Global Market Comments

June 15, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WAITING FOR MY SUGAR CUBE),

(SPY), (INDU), (UUP), (GLD), (TLT), (HTZ), (TSLA)

Global Market Comments

June 15, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WAITING FOR MY SUGAR CUBE),

(SPY), (INDU), (UUP), (GLD), (TLT), (HTZ), (TSLA)

I was born in the middle of a pandemic.

It was polio, and in the early 1950s, it was claiming 150,000 kids a year just in the US. You know polio. You’ve seen the pictures of the kids with withered legs or living in iron lungs, the ventilators of their day.

My mom contracted polio in the 1930s and spent a year in quarantine. They didn’t understand then that the virus was in the drinking water.

She lost the use of her legs for a time. My grandfather’s cure was to take her hiking in the High Sierras every weekend to rebuild her muscles. During WWII, he had to buy gas coupons on the black market to make the round trip from LA to Yosemite.

It worked well enough for mom to earn a scholarship to USC where she met my dad, a varsity football player. By the time I came along, Jonas Salk discovered a vaccine, which was infused into a sugar cube and given to me at the Santa Anita Racetrack along with tens of thousands of others. It was one of the big events of American history.

Some 70 years later, I am maintaining the family tradition, forcing my kids out on backpacks a couple of times a week, they're moaning and complaining all the way.

It looks like the first wave of the Corona pandemic isn’t even over yet. That’s why the Dow Average managed to puke out some 10% in days.

So, here is the conundrum: How much can we take the market down in the face of the greatest monetary and fiscal stimulus in history. Some $9 trillion has already been spent and there is at least another $5 trillion behind it.

My bet is a few more thousand points down to 24,000 but not much more than that. If this turns into a rout and a retest of the lows, the Fed will simply turn on the presses and print more money. After all, the marching orders from the top are to keep stocks high into the election, whatever the cost.

One of the reasons we are seeing such wild swings in the market is that the market itself doesn’t know what it’s worth. That’s because this is the most artificially manipulated market in history, thanks to the government stimulus, 20 times what we saw in 2008-2009.

Stocks can’t figure out if they are worthless, or worth infinity, and we are wildly whipsawing back and forth between two extremes.

Take that stimulus away and the Dow Average would be worth 14,000 or less. Stimulus will go away someday, and when it goes away, there will be a big hit to the market. It’s anyone’s guess as to timing. Ask the Covid-19 virus.

We have seen countless market gurus being wrong about this market, many of whom are old friends of mine. That’s because they, like I, see the long-term damage being wrought to the economy. Recovering 80% of what we lost will be easy. The last 20% will be a struggle.

That alone amounts to one of the worst recessions we have ever seen. This is going to be a loooong recovery. Some forecasters don’t expect US GDP to recover to the 2019 level of $21.43 trillion until 2025.

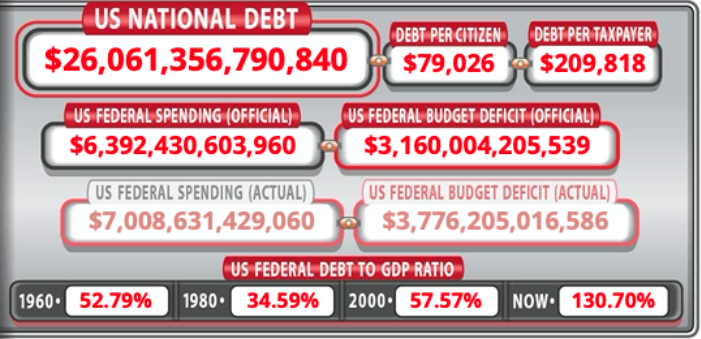

In the meantime, the national debt is soaring, now at $26 trillion, and will soon become a major drag on the economy. The budget deficit alone this year is now pegged at an eye-popping $3 trillion, the largest in history.

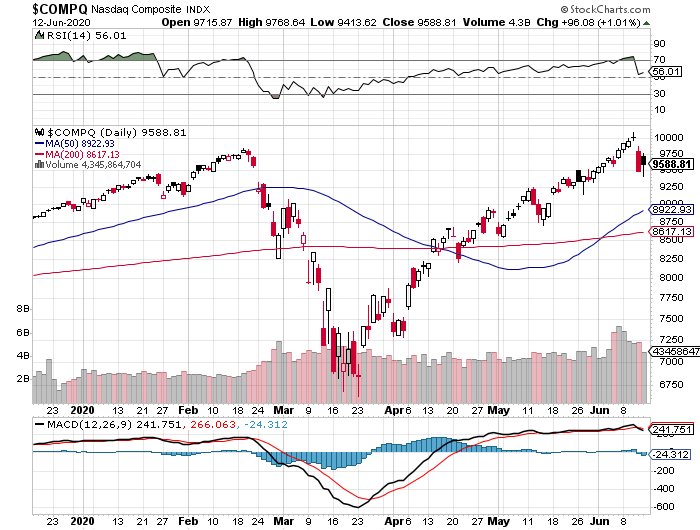

The S&P 500 turned positive on the year for a whole day. It’s been an amazing move, the largest in history in the shortest time, some 47% in ten weeks. NASDAQ hit my year-end target of $10,000, then immediately gave back 10%.

The problem now is that stocks are still the most overbought in history and risk is the highest since January. Much trading is now dominated by newly minted day traders chasing bankrupt stocks like Hertz (HTZ) with their $1,200 stimulus check. Far and away, the better trade is to sell short bonds. After that, buy gold (GLD) and sell short the US Dollar (UUP).

Stocks then dove 7.4% on second wave fears as US cases top 2 million and deaths exceeded 114,000. Jay Powell says he won’t raise interest rates until 2023 at the earliest. The “reopening” stocks of airlines, hotels, and cruise lines are leading the downturn from crazy overbought levels.

Houston may have to close down again, in the wake of soaring Corona cases after a too early reopening. Other cities will follow. Cases in Arizona are also hitting new highs. It’s not what the market wanted to hear.

Weekly Jobless Claims hit 1.54 million, at a falling rate, but still at horrendous absolute levels. That’s better than last week’s 1.9 million. Some 20.9 million are still receiving state unemployment benefits, or 13.1% or the total workforce. These numbers certainly don’t justify a stock market near an all-time high.

The Fed expects Unemployment to remain stubbornly high, not falling to 9.3% by yearend. I think that’s highly optimistic. Some 20% of the 43 million lost jobs are never coming back, giving you an embedded U-6 rate of over 10%. It is easier and faster to fire people than to hire them back.

Election Poll numbers are starting to affect the market. Polls showing Trump 10%-14% points behind Joe Biden in the November presidential election opened stocks down 400 points on Monday. The betting polls in London are confirming these numbers.

The Republican leadership is jumping ship. A Biden win will bring higher corporate taxes, balanced budgets, less liquidity for the stock market, fewer Tweets, and clipped wings for the top 1%. Is this a trigger for the next market correction? We’ll find out in five months. When will stocks notice that?

Bond King Jeffrey Gundlach absolutely hates stocks, predicting we could take out the March lows. He believes the monster rally in big tech is unsustainable. The better trades are to sell short the US dollar (UUP) and to buy gold (GLD). I agree with much of this, but Geoff’s calls can take 6-12 months to come true, so don’t hold your breath, or bet the ranch.

Tesla hit a new all-time high, as I expected, ticking at $1,220. An 11% price cut is boosting sales and market share, while (GM) and (F) are dying. The Model Y, which looks like the love child of a Model X and Tesla 3, is expected to be their biggest seller ever. This is one bubble stock that IS worth chasing. Buy (TSLA) dips up to $2,500. No kidding!

New Zealand became the first Corona-free country, with zero cases, so it can be done. An island country with all international flights grounded, aggressive social distancing restrictions, and an ambitious contract tracing, the land of kiwis had everything going for it. Most importantly, they had the right leadership that listened to scientists, which the worst-hit countries of Sweden, Brazil, and the US are sadly lacking.

The Mad Hedge June 4 Traders & Investors Summit recording is up. For those who missed it, I have posted all 9:15 hours of recordings of every speaker. This is a collection of some of the best traders and investors I have stumbled across over the past five decades. To find it please click here.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil at a cheap $34 a barrel, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

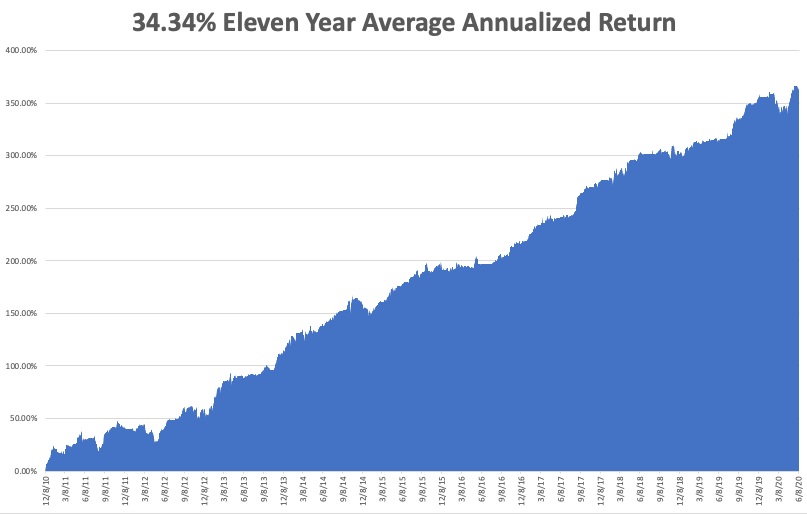

My Global Trading Dispatch performance took it on the nose last week. I got stopped out of my shorts at the market top, then took a hit on my bonds shorts. My 11-year performance stands at 360.61%.

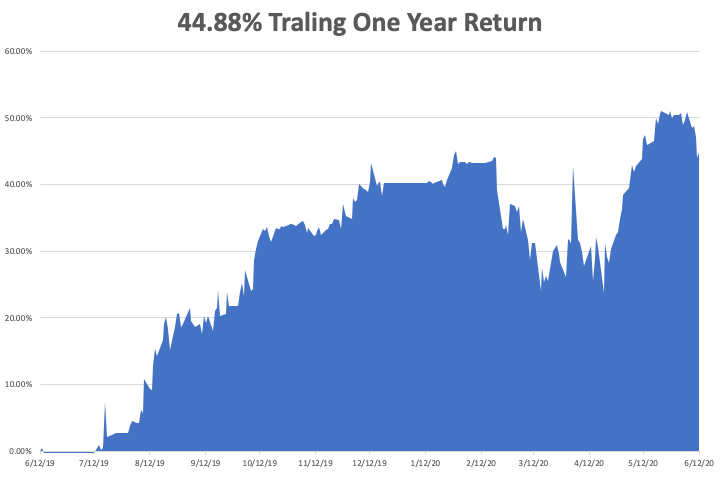

That takes my 2020 YTD return up to a more modest +4.70%. This compares to a loss for the Dow Average of -12.2%, up from -37%. My trailing one-year return retreated to 44.88%. My eleven-year average annualized profit backed off to +34.34%.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, June 15 at 12:00 PM EST, the June New York State Manufacturing Index is out.

On Tuesday, June 16 at 12:30 PM EST, US Retail Sales for May are released.

On Wednesday, June 17 at 8:15 AM EST, Housing Starts for May are announced.

At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are published.

On Thursday, June 18 at 8:30 AM EST, Weekly Jobless Claims are announced.

On Friday, June 19 at 2:00 PM EST, the Baker Hughes Rig Count is out.

As for me, I am waiting for my sugar cube.

In the meantime, I will spend the weekend carefully researching the recreational vehicle market. If everything goes perfectly, a Covid-19 vaccine will be not available to the general public for at least two years.

Until then, my travel will be limited to the distance I can drive. Travel while social distancing with my own three-man “quaranteam” will be the only safe way to go.

When the New York Times highlights it, as they did this weekend, it’s got to be a major new thing.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

June 12, 2020

Fiat Lux

Featured Trade:

(WHEN THE BILL COMES DUE)

(SPY), (TLT), (GD), (USO), (HTZ), (JCP)

This was a top you could see coming a mile off. Now, the correction for the greatest rally in stock market history has begun. Will it be the greatest correction in history?

It could be.

It was the awful news that the Coronavirus is starting to run away again that started the panic. New cases in Texas and Arizona are growing so fast that the local hospital systems are getting overwhelmed once again. The Armageddon scenario is back on the table once again.

You knew we were in trouble when the stocks of bankrupt companies, like Hertz (HTZ) and JC Penny (JCP) started doubling in a day, even though they have no equity value whatsoever. They were bid up simply because they had low single-digit prices, as bankrupt companies always do.

They were bid up by greater fools and the market just ran out of them.

It wasn’t just equities that got slammed. Oil (USO) suffered a horrific day, down 8.2%. because of burgeoning inventories leftover from a dead-in-the water economy. Bonds rocketed three points and are up an eye-popping 11 points from last week. Even gold (GLD) failed to move, held back by widespread margin calls.

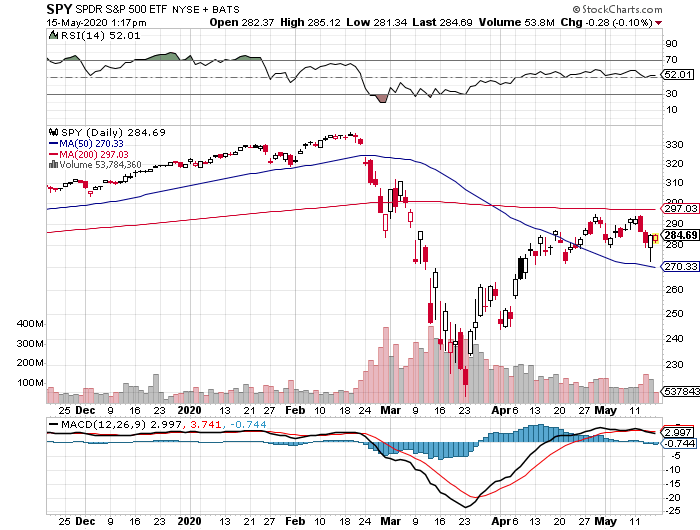

It seems we have returned to the terrors of February-March, the down 2,000 points a day kind. There was barely a rally all day. It basically went straight down. How much more is there to go? Let’s look at the obvious targets in the S&P 500 (SPY) and the distance from the Monday top.

$299 – Down 7.7% from the top – the 200-day moving average and top of the April - May double top

$288.74 – Down 10.9% - The 50-day moving average

$272 – Down 15% - bottom of the April - May double bottom

$262 – Dow 19.4% - Top of the initial rally off the March 23 bottom and the level where a new bear market is declared. Two bear markets in two quarters?

$219 – Down 32.6% - the March 23 low gets retested.

There is quite a lot to chew on here. In the end, it will depend on how much the first Corona wave ramps up after a far too early re-opening. Even if there are no further shutdowns of the economy, a world where consumers are too afraid to leave their homes doesn’t generate a lot of growth or earnings.

When the president says things are great, but you see 5% of normal traffic in the local shopping mall, you want to run a mile.

Forget about the second wave, we haven’t even gotten out of the first wave yet. Corona deaths topped 114,000 today. We could hit 250,000 by August, not a great mall traffic generator.

If the selloff continues, and it probably will until the Q2 earnings are published starting in mid-July, then this is the dip you want to buy. For if the lows hold, we will be at the beginning of a 400% move in the main indexes over the next decade.

To get the depth of the argument why this will happen, please read about the coming Roaring Twenties and the next American Golden Age by clicking here.

Here is what you want to do on this move down:

*Stocks - buy big dips

*Bonds – sell rallies aggressively

*Commodities - buy dips

*Currencies - sell US dollar rallies

*Precious Metals – buy dips

*Energy – stand aside

*Volatility - sell short over $50

*Real Estate – buy dips

And buy LEAPS (Long Term Equity Anticipation Securities), lots of LEAPS. This is where traders have been picking up 500%-1,000% returns this year.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

June 8, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HISTORY IS REPEATING),

(SPY), (INDU), (TLT), (TBT) (TSLA), (DAL), (BA)

When I was 13 years old in 1965, the week-long Watts Riots broke out in impoverished South Los Angles, killing 34. It was sparked by a police arrest for reckless driving.

While the ruins were still smoking, my dad drove me downtown to view the wreckage. Prudently, he kept his loaded Marine 1911 Browning .45 caliber automatic under a newspaper on the front seat. It looked like a war zone, with some 256 buildings burned to the ground and another 200 looted.

I have been running towards the sound of guns ever since.

Some 55 years later, we are seeing history repeat itself. However, instead of seeing the riots occur in major cities one at a time, as they did in the 1960s, we saw demonstrations and riots in 356 US cities all at the same time!

The impact on the economy, and eventually the stock market, will be immense.

As a long term follower of the structure of the US economy, what is going on now is utterly fascinating. A million connections within the economy have been severed forever and a million new ones created, which few understand.

The end result will be a far more efficient and profitable form of American capitalism. Companies are rebuilding time-tested business models in weeks. Those who can discern these new connections early will make fortunes. Those who don’t will dry up and blow away like so much dust into the ashcan of history.

Of course, the defining announcement of the week came on Friday morning with the Headline Unemployment Rate, which delivered a blockbuster FALL, from 14.7% to 13.3%, sending stock up 1,000 points. It’s proof that the stimulus is largely going into the stock market.

Economist forecasts were off by a whopping 10 million jobs, delivering the biggest miss in history. Leisure and Hospitality accounted for 1.2 million job gains, half the total.

Something doesn’t smell right here. How do you miss 10 million jobs? The streets and traffic levels tell me the real jobless rate is more like 20%. I can’t even get into my bank to deposit a check.

I believe the streets.

Look for big downward revisions, which may pose another threat to the market, and possibly a secondary crash, but not for another month.

A client told me last week that he wishes there were major market crashes more often where he could load the boat with deep out-of-the-money LEAPS which then double or triple in weeks.

He may get his wish. The faster we rise now, the greater the risk of a secondary crash which could wipe out half the recent gains.

I managed to catch the bottom of the biggest stock market rally of all time with dozens of LEAPS like with (TSLA), (DAL), (UAL), (BRKB), and (BA). I took profits all the way up and went into last week modestly “Risk On.” But the 1,000-point rally on Friday caught me totally by surprise, as it did everyone else.

I’m sorry, but I guess I’m lousy at trading those once in hundred-year events.

My saving grace has been the most aggressive, in-your-face short positions in the bond market (TLT), (TBT) in the 13-year history of this letter at the same time. It’s still a great trade. Selling short US Treasury bonds now with a 0.90% yield is the same as buying the Dow Average at 20,000….again.

Pending Home Sales collapsed 21.8% in April and off 33.8% YOY on a signed contract basis. These are the worst numbers since the data series started. The West was hardest hit, down 50%. No wonder I’ve seen so many real estate agents at the beach. We already know that a sharp rebound is underway as Millennials move to the burbs and flee Corona-infested cities. Home prices will be up this year.

Mortgage Demand is soaring as ultra-low rates spur demand. Housing will lead the recovery of the bricks and mortar economy. It will take another year before jumbo loan rates start to decline as banks avoid risk like the plague. Buy (LEN) and (KHB) on dips.

Stocks are the most overbought in 20 years since the top of the Dotcom bubble. Risk is extreme for new longs. Almost all S&P 500 stocks are trading above 50 day moving average. The technical indicators are screaming “SELL”.

Consumer Confidence is recovering as even the slightest bit of reopening looks like a lot coming off of zero. The Conference Board’s consumer confidence index rose to 86.6 this month from 85.7 in April, well up from an expected 82. Call it “green shoots”.

Used Car Prices have crashed with Hertz going bankrupt and defaults on new car loans reaching record levels. Surviving rental companies have cancelled all new car orders. Vacation travel has vaporized. Wells Fargo has ceased lending to car dealers. Time to upgrade that second car?

The greatest 50-day rally in the S&P 500 is now over, up 40% since March 23. Buyers are getting nervous and exhausted and are overdue for a pullback. But the historical six-month gain after a move like this is another 10.2% up, followed by a one-year gain of 17.3%. Over $14 Trillion in Fed and fiscal stimulus can go a long way.

US Factory Orders collapsed further, down 13% in May after a 14% crash in April. Don’t expect these numbers to decline any time soon. The stock market will never notice.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil at a cheap $34 a barrel, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

My Global Trading Dispatch performance was up modestly on the week, my downside hedges costing me money in a steadily rising but wildly overbought market. We stand at an eleven-year performance all-time high of 366.68%.

My huge short bond positions, which I have been adding to all the way down, are still delivering big profits. That’s because time decay is really starting to kick in with nine trading days left until the June expiration.

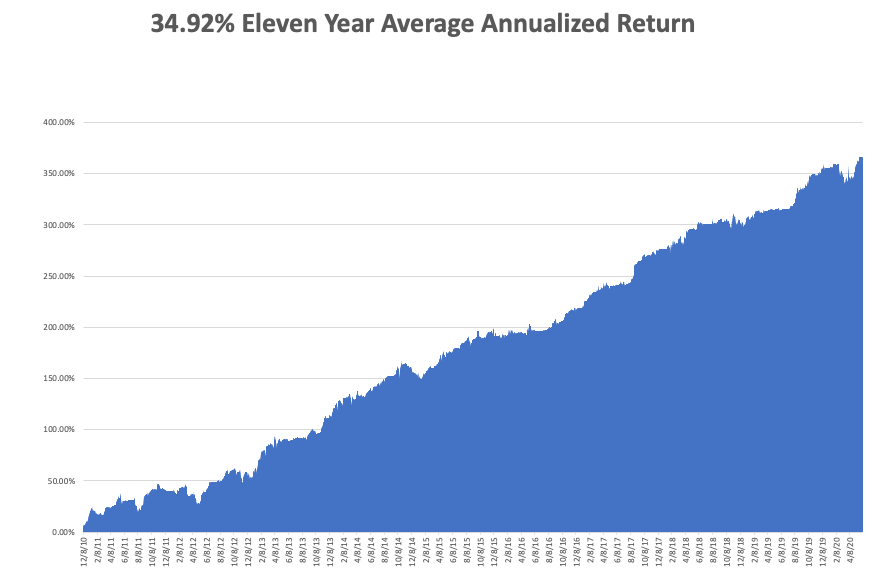

That takes my 2020 YTD return up to a lofty +10.77%. This compares to a loss for the Dow Average of -4.9%, up from -37%. My trailing one-year return exploded to a near-record 52.27%. My eleven-year average annualized profit ballooned to +34.92%.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, June 8 at 8:00 AM EST, Consumer Inflation Expectations for May are announced.

On Tuesday, June 9 at 10:30 AM EST, we learn the NFIB Small Business Optimism Index for May.

On Wednesday, June 10 at 8:15 AM EST, the US Core Inflation Rate for May is printed. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are published.

On Thursday, June 11 at 8:30 AM EST, Weekly Jobless Claims are announced.

On Friday, June 5, at 10:00 AM EST, the University of Michigan Consumer Sentiment figures are out. The Baker Hughes Rig Count follows at 2:00 PM EST.

As for me, I traveled to the local shopping mall to see how real this 2.5 million gain in jobs really exists. More than 50% of the shops were closed, several had already gone bankrupt and traffic was easily below 10% of pre-pandemic levels. Restaurants had maybe 5% of peak traffic sitting at outside tables. Mall police were there to enforce facemask rules.

Nope, not seeing any recovery here. Caveat Emptor.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

May 21, 2020

Fiat Lux

Featured Trade:

(MAY 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(GLD), (SDS), (TSLA), (VIX), (ROM), (SPY),

(TLT), (TBT), (DRI), (CCI), (BOTZ)

(TESTIMONIAL)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader May 20 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Do you believe chairman Powell when he says no negative rates?

A: I do believe that he does not want negative rates—that would be hugely detrimental to the economy. Europe and Japan have been trying them for the last ten years and they absolutely do not work. When it costs something to deposit money in the bank, people take it out of the financial system and hide it under their mattresses or buy gold (GLD). Although Powell doesn’t want negative rates, he may not have a choice; the market’s already taking them there in the futures market one year out. If we do get a big second wave of corona in the fall, and we do go to new lows in the stock market, and unemployment goes to new highs, negative rates will happen on their own whether Powell wants them or not.

Q: What is your best metric for determining when this bounce is over?

A: We passed those metrics on when a normal bounce is over weeks and weeks ago, and it just keeps going up. If you’ll notice, I have no stocks right now. I have some balanced long and short stock indexes but that’s it. My big trade is short bonds. When an asset class is no longer attractive, avoid it like Covid-19.

Q: What range should I wait for to buy the Proshares Ultra Short S&P 500 ETF (SDS)?

A: I’m really only using (SDS) as a hedge to limit the risk on much bigger long positions that I may have. (SDS) doesn’t lend itself to normal technical analysis because it is an artificial construct.

Q: What price to get into Tesla (TSLA)?

A: If you look at the Tesla chart, it's almost exactly the same as all of the other FANGS, as it’s essentially becoming the next FANG. So, they will trade with the FANGS for that reason, at least in the short term. Don’t buy it here, wait for the next major selloff to $600 or so. We actually had a bunch of concierge customers to buy long term leaps under $500 dollars in March, and they got 500% returns in 3 weeks.

Q: Why didn’t we just buy the ProShares Ultra Technology ETF (ROM) and go to sleep for five years?

A: If you recall, I was actually recommending just that in March when (ROM) was trading in the $80s, and we actually had a (ROM) position that we got stopped out of. The (ROM) is the 2x long technology ETF that's gone from $80 to $160 since the market bottomed almost 2 months ago.

Q: Why do you keep using deep in the money put spreads and call spreads?

A: You use them when volatility is very high like it is now—right now the Volatility Index (VIX) is at $28. The normal price is at $14 or $15, and we’ve just come down from $80. Even in the high $20s, you still get huge payoffs (like 10% a month) per call and put spread. As long as (VIX) is that high, we’ll keep doing them. They are also the perfect trade to have in range trading markets like we’ve had for the past month. They give you a nice extra kicker on your P&L.

Q: What is the worst-case scenario?

A: We get a second wave of the virus, another couple hundred thousand Americans die, the stock market goes to new lows, and we have a presidential election. How’s that for a worst-case scenario? Other than that, how is your day going?

Q: Do you trade pre and post market?

A: No; I used to when I ran my hedge fund, but I don’t do anything now if it’s beyond the capability of most individuals. I only want to put out trade alerts that people can get done. So, I'm only trading US hours. The reason you trade overseas is that you always get the highest highs and lowest lows in the Asian markets. During the late 1990s, I was the number one or two volume trader in the Singapore futures market.

Q: Do you think the 200-day moving average will be substantial resistance to the market?

A: I think absolutely yes, and I also believe that the only downside trigger for a major breakdown in the market is a second corona wave.

Q: If we get negative interest rates, would (SDS) fall?

A: No, (SDS) is a 2X bear (SPY) ETF that would go through the roof because negative rates would only happen if the stock market was collapsing. You might get a double on (SDS) on a second corona wave and negative interest rates. That’s why I’m keeping my position.

Q: Could the market just keep going up with no major pullbacks if the Fed keeps stimulating the economy?

A: Yes, and that’s what has been happening. Jerome Powell has said that the Fed’s ability to borrow is unlimited, therefore the amount of stimulus they can keep throwing is also unlimited, and if that’s what happens, all of that money will go into financial assets, even if the real economy is in utter freefall (which it has been). You can’t rule out anything these days. You always have to trade with the belief that anything can happen at any time.

Q: I need help setting up Long term Equity Participation Securities (LEAPS). Is there a video on that?

A: You can take all the educational videos we have on call spreads and put spreads, and everything applies exactly the same, except that instead of doing a one-month maturity, you do a two-year maturity. If you play around with the maturity tab on your platform, you can find the longest dated maturity on each option series. Sometimes, it’s only a year, sometimes all the way up to 2.5 years.

Q: Are there any other options besides the United States Treasury Bond Fund (TLT) to short the bond market?

A: Yes, there’s the ProShares Ultra Short 20 Year Treasury ETF (TBT); that’s a 2x short bond market ETF. But you don’t get anywhere near the leverage that we have in the (TLT) put options spreads.

Q: Do you expect a return in inflation with all the stimulus going on?

A: Absolutely yes; food prices have already increased 20%—that will be a big inflationary push. Another $14 trillion in government QE and spending hitting the economy is also highly inflationary. And a lot of the price cuts which fueled deflation are ending as global supply chains are cut and the US food distribution system breaks down.

Q: Is the Great Depression on the table?

A: We are in a Great Depression now that is already far worse than the last one, except that this one will be shorter than the decade seen in the 1930s.

Q: How long will it take for unemployment to recover to the December 2019 3.5% unemployment lows?

A: We will never get back to those lows. A lot of that was over employment (artificial employment), with a lot of temporary marginal workers being picked up. And the net effect of the epidemic will be to make businesses forcibly more efficient; that means getting a lot more done with a lot fewer workers. So, I don't think we’ll ever see that 3.5% rate again. Economists are predicting that the next new low in unemployment may be 5% or 6%, and even that could take 2 or 3 years to get there.

Q: Will the market soar on vaccine news?

A: Well probably not; I would bet that two-thirds of any real vaccines are already in the price. We are getting vaccine announcements every day and the market is immediately discounting it, so when we actually do get the real thing, we may get a rally of only a few days and that’s it. We also won’t know for many months if it is real and is moved to mass production.

Q: If you would buy one restaurant, what would it be?

A: None; I would not touch the restaurants here with a 10-foot pole. None of the restaurant chains have any prospect of making a profit, except for maybe the ones that already had takeout models like Subway or Chipotle Mexican Grill (CMG). Some hedge funds are buying Darden (DRI), but with their money, not mine.

Q: Should I double my short position in volatility (VIX)?

A: No, not down here, especially after a huge run in the stock market like we had—a 40% rise off the bottom. If we do get above $50 though, I will be shorting volatility then.

Q: I bought the (BOTZ) AI and robotics ETF, on your recommendation—it’s now almost double off the lows. What should I do with it now?

A: Short term, take profits, long term keep it. I think the (BOTZ) doubles again from these levels, and I know some of you out there bought LEAPS on the (BOTZ) at the lows and you’re up 1,000% on those. If you have a 1,000% profit take it, you probably won’t get another one in your lifetime.

Q: Time to refi the house?

A: No, I think refi rates are artificially high now (and totally out of line with the bond market) because the default rate is so high—8%. Once that default rate starts to drop, the interest rate on mortgages should also fall, and I think you could see 2.5% on the 30-year fixed rate mortgage. Europe has had 0% rates for almost 10 years, and their home mortgages are at 2%, so that’s ultimately how low we could go.

Q: Are you worried about the debt related to Crown Castle International (CCI)?

A: No because they’re putting all the debt to good use and they can always refi at lower rates. There is no question that the demand for cell phone towers is going to be enormous—epidemic or not, because of the roll-out of 5G phones.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

May 18, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE MARKET IS BRACKETED)

(SPY), (TLT), (VIX), (DIS)

We are all living the Bill Murray movie “Groundhog Day” over and over again. Every day seems to blend seamlessly into the next, ad infinitum.

I think it’s Monday, but I’m not sure. The stock market is open so that must mean it’s Monday to Friday. The trash goes out tomorrow, so it might be Tuesday. No, wait! CBS 60 Minutes was on last night, so it has to be Monday. Maybe.

When a Marine Corp 60mm mortar team zeros in on a target, it is said to be “bracketed.” No matter which way the enemy goes, he gets blown up.

The S&P 500 is now “bracketed”.

If it falls, the support of the free Fed put option kicks in to limit the damage via QE infinity. If the market tries to rally, it is capped by the worst economic data in history, last week joined by a new trade war with China.

Who is the enemy that gets destroyed in this military metaphor? Anyone betting on an imminent upside or downside breakout, especially those who are long the Volatility Index (VIX).

That means the thousands who follow the Mad Hedge Fund Trader have just been given a money-printing machine, a new rich uncle.

For every time the market rallies, you simply buy a vertical bear put option spread in the front month with strikes prices well outside the bracketed area as I did last week with (DIS). When it dives, you strap on vertical bull call spreads, as I did last week with the (DIS) and the (SPY). Then you laugh all the way to the bank.

We could be bracketed a long time. The early data from opening-up states is that consumers returning to stores only amounts to a ruinous 7% of pre-pandemic levels. That suggests the Unemployment Rate will soar to 30% or more before it peaks, exceeding the Great Depression apex. There are easily another 10 million that haven’t been counted yet because the state benefit processors are so slow.

However, as long as we are bracketed, I reckon I can make 10% a month, as I already have done from the Middle of April and in May.

It is not a riskless strategy.

The day an actual vaccine is announced, the market Dow Average could soar by 3,000 points in a day, wiping out the shorts. The White House has been declaring this on a daily basis. But until we get a vaccine the market believes, we will remain bracketed. That could take years, if ever.

Dr. Fauci triggered a 1,000-point market dive with his sobering analysis of the course of the pandemic in the coming months. Don’t count on going back to school in the fall.

No “V” for the economy, said the Fed. The job losses are a complete economic disaster that will take years to recover from. That’s the opinion of Minneapolis Federal Reserve Bank President Neel Kashkari. The president just said Corona deaths will reach 100,000. Buzzkill. Do you think the stock market will notice?

Fed funds futures are discounting negative interest rates in a year. They say they don’t want negative rates but may not have a choice. The markets may go there without them. The disruptions to the financial service will be enormous. Do you really want to pay the bank to deposit your hard-earned money?

Fed Governor Powell warns the worst is yet to come, and the need for more stimulus is paramount. However, negative interest rates which failed in Europe and Japan won’t work here either. The problem is rampant fear, not the overnight cost of funds.

Weekly Jobless Claims are still soaring, up 3 million on the week to 36.5 million. It’s going to get worse before it gets better. The Fed is targeting a peak of 36.5 million. Connecticut is the worst-performing state, California the best.

Stan Druckenmiller says stocks are the most overvalued in his career, says my former client, one of the best traders in the market. My friend David Tepper says they’re the most expensive since 1999. It may be splitting hairs, but how much do you want to own here? Keep those shorts!

Another death knell for US Treasury bonds (TLT) as the April budget deficit soars to $738 billion. That is an $8.85 trillion annual rate. Overissuance is about to destroy deflation big time.

Retail Sales collapse by 16.4%, the worst on record in another Great Depressionary data release. The stock market is starting to lean towards a view that the economy will take years to recover, not months. I’m somewhere in the middle.

A new trade war with China heats up, with the president banning more export items, especially chips for telecom giant Huawei. I guess our economy isn’t bad enough. Knock another few thousand off the Dow.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $0 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

My Global Trading Dispatch performance had another fabulous week, up an awesome +11.26%, and blasting us up to a new eleven-year all-time high of 20%. It has been one of the most heroic performance comebacks of all time.

My aggressive short bond positions gave back some money on the ‘RISK OFF” posture for the week. However, we offset those losses and a lot more on longs in bonds and shorts in the (SPY) and Walt Disney (DIS).

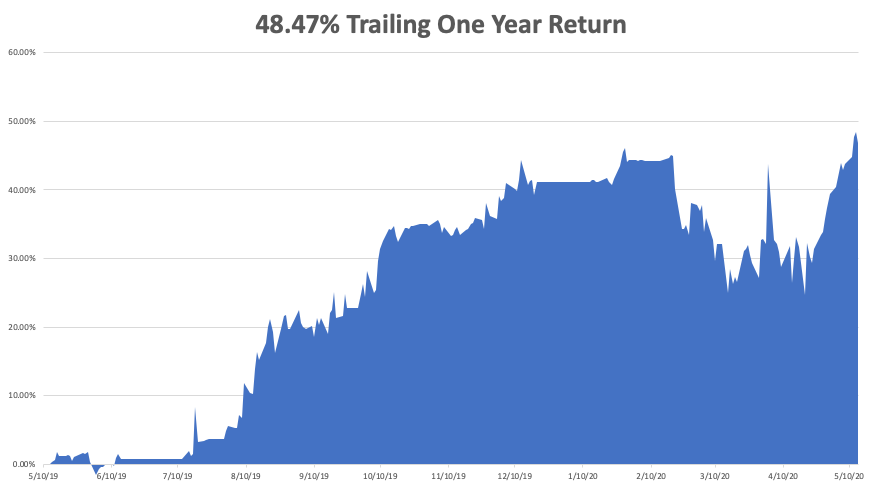

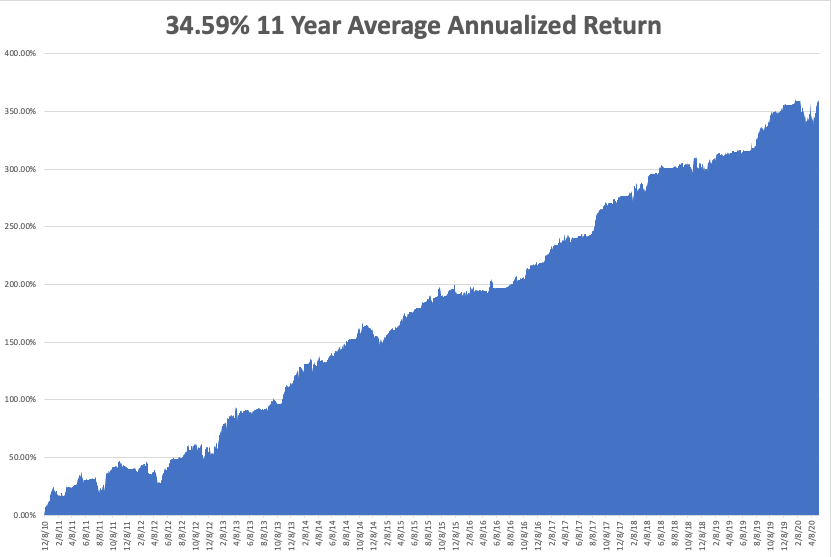

That takes my 2020 YTD return up to +7.29%. That compares to a loss for the Dow Average of -16.89%. My trailing one-year return exploded to 48.47%. My eleven-year average annualized profit returned to +34.59%.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, May 18 at 10:00 AM, the NAHB Housing Market Index for May is released.

On Tuesday, May 19 at 8:30 AM, US Housing Starts for April are printed. Home Depot (HD) and Walmart (WMT) report.

On Wednesday, May 20, at 10:30 AM, weekly EIA Crude Oil Stocks are published. Target (TGT) and Lowes (LOW) report.

On Thursday, May 21 at 8:30 AM, Weekly Jobless Claims are announced. NVIDIA (NVDA) reports.

On Friday, May 22, the Baker Hughes Rig Count follows at 2:00 PM. Alibaba (BABA) reports.

As for me, I am headed back up to Incline Village, NV, a town completely free of Covid-19. The village is thinking of barring entry to all non-residents. Maybe it’s the fresh air.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds: