Apple holders (AAPL) were ecstatic and even apoplectic when they heard that their beloved company would be joining the Dow Average last year.

The move required thousands of portfolio managers to add Apple to their portfolios, like the $32 billion worth of Dow index managers, whether they wanted to or not. From then on it would be illegal for them not to own Apple.

At the very least it put the fear of Jobs into moneymen everywhere, especially if the Dow is the benchmark they are measured against.

The world?s now second largest listed company replaced tired and flagging AT&T (T), one of my perennial favorite short positions.

The symbolism couldn?t be more evident. A former monopoly with a literally rusting infrastructure is getting booted for iPhones, iPads, iTunes, Apps and the Cloud. Oh, how the mighty have fallen.

AT&T was one of the oldest Dow stocks, joining the closely followed index in 1916. The new listing then had a symbolic move of its own, taking place the year after the first-ever transcontinental telephone call was placed.

Who made that call? Alexander Graham Bell in New York telephoned his former assistant, Thomas Watson, in San Francisco in a replay of the first phone call in history 50 years earlier in 1876, from room to room at their lab. ?Mr. Watson, come here, I want to see you,? the first words ever uttered on a phone line, were repeated once more.

AT&T, or ?Ma Bell? as it was known, lost its listing in 2004 after it merged with SBC Communications. It was reinstated a year later when the new firm?s name was changed back to AT&T.

However, Apple shareholders should be careful what they wish for.

There is not exactly a great track record for share price performance after a company joins the Dow, especially a technology stock.

In 1999, Microsoft (MSFT) fell 43% after becoming a Dow 30 stock, while Intel (INTC) shed 52%. Cisco Systems (CSCO) lost 16% after joining the club in 2009.

The problem is that Apple entered the index after a meteoric 18 month, 130% run up. So the Dow, having missed the rise in Apple on the upside, fully participated on the downside in the stock meltdown that followed.

Apple is the second largest component in the Dow, with a hefty $575 billion market capitalization. This means that future Dow corrections will be bigger and more ferocious than they would have been without Apple and with boring AT&T.

The volatility of the lead index has just gone up, a lot.

I remember too well that the Japanese made a similar blunder in 2000. The government wanted to have a national stock index that reflected the economy of the future, not of the past.

They had watched with great envy America?s NASDAQ hog the global spotlight, soaring from 1,000 to 5,000 in just a couple of years.

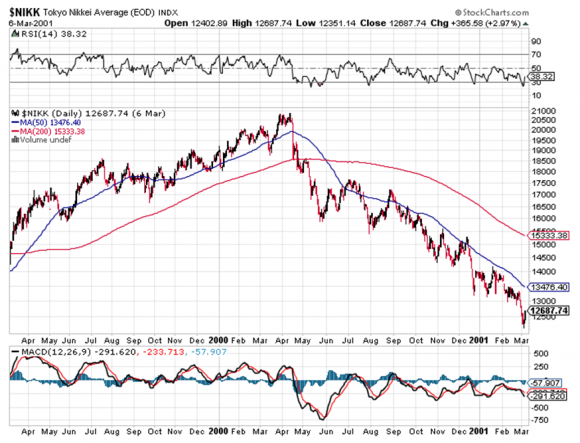

So what did these geniuses do? They reconstituted the Nikkei Average from a 90% boring industrial, 10% technology index to a 50/50 weighting. And they did this mere weeks after NASDAQ peaked!

As a result, the Nikkei Average got the stuffing knocked out of it in the dotcom collapse. It fell a stunning 15% in the week just after the reconstitution announcement. It cratered from 21,000 to eventually bottom at 7,200. Without the reconstitution, it would have sold out at 10,000.

Having missed the dotcom boom on the upside, the Nikkei fully participated on the downside. Apple shareholders please take note.

Apple?s rise was amply chronicled by a steady series of Trade Alerts in this newsletter.

You can go back to my 2012 prediction that Apple would soar from $485 to $1,000 (click here). On a split adjusted basis we? already reached $931.

I followed that up with ?Apple is Ready to Explode? in October, 2013 (click here), when the post split share price was back at $70.

Indeed, I have issued more Trade Alerts to buy Apple over the seven-year life of this newsletter than any other single name.

It looks like I will be issuing a lot more Apple Trade Alerts in the near future as well.

Guess When the Index Reconstitution Took Place?