Global Market Comments

August 19, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WHAT A ROLLER COASTER RIDE!),

(SPY), (TLT), (VIX), (VXX), (M),

(WMT), (FB), (AMZN), (GOOGL), (IWM)

Tag Archive for: (TLT)

I like roller coasters. The Giant Dipper at the Santa Cruz Boardwalk is tough to beat, the last operating wooden coaster in the United States. And I’ll always have fond memories of the Cyclone at Coney Island in New York.

I especially liked this week in the financial markets, which provided more profitable trading opportunities, both on the long and the short side, that any other week of the past decade.

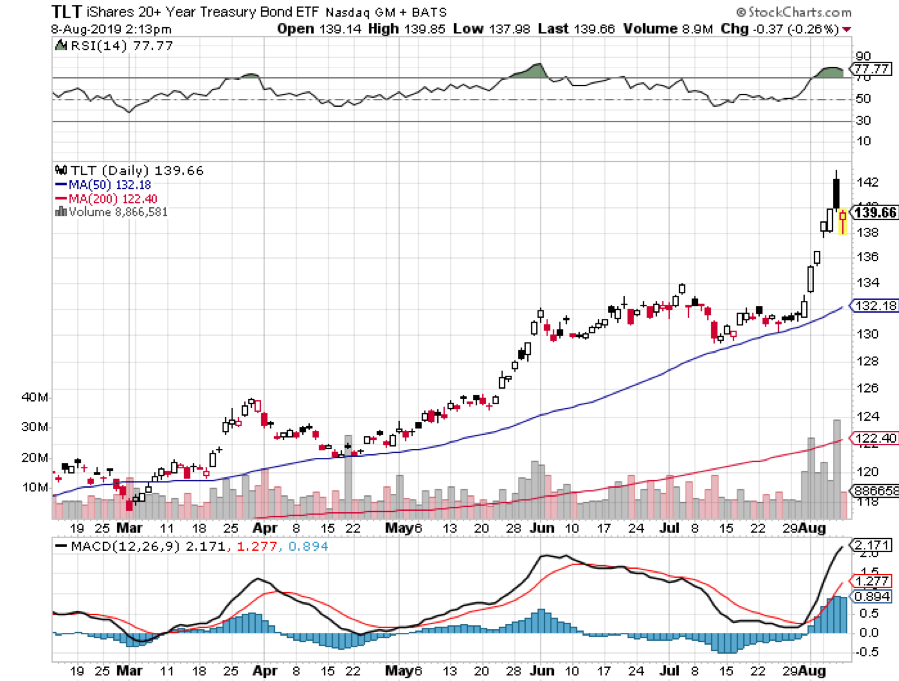

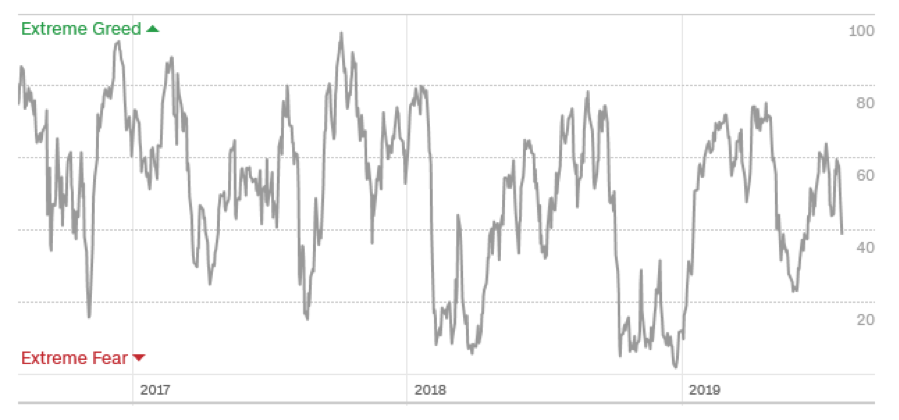

Perhaps the highpoint was on Thursday when I was staring at my screens watching ten year US Treasury bond yields (TLT) bottom at a near historic 1.46%, and my own Mad Hedge Market Timing Index plunging to a lowly 19.

Impulsively, I covered the last of my short positions and started piling on longs in the FANGs. The next morning, the Dow Average opened up 300 points. But then, it’s easy to be bold and decisive when you’re up 30% on the year, compared to only 11% for the Dow Average.

And guess what? The best may be yet to come!

As long as the Volatility Index stays over $20, you will be able to print all the money you want with options spreads. I’m talking 10%-15% A MONTH!

All eyes are now on September 1 when the Chinese announce their own retaliation to our tariff increase. Will they target ag again? Or does the bond market (TLT) take the hit this time (the Chinese government owns $900 billion worth of our debt).

And now for the question that everyone is asking: How far will the stock market fall in this cycle. We have already plunged 10% from the highs on an intraday basis. Could we drop another 10% in this period of high anxiety? Certainly. However, I tend to think it will be less than that.

The initial market pop on Monday came when the new Chinese tariffs were delayed, from September 1 to December 15, on some items. Tell me who saw this one coming. The potential costs of the tariffs are hitting the US more than China. It was worth a 550-point rally in the Dow Average. In 50 years, I’ve never seen such blatant market manipulation.

Gold hit a new six-year high, with the collapse of the Argentine Peso a new factor. A poor election result drove the beleaguered currency down 15% in one day, a massive move.

Now you have to worry about what’s happening in China AND Argentina. For the first time in history, gold now has a positive yield versus the Europe and the Japanese Yen, which both offer negative interest rates.

Hong Kong is becoming a factor driving US markets down. If there is a repeat if the 1989 Tiananmen Square massacre where thousands died, global markets could collapse. The hit to growth will be more than it currently can stand in its present weakened state.

Inflation is taking off, with Core Consumer Inflation for July coming in at a red hot 0.3%, delivering the strongest two-month price burst since 2006. If it keeps up, you can kiss those future interest rate cuts goodbye.

Germany is in recession. That is the only conclusion possible when you see Q2 at -0.1% growth and the economy still in free fall. The ZEW’s figures regarding Germany yesterday were nothing short of horrific as the Economic Sentiment Index fell to -44. When you damage China’s economy, it puts the rest of the world into recession. The global economy has become so interlinked, it can’t become undone without another great recession.

Bonds rates bottomed yesterday, at least for the short term, the intraday low for the ten-year US Treasury yield hitting 1.46%. Welcome to inversion land, where long term interest rates are below short-term ones. Confidence in the economy is melting like an Alaskan glacier. But with three more 25 basis point rate cuts to come, an eventual break below 1.0% is inevitable. Watch for stocks to remake half their recent losses.

Consumer Sentiment cratered in August from 97.0 estimated to 92.1. And that was before the stock market sold off. Consumer spending remains strong. The last time it was this strong was at the market top in 2008, the market top in 1999, and the market top in 1987.

July Housing Starts plunged 4.0%, to 1.191 million units as homebuilders move into recession mode. Not even record low-interest rates can get them to stick their necks out this time. Those that did last time got wiped out.

It’s been pedal to the metal all month with the Mad Hedge Trade Alert Service, with no less than 31 Trade Alerts going out so far. Some 18 or the last 19 round trips have been profitable, generating one of the biggest performance jumps in our 12-year history.

Since July 12, we have clocked a blistering 15.15% in profits or $15,150 for the model $100,000 trading portfolio.

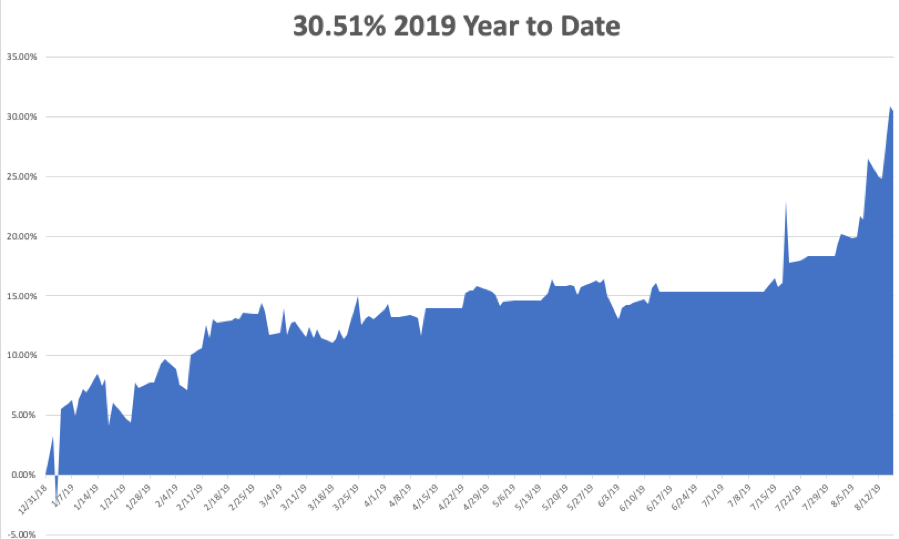

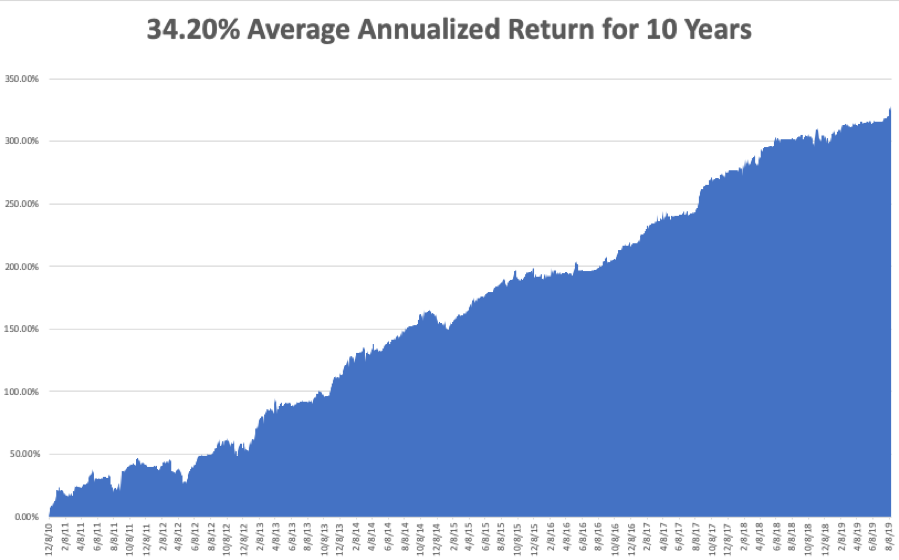

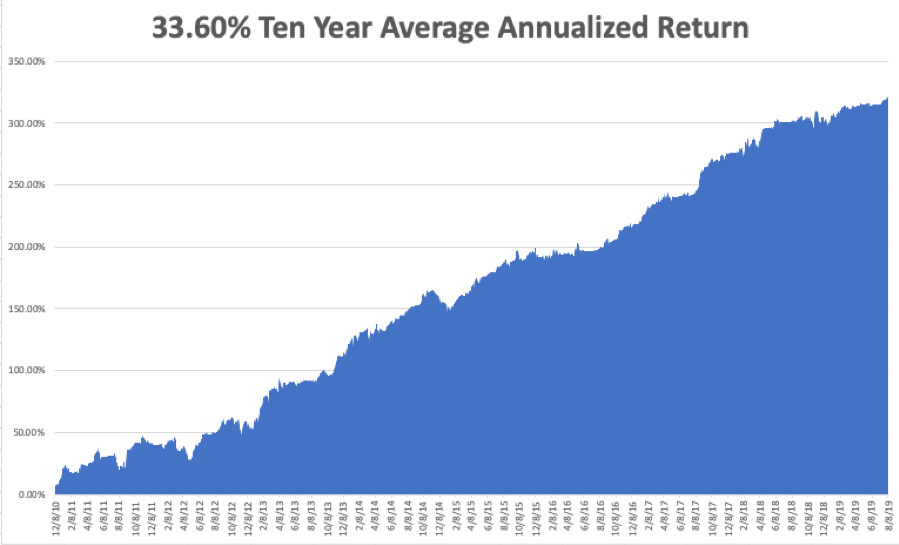

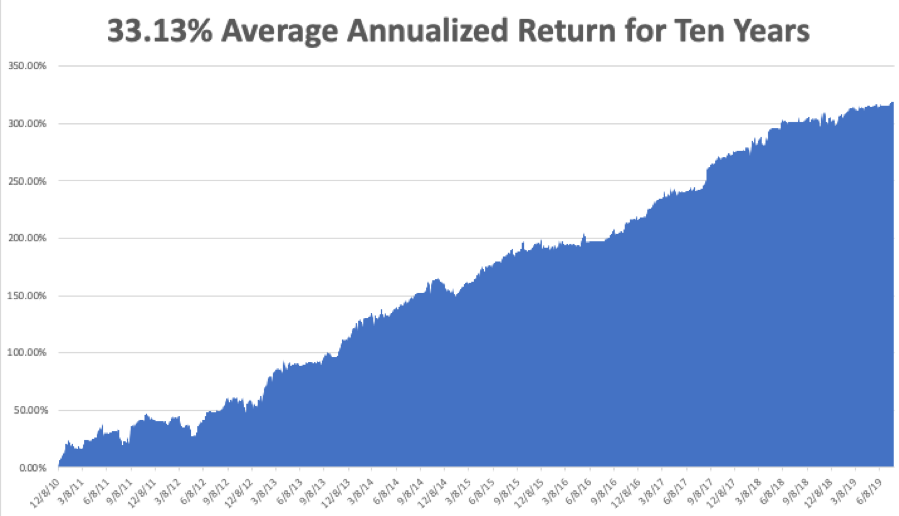

My Global Trading Dispatch has hit a new all-time high of 330.65% and my year-to-date shot up to +30.51%. My ten-year average annualized profit bobbed up to +34.20%.

I have coined a blockbuster 12.18% so far in August. All of you people who just subscribed in June and July are looking like geniuses. My staff and I have been working to the point of exhaustion, but it’s worth it if I can print these kinds of numbers.

The coming week will be a snore on the data front. Believe it or not, it could be quiet.

On Monday, August 19, nothing of note is released.

On Tuesday, August 20 at 10:30 AM, we get API Crude Oil Stocks.

On Wednesday, August 21, at 10:00 the Existing Home Sales are published for July.

On Thursday, August 22 at 8:30 AM, the Weekly Jobless Claims are printed. The Jackson Hole conference of global central bankers and economists begins.

On Friday, August 23 at 8:30 AM the July New Home Sales are announced.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I will be attending the Pebble Beach Concourse d’Elegance vintage car show where I will be exhibiting my 1925 Rolls Royce Phantom I, the best car ever made.

I don’t mind the wooden brakes, but it’s too bad they didn’t make adjustable seats in those days to fit my 6’4” frame. However, its price appreciation has been better than Apple’s (AAPL) which I bought as a fixer upper in England during the 1980s for $20,000. My average cost on Apple is a split adjusted 25 cents.

My Rolls will be shown alongside James Bond’s 1964 Aston Martin which sold for $6.3 million, a 1939 Volkswagen Type 64 priced at more than $20 million, and a $13 million 1958 Ferrari 250 GT BBT.

And what am I doing next weekend? Taking the Boy Scouts to the Six Flags roller coaster farm in Vallejo.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

My Phantom I

1939 Volkswagen

1954 Ferrari

Global Market Comments

August 16, 2019

Fiat Lux

Featured Trade:

(DON’T MISS THE AUGUST 21 GLOBAL STRATEGY WEBINAR),

(WHY CRASHING YIELDS COULD BE SIGNALING AN END TO THE STOCK SELLOFF),

(TLT), (QQQ), (DBA), (EEM), (UUP)

Global Market Comments

August 13, 2019

Fiat Lux

Featured Trade:

(THE TRADE OF THE CENTURY IS SETTING UP),

(TLT),

(HOW TO BUY A SOLAR SYSTEM),

(SCTY), (SPWR), (TSLA)

Global Market Comments

August 12, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or

(CYB), (FXE), (TLT), (FXY), (COPX), (USO),

(GLD), (VIX), (FXB), (IWM0, (DIS), (CRB), (FB)

(A COW BASED ECONOMICS LESSON)

So, this is what the best trading week looks like.

Investors panicked. The hot money fled in droves. Predictions of escalating trade wars, recessions, and depressions abounded.

The bottom line for followers of the Mad Hedge Fund Trader? We picked up 4.4% on the week, as may make as much next week.

A number of trading nostrums were re-proven once again. That which can’t continue, won’t. When too many people gather on one side of the canoe, it will capsize. If you execute a trade and then throw up on your shoes, you know it will be a good one. I could go on and on.

The week also highlighted another trend. That is the market has become a one-trick pony. The focus of the market is overwhelmingly on technology, the only sector that can promise double digit growth for years to come. And it’s not just technology, but a handful of large cap companies. Investing has become a matter of technology on, or technology off.

This is always how bull markets end, be it the Nifty 50 of the early 1970s, Japanese stocks of the late 1980s, or the Dotcom Bubble of the 1990s.

It was a week that ran off fast forward every day.

China retaliated against the US in the trade war and stocks dove 900 points intraday. The Middle Kingdom imposed a total ban on all US agricultural imports and took the Yuan (CYB) down to a decade low to offset tariffs.

All financial markets and asset classes are now flashing recession and bear market warnings. The Mad Hedge Market Timing Index fell from 70 to 22, the steepest drop in recent memory. The US dollar dropped sharply against the Euro (FXE) and the Japanese yen (FXY). Oil (USO) went into free fall. Copper (COPX) collapsed to a new low for the year.

The New York Fed lowered its Q3 GDP growth to a lowly 1.56%, with the Atlanta Fed pegging 1.9%. Payrolls, orders, import/export prices, and trade are shrinking across the board, all accelerated by the ramp up in the trade war. Manufacturing and retailing are going down the toilet. Sow the wind, reap the whirlwind.

The German economy (EWG) is in free fall, as most analysts expect a negative -0.1% GDP figure for Q2. The fatherland is on the brink of a recession which will certainly spill into the US. That Mercedes Benz AMG S class you’ve been eyeing is about to go on sale. Great Britain (FXB) is already there, with a Brexit-induced negative -0.2% for the quarter.

Some 50% of S&P 500 dividends now yield more than US Treasury bonds. At some point, that makes equities a screaming “BUY” in this yield-starved world, but not quite yet. Is TINA (there is no alternative to stocks) dead, or is she just on vacation?

Ten-year US Treasury bonds (TLT) hit 1.61%, down an incredible 50 basis point in three weeks. Zero rates are within range by next year. The problem is that if the US goes into the next recession at zero interest rates, there is no way to get out. A decades-long Japanese style Great Depression could ensue.

Bond giant PIMCO too says zero interest rates are coming to the US. Too bad they are six months late from my call. It’s all a matter of the US coming into line with the rest of the world. The global cash and profit glut has nowhere else to go but the US. Much of the buying is coming from abroad.

Gold (GLD) hit a six-year high, as a rolling stock market panics drive investors into “RISK OFF” trades and downside hedges. While high interest rates are the enemy of the barbarous relic, low rates are its best friend and negative rates are even better. We are rapidly approaching century lows on a global basis.

Do your Christmas shopping early this year, except do it at the jewelry store and for your portfolio. Above $1,500 an ounce gold is beating stocks this year and the old all-time high of $1,927 is in the cards.

As I expected, August is proving to be the best short selling opportunity of the year. Not only can we make money in falling markets, elevated volatility means we can get into long side plays at spectacularly low levels as well.

With the Volatility Index (VIX) over $20, it is almost impossible to lose money on option spreads. The trick was to get positions off while markets were falling so fast.

The week started out with a rude awakening, my short in the US Treasury Bond Fund rising 1 ½ points at the opening. I covered that for a tear-jerking 3.26% loss, my biggest of the year. But I also knew that making money had suddenly become like falling off a log.

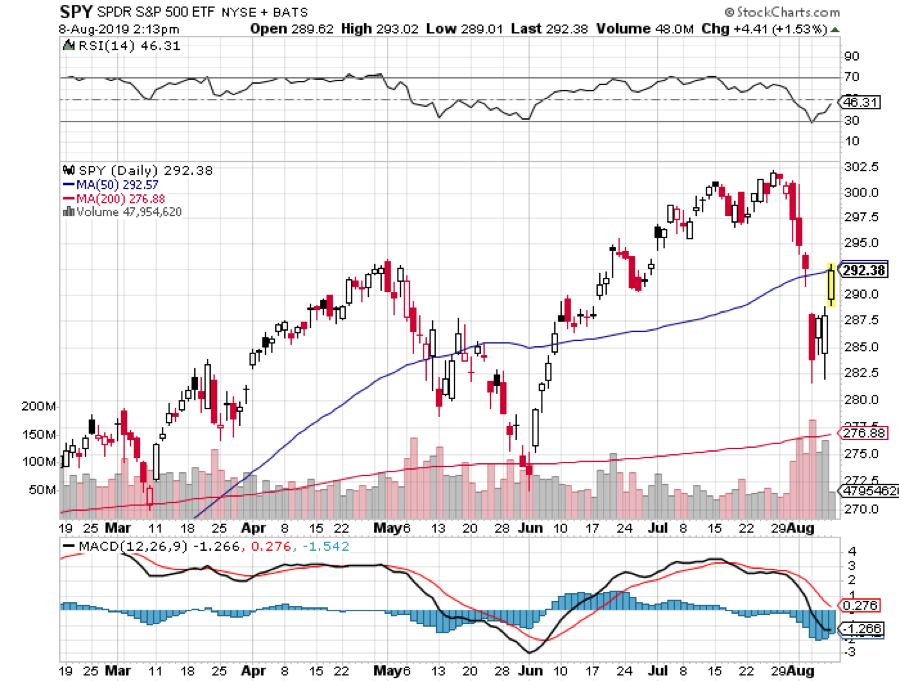

I fortuitously covered all of my short positions in the S&P 500 (SPY) and the Russell 2000 (IWM) right when the Dow average was plumbing depths 2,000-2,200 points lower than the highs of only two weeks ago. Then I went aggressively long technology with very short dated August plays in Walt Disney (DIS), Salesforce (CRM), and Facebook (FB).

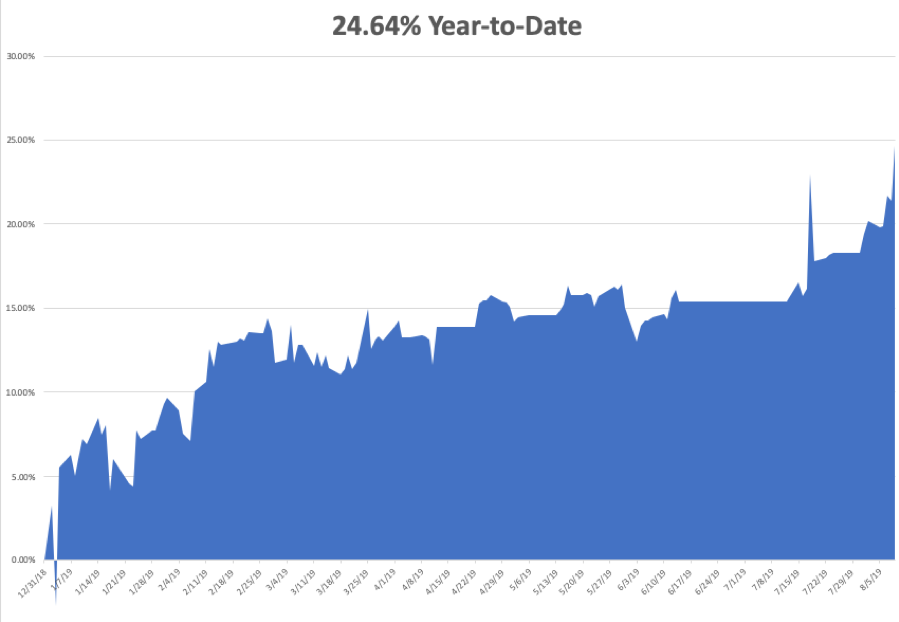

My Global Trading Dispatch has hit a new all-time high of 324.78% and my year-to-date shot up to +24.68%. My ten-year average annualized profit bobbed up to +33.60%.

I coined a blockbuster 6.31% so far in August. In a mere three weeks I shot out 12 Trade Alerts, 11 of which made money, bringing in a 10% profit net of the one-bond loss. All of you people who just subscribed in June and July are looking like geniuses.

The coming week will be a snore on the data front. Believe it or not, it could be quiet.

On Monday, August 12 at 11:00 AM EST, the Consumer Inflation Expectations for July are released.

On Tuesday, August 13 at 8:30 AM US Core Inflation for July is published.

On Wednesday, August 14, at 10:30 the IEA Crude Oil Stocks are announced for the previous week.

On Thursday, August 15 at 8:30 AM EST, the Weekly Jobless Claims are printed. At 9:15 we learn July Industrial Production.

On Friday, August 16 at 8:30 AM, the July Housing Starts are out.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be headed to the Land’s End Music Festival in San Francisco this weekend and listen to many of the local rock groups. Hopefully, I will be able to unwind from the stress and volatility of the week.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

You Need Special Glasses to Understand This Market

Global Market Comments

August 9, 2019

Fiat Lux

Featured Trade:

(AUGUST 7 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (XLK), (GLD), (DIS), (TLT),

(FXA), (FXY), (VIX), (VXX), (UNG), (USO)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader August 7 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Are we headed for a worldwide depression with today’s crash and interest rates?

A: No, I think the interest rates are more of an anomaly unique to the bond market. There is a global cash glut all around the world and all that money is pouring into bonds—not for any kind of return, but as a parking place to avoid the next recession. The economic data is actually stronger than usual for pre-recession indicators. US interest rates going to zero is just a matter of coming in line with the rest of the world. Three to six months from now we may get our final bear market and recession indicators.

Q: Do you think the market has more downside?

A: Yes; if the 200-day moving average for the (SPY) doesn’t hold, then you’re really looking at a potential 20% correction, not the 8% correction we have seen so far.

Q: Which sector would you focus on for any dips?

A: Technology (XLK). If they lead the downturn, they’re going to lead the upturn too. It’s the only place where you have consistent earnings growth going out many years. You’re really all looking for an opportunity to go back into Tech, but the answer is a firm not yet.

Q: Would you buy gold (GLD), even up here?

A: Only if you can take some pain. We’re way overdue for a correction on essentially everything—stocks, bonds, gold, commodities—and when we get it, you can get a real snapback on all these prices. The time to enter gold trade was really a month ago before we took off, and I’ve been bullish on gold all year. So, I think you kind of missed the entry point for gold just like you missed the entry point for shorts on the stock market last week. You only want to be selling decent rallies now. You don’t want to be selling into a hole that makes the risk/reward no good.

Q: What can you say about the (FXA) (the Australian dollar)?

A: It’s holding up surprisingly well given the carnage seen in the rest of the financial markets. I want to stand aside until we get some stability, at which point I think (FXA) will pop up back to the $71 level. New Zealand cutting their rates by 50 basis points really came out of the blue and could eventually feed into a weaker Aussie.

Q: Do you think China (FXI) has no reason to make a trade deal until the US elections?

A: Absolutely not; and this puts a spotlight on the administration’s total inexperience in dealing with China. I could have told you on day one: there’s no way they’re going to settle. Pride is a major factor in China. They have long memories of the opium wars and all the abuses they received at the hands of the western powers and are highly sensitive to any kind of foreign abuse. If you want to get the opposite of a settlement, do exactly what Trump is doing. The administration’s policy has no chance of accomplishing anything. He’s willing to take a lot more pain in the stock market until he gets a deal and that’s bad for all of us.

Q: How does the extra 10% tariff affect the market?

A: Think of everything you’re buying for Christmas; the price goes up 10%. That’s the effect, and it completely wipes out any earnings the retail industry might have had. It’s only bad. We are suffering less harm than China in the trade war, but we are suffering, nonetheless.

Q: Do you think volatility will spike soon?

A: It may very well have already spiked. I don’t think we’ll get a spike as high as in past selloffs because there’s a big short volatility industry that has come back. Any moves more than $30, you have short sellers come in there very quickly to hammer things back down. Also (VIX) isn’t necessarily something you want to be buying after the stock market has already dropped 8%. That train has left the station.

Q: Would a weaker dollar benefit the US economy?

A: Yes; it makes our exports cheaper on the global market. However, if the rest of the world is weakening their currencies as well, it will have no effect. Also, the last time this kind of currency war was attempted was in the early 1930s, and the outcome was the Great Depression.

Q: Defensive stocks—the China story is getting uglier?

A: In this kind of market, I’ve never been a big fan of defensive stocks like utilities or healthcare because defensive stocks go down in bear markets, just at a slower rate than growth stocks because they never went up in the first place. The best defensive stock is cash.

Q: If US interest rates are going to zero, how about buying leaps on (TLT)?

A: Multi-year highs is just not leap buying territory. Multiyear lows are where you buy LEAPS, which are Long Term Equity Participation Certificates. They are basically long-dated 1-2-year call options on stocks that are rising over the long term. The better trade—when we get to zero interest rates and it becomes impossible for rates to go any lower—would be to do a reverse leap. If (TLT) goes up to $200, I would do something like a $150-$160 on the put side betting that sometime over the next 2 years, interest rates go back up again and bonds go down. Too late for LEAPS on bonds, too early for LEAPS on equities.

Q: Do you buy out of the money LEAPS?

A: Yes; that is where you get the triple-digit returns. For example, you can buy the Walt Disney (DIS) June 2021 $150-$160 vertical bull call spread today for $3.30. If we close over $160 by then the spread will be worth $10, up 203% from your cost. And you only need a rise of 25% from here to get that return. This is why I love LEAPS, but only at medium term market bottoms.

Q: Is crude oil (USO) going to $25 on a barrel global slowdown fears?

A: I think you need an actual recession to go down to $25; in the current environment, $42 is a nice target. The basic problem is global structural oversupply and falling demand, which is a classically unfortunate combination for prices.

Q: When will interest rates go to zero?

A: Sooner than later, I would say. My original guess was sometime next year but at the rate we’re going, we could be there by the end of the year.

Q: Would you get involved in natural gas (UNG)?

A: Absolutely not; this is the high season for natural gas right now when summer air conditioner use creates peak demand. It certainly has been hot this summer, especially on a global basis, and if you can’t rally natural gas in this environment you never will. There is also a huge contango in (UNG) which most people can’t beat.

Global Market Comments

August 5, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or TAKING THE ELEVATOR DOWN),

($INDU), (SPY), (TLT), (IWM), (WMT), (FXB)

It is often said the markets take the escalator up and the elevator down. A thousand Dow points in three days? That’s like taking the elevator down from the 101st floor of the Empire State Building down to the basement in one shot.

Welcome to your new $30 billion tax, or about $90 per American per year. That will be the effect of the new 10% tariff increase on $300 billion worth of goods imported from China. Unfortunately, this comes on top of an existing $210 per American, bring the total bill due from the China trade war to $300 per person.

Clearly, the Chinese think they can get a better deal from the next president and are inclined to wait it out. This has been my base case since the trade war started 18 months ago.

It was one of the most frenetic, emotion-charged, and violent weeks of the year, with almost daily wild swings on a daily basis. This is the environment where hedge funds and newsletters like this one earn their pay.

The July Nonfarm Payroll Report came in at 164,000, keeping the headline unemployment report to 3.7%. Average hourly earnings grew by a hot 3.2% YOY. The previous two months were revised down by 41,000. Overall, it was a disappointing report.

Manufacturing has been especially weak all year, adding only 16,000 jobs in July and averaging 8,000 jobs a month all year. The headline charge into the services economy continues. Retail lost 3,600, the sixth consecutive monthly decline. The strength was in Professional Services, up 31,000, Health Care at 30,000, and Social Assistance at 20,000.

The broader U-6 “discouraged worker” structural unemployment rate dropped from 7.2% to 7.0%, a new cycle low.

The British Pound (FXB) crashed by 1%, as the harsh reality of a hard Brexit looms. That’s because Boris Johnson, the pro Brexit activist, was named UK prime minister and filled his cabinet with anti-EC doormats. It virtually guarantees a recession there and will act as an additional drag on the US economy.

The end result may be a “Disunited Kingdom”, with Scotland declaring independence in order to stay in the EC, and Northern Ireland splitting off to create a united Emerald Island. The stock market there will crater and the pound will go to parity against the greenback.

Home Price Gains are Still Shrinking, from a 3.5% to a 3.4% annual gain in May, according to the S&P Corelogic Case Shiller National Home Price Index. The Median Home Price hit a new high of $285,700. That can’t buy you a parking space in San Francisco. This is removing a major leg from the economy.

Las Vegas saw the biggest increase at 6.4%, followed by Phoenix at 5.7% and Tampa at 5.1%. Shrinking price gains in the face of falling interest rates is a classic pre-recessionary indicator.

Apple hurdled a low bar, with an upward forward guidance delivering a 5% pop in the stock. Revenues rose 1% to $53.8 billion, while profits dropped 7%. The future looks bright on the eve of 5G iPhones. Hardware drops to less than half of sales for the first time. Services revenues jump to 21% of the total.

China is still a drag. Amazingly, Apple only bought $17 billion worth of its own stock last quarter against a commitment of $100 billion. So why are analyst “BUY” ratings at a decade low? Maybe it's because threats of retaliation in the China trade war are hanging over Apple like a sword of Damocles.

It took only three words to kill Wall Street. Confusion reigns. “Mid Cycle Adjustment” was how Fed governor Jay Powell described Wednesday’s 25 basis point interest rate cut, the first in 12 years, absolutely what the market didn’t want to hear. That implies that the Fed is “one and done,” and that there will be no more interest rate cuts in this economic cycle.

The president added insult to injury piling abuse on his own appointee, further eroding confidence in the independence of the Fed. A truly data dependent Fed wouldn’t have budged last week.

Bonds soared on “one and done.” Higher rates for longer give a new lease on life for the fixed income markets everywhere. Since 2008, major central bank balance sheets have exploded from $3 trillion to $16 trillion, and there is nowhere better for this mountain of money to go but the ten-year US Treasury bond.

Yields have smashed the four-year low at 1.82% and are headed to 1.40% by yearend. The market is wildly overbought for now on the back of an instant three-point rally, so keep buying those dips. Next up is the century low in rates.

Oil crashed 8% on increased global recession fears, in the worst plunge in four years and one of the biggest swan dives in history. The strong dollar doesn’t help either. I have recommended that investors avoid energy like the plague all year and it has worked like a charm. Long term, it’s going out of business anyway, so I don’t even want to trade it here.

Retailers got destroyed on the China news, with stocks down 6%-12% across the board. Best Buy (BBY) did a 12% swan dive. This will be the stick that broke the camel’s back for a lot of retailers already hanging on by their fingernails. Some 42% of US apparel, 69% of footwear, and 84% of accessories come from China.

Squeezed by Amazon on one side and administration China policies on the other, this will spell the death of retail. It looks like we’re going to have to go barefoot this winter. Thank goodness there’s global warming. The death spiral was further confirmed by the weak jobs figures in retail this morning.

I went into the week 100% in cash, giving me the dry powder to pursue the short side aggressively. I always tell followers that cash is a position, that it has option value, and this was a classic example of how well that can work.

The second I heard about the China tariff increase, I went pedal to the metal and increased my shorts from 0% to 40%, against 60% cash. My current shorts include the S&P 500 (SPY), US Treasury bonds (TLT), the Russel 2000 (IWM), and the giant retailer (WMT).

I see August as the best short selling opportunity of the year. I put out my first shorts the day after the Fed rate cut. My Global Trading Dispatch has hit a new all-time high of 320.30% and my year-to-date shot up at +20.16%. A robust earned a robust 1.83% so far in August, and 4.78% since I went back into the market from Zermatt, Switzerland three weeks ago.

My ten-year average annualized profit bobbed up to +33.13%. My Mad Hedge Market Timing Index saw one of the sharpest declines in its history, plunging from 65 to 23 on only two days. We could even be back to “BUY” territory by the end of next week.

The coming week will be a feeble one on the data front. Believe it or not, it could be a quiet week.

On Monday, August 5 at 2:00 PM, the July ISM Non-Manufacturing PMI is out.

On Tuesday, August 6 at 2:00 PM, the June JOLTS Jobs Openings report is published.

On Wednesday, August 7, at 8:30 AM, June Consumer Credit is released.

On Thursday, August 8 at 8:30 AM, the Weekly Jobless Claims are printed.

On Friday, August 9 at 8:30 AM, July Core Purchasing Price Index is printed, an inflation indicator.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, believe it or not, I have not been to the beach this year. As a native Californian, that is near high treason. So I am loading up the old Tesla with an ice chest, boogie boards, and kids and headed to nearby Stinson Beach in Marin County. I’m going early to beat the traffic and will take my usual short cuts I learned while living there eons ago.

Surf’s up!

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.