mine at Thacker Pass, the largest such US investment so far. (GM) says it will raise EV production to 400,000 this year versus 120,000 for all of 2022. Good luck because local environmental opposition to the new mine has been enormous. Goodbye China.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, February 6, no data of note is announced.

On Tuesday, February 7 January 31 at 5:30 AM EST, the Balance of Trade is out.

On Wednesday, February 8 at 7:30 AM, the Crude Oil Stocks are published.

On Thursday, February 9 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, February 10 at 8:30 AM, the University of Michigan Consumer Sentiment is printed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, the telephone call went out amongst the family with lightning speed, and this was back in 1962 when long-distance calls cost a fortune. President Dwight D. Eisenhower was going to visit my grandfather’s cactus garden in Indio the next day, said to be the largest in the country, and family members were invited.

I spent much of my childhood in the 1950s and 1960s helping grandpa look for rare cactus in California’s lower Colorado Desert, where General Patton trained before invading Africa. That involved a lot of digging out a GM pickup truck from deep sand in the remorseless heat. SUVs hadn’t been invented yet, and a Willys Jeep (click here) was the only four-wheel drive then available in the US.

I have met nine of the last 13 presidents, but Eisenhower was my favorite. He certainly made an impression on me as a ten-year-old boy, who I remember as a kindly old man.

I walked with Eisenhower and my grandfather plant by plant, me giving him the Latin name for its genus and species, and citing unique characteristics and uses by the Indians. The former president showed great interest and in two hours we covered the entire garden. I still make my kids learn the Latin names of plants.

Eisenhower lived on a remote farm at the famous Gettysburg, PA battlefield given to him by a grateful nation. But the winters there were harsh so he often visited the Palm Springs mansion of TV Guide publisher Walter Annenberg, a major campaign donor.

Eisenhower was one of the kind of brilliant men that America always comes up with when it needs them the most. He learned the ropes serving as Douglas MacArthur’s Chief of Staff during the 1930s. Franklin Roosevelt picked him out of 100 possible generals to head the allied invasion of Europe, even though he had no combat experience.

After the war, both the Democratic and Republican parties recruited him as a candidate for the 1952 election. The latter prevailed, and “Ike” served two terms, defeating the governor of Illinois Adlai Stevenson twice. During his time, he ended the Korean War, started the battle over civil rights at Little Rock, began the Interstate Highway System, and admitted Hawaii as the 50th state.

As my dad was very senior in the Republican Party in Southern California during the 1950s, I got to meet many of the bigwigs of the day. New York prosecutor Thomas Dewy ran for president twice, against Roosevelt and Truman, and was a cold fish and aloof. Barry Goldwater was friends with everyone and a decorated bomber pilot during the war.

Richard Nixon would do anything to get ahead, and it was said that even his friends despised him. He let the Vietnam War drag out five years too long when it was clear we were leaving. Some 21 guys I went to high school with died in Vietnam during this time. I missed Kennedy and Johnson. Wrong party and they died too soon. Ford was a decent man and I even went to church with him once, but the Nixon pardon ended his political future.

Peanut farmer Carter was characterized as an idealistic wimp. But the last time I checked, the Navy didn’t hire wimps as nuclear submarine commanders. He did offer to appoint me Deputy Assistant Secretary of the Treasury for International Affairs, but I turned him down because I thought the $15,000 salary was too low. There were not a lot of Japanese-speaking experts on the Japanese steel industry around in those days. Biggest mistake I ever made.

Ronald Reagan’s economic policies drove me nuts and led to today’s giant deficits, which was a big deal if you worked for The Economist. But he always had a clever dirty joke at hand which he delivered to great effect….always off camera. The tough guy Reagan you saw on TV was all acting. His big accomplishment was to not drop the ball when it was handed to him to end the Cold War.

I saw quite a lot of George Bush, Sr. who I met with my Medal of Honor Uncle Mitch Paige at WWII anniversaries, who was a gentleman and fellow pilot. Clinton was definitely a “good old boy” from Arkansas, a glad-hander, and an incredible campaigner, but was also a Rhodes Scholar. His networking skills were incredible. George Bush, Jr. I missed as he never came to California. And 22 years later we are still fighting in the Middle East.

Obama was a very smart man and his wife Michelle even smarter. Stocks went up 400% on his watch and Mad Hedge Fund Trader prospered mightily. But I thought a black president of the United States was 50 years early. How wrong was I. Trump I already knew too much about from when I was a New York banker.

As for Biden, I have no opinion. I never met the man. He lives on the other side of the country. When I covered the Senate for The Economist, he was a junior member.

Still, it’s pretty amazing that I met 9 out of the last 13 presidents. That’s 20% of all the presidents since George Washington. I bet only a handful of people have done that and the rest all live in Washington DC. And I’m a nobody, just an ordinary guy. It just makes you think about the possibilities.

Really.

It’s Been a Long Road

Global Market Comments

January 30, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MY NEW THEORY OF EQUITIES)

(TSLA), (SPY), (TLT), (TSLA), (OXY), (UUP), (AAPL), ($VIX)

CLICK HERE to download today's position sheet.

After 54 years of trading, and 60 if you count my paper boy days, I have never seen the conventional wisdom be so wrong about the markets.

There was near universal sentiment that we would crash come January. Instead, with have only seen four down days this year. The shorts got slaughtered.

So it’s clear that something brand new is going on here in the markets. I call it “My New Theory of Equities.”

I always have a new theory of equities. That’s the only way to stay ahead of the unwashed masses and live on the cutting edge. After all, I don’t have to run faster than the bear, just faster than the competition to keep you making money.

So here is my new theory.

Many strategists are bemoaning the loss of the free money that zero interest rates made available for the last decade. They are convinced that we will never see zero interest rates again.

But guess what? Markets are acting like free money is about to return, and a lot faster than you think. Free money isn’t gone forever, it is just taking a much-needed vacation.

What if free money comes from somewhere else? You can forget about free money from the government. Fear of inflation has ended that source, unless we get another pandemic, which is at least a decade off.

No, I found another source of free money, and that would be exponentially growing technology profits. Those who don’t live in Silicon Valley are ignorant of the fact that technology here is hyper accelerating and tech companies are becoming much more profitable.

You know those 80,000 tech workers who just got laid off? They all averaged two job offers each from the thousands of startup companies operating from garages and extra bedrooms all around the Bay Area. As a result, the Silicon Valley unemployment rate is well under 2%, nearly half the national average.

I bet you didn’t know that there are over 100 industrial agricultural startups here growing food in indoor ultraviolet lit lowers. It turns out that these use one tenth of the inputs of a conventional input, like water and fertilizer in half the time.

There are hundreds of solar startups in play, many venture capital financed by Saudi Arabia. While the kingdom has a lot of oil, they have even more sunshine. And what are they going to do with all that oil? Use solar generated electricity to convert it to hydrogen to sell to us as “green” energy.

Solar itself will just be a bridge technology to fusion, which you may have heard about lately. What happens when energy becomes free? It boggles the mind. This appears to be a distant goal now. But remember that we went from atomic bombs to nuclear power plants in only 12 years, the first commercially viable one supplying electricity to Pittsburgh in 1957 (click here for the link).

The future happens fast, far faster than we realize. Always.

Here is another anomaly for you. While these massive tech layoffs have been occurring, Weekly Jobless Claims have plunged to a two-year low from 240,000 to only 186,000.

That is because tech workers aren’t like you and me. When they get laid off the first thing, they do is cheer, then take a trip to Europe. They are too wealthy to qualify for unemployment benefits, so they never apply. When they get home, they immediately get new jobs that pay more money with extra stock options.

I know because I have three kids working in Silicon Valley and enjoy a never-ending stream of inside dope.

This means that you need to be loading the boat with tech stocks on every major dip for the rest of your life, or at least my life. The profit opportunities are exponential.

This creates a new dilemma.

You can pick up the easy doubles and triples now just though buying listed companies. But many of the hundred and thousand baggers haven’t even been created yet. That’s where newly unemployed tech workers are flocking to. That’s where you’ll find the next Tesla (TSLA) at $2 trade.

How will you find those? Don’t worry, that’s my job. After all, I found the last Tesla at $2, minting many new millionaires along the way.

My trading performance certainly shows the possibilities of this My New Theory of Equities, which so far in January has tacked on a robust +19.94%. My 2023 year-to-date performance is the same at +19.94%, a spectacular new high. The S&P 500 (SPY) is up +7.32% so far in 2023.

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 15 years ago. My trailing one-year return maintains a sky-high +95.09%.

That brings my 15-year total return to +617.13%, some 2.66 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +46.87%, easily the highest in the industry.

Last week, I took profits on my longs in Tesla (TSLA) and Occidental Petroleum (OXY). That leaves me 90% in cash, with one lonely 10% short in the (QQQ). Markets are wildly overextended here; the Volatility Index ($VIX) is at a two-year low at $18, and my own Mad Hedge Market Timing Index is well into “SELL” territory at 70.

My invitation on the long side is wearing thin.

And while I’m at it, let me introduce one of my favorite secret economic indicators.

I call it the “Flat Tire Indicator”.

It goes something like this. The stronger the economy, the more trucks you have driving to new construction sites to build factories and homes. That means more trucks wearing out the roads, creating more potholes, and bouncing more nails out the back.

Tadah! You get more flat tires.

I am not citing this as some Ivory Tower, pie-in-the-sky academic theory. I spent the morning getting a flat tire on my Tesla Model X fixed. This wasn’t just any old tire I could pick up on sale at Big O Tires. It was a Pirelli Scorpion Zero 265/35 R22 All Season staggered racing tire.

Still, Tesla did well. From the time I typed in my request on the Tesla app on my smartphone to the time the repair was completed at my home, only 45 minutes had elapsed.

Still, $500 for a tire Elon? Really?

Elon Musk Ambushed the shorts, with a Massive Short Squeeze Hitting Tesla, up 80% in three weeks and far and away the top-performing major stock of 2023. Tesla now accounts for an incredible 7% of the entire options market. Bearish hedge funds are panicking. It’s dragging the rest of big tech with it. I think we are due for a rest around the Fed interest rates decision in three days. I warned you about an onslaught of good news coming out about Tesla. It has arrived!

Will This Week See the Last Interest Rate Hike, in this cycle on February 1? That’s what stocks seem to be discounting now, with the major indexes up almost every day this year. And even next week may only deliver a 25-basis point hike.

The Fed’s Favorite Inflation Indicator Fell in December, Core PCE up only 4.4% YOY. It’s fanned the tech flames for a few more days. The University of Michigan is calling for only 3.9%.

Q4 GDP is Up 2.9%, far higher than expected. This is becoming the recession that may not show. New car sales went ballistic and there were huge orders for Boeing. Bonds sold off on the news.

Recession Risk Falls, from a 98% probability to only 73% according to an advanced model from JP Morgan Bank. Other models say it’s dropped to only 50%. A soft landing is now becoming the conventional view. The view is most clearly seen in high-yield bonds which have recently seen interest rates plunge. This may become the recession that never happens.

Tech Layoffs Top 75,000, or 2% of the tech workforce. Most get two job offers on hitting the street from the thousands of garage startups percolating in San Francisco Bay Area garages, taking the Silicon Valley unemployment rate below 2%. All tech is losing is the froth it picked up during the pandemic. As I tell my kids, you want to work in the industry where 2% of the US population spin off 35% of America’s profits. Buy big tech on the coming dips.

Tesla Price Cuts Crush the EV Industry, in a clear grab by Elon for market share, already at 65% globally. Teslas are now the cheapest EVs in the world on a per mile basis, and with the new federal subsidies they now qualify for the discount rises to 35%. (GM), (F), and Volkswagen can’t match the cuts because they are already hemorrhaging money on EVs and lack the parts to appreciably boost production. Keep buying (TSLA) on dips, which is up $8 this morning.

Tesla Beats, on both earnings and guidance. It’s looking for 1.8 million vehicles sold in 2023 versus 2022 sales of 1.31 million. Elon is still planning on 50% annual growth over the foreseeable future. The shares jumped an incredible 12% on the news. The Cybertruck will roll out at the end of this year, and I am on the list. The recent price cuts were hugely successful, killing the EV competition, and could take 2023 production to 2 million. It all makes (TSLA) a strong buy and long-term hold on the next $20 dip.

China is Taking Over the Auto World and is the only country that outsold the US in EVs. The Middle Kingdom exported more than 2.5 million cars last year, taking it just behind Germany. The country is targeting 8 million exports by 2030, double Japan’s. What is not said is that most of these will go to low waged emerging countries without auto regulations, safety standards, or even laws. No Chinese cars were sold in the US, far and away the world’s largest market at 15 million units last year in a global market of 67.6 million.

Pending Home Sales Jump in December, up 2.5%, providing more green shoots for the real estate market. This is on a signed contracts-only basis, the best in 14 months. The January numbers will get a huge boost from dramatically lower mortgage rates.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, January 30 a6 7:30 AM EST, the Dallas Fed Manufacturing Index is announced. NXP Semiconductor (NXPI) reports.

On Tuesday, January 31 at 6:00 AM, the S&P Case Shiller National Home Price Index is updated. Caterpillar (CAT) reports.

On Wednesday, February 1 at 7:00 AM EST, the JOLTS Private Sector Job Openings are released. The Fed Interest Rate Decision is disclosed. Meta (META) reports.

On Thursday, February 2 at 8:30 AM EST, the Weekly Jobless Claims are announced. Apple (AAPL), Amazon (AMZN), and Alphabet (GOOGL) report.

On Friday, February 3 at 8:30 AM EST, the January Nonfarm Payroll Report is printed. Regeneron (REGN) reports.

At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, when Anne Wijcicki founded 23andMe in 2007, I was not surprised. As a DNA sequencing pioneer at UCLA, I had been expecting it for 35 years. It just came 70 years sooner than I expected.

For a mere $99 back then they could analyze your DNA, learn your family history, and be apprised of your genetic medical risks. But there were also risks. Some early customers learned that their father wasn’t their real father, learned of unknown brothers and sisters, that they had over 100 brothers and sisters (gotta love that Berkeley water polo team!) and other dark family secrets.

So, when someone finally gave me a kit as a birthday present, I proceeded with some foreboding. My mother spent 40 years tracing our family back 1,000 years all the way back to the 1086 English Domesday Book (click here).

I thought it would be interesting to learn how much was actually fact and how much fiction. Suffice it to say that while many questions were answered, alarming new ones were raised.

It turns out that I am descended from a man who lived in Africa 275,000 years ago. I have 311 genes that came from a Neanderthal. I am descended from a woman who lived in the Caucuses 30,000 year ago, which became the foundation of the European race.

I am 13.7% French and German, 13.4% British and Irish, and 1.4% North African (the Moors occupied Sicily for 200 years). Oh, and I am 50% less likely to be a vegetarian (I grew up on a cattle ranch).

I am related to King Louis XVI of France, who was beheaded during the French Revolution, thus explaining my love of Bordeaux wines, Chanel dresses, and pate foie gras.

Although both my grandparents were Italian, making me 50% Italian, I learned there is no such thing as a pure Italian. I come it at only 40.7% Italian. That’s because a DNA test captures not only my Italian roots, plus everyone who has invaded Italy over the past 250,000 years, which is pretty much everyone.

The real question arose over my native American roots. I am one sixteenth Cherokee Indian according to family lore, so my DNA reading should have come in at 6.25%. Instead. It showed only 3.25% and that launched a prolonged and determined search.

I discovered that my French ancestors in Carondelet, MO, now a suburb of Saint Louis, learned of rich farmland and easy pickings of gold in California and joined a wagon train headed there in 1866. The train was massacred in Kansas. The adults were massacred, and all the young children adopted into the tribe, including my great X 5 Grandfather Alf Carlat and his brother, then aged four and five.

When the Indian Wars ended in the 1870s, all captives were returned. Alf was taken in by a missionary and sent to an eastern seminary to become a minister. He then returned to the Cherokees to convert them to Christianity. By then Alf was in his late twenties so he married a Cherokee woman, baptized her, and gave her the name of Minto, as was the practice of the day.

After a great effort, my mother found a picture of Alf & Minto Carlat taken shortly after. You can see that Alf is wearing a tie pin with the letter “C” for his last name of Carlat. We puzzled over the picture for decades. Was Minto French or Cherokee? You can decide yourself.

Then 23andMe delivered the answer. Aha! She was both French and Cherokee, descended from a mountain man who roamed the western wilderness in the 1840s. That is what diluted my own Cherokee DNA from 6.50% to 3.25%. And thus, the mystery was solved.

The story has a happy ending. During the 1904 World’s Fair in St. Louis (of Meet me in St. Louis fame), Alf, then 46 placed an ad in the newspaper looking for anyone missing a brother from the 1866 Kansas massacre. He ran the ad for three months and on the very last day his brother answered and the two were reunited, both families in tow.

Today, it costs $169 to get you DNA analyzed, but with a much larger data base it is far more thorough. To do so click here at https://www.23andme.com

My DNA has Gotten Around

It All Started in East Africa

1880 Alf & Minto Carlat, Great X 5 Grandparents

My New Coincident Economic Indicator

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.