Global Market Comments

May 11, 2022

Fiat Lux

Featured Trade:

(JOIN ME ON CUNARD’S MS QUEEN VICTORIA

FOR MY JULY 9, 2022 SEMINAR AT SEA)

Global Market Comments

May 11, 2022

Fiat Lux

Featured Trade:

(JOIN ME ON CUNARD’S MS QUEEN VICTORIA

FOR MY JULY 9, 2022 SEMINAR AT SEA)

Global Market Comments

May 10, 2022

Fiat Lux

Featured Trade:

(MAY 4 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (ROM), (ARKK), (LMT), (RTN), (USO), (AAPL), (BRKB), (TLT), (TBT), (HYG), (AMZN)

Below please find subscribers’ Q&A for the May 4 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: How confident are you to jump into stocks right now?

A: Not confident at all. If you look at all of my positions, they’re very deep in the money and fully hedged—I have longs offsetting my shorts—and everything I own expires in 12 days. So, I’m expecting a little rally still here—maybe 1,000 points after the Fed announcement, and then we could go back to new lows.

Q: Would you scale into ProShares Ultra Technology ETF (ROM) if you’ve been holding it for several years?

A: I would—in the $40s, the (ROM) is very tempting. On like a 5-year view, you could probably go from the $40s to $150 or $200. But don’t expect to sleep very much at night if you take this position, because this is volatile as all get out. It's not exactly clear whether we have bottomed out in tech or not, especially small tech, which the (ROM) owns a lot of.

Q: Is it time to buy the Ark Innovation ETF (ARKK) with the 5-year view?

A: Yes. I mentioned the math on that a couple of days ago in my hot tips. Out of 10 positions, you only need one to go up ten times to make the whole thing worth it, and you can write off everything else. Again, we’re looking at venture capital type math on these leverage tech plays, and that makes them very attractive; however I’m always trying to get the best possible price, so I haven’t done it yet.

Q: We’ve been hit hard with the tech trade alerts since March. Any thoughts?

A: Yes, we’re getting close to a bottom here. The short squeeze on the Chinese tech trade alerts that we had out was a one-day thing. However, when you get these ferocious short covering rallies at the bottom—we certainly got one on Monday in the S&P 500 (SPY) —it means we’re close to a bottom. So, we may go down maybe 4%-6% and test a couple more times and have 500- or 1000-point rallies right after that, which is a sign of a bottom. There’s a 50% chance the bottom was at $407 on Monday, and 50% chance we go down $27 more points to $380.

Q: Is the Roaring 20s hypothesis still on?

A: Yes absolutely; technology is still hyper-accelerating, and that is the driver of all of this. And while tech stocks may get cheap, the actual technology underlying the stocks is still increasing at an unbelievable rate. You just have to be here in Silicon Valley to see it happening.

Q: Do you like defense stocks?

A: Yes, because companies like Lockheed Martin (LMT) and Raytheon (RTN) operate on very long-term contracts that never go away—they basically have guaranteed income from the government—meeting the supply of F35 fighters for example, for 20 years. Certainly, the war in Ukraine has increased defense spending; not just the US but every country in the world that has a military. So all of a sudden, everybody is buying everything—especially the javelin missiles which are made in Florida, Georgia and Arizona. The Peace Dividend is over and all defense companies will benefit from that.

Q: Is Buffet wrong to go into energy right now? How will Berkshire Hathaway Inc. (BRK.B) perform if energy tanks?

A: Well first of all, energy is only a small part of his portfolio. Any losses in energy would be counterbalanced by big gains in his banking holdings, which are among his largest holdings, and in Apple (AAPL). Buffet does what I do, he cross-hedges positions and always has something that’s going up. I think Berkshire is still a buy. And he's not buying oil, per say; he is buying the energy producing companies which right now have record margins. Even if oil goes back down to $50 a barrel, these companies will still keep making money. However, he can wait 5 years for things to work for him and I can’t; I need them to work in 5 minutes.

Q: You must have suffered big oil (USO) losses in the past, right?

A: Actually I have not, but I have seen other people go bankrupt on faulty assumptions of what energy prices are going to do. In the 1990s Gulf War, someone made an enormous bet that oil would go up when the actual shooting started. But of course, it didn’t, it was a “buy the rumor, sell the news” situation. Energy prices collapsed and this hedge fund had a 100% loss in one day. That is what keeps me from going long energy at the top. And the other evidence that the energy companies themselves believe this is true is that they’re refusing to invest in their own businesses, they won’t expand capacity even though the government is begging them to do so.

Q: Why should we stay short the iShares 20 Plus Year Treasury Bond ETF (TLT) instead of selling out for a profit or holding on due to your statement that the TLT will go down to $105/$110?

A; If you have the December LEAPS, which most of you do, there’s still a 10% profit in that position running it seven more months. In this day and age, 7% is worth going for because there isn’t anything else to buy right now, except very aggressive, very short term, front month options, which I've been doing. So, the only reason to sell the TLT now and take a profit—even though it’s probably the biggest profit of your life—is that you found something better; and I doubt you're finding anything better to do right now than running your short Treasuries.

Q: Are you still short the TLT?

A: Yes, the front months, the Mays, expire in 8 days and I’m running them into expiration.

Q: What will Bitcoin do?

A: It will continue to bounce along a bottom, or maybe go lower as long as liquidity in the financial system is shrinking, which it is now at roughly a $90 billion/month rate. That’s not good for Bitcoin.

Q: Is now the time for Nvidia Corporation (NVDA)?

A: Yes, it’s definitely time to nibble here. It’s one of the best companies in the world that’s dropped more than 50%. I think we’d have a final bottom, and then we’re entering a new long term bull market where we’d go into 1-2 year LEAPS.

Q: What do you think of buying the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) junk bond fund here for 6% dividend?

A: If you’re happy with that, I would go for it. But I think junk is going to have a higher dividend yet still. This thing had a dividend in the teens during the financial crisis; I don’t think we’ll get to the teens this time because we don’t have a financial crisis, but 7% or 8% are definitely doable. And then you want to look at the 2x long junk bond special ETFs, because you’re going to get a 16% return on a very boring junk bond fund to own.

Q: What do you think about Amazon (AMZN) at this level?

A: I think it’s too early and it goes lower. Not a good stock to own during recession worries. At some point it’ll be a good buy, but not yet.

Q: Energy is the best sector this year—how long can it keep going?

A: Until we get a recession. By the way, if you want evidence that we’re not in a recession, look at $100/barrel oil. When you get real recessions, oil goes down to 420 or $30….or negative $37 as it did in 2020. There’s a lot of conflicting data out in the market these days and a lot of conflicting price reactions so you have to learn which ones to ignore.

Q: Should we stay short the (TLT)?

A: Yes, we should. I’m looking for a 3.50% yield this year that should take us down to $105.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

May 9, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HEADED FOR THE LEPER COLONY),

(SPY), (TLT), (TBT), (BRKB), (TSLA), (GLD), (AAPL), (GOOGL), (MSFT), (NVDA)

My worst-case scenario for the S&P 500 this year was a dive of 20%. We are now off by 14%. And of course, most stocks are down a lot more than that.

Which means that we are getting close to the tag ends of this move. The kind of wild, daily 1,000-point move up and down we saw last week is typical of market bottoms.

Some $7 trillion in market capitalization lost this year. That means we could be down $10 trillion from a $50 trillion December high before this is all over. That’s a heck of a lot of wealth to disappear from the economy.

So, it may make sense to start scaling into the best quality names on the bad days in small pieces, like Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), and NVIDIA (NVDA).

Whatever pain you may have to take what follows, the twofold to threefold gain that will follow over the next five years will make it well worth it. Is a 20% loss upfront worth a long-term gain of 200%? For most people, it is.

Bonds may also be reaching the swan song for their move as well. The United States Treasury Bond Fund (TLT) at $113 has already lost a gobsmacking $42 since the November $155 high.

The markets have already done much of the Fed’s work for it, discounting 200 basis points of an anticipated 350 basis points in rate rises in this cycle. Therefore, I wouldn’t get too cutesy piling on new bond shorts here just because it worked for five months.

Yes, there is another assured 50 basis point rise in six weeks towards the end of June. Jay Powell has effectively written that in stone. We might as well twiddle our fingers and keep playing the ranges until then. We have in effect been sent to the trading leper colony.

The barbarous relic (GLD) seems to be looking better by the day. Q1 saw a massive 551 metric tonnes equivalent pour into gold ETF equivalents, an increase of 203%. Of course, we already know of the step-up in Russian and Chinese demand to defeat western sanctions.

But the yellow metal is also drawing more traditional investment demand. Gold usually does poorly during rising interest rates. This time, it's different. An inflation rate of 8.5% minus an overnight Fed rate of 1.0%, leaving a real inflation rate of negative -7.5%. That means gold has 7.5% yield advantage over cash equivalents.

Gold’s day as an inflation hedge is back!

The April Nonfarm Payroll Report came in near-perfect at 459,000, holding the headline Unemployment Rate at 3.5%. It’s proof that a recession is nowhere near the horizon. A record 2 million workers have recovered jobs during the last four months and 6.6 million over the past 12.

Warren Buffet is Buying Stocks, some $51 billion in Q1. That includes $26 billion into California energy major Chevron (CVX), followed by a big bet on Occidental Petroleum (OXY). These are clearly a bet that oil will remain high for at least five more years. That has whittled his cash position down from $147 billion to only $106 billion. Buffet likes to keep a spare $100 billion on hand so he can take over a big cap at any time. Warren clearly eats his own cooking, buying $26 billion worth of his own stock in 2021. If you can’t afford the lofty $4,773 price for the “A” shares, try the “B” shares at $322.83, which also offer listed options on NASDAQ and in which Mad Hedge Fund Trader currently has a long position.

Elon Musk Crashes His Own Stock, selling $8.4 billion worth last week. His Twitter purchase has already been fully financed, so what else is he going to buy. The move generates a massive Federal tax bill, but Texas, his new residence, is a tax-free state. It continues a long-term trend of billionaires piling fortunes in high tax states, like Jeff Bezos in Washington, and then realizing the gains in tax-free states.

Adjustable-Rate Mortgages are Booming, replacing traditional 30-year fixed-rate mortgage at a rapid pace. Interest rates are 20% lower, but if rates skyrocket to double digits or more in five years, you have a really big problem. ARMs essentially take the interest rate risk off the backs of the lenders and place it firmly on the shoulders of the borrowers.

Travel Stocks are On Fire, with all areas showing the hottest numbers in history. Average daily hotel rates are up 20% YOY, stayed room nights 52%, airfares 39%, and airline tickets sold 48%. Expect these numbers to improve going into the summer.

JOLTS Hits a Record High, with 11.55 million job openings in March, up 205,000 on the month. There are now 5.6 million more jobs than people looking for them. No sign of a recession here. It augurs for a hot Nonfarm Payroll report on Friday.

Natural Gas Soars by 9% in Europe as the continent tries to wean itself off Russian supplies. In the meantime, US producers are refusing to boost output for a commodity that may drop by half in a year, as it has done countless times in the past. If the oil majors are avoiding risk here, maybe you should too.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility seen since 1987, my May month-to-date performance lost 4.27%. My 2022 year-to-date performance retreated to 25.91%. The Dow Average is down -9.3% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 56.62%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 50% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 538.47%, some 2.30 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 43.36%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 81.9 million, up 500,000 in a week, and deaths topping 998,000 and have only increased by 5,000 in the past week. You can find the data here.

The coming week is a big one for jobs reports.

On Monday, May 9 at 8:00 AM EST, US Consumer Inflation Expectations are released.

On Tuesday, May 10 at 7:00 AM, the NFIB Business Optimism Index is confirmed.

On Wednesday, May 11 at 8:30 AM, the Core Inflation Rate for April is printed.

On Thursday, May 12 at 8:30 AM, Weekly Jobless Claims are disclosed. Conoco Phillips (COP) reports. We also get the Producer Price Index.

On Friday, May 13 at 8:30 AM, the University of Michigan Consumer Price Index for May is disclosed. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, not just anybody is allowed to fly in Hawaii. You have to undergo special training and obtain a license endorsement to cope with the Aloha State’s many aviation challenges.

You have to learn how to fly around an erupting volcano, as it can swing your compass by 30 degrees. You must master the fine art of getting hit by a wave on takeoff since it will bend your wingtips forward. And you’re not allowed to harass pods of migrating humpback whales, a sight I will never forget.

Traveling interisland can be highly embarrassing when pronouncing reporting points that have 16 vowels. And better make sure your navigation is good. Once a plane ditched interisland and the crew was found months later off the coast of Australia. Many are never heard from again.

And when landing on the Navy base at Ford Island, you were told to do so lightly, as they still hadn’t found all the bombs the Japanese had dropped during their Pearl Harbor attack.

You are also informed that there is one airfield on the north shore of Molokai you can never land at unless you have the written permission from the Hawaii Department of Public Health. I asked why and was told that it was the last leper colony in the United States.

My interest piqued, the next day found me at the government agency with application in hand. I still carried my UCLA ID which described me as a DNA researcher which did the trick.

When I read my flight clearance to the controller at Honolulu International Airport, he blanched, asking if a had authorization. I answered that yes, I did, I really was headed to the dreaded Kalaupapa Airport, the Airport of no Return.

Getting into Kalaupapa is no mean feat. You have to follow the north coast of Molokai, a 3,000-foot-high series of vertical cliffs punctuated by spectacular waterfalls. Then you have to cut your engine and dive for the runway in order to land into the wind. You can only do this on clear days, as the airport has no navigational aids. The crosswind is horrific.

If you don’t have a plane, it is a 20-mile hike down a slippery trail to get into the leper colony. It wasn’t always so easy.

During the 19th century, Hawaiians were terrified of leprosy, believing it caused the horrifying loss of appendages, like fingers, toes, and noses, leaving bloody open wounds. So, King Kamehameha I exiled them to Kalaupapa, the most isolated place in the Pacific.

Sailing ships were too scared to dock. They simply threw their passengers overboard and forced them to swim for it. Once on the beach, they were beaten a clubbed for their positions. Many starved.

Leprosy was once thought to be the result of sinning or infidelity. In 1873, Dr. Gerhard Henrik Armauer Hansen of Norway was the first person to identify the germ that causes leprosy, the Mycobacterium leprae.

Thereafter, it became known as Hanson’s Disease. A multidrug treatment that arrested the disease, but never cured it, did not become available until 1981.

Leprosy doesn’t actually cause appendages to drop off as once feared. Instead, it deadens the nerves and then rats eat the fingers, toes, and noses of the sufferers when they are sleeping. It can only be contracted through eating or drinking live bacteria.

When I taxied to the modest one-hut airport, I noticed a huge sign warning “Closed by the Department of Health.” As they so rarely get visitors, the mayor came out to greet me. I shook his hand but there was nothing there. He was missing three fingers.

He looked at me, smiled, and asked, “How did you know?”

I answered, “I studied it in college.”

He then proceeded to give me a personal tour of the colony. The first thing you notice is that there are cemeteries everywhere filled with thousands of wooden crosses. Death is the town’s main industry.

There are no jobs. Everyone lives on food stamps. A boat comes once a week from Oahu to resupply the commissary. The government stopped sending new lepers to the colony in 1969 and is just waiting for the existing population to die off before they close it down.

Needless to say, it is one of the most beautiful places on the planet.

The highlight of the day was a stop at Father Damien’s church, the 19th century Belgian catholic missionary who came to care for the lepers. He stayed until the disease claimed him and was later sainted. My late friend Robin Williams made a movie about him but it was never released to the public.

The mayor invited me to stay for lunch, but I said I would pass. I had to take off from Kalaupapa before the winds shifted.

It was an experience I will never forget.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

May 5, 2022

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY)

(TLT), (BRKB), (SPY), (CCJ), (GLD)

As I expected, the markets have continued their march to “cheap”, with the price-earnings multiple plunging in a week from 19X to 17X. This has occurred both through rising earnings and falling share prices.

“Cheap,” is now within range, a mere 10% drop in the (SPX) to $3,800 only 10% away, taking us to a 15X multiple. With the Volatility Index (VIX) at a sky-high $34, in another week we could be there.

The long-term smart money isn’t bothering to wait and has already started to scale into the best names. For now, they are overwhelmed by sellers panicking to sell the next market bottom, as they usually do. That won’t last.

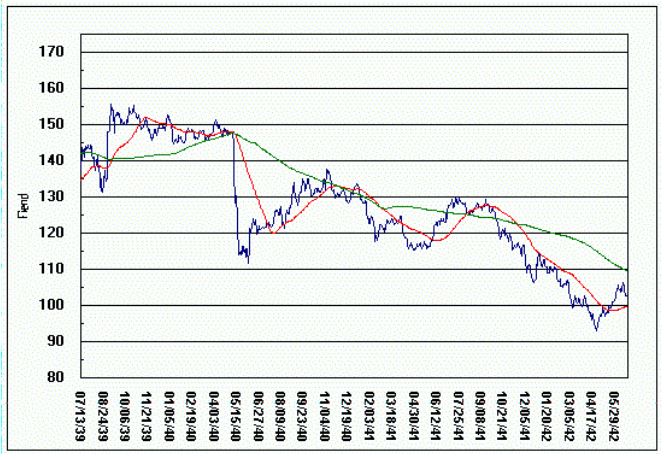

Stocks have seen their worst start to a year since 1942, right after the crushing Japanese attack on Pearl Harbor attack. They didn’t bottom until the US won the Battle of Midway in May, seven months later, even though the public didn’t learn about the strategic victory until months later.

That took the Dow Average down exactly 20%, from $115 to $92. Thereafter, the market began one of the greatest bull moves of all time, exploding from $92 to $240, up 161%.

That is how long and how much we may have to wait for a recovery this time as well with the same long-term outcome.

Those of you who have traditional 60/40 portfolios (60% stocks and 40% bonds), which are most of you, even though I advised against it, have suffered their worst start to a year since 1981, 40 years ago. Both bonds AND stocks have gone down huge.

NASDAQ, the red-headed stepchild of the day, delivered the worst monthly performance since October 2008. Playing from the short side has been like shooting fish in a barrel. The Mae Wests which have floated this market for years have been found to be full of holes.

Consumer discretionary stock delivered a horrific performance. The discretion of consumers right now is to flee stocks and own cash.

I prefer Oracle of Omaha Warren Buffet’s approach. For the first time in years, he is pouring money into stocks, some $51 billion in Q1. That includes $26 billion into California energy major Chevron (CVX), followed by a big bet on Occidental Petroleum (OXY) (click here for my piece at https://www.madhedgefundtrader.com/take-a-look-at-occidental-petroleum-oxy-4/ ).

These are clearly a bet that oil will remain high for at least five more years. That has whittled his cash position down from $147 billion to only $106 billion. Buffet likes to keep a spare $100 billion on hand so he can take over a big cap at any time.

Warren clearly eats his own cooking, buying $26 billion worth of his own stock in 2021. If you can’t afford the lofty $4,773 price for the “A” shares, try the “B” shares at $322.83, which also offer listed options on NASDAQ and in which Mad Hedge Fund Trader currently has a long position.

Rather than fleeing what you already own, because it’s too late, you’re better off building lists of what to buy at the bottom. And the farther the market falls, the more volatility I am looking for.

Investors are salivating at the demise of Cathy Wood’s Ark Innovation ETF (ARKK), which has collapsed by 72% in 14 months. In the meantime, the short Ark ETF (SARK) rose by 50% in April Alone.

You can scale into (ARKK) on the next Armageddon Day. Better yet, you can pick up their ten largest holdings. Those include:

Tesla (TSLA)

Zoom (ZM)

Roku (ROKU)

Coinbase (COIN)

Block (BLOK)

Exact Sciences (EXAS)

Unity Software (U)

Teladoc (TDOC)

Unity

UiPath (PATH)

Over five years, you can expect two of these to go bust, three to do nothing, two to get taken over at a 50% premium, one to double, one to go up ten times, and one to go up 50 times. If you do the math on this, it’s pretty attractive. Guess which one I think is going up ten times?

After listening to endless talking heads postulating about what Bitcoin is, I have finally come up with a definition. It is a small-cap non-earning stock. For that is the asset close showing the closest correlation in the current meltdown. That is not good because I expect small-cap non-earning stocks to go nowhere for the foreseeable future. Don’t hold your breath, but when they turn, you can expect a 2X-10X return on investment, as we did before.

My Ten Year View

When we come out the other side of the pandemic, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My April month-to-date performance added a decent 3.33%. My 2022 year-to-date performance ended at a chest-beating 30.18%. The Dow Average is down -13.5% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 62.56%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 542.74%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 43.71%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 81.4 million, up only 300,000 in a week, and deaths topping 993,000 and have only increased by 5,000 in the past week. Wow, we only lost the equivalent of 12 Boeing 747 crashes in a week! Great news indeed. You can find the data here at https://coronavirus.jhu.edu.

The coming week is a big one for the jobs reports.

On Monday, May 2 at 7:00 AM EST, the ISM Manufacturing PMI is published. NXP Semiconductors (NXPI) reports.

On Tuesday, May 3 at 7:00 AM, the JOLTS Job Openings report is announced. Skyworks Solutions Reports (SWKS).

On Wednesday, May 4 at 8:30 AM, ADP Private Sector Employment Change is printed. At 11:00 AM the Federal Reserve announced its interest rate decision. Jay Powell’s press conference follows at 11:30. Moderna (MRNA) reports.

On Thursday, May 5 at 8:30 AM, Weekly Jobless Claims are disclosed. Conoco Phillips (COP) reports.

On Friday, May 6 at 8:30 AM, the Nonfarm Payroll Report for April is released.

At 2:00 PM, the Baker Hughes Oil Rig Count are out.

As for me, I spent a decade flying planes without a license in various remote war zones because nobody cared.

So, when I finally obtained my British Private Pilot’s License at the Elstree Aerodrome, home of the WWII Mosquito twin-engine bomber, in 1987, it was cause for celebration.

I decided to take on a great challenge to test my newly acquired skills. So, I looked at an aviation chart of Europe, researched the availability of 100LL aviation gasoline, and concluded that the farthest I could go was the island nation of Malta.

Caution: new pilots with only 50 hours of flying time are the most dangerous people in the world!

Malta looms large in the history of aviation. At the onset of the second world war, Malta was the only place that could interfere with the resupply of Rommel’s Africa Corps, situated halfway between Sicily and Tunisia. It was also crucial for the British defense of the Suez Canal.

So, Malta was mercilessly bombed, at first by Mussolini’s Regia Aeronautica, and later by the Luftwaffe. By April 1942, the port at Valletta became the single most bombed place on earth.

Initially, Malta had only three obsolete 1934 Gloster Gladiator biplanes to mount a defense, still in their original packing crates. Flown by volunteer pilots, they came to be known as “Faith, Hope, and Charity.”

The three planes held the Italians at bay, shooting down the slower bombers in droves. As my Italian grandmother constantly reminded me, “Italians are better lovers than fighters.” By the time the Germans showed up, the RAF had been able to resupply Malta with as many as 50 infinitely more powerful Spitfires a month, and the battle was won.

So Malta it was.

The flight school only had one plane they could lend me for ten days, a clapped-out, underpowered single-engine Grumman Tiger, which offered a cruising speed of only 160 miles per hour. I paid extra for an inflatable life raft.

Flying over the length of France in good weather at 500 feet was a piece of cake, taking in endless views of castles, vineyards, and bright yellow rapeseed fields. Italy was a little trickier because only four airports offered avgas, Milan, Rome, Naples, and Palermo. Since Italy had lost the war, they never experienced a postwar aviation boom as we did.

I figured that if I filled up in Naples, I could make it all the way to Malta nonstop, a distance of 450 miles, and still have a modest reserve.

Flying the entire length of Italy at 500 feet along the east coast was grand. Genoa, Cinque Terra, the Vatican, and Mount Vesuvius gently passed by. There was a 1,000-foot-high cable connecting Sicily with the mainland that could have been a problem, as it wasn’t marked on the charts. But my US Air Force charts were pretty old, printed just after WWII. But I spotted them in time and flew over.

When I passed Cape Passero, the southeast corner of Sicily, I should have been able to see Malta, but I didn’t. I flew on, figuring a heading of 190 degrees would eventually get me there.

It didn’t.

My fuel was showing only quarter tanks left and my concern was rising. There was now no avgas anywhere within range. I tried triangulating VORs (very high-frequency omnidirectional radar ranging).

No luck.

I tried dead reckoning. No luck there either.

Then I remembered my WWII history. I recalled that returning American bombers with their instruments shot out used to tune into the BBC AM frequency to find their way back to London. Picking up the Andrews Sisters was confirmation they had the right frequency.

It just so happened that buried in my pilot’s case was a handbook of all European broadcast frequencies. I look up Malta, and sure enough, there was a high-powered BBC repeater station broadcasting on AM.

I excitedly tuned in to my Automatic Direction Finder.

Nothing. And now my fuel was down to one-eighth tanks and it was getting dark!

In an act of desperation, I kept playing with the ADF dial and eventually picked up a faint signal.

As I got closer, the signal got louder, and I recognized that old familiar clipped English accent. It was the BBC (I did work there for ten years as their Tokyo correspondent).

But the only thing I could see were the shadows of clouds on the Mediterranean below. Eventually, I noticed that one of the shadows wasn’t moving.

It was Malta.

As I was flying at 10,000 feet to extend my range, I cut my engines to conserve fuel and coasted the rest of the way. I landed right as the sunset over Africa.

While on the island, I set myself up in the historic Excelsior Grand Hotel. Malta is bone dry and has almost no beaches. It is surrounded by 100-foot cliffs. I paid homage to Faith, the last of the three historic biplanes, in the National War Museum in Valetta.

The other thing I remember about Malta is that CIA agents were everywhere. Muammar Khadafy’s Libya was a major investor in Malta, recycling their oil riches, and by the late 1980’s owned practically everything. How do you spot a CIA agent? Crewcut and pressed creased blue jeans. It’s like a uniform. What they were doing in Malta I can only imagine.

Before heading back to London, I had to refuel the plane. A truck from air services drove up, dropped a 50-gallon drum of avgas on the tarmac along with a pump then they drove off. It took me an hour to hand pump the plane full.

My route home took me directly to Palermo, Sicily to visit my ancestral origins. On takeoff to Sardinia wind shear flipped my plane over, caused me to crash, and I lost a disk in my back.

But that is a story for another day.

Who says history doesn’t pay!

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Faith”

The Andrews Sisters

Spitfire

Grumman Tiger

Global Market Comments

April 25, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE ESCALATOR UP AND THE WINDOW DOWN)

($INDU), (SPY), (TLT), (WFC), (JPM),

(TSLA), (TWTR), (FCX), (NFLX), (GLD)

On Friday, we saw the worst day in the market since October 2020. And it won’t be the last such meltdown day.

The big question for the market now is how far it can fall without actually having a recession. The answer is 20%, and we are down 8.6% so far.

The economy is as strong as ever and everyone that is predicting a recession is using outdated, useless models. If I have to wait nine months for the delivery of my sofa demand is still off the charts.

Spoiler Alert!

I have to do some math here to explain the current situation. So, don’t run down the street screaming with your hair on fire. Math is your friend, not your enemy.

With an average estimated $227.33 forecast earnings for the S&P 500, we are currently trading at a multiple of 19.29X ($4,386 divided by $227.33). At the November high, we were trading at 24X. At the 2009 Financial Crisis low, we saw 9.5X for a few nanoseconds. There’s our range, 9.5X to 24X.

So, stocks are still historically expensive. They won’t start to approach cheap until we drop to 15X, a level we haven’t seen in nearly a decade. That is another 4.29 multiple points lower, or down 22.23%.

How do we get to cheap?

Since November, the S&P 500 has earned another $60, or 1.36X multiple points. We’ll probably pick up another $55, or 1.25X multiple points in Q2. That gets us halfway there.

The (SPX) is down 8.6% so far in 2022, or $414. If Q2 earnings come in as expected, then the (SPX) only has to fall by another 1.68X multiple points, or 8.72% to $4,004 to get to our 15X downside target.

I hasten to remind you that this was exactly 10% below my downside forecast of an H1 loss of 10% in my 2022 Annual Asset Class Review (click here)for the link.

The Ukraine War and the third oil shock, neither of which I, or anybody else, predicted, account for the second 10% loss.

How long will it take to reach these new, enhanced downside targets? My guess is by the summer.

And you wondered why I was still 100% in cash….until Thursday?

So what does the Federal Reserve make of all this? Even though they say they don’t care about the stock market, it really does, especially when it is crash-prone.

Some 2.50% in expected interest rate hikes are already discounted by the futures market. The market has already done the Fed’s work, and we were short all the way, via the (TLT). We will likely get aggressive half-point rate hikes through April to June, especially if inflation goes double-digit, which it might.

At that point, the Fed may be ahead of the curve. If we get the slightest backtrack in inflation, even just for one month, the Fed may well back off a bit on its tightening strategy and skip a meeting, igniting a monster stock market rally in the second half.

Poof! Your inflation fears have gone away.

Jay Powell Thrust a Dagger into the heart of the Stock Market, sending the Dow down 1,000. At this point, the only question is whether we get two back-to-back 50 basis point rate hikes coming, or two back-to-back 75 basis point rate hikes. 75 basis points is becoming the new 25 basis points.

TINA is dead (there is no alternative to stocks) with virtually all fixed income securities offering a 3.00% yield and junk bonds paying 6%. These kinds of yields have started sucking money out of stocks into bonds, which is why I am long bonds.

There is one other sparkly asset class that is worthy of attention here. Gold, the yellow metal, the barbarous relic (GLD), may have just entered a long-term structural bull market. By evicting Russia from the global financial system, we have driven it out of dollars and into gold and Bitcoin for good. Take a look at the Gold Miners ETF (GDX).

And Russia is not alone in pouring its revenues into gold, which can’t be seized by foreign governments, so is every other country that might be subject to future sanctions, like China. This adds up to a heck of a lot of new gold buying and could take the barbarous relic to my old long-term target of $3,000 an ounce.

Bonds Crash Again, with ten-year US Treasury bond yields topping 3.02% overnight, a three-year high. Those who took my advice to buy the (TBT) in November are now up 44%. The market is now oversold in the extreme and could rally $5-$10 at any time. This could happen right around the next Fed meeting on April 28.

Tesla Earnings Soar by 87% YOY, taking the stock up $90. Musk is still predicting that 50% YOY growth in sales will continue as far as the eye can see and could reach 2 million this year if they can get the lithium. There is a one-year wait for a Tesla now. With gasoline at $6.00 a gallon everyone who bought a Tesla in the last 12 years is looking like a genius. $10,000 a share here we come! Keep buying (TSLA) on dips, as I have been begging you do to for the last 12 years.

Netflix Gets Destroyed, on horrific earnings and falling subscribers. Disney and Amazon are clearly eating their lunch. Hedge fund manager Bill Ackman dumped his position with a $400 million loss. At this point, (NFLX) is a high risk, high return trade than may take years to play out, not my cup of tea.

Corn Hits Nine-Year High, above $8 a bushel. Russia’s invasion of Ukraine may take one-third of the global wheat supply off the market and cause Africa to starve. Who is the world’s largest food importer? China, which may be why the yuan has seen a rare selloff.

Weekly Jobless Claims Fall to 184,000, why the unemployed hit a 52-year low. No need for stimulus here. It’s clear that fear of interest rate rises is not scaring off companies from hiring. Fifty basis points here we come. The unemployment rate may hit an all-time low with the April report on May 6.

Twitter Adopts Poison Pill, to fight off Elon Musk’s takeover attempt. Musk’s offer is a generous 20% higher than the Friday close. If the poison pill is successful then Musk will dump his 9.9% holding, cratering the stock. The battle of the century is on! Incredibly, the stock is up today. (TWTR) holders should take the money and run.

Investor Optimism Hits 30-Year Low, according to the Association of Individual Investors. Now only 15.8% of investors are bullish, down 9% in a week. A lot of pros are starting to see this as a “BUY” signal.

World Bank Cuts Global Growth Outlook on Russian War, from 4.1% in January to 3.2%. This compares to 5.7% in 2021. Europe and central Asia are taking the big hits.

Natural Gas Hits 13-Year High, to $7.80 per MM BTU, up 100% YTD. American exports are rushing to fill the gap in Europe. With the war showing no end in sight, prices will go higher before they go lower.

Copper is Facing a Giant Short Squeeze, and the world rushes into alternative energy, says Freeport McMoRan (FCX) CEO Richard Adkerson. World copper output will have to triple just to accommodate Tesla’s long-term target of 20 million vehicles a year. Buy (FCX) on dips, like this one.

US Housing Starts Hit 15 Year High, up 0.3% in March to 1.79 million. Applications to build top 1.87 million. The US has a structural shortage of 10 million homes caused by the large number of small builders that went under during the financial crisis and never came back.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My March month-to-date performance retreated to a modest 2.58%. My 2022 year-to-date performance ended at a chest-beating 29.28%. The Dow Average is down -6.8% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 71.86%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 541.94%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.54%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 80.6 million, up only 300,000 in a week, and deaths topping 988,000 and have only increased by 3,000 in the past week. Wow, we only lost the equivalent of eight Boeing 747 crashes in a week! Great news indeed. You can find the data here. Growth of the pandemic has virtually stopped, with new cases down 98% in two months.

The coming week is a big one for tech earnings.

On Monday, April 25 at 8:30 AM EST, the Chicago Fed National Activity Index for March is out. Activision Blizzard Reports (ATVI).

On Tuesday, April 26 at 8:30 AM, US Durable Goods for March are printed. At 9:00 AM the S&P Case Shiller National Price Index is announced. Alphabet (GOOGL) and Microsoft (MSFT) report.

On Wednesday, April 27 at 8:30 AM, the Pending Homes Sales for March are released. Qualcomm and Meta (FB) report.

On Thursday, April 28 at 8:30 AM, the Weekly Jobless Claims are printed. We also get the first look at Q1 GDP. Apple (AAPL), Amazon (AMZN) and Intel (INTC) report.

On Friday, April 29 at 8:30 AM, the Personal Income and Spending for March are disclosed.At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, when you are a guest of the KGB in Russia, you get treated like visiting royalty par excellence, no extravagance spared. That was the setup I walked into when I was sent by NASA to test fly the MiG 25 in 1993.

Far a start, I was met at Moscow’s Sheremetyevo Airport by Major Anastasia Ivanova, who was to be my escort and guide for the week. She had a magic key that would open any door in Russia and gave me a tour worthy of a visiting head of state.

Anastasia was drop-dead gorgeous. She topped 5’11” with light blonde hair, and was statuesque with chiseled high cheekbones and deep blue eyes. She could easily have taken a side job as a Playboy centerfold. But I could tell from her hands she was no stranger to martial arts and was not to be taken lightly. And wherever we went people immediately tensed up. They knew.

For a start, I was met on the tarmac by a black Volga limo. No need for customs or immigration here. Anastasia simply stamped my passport and welcomed me to Russia, whisking me off to the country’s top Intourist hotel.

The next morning, I was given a VIP tour of the Kremlin and its thousand-year history. I was shown a magnificent yellow silk 18th century ball gown worn by Catherine the Great. I asked her if the story about the horse was true, and she grimaced and said yes.

In a side room were displayed the dress uniforms of Adolph Hitler. I asked what happened to the rest of him and she said he was buried under a parking lot in Magdeburg, East Germany.

Out front, I was taken to the head of the line to see Lenin’s Tomb, which looked like he was made of wax. I think he has since been buried. In front of the Kremlin Armory, I found the Tsar Cannon, a gigantic weapon meant to fire a one-ton ball.

There was only one decent restaurant in Moscow in those days and Anastasia took me out to dinner both nights. Suffice it to say that the Beluga caviar and Stolichnaya vodka were flowing hot and heavy. The service was excellent. We were never presented with a bill. I guess it just went on the company account.

After my day in the capital, I was whisked away 200 miles north to the top secret Zhukovky Airbase to fly the MiG 25. A week later, Anastasia was there in her limo to take me back to Moscow.

The next morning Anastasia was knocking on my door. “Get dressed,” she said. “There’s something you want to see.”

She drove me out to a construction site on the southwestern outskirts of the city. As Moscow was slowly westernizing, suburbs were springing up to accommodate a rising middle class. One section was taped off and surrounded by the Moscow Police. That’s where we headed.

While digging the foundation for a new home, the builders had broken into a bunker left from WWII. Moscow had grown to reach the front lines of the 1942 Battle of Moscow. In Berlin during the 1960s, I worked with a couple of survivors of this exact battle. I was handed a flashlight and we ventured inside.

There were at least 30 German bodies inside in full uniform, except that only the skeletons were left. They still wore their issued steel helmets, medals, belt buckles, and binoculars. There were also dozens of K-98 8 mm rifles, an abundance of live ammunition and potato mashers (hand grenades), and several MG-42’s (yes, I know my machines guns).

The air was dank and musty. My guess was that the bunker had taken a direct hit from a Soviet artillery shell and had remained buried ever since. As a cave in threatened, we got the hell out of there in a few minutes.

Then Anastasia continued with our planned day. Since it was Sunday, she took me to the Moscow Flea Market. Russia was suffering from hyperinflation at the time, and retirees on fixed incomes were selling whatever they had in order to eat.

Everything from the Russian military was for sale for practically nothing, including hats, uniforms, medals, and night vision glasses. I walked away with a pair of very high-powered long-range artillery binoculars for $5. I paused for a moment at an 18th century German bible printed in archaic fraktur. But then Anastasia said I might get hung up by Russia’s antique export ban on my departure.

Anastasia and I kept in touch over the years. I sent him some pressed High Sierra wildflowers, which impressed her to no end. She said such a gesture wouldn’t even occur to a Russian man.

We gradually lost contact over the years, given all the turmoil in Russia that followed. But Anastasia left me with memories I will never forget. And I still have those binoculars to use at the Cal football games.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 22, 2022

Fiat Lux

Featured Trade:

(APRIL 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPX), (TSLA), (TBT), (TLT), (BAC), (JPM), (MS),

(BABA), (TWTR), (PYPL), (SHOP), (DOCU),

(ZM), (PTON), (NFLX), (BRKB), (FCX), (CPER)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.