Global Market Comments

February 22, 2023

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(TEN MORE TRENDS TO BET THE RANCH ON),

(AAPL), (AMZN), (GOOGL), (TSLA), (CRSP), (EDIT), (NTLA)

CLICK HERE to download today's position sheet.

Global Market Comments

February 22, 2023

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(TEN MORE TRENDS TO BET THE RANCH ON),

(AAPL), (AMZN), (GOOGL), (TSLA), (CRSP), (EDIT), (NTLA)

CLICK HERE to download today's position sheet.

I believe that the pandemic and hyper-accelerating technology is bringing forward the future at an astonishing rate.

More applications will be created in the next year than over the last 40, some 500,000. The sum total of human knowledge is now doubling every year. The profits spun off and investment opportunities will be incredible, which is why I just doubled my ten-year forecast for the Dow Average (INDU) from 120,000 to 240,000.

Here are ten major trends for the economy and the markets that we can see already. It’s the unseen ones that will be really interesting.

(1) The Insurance Industry Changes Beyond All Recognition, confirming from “Recovery After Risk” to “Prevention of Risk”. Today, fire insurance pays you after your house burns down. Life insurance pays your next of kin after you die. And health insurance (which is really sick insurance) pays only after you get sick. During the next decade, we’ll see a new generation of insurance providers that offer you a service to KEEP you healthy and keep your house safe during a wildfire. Also, full autonomous driving will cut hospital admissions by half, dramatically dropping the cost of insurance. This is driven by machine learning, ubiquitous sensors, low-cost genome sequencing, and robotics to detect risk, prevent disaster, and guarantee safety before any costs are incurred.

(2) Autonomous Vehicles and Flying Cars (eVTOL) will make travel cheaper and easier. Fully autonomous vehicles (TSLA), (GOOGL), car-as-a-service fleets, and aerial ridesharing (flying cars) will be fully operational in most major metropolitan cities in the coming decade. The cost of transportation will plummet 3-4X, transforming real estate, finance, insurance, the materials economy, and urban planning. Where you live and work, and how you spend your time, will all be fundamentally reshaped by this future of human travel. Your kids and elderly parents will never drive. Already, a half dozen eVTOL companies have gone public raising more than $10B to fuel their growth. These vehicles are real and will help define the decade ahead. This is driven by machine learning, sensors, materials science, battery storage improvements, and ubiquitous gigabit connections.

(3) On-demand Production and On-demand Delivery Will Create an “Instant Economy of Things”. Urban dwellers will learn to expect “instant fulfillment” of their retail orders as drone and robotic last-mile delivery services carry products from local supply depots directly to your doorstep. Further riding the deployment of regional on-demand digital manufacturing (3D printing farms), individualized products can be obtained within hours—anywhere, anytime. I ordered a new high-end 50-pound garage door opener from Amazon Prime (AMZN) last month after my old one went kaput. Incredibly, they delivered it in hours! This is driven by networks, 3D printing, robotics, and AI.

(4) The Ability to Sense and Know Anything, Anytime, Anywhere. We’re rapidly approaching the era where 100 billion sensors (the Internet of Everything) are monitoring and sensing (imaging, listening, measuring) every facet of our environments, all the time. Global imaging satellites, drones, autonomous car LIDARs, and forward-looking augmented reality (AR) headset cameras are all part of a global sensor matrix, together allowing us to know anything, anytime, anywhere. In this future, it’s not “what you know,” but rather “the quality of the questions you ask” that will be most important. That gives us old guys a huge advantage. This is driven by the convergence of terrestrial, atmospheric, and space-based sensors, vast data networks, 5G and 6G communication networks (AAPL), next-gen Wi-Fi, and machine learning.

(5) Advertising Hyper Evolves. As ads become the primary driver of new services for free, AI becomes increasingly embedded in everyday life and your custom personal AI will soon understand what you want better than you do. In turn, we will begin to both trust and rely upon our AIs to make most of our buying decisions, turning over shopping to AI-enabled personal assistants. Your AI might make purchases based on your past desires, current shortages, conversations you’ve allowed your AI to listen to, or by tracking where your pupils focus on a virtual interface (i.e., what catches your attention). As a result, the advertising industry—which normally competes for your attention (whether at the Superbowl or through search engines)—will have a hard time influencing your AI. This is driven by machine learning, sensors, augmented reality, and 5G/networks.

(6) Cellular Agriculture Moves from the Lab to Inner Cities, Providing High-quality Protein that is Cheaper and Healthier. The next decade will witness the birth of the most ethical, nutritious, and environmentally sustainable protein production system devised by humankind. Stem cell-based “cellular agriculture” will allow the production of beef, chicken, and fish anywhere, on-demand, with far higher nutritional content, and a vastly lower environmental footprint than traditional livestock options. Traditional legacy steaks found at Ruth’s Chris and Morton’s will only to available to the wealthy. This is driven by biotechnology, materials science, machine learning, and agtech.

(7) Your Brain Will Integrate with Super-Fast Hardware and Software. My friend, technologist and futurist Ray Kurzweil, has predicted that by the mid-2030s, we will begin connecting the human neocortex to the cloud. This next decade will see tremendous progress in that direction, first serving those with spinal cord injuries, whereby patients will regain both sensory capacity and motor control. Yet beyond assisting those with motor function loss, several BCI pioneers are now attempting to supplement their baseline cognitive abilities, a pursuit with the potential to increase their sensorium, memory, and even intelligence. Recent demonstrations of a macaque monkey playing Pong using a Neuralink implant is proof of incredible progress. This is driven by materials science, AI/machine learning, robotics, and some fantastic imaginations.

(8) High-resolution Virtual Reality Will Transform Both Retail and Real Estate Shopping & the Future of Education. If you were a couch potato, you are about to become one on steroids. High-resolution, lightweight virtual reality headsets will allow individuals at home to shop for everything from clothing to real estate—all from the convenience of their living room. Need a new outfit? Your AI knows your detailed body measurements and can whip up a fashion show featuring your avatar wearing the latest 20 designs on a runway. Want to see how your furniture might look inside a house you’re viewing online? No problem! Your AI can populate the property with your virtualized inventory and give you a guided tour. On the education front, the use of VR and AI-driven avatars with technology such as that demonstrated by Dreamscape promises a future of game-like, immersive, and powerful education and training. This is driven by VR, machine learning, and high-bandwidth networks. Get your Oculus Rift from Facebook (FB) now!

(9) Increased Focus on Sustainability and the Environment will drive companies to invest in sustainability—both from a necessity standpoint and for marketing purposes. Breakthroughs in materials science, enabled by AI, will allow companies to drive tremendous reductions in waste and environmental contamination. One company’s waste will become another company’s profit center. Want to visit my chalet in Switzerland? You can do so by connecting your Oculus Rift headset to Google Maps….today! This is driven by materials science, AI, CRISPR, digital biology, and broadband networks.

(10) CRISPR and Gene Therapies Will Eliminate Disease. Perhaps one of the most powerful, underappreciated technologies in the world is CRISPR. In 2020, two incredible women won the Nobel Prize in medicine for its discovery, and revenues from CRISPR doubled between 2019 and 2020 to over $1.5B. A vast range of infectious diseases, from AIDS to Ebola, are now potentially curable, as are a wide range of genetic ailments like sickle cell anemia, thalassemia, and certain forms of congenital blindness. In addition, gene-editing technologies continue to advance in precision and ease of use, allowing families to treat and ultimately cure hundreds of inheritable genetic diseases. This is driven by various biotechnologies (CRISPR, Gene Therapy), genome sequencing, and AI. Only three companies have a monopoly in this sector right now, (CRSP), (EDIT), and (NTLA).

In the decade ahead, master entrepreneurs will look beyond the immediate effects of a given technology to seize secondary and tertiary, Google-sized business opportunities on the horizon.

As an investor, you should be asking yourself: What challenges or problems can I help solve? How can I leverage the coming waves of tech advancements?

I just thought you’d like to know.

John Thomas

Global Market Comments

February 10, 2023

Fiat Lux

Featured Trade:

(FEBRUARY 8 BIWEEKLY STRATEGY WEBINAR Q&A),

(RCL), (TSLA), (UUP), ($VIX), (BRKB), (TLT), (TBT), (ROM), (CVNA), (SLV), (DIS)

CLICK HERE to download today's position sheet.

NOTE TO SUBSCRIBERS: There will be no strategy letter for

February 13 and 21 as I will be traveling. - JT

Below please find subscribers’ Q&A for the February 8 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: What do you make of the Chinese balloon that crossed the United States last week?

It was the most overhyped, least consequential event in recent memory, and is not a new thing. There is no chance this was an innocent scientific mission as there was no flight plan filed. What’s China’s new frontline weapon? A catapult? A bow and arrow? Are American balloon makers going to demand increased defense spending? Curiously, no mention was ever made of the three Chinese balloons that crossed the US during the previous administration when no action was taken. My guess is that a Chinese Army faction wanted to keep their defense spending rising and torpedoed any rapprochement that was in the works with the US. Another theory was that they wanted to test our response. There is nothing the balloon could have captured that the Chinese didn’t already have from their satellites or even Google Earth for free. The media coverage has been a flood of false information. If the Chinese really can predict global winds at 60,000 feet two weeks in advance, then their math is so far more advanced than our own then we might as well surrender. By the way, during WWII the Japanese sent 20,000 balloons our way in an attempt to set the Western US on fire. Only one exploded, killing a family in Oregon.

Q: I’m getting worried about my long-term LEAPS in (TLT) and (FCX) given the recent market action. Thanks in advance for your help.

A: The (TLT)'s should be OK by expiration because they hit max profit even in an unchanged bond market. But Republican radicals who want a government shutdown at any price are definitely going to rattle your cage. That’s why I currently have no short-term position in bonds and am waiting for a bigger pullback to maybe $101 before I get back in. As for Freeport McMoRan (FCX) you can take profits any time. The stock doubled after we recommended the LEAPS in October. Longer term, I think (FCX) goes to $100 because of a coming global copper shortage.

Q: Should I buy Royal Caribbean (RCL) because we’re looking at a record-breaking cruise season coming up this year?

A: The time to buy Royal Caribbean was actually last June; it was one of the first outperformers in the market, completely skipped the October meltdown, and is practically doubled off the low. So great idea, just 8 months too late. And that actually is the case with a lot of stocks now—they've had such enormous runs over a short time, that you’re taking a lot of risks to get involved here.

Q: Do you think Silicon Valley should force all workers back into the office? Wouldn't that enhance creativity?

A: It does enhance creativity but at the cost of productivity. People are much more productive when they work at home, don’t have to spend 2 hours commuting, and can build their job around their lifestyle. They work at home cheaper too. So, it’s a trade-off, do you want creativity or do you want productivity? Well, the productive people should stay at home, the creative people should go to the office—it’s a company by company, product by product decision.

Q: You say you never touch 2x and 3x ETFs?

A: The only exception to that is the ProShares UltraShort 20+ Year Treasury ETF (TBT) which we traded for 2.5 years while the bonds were making a straight line move down, or the ProShares Ultra Technology ETF (ROM) which tends to have straight up move like this year. And the only time you could do a 2x is if you think the move in the underlying is going to be so enormous it covers up all the costs of dealing in these ETFs, then it’s worth doing. 3xs I never ever touch them because those reset at the end of the day and are really designed to be intraday hedging instruments, which we’re not interested in.

Q: Are you still bearish on the US dollar (UUP)?

A: Absolutely, we’ve had almost a straight line move down ever since October, and we’re getting a temporary break on that while interest rates stay higher for longer. The next dive in interest rates, the dollar collapses once again.

Q: When you buy back into bonds, where in the curve will you be buying?

A: In bull markets, you always want to buy the longest maturity available. Back in the 1970s, I used to buy WWI infinite British Treasury bonds because they had 100-year maturities, and therefore, in any bull market, have the largest gains. In the US, the 30-year instruments are pretty illiquid, so I focus on the 10-year, which is the iShares 20 Plus Year Treasury Bond ETF (TLT).

Q: What could be the next entry point for Tesla (TSLA) LEAPS?

A: I’m afraid that we have left LEAPS land for Tesla, I mean $100, $110, $120, $130—that’s all LEAP territory. Up here? Not unless you want to do a very low return LEAP like a $150/$160. I don’t see Tesla going below $150. Too many people trying to get into the stock, and Elon Musk is a master at delivering short squeezes, which he has done a perfect job of this year.

Q: What do you think about Real Estate Investment Trusts (REITS)?

A: I love REITS. They are a falling interest rate play. Highly exposed to interest rates, highly leveraged, and you get some great performance—and we’ve already had some since October. I think the bear market in real estate ends this year and we get a new bull in housing that starts next year because we still have a chronic structural shortage of housing. We’re missing about 10 million houses that we need—in that situation, prices go up. In fact, there are still bidding wars going on in the prime residential (mostly rural) parts of the country.

Q: Wouldn’t you want to buy at-the-money calls, not spreads in a low Volatility Index ($VIX) market on a 4-6 month view, because of cheaper pricing?

A: Yes you do, but not on top of a record move to the upside. If we can get a pullback in the markets of a1 /3-1/2 of their recent moves, and the ($VIX) is still low, then that makes all the sense in the world, to buy at the money calls with ($VIX) of $17. The only problem is if we give up half the recent gains, you’re not going to have a ($VIX) at $17 anymore, it’ll be more like $27 if we get a pullback like that and options will be expensive again. It’s amazing how cheap upside exposure gets at market tops—that’s what the ($VIX) market is telling you. In other words, it’s a sucker’s bet. You can’t have your cake and eat it too.

Q: What do you think about Alphabet (GOOGL)?

A: It’s overbought like the rest of the stocks in the sector. But the charts are looking very attractive, with an upside breakout of the 200-day. Long-term, they have a killer business model, but they also have antitrust problems. Again, everything is way too overbought for me to get involved on a short-term basis.

Q: What price would you get in at for Berkshire Hathaway (BRK/B)?

A: It’s not selling off, it’s flatlining. So even a small dip like we had yesterday would be a decent place to get into. Long term we’re looking for $400/share for this by the end of this year.

Q: Will strong wage growth lead the Fed to raise interest rates higher?

A: Well they’ve already said essentially they’re going to do 2 more quarter point rises. Beyond that, the Fed itself doesn’t know. When you have interest rates at 10-20 year highs, and 3.4% unemployment. No one has ever seen that before, there is no playbook for what’s happening now—either in the economy or in the stock market. So everyone’s standing around, scratching their heads, trying to figure out what to do, and waiting for more data to come out to give direction. And I’m in the same position really.

Q: Will the US Treasury bond get down to a 2.0% yield by the end of the year?

A: I think it's a possibility but expect a lot of volatility and fears around prospects of a government shutdown this summer and a debt default. Part of the Republican party seems intent on forcing that, and that is not good for bond longs. You get through that, you could have an absolutely ballistic move up in the (TLT), to $120 or even $130.

Q: Would you consider a LEAPS on housing stocks?

A: LEAPS are things you do at multi-year market bottoms, not after 50% moves; and the housing stocks have actually been moving since June; so that was a June story. Buy low, sell high—it’s my revolutionary new concept; most people do the opposite.

Q: Should I invest in Disney (DIS) on a buy it on a Bob Iger turnaround?

A: Yes, but only on a dip; we’ve already had a massive move. If we don’t get a recession, that is fantastic for Disney’s park business.

Q: What is your target for Silver (SLV)?

A: $50/oz. We’re at $20 now. Silver is becoming the new industrial metal, far outstripping any jewelry demand that you used to have; and that’s because of EVs and solar. Who knew that we’re at 10 million homes with solar panels in California now? That is just an enormous number that’s happened mostly in the last five years.

Q: When you look at Natural Gas, would you consider LEAPS?

A: Yes, but I haven’t run the numbers yet. The price has gotten so low, down 80% in eight months that you buy it even if you hate it.

Q: Should I pay attention to demographics when I invest? What is the most important one right now?

A: Demographics are very important, because children born today become customers in 20 years, and companies will start adapting their policies for those customers now in terms of capital investments and so on. It also affects stock markets now. Also, you always want to invest in the country that had the fastest growing population, which used to be China but isn’t anymore. By the way, the reason the US economy has outperformed Europe by 1% a year in GDP growth for the last 70 years is because we allow immigrants, and they don’t. All parties used to be in favor of immigration while now only one is. Why, I don’t understand.

Q: What about a LEAP on Silver (SLV)?

A: That is a possible candidate because we have had a move, but it’s only been about 20%. It’s not like 50% or 100% like we’ve seen with Tesla (TSLA). There are a few asset classes that are still in LEAPS territory—I think Silver would be one of them, and certainly natural gas (UNG). If I were to do a LEAPS, I’d go out 2 years and do something like a $25-$27; the old high is $50. You should get about a 5x leverage on that kind of LEAPS.

Q: Would you buy LEAPS puts on Carvana (CVNA)?

A: Absolutely not. Again, another great one-year-ago idea, not a now idea. Buy Put LEAPS at extreme market tops, not now. Carvana had dropped 95% in the last year.

Q: Is seasonality an important consideration in your trading strategy?

A: Absolutely yes. If you buy stocks in November and do the sell-in-May strategy, your average annual return is something like 20% a year. If you buy stocks in May and sell them in December, the 70-year return on that is zero. I love having the tailwind of seasonality; I can’t remember seeing it when it didn’t work. It’s an important consideration, and we’re right in the middle of the “BUY” season and the market is agreeing with me.

Q: You should do a LEAPS letter.

A: I already do in fact do a LEAPS letter, and it’s called the Mad Hedge Concierge Service where we have a whole website dedicated to just LEAPS. Some ten out of 12 made money last year, and some went up 10X. Contact customer support at support@madhedgefundtrader.com if you’re interested. Concierge members are very happy with their LEAPS coverage.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

At 29 Palms in my M1 Abrams Tank in 2000

Global Market Comments

February 6, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WELCOME TO THE WHIPSAW)

(SPY), (TLT), (TSLA), (QQQ), (DOCU), (META), (AMZN)

CLICK HERE to download today's position sheet.

Note: We are moving webinar platforms to Zoom for the February 8, 12:00 EST Mad Hedge Biweekly Strategy

Webinar. To join, please click here.

Well, that was some week!

The next time there is a Fed interest rate announcement, earnings from all the big tech companies, and a Nonfarm Payroll Report all within five days, I am going to call in sick, volunteer at the Oakland Food Bank, or explore some remote Pacific island!

For good measure, a top-secret Chinese spy balloon passed overhead before it was shot down, which I was able to read all about in USA Today.

Still, when you live life in the front trenches and on the cutting edge and use the kind of leverage that I do, you are going to take hits. It’s all a cost of doing business. If you can’t stand the heat, get out of the kitchen.

The last month in the markets have seen one of the greatest whipsaws of all time. Many leading stocks are up 40%-100%, while the Volatility Index ($VIX) plunged to a two-year low. Stocks have gone from zero bid to zero offered. The bulls are back in charge, for now.

Go figure.

This year has proved full of flocks of black swans so far, with February setting me back -5.70%. My 2023 year-to-date performance is still at the top at +16.65%. The S&P 500 (SPY) is up +9.92% so far in 2023. My trailing one-year return maintains a sky-high +84.10%.

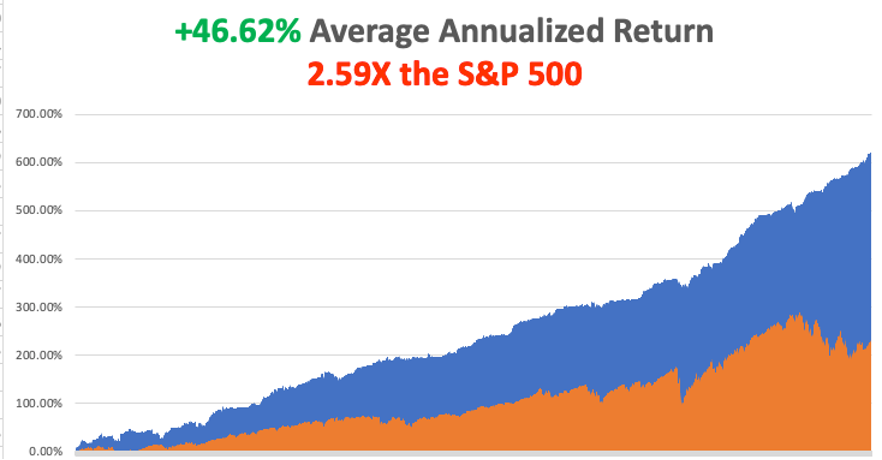

That brings my 15-year total return to +613.84%, some 2.59 times the S&P 500 (SPX) over the same period. My average annualized return has retreated to +46.62%, still the highest in the industry.

Last week, I got stopped out of my short position in the (QQQ), in what will hopefully be my biggest loss of the year, but not the last. Once or twice a year, you get a major gap opening that takes you through one, and sometimes two full strike prices, taking you to the cleaners, and this was one of those times. It takes three more winning trades to make up for these.

I also took small profits on my remaining long in Apple (AAPL). That leaves me 80% in cash, with a double short in Tesla (TSLA). Markets are wildly overextended here with my own Mad Hedge Market Timing Index well into “SELL” territory at 76. Tread at your own peril. Cash is king right here.

Growth stocks are on fire and small caps have been prospering, all classic bull market indicators. This has triggered panic short covering by hedge funds which have seen their worst start to a New Year in decades. The old pros are getting carried out on stretchers.

Maybe this is a good time to hire some kid to do your trading, like one who has never seen markets go down before, one who started his career only on January 1? Or maybe one who retired on December 31 2021, and took a year off?

So, what are markets trying to tell us? That in an hour, the view of the economy has flipped from a mild recession to a soft landing? That interest rates don’t matter anymore? That big chunks of the economy can operate without outside money? That big tech will always make money, it will just rotate from large profits to small ones and back to outrageous ones again?

Those who instead bet on a severe recession are currently filling out their applications as Uber drivers. Warning: it’s harder than it used to be, no more fake IDs or salvage title cars. Next, they’ll want your DNA sample.

If it is any consolation, Fed governor Jay Powell hasn’t a clue about what’s happening either, and that’s with 100 PhD's in economics on his staff. He was just as flummoxed as we over a January Nonfarm Payroll Report that came in 2.5 X expectations on top of 4.5% in interest rate hikes.

Clearly, a new economy has emerged from the wreckage of the pandemic, and no one, not anyone, has quite figured out what it is yet.

Some ten years’ worth of economic evolution has been pulled forward. Everything is digitizing at an astonishing rate. What do I do after slaving away in front of a computer all day? Go back to my computer to have fun. Lots of “zeros” and “ones” there.

It looks like we get a new stock market too.

All of this frenetic market action does fit one theory that I spelled out for you in great detail last week. It is that technology stocks are about to spin off such immense profits that it is about to replace the Fed as a new immense supply of free money.

META up 20% in a day? That’s what it says to me. Notice that Mark Zuckerberg mentioned “AI” 16 times in his earnings call.

Is it possible that I nailed this one….again?

On another related topic, the last three months have just given us a wonderful illustration of how well the Mad Hedge Market Timing Index works (see chart below). We got a strong BUY at an Index reading of 30 on December 22, when the (SPY) began a robust 12% move up. We are now at the top end of an upward trend with my Index at 76. You’d be Mad to add a long position here, at least for the short term.

Someone asked me the other day if the algorithm has gotten smarter in the seven years I have been using it. The answer is absolutely “yes,” and you can see it in my performance. During this time, my average annualized return has jumped from 31% to 46%. That’s because the algorithm gets smarter with the hundreds of new data points that are added every day. Believe it or not, this is how much of the economy is run now.

But there is another factor. I get smarter every year. Believe it or not, when you go from year 54 to 55, you actually learn quite a lot about the markets. Of course, markets are evolving all the time and the rate of change is accelerating. When I saw the market moving towards algorithms, I wrote an algorithm. The challenge is to solve each new problem the market throws at you every year, which I love doing.

Nonfarm Payroll Report at 513,000 Blows Away Estimates, more than double expectations. The Headline Unemployment Rate fell to a new 53-year low at 3.4%. Leisure & Hospitality gained an incredible 128,000, Professional & Business Services 82,000, and Government 74,000. You can kiss that interest rate cut goodbye. Bonds believe it, down 3 points, but stocks are still in Lalaland, reversing a 300-point reversal in the (QQQ)s.

Fed Raises Rates 25 basis points, but Powell talks hawkish, smashing stocks for an hour. He needs more evidence that inflation is finally headed down. He might as well have said he’ll burn the place down. One or two more rate rises to go before the pivot.

Weekly Jobless Claims Hit New 9 Month Low, at 183,000, down 3,000, and is close to a multi-generational low. A recession is rapidly moving off the table as today’s move in tech stocks indicates.

JOLTS Surges Past 11 Million Job Openings in December to a five-month high. The Fed’s assault on labor clearly isn’t working. The million who died from Covid certainly aren’t coming back to work, nor are the 500,000 long Covid cases. That’s 1% of the US workforce.

Ukraine War is Accelerating Move to Green Energy, or so thinks British Petroleum, cutting its ten-year energy demand forecast. Russian energy has proven unreliable at best, and the key pipelines have been blown up anyway. Massive subsidies have been unleashed in Europe and the US for solar, wind, EVs, hydro, and even nuclear. The war gave coal a respite from oblivion, but only a temporary one.

S&P Case Shiller Drops to an 8.6% Annual Gain, the National Home Price Index falling for five consecutive months. No green shoots here. The deeply lagging indicator may not turn positive until yearend. Miami, Tampa, and Atlanta showed the biggest gains, with San Francisco the biggest loser.

Office Occupancy Recovers to 50%, according to a private research firm. New York, San Jose, and San Francisco are still lagging. With the work-from-home trend and high interest rates, commercial properties have entered a perfect storm. Austin, TX was the highest at 68%.

Europe Delivers Surprising Q4 Growth, despite WWIII playing out on its doorstep. GDP increased by 0.1% when a decline was expected. European stocks should outperform American ones in 2023.

IMF Upgrades Global Growth Forecast for 2023 to 2.9% and sees a modest recovery in 2024. The figures are an improvement from the last report, thanks to falling inflation and energy prices. China ending lockdowns is another plus.

General Motors to Invest $650 Million in Lithium Americas, pouring money into a Nevada mine at Thacker Pass, the largest such US investment so far. (GM) says it will raise EV production to 400,000 this year versus 120,000 for all of 2022. Good luck because local environmental opposition to the new mine has been enormous. Goodbye China.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, February 6, no data of note is announced.

On Tuesday, February 7 January 31 at 5:30 AM EST, the Balance of Trade is out.

On Wednesday, February 8 at 7:30 AM, the Crude Oil Stocks are published.

On Thursday, February 9 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, February 10 at 8:30 AM, the University of Michigan Consumer Sentiment is printed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, the telephone call went out amongst the family with lightning speed, and this was back in 1962 when long-distance calls cost a fortune. President Dwight D. Eisenhower was going to visit my grandfather’s cactus garden in Indio the next day, said to be the largest in the country, and family members were invited.

I spent much of my childhood in the 1950s and 1960s helping grandpa look for rare cactus in California’s lower Colorado Desert, where General Patton trained before invading Africa. That involved a lot of digging out a GM pickup truck from deep sand in the remorseless heat. SUVs hadn’t been invented yet, and a Willys Jeep (click here) was the only four-wheel drive then available in the US.

I have met nine of the last 13 presidents, but Eisenhower was my favorite. He certainly made an impression on me as a ten-year-old boy, who I remember as a kindly old man.

I walked with Eisenhower and my grandfather plant by plant, me giving him the Latin name for its genus and species, and citing unique characteristics and uses by the Indians. The former president showed great interest and in two hours we covered the entire garden. I still make my kids learn the Latin names of plants.

Eisenhower lived on a remote farm at the famous Gettysburg, PA battlefield given to him by a grateful nation. But the winters there were harsh so he often visited the Palm Springs mansion of TV Guide publisher Walter Annenberg, a major campaign donor.

Eisenhower was one of the kind of brilliant men that America always comes up with when it needs them the most. He learned the ropes serving as Douglas MacArthur’s Chief of Staff during the 1930s. Franklin Roosevelt picked him out of 100 possible generals to head the allied invasion of Europe, even though he had no combat experience.

After the war, both the Democratic and Republican parties recruited him as a candidate for the 1952 election. The latter prevailed, and “Ike” served two terms, defeating the governor of Illinois Adlai Stevenson twice. During his time, he ended the Korean War, started the battle over civil rights at Little Rock, began the Interstate Highway System, and admitted Hawaii as the 50th state.

As my dad was very senior in the Republican Party in Southern California during the 1950s, I got to meet many of the bigwigs of the day. New York prosecutor Thomas Dewy ran for president twice, against Roosevelt and Truman, and was a cold fish and aloof. Barry Goldwater was friends with everyone and a decorated bomber pilot during the war.

Richard Nixon would do anything to get ahead, and it was said that even his friends despised him. He let the Vietnam War drag out five years too long when it was clear we were leaving. Some 21 guys I went to high school with died in Vietnam during this time. I missed Kennedy and Johnson. Wrong party and they died too soon. Ford was a decent man and I even went to church with him once, but the Nixon pardon ended his political future.

Peanut farmer Carter was characterized as an idealistic wimp. But the last time I checked, the Navy didn’t hire wimps as nuclear submarine commanders. He did offer to appoint me Deputy Assistant Secretary of the Treasury for International Affairs, but I turned him down because I thought the $15,000 salary was too low. There were not a lot of Japanese-speaking experts on the Japanese steel industry around in those days. Biggest mistake I ever made.

Ronald Reagan’s economic policies drove me nuts and led to today’s giant deficits, which was a big deal if you worked for The Economist. But he always had a clever dirty joke at hand which he delivered to great effect….always off camera. The tough guy Reagan you saw on TV was all acting. His big accomplishment was to not drop the ball when it was handed to him to end the Cold War.

I saw quite a lot of George Bush, Sr. who I met with my Medal of Honor Uncle Mitch Paige at WWII anniversaries, who was a gentleman and fellow pilot. Clinton was definitely a “good old boy” from Arkansas, a glad-hander, and an incredible campaigner, but was also a Rhodes Scholar. His networking skills were incredible. George Bush, Jr. I missed as he never came to California. And 22 years later we are still fighting in the Middle East.

Obama was a very smart man and his wife Michelle even smarter. Stocks went up 400% on his watch and Mad Hedge Fund Trader prospered mightily. But I thought a black president of the United States was 50 years early. How wrong was I. Trump I already knew too much about from when I was a New York banker.

As for Biden, I have no opinion. I never met the man. He lives on the other side of the country. When I covered the Senate for The Economist, he was a junior member.

Still, it’s pretty amazing that I met 9 out of the last 13 presidents. That’s 20% of all the presidents since George Washington. I bet only a handful of people have done that and the rest all live in Washington DC. And I’m a nobody, just an ordinary guy. It just makes you think about the possibilities.

Really.

It’s Been a Long Road

Global Market Comments

February 3, 2023

Fiat Lux

Featured Trade:

(QUEEN MARY II JULY 13 SEMINAR AT SEA)

(SOME BASIC TRICKS FOR TRADING OPTIONS)

CLICK HERE to download today's position sheet.

Global Market Comments

February 2, 2023

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(HOW THE COST OF ENERGY IS GOING TO ZERO),

(SPWR), (TSLA),

CLICK HERE to download today's position sheet.

A key part of my argument for a new Golden Age to take place during the coming Roaring Twenties is that the price of energy is going to zero.

It may not actually make it to zero. I’ll settle for a 90%-95% decline, which is good enough for me.

Take a look at the charts below.

The first one shows how the price of a watt of solar-generated electricity has plunged by 99.60% since 1977, from $76.67 to $0.30.

Just in the past six years, retail prices for completed solar panels dropped by a staggering 80%.

That is cheaper than electricity supplies generated by new natural gas plants, which now cost 7 cents per kWh.

Squeezing efficiencies out of our existing solar technology through improved software, production methods, chemistry, and design are nearly unlimited, and are expected to drive solar costs by half down to 3 cents per kWh by 2035.

And here is the great shortcoming of all these wonderful predictions. Technology NEVER stays the same.

My own SunPower (SPWR) panels with their Maxeon solar cell technology deliver an efficiency of 22.7%, the best on the market available 18 months ago. That means that convert 22.7% of the solar energy they receive into electricity.

SunPower is now producing 25.1% efficiency panels in the lab. Another research lab in Germany, Fraunhofer, is getting 44.7%.

And my friends at the Defense Department tell me they have functioning solar cells delivering 70% efficiencies. Whether they are economic and scalable is anyone’s guess.

(Warning: most cheap Chinese-made solar cells have only lowly 15% efficiencies, so don’t be tricked by any great “deals”).

And this is how most long-term predictions fall short.

Not only do they assume that technology doesn’t change, they fail to account for dramatic improvements in other related fields.

Electric car technology is a classic example. Battery costs are currently falling off a cliff.

When I bought the first Nissan Leaf offered for sale in California in 2010, the battery cost $833 per kilowatt. In 2012, I purchased a high-performance Tesla (TSLA) P85 Model S-1 at $353 per kilowatt. My last purchase in 2018 of a Tesla Model X P100D further dropped the cost to $150.

Efficiencies gained through the economies of scale from the Sparks, Nevada Gigafactory could take that down to under $100. From $833 down to $100, not bad.

However, that is not the end of the story.

The car industry will start to move towards carbon fiber in five years, which has five times the strength of steel at one-tenth the weight. The only issue now is mass production cost.

Some 67% of the weight of a Tesla S-1 is in the body, with the four motors at 13%, and the 1,200-pound lithium-ion battery at 20%.

What happens when the body weight falls by 90%? The battery weight, and cost decline by two-thirds. That cuts the effective cost of the battery to $66/kilowatt.

Add up all of this, and it is easy to see how energy costs can plunge by 90% or more. And it will happen must faster than you expect.

This has been the experience with memory costs, processor speeds, and hundreds of other technologies over the past half-century I have been following them.

I could go on and on.

This is why the State of California has mandated to get 50% of its energy from alternative sources by 2030. Some researchers believe an 80% target could be achieved. And it is doing this while closing its two remaining nuclear power plants.

To say that free energy would be a game-changer is a huge understatement.

The elimination of energy as a cost has enormous consequences for all companies. You can start with the energy-intensive ones in transportation, steel, and aluminum, and work your way down the list.

My bet is that you won’t recognize the car industry in 20 years. At a $66/kilowatt effective battery cost, it will make absolutely no sense to build internal combustion engines in new cars. Too bad Detroit is a decade behind in this technology.

Lose transportation, and you lose 50% of US oil consumption, or about 10 million barrels a day. Guess what that does to oil prices.

Goodbye Middle East and Russia.

The profitability and efficiency of the entire economy will take a great leap forward, much like we saw with the mass industrialization that was first made possible by electricity during the 1920s.

Share prices of all kinds will go ballistic.

Since energy costs will eventually fall effectively to zero, that wipes out the present business model of the entire electric power, coal, oil, and gas industries, about 10% of US GDP.

Their business models will be reduced to trying to sell something that is free, like air.

Dow 240,000 anyone?

For more about the economic rationale behind these predictions, please read my book, Stocks to Buy for the Coming Roaring Twenties.

Enough Batteries to Operate Grid-Free Forever!

Global Market Comments

January 30, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MY NEW THEORY OF EQUITIES)

(TSLA), (SPY), (TLT), (TSLA), (OXY), (UUP), (AAPL), ($VIX)

CLICK HERE to download today's position sheet.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds: