Mad Hedge Technology Letter

January 27, 2020

Fiat Lux

Featured Trade:

(HOW TO PLAY THE CHINESE PANDEMIC)

(TRIP), (TCOM), (GOOGL), (EXPE)

Mad Hedge Technology Letter

January 27, 2020

Fiat Lux

Featured Trade:

(HOW TO PLAY THE CHINESE PANDEMIC)

(TRIP), (TCOM), (GOOGL), (EXPE)

Am I going to rant about Peloton today?

No, I’ll save that for another day.

Let’s get straight to the chase – the epidemic from Wuhan is crushing tech stocks.

If you want a way to play the Chinese coronavirus outbreak, then look no further than Trip.com Group Limited (TCOM).

This company owns a series of reputable Chinese travel apps from Trip.com, Skyscanner, and Ctrip.com.

The Mad Hedge Technology Letter doesn’t tend to do tech alerts on Chinese companies listed in America as American depository receipts.

We rather not expose readers to the high risk of one of them suddenly being kicked off of one of the exchanges.

American investors have zero rights of recouping any losses if Alibaba or Baidu delists or even announces to switch its listing on the Shenzhen tech exchange.

Remember that founder of Alibaba Jack Ma signed over the PayPal of China Alipay to himself without even telling Yahoo about it.

Yahoo was also locked out of any profits from the decision as well even though they were seed investors in Alibaba.

That is China in a nutshell for you!

So what’s happening now? Tourists are staying home in droves and the ones that support the economy which are the Chinese ones during the peak travel season of Chinese New Year.

Cities are getting quarantined left and right in China and the mainland has ordered all travel agencies to suspend sales of domestic and international tours.

Chinese shares have felt the pain with shares of China Southern Airlines Co. – the carrier most exposed to the site of the outbreak – cratering 20% since the second death from the virus was confirmed.

If the situation unfolds like the SARS outbreak of 2003, things could turn bleak quickly.

Remember that in just one month of the SARS outbreak, Chinese air passenger traffic fell 71%, and Trip.com was rerated and has fell off the face of the earth.

I am predicting the same type of devastating numbers to the online travel world.

Trip.com has struggled to keep up with competition from digital rivals like Meituan Dianping and Alibaba, and even if the virus is conquered, business might never come back.

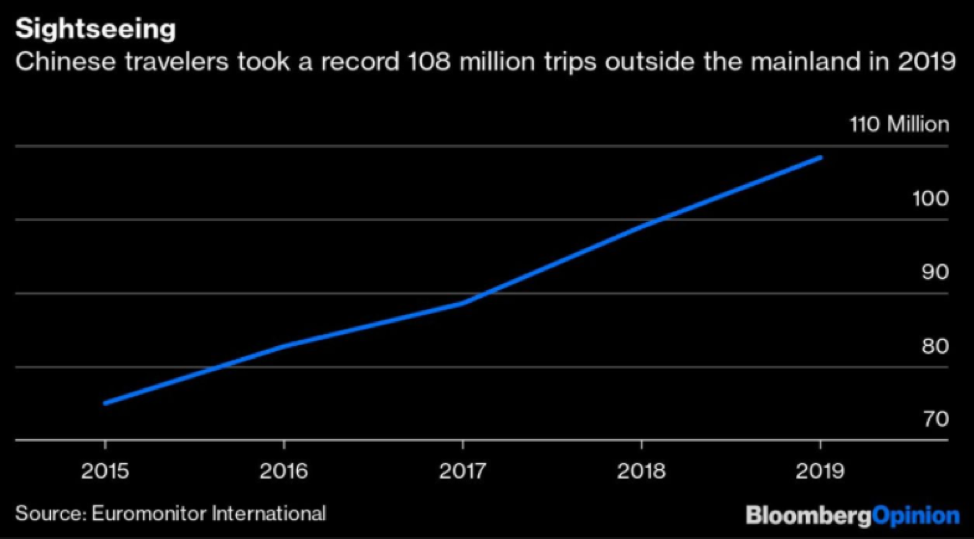

Despite the trade war and Hong Kong’s protests, the world has been held up by the Chinese tourist.

108.39 million Chinese overseas trips were taken last year, a 9.5% gain, after surging 11.7% in 2018.

Flight volume was brimming along nicely until the virus, but the hotel-booking sector is getting crowded.

Meituan Dianping has recently overtaken Trip.com as China’s top site, and now has 47% of China's market, 13% higher than Trip.com.

Now, Meituan is moving further onto Trip.com’s turf with luxury hotels, while chains like Marriott International Inc. are pushing for direct booking on their China websites.

Alibaba said part of the $13 billion it raised from its Hong Kong listing in November would go toward fliggy.com, its online travel group site.

The way the Mad Hedge Technology Letter is playing the sudden drop in overseas travel confidence is through the travel app I dislike the most – TripAdvisor (TRIP).

I actually don’t have a personal problem with the functionality, but the business behind it is terrible.

That was the main reason I strapped on a put spread and I can’t see TripAdvisor outperforming dramatically in the next few weeks in the face of a global pandemic.

This was a short-term trade that TripAdvisor won’t rise 11% in 30 day

I didn’t like this company before the coronavirus and now that Chinese tourists are home sitters for the Chinese New Year, this could put a dent into TripAdvisor’s new China initiative.

Trip.com Group had taken the lead in the day-to-day running of TripAdvisor China. It owns the majority share, with TripAdvisor claiming a 40 percent stake.

Chinese were supposed to increasingly travel the world while its customer base is also becoming more global, in particularly with Trip.com and Skyscanner.

But that is all on hold now.

Yes, it is possible that there could be a dead cat bounce in shares if the virus is tamed, but the 2-week travel season is something you can’t get back once it’s over for TripAdvisor.

I believe this will come out in the numbers along with details about Google’s algorithms further destroying TripAdvisor’s relevancy in the online travel industry.

Then take into account that the company just announced a 200-employee purge for the explicit reason of increased competition from Google and things seem to be going from bad to worse.

The company has done a proverbial deal with the devil by positioning itself to be utterly tied to Google’s search algorithm while Google is going head-to-head with them.

Google has upgraded its travel search tools recently to turn the screws on several trip booking websites like TripAdvisor, Booking.com and Priceline.

In its last earnings release, TripAdvisor noted that Google has placed ads at the top of its search results, forcing companies like it to buy more ads.

The company had a rough last quarter, reporting adjusted earnings of 58 cents a share, down from 72 cents a year earlier and short of analysts’ estimates of 69 cents.

Rhetoric from management was equally as disappointing with them saying, “Google (is) pushing its own hotel products in search results and siphoning off quality traffic that would otherwise find TripAdvisor via free links and generate high margin revenue in our hotel click-based auction.”

“Google has got more aggressive. We’re not predicting that it’s going to turn around.” TripAdvisor CEO Stephen Kaufer said at the time and I don’t see how our put spread will lose money in the short-term.

I will advise readers to take profits when the time comes. Be aware that TripAdvisor also has an earnings report coming up in 2 weeks that could gyrate the stock.

I expect broad-based weakness in guidance and poor performance last quarter in the report.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds: