Global Market Comments

October 3, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or BET THE RANCH TIME IS APPROACHING),

(SPY), (VIX), (UUP), (TSLA), (RIVN), (USO), (TLT), (FCX), (SPY), (NVDA), (BRKB)

Global Market Comments

October 3, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or BET THE RANCH TIME IS APPROACHING),

(SPY), (VIX), (UUP), (TSLA), (RIVN), (USO), (TLT), (FCX), (SPY), (NVDA), (BRKB)

September is notorious as the worst month of the year for the market. Boy, did it deliver, down a gut busting 9.7%!

As for the Mad Hedge Fund Trader, September was one of the best trading months of my 54-year career. But then I knew what was coming.

So did you.

With some of the greatest market volatility in market history, my September month-to-date performance exploded to exactly +9.72%.

I used last week’s extreme volatility and move to a Volatility Index (VIX) of $34 to add longs in Freeport McMoRan (FCX), S&P 500 (SPY), NVIDIA (NVDA), and Berkshire Hathaway (BRKB). I added shorts in the (SPY) and the (TLT). That takes me to 70% long, 20% short, and 10% cash. I am holding back my cash for any kind of rally to sell into.

My 2022 year-to-date performance ballooned to +69.68%, a new high. The Dow Average is down -23.44% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky high +80.08%.

That brings my 14-year total return to +582.24%, some 3.03 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +45.45%, easily the highest in the industry.

It was in May of 2020 when 34 of my clients became millionaires through buying TESLA at precisely the right time…

Well, the stars have aligned once again!!!!

In my TESLA free report, I list 10 reasons I’d tell my grandmother to mortgage her house and go all in.

Go to MADHEDGERADIO.com and download my “Tesla takes over the world” free report…that’s

madhedgeradio.com.

At the end of the month, the market was down six days in a row. That has only happened 20 times since 1950.

However, bet the ranch time is approaching. It’s time to start scaling in in a small way into your favorite long term names where the value is the greatest.

The Fed has taken away the free put that the stock market has enjoyed for the last 13 years. Now, it’s the bond market that has the free put. Hint: always own the market where the Fed is giving you free, unlimited downside protection.

People often ask what I do for a living. I always answer, “Talking people out of selling stocks at the bottom.” Here is the cycle I see repeating endlessly. They tell me they are long term investors. Then the markets take a sudden dive, like to (SPX) $3,300, a geopolitical event takes place, and the TV networks only run nonstop Armageddon gurus. They sell everything.

Then the market turns sharply, and they helplessly watch stocks soar. When they get frustrated enough, they buy, usually near a market top.

Sell low, buy high, they are perfect money destruction machines. And they wonder why they never make money in the stock market!

If any of this sounds familiar you have a problem and need to read more Mad Hedge newsletters. The people who ignore me I never hear from again. Those who follow me stick with me for decades.

Don’t make the mistake here of only looking at real GDP growth which, in recessions, is always negative. Nominal GDP is growing like a bat out of hell, 12% in 2021 and 8% in 2022. That’s 20% in two years, nothing to be sneezed at.

The problem is that all economic data has been rendered useless by the pandemic, even for legitimate and accomplished Wall Street analysts. The US economy was put through a massive restructuring practically overnight, the long-term consequences of which nobody will understand for years. Typical is the recently released Consumer Price Index, which said that real estate prices are rocketing, when in fact they are crashing.

A lot of people have asked me about the comments from my old friend, hedge fund legend Paul Tudor Jones, that the Dow Average would show a zero return for the next decade.

For Paul to be right, technological innovation would have to completely cease for the next decade. Sitting here in the middle of Silicon Valley, I can tell you that is absolutely not happening. In fact, I’m seeing the opposite. Innovation is accelerating at an exponential rate. For goodness sakes, Apple just brought out a satellite phone with its iPhone 14 pro for a $100 upgrade!

Remember, Paul got famous, and rich, from the trades he did 40 years ago with me, not because of anything he did recently. Paul has in fact been bearish for at least five years.

Still, we have a long way to go on earnings multiples. The trailing S&P 500 market multiple is now at 19. The historic low is at 15. Current earnings are $245 per (SPX) share. The 3,000 target the bears are shouting from the rooftops assumes that a severe recession takes earnings down to $200 a share ($3,000/$200 = 15X).

I don’t think earnings will get that bad. Big chunks of the economy are still growing nicely. Companies are commanding premium prices for practically everything. There is no unemployment because the jobs market is booming.

That suggests to me a final low in this market of $3,000-$3,300. That means you can buy 15%-20% deep in-the-money vertical bull call spreads RIGHT HERE and make a killing, as Mad Hedge has done all year.

Let me plant a thought in your mind.

After easing for too long, then tightening for too long, what does the Fed do next? It eases for too long….again. You definitely want to be long stocks when that happens, which will probably start some time next year.

Let me give you one more data point. The (SPY) has been down 7% or more in September only seven times since 1950. In six of the Octobers that followed, the market was up 8% or more.

Sounds like it’s time to bet the ranch to me.

Capitulation Indicators are Starting to Flash. Cash levels at mutual funds are at all-time highs. The Bank of America Investors Survey shows the high number of managers expecting a recession since the 2020 pandemic low, the last great buying opportunity. Commercial hedgers are showing the largest short positions since 2020. And of course, my old favorite, the Volatility Index (VIX) hit $34.00 on Tuesday. The risks of NOT being invested are rising.

Bank of England Moves to Support a Crashing Pound (FXB), by flipping from a seller to a buyer in the long-dated bond market, thus dropping interest rates. The move is designed to offset the new Truss government’s plan to cut taxes and boost deficit spending. The BOE also indicated that interest rate hikes are coming. The bond vigilantes are back.

Here’s the Next Financial Crisis, massive unrealized losses in the bond market. The (TLT) alone has lost 43% in 2 ½ years. Apply that to a global $150 trillion bond market and it adds up to a lot of money. Anybody who used leverage is now gone. How many investors without swimsuits will be discovered when the tide goes out?

Will the Strong Dollar (UUP) Do the Fed’s Work, forestalling a 75-basis point rate rise? It will if the buck continues to appreciate at the current rate, up a record five cents against the British pound, taking it to a record low of $1.03. Such is the deflationary impact of weak foreign currencies, which are seriously eating into US multination earnings.

Weekly Jobless Claims Hit Five-Month Low at 195,000, far below expectations. If the Fed is waiting for the job market to roll over before it quits raising interest rates, it could be a long wait.

EV Sales to Hit New All-Time High in 2022, to 13% of global new vehicle sales, up from 9% last year. The IEA expects this figure to reach 50% by 2030. That works out to 6.6 million EVs in 2021, 9.5 million in 2022, and 36 million by 2030. Buy (TSLA), the world’s largest EV seller, and (RIVN), the fastest grower in percentage terms, on dips.

EVs Take 25% of China New Vehicle Sales, and Tesla’s Shanghai factory is a major participant. Tesla just double production there. Some 403,000 EVs were sold in China in May alone. China is also ramping up its own EV production, up 183% YOY. China is much more dependent on imported oil than other large nations, most of which goes to transportation. Global EV production is expected to soar from 8 to 60 million vehicles in five years and Tesla is the overwhelming leader. Buy (TSLA) on dips again.

Oil (USO) Hits New 2022 Low at $78 a Barrel, cheaper than pre–Ukraine War prices, thanks to exploding recession fears. Is Jay Powell the most effective weapon against Russia with his most rapid interest rate rises in history?

Consumer Sentiment Hits Record Low at 59.1 according to the University of Michigan. That’s worse than the pandemic low and the 2009 Great Recession low. It could be that politics has ruined this data source making everyone permanently negative about the future. Inflation at a 40-year high isn’t helping either, nor is the prospect of nuclear war.

Case Shiller Delivers a Shocking Fall, down from 18.7% to 16.1% in June. The other shoe is falling with the sharpest drop in this data series in history. Tampa was up (31.8%), Miami (31.7%), and Dallas (24.7%). Many more declines to come.

30-Year Fixed Rate Mortgage Hits 7.08%, up from 2.75% a year ago. You can kiss those retirement dreams goodbye. It has been the sharpest rise in mortgage rates in history. Real estate has just become an all-cash market. That screeching juddering sound you hear is the existing home market shutting down.

Pending Home Sales Drop, down 2.0% in August on a signed contract basis. Sales are down for the third month in a row and are off 24% YOY. Only the west gained. Mortgage interest rates are now at 20-year highs. Buyers catching recession fears are breaking contracts and walking away from deposits.

Stock Crash Wipes Out $9 Trillion in Personal Wealth, which is the fall in equity holdings and mutual funds as of the end of June. The drop has been from $42 to $33 trillion. The bad news: it’s still going down, putting a dent in consumer spending.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil in a sharp downtrend and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, October 3 at 8:30 AM, the ISM Manufacturing PMI for September is released.

On Tuesday, October 4 at 7:00 AM, the JOLTS Report for private job openings for September is out.

On Wednesday, October 5 at 7:00 AM, ADP Private Employment Report for September is published.

On Thursday, October 6 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, October at 8.30 AM, the Nonfarm Payroll Report for September is disclosed. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, while working for The Economist magazine in London, I was invited to interview some pretty amazing people: Margaret Thatcher, Ronald Reagan, Yasir Arafat, Zhou Enlai.

But one stands out as an all time favorite.

In 1982, I was working out of the magazine’s New York Bureau off on Third Avenue and 47th Street, just seven blocks from my home on Sutton Place, when a surprise call came in from the editor in London, Andrew Knight. International calls were very expensive then, so it had to be important.

Did anyone in the company happen to have a US top secret clearance?

I answer that it just so happened that I did, a holdover from my days at the the Nuclear Test Site in Nevada. “What’s the deal,” I asked?

A person they had been pursuing for decades had just retired and finally agreed to an interview, but only with someone who had clearance. Who was it? He couldn’t say now. I was ordered to fly to Los Angeles and await further instructions.

Intrigued, I boarded the next flight to LA wondering what this was all about. What I remember about that flight is that sitting next to me in first class was the Hollywood director Oliver Stone, a Vietnam veteran who made the movie Platoon. When Stone learned I was from The Economist, he spent the entire six hours grilling me on every conspiracy theory under the sun, which I shot down one right after the other.

Once in LA, I checked into my favorite haunt, the Beverly Hills Hotel, requesting the suite that Marilyn Monroe used to live in. The call came in the middle of the night. Rent a four-wheel drive asap and head out to a remote ranch in the mountains 20 miles east of Santa Barbara. And who was I interviewing?

Kelly Johnson from Lockheed Aircraft (LMT).

Suddenly, everything became clear.

Kelly Johnson was a legend in the aviation community. He grew up on a farm in Michigan and obtained one of the first masters degrees in Aeronautical Engineering in 1933 at the University of Michigan.

He cold called Lockheed Aircraft in Los Angeles begging for a job, then on the verge of bankruptcy in the depths of the Great Depression. Lockheed hired him for $80 a month. What was one of his early projects? Assisting Amelia Earhart with customization of her Lockheed Electra for her coming around-the-world trip, from which she never returned.

Impressed with his performance, Lockheed assigned him to the company’s most secret project, the twin engine P-38 Lightning, the first American fighter to top 400 miles per hour. With counter rotating props, the plane was so advanced that it killed a quarter of the pilots who trained on it. But it allowed the US do dominate the air war in the Pacific early on.

Kelley’s next big job was the Lockheed Constellation (the “Connie” to us veterans), the plane that entered civil aviation after WWII. It was the first pressurized civilian plane that could fly over the weather and carried an astonishing 44 passengers. Howard Hughes bought 50 just off of the plans to found Trans World Airlines. Every airline eventually had to fly Connie’s or go out of business.

The Cold War was a golden age for Lockheed. Johnson created the famed “Skunkworks” at Edwards Air Force base in the Mojave Desert where America’s most secret aircraft were developed. He launched the C-130 Hercules, which I flew in Desert Storm, the F-104 Starfighter, and the high altitude U-2 spy plane.

The highlight of his career was the SR-71 Blackbird spy plane where every known technology was pushed to the limit. It could fly at Mach 3.0 at 100,000 feet. The Russians hated it because they couldn’t shoot it down. It was eventually put out of business by low earth satellites. The closest I ever got to the SR-71 was the National Air & Space Museum in Washington DC at Dulles airport where I spent an hour grilling a retired Blackbird pilot.

Johnson greeted me warmly and complimented me on my ability to find the place. I replied, “I’m an Eagle Scout.” He didn’t mind chatting as long as I accompanied him on his morning chores. No problem. We moved a herd of cattle from one field to another, milked a few cows, and fertilized the vegetables.

When I confessed to growing up on a ranch, he really opened up. It didn’t hurt that I was also an engineer and a scientist, so we spoke the same language. He proudly showed off his barn, probably the most technologically advanced one ever built. It looked like a Lockheed R&D lab with every imageable power tool. Clearly Kelley took work home on weekends.

Johnson recited one amazing story after the other. In 1943, the British had managed to construct two Whittle jet engines and asked Kelly to build the first jet fighter. The country that could build jet fighters first would win the war. It was the world’s most valuable machine.

Johnson clamped the engine down to a test bench and fired it up surrounded by fascinated engineers. The engine immediately sucked in a lab coat and blew up. Johnson got on the phone to England and said “Send the other one.”

The Royal Air Force placed their sole remaining jet engine on a plane which flew directly to Burbank airport. It arrived on a Sunday, so the scientist charged with the delivery took the day off and rode a taxi into Hollywood to sightsee.

There, the Los Angeles police arrested him for jaywalking. In the middle of WWII with no passport, no ID, a foreign accent, and no uniform, they hauled him straight off to jail.

It took two days for Lockheed to find him. Johnson eventually attached the jet engine to a P-51 Mustang, creating the P-80, and eventually the F-80 Shooting Star (Lockheed always uses astronomical names). Only four made it to England before the war ended. They were only allowed to fly over England because the Allies were afraid the Germans would shoot one down and gain the technology.

But the Germans did have one thing on their side. The Los Angeles Police Department delayed the development of America’s first jet fighter by two days.

Germany did eventually build 1,000 Messerschmitt Me 262 jet fighters, but too late. Over half were destroyed on the ground and the engines, made of steel and not the necessary titanium, only had a ten hour life.

That evening, I enjoyed a fabulous steak dinner from a freshly slaughtered steer before I made my way home. I even helped Kelly slaughter the animal, just like I used to do on our ranch in Montana. Steaks are always better when the meat is fresh and we picked the best cuts. I went back to the hotel and wrote a story for the ages.

It was never published.

One of the preconditions of the interview was to obtain prior clearance from the National Security Agency. They were horrified with what Johnson had told me. He had gotten so old he couldn’t remember what was declassified and what was still secret.

The NSC already knew me well from our previous encounters, but MI-6 showed up at The Economist office in London and seized all papers related to the interview. That certainly amused my editor.

Johnson died at age 80 in 1990. As for me, it was just another day in my unbelievable life.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

SR-71 Blackbird

My Former Employer

Global Market Comments

September 26, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HOW TO TRADE THE 4TH QUARTER)

(SPY), (TLT), (AAPL), (TSLA), (RIVN)

In a mere six months, the Federal Reserve has morphed from Dr. Jekyll into Mr. Hyde.

It has changed from the stock market’s best friend to its worst enemy. Not only has the punch bowl been taken away, but it has also been smashed on the floor in a thousand pieces. A regime change has taken place in risk.

Welcome to a hostile Fed, one that utterly hates the stock market and loves cash. In fact, it loves cash so much it has raised its bid for overnight money from nothing to 4.2% in only six months. It is the fastest rise in interest rates in history.

To say that conditions have changed for the stocks would be the understatement of the century. This makes stocks less valuable, especially anything connected with growth, like technology stocks, and big borrowers, such as cruise lines.

Which raises the important question of the day: How the HECK are we going to trade the stock market in Q4?

It was in September of 2020 when 34 of my clients became millionaires buying TESLA at precisely the right time…

Well, the stars have aligned once again!!!!

In my TESLA free report, I list 10 reasons I’d tell my grandmother to mortgage her house and go all in.

Go to madhedgeradio.com and download my “Tesla Takes Over the World” free report.

Let me give you the good news first.

Q4 is likely to establish the final low for the bear market in stocks for this cycle. I don’t buy the endless years of suffering or the “lost decade” theories. Technology is just evolving too fast. It really makes no difference whether that low is at (SPX) $3,600, $3,300, or even $3,000. The best entry point for stocks in a decade will soon be at hand.

Keep in mind that with an (SPX) at $3,000 the market will be down a horrific 37.5% in a year. That is a worst-case scenario. A collapse this rapid has not happened since 1929.

This is for an economy that has seen no financial stresses whatsoever, except in crypto. This time, there are no banks going under, brokers going bust, housing crashes, or other similar stresses that drove the (SPX) down 52% by 2009.

There is nowhere near the misallocation of capital and malinvestment that we saw 15 years ago. Down 37.5% sounds like a screaming bargain to me.

The early “tell” that we are approaching the end came on Friday when the Volatility Index (VIX) hit $32.31. With any luck, it could top $40 in the coming weeks. Friday, when the Dow Average was down 800 points, we saw the largest put option buying in market history.

At that point, it will be possible for me to construct positions for you that are mathematically impossible to lose money with and offer the upside potential return of 10:1.

Once a handful of other technical indicators kick in, we’re there. This is what you should be looking for:

The (VIX) tops $40

Volume spikes

Down stocks top up ones by 90:10

The put:call ratio hits 2:1

A big intraday reversal that closes higher, like down $100 for the (SPX), up $150

Technology stocks, the most volatile sector in the market, also deliver a major turnaround

We get a dramatically lower report for the Consumer Price Index (and the next one is out October 13)

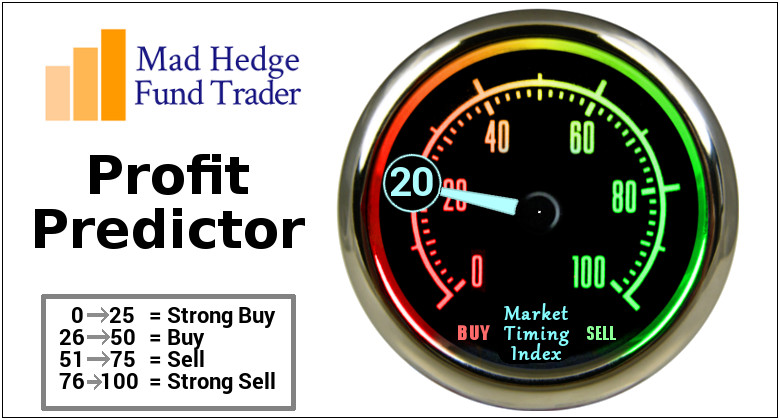

The Mad Hedge Market Timing Index falls below 10

So, what to buy this time?

With the Midterm elections now only 43 days away on Tuesday, November 8, it’s time to contemplate the implications for your retirement portfolio. The play of the decade is setting up.

Let me give you the good news first.

Whoever wins, and at this point, it really could be anyone, markets will rally after the election and power on until the end of 2022, some 10%-20%. The mere fact that the election is over is a huge market positive.

That’s the easy part.

But what if the election was held today?

The polls are telling us that the Democrats could pick up 2-3 seats in the Senate. The House now looks like a 50/50 split. Control could literally hinge on a handful of battleground states.

Suburban housewives now appear to be the great deciders.

So, what happens if the Democrats keep control of both houses, and the status quo is maintained?

For a start, taxes will be going up a lot, especially for the wealthy. Carried interest might finally make the ultimate sacrifice after coming back from the dead countless times. SALT taxes might get a break, but it is not likely. Once the government gets its hands on a revenue stream, it is loath to give it up.

It’s spending where we will see some important changes. Think more of the last two years, but in larger amounts.

Support for the Ukraine War will continue. So far, the US is getting great value for money. To eliminate the major military threat to the US and Europe for only $50 billion is the deal of the century. I’d pay ten times that.

So far, the Ukrainians are doing all the dying and we only write the checks. I greatly prefer that to a Vietnam-style commitment that bleeds us white (and by the way, I did some of that bleeding). Believe me, I’m doing everything I can to help by advising the Joint Chiefs of Staff.

The real game changer will be an alternative energy bill much larger than the last $733 billion bill. The goal will be to accelerate the decarbonization of the US, and ultimately the global economy. Of course, the free market will drive this anyway. No major automaker will be building internal combustion engines after 2030. What the government can do is to make it happen fast.

A year ago, climate change was an “it might happen someday after I’m long gone” kind of possibility. After a summer of 116 degrees in California and 114 degrees in France, “someday” has become “Yikes, it’s happening now!”

The last bill was truly misnamed as the “Inflation Reduction Act.” It really should have been called the “Tesla Shareholder Enrichment Bill”. Virtually every aspect of the bill somehow impinges on Elon Musk’s creation positively, which has been an overwhelming market leader in national electrification, enhanced EV subsidies, mass construction of charging stations, solar panels, and power walls, and decarbonization.

Since I am a major shareholder in (TSLA) and have been since the shares traded at $2.35, that’s fine with me. That probably explains why the shares are in the process of engineering a major upside breakout well before the election.

It isn’t just Tesla that will cash in. There is a broadening new leadership developing for the market to replace my technology stocks. Call it the “decarbonization sector”.

It includes EVs like Tesla (TSLA) and Rivian (RIVN), commodity stocks like copper miner Freeport McMoRan (FCX), uranium stocks like Cameco (CCJ) and the Uranium ETF (URA), solar companies like First Solar (FSLR) and SunPower (SPWR), alternative utilities like NextEra Energy (NEE), the world’s largest generator of electricity from wind and the sun, and silver plays like the iShares Silver Trust (SLV) and Wheaton Precious Metals (WPM), essential for high-efficiency wiring.

I will be adding more names to this list as I find them. Watch your research inbox.

Of course, 43 days in the political world is a couple of lifetimes in the real world, so anything can happen. A boatload of October surprises is probably just around the corner.

As for me, I’m putting more of my money into Tesla.

It all raises a new risk that we haven’t dealt with before.

What if the US government can’t afford to pay its own debt? When the last financial crisis and recession began in 2007, the US national debt was only a paltry $9 trillion, or 60% of GDP. It has since risen to $30 trillion, or 140% of GDP. Holy smokes!

That was all well and good while interest rates were dropping from 7% to zero. What happens when rates go back up from zero to 7.0%? The cost of carry for the US Treasury more than doubles as well, taking a much bigger bite of government spending, more than it can afford.

Just thought you’d like to know.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility in market history, my September month-to-date performance maintained at +1.68%.

I used last week’s extreme volatility to add shorts in Apple (AAPL), the S&P 500 (SPY), and the United States US Treasury bond fund (TLT). That takes me to 30% long, 30% short, and 40% cash. I am holding back my cash for a truly cataclysmic market selloff.

My 2022 year-to-date performance ballooned to +61.64%, a new high. The Dow Average is down -18.48% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +72.06%.

That brings my 14-year total return to +574.20%, some 2.86 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +44.74%, easily the highest in the industry.

On Monday, September 26 at 8:30 AM, the Chicago Fed National Activity Index for August is released.

On Tuesday, September 26 at 7:00 AM, the Durable Goods Index for August is out. New Home Sales are also printed.

On Wednesday, September 28 at 7:00 AM, Pending Home Sales for August are published.

On Thursday, September 29 at 8:30 AM, Weekly Jobless Claims are announced. We also learn the final report for US Q2 GDP.

On Friday, September 30 at 7:00 AM, the Personal Income and Spending are disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, I’ve found a new series on Amazon Prime called 1883. It is definitely NOT PG rated, nor is it for the faint of heart. But it does remind me of my own cowboy days.

When General Custer was slaughtered during his last stand at the Little Big Horn in 1876 in Montana, my ancestors spotted a great buying opportunity. They used the ensuing panic to pick up 50,000 acres near the Wyoming border for ten cents an acre.

Growing up as the oldest of seven kids, my parents never missed an opportunity to farm me out with relatives. That’s how I ended up with my cousins near Broadus, Montana for the summer of 1966.

When I got off the Greyhound bus in nearby Sheridan, I went into a bar to call my uncle. The bartender asked his name and when I told him “Carlat”, he gave me a strange look.

It turned out that my uncle had killed someone in a gunfight in the street out front a few months earlier, which was later ruled self-defense. It was the last public gunfight seen in the state, and my uncle hasn’t been seen in town since.

I was later picked up in a beat-up Ford truck and driven for two hours down a dirt road to a log cabin. There was no electricity, just kerosene lanterns and a propane-powered refrigerator.

Welcome to the 19th century!

I was hired as a cowboy, lived in a bunk house with the rest of the ranch hands, and was paid the princely sum of a dollar an hour. I became popular by reading the other cowboys newspapers and their mail since they were all illiterate. Every three days we slaughtered a cow to feed everyone on the ranch. I ate steak for breakfast, lunch, and dinner.

On weekends, my cousins and I searched for Indian arrowheads on horseback, which we found by the shoe box full. Occasionally, we got lucky finding an old rusted Winchester or Colt revolver just lying out on the range, a remnant of the famous battle 90 years before. I carried my own six-shooter to help reduce the local rattlesnake population.

I really learned the meaning of work and developed callouses on my hands in no time. I had to rescue cows trapped in the mud (stick a burr under their tail and make them mad), round up lost ones, and sawed miles of fence posts. When it came time to artificially inseminate the cows with superior semen imported from Scotland, it was my job to hold them still. It was all heady stuff for a 15-year-old.

The highlight of the summer was participating in the Sheridan Rodeo. With my uncle being one of the largest cattle owners in the area, I had my pick of events. So, I ended up racing a chariot made from an old oil drum, team roping (I had to pull the cow down to the ground), and riding a brahman bull. I still have a scar on my left elbow from where a bull slashed me, the horn pigment clearly visible.

I hated to leave when I had to go home and back to school. But I did hear that the winters in Montana are pretty tough.

It was later discovered that the entire 50,000 acres were sitting on a giant coal seam 50 feet thick. You just knocked off the topsoil and backed up the truck. My cousins became millionaires. They built a modern four-bedroom house closer to town with every amenity, even a big screen TV. My cousin also built a massive vintage car collection.

During the 2000s, their well water was poisoned by a neighbor’s fracking for natural gas, and water had to be hauled in by truck at great expense. In the end, my cousin was killed when the engine of the classic car he was restoring fell on top of him when the rafter above him snapped.

It all gave me a window into a lifestyle that was then fading fast. It’s an experience I’ll never forget.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

September 23, 2022

Fiat Lux

Featured Trade:

(SEPTEMBER 21 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (INTC), (NVDA), (AMD), (MU) (TBT), (TLT), (AMGN),

(VIX), (CHPT), (TSLA), (GS), (BAC), (MS), (JPM), (USO), (TLT)

Below please find subscribers’ Q&A for the September 21 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: What would cause you to look for a lower bottom than $330 on the (SPY)?

A: Nuclear war with Russia would certainly do the trick—they’re now threatening to use tactical nuclear weapons in Ukraine—and higher-than-expected interest rates. If we get another 75 basis points after this one today, then I think you’re looking at new lows, but we won’t find that out until November 2. So, the market may just bounce along the bottom here for a while until it sees what the Fed is going to do, not on this rate hike but the next one after that. Other than that, a few dramatically worse earnings from corporations would also allow us to test a lower low.

Q: Is it time to nibble on Nvidia Corporation (NVDA)?

A: Nvidia is one of the most volatile stocks in the market. You don’t want to go into it until you’re absolutely sure the bottom is in. If that means you miss the first 10% of the following move up, that’s fine because when this thing moves, you get a double or triple out of it. I would wait for the indecision in the market to resolve itself before you get too aggressive on the most volatile stocks in the market. The same is true for the rest of the semiconductor sector.

Q: What does a final capitulation look like?

A: The Volatility Index (VIX) ever $40. We’ve had a high of VIX at $37 so far this year. If really get over $40, that would be a new high for the year. That would signal people that are throwing in the towel, giving up the market, selling everything—of course that is always the best time to buy.

Q: How do we get LEAPS guidance?

A: We send our LEAPS recommendations first to our concierge members—we only have a small number of those—and then after that, they go out to all subscribers to the Mad Hedge Global Trading Dispatch. Everyone gets exposure to the LEAPS. By the way, with LEAPS, you can take up to a month to execute a position. What I do is literally buy 1 contract a day, so I get a nice average over the period of a month when the market is most likely bottoming.

Q: Do you see Intel Corporation (INTC) as a good candidate for a Taiwan invasion hedge?

A: Well, first of all, China’s not going to invade Taiwan. I’ve been waiting for this for 70 years and it’s not going to happen. Also, Intel’s new management has yet to prove itself. You have a salesman running the company; I never like companies run by a salesman. I’d prefer to have an engineer run an engineering company. The court is still out on Intel and whether they can turn that company around or not; so, I would much rather buy the market leaders, Nvidia (NVDA), Advanced Micro Devices (AMD), and Micron Technology (MU) in the semiconductor space.

Q: You talked dollar/cost averaging before. Should we pause on averaging in?

A: No, that's why I say buy one contract a day and put it in order to buy at the bid side of the market. That way, any sudden swoosh down in the market and you’ll get filled. The spreads on these LEAPS are quite wide, so you want to try to buy as close to the middle or bottom end of the spread, and putting in single contract orders over a month, of course, will do that to you.

Q: Does that mean it’s time to sell the ProShares UltraShort 20+ year Treasury Yield (TBT)?

A: I would say yes; (TBT) hit $30.30 yesterday, which is a new multi-year high. I would be taking profits on that because on the next turnaround in bonds, you could get a very rapid move in (TBT) from $30 back down to $20. I’d rather have you keep that profit than try to squeeze the last dollar out of it. Remember, the (TBT) has a negative cost of carry now of 8% a year and that is a big nut to cover.

Q; Market outlook for mid-2023?

A: We could hit my $4,800 target by mid-2023; that is up 28% from here.

Q: Can we buy LEAPS on Amgen (AMGN)?

A: Absolutely yes, you can. Go for the highest listed strike prices on the call side with the longest possible maturity. I would do the January 17, 2025 $350-$360 vertical bull call spread which you can buy now for $1.00. That gives two years and four months to get a tenfold return. That’s enough time for a full-bore recession to happen and then a recovery where markets take off like a rocket. The call spread you bought for $1.00 becomes worth $10.00.

Q: Is there a long position on the beneficiary of government plans to build EV charging stations?

A: There is, but I'm not recommending EV charging stations because it’s a low value-added business. You buy electric power from the local utility, add 10 cents and resell it. The margins are small, the competition is heating up. There are much smarter ways to play EVs than the charging station. ChargePoint (CHPT) is certainly one of them, but it’s not a great investment idea. Look at how ChargePoint (CHPT) has performed over the last six months compared to Tesla (TSLA) and you see what I mean.

Q: Given the very poor investor sentiment, why don’t we get a testing of the lows and result in a (VIX) pop?

A: Absolutely yes—that is what everybody in the market is waiting for. And it could happen as soon as this afternoon. If it doesn’t happen this afternoon, allow for a little rally and then a meltdown on the next piece of bad news.

Q: I’m not able to get an email response from customer support.

A: Try emailing filomena@madhedgefundtrader.com. If that doesn’t work, you can try calling at (347) 480-1034. Filomena will always be happy to take care of you.

Q: What maturity of US Treasury securities would you buy now?

A: I would buy the 30-year. You’re getting close to a 4% yield on that—that is starting to look attractive to people who don’t want to work for a living picking stocks on a daily basis. We are about to see the rebirth of bond investing.

Q: What about banks?

A: Banks will be a screaming buy and a three-year double once recession fears end, which could be in a couple of months. We now have sharply rising interest rates, which banks love, but the bear market in stocks has killed off the IPO business, credit risk is rising, and of course, the Bitcoin business has gone to zero also. So, I would wait for fears of credit quality to end, and then you’ll get a double in the banks very quickly, and notice how they’re all flatlining at a bottom, they’re not actually going down anymore.

Q: Which banks are good choices?

A: Goldman Sachs (GS) and Bank of America (BAC) are two great ones, along with Morgan Stanley (MS) and JP Morgan (JPM).

Q: Do you think the market will bottom by the midterms?

A: I do, I think we will bottom a few weeks before the midterms, or the day after. Sometimes that’s the way it goes, and then it will be off like a rocket for the rest of the year. If we can do this from a much lower level in the SPYs, so much the better. Remember, the next Fed meeting is six days before the election. Yikes!

Q: If OPEC cuts production (USO), won’t the supply/demand cause oil prices to start rising again, increasing inflation and people’s prices at the pump?

A: Yes, but OPEC needs the money. Not necessarily Saudi Arabia, but all the other members of OPEC are starved for cash, and that is always how these shortages end. The smaller members cheat on quotas and bust the price. That's clearly what’s driven us down $50 since the February high, small member cheating. And that will continue. It is a cartel with some serious internal conflicts that will never resolve.

Q: Does it cost $17,000 to mine a Bitcoin?

A: It did four months ago. My guess is it’s more expensive now because of the higher cost of electricity around the world. We may even be up to $20,000 cost, which is why it tends to hang around the $20,000 level on the low side. Below that, miners lose money and the supply dries up, just like you see in the gold market.

Q: Do you have an opinion on Real Estate Investment Trusts (REIT)?

A: Yes; credit risk is rising, as are the yields. In a real estate recession, you start to get more defaults on REITS, but the yields on them are very high; so if you are going to play, buy a basket to spread your risk.

Q: Would you buy ProShares UltraShort 20+ year Treasury Yield (TLT) calls spreads now?

A: Yes, but I would go farther in the money, like the mid $90s, because I don’t think we’ll get that low in this cycle. I would also go out another month; instead of a one-month call spread in the mid $90s, I would do a two-month maturity. You could probably take in about $2,000 on a $10,000 position in the mid $90s.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Back at Lake Tahoe

Global Market Comments

September 19, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE FART HEARD ROUND THE WORLD)

(SPY), (TLT), (TSLA), (RIVN), (FDX), (FCX)

It was the fart heard around the world.

Every investor was positioned for inflation to crater and stocks to soar. We got the opposite instead with the Dow delivering its worst day since the pandemic lows 2 ½ years ago.

But every trader I know thought the recent rally smelled of three-day old fish and was poised for a selloff. I was expecting the latter and went into a rare 100% cash position. I have probably had 100% cash positions maybe six days over the last 15 years.

A lot of traders who only trade the CPI got flushed out of the market on Wednesday at the lows because they were the wrong way.

I attended karate school in Japan for ten years, and besides learning a fearsome attitude and losing my front teeth I also picked up a valuable lesson. ALWAYS kick a man when he is down because that is when he is least likely to hit you back.

The market got that second kick-in with the FedEx earnings on Friday indicating that the economy is in much worse shape than traders realize. Not only did (FDX) crater by 23%, the entire technical structure of the market broke down.

A double bottom in the (SPY) at $362 is now not only a possibility, but a probability and a cycle final low of (SPY) $330 is now on the table, if only for seconds. The latter would give us a top to bottom bear market of $150, or 31.25%. This is “screaming buy” territory.

It’s an old market that has seen the stock market discount 12 of the last six recessions. This is one of those “non-recessions.” Tuesday saw only 1% of stocks up on the day. Whenever this happens the return for the following 12 months averages 15.6%. Sell here at your peril.

The next major market event will be a Fed interest rate rise of 75 basis points on September 21. That will probably be the last hike of this magnitude this decade. After that, we’re dealing with quarter-point rate rises at worst and cuts at best.

Inflation expectations are falling. Consumers are morphing from “I’ll take it whatever the price” to “can you give me a deal.” Price competition is returning after a long absence. Supply chain problems have disappeared. All those ships in the harbor have gone.

Competition from imports is also increasing, thanks to a super strong US dollar. Look how fast they turned the lights out in the residential real estate market.

I have been in the market for 54 years and can tell you that when inflation peaks, stocks bottom. That means you should start scaling into your favorite positions right now.

With my Mad Hedge Market Timing Index gaping down to 32, I decided to dip my toe in the water with what will probably be the lead sector in the market for the next decade. You may not have noticed, but we have just entered the golden age of the electric vehicle, thanks to climate change and massive government support.

That draws me to Tesla (TSLA), the overwhelming leader and Rivian (RIVN), the top up and comer, or should I say it, the next Tesla.

Of course, whenever a report defies expectations like the CPI, naysayers come out of the woodwork decrying its validity. My old friend, Dr. Jeremy Siegel of Wharton School of Business, says the CPI is overreading inflation by employing an arcane method of calculating housing costs that make up half the index.

The result is a read on real estate costs which is 18 months out of date. The CPI says home costs are still rising sharply, while any real estate broker in the country will tell you it’s in free fall.

My own agent has six homes for sale and expects to get another seven this month. The only people showing up for her open houses are neighborhood gawkers. Actual buyers are a thing of yesterday and prices have easily dropped 10% in six months and that’s being charitable.

And here is the bet that you are going long here. In 2021, technology stocks, the overwhelming lead sector in the market, saw earnings increase by 30%. In 2022, they will probably come in at 6%. In 2023, they will likely bounce back to 10-12%. Here, today, the market has not yet discounted next year’s bounce. If there is a recession, it is a small one and is already fully backed into prices.

I have been fighting off requests for LEAPS (Long Term Equity Anticipation Securities) all year. Well, start checking your inbox because my LEAPS alerts are going to start coming hot and heavy. I sent out LEAPS for Tesla (TSLA) and Rivian (RIVN) last week and there are more to come. Hint: watch the price of copper with an eagle eye.

Consumer Price Index Came in at a hot 8.3% in August, much higher than expected. Stocks dropped 500 points in a heartbeat. It’s not what traders wanted to hear, up from 8.2% last month. It guarantees a 75-basis point rate hike next week. Is 100 basis points now on the table? Good thing I’m 100% cash.

Yikes! That’s Going to Leave a Bruise after the worst day in the markets since the pandemic low 2 ½ years ago. Investors were perfectly positioned for falling inflation. Tech stocks led the charge to the downside, with NASDAQ off 5%. Bitcoin crashed 10%. Bonds almost hit my 2022 target with a 2.43% yield. The US Dollar (UUP) soared. Get the Volatility Index (VIX) over $30 and I will start adding call spreads from my 100% cash position.

Are US Treasury Bonds Now a “BUY” with yields approaching my 2022 target of 3.50%? Even allowing for overshoot, you can start adding longs close to here. Notice how the (TLT) opened low and then rallied all day, despite despicable trading conditions. We all know that inflation will be back to 2% in a year.

Google gets hit with a $4.1 Billion fine in Europe over antitrust concerns where it controls 92% of the online advertising market. It’s the largest fine in corporate history, but it’s like water off a duck's back with a $1.67 trillion market capitalization. Just a cost of doing business. Buy (GOOGL) on dips.

It’s Like They Shut the Lights Out in the real estate market, which flipped from the offer to the bid side of the market in weeks. A 30-year fixed at 5.89% hasn’t helped. Open Houses are now clogged with gawking neighbors and few buyers. Six months ago, you needed an appointment. No More. It’s a global problem. I can get you a great deal on a mansion.

British Pound Hits 37-Year Low at $1.14 to the US dollar. Traders cite a lack of confidence in the new prime minister Liz Truss. The real reason is the structural toll taken by Brexit, the consequences of which will take a half-century to play out. It means a weak economy, falling standards of living, and a much lower British pound.

US Oil Reserves Hit 38-Year Low at 434 million barrels, down 39% from maximum capacity. That is about 22 days of consumption. Capping oil prices to save consumers has its price.

Weekly Jobless Claims Come in at 213,000, down 5,000 and lower for the fifth consecutive week according to the Department of Labor. The data gives ample room for a 75-basis point Fed rate hike next week.

Rail Strike Averted at the last possible minute after an all-night session. Biden clearly called in his IOUs with the unions to get a deal done. A rail strike would have been a complete disaster for the economy and demolished his election hopes.

Ether Dives on the Merge, down 6%, with the short sellers piling in at the highest possible prices. The merge involved the transition from a proof-of-work to proof-of-stake model. Avoid all crypto while the winter continues, especially (ETHE). Looks like a great head-and-shoulders top on the charts to me.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility in market history, my September month-to-date performance clawed its way up to +2.45%. My 2022 year-to-date performance ballooned to +62.41%, a new high.

I used the monster selloff to add my first new longs in a while, in EV makers Tesla (TSLA) and Rivian (RIVN).

The Dow Average is down -18.26% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +74.75%.

That brings my 14-year total return to +574.97%, some 2.66 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +44.84%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 95.6 million, up 100,000 in a week and deaths topping 1,053,000 and have only increased by 1,000 in the past week. You can find the data here.

On Monday, September 19 at 8:30 AM, the NAHB Housing Market Index for September is released.

On Tuesday, September 20 at 7:00 AM, the Housing Starts and Building Permits for August are out.

On Wednesday, September 21 at 7:00 AM, Existing Homes Sales for August are published. At 11:00 AM EDT, we get the Fed interest rate decision where they are likely to raise by 75 basis points.

On Thursday, September 22 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, September 23 at 7:00 AM, the S&P Global Flash PMI for September is disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, I am reminded of my own summer of 1967, back when I was 15, which may be the subject of a future book and movie.

My family summer vacation that year was on the slopes of Mount Rainer in Washington state. Since it was raining every day, the other kids wanted to go home early. So my parents left me and my younger brother in the hands of Mount Everest veteran Jim Whitaker to summit the 14,411 peak (click here for his story). The deal was for us to hitchhike back to Los Angeles when we got off the mountain.

In those days, it wasn’t such an unreasonable plan. The Vietnam war was on, and a lot of soldiers were thumbing their way to report to duty. My parents figured that since I was an Eagle Scout, I could take care of myself.

When we got off the mountain, I looked at the map and saw there was this fascinating country called “Canada” just to the north. So, we were off to Vancouver. Once there, I learned there was a world’s fair going on in Montreal some 2,843 away, so we hit the TransCanada Highway going east.

Crossing the Rockies, the road was closed by a giant forest fire. The Mounties were desperate and were pulling all abled-bodied men out of the cars to fight the fire. Since we looked 18, we were drafted, given an ax and a shovel, and sent to the front line for a week, meals included.

We ran out of money in Alberta, so we took jobs as ranch hands. There we learned the joys of running down lost cattle on horseback, working all day at a buzz saw, inseminating cows with a giant hypodermic, and eating steak three times a day.

I made friends with the cowboys by reading them their mail, which they were unable to do. There were lots of bills due, child support owed, and alimony demands. Now I know where all those country western lyrics come from.

In Saskatchewan, the roads ran out of cars, so we hopped on a freight train in Manitoba, narrowly missing getting mugged in the rail yard in the middle of the night. We camped out in a box car occupied by other rough sorts for three days. There’s nothing like opening the doors and watching the scenery go by with no billboards and the wind blowing through your hair!

When the engineer spotted us on a curve, he stopped the train and invited us to up to the engine room. There, we slept on the floor, and he even let us take turns driving! That’s how we made it to Ontario, the most mosquito-infested place on the face of the earth.

Our last ride into Montreal offered to let us stay in his boat house as long as we wanted, so there we stayed. Thank you, WWII RAF bomber pilot Group Captain John Chenier!

Broke again, we landed jobs at a hamburger stand at Expo 67 in front of the imposing Russian pavilion. The pay was $1 an hour and all we could eat. At the end of the month, Madame Desjardin couldn’t balance her inventory, so she asked how many burgers I was eating a day. I answered 20, and my brother answered 21. “Well, there’s my inventory problem” she replied.

And then there was Suzanne Baribeau, the love of my life. I wonder whatever happened to her?

I had to allow two weeks to hitchhike home in time for school. When we crossed the border at Niagara Falls, we were arrested as draft dodgers as we were too young to have driver’s licenses. It took a long conversation between US Immigration and my dad to convince them we weren’t.

Then they asked Dad if we should be arrested and sent back on the next plane. He replied, “No, they can make it on their own.”

We developed a clever system where my parents could keep track of us. Long-distance calls were then enormously expensive. So, I called home collect and when my dad answered, he asked what city the call was coming from. When the operator gave him the answer, he said he would not accept the call. I remember lots of surprised operators. But the calls were free, and dad always knew where we were.

We had to divert around Detroit to avoid the race riots there. We got robbed in North Dakota, where we were in the only car for 50 miles. We made it as far as Seattle with only three days left until school started.

Finally, my parents had a nervous breakdown. They bought us our first air tickets ever to get back to LA, then quite an investment.

I haven’t stopped traveling since, my tally now topping all 50 states and 135 countries.

And I learned an amazing thing about the United States. Almost everyone in the country is honest, kind, and generous. Virtually every night our last ride of the day took us home and provided us with an extra bedroom or a garage to sleep in. The next morning, they fed us a big breakfast and dropped us off at a good spot to catch the next ride.

It was the adventure of a lifetime and am a better man for it.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Summit of Mt. Rainier 1967

McKinnon Ranch Bassano Alberta 1967

American Pavilion Expo 67

Hamburger Stand at Expo 67

Picking Cherries in Michigan 1967

Global Market Comments

September 12, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or STUCK IN THE MIDDLE)

(SPY), (TSLA), (TLT), (USO), (VIX), (AAPL)

Buy fear, sell greed.

That is what has been my magic formula for making money over the past 50 years.

But what happens if you get nothing?

What happens if you are stuck in a big fat middle of a range? That seems to be the case now that the market is nailed to the (SPY) 4,000 level, which it turns out is exactly the middle of a four-month trading range.

The market fought the Fed for two months from June and won. It has lost since Jackson Hole. The market has only seen that degree of whipsaw four times since 1950.

It now appears that it is front running a very weak number for the Consumer Price Index on September 13. After that, we get a 75-basis point rate rise on September 20. Good cop first, then bad cop.

That leaves me twiddling my thumbs along with everyone else, waiting for the market to throw up on its shoes. We were almost getting there last week when the Volatility Index (VIX) clawed its way back to $27. Then it gave it all up, falling back to $22. Some $5 is just not enough spread with which to make a living, or worth executing a trade.

And here is the key to the market right now.

You’re not buying stocks for headlines you are seeing today, which are universally dire, cataclysmic, and predicting Armageddon.

You are buying for the headlines that will appear in a year. This will include:

Russia loses the Ukraine War

The price of oil (USO) collapses below $50 a barrel

The European energy crisis ends

Gasoline prices fall below $2.00 a gallon

Inflation falls below 4%

Interest rates stabilize around 3.50%-4.00%

Corporate earnings reaccelerate

We get another $1 trillion in corporate share buybacks

That sounds like one heck of a market to buy into. Why not buy now when everything is on sale, rather than in a year when it is expensive once again?

You don’t have to bet the ranch today. Just scale in, buying 10% of a position a day in your favorite names until you are fully invested. That way, you’ll get an average close to a bottom. You’ll at least get a seat on the train and won’t be left behind waving goodbye from the platform.

That means adding technology stocks to your portfolio, which will be the top-performing sector for the rest of this century.

The other thing you can do is to start getting rid of your defensive names. If you think oil is going below $50 in a year as I do, you don’t want to have a single oil name in your portfolio.

You want to own boring stocks in falling markets and exciting ones in rising markets.

You can’t get THE bottom. I can’t do it, so how are you going to?

There is one other factor that I guarantee you no one is looking at. Do you know anyone who bought a spec home for a quick flip lately? I bet not.

That means there is a lot of speculative capital looking for a new home and I bet that a lot of it is going into the stock market. The same is true with bitcoin.

I just thought you’d like to know.

Apple Rolls Out Next-Gen iPhone. The focus will be on larger phones with faster processors and a better camera. There may also be an inflationary $100 price increase. A new watch and Airpods are also expected. Buzz kill: every two years, this event usually marks a six-month high in the stock. Apple may no longer be the safest stock in the market.

Russia Cuts Gas Supplies to Europe until Ukraine sanctions are lifted. That took the Euro to a 20-year low of under 99 cents. You get into bed with the devil, and you pay the consequences. Russia must desperately need that trade with Europe.

Germany Fights Russia with Coal. Coal is enjoying a renaissance in Germany where it is being used to replace the total cut-off in Russian natural gas. In 2022, coal has jumped from 27% to 33% of electricity production, while gas has plunged from 18% to 11.7%. It goes against the country’s strong environmental principles and will only be used as a bridge towards greatly accelerated alternative energy efforts. Importing all the natural gas they can from the US also helps. It will greatly help Europe hold together this winter to face down the Russian energy war.

Home Equity is Shrinking, down $500 billion from the $11.5 trillion peak. It means less money is available to go into stocks. But we are nowhere near a crash, like we saw in 2008, when home equity nearly went to zero. No liar loans, exaggerated appraisals, or financial crisis this time. This housing recession will be about ice, not fire. There won’t be much of a housing crash when we’re still short 10 million homes. If you sell, your new mortgage will have double the interest rate. Ergo, don’t sell.

Weekly Jobless Claims Hit 3-Month Low, down 6,000 to 222,000. This number is not even close to an economic slowdown. In the wake of the decent nonfarm payroll report last week, it shows that employment is anything but slowing.

Tesla (TSLA) Triples China Deliveries after expanding the Shanghai factory. Elon Musk seems able to accomplish what others can’t, increasing production and sales in the face of rolling Covid lockdowns, heat waves, and materials shortages. Buy (TSLA) on dips.

California Sets a $22 Minimum Wage for fast food workers starting from 2023. It’s a catch-up with minimum wages that haven’t changed for 20 years and represents a broader issue for the rest of the country. Think this may be inflationary? Count on all of this going straight into product price rises. It may become cheaper to make your cheeseburgers at home.

The Bond Market Crashes, with ten-year US Treasury bond soaring 20 basis points to a 3.35% yield. The (TLT) hit a new 2022 low at $107.49. Bonds are reading the writing on the wall from Jackson Hole, even if stocks aren’t. Avoid (TLT).

Oil Crashes $4 on recession fears. Most Russian sales are now taking place 20% below the market to China and India. We may be approaching an interim low as winter approaches unless the Ukraine war ends.

A US Rail Strike Threatens as wage talks stall. A recession could be the result. Negotiators have until September 16 to reach a deal for 115,000 workers. A strike would also spike inflation. This could be our next black swan.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil in a sharp decline, inflation falling, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With markets now a snore, my September month-to-date performance ground up to +1.02%. I took profits in my last long in Microsoft (MSFT) going into a rare 100% cash position awaiting the next market entry point.

My 2022 year-to-date performance improved to +60.98%, a new high. The Dow Average is down -12% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +73.65%.

That brings my 14-year total return to +573.54%, some 2.48 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +44.98%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 95.2 million, up 300,000 in a week and deaths topping 1,050,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, September 12 at 8:30 AM, US Consumer Inflation Expectations for August is released.

On Tuesday, September 13 at 8:30 AM, the US Core Inflation Rate for August is out.

On Wednesday, September 14 at 7:00 AM, the Producer Price Index for August is published.

On Thursday, September 15 at 8:30 AM, Weekly Jobless Claims are announced. We also get Retail Sales for August.

On Friday, September 16 at 7:00 AM, the University of Michigan Consumer Sentiment is disclosed. At 2:00 the Baker Hughes Oil Rig Count are out.

As for me, when you’re 6’4” and 180 pounds, there is not a lot of things that can seriously toss you around. One is a horse, and another is a wave.

It was the latter that took me down to Newport Beach, CA to a beachfront house for my annual foray into body surfing. Newport Beach has some of the best waves in California.

This is the beach that made John Wayne a movie star.

John, whose real name was Marion Morrison, grew up in a Los Angeles suburb and won a football scholarship to the University of Southern California. While still a freshman in 1925, he went bodysurfing at Newport Beach with a carload of buddies. A big wave picked him up and smashed him down on the sand, breaking his right shoulder.

At football practice, there was no way a big lineman could block and tackle with a broken shoulder, so he was kicked off the team and lost his scholarship.

He still had to eat, so he resorted to the famed student USC jobs bulletin board, which I have taken advantage of myself (it’s where I got my LA coroner’s job).

The 6’4” Wayne was hired as a stagehand by up-and-coming movie director John Ford, himself also a former college football star. In 14 years, Wayne worked himself up from gopher, to extra, to a leading man in 1930, and then his breakout 1939 film Stagecoach.

During WWII, Wayne, too old, was confined to entertainment for the USO shows and making propaganda films while the rest of his generation was at the front. He never recovered from that humiliation and spent the rest of his life as a super patriot.

I saw John Wayne twice. My uncle Charles, who was the CFO of the Penn Central Railroad in the 1960s, made a fortune selling short the stock right before it went bankrupt (maybe that was legal then?). He bought a big beach house on California Balboa’s Island right next door to John Wayne’s.

One day, the family was cruising by Wayne’s house, and he was sitting on his front patio in a beach chair. Then one of our younger kids shouted out “he’s bald” which he was. Wayne laughed and waved.

The second time was in the early 1970s. I was walking across the lobby of the Beverly Hills Hotel with the movie star and Miss America runner-up Cybil Shephard on my arm. He walked right up to us and with a big smile said, “hello gorgeous”. He wasn’t talking to me.

I learned a lot about Wayne from my uncle, Medal of Honor winner Mitchell Paige, who was hired as the technical consultant for the 1949 film Sands of Iwo Jima and spent several months working closely with him. The lead character, Marine Sargent John Striker, was based on Mitch.

Film critics complained that Wayne couldn’t act, that he was just himself all the time. But I knew my uncle Mitch well, a humble, modest, self-effacing man, and Wayne absolutely nailed him to a tee.

The Searchers, made in 1958, and directed by John Ford, is considered one of the finest movies ever made. I show it to my kids every Christmas to remind them where they came from because we have an ancestor who was kidnapped in Texas by the Comanches and survived.

John Wayne was a relentless chain smoker, common for the day, and lung cancer finally caught up with him. His first bout was in 1965 when he was making In Harm’s Way, the worst war movie he ever made. His last film, The Shootist, made in 1978, was ironically about an old gunslinger dying of prostate cancer.

John Wayne hosted the 1979 Academy Awards rail thin, racked by chemotherapy and radiation treatments. He died a few months later after making an incredible 169 movies in 50 years.

John Wayne was one of those people you’re lucky to run into in life. He was a nice guy when he didn’t have to be.

As for those waves at Newport Beach, I can vouch they are just as tough as they were 100 years ago.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.