Cashless payments have gained a major foothold into consumer’s lives all brought about by the pandemic, according to a new consumer survey.

This transformational trend is just another reason traders should look at Fintech firm Square (SQ) which has been one of my favorite tech stocks for the past 2 years.

The never-ending pandemic has accelerated the trend toward cashless transactions and the digit economy.

Conversely, the non-cashless society has taken the brunt of the pain in the form of job losses and the jobless rates remain stubbornly high in the Northeast and West trending above 10% in 10 states in the U.S. last month.

It’s clear which area of the economy to invest in and that’s digital payments.

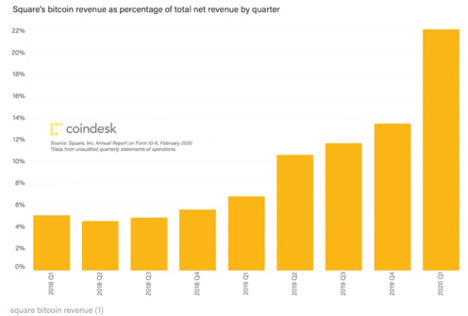

Before the pandemic, in February 2020, 5.4% of Square sellers in the US were cashless, which Square defines as any business accepting more than 95% of their sales by in-person credit or debit card payments, online payments, or contactless payments.

Moving to April, that number soared to 23.2% and by August, when many stay-at-home restrictions were lifted, it was 30%.

To highlight the trend away from a hard currency society, for payments transacted by Square sellers, the share of cash transactions dropped from 37% in February to 33% in April at the height of the lockdown.

Square delivered an analysis indicating it would take over four years to achieve this oversized cashless drop.

That is the underlying story of the pandemic – multiple years of digital transformation and acceleration scrunched into 7 months.

Not only have the secular trends strengthened tech’s fundamentals, but the employees themselves have collaborated to deliver new products such as On-Demand Pay which will allow Square merchant employees to take a cash advance of up to $200 with no fee. The second service is Instant Payments which allows sellers to fund their payroll from their Square Seller account, speeding up the transaction.

Both services take advantage of the increasing number of consumers using Cash App, delivering wider access to cash for both employers and employees. The synergies between Square's consumer and seller ecosystem is a significant competitive advantage for the company that should drive continued adoption of its products and services.

Scaling the individual ecosystem, cross-selling services within each ecosystem, and finally connecting the ecosystem has been an effective three-prong strategy for Square’s management.

These are services that minimize business risk and an example of how it can disrupt the old way of handling something like payroll. As the two ecosystems grow, Square may find other areas where it can create value between them.

The new products will improve adoption for Payroll among merchants while boosting Cash App adoption and the direct-deposit feature in particular.

Both services will boost increased balances in seller and Cash App accounts. That should increase the appeal of other Square services like the Square Card or Cash Card. It could also lead to more Cash App users investing or sending cash to friends.

It would make sense that greater balances in seller accounts would produce similar results on the seller side. And as Square merchants use more than one service from the company, Square can start offering even better deals to sellers.

In the future, other products that could be rolled out include avenues like loyalty programs, lending products, or other ways to facilitate commerce. Square is just getting started, but the fintech company's new Payroll products show the potential to create significant change in the small business financial services industry and seize market share.

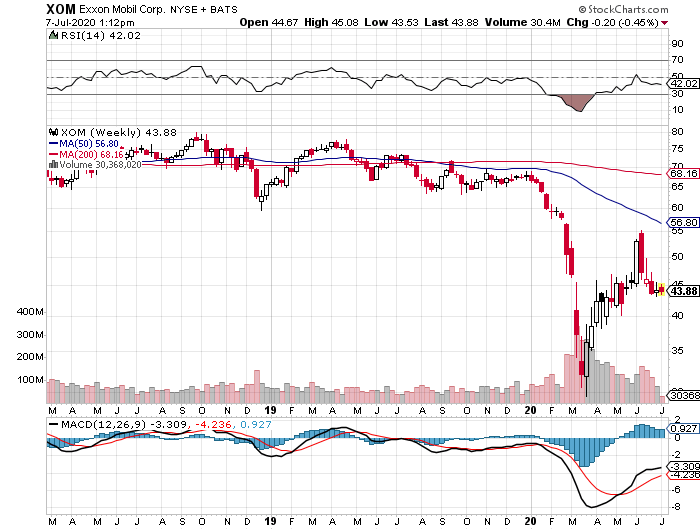

Contrast the bustling activity happening in the fintech space with brick and mortar stores and the difference couldn’t be starker.

The follow-through has been vivid with Square’s shares lurching higher by 150%.

Not only do Square’s engineers work together to create more revenue-building products at scale, but Square is feasting from a once in a generation pivot to mobile digital payments.

Square’s formula has been a recipe for success proving that the road to Damascus is shorter than it seems.

I am highly bullish Square.