The drumbeat of a coming recession is getting louder and louder.

There is no doubt that the traditional signals of a slowing economy are already flashing yellow, if not bright red.

Rocketing interest rates are the most obvious one, with ten-year US Treasury bonds yield soaring from 1.33% to 2.71% in a mere four months. This is why investors pulled a gut-punching $87 billion out of bond funds in Q1.

If the Fed continues with a quarter point rise at every meeting for the rest of the year, we might escape this cycle without a recession. If the Fed ramps up to a half point rate at every meeting as was discussed last week a recession becomes a sure thing.

Imminent positive real yields for the first time in a decade also threaten to draw money out of stocks and into bonds.

I happen to be in the non-recessionary camp and the reason is very simple. Companies are making too much damn money. This is especially true for technology companies, which account for some 75% of the profits made in the US. If anything, their profits are accelerating, although at a lower rate than seen in 2021.

Certainly, the tech companies themselves aren’t buying the recession scenario. They are hiring and investing as if the economic boom will continue forever. Tesla alone has completed two new factories in the past month, in Berlin, Germany and Austin, Texas, each capable of producing a half million vehicles a year. Tesla’s existing factories are all expanding capacity.

Sitting here in Silicon Valley, I can tell you that the job market is as hot as ever. Those who have jobs, like my own kids, are besieged with multiple job offers. It seems the standard time to keep a job these days is a year, after which one takes the next upgrade, promotion, and batch of stock options.

But the stock market seems hell-bent on discounting a recession anyway. You see this in the most economically sensitive sectors of the market, banks, semiconductors, and transport, which have just clocked a miserable month. If I am right (I’m always right), and there is no recession, these will be the sectors that lead the recovery.

Until the market makes up its mind, the disciplined among us will have to while away our time constructing lists of companies to buy for the rebound. That’s when the next leg of the bull market resumes.

We find out when this happens on Wednesday when the next batch of inflation data is released, which is likely to be diabolical.

Quantitative Tightening to Start as Soon as May, according to Fed Governor Brainard. That means our central bank will start selling its vast $9 trillion in bond holding in two months, a huge market negative. Bonds tanked. The Fed only quit quantitative easing in March.

Tesla Blows Away Q1 Sales, shipping 310,000 vehicles, far above expectations. This is despite supply chain problems, soaring interest rates, and the Ukraine War. Sky-high gasoline prices helped a lot, which is driving buyers into Tesla showrooms in drives. All other competitors are falling farther behind, unable to obtain parts and commodities which Tesla locked up long ago. This puts Tesla well on its way to its 1.5 million production goal for this year. Keep buying (TSLA) on dips. My long-term target is $10,000 a share.

The Metaverse May be Worth $13 Trillion by 2030, says Citibank. The same is so for Web 3.0, which includes virtual worlds, like gaming and applications in virtual reality. Citi’s broad vision of the metaverse includes smart manufacturing technology, virtual advertising, online events like concerts, as well as digital forms of money such as cryptocurrencies like I’ll be looking for the best plays.

Biotech May Be Staging a Comeback, after spending a year in hell, taking some shares down 80%-90%. Investors are also nibbling at the sector as a recession and bear market plays, as these companies keep growing regardless of the economic cycle. Buy (CRSP), Teledoc (TDOC), Gilead Sciences (GILD), ad Editas Medicine (EDIT) on dips.

US Bonds Just Suffered their Worst Quarter in a Half Century, with yields rocketing from 1.33% to 2.71%, and Mad Hedge was triple short most of the way down. Bear LEAPS holders, which are many of you, made fortunes. We could stall around current levels until the Fed delivered both barrels of a shot gun, two back-to-back half point rate rises from the Fed.

30-Year Fixed Rate Mortgage Rates Top 5.00%, trashing the home builders. If you thought buying a home was tough, its worst now. So far, no impact on home prices.

US Dollar Hits New Two-Year High. It’s all about rising interest rates. Expect a stronger greenback to come before the turn. The coming QT will put a two-step turbocharger on the move.

German Battery Sales Soar By 67%, to residential buyers to cope with pending energy shortages. Germany already has 2.2 million solar installations out of a population of 83 million. It’s a very smart move as batteries powered by solar panels can remove you from the grid entirely, as I have amply proven with my own installation. It may be the permanent solution to over-dependence on Russian energy supplies.

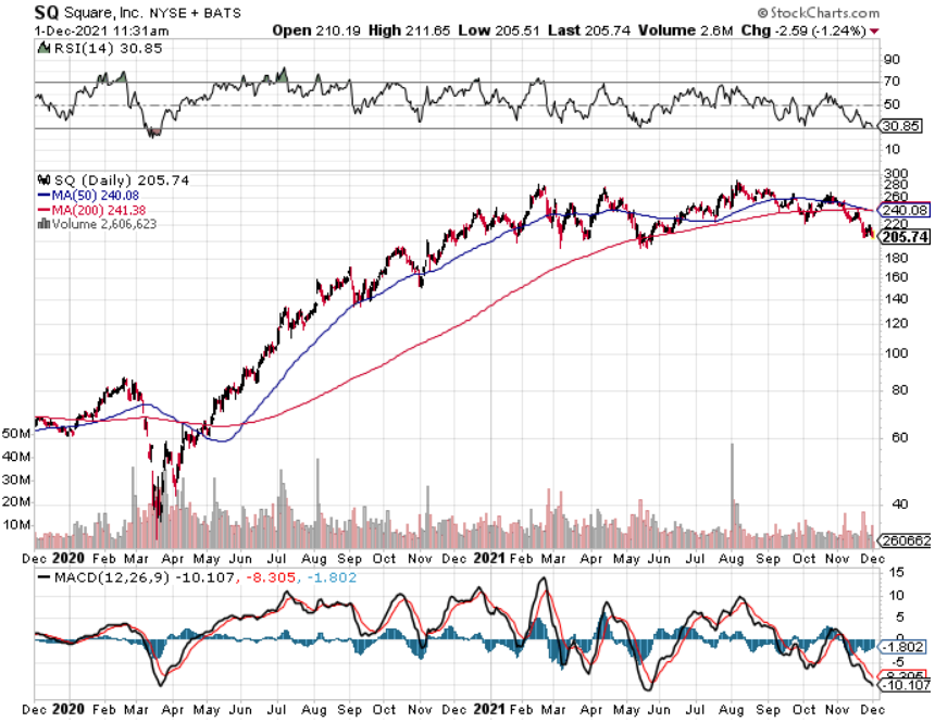

Tesla Moving into Bitcoin Mining, in partnership with Blockstream and Block, formerly Square (SQ). Tesla will supply the electric power with its massive 3.8-megawatt solar array. That is the size of a large nuclear power plant. The mining facility is designed to be a proof of concept for 100% renewable energy bitcoin mining at scale. If Elon Musk likes Bitcoin maybe you should too.

The Bank of Japan Now Owns 7% of the Japanese Stocks Market. The central bank had to buy the shares after it had already bought all the bonds in the country to support the economy. So, what happens when the policy flips from QE to QT? How about unloading $371 billion worth of shares on the market. This would e a neat trick since so much of the country’s shares are locked up in corporate cross holdings. Methinks I’ll be steering clear of Japanese stocks for the foreseeable future.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

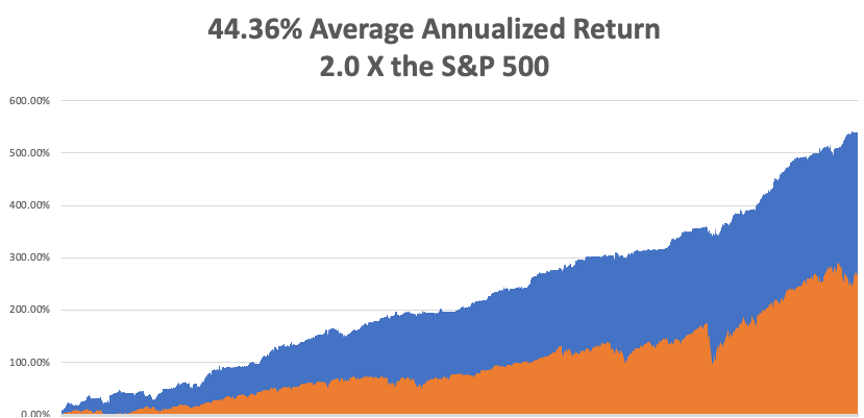

My March month-to-date performance retreated to a modest 0.38%. My 2022 year-to-date performance ended at a chest-beating 27.23%. The Dow Average is down -4.20% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 68.89%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 539.79%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.36%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 80.3 million, up only 100,000 in a week and deaths topping 985,000 and have only increased by 2,000 in the past week. You can find the data here. Growth of the pandemic has virtually stopped, with new cases down 98% in two months.

On Monday, April 11 at 8:00 AM EST, Consumer Inflation Expectations are released.

On Tuesday, April 12 at 8:30 AM, the Core Inflation Rate for March is announced.

On Wednesday, April 13 at 8:30 AM, the Producer Price Index for March is printed.

On Thursday, April 14 at 7:30 AM, the Weekly Jobless Claims are printed. We also get Retail Sales for March.

On Friday, April 8 at 8:30 AM, NY Empire State Manufacturing Index for March. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, back in 2002, I flew to Iceland to do some research on the country’s national DNA sequencing program called deCode, which analyzed the genetic material of everyone in that tiny nation of 250,000. It was the boldest project yet in the field and had already led to several breakthrough discoveries.

Let me start by telling you the downside of visiting Iceland. In the country that has produced three Miss Universes over the last 50 years, suddenly you are the ugliest guy in the country. Because guess what? The men are beautiful as well, the decedents of Vikings who became stranded here after they cut down all the forests on the island for firewood, leaving nothing with which to build long boats. I said they were beautiful, not smart.

Still, just looking is free and highly rewarding.

While I was there, I thought it would be fun to trek across Iceland from North to South in the spirit of Shackleton, Scott, and Amundsen. I went alone because after all, how many people do you know who want to trek across Iceland? Besides, it was only 150 miles or ten days to cross. A piece of cake really.

Near the trailhead, the scenery could have been a scene from Lord of the Rings, with undulating green hills, craggy rock formations, and miniature Icelandic ponies galloping in herds. It was nature in its most raw and pristine form. It was all breathtaking.

Most of the central part of Iceland is covered by a gigantic glacier over which a rough trail is marked by stakes planted in the snow every hundred meters. The problem arises when fog or blizzards set in, obscuring the next stake, making it too easy to get lost. Then you risk walking into a fumarole, a vent from the volcano under the ice always covered by boiling water. About ten people a year die this way.

My strategy in avoiding this cruel fate was very simple. Walk 50 meters. If I could see the next stake, I proceeded. If I couldn’t, I pitched my tent and waited until the storm passed.

It worked.

Every 10 kilometers stood a stone rescue hut with a propane stove for adventurers caught out in storms. I thought they were for wimps but always camped nearby for the company.

I was 100 miles into my trek, approached my hut for the night, and opened the door to say hello to my new friends.

What I saw horrified me.

Inside was an entire German Girl Scout Troop spread out in their sleeping bags all with a particularly virulent case of the flu. In the middle was a girl lying on the floor soaking wet and shivering, who had fallen into a glacier fed river. She was clearly dying of hypothermia.

I was pissed and instantly went into Marine Corp Captain mode, barking out orders left and right. Fortunately, my German was still pretty good then, so I instructed every girl to get out of their sleeping bags and pile them on top of the freezing scout. I then told them to strip the girl of her wet clothes and reclothe her with dry replacements. They could have their bags back when she got warm. The great thing about Germans is that they are really good at following orders.

Next, I turned the stove burners up high to generate some heat. Then I rifled through backpacks and cooked up what food I could find, force-fed it into the scouts and emptied my bottle of aspirin. For the adult leader, a woman in her thirties who was practically unconscious, I parted with my emergency supply of Jack Daniels.

By the next morning, the frozen girl was warm, the rest were recovering, and the leader was conscious. They thanked me profusely. I told them I was an American “Adler Scout” (Eagle Scout) and was just doing my job.

One of the girls cautiously moved forward and presented me with a small doll dressed in a traditional German Dirndl which she said was her good luck charm. Since I was her good luck, I should have it. It was the girl who was freezing the death the day before.

Some 20 years later I look back fondly on that trip and would love to do it again.

Anyone want to go to Iceland?

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Iceland 2002