The calls started coming in as soon as the market closed.

More than a dozen subscribers called, emailed, and texted me on Thursday to say that they just had the best day in the market this year, and for some, their entire lives.

Holding fire until you saw the whites of their eyes worked. I used both visits to the (SPY) to $430 to load the boat with financial stocks, which then took off like a tribe of scalded chimps.

Mad Hedge made 5.6% on that day alone. One Concierge client reported a breathtaking $5.3 million profit after dumping a lot of his techs and piling into banks and brokers. Suffice it to say that I am very welcome in a well-to-do suburb of Seattle, Washington.

The washout was so dramatic and the recovery so rapid I think it is safe to say that our fall correction is over. We may get some small retracements and sideways chop from here. But the writing is on the wall. We are headed to new all-time highs in stocks by the end of 2022.

I received a lot of questions about how easily I was able to spot the bottom so easily. A Volatility Index (VIX) of $29 was a big help. So was the outflow of $34 billion from equity ETFs and mutual funds the previous week, the most in six months. And when the Mad Hedge Market Timing Index hits a rare low of 19, you don’t sit on your hands very long.

The $300 billion China Evergrande Group debt crisis gave us the crisis and the final flush we needed to establish a clear bottom.

Nothing else can stop this. New Covid cases are falling off a cliff, and childhood vaccinations out next month will accelerate this trend.

A massive infrastructure budget will pass in congress. It is almost irrelevant whether it’s a $3.5 trillion or $1.5 trillion. It will be more than can be spent in any reasonable amount of time.

In the meantime, the ultimate driver of share prices, the exponential growth of post covid corporate profits, continues unabated.

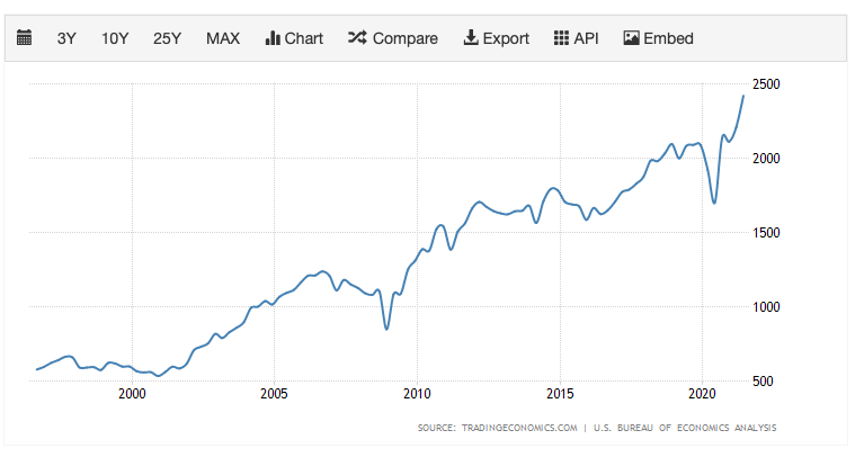

The wall of money keeps getting ever larger. The Fed reported that in Q2, Household Net Worth soared by $5.9 trillion is an incredible $141.7 trillion largely through the appreciation of stock and home prices. The Fed balance sheet has exploded from $4.1 trillion to $8.4 trillion in a mere 18 months.

This will continue for another decade. Keep piling on those leveraged long-term LEAPS. Flat is the new down.

Enjoy.

Four to six Interest RatesRises by 2024 which may start as early as 2024, says Fed governor Jay Powell. The taper could start in November. Bonds rose slightly on the news, but the writing is now definitely on the wall. The Fed now expects a stratospheric 5.9% GDP for 2021 and 3.8% for 2022. Sell all rallies in the (TLT) and buy all financial stocks.

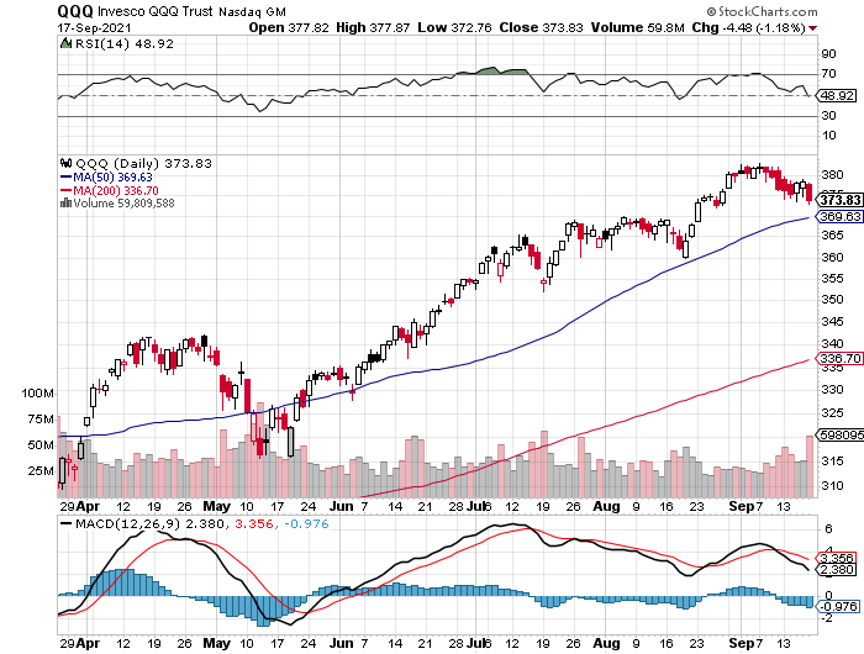

Bonds Crash, down -$3.43 points after Jay Powell’s super bearish comments from Wednesday soak in. The 50-day moving average has been smashed and the next target is the 200-day at $1344.59. Watch the 50-day rollover from here on. My final target is a 1.76% yield on the ten-year US Treasury bond by January.

Back up the Truck, it’s time to load up on stocks on the back of yesterday’s 985-point swan dive. You especially want domestic recovery ones that benefit from rising interest rates, like banks, brokers, fund managers, commodities, and steel. The taper may be only weeks away and will drive stocks to new highs by yearend. You wanted a dip to buy, so buy the dip. Don’t expect much from technology stocks for a while.

China’s Largest Real Estate Developer Goes Bust, China Evergrande Group, with $300 billion in debt. The move smashed risk markets globally, opening the Dow Average down 650. Bitcoin plunged 10%. Is this China’s Lehman moment, or just another day at the office? It does take them another step back towards real communism.

China Bans Crypto, triggering a 7% plunge in Bitcoin. Financial systems the government can’t control are forbidden in the Forbidden City. It’s all part of a flight out of a restricted Yuan into unrestricted crypto by wealthy Chinese. China used to account for 99% of all Bitcoin mining and now it is at zero. The business will flock to the US, Canada, and any other country with cheap electricity. It’s a short-term negative for crypto but a long term positive. Buy Bitcoin and Ethereum on the dip.

Pfizer Boosters for over 65 were approved by the FDA for immediate distribution. Those younger will have to wait. It turns out that the Pfizer effectiveness drops from 99% to 66% in eight months. That puts older recipients, like me, at risk. Under 12 kids to come in October. See you at Costco! Buy (PFE) on dips.

Pandemic Tops 1918 US Death Toll at 675,000, although on a per capita basis we are still only a third of the Spanish Flu. We are not even close to this ending yet. We need vaccinations for kids and booster shots for all to be dome with this, getting national immunity up to 90%.

Housing Starts for August up 3.9% with apartment buildings the big driver. Single family homes fell. Building Permits are up 6.0% and are a 50% increase from the summer lows.

Existing Home Sales Drop, by 2% in August to 5.88 million units annualized according to a signed contract basis. Only 1.29 million homes are for sale, a 2.6-month supply, down 13% YOY. The Median Price rose to an eye-popping $356,700, up 14.9% YOY. Million-dollar homes are up 40% YOY.

Google (GOOG) Buys $2.1 Billion in New York Office Space, which is why I love this company. You can forget about those end of New York City stories. Always follow the money, where companies are putting their money, and you will find great stock. Or so the chairman of JP Morgan Bank taught me 40 years ago. Buy (GOOG) on dips.

Weekly Jobless Claims Pop to 351,000 last week, up 16,000. Leading Economic Indicators jump in August, coming in at 0.9%. March saw the high for the year at 1.3%. Getting a lot of noisy and conflicting economic data points this week as delta works its way through the system.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My Mad Hedge Global Trading Dispatch saw a robust +6.63% gain so far in September. My 2021 year-to-date performance soared to 85.20%. The Dow Average was up 13.60% so far in 2021. September 23 saw my biggest up day of the year, some 5.61%

I held fire until the Dow Average 1,000-point washout, then loaded the boat with financial stocks, writing the trade alerts as fast as I could. That leaves me 70% long financial stocks, 10% in cash, and 20% in short (TLT).

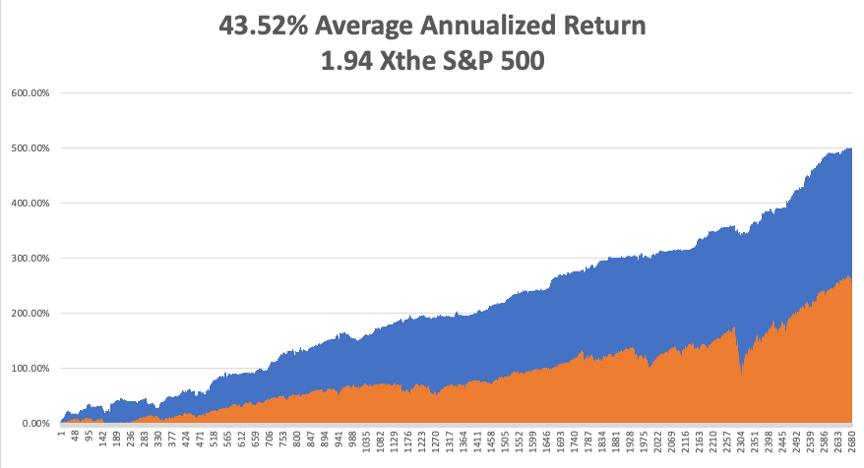

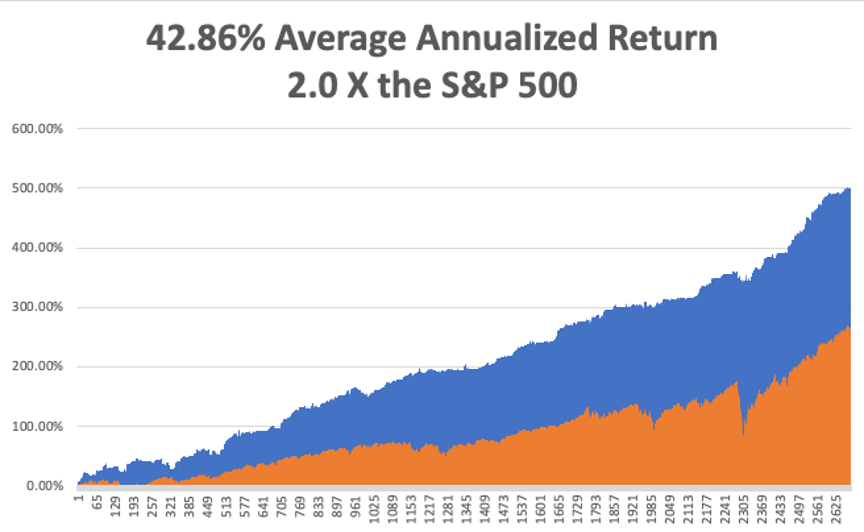

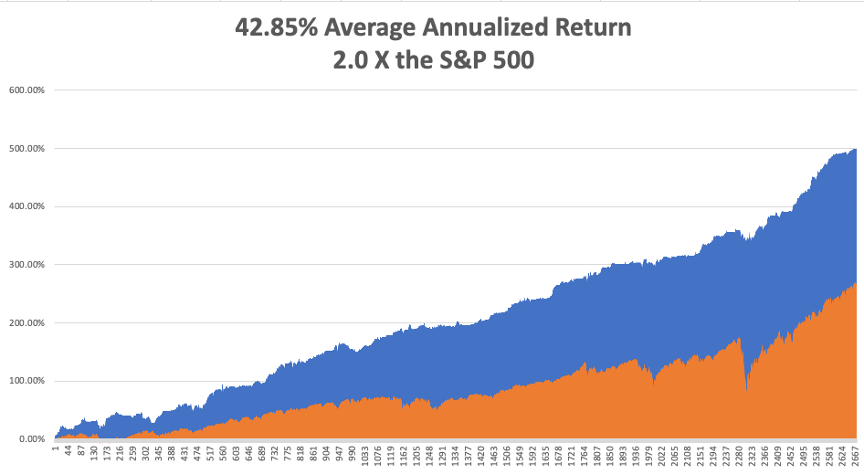

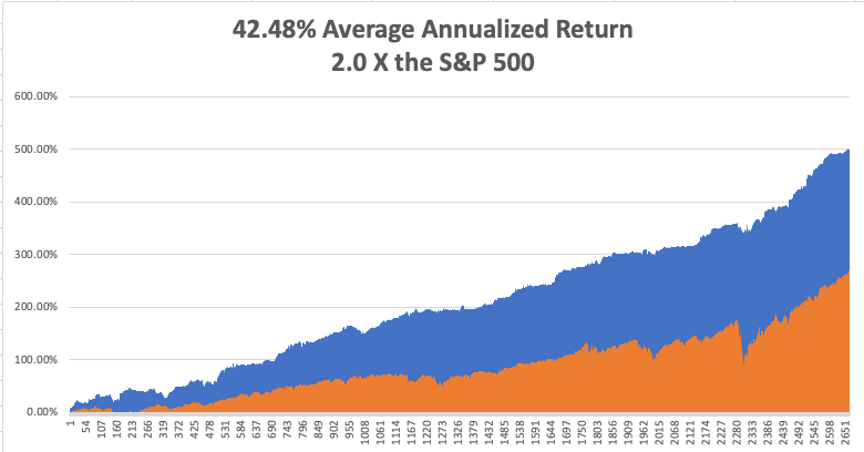

That brings my 12-year total return to 507.75%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 43.52%, easily the highest in the industry.

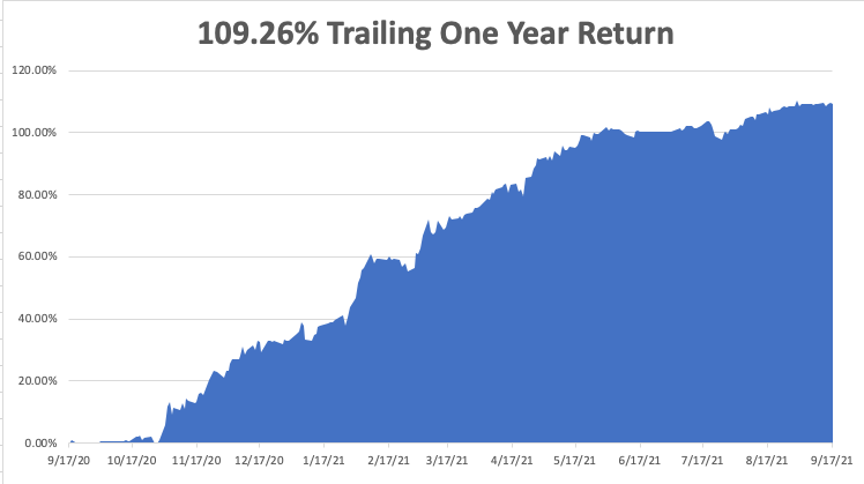

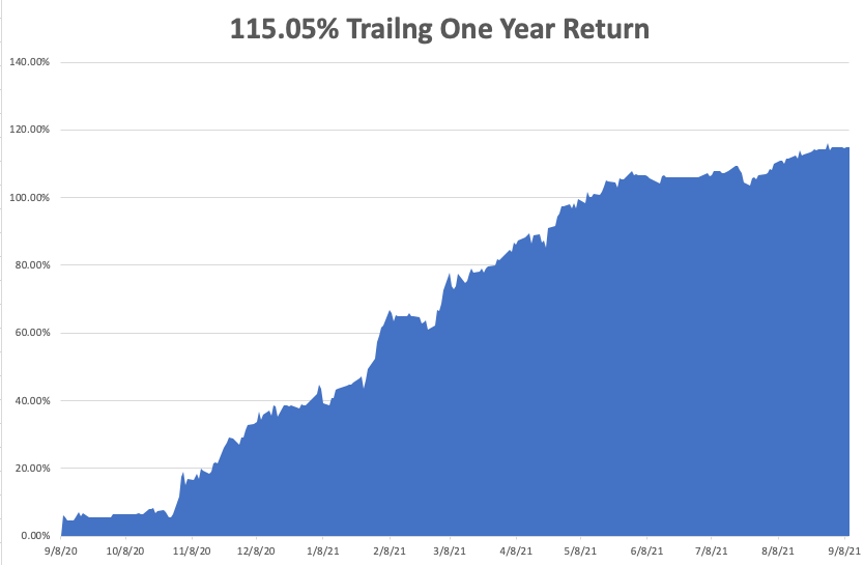

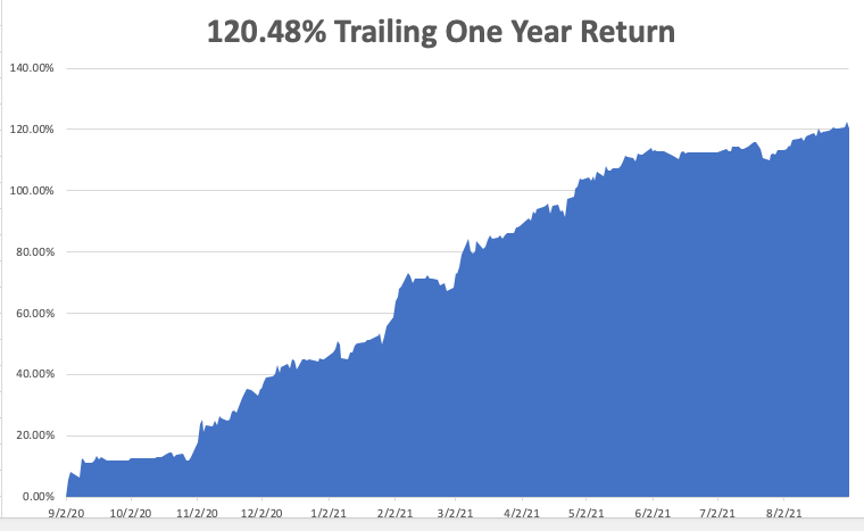

My trailing one-year return popped back to positively eye-popping 117.34%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 43 million and rising quickly and deaths topping 685,000, which you can find here.

The coming week will be slow on the data front.

On Monday, September 27 at 8:30 AM, Durable Goods are for August are reported.

On Tuesday, September 28 at 9:00 AM, The S&P Case Shiller National Home Price Index for July is published.

On Wednesday, September 29 at 10:00 AM, we get Pending Home Sales for August.

On Thursday, September 30 at 8:30 AM, Weekly Jobless Claims are announced. The final report of the Q2 US GDP is disclosed.

On Friday, October 1 at 8:30 AM, we learn Personal Income and Spending for August. The September Nonfarm Payroll Report is not out for another week due to the first day of the month rule. At 2:00 PM, the Baker Hughes Oil Rig Count is disclosed.

As for me, when I first met Andrew Knight, the editor of The Economist magazine in London 45 years ago, he almost fell off his feet. Andrew was well known in the financial community because his father was a famous WWII Battle of Britain Spitfire pilot from New Zealand.

At 34, he had just been appointed the second youngest editor in the magazine’s 150-year history. I had been reporting from Tokyo for years, filing two stories a week about Japanese banking, finance, and politics.

The Economist shared an office in Tokyo with the Financial Times, and to pay the rent, I had to file an additional two stories a week for them as well. That’s where I saw my first fax machine, which then was as large as a washing machine even though the actual electronics would fit in a notebook. It cost $5,000.

The Economist was the greatest calling card to the establishment one could ever have. Any president, prime minister, CEO, central banker, or war criminal were suddenly available for a one-hour chat about the important affairs of the world.

Some of my biggest catches? Presidents Gerald Ford, Jimmy Carter, Ronald Reagan, George Bush, and Bill Clinton, China’s Zhou Enlai and Deng Xiaoping, Japan’s Emperor Hirohito, terrorist Yasir Arafat, and Teddy Roosevelt’s oldest daughter, Alice Roosevelt Longworth, the first woman to smoke cigarettes in the White House in 1805.

Andrew thought that the quality of my posts was so good that I had to be a retired banker at least 55 years old. We didn’t meet in person until I was invited to work the summer out of the magazine’s St. James Street office tower, just down the street from the palace of Prince Charles.

When he was introduced to a gangly 25-year-old instead, he thought it was a practical joke, which The Economist was famous for. As for me, I was impressed with Andrew’s ironed and creased blue jeans, an unheard-of concept in the Wild West.

The first unusual thing I noticed working in the office was that we were each handed a bottle of whisky, gin, and wine every Friday. That was to keep us in the office working and out of the pub next door, the former embassy of the Republic of Texas from pre-1845. There is still a big white star on the front door.

Andrew told me I had just saved the magazine.

After the first oil shock in 1972, a global recession ensued, and all magazine advertising was cancelled. But because of the shock, it was assumed that heavily oil-dependent Japan would go bankrupt. As a result, the country’s banks were forced to pay a ruinous 2% premium on all international borrowing. These were known as “Japan rates.”

To restore Japan’s reputation and credit rating, the government and the banks launched an advertising campaign unprecedented in modern times. At one point, Japan accounted for 80% of all business advertising worldwide. To attract these ads, the global media was screaming for more Japanese banking stories, and I was the only person in the world writing them.

Not only did I bail out The Economist, I ended up writing for over 50 business publications around the world in every English-speaking country. I was knocking out 60 stories a month, or about two a day. By 26, I became the highest-paid journalist in the Foreign Correspondents’ Club of Japan and a familiar figure in every bank head office in Tokyo.

The Economist was notorious for running practical jokes as real news every April Fool’s Day. In the late 1970s, an April 1 issue once did a full-page survey on a country off the west coast of India called San Serif.

It warned that if the West coast kept eroding, and the East coast continued silting up, the country would eventually run into India, creating serious geopolitical problems.

It wasn’t until someone figured out that the country, the prime minister, and every town on the map was named after a type font that the hoax was uncovered.

This was way back, in the pre-Microsoft Word era, when no one outside the London Typesetter’s Union knew what Times Roman, Calibri, or Mangal meant.

Andrew is now 82 and I haven’t seen him in yonks. My business editor, the brilliant Peter Martin, died of cancer in 2002 at a very young 54, and the magazine still awards an annual journalism scholarship in his name.

My boss at The Economist Intelligence Unit, which was modelled on Britain’s MI5 spy service, was Marjorie Deane, who was one of the first women to work in business journalism. She passed away in 2008 at 94. Today, her foundation awards an annual internship at the magazine.

When I stopped by the London office a few years ago, I asked if they still handed out the free alcohol on Fridays. A young writer ruefully told me, “No, they don’t do that anymore.”

Good Luck and Good Trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader