What if the consensus is wrong?

What if instead of being in the 12th year of a bull market, we are actually in the first year, which has another decade to run? It’s not only possible but also probable. Personally, I give it a greater than 90% chance.

There is a possibility that the bear market that everyone and his brother have been long predicting and that the talking heads assure you is imminent has already happened.

It took place during the first quarter of 2020 when the Dow Average plunged a heart-rending 40%. How could this be a bear market when historical ursine moves down lasted anywhere from six months to two years, not six weeks?

Blame it all on hyperactive algorithms, risk parity traders, Robin Hood traders, and hedge funds, which adjust portfolios with the speed of light. If this WAS a bear market and you blinked, then you missed it.

It certainly felt like a bear market at the time. Lead stocks like Amazon (AMZN), Apple (AAPL), Facebook (FB), and Alphabet (GOOGL) were all down close to 40% during the period. High beta stocks like Roku (ROKU), one of our favorites, were down 60% at the low. It has since risen by 600%.

It got so bad that I had to disconnect my phone at night to prevent nervous fellows from calling me all night.

In my experience, if it walks like a duck and quacks like a duck, then it is a bear. If true, then the implications for all of us are enormous.

If I’m right, then my 2030 target of a Dow Average of $120,000, an increase of 300% no longer looks like the mutterings of a mad man, nor the pie in the sky dreams of a permabull. It is in fact eminently doable, calling for a 15% annual gain until then, with dividends.

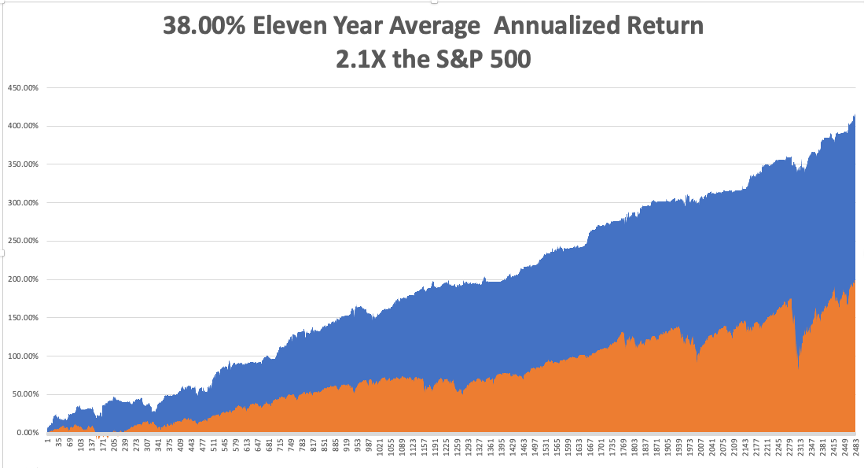

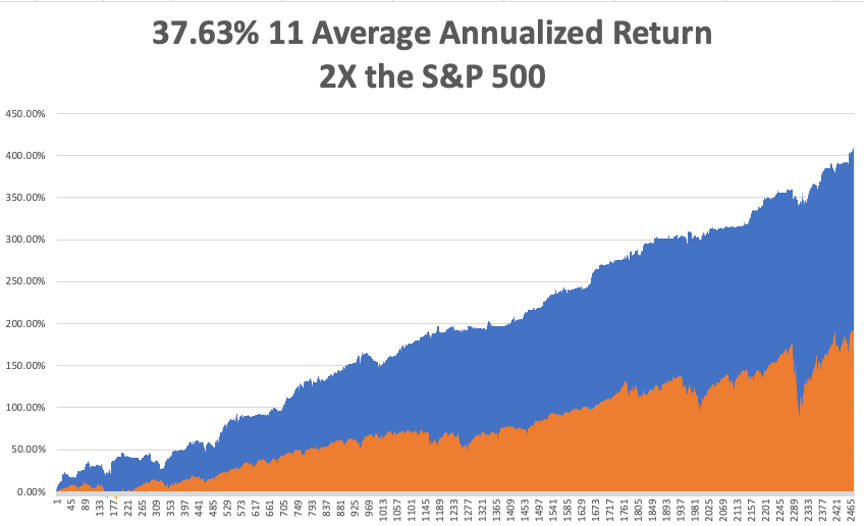

What have we done over the last 11 years? How about 13.08% annually with dividends reinvested for a total 313% gain.

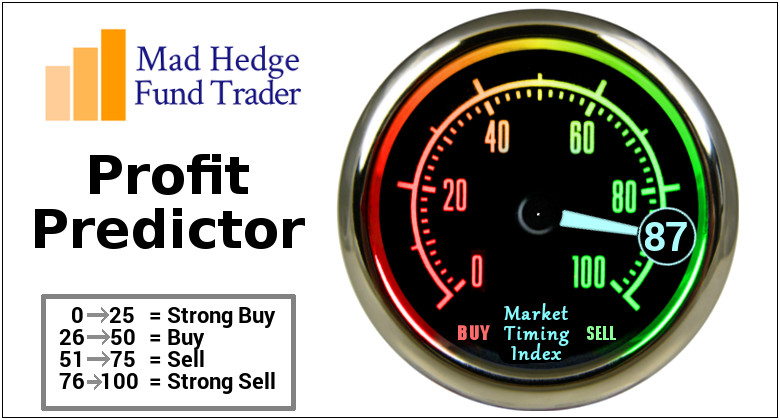

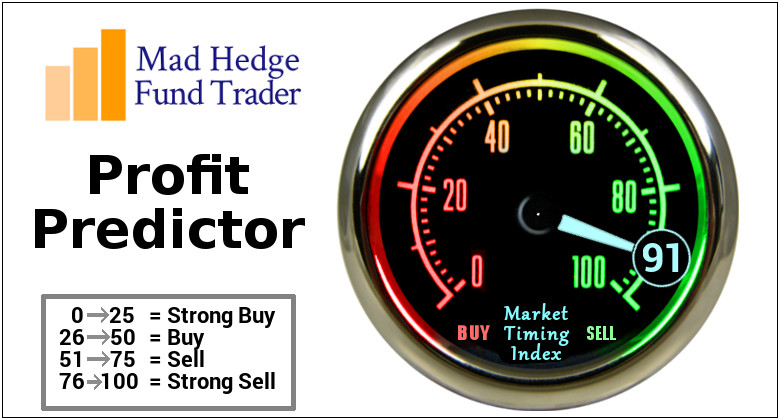

For a start, from here on, we should be looking to buy every dip, not sell every rally. Institutional cash levels are way too high. Markets have gone up so fast, up 12,000 Dow points in eight months, that many slower investors were left on the sideline. Most waited for dips that never came.

It all brings into play my Golden Age scenario of the 2020s, a repeat of the Roaring Twenties, which I have been predicting for the last ten years. This calls for a generation of 85 million big spending Millennials to supercharge the economy. Anything you touch will turn to gold, as they did during the 1980s, the 1950s, and well, the 1920s. Making money will be like falling off a log.

If this is the case, you should be loading the boat with technology stocks, domestic recovery stocks, and biotech stocks at every opportunity. Although stocks look expensive now, they are still only at one fifth peak valuations of the 2000 market summit.

Let me put out another radical, out of consensus idea. It has become fashionable to take the current red-hot stock market as proof of a Trump handling of the economy.

I believe the opposite is true. I think stocks have traded at a 10%-20% discount to their true earnings potential for the past four years. Anti-business policies were announced and then reversed the next day. Companies were urged to reopen money-losing factories in the US. Capital investment plans were shelved.

Yes, the cut in corporate earnings was nice, but that only had value to the 50% of S&P 500 companies that actually pay taxes.

Now that Trump is gone, that burden and that discount are lifted from the shoulders of corporate America.

It makes economic sense. We will see an immediate end to our trade war with the world, which is currently costing us 1% a year in GDP growth. Take Trump out of the picture and our economy gets that 1% back immediately, leaping from 2% to 3% growth a year and more.

The last Roaring Twenties started with doubts and hand wringing similar to what we are seeing now. Everyone then was expecting a depression in the aftermath of WWI because big-time military spending was ending.

After a year of hesitation, massive reconstruction spending in Europe and a shift from military to consumer spending won out, leading to the beginning of the Jazz Age, flappers, and bathtub gin.

I know all this because my grandmother regaled me with these tales, an inveterate flapper herself, which she often demonstrated. This is the same grandmother who bought the land under the Bellagio Hotel in Las Vegas for $500 in 1945 and then sold it for $10 million in 1978.

And you wonder where I got my seed capital.

It all sets up another “Roaring Twenties” very nicely. You will all look like geniuses.

I just thought you’d like to know.