Did the election finally hit the stock market? It could have been both or neither.

Certainly, the passing of Supreme Court Justice Ruth Bader Ginsberg was worth 1,000 points, and maybe more. It may open the door to a period in politics that is uncertain at best or become violent at worst.

But the Coronavirus is making a comeback too. The US topped 7 million cases and 200,000 deaths, more than any other country in the world. The president’s new pandemic advisor, Scott Atlas, seems to be advocating a “herd immunity” approach. If so, 53% of the population will get the disease causing a total of 3 million deaths. The pandemic will continue for years.

New cases are spiking in Europe. The UK, which was on the verge of ordering workers back to their offices is now going back to a total shutdown. That augers for a second big wave in the US as kids go back to school and universities reopen.

With the S&P 500 now down 1% on the year, 2020 basically never happened. We saw a whole lot of volatility with no net movement. It makes my own 34.50% profit this year look stellar by comparison.

With the twin challenges of Covid-19 and the election lower lows for the market beckon. The one-year charts show that a “head and shoulders” top is in place for the (SPY), so my downside target at the 200-day moving average stands. That would be 3,074 for the (SPX) and $84 for Apple (AAPL).

There is a chance that the Fed could intervene in the stock market one more time right before the election if the markets resume the cascading falls of the spring. If that happens, buyers will return in hoards. My view is that this is but another dip in a long-term bull market that started in 2009 and may run all the way to 2030. You especially want to load the boat with Apple again.

However, the mystery of why technology stocks are so expensive remains. Let me take another shot at this.

From a technology point of view, we have just completely skipped the 2020s and are already in 2030. A year ago, would you have ever imagined that all of the country’s children would now be going to school online or that you’d be sending your business suits to the Good Will?

Stock markets have yet to price in the 2030 level of technology and profit, so the stocks will keep going up. Maybe we are already at 2023 or 2025 prices. I’ll let you know when I find out.

Volatility rocketed last week, and stocks collapsed. Any chance of further Covid-19 economic stimulus this year has just been demolished. If you were worried about the presidential election eroding confidence in the market before, now you have to be positively suicidal.

Any doubts about traders going into cash before the election have been vaporized. A 4-4 Supreme Court now makes an election outcome uncertain, no matter what the actual vote. Price that into your dividend discount model!

US Corona Deaths topped 200,000, weighing heavily on the economy and the election. There is no sign that the death rate is slowing, possibly reaching 400,000 by yearend. I went out to dinner last weekend and one-third of all businesses were boarded up, with no sign of reopening, ever.

Twelve IPOs to hit last week. This is in the wake of the Snowflake (SNOW) deal last week that tripled off its initial price talk. Apparently, there is an extreme shortage of high-growth large cap technology stocks and Silicon Valley is more than happy to meet that demand. Flooding the market like this ends up killing the goose that laid the golden eggs and is a common signal of market tops. Existing stock holdings have to be sold to buy new ones, taking markets south.

The economy slows as stimulus hopes fade as confirmed by last week’s economic data. US Consumer Sentiment dove in August, while Weekly Jobless Claims hover just below a Great Recessionary one million. The pandemic remains the dominant economic issue unless you live online.

The NASDAQ whale continues to sell, as Softbank (SFTBY) continues to unwind its massive technology long options positions. Last week, it was Adobe (ADBE), Salesforce (CRM), and Facebook (FB) that got hit. We won’t know if they made money on these for months, but they certainly put the final spike top in for the technology bubble.

The biggest debt increase in history occurred, with Federal government borrowing up an eye-popping 59% YOY. Sell every rally in the (TLT). It’s just a matter of time before a flood of new issuance destroys this market. We are sowing the seeds for the next financial crisis. The government was running record deficits BEFORE the pandemic even started.

Existing Home Sales soared in August, up 2.4% MOM to 6 million units, the hottest since 2006. Prices are up a huge 11.4% YOY. Homes over $1 million increased by 44% YOY as both work and school move home. Properties sit only 22 days on the market to sell, a record low.

Elon Musk promised a $25,000 car in three years, fully autonomous with long range and no maintenance for the life of the vehicle. The lifetime cost would be half of conventional gasoline-powered cars. That was the outcome of Battery Day in Fremont, CA, attended by hundreds of devotees safely enclosed in Teslas who honked instead of clap. It is all the result of dozens of revolutionary design and manufacturing improvements currently in the works, like moving from lithium to raw silicon for batteries. If so, General Motors (GM) and Ford (F) have had it.

A US dollar crash is imminent, says my old Morgan Stanley colleague Steven Roach. The double dip recession is here inviting even lower interest rates. The current account deficit soared to record highs in Q2. Buy the Aussie (FXA), Euro (FXE), and yen (FXY) on this dip.

Investors pull $25 billion from Equity funds last week as a new wave of nervousness hit the market. It’s the third largest weekly outflow in history. Everyone and his brother is trying to get out before the election. Pick your conspiracy theory as to what could go wrong.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old.

My Global Trading Dispatch stayed level at just short of an all-time high this week. I dumped my last two positions at the Monday morning opening as I could see the 1,000-point drop coming from a mile off, going to a rare 100% cash position.

The risk/reward in the market now is terrible. I believe we have to test the 200-day moving averages before it is safe to go back in with the indexes and single stocks.

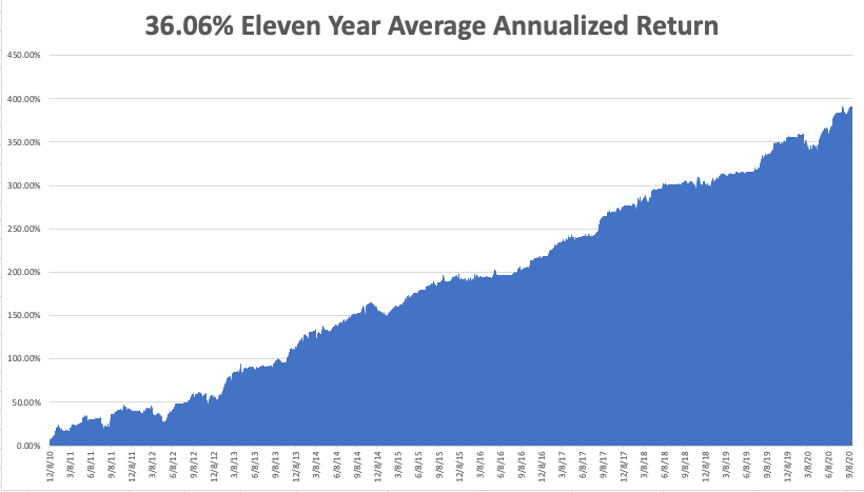

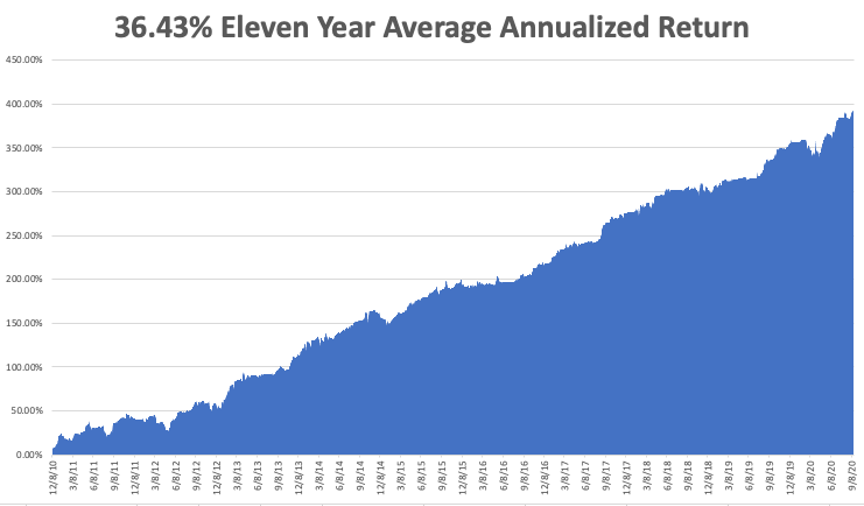

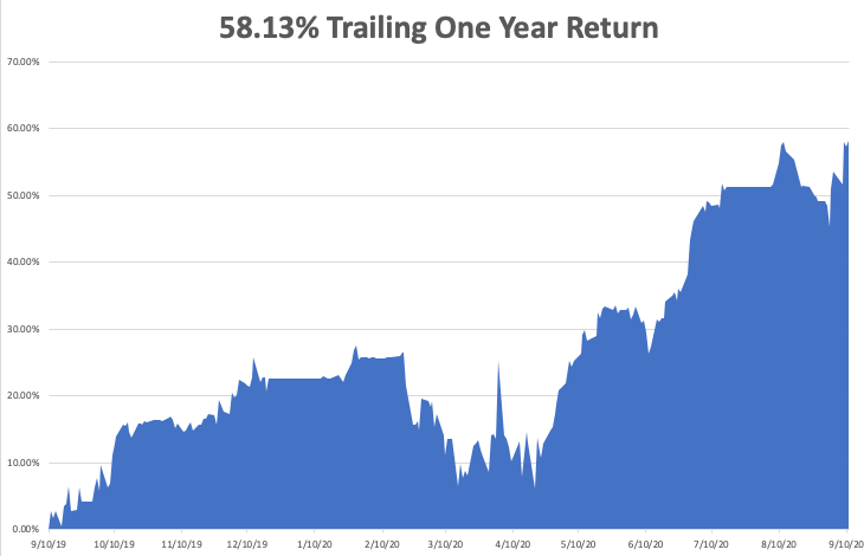

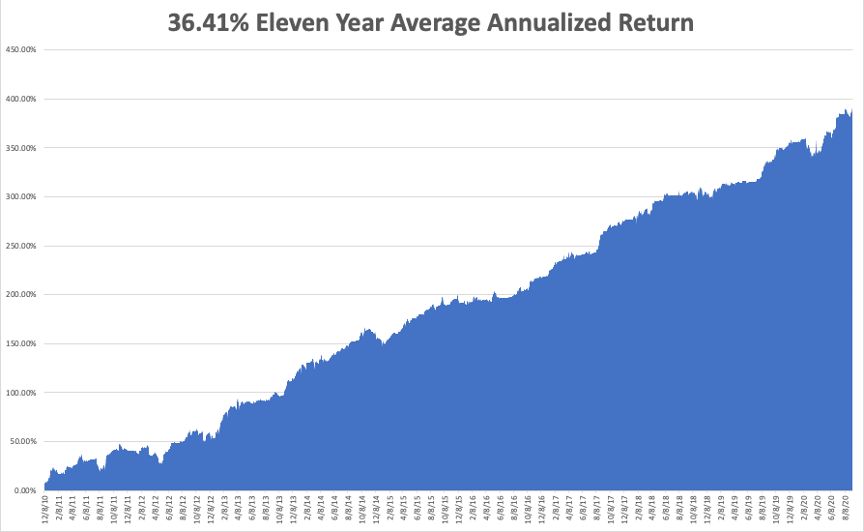

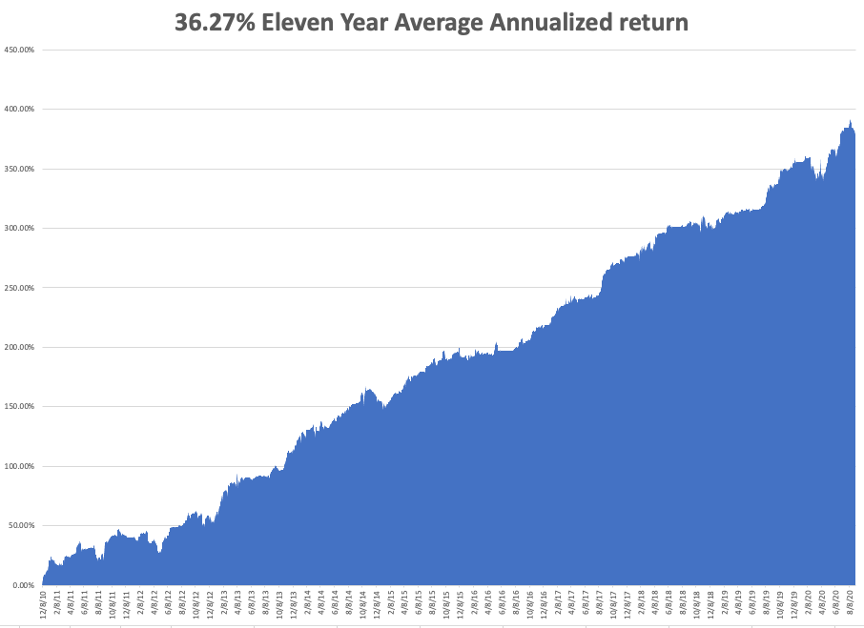

That takes our 2020 year-to-date back up to a blistering 34.50%, versus a loss of 7.00% for the Dow Average. September stands at a nosebleed 7.95%. That takes my eleven-year average annualized performance back to 36.06%. My 11-year total return returned to another new all-time high at 390.41%. My trailing one-year return popped back up to 54.09%.

The coming week is a big one for jobs data. The only numbers that really count for the market are the number of US Coronavirus cases and deaths, now at 203,000, which you can find here.

On Monday, September 28 at 10:30 AM EST, the Dallas Fed Manufacturing Index is released.

On Tuesday, September 29 at 9:00 AM EST, the S&P Case Shiller National Home Price Index for July is announced.

On Wednesday, September 30, at 8:15 AM EST, the ADP Private Employment Report is printed. At 8:30 AM EST, the final figure for US Q2 GDP is disclosed. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out.

change.

On Thursday, October 1 at 8:30 AM EST, the Weekly Jobless Claims are announced.

On Friday, October 2 at 8:30 AM EST, the all-important September Nonfarm Payroll Report is out. At 2:00 PM The Bakers Hughes Rig Count is released.

As for me, we have another superheating of the climate in store this weekend, with San Francisco Bay Area temperatures expected to top 100 degrees. The fires are out now, but high winds are coming so PG&E is expected to cut off electric power once again.

I’ll be fine with my solar and battery back-up. The Tesla power management software knows in advance when this is going to happen and automatically goes into maximum storage mode. But just to be safe and to keep the trade alerts coming, I am charging up the car and every battery I own.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader