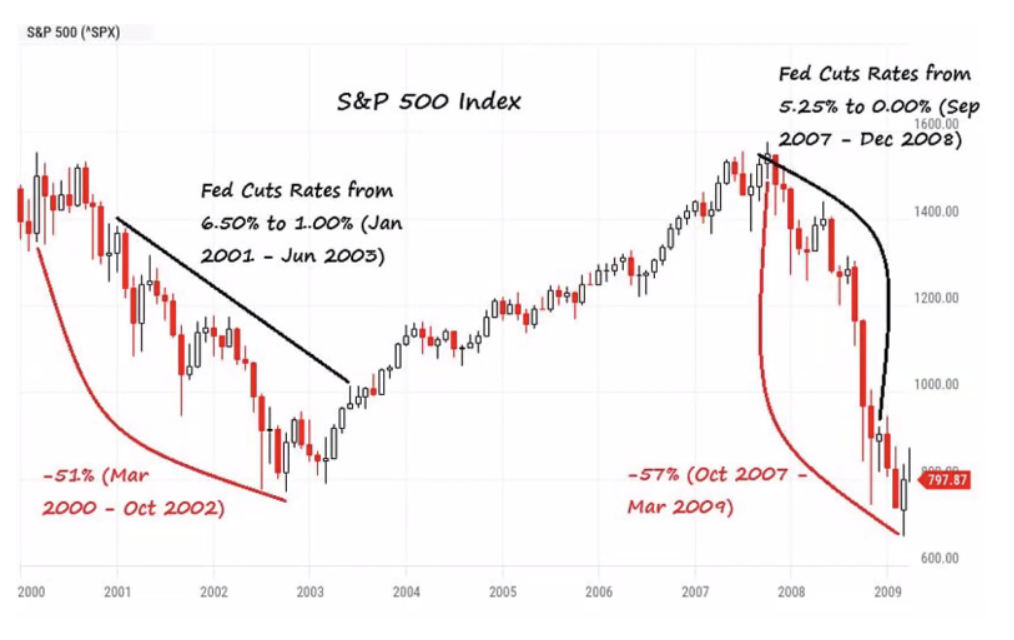

There are always many unintended consequences to any Fed move, such as the 50-basis point interest rate cut on September 18. This time, a big one is that China would match and then exceed our own central bank’s move with a blockbuster stimulus package of their own. China has finally reached the “whatever it takes” moment, and the programs are squarely aimed at stimulating consumption.

You will hear from the talking heads on TV that the package is inadequate, a weak effort, an hour late, and a Yuan short, and will fail. But China has massive resources and will follow up with a second, larger package if they need to.

For a start, they own $860 billion worth of our US Treasury bonds, more than any foreign country, and unimaginable amounts of rapidly appreciating gold (GLD), which they have been accumulating since it was $1,020 an ounce (it is now $2,600).

China really pulled out all the stops on this one. The People's Bank of China on Wednesday cut its medium-term lending facility -- the interest for one-year loans to financial institutions -- from 2.3% to 2.0%, the lowest since 2020. The rate cuts are going to bring $140 billion in new lending.

They reduced deposits for new investment property purchases to 10% in a move clearly aimed at resuscitating their moribund real estate market. For the first time ever, they are handing out cash payments to poor people. It is the most stimulus since Covid.

China is not to be taken lightly.

Certainly, the stock market is buying it….at least for now. The main China ETF, the (FXI) had its best week in history, up 20%. Most of this was short covering. The short interest in the leading Chinese stocks like Alibaba (BABA), Baidu (BIDU), and Tencent Music Holdings (TNE) was running close to an eye-popping 50%.

So, why bother with a country half the size of our own, where the writing looks like chicken scratching, and the food has way too much MSG? Because the Middle Kingdom is the largest buyer of almost everything, including oil (USO), coal (BTU), natural gas (UNG), corn (CORN), wheat (WEAT), and soybeans (SOYB), most of which is supplied by the United States.

So, have I been burying you with China-oriented trade alerts this week? No, not really. First of all, I never buy on top of a 20% move in five days. It just goes against my bargain-hunting character. More importantly, the best China plays are here in the US. You can start with all of the ticker symbols I listed above.

There are also quite a few indirect China plays available in the West. Notice that the casinos Las Vegas Sands (LVS) and Wynn Resorts (WYNN) are up 20% across the board. The luxury stocks like LVMH Moet Hennessy (LVUY) and Hermes International (HESAF) also saw monster moves.

Dare I say it? Buy China on dips, especially blue-chip names like Alibaba (BABA) and Baidu (BIDU). If this Beijing stimulus fails, they’ll probably follow up with another one.

And what do newly enriched Chinese consumers do? They buy more gold. In fact, the gold story keeps getting better the higher it goes.

Another gold positive is the US National Debt, now at $35 trillion. Whichever candidate wins the presidential election, the national debt will keep rising, either by $500 billion a year or $2.5 trillion. Foreigners seem more worried about our debt than we are and are finding any non-dollar asset more attractive by the day. Gold is at the very top of that list.

It turns out that in a world of falling interest rates, a declining dollar, and fading faith in financial institutions, quite a few Americans like gold as well. Hey, Costco (CSCO) is selling it. How bad can it be?

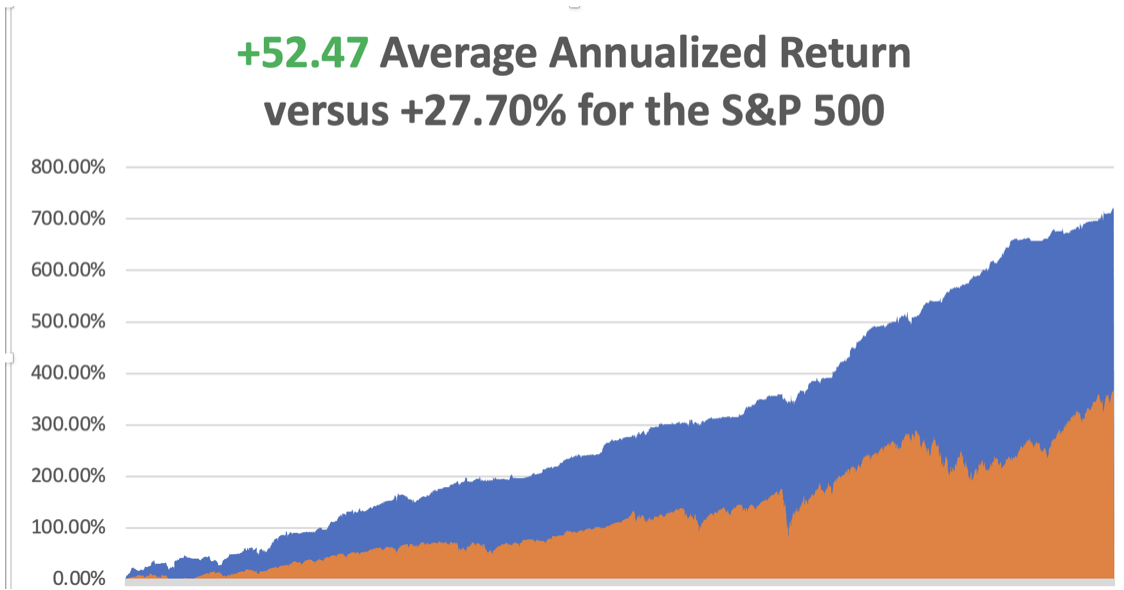

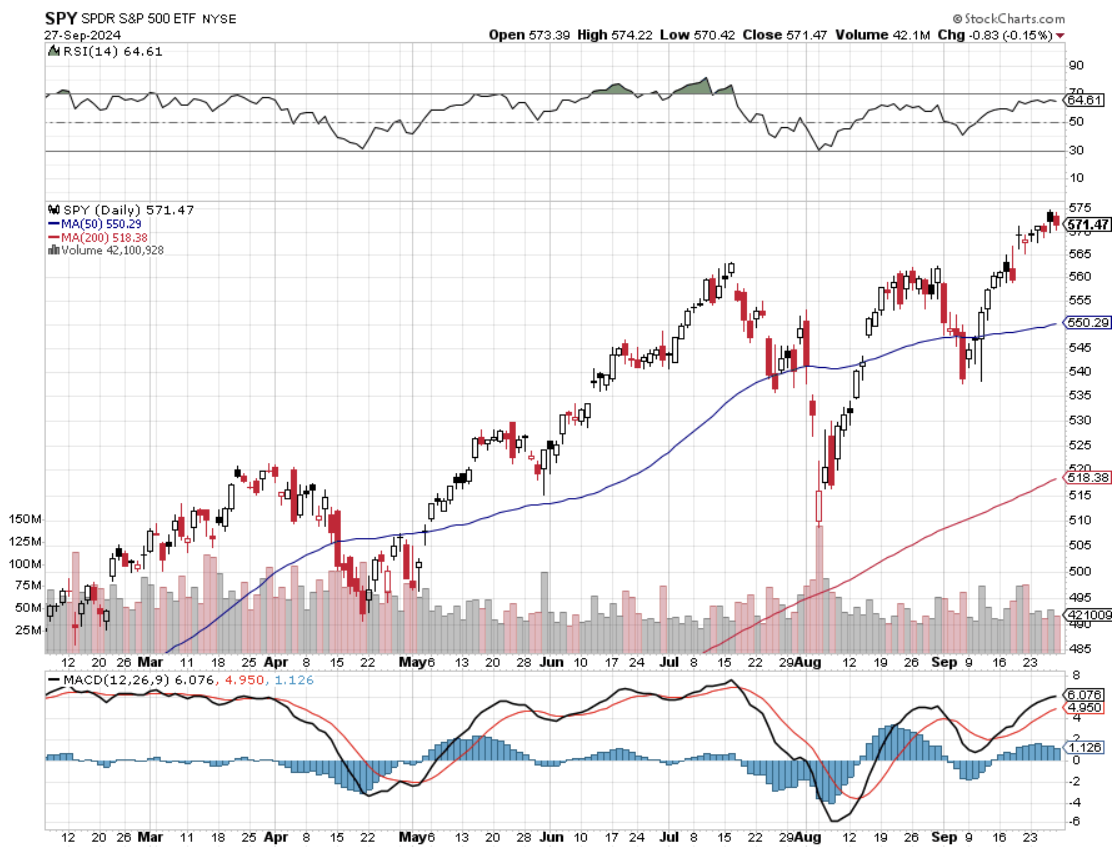

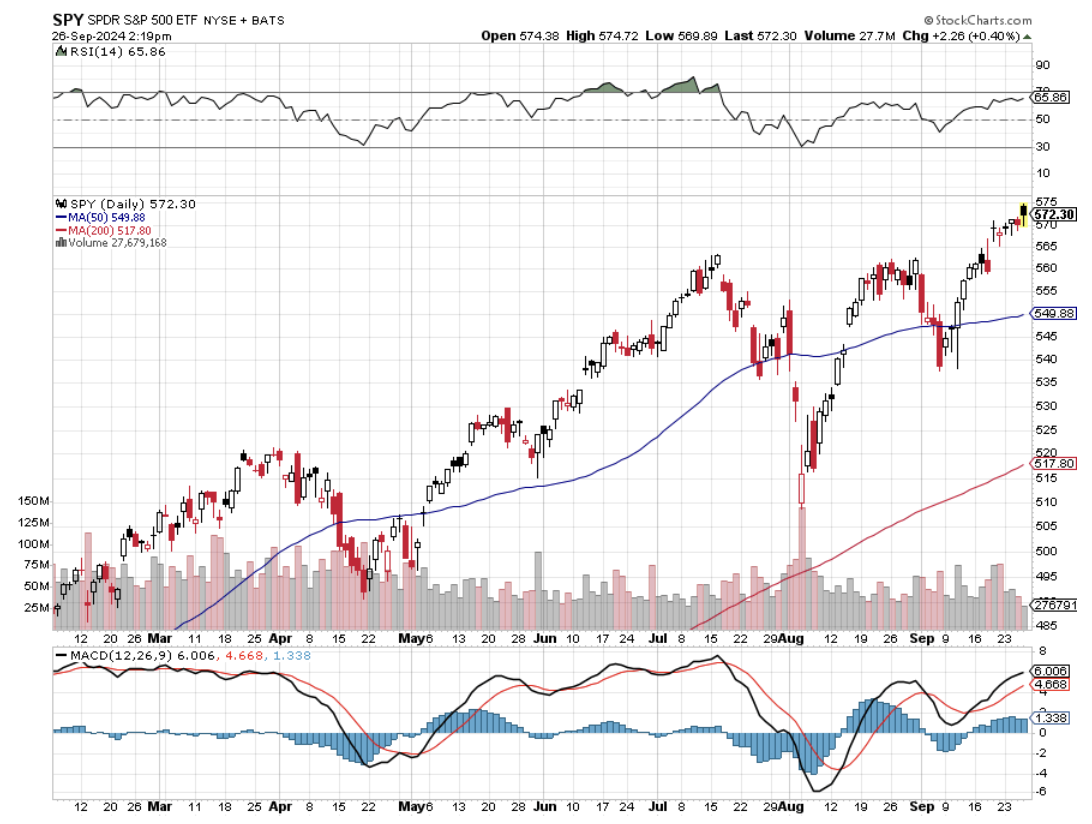

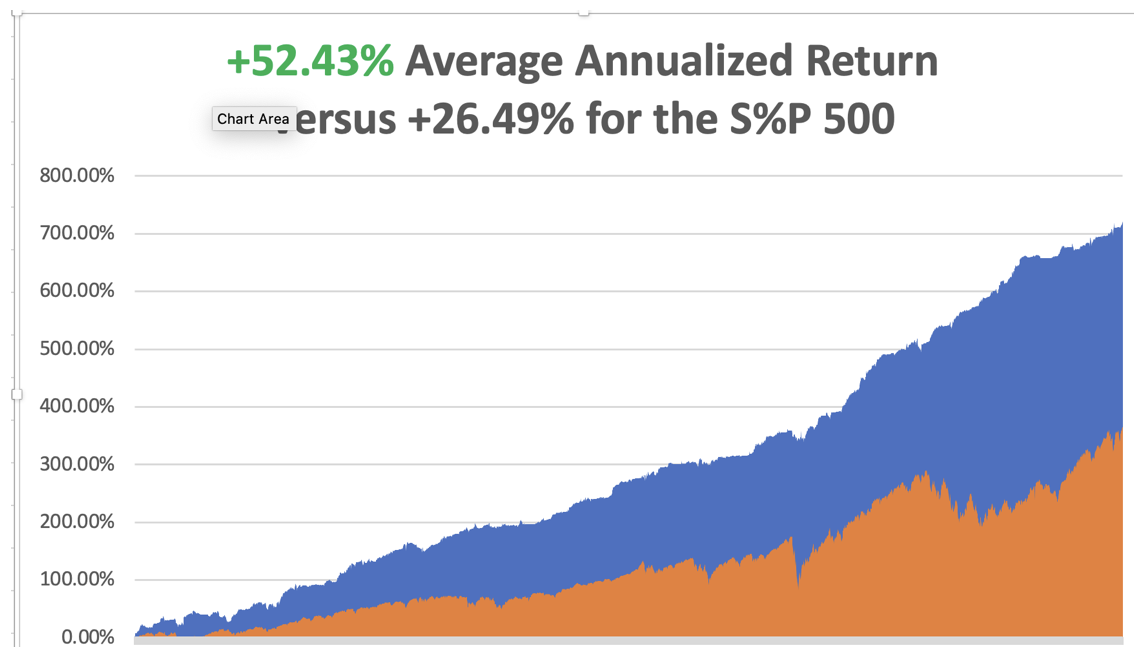

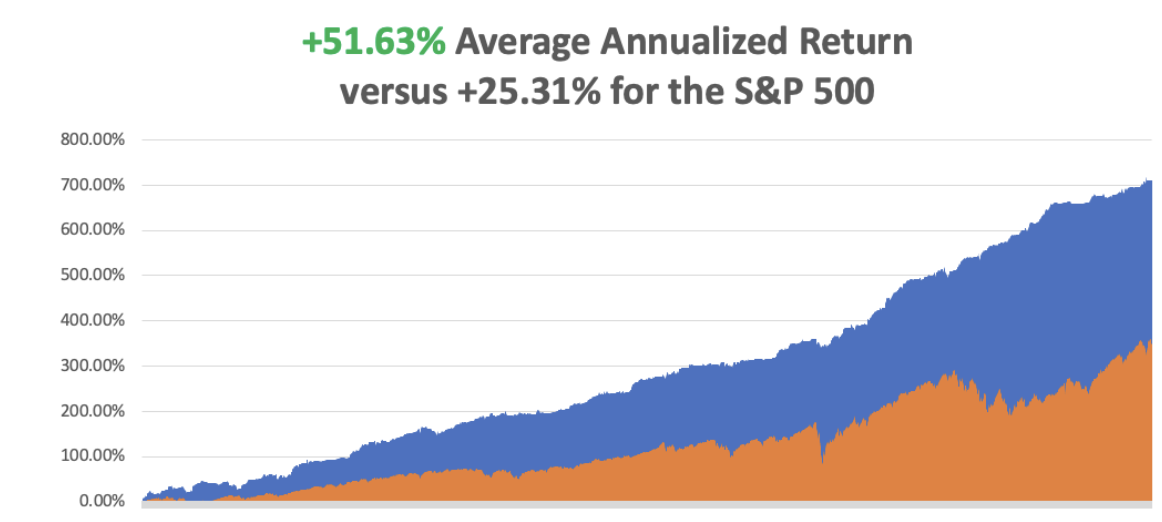

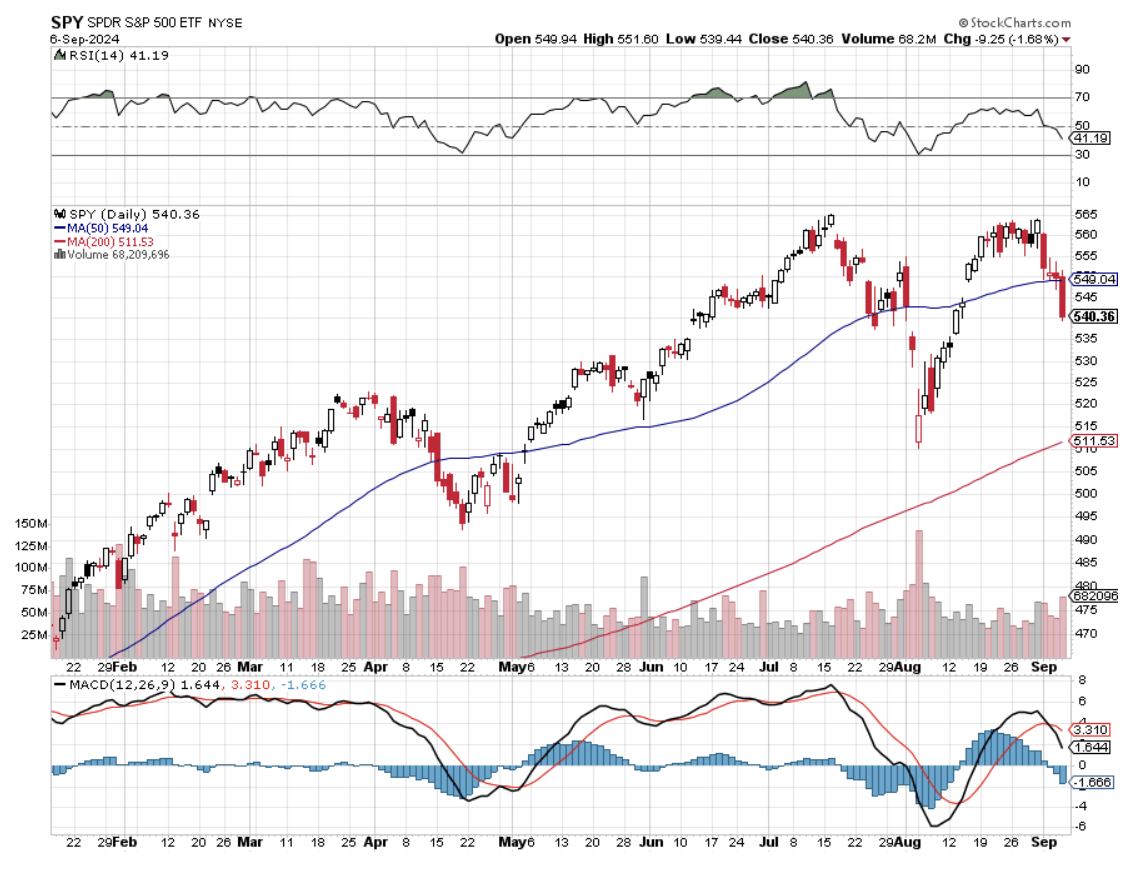

So far in September, we are up by a spectacular +9.54%. My 2024 year-to-date performance is at +44.23%. The S&P 500 (SPY) is up +20.33% so far in 2024. My trailing one-year return reached +62.87%. That brings my 16-year total return to +720.86%. My average annualized return has recovered to +52.47%.

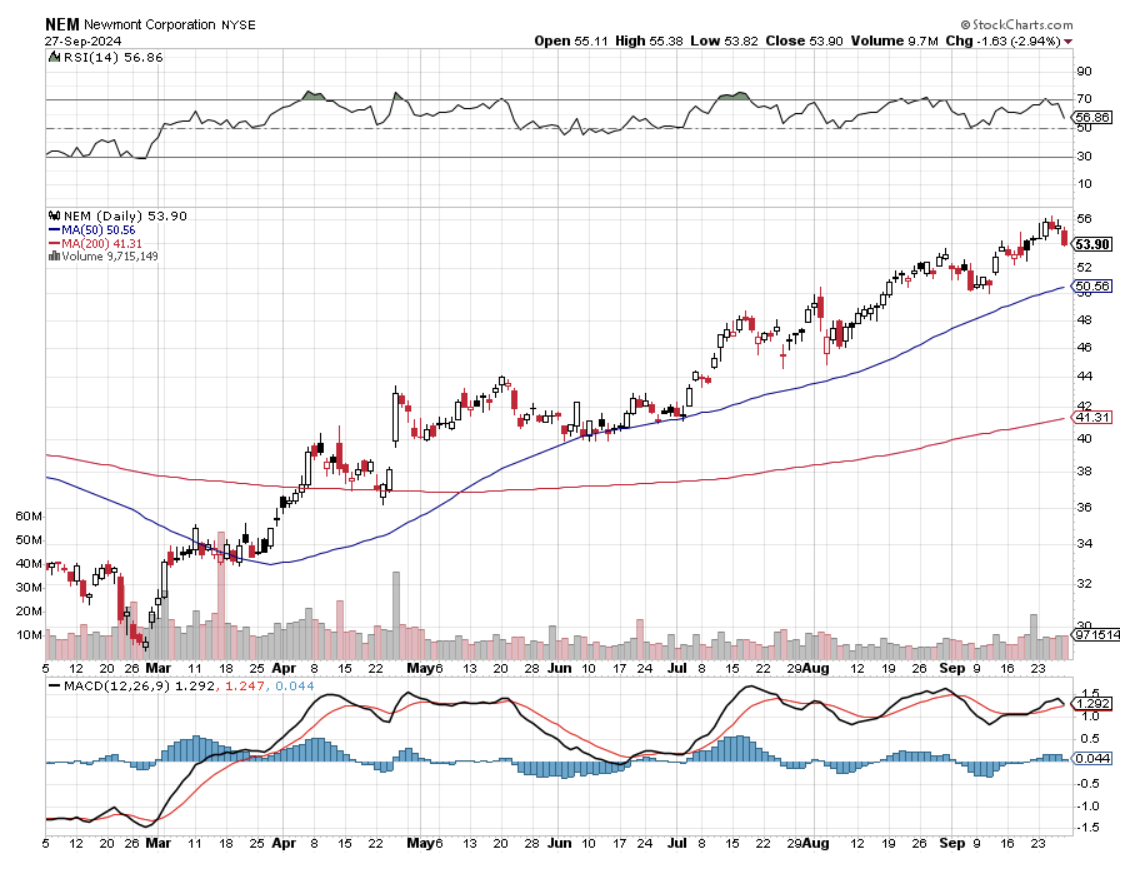

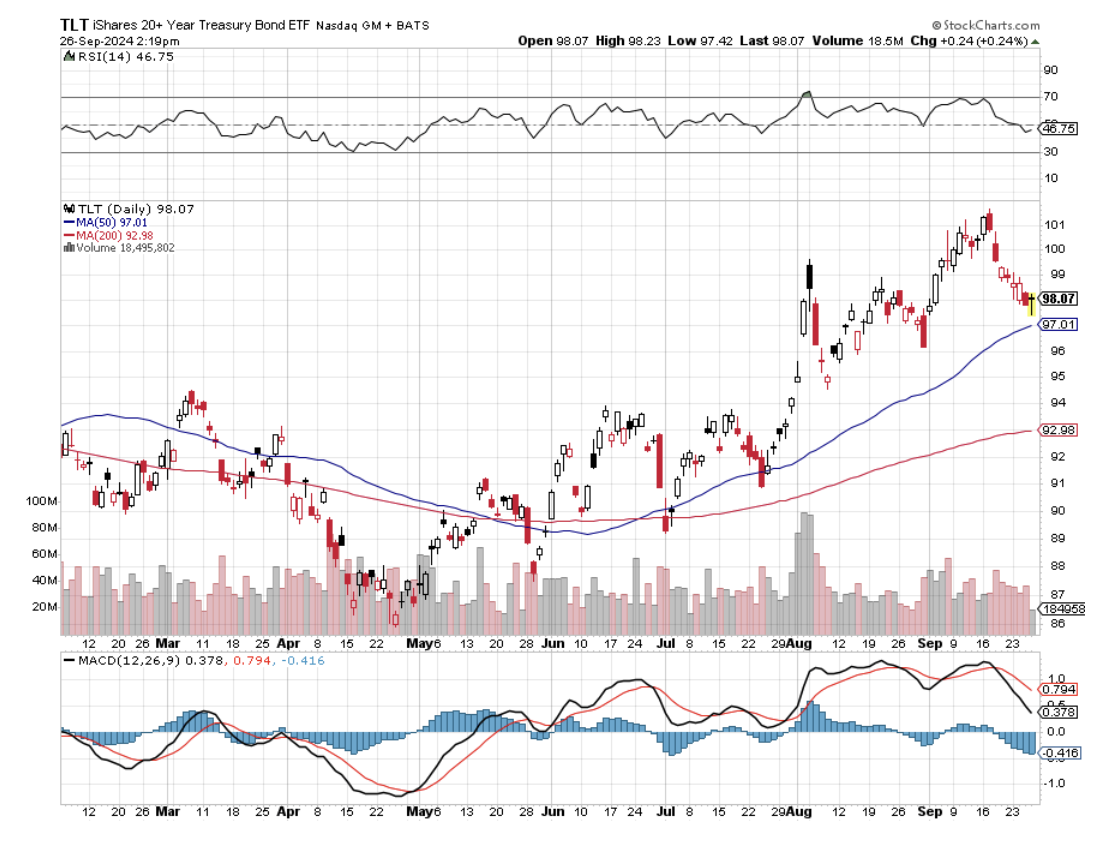

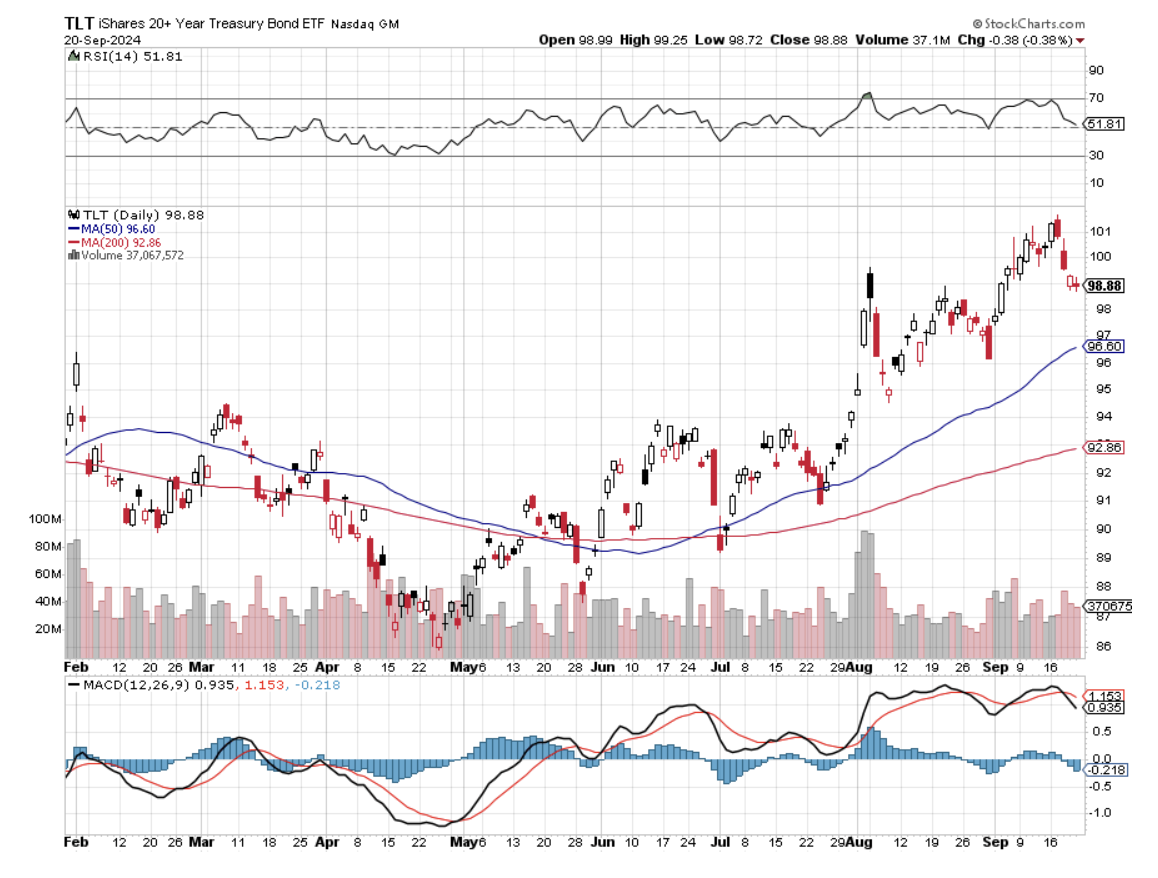

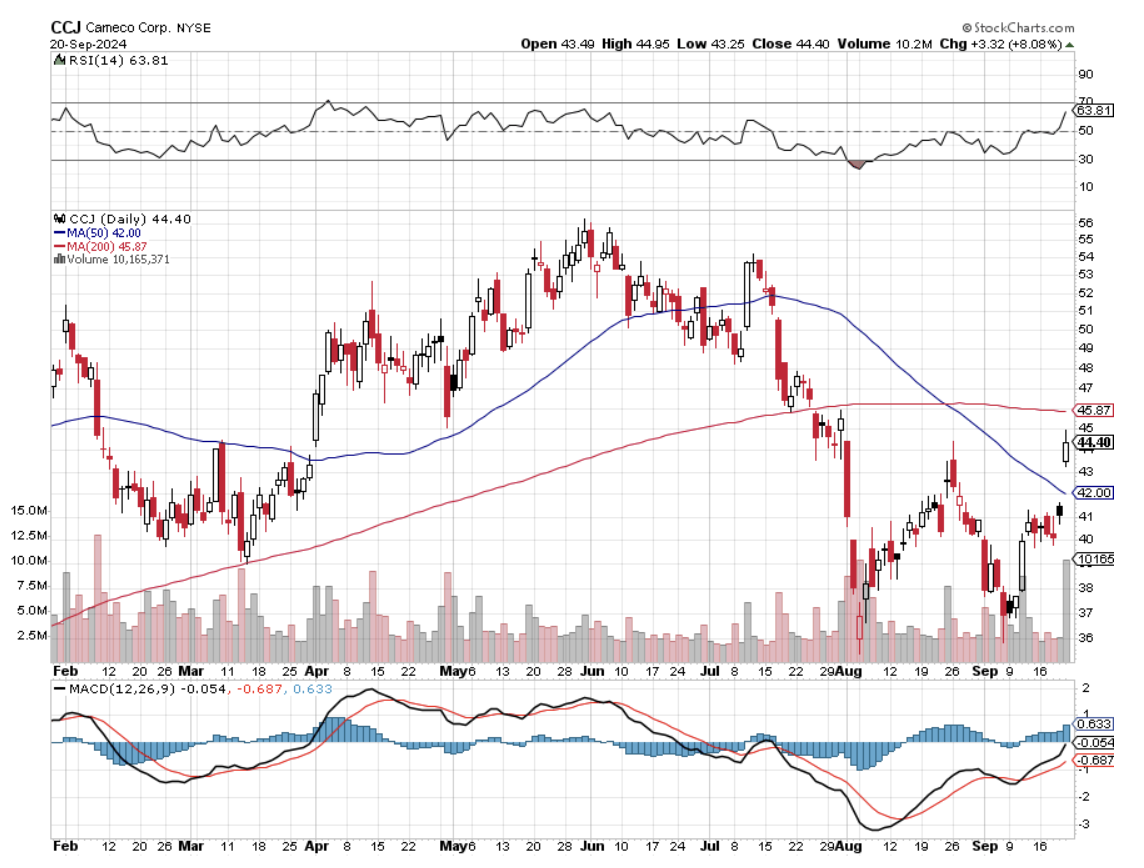

Last week was mostly about running existing successful long positions. Those would include (CCJ), (NEM), (TLT), (TSLA), and (DHI). I have one short position in (TLT).

I did add a (TLT) call spread, taking advantage of a rapid $4 dip. I also increased my Tesla (TSLA) long to a double, believing that the stock will keep running into the October 10 Robotaxi announcement.

Some 63 of my 75 round trips, or 90%, were profitable in 2023. Some 59 of 77 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of +76.62%.

Try beating that anywhere.

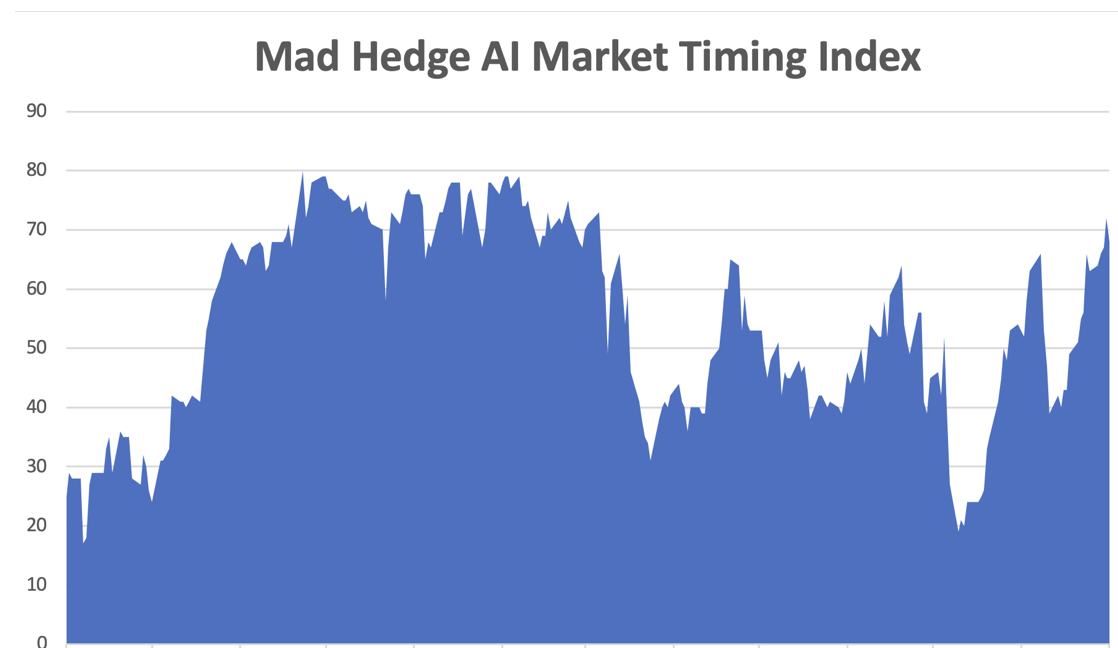

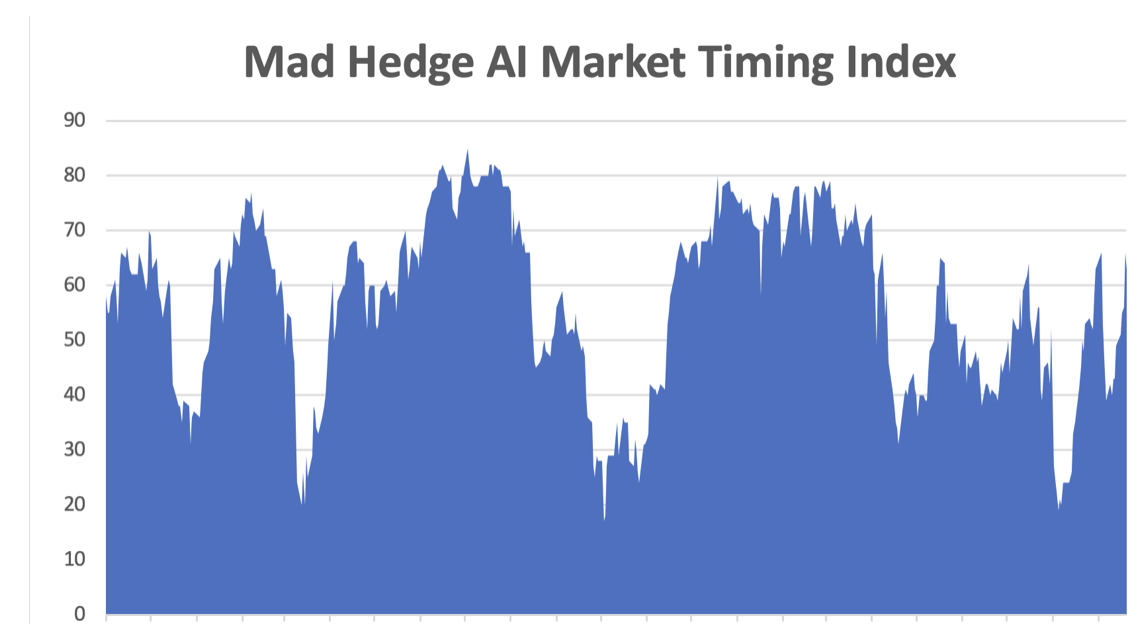

Are Markets Melting Up? So thinks my friend Ed Yardeni. The latest policy decision lifted the odds of an “outright melt-up” in equity prices — like during the dot-com bubble when the (SPY) roared 220% from 1995 to the end of the century — to 30% from 20%. Another 50-basis point rate cut might do it. One can only hope.

What Happens When Gold Hits $3,000? It then moves on to $4,400 an ounce. Chinese savers will still have nowhere else to go. The real estate market is still dead, Chinese stocks are moribund, and they don’t trust their own currency. Keep buying (GLD), (NEM), and (GOLD) on dips.

The Core Personal Consumption Expenditures Price Index Falls, to a 2.2% annual rate, much lower than expected. The Federal Reserve’s preferred gauge to measure underlying inflation,rose 0.1% for the month, putting the 12-month inflation rate at 2.2%. Excluding food and energy, core PCE rose 0.1% in August and was up 2.7% from a year ago. The all-items inflation gauge was below Wall Street estimates and the lowest since early 2021.

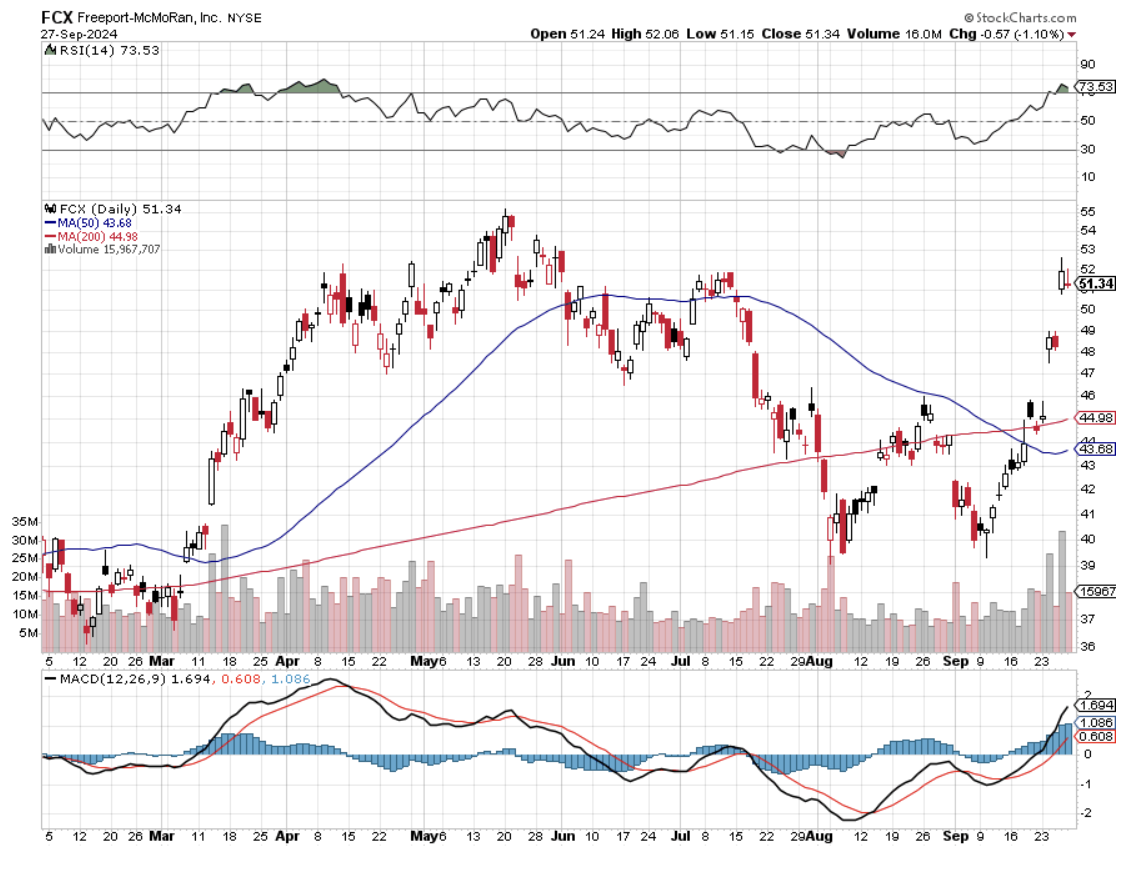

American China Plays Roar, like commodities plays Freeport McMoRan (FCX), the Copper ETF, COPX), Peabody Energy (BTU), and the Platinum ETF. Indirect plays like the casinos Las Vegas Sands (LVS) and Wynn Resorts (WYNN). Dare I say it? Buy China on dips, like Alibaba (BABA) and Baidu (BIDU). If this Beijing stimulus fails, they’ll probably follow up with another one.

Silver is on a Roll, and is finally outperforming gold, as it has historically done. Silver just hit its highest price in more than a decade, and growing demand and falling interest rates mean it could have more room to run.

On Thursday, silver hit $32.43 an ounce, its highest price since 2012. The metal is up 35% so far this year. That beats a 30% rally for gold, which has been trading at all-time highs. Silver is much more sensitive to an industrial recovery than gold. Buy (SLV), (AGQ), (SIL), and (WPM) on dips.

Oil Gets Crushed on Saudi Output Burst. After a brief bounce back last week, it looks like oil is in a bearish pattern now that will be hard to break for the next few months. OPEC and its allies have been holding at least 5 million barrels of daily output off the market to prop prices, but they are expected to start bringing back production soon. Saudi Arabia, the strongest member of OPEC in that it has the most capacity to pump oil, is no longer willing to hold back production to try to push the price up to $100 a barrel.

US GDP Revised up to 5.5% Growth, since the second quarter of 2020, when the pandemic began through 2023. It was spurred mainly by bigger consumer-driven growth fueled by robust incomes. The revised figure is compared with a previously published 5.1% advance. You can’t beat America.

Electrification is the Latest Hot Investment Theme, seeking to cash in on AI demands on the power grid. Issuer Global X last week filed for its U.S. Electrification ETF, which would track an index of conventional companies in the sector, as well as those involved in alternative or cleaner energy sources — such as wind and solar — and grid infrastructure firms. Fund firm Tema also recently submitted paperwork for an ETF that would invest in companies “tied to global electrification.” These funds could become big winners.

US Homes Plunge, down 4.7% in August. Buyers are clearly remaining patient amid steadily declining mortgage rates. New single-family home sales decreased last month to an annualized rate of 716,000 after rising at the fastest pace since early 2022. The median sales price, in the meantime, decreased by 4.6% from a year earlier to $420,600. That marked the seventh straight month of annual price declines, extending what was already the longest streak since 2009

Home Mortgage Rates are in Free Fall, with the 30-year fixed at 6.08% and adjustable well into the fives. Refi activity is also exploding. Expect a real estate boom to ensue.

Can Tesla Reach $300? With (TSLA) possibly looking at a great quarter in China, Wall Street pros are rushing to increase their outlooks for the electric vehicle maker’s quarterly sales. At least four analysts have boosted their estimates for Tesla’s third-quarter delivery numbers, which are due next week. All point to signs that sales are starting to pick up in China, a key area for Tesla and a major market for electric cars globally.

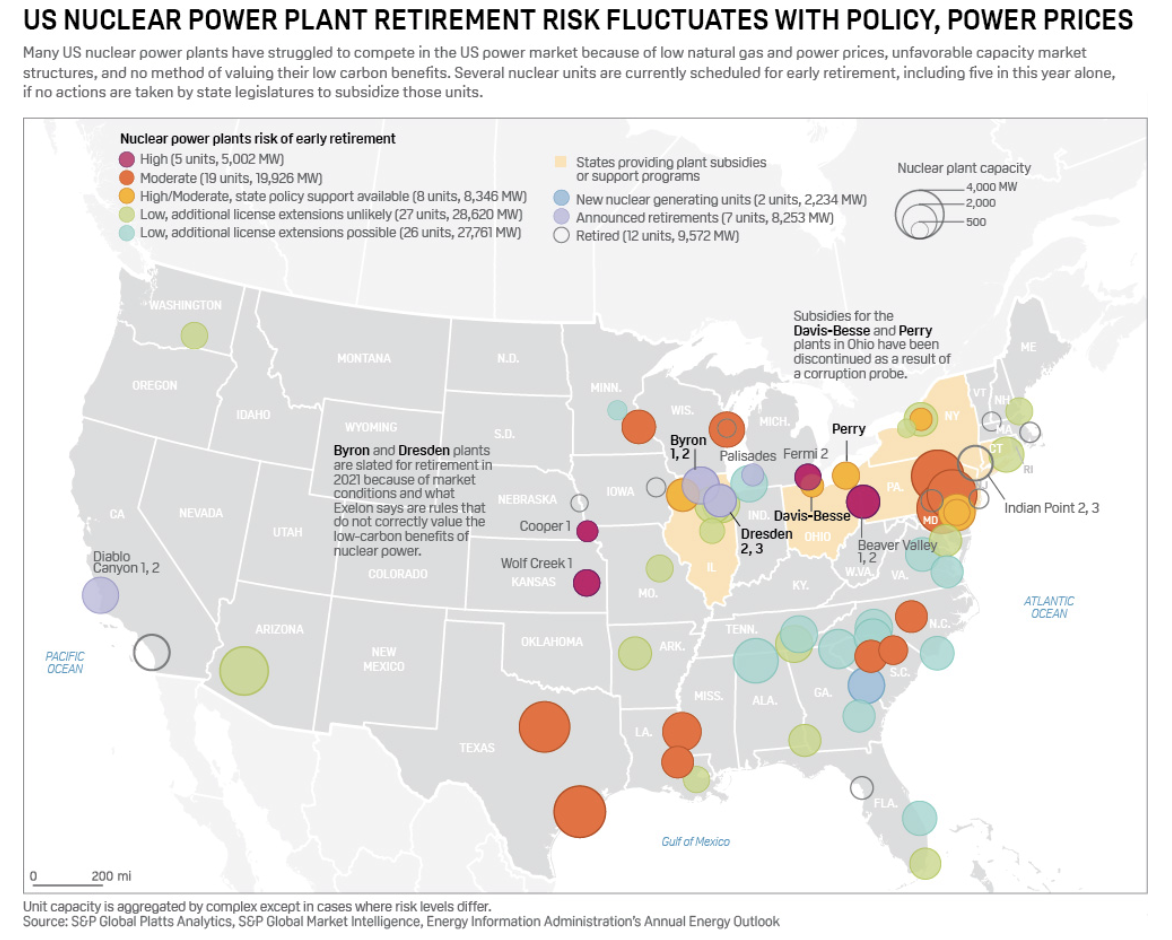

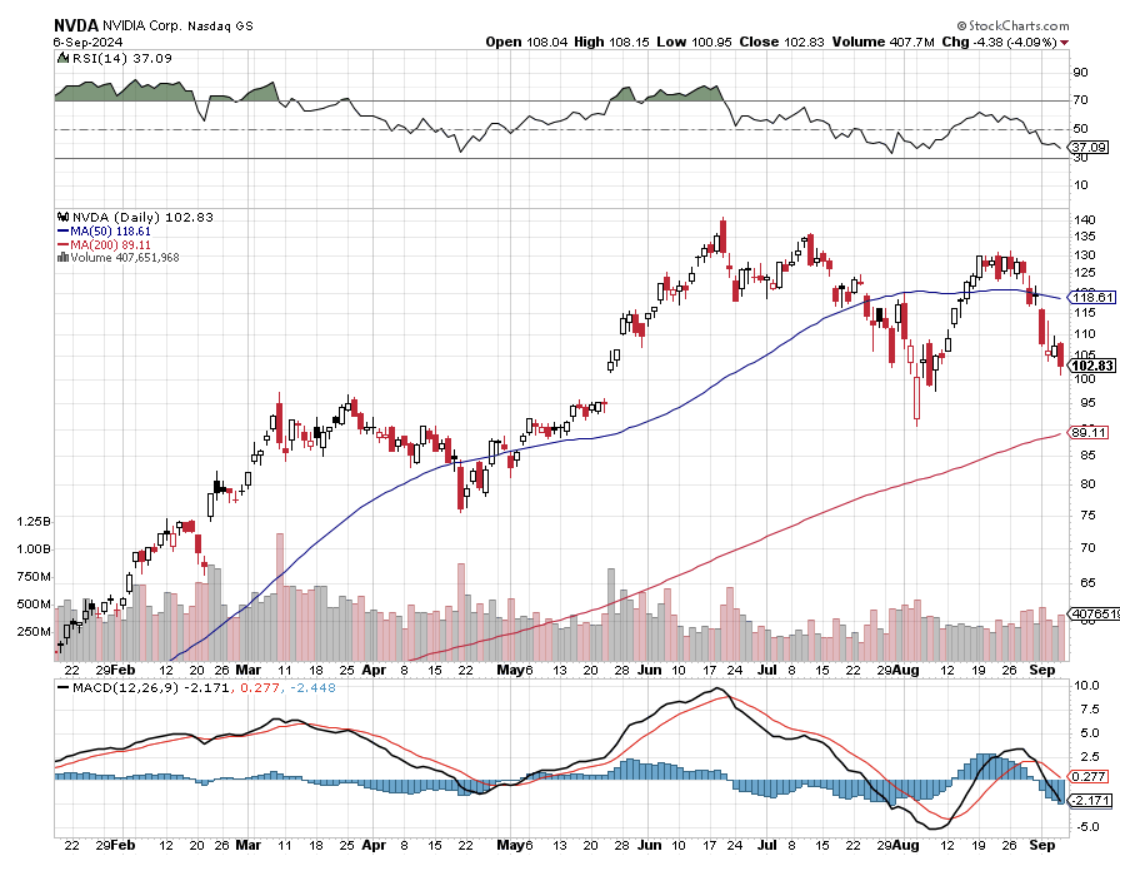

Vistra Tops Nvidia, as the top S&P 500 stock this year. Vistra is a utility company based in Irving, Tex. that just so happens to be the second-largest owner of independent nuclear plants after buying three nuclear plants in Pennsylvania last year, and these days nuclear power is all the rage. Buy (VST) on dips.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, September 30 at 8:30 AM EST, the Chicago PMI is out

On Tuesday, October 1 at 6:00 AM, the JOLTS Job Openings Report is released.

On Wednesday, October 2 at 7:30 PM, ADP Employment Change is printed.

On Thursday, October 3 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the ISM Services PMI.

On Friday, October 4 at 8:30 AM, we get the September Nonfarm Payroll Report. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, I am often told that I am the most interesting man people ever met, sometimes daily. I had the good fortune to know someone far more interesting than myself.

When I was 14, I decided to start earning merit badges if I was ever going to become an Eagle Scout. I decided to begin with an easy one, Reading Merit Badge, where you only had to read four books and write one review. I loved reading, so “piece of cake”, I thought.

I was directed to Kent Cullers, a high school kid who had been blind since birth. During the late 1940s, the medical community thought it would be a great idea to give newborns pure oxygen. It was months before it was discovered that the procedure caused the clouding of corneas and total blindness in infants.

Kent was one of these kids.

It turned out that everyone in the troop already had Reading Merit Badge and that Kent had exhausted our supply of readers. Fresh meat was needed.

So, I rode my bicycle over to Kent’s house and started reading. It was all science fiction. America’s Space Program ignited a science fiction boom during the early 1960s and writers like Isaac Asimov, Jules Verne, Arthur C. Clark, and H.G. Wells were in huge demand. Star Trek came out the following year, in 1966. That was the year I became an Eagle Scout.

It only took a week for me to blow through the first four books. In the end, I read hundreds of books to Kent. Kent didn’t just listen to me read. He explained the implications of what I was reading (got to watch out for those non-carbon-based life forms).

Having listened to thousands of books on the subject Kent gave me a first class education and I credit him with moving me towards a career in science. Kent is also the reason why I got an 800 SAT score in Math.

When we got tired of reading, we played around with Kent’s radio. His dad was a physicist and had bought him a state-of-the-art high-powered short-wave radio. I always found Kent’s house from the 50 foot tall radio antenna.

That led to another merit badge, one for Radio, where I had to transmit in Morse Code at five words a minute. Kent could do 50. On the badge below the Morse Code says “BSA.” In those days, when you made a new contact, you traded addresses and sent each other postcards.

Kent had postcards with colorful call signs from more than 100 countries plastered all over his wall. One of our regular correspondents was the president of the Palo Alto High School Radio Club, Steve Wozniak, who later went on to co-found Apple (AAPL) with Steve Jobs.

It was a sad day in 1999 when the US Navy retired the Morse Code and replaced it with satellites and digital communication far faster than any human could send. However, it is still used as beacon identifiers at US airfields.

Kent’s great ambition was to become an astronomer. I asked how he would become an astronomer when he couldn’t see anything. He responded that Galileo, the inventor of the telescope, was blind in his later years.

I replied, “Good point”.

Kent went on to get a PhD in Physics from UC Berkeley, no mean accomplishment even for sighted people. He lobbied heavily for the creation of SETI, or the Search for Extra-Terrestrial Intelligence, once an arm of NASA. He became its first director in 1985 and worked there for 20 years.

In the 1987 movie Contact written by Carl Sagan and starring Jodie Foster, the movie was filmed at the Very Large Array in western New Mexico. The algorithms Kent developed there are still in widespread use today. I’ve never been there because I never had the time to drive an hour and a half down a dirt road.

Out here in the West, aliens have been a big deal, ever since that weather balloon crashed in Roswell, New Mexico in 1947. In fact, it was a spy balloon meant to overfly and photograph Russia, but it blew back on the US, thus its top secret status.

When people learn I used to work at Area 51, I am constantly asked if I have seen any spaceships. The road there, Nevada State Route 375, is called the Extra Terrestrial Highway. Who says we don’t have a sense of humor in Nevada?

After devoting his entire life to searching, Kent gave me the inside story on searching for aliens. We will never meet them but we will talk to them. That’s because the acceleration needed to get to a high enough speed to reach outer space would tear apart a human body. On the other hand, radio waves travel effortlessly at the speed of light.

Sadly, Kent passed away in 2021 at the age of 72. Kent, ever the optimist, had his body cryogenically frozen in Hawaii where he will remain until the technology evolves to wake him up. Minor planet 35056 Cullers is named in his honor.

There are no movies being made about my life…. yet. But there are a couple of scripts out there under development.

Watch this space.

Dr. Kent Cullers

New Mexico Very Large Array

Reading Merit Badge

Radio Merit Badge

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader