The healthcare sector is one of the biggest and most intricate industries in the stock market.

It’s a multi-trillion dollar area that offers investors with virtually unlimited opportunities to build a life of financial freedom via sound long-term investing.

This industry has several quality stocks—businesses that offer to cure diseases, develop revolutionary medical devices and treatments, or even just to offer personal care items you purchase from drugstores.

One of the most lucrative sectors of the field is surgery.

Surgery dates back centuries and is one of the oldest practices in the field of healthcare and medicine. Thankfully, its technology has evolved since then.

The surgical robotics market is projected to expand exponentially, and ISRG is in a prime spot to reap the rewards from this impending growth.

So far, approximately 15% of surgeries are already conducted via robots, showing a massive room for expansion as the technology gains traction among the medical experts and patients.

Robotic assistants are gradually entering the mainstream market, opening another revenue stream. Overall, the anticipated market for this field is calculated to rise at a range somewhere from 9.5% to 19.3% from 2022 to 2032.

The growth won’t likely stop there considering the myriad of benefits that robotically assisted surgeries offer compared to traditional surgeries, such as shorter recovery periods and alleviated discomfort among patients.

These advantages make these systems attractive to healthcare providers, especially considering the way the technology optimizes the recovery process of their patients and delivers more precise and safe surgical results.

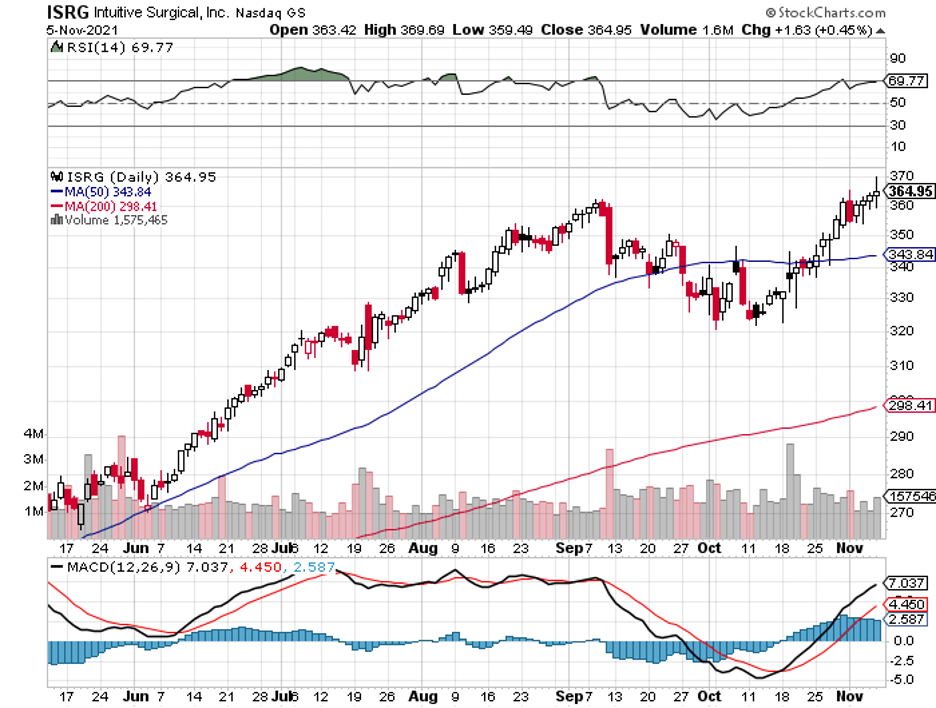

Today, one of the emerging leaders in this sector of the healthcare community is Intuitive Surgical (ISRG).

Basically, ISRG is a company that focuses on medical devices, specifically on minimally invasive robotic systems that perform surgeries. Its flagship platform is called the “Da Vinci” system.

To date, it has installed roughly 6,700, with revenue climbing by 12% annually over the past decade.

Since the launch of the da Vinci platform, ISRG has expanded at quite a rapid pace. Its revenue climbed from $1.8 billion in 2011 to $5.7 billion in 2021.

In terms of expanding its services, ISRG recently announced a new platform called Ion. This is a lung biopsy robot, which is projected to become yet another remarkable revenue stream for the company.

The more da Vinci units ISRG ships out, the stronger its competitive edge becomes.

Aside from raking in profits from their surgical robotic units, which typically cost roughly $500,000 to $2.5 million depending on the complexity of the machine, the da Vinci units require a considerable time investment to master its operation.

This leads to high switching expenses, which all but guarantees retained and returning clients for ISRG’s business.

To put this into context, system revenue for ISRG was recorded at $1.7 billion in 2021. This indicates that about 70% of its $5.7 billion total revenue came from recurring products and services.

Thus far, ISRG has been the dominant leader in this cutting-edge space in healthcare and has shown incredible growth since its IPO. More importantly, the company has an impressive cash flow and cash balance.

Moreover, ISRG is an industry leader. As with every company in this position, ISRG has captured the lion’s share of the market.

At this point, the company currently controls 80% of the market and is expected to increase this dominance as it continues to make headway.

Considering the massive potential of this market, it comes as no surprise that more and more companies are working to topple ISRG.

Other companies have already started introducing their own specialized robots.

Medtronic (MDT) launched a spine and brain robot, Stryker (SYK) created one for knee and hip replacement, and Zimmer Biomet (ZBH) introduced a competitor in the spine and knee procedures space. Even Johnson & Johnson (JNJ) entered the fray with its lung biopsy robot.

Overall, ISRG is a brilliant company.

It possesses technological superiority over its rivals and a virtual monopoly of a rapidly growing market. These factors make ISRG an excellent long-term healthcare stock to buy and forget.